- Home

- »

- Next Generation Technologies

- »

-

IT Services Outsourcing Market Size And Share Report, 2030GVR Report cover

![IT Services Outsourcing Market Size, Share & Trends Report]()

IT Services Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Location (On-shore, Off-shore), By End Use (BFSI, Healthcare), By Service, By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-519-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IT Services Outsourcing Market Summary

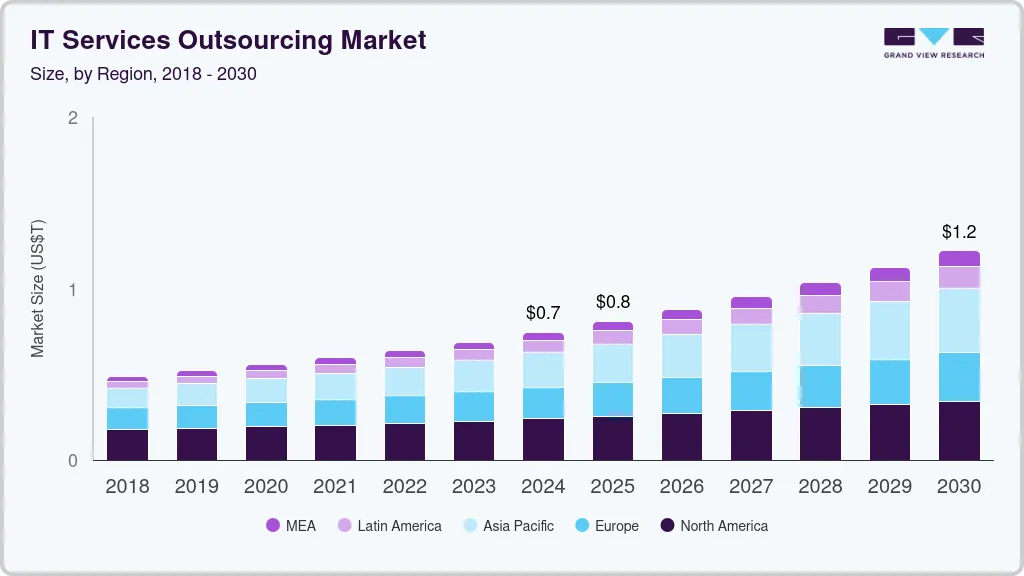

The global IT services outsourcing market size was estimated at USD 744,623.5 million in 2024 and is expected to reach USD 1,219.31 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The market is driven by the rapid evolution of technologies such as cloud computing, artificial intelligence (AI), Internet of Things (IoT) and a heightened focus on cybersecurity.

Key Market Trends & Insights

- North America IT services outsourcing market dominated globally with a revenue share of over 32% in 2024.

- The U.S. IT services outsourcing market held a dominant position in 2024.

- Based on service, the end use services segment accounted for the largest market share of over 19% in 2024.

- Based on location, the on-shore segment accounted for the largest market share in 2024.

- Based on end-use, the BFSI segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 744,623.5 Million

- 2030 Projected Market Size: USD 1,219.31 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the ongoing shift towards digitalization across industries is compelling companies to seek external expertise in IT services. This trend is particularly strong in sectors such as banking, financial services, and insurance (BFSI), where technological advancements are critical for competitiveness. Furthermore, the rising demand for managed services and subscription-based models is expected to drive market growth in the coming years.

The increase in remote work, accelerated by the COVID-19 pandemic, has fueled the demand for IT outsourcing services that support distributed teams and remote workflows. Companies are increasingly seeking managed services to address challenges in cybersecurity, data privacy, and collaboration technologies to sustain remote workforces. This trend is likely to continue as hybrid work models gain popularity, further driving demand for flexible and secure IT outsourcing solutions.

In addition, with rising cybersecurity threats, businesses are turning to specialized IT outsourcing providers to manage security protocols and ensure compliance with global data protection regulations. Outsourcing partners bring expertise in advanced cybersecurity solutions, such as threat intelligence, vulnerability management, and regulatory compliance, which are essential in today’s threat landscape. This trend is creating a robust demand for security-focused outsourcing services across industries, thereby boosting market expansion.

Furthermore, the integration of AI and automation into IT services is reshaping the outsourcing landscape. Service providers are increasingly leveraging AI-driven analytics, machine learning, and robotic process automation (RPA) to enhance service delivery and improve productivity. These technologies enable faster response times, predictive maintenance, and better insights, which make IT outsourcing more valuable to clients seeking to modernize their IT functions. This trend is expected to further boost market growth in the coming years.

Moreover, companies across industries are prioritizing digital transformation to enhance agility, improve efficiency, and optimize customer experience. The demand for outsourcing partners who can bring expertise in new technologies such as cloud computing, artificial intelligence (AI), and big data is growing. These partners enable businesses to accelerate their digital journeys without the heavy upfront investments and development time associated with building in-house capabilities.

Service Insights

The end use services segment accounted for the largest market share of over 19% in 2024. The growth is primarily driven by organizations seeking to leverage specialized expertise and technology solutions that improve operational performance and customer engagement. As businesses increasingly adopt cloud-based services and digital transformation strategies, the demand for tailored end-use services is expected to grow significantly in the coming years.

The emerging technology services segment is expected to witness the fastest CAGR from 2025 to 2030. This rapid growth can be attributed to the increasing integration of these technologies into business operations, which enhances decision-making processes and operational efficiencies. As companies strive to remain competitive in a technology-driven landscape, investments in emerging technologies are becoming essential for driving innovation and meeting evolving customer demands. The focus on automation and data-driven insights further propels this segment's expansion.

Location Insights

The on-shore segment accounted for the largest market share in 2024, primarily driven by the increasing need for improved communication, data security, and operational efficiency. Companies are increasingly opting for onshore outsourcing to mitigate challenges associated with offshoring, such as communication gaps and quality control issues. By partnering with vendors located within the same time zone and legal jurisdiction, businesses can enhance collaboration and streamline processes, leading to more effective service delivery.

The off-shore segment is expected to register the fastest CAGR from 2025 to 2030, experiencing a trend towards rapid growth driven by significant cost advantages and access to a vast talent pool. The demand for specialized skills in emerging technologies like artificial intelligence, cloud computing, and big data analytics is also fueling this trend, as offshore providers often have established expertise in these areas. Furthermore, companies are leveraging offshore outsourcing to gain flexibility and scalability in their operations, enabling them to quickly adapt to changing market demands without substantial investments in infrastructure.

End Use Insights

The BFSI segment dominated the market in 2024, owing to its critical reliance on technology for operations, compliance, and customer engagement. This sector has increasingly adopted outsourcing to manage complex IT infrastructures, enhance cybersecurity measures, and leverage advanced analytics for better decision-making. As financial institutions strive to improve service delivery and operational efficiency while adhering to stringent regulatory requirements, they turn to specialized IT service providers that can offer tailored solutions. This trend is further supported by the growing need for digital transformation initiatives aimed at enhancing customer experience and operational agility, thereby driving segmental growth.

The retail & e-commerce segment is expected to register the fastest CAGR from 2025 to 2030. This rapid growth is driven by the increasing adoption of online shopping platforms and the shift in consumer behavior towards digital transactions. Factors such as the proliferation of smartphones, improved internet accessibility, and advancements in logistics are facilitating a seamless online shopping experience. Additionally, the rise of social commerce and changing purchasing patterns are encouraging retailers to invest in e-commerce solutions that enhance customer engagement and streamline operations. These factors are expected to drive the market growth in the coming years.

Enterprise Size Insights

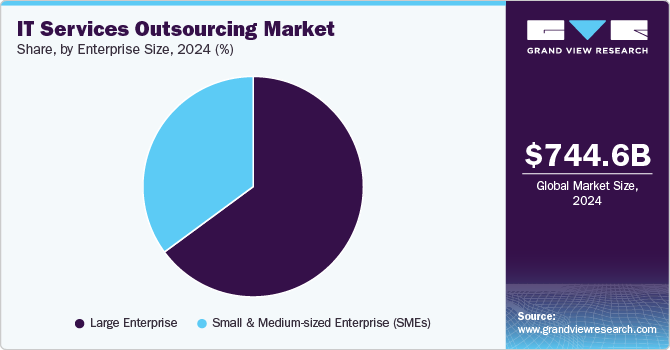

The large enterprise segment accounted for the largest market share in 2024, primarily owing to their substantial budgets and the complexity of their IT needs. Large enterprises often require comprehensive IT solutions that can efficiently manage vast infrastructures, data security, and compliance challenges. As these organizations increasingly focus on core competencies and seek cost-effective solutions, they turn to outsourcing to enhance operational efficiency and leverage advanced technologies without the burden of maintaining extensive in-house capabilities. This trend is supported by a growing demand for managed services that align with their operational goals, which positions large enterprises as dominant players in the outsourcing landscape.

The small & medium enterprises (SME’s) segment is expected to register the fastest CAGR from 2025 to 2030. This growth can be attributed to SMEs' increasing recognition of the benefits of outsourcing IT services, such as cost savings, access to specialized skills, and enhanced focus on core business activities. As SMEs often face budget constraints and resource limitations, outsourcing allows them to adopt advanced technologies and services that would otherwise be unaffordable. The rising adoption of cloud-based solutions and flexible pricing models further enables these smaller organizations to scale their IT capabilities efficiently while minimizing upfront investments, thus driving rapid growth in this segment.

Regional Insights

North America IT services outsourcing market dominated globally with a revenue share of over 32% in 2024, driven by the increasing need for cost reduction and operational efficiency among businesses. Companies are increasingly outsourcing IT functions to focus on core competencies while leveraging external expertise to enhance service delivery. The rapid adoption of cloud computing and digital transformation initiatives further fuels this demand as organizations seek scalable and flexible solutions to manage their IT infrastructure. Additionally, the ongoing skills shortage in the region compels companies to look for talent in offshore markets, making outsourcing an attractive option for accessing specialized skills at lower costs.

U.S. IT Services Outsourcing Market Trends

The U.S. IT services outsourcing market held a dominant position in 2024, driven by the need for cost efficiency and access to specialized expertise. With a highly competitive business landscape, companies are increasingly outsourcing IT functions to focus on their core operations while benefiting from advanced technologies and innovative solutions provided by third-party vendors.

Europe IT Services Outsourcing Market Trends

European IT services outsourcing market is expected to grow at a considerable CAGR of over 7% from 2025 to 2030, primarily driven by the need for cost reduction and enhanced efficiency in operations. The ongoing digital transformation across various industries is pushing businesses to adopt advanced technologies such as cloud computing and artificial intelligence, necessitating external support for implementation and management. Additionally, a shortage of skilled IT professionals in many European countries is prompting organizations to seek outsourcing solutions from both nearshore and offshore providers.

The UK IT services outsourcing market is expected to grow rapidly in the coming years, owing to the increasing demand for digital transformation and operational efficiency among businesses. The ongoing skills shortage in the UK further drives organizations to seek outsourcing solutions to fill gaps in technical expertise, thereby driving segmental growth.

The Germany IT services outsourcing market held a substantial market share in 2024, driven by a strong focus on cost reduction and operational efficiency as businesses increasingly outsource non-core functions.

Asia-Pacific IT Services Outsourcing Market Trends

The IT services outsourcing market in the Asia Pacific region is expected to grow at the fastest CAGR of 11% from 2025 to 2030, driven by a combination of factors including rapid digitalization, a burgeoning tech-savvy workforce, and competitive labor costs. The increasing demand for cloud services, cybersecurity solutions, and data analytics is propelling businesses to adopt outsourcing strategies to enhance their operational capabilities. Furthermore, government initiatives promoting technology adoption and innovation are creating a conducive environment for IT services outsourcing in the region.

The Japan IT services outsourcing market is expected to grow rapidly in the coming years. The growing emphasis on automation and artificial intelligence is also prompting organizations to partner with external providers for advanced IT solutions. Moreover, Japan's strong focus on cybersecurity has led many firms to engage outsourcing partners that can offer comprehensive security management services, ensuring compliance with stringent regulations while mitigating risks associated with cyber threats.

The IT services outsourcing market in China held a substantial market share in 2024. The growth is attributed to the country's robust economic growth and increasing digitalization across various industries. Additionally, the availability of a large pool of skilled IT professionals at competitive costs makes China an attractive destination for both domestic and international companies looking to outsource their IT services.

