- Home

- »

- Medical Devices

- »

-

Intraoral Cameras Market Size, Share & Growth Report, 2030GVR Report cover

![Intraoral Cameras Market Size, Share & Trends Report]()

Intraoral Cameras Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Intraoral Wand, Single Lens Reflex), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-391-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intraoral Cameras Market Summary

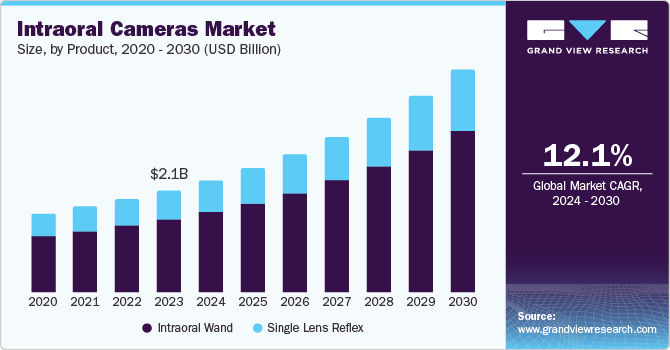

The global intraoral cameras market size was valued at over USD 2.10 billion in 2023 and is projected to reach USD 4.58 billion by 2030, growing at a CAGR of 12.1% from 2024 to 2030. The increasing prevalence of dental caries is anticipated to drive the market.

Key Market Trends & Insights

- North America intraoral camera market dominated and accounted for the largest revenue share of 36.2% in 2023.

- By product, the intraoral wand segment dominated the market for intraoral cameras and accounted for a revenue share of 71.7% in 2023.

- By technology, the fiber optic camera segment dominated the market for intraoral cameras and accounted for the largest revenue share of 37.1% in 2023.

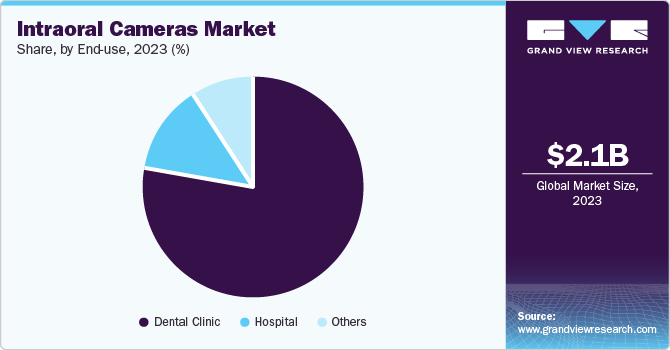

- By end-use, the dental clinics segment dominated the market for intraoral cameras and held the largest revenue share of 78.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.10 Billion

- 2030 Projected Market Size: USD 4.58 Billion

- CAGR (2024-2030): 12.1%

- North America: Largest market in 2023

Furthermore, technological advancements in dentistry are anticipated to further boost the market growth. The traditional intraoral cameras lacked versatility and were complex to operate.

In addition, the devices had a premium purchase price including these features. However, technological advancements in this field have led to the introduction of small and lightweight devices, which are easy to operate and relatively inexpensive (costing nearly USD 5,000). These benefits of technologically advanced devices are anticipated to boost the market growth.

The technology has pushed forward the functionality and image quality of intraoral cameras based on improvements in imaging and dental equipment. For instance, features such as real-time image sharing, wireless connectivity, and easy compatibility with electronic health records has further augmented their demand in dental practices globally. The increasing number of dental procedures, rising awareness, and demand for surgical services for dental care are fueling the market growth for intraoral cameras. In addition, favorable government initiatives regarding oral hygiene are a significant factor that is leading to the adoption of dental treatment.

As per The Centers for Disease Control and Prevention data, periodontal disease is largely prevalent in the U.S. Tooth decay and cavities are some of the most common causes of oral disease in adults and children worldwide. This is increasing the need for a routine oral checkup, thereby boosting market growth. The demand has grown substantially due to improved dental diagnostics and patient care. Increasing awareness and demand for advanced dental procedures have led to the adoption of intraoral cameras. These devices help dentists with precise diagnoses, and improved treatment planning resulting in an improved outcome and patient satisfaction.

Product Insights

The intraoral wand segment dominated the market for intraoral cameras and accounted for a revenue share of 71.7% in 2023. The intraoral wand has excellent visualization and clarity due to its ability to be used inside the mouth which makes it effective in reaching posterior areas of the mouth. The camera also has a high magnification capability due to its high-intensity light source. Owing to such factors, the intraoral wand segment accounted for the largest revenue share.

The single-lens reflex segment is anticipated to grow lucratively over the forecast period. The cost of a single-lens reflex is low and the product is economical. These cameras are used in various applications due to their high-quality images. Many dental photography professionals use digital single-lens reflexes to expand their camera work.

Technology Insights

The fiber optic camera segment dominated the market for intraoral cameras and accounted for the largest revenue share of 37.1% in 2023. The system delivers the highest image quality due to its high-end optical system.

The USB camera segment is expected to witness a steady CAGR over the forecast period for its features such as lightweight, in-built light source, portability, and connectivity. However, certain drawbacks of using a USB camera are the system’s compatibility with selected software programs, and the image quality may not be ideal for endo procedures.

End-use Insights

The dental clinics segment dominated the market for intraoral cameras and held the largest revenue share of 78.1% in 2023. Dental clinics are the major end-users of intraoral cameras. These clinics heavily rely on intraoral cameras as crucial tools for diagnosing and planning treatments for various dental procedures. Intraoral cameras allow dentists to capture precise and detailed images of patients' oral conditions, facilitating accurate diagnoses and effective communication with patients. The seamless integration into existing dental equipment and user-friendly design make intraoral cameras a highly desirable tool for dental clinics enabling a widespread use and dominance in the forecast period.

The hospitals segment is expected to witness a steady CAGR in the forecast period. In recent years, there has been a noticeable trend of hospitals integrating dental departments to offer comprehensive healthcare services. Now-a-days, dental health is becoming increasingly recognized as an important factor in overall well-being. Hospitals are continuously investing in advanced dental equipment, such as intraoral cameras to meet the increasing demand for specific dental care within their facilities.Intraoral cameras have revolutionized the dental and medical field by offering instant and accurate images, which speed up treatment decisions and promote teamwork between professionals. Moreover, these cameras exhibit the potential to enhance patient satisfaction and improve overall outcomes.

Regional Insights

North America intraoral camera market dominated and accounted for the largest revenue share of 36.2% in 2023. The high prevalence of oral diseases such as caries, gingivitis, and periodontics are some of the major factors contributing to the market growth in this region. In addition, an increase in technologically advanced healthcