- Home

- »

- Organic Chemicals

- »

-

Isobutyric Acid Market Size, Share & Growth Report, 2030GVR Report cover

![Isobutyric Acid Market Size, Share & Trends Report]()

Isobutyric Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Synthetic Isobutyric Acid, Renewable Isobutyric Acid), By End Use (Animal Feed, Chemical Intermediates), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-398-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Isobutyric Acid Market Size & Trends

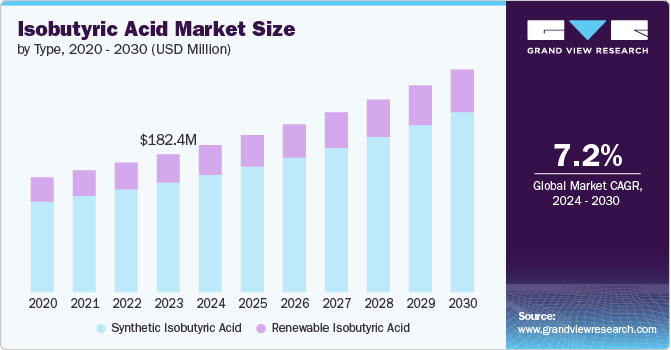

The global isobutyric acid market size was estimated at USD 194.4 million in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. This growth is attributed to its versatile applications across various industries. It is an important raw material in the manufacturing of fragrances, flavors, and various chemicals, including paints, plastics, and coatings. Moreover, its role as an intermediate in the synthesis of pharmaceuticals and agricultural chemicals is further expected to drive its demand over the coming years. The rising focus on sustainable and bio-based chemicals is also contributing to the growth, as isobutyric acid can be derived from renewable resources.

The market for isobutyric acid is likely to be hampered by rising environmental concerns and stringent regulations regarding the production and disposal of chemical compounds pose significant challenges, as they may increase manufacturing costs and limit operational flexibility. Moreover, the volatility of raw material prices also has an impact on the profit margins and market stability.

In addition, the competition from alternative chemicals and substitutes, which also provide similar properties at lower costs or with lesser environmental impacts, can also detract from the demand for isobutyric acid. Moreover, economic uncertainties and market fluctuations in various end use industries, including automotive and construction, can also negatively impact the growth and adoption of the product in these sectors.

Major players in the market are opting for various strategies to gain market share. They are highly investing in research and development to innovate and improve manufacturing processes, trying to enhance product quality and cost-efficiency. These players are also increasing their production capacities and geographical presence to meet the rising global demand.

Type Insights

Based on type, the market is segmented into synthetic isobutyric acid and renewable isobutyric acid. Among these, synthetic isobutyric acid dominated the market with a revenue share of 79.5% in 2023 and is further expected to grow at a significant rate over forecast period. The market growth is attributed to its high purity, consistent quality, and reliable supply. Synthetic production processes allow for large-scale manufacturing, ensuring industrial requirements for isobutyric acid are met efficiently. Its wide application across various industries, including pharmaceuticals, cosmetics, and food additives, makes it a preferable chemical. In addition, advancements in synthetic methods are improving manufacturing efficiency and cost-effectiveness, which is likely to contribute to its growing demand.

Demand for renewable isobutyric acid manufacturing is expected to grow at a fastest rate over the period of 2024-2030. This is due to the rising shift of industries towards sustainable and eco-friendly solutions. Renewable isobutyric acid is derived from biomass and other renewable resources, associates with the global push for greener alternatives and reduced carbon footprints. This rising environmental awareness, along with stricter regulations by the government on carbon emissions, is expected to drive companies to adopt bio-based chemicals. Moreover, advancements in biotechnology and renewable chemical processes are making the manufacturing of renewable isobutyric acid more economically viable, further boosting its demand over the coming years.

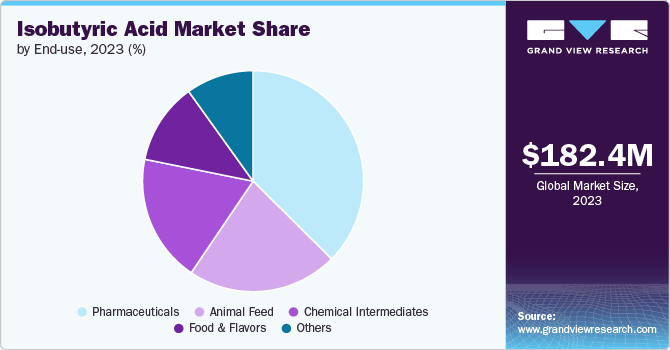

End Use Insights

On the basis of end use, isobutyric acid market is segmented into animal feed, chemical intermediates, food & flavors, pharmaceuticals, and others. Pharmaceuticals end use accounted for the largest revenue share of 37.4% in 2023. The market is driven by its role as an essential intermediate in the synthesis of various active pharmaceutical ingredients (APIs) and specialty chemicals. Isobutyric acid's exceptional chemical properties make it important in the production of drugs used to treat a range of medical conditions. With the constant growth of the global pharmaceutical industry, driven by an aging population and the rising prevalence of chronic diseases, the requirement for high-quality raw materials such as isobutyric acid is further likely to expanding, thereby fueling the market growth.

Animal feed end use is anticipated to grow at a significant rate over the forecast period. Isobutyric acid is used as a feed additive which improves the nutritional value and palatability of animal feed. It helps in encouraging better digestion and nutrient absorption, leading to increased growth and health of livestock. With the rise in global population, the demand for meat and other animal products is further expected to increase, requiring more efficient and effective animal husbandry practices. The use of isobutyric acid in animal feed contributes to higher productivity and better feed conversion rates, which are critical for meeting the increasing food demand.