Key IT Services Outsourcing Company Insights

Some of the key players operating in the market include Accenture PLC and Oracle Corporation, among others.

-

Accenture Plc is a global professional services company specializing in strategy, consulting, digital, technology, and operations services. The company provides a broad range of solutions that include cloud services, cybersecurity, data analytics, and intelligent operations. The company is recognized for its strong industry expertise across various sectors, such as banking, healthcare, and consumer goods.

-

Oracle Corporation is a multinational technology company renowned for its comprehensive suite of software products and cloud services. The company specializes in database management systems and enterprise software solutions that support businesses in managing their data efficiently. The company's cloud offerings include Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), catering to various industries such as finance, healthcare, and retail.

Capgemini Services SAS and NTT DATA GROUP Corporation are some of the emerging participants in the market.

-

Capgemini Services SAS is a consulting, technology services, and digital transformation company that offers a diverse range of services, including application development, cloud computing, cybersecurity, and data analytics. The company focuses on helping clients navigate their digital journeys by leveraging innovative technologies and methodologies.

-

NTT DATA GROUP Corporation is a global IT service provider specializing in consulting services and system integration. The company offers a wide array of services, including application development, infrastructure management, and business process outsourcing. The company emphasizes innovation through its investment in emerging technologies such as artificial intelligence and cloud computing.

Key IT Services Outsourcing Companies:

The following are the leading companies in the IT services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture PLC

- IBM Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- SAP SE

- Capgemini Services SAS

- Cognizant Technology Solutions Corporation

- Infosys Limited

- NTT DATA GROUP Corporation

- Oracle Corporation

Recent Developments

-

In June 2024, Oracle Corporation announced a significant investment exceeding USD 1 Million to establish a new cloud region in Madrid, Spain, aimed at enhancing the capabilities of local businesses in various sectors. This initiative aims to facilitate the migration of critical workloads to Oracle Cloud Infrastructure, helping organizations meet compliance requirements such as the Digital Operational Resilience Act.

-

In February 2024, Accenture PLC acquired Insight Sourcing, a strategic sourcing and procurement services provider, aimed at enhancing its offerings for private equity firms and various industries, including consumer goods and technology. This acquisition aims to add approximately 220 sourcing consultants to Accenture PLC’s team and integrate over 40 technology procurement tools, enabling clients to optimize costs in sourcing direct and indirect materials as well as capital expenditures.

-

In December 2023, NTT DATA GROUP Corporation announced a new global cybersecurity strategy aimed at enhancing support for clients facing increasingly sophisticated cyber threats. The strategy aims to provide comprehensive cybersecurity services, including managed security services and incident response, which are integral components of IT outsourcing.

IT Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 807.91 billion

Revenue forecast in 2030

USD 1,219.31 billion

Growth Rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, location, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

Accenture PLC, IBM Corporation, Fujitsu Limited, Hewlett Packard Enterprise Development LP, SAP SE, Capgemini Services SAS, Cognizant Technology Solutions Corporation, Infosys Limited, NTT DATA GROUP Corporation, and Oracle Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IT services outsourcing market report based on service, location, enterprise size, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Services

-

Emerging Technology Services

-

Data Center Operations

-

Helpdesk Services

-

Infrastructure Capacity Services

-

Managed Security Operations

-

Network Operations

-

Others

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

On-shore

-

Off-shore

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SME’s)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

BFSI

-

Healthcare

-

Retail & e-commerce

-

Telecom & Media

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IT services outsourcing market size was valued at USD 744,623.5 million in 2024 and is expected to reach USD 807.91 billion in 2025.

b. The global IT services outsourcing market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 1,219.31 billion by 2030.

b. BFSI segment registered the largest revenue share of around 25% in 2024, owing to its significant investment in automation, artificial intelligence-based conversational systems, and cybersecurity.

b. Some key players operating in the IT services outsourcing market include Accenture PLC, IBM Corporation, Fujitsu Limited, Hewlett Packard Enterprise Development LP, SAP SE, Capgemini Services SAS, Cognizant Technology Solutions Corporation, Infosys Limited, NTT DATA GROUP Corporation, and Oracle Corporation.

b. The growing vigilance regarding data security and customer-centricity in projects, especially in the aerospace & defense and BFSI sectors, are projected to propel the demand for information technology services outsourcing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.