Regional Insights

North America market for isobutyric acid accounted for a revenue share of 22.5% in 2023. This is due to the robust growth in the pharmaceutical, food, and chemical industries. The region's well-established industrial infrastructure and significant investments in research and development is likely to foster innovation and higher manufacturing efficiency. In addition, the increasing focus on sustainable and bio-based chemicals also expected to propels the market forward, supporting with environmental regulations and consumer preferences in North America.

U.S. Isobutyric Acid Market Trends

The isobutyric acid market in the U.S. is growing at a CAGR of 7.4% over the forecast period. The country's strong focus on research and development and innovation is expected to lead to the development of new applications and more efficient production processes for isobutyric acid.

Europe Isobutyric Acid Market Trends

Europe isobutyric acid market is growing at a CAGR of 6.9% from 2024-2030. Stringent environmental regulations and the region's commitment to sustainability are key drivers for the increased demand for isobutyric acid. The European Union's emphasis on green chemistry and renewable resources encourages the adoption of bio-based isobutyric acid. In addition, the region's advanced pharmaceutical and chemical industries heavily rely on high-purity raw materials, which is further anticipated to boost the product demand.

Asia Pacific Isobutyric Acid Market Trends

The isobutyric acid market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. Industry growth is driven by rapid industrialization and urbanization, especially in developing countries such as China and India. The expanding pharmaceutical and chemical industries in these emerging markets are key consumers of isobutyric acid. Moreover, increasing middle-class population with rising disposable incomes of consumer also anticipated to fuel demand for high-quality food and personal care products, which in turn is predicted to drive the requirement for isobutyric acid over the forecast period.

Key Isobutyric Acid Company Insights:

Some of the key players operating in the market include Evonik and Eastman Chemical Company.

-

Evonik is a leading Speciality chemical company provider for various industries such as aerospace, agriculture, construction, automotive, coating, paints, food & beverages, pharmaceuticals, healthcare, metals, mining, oil & gas, and pulp, paper, and packaging. The company has its presence in more than 100 countries with about 33,000 employees working globally.

-

Eastman Chemical Company was established in 1920 and is headquartered in U.S. The company is a leading producer of wide range of products including acids, adhesion promoters, aldehydes, amides, amines, anhydrides, antioxidants, hydroquinones and preservatives, aviation fluids, benzene, cellulose esters, coalescents, copolyesters, and others.

Glentham Life Sciences Limited and Central Drug House are some of the emerging participants in market.

-

Glentham Life Sciences Limited is a UK-based producer and supplier of high-quality fine chemicals, biochemicals, and life science research products. The company offers a wide range of products, including peptides, reagents, amino acids, and specialized chemicals such as isobutyric acid. The company prides itself on providing high-purity, reliable products that are essential for research and development across various fields, including pharmaceuticals, biotechnology, and academic research.

-

Central Drug House (CDH) is a renowned pharmaceutical company based in India. It is involved in the manufacturing and distributing of high-quality chemicals and pharmaceutical products. The company's extensive product range includes analytical reagents, fine chemicals, and specialty chemicals, catering to various industries such as pharmaceuticals, healthcare, research and development, and education.

Key Isobutyric Acid Companies:

The following are the leading companies in the isobutyric acid market. These companies collectively hold the largest market share and dictate industry trends.

- OQ Chemicals GmbH

- Eastman Chemical Company

- Tokyo Chemical Industry (India) Pvt. Ltd.

- Evonik

- AFYREN

- Nanjing Chemical Material Corp.

- Yufeng International Group Co., Ltd.

- Jiangsu Dynamic Chemical Co., Ltd.

- Glentham Life Sciences Limited

- Central Drug House

Recent Developments

- In April 2021, Eastman Chemical Company announced the acquisition of 3F Feed & Food, a European company focusing on the commercial development of additives for human food and animal feed. With this acquisition, Eastman will boost the development of next-generation solutions and strengthen its ability to better serve its customers globally. This acquisition will also include the strategic expansion of its services and products.

Isobutyric Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 207.6 million

Revenue forecast in 2030

USD 294.4 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

OQ Chemicals GmbH; Eastman Chemical Company; Tokyo Chemical Industry (India) Pvt. Ltd.; Evonik; AFYREN; Nanjing Chemical Material Corp.; Yufeng International Group Co., Ltd.; Jiangsu Dynamic Chemical Co., Ltd.; Glentham Life Sciences Limited; Central Drug House

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isobutyric Acid Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global isobutyric acid market on the basis of type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic Isobutyric Acid

-

Renewable Isobutyric Acid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal Feed

-

Chemical Intermediates

-

Food & Flavors

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global isobutyric acid market was estimated at USD 182.4 million in 2023 and is expected to reach USD 194.4 million in 2024.

b. The global isobutyric acid market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 294.4 million by 2030.

b. Synthetic isobutyric acid dominated the market with a revenue share of 79.5% in 2023 and is further expected to grow at a significant rate over forecast period. The market growth is attributed to its high purity, consistent quality, and reliable supply.

b. Some prominent manufacturers in the isobutyric acid market include OQ Chemicals GmbH, Eastman Chemical Company, Tokyo Chemical Industry (India) Pvt. Ltd., Evonik, AFYREN, Nanjing Chemical Material Corp., Yufeng International Group Co., Ltd., Jiangsu Dynamic Chemical Co., Ltd., Glentham Life Sciences Limited, Central Drug House

b. The isobytyric acid market growth is attributed to its versatile applications across various industries. It is an important raw material in the manufacturing of fragrances, flavors, and various chemicals, including paints, plastics, and coatings. Moreover, its role as an intermediate in the synthesis of pharmaceuticals and agricultural chemicals is further expected to drive its demand over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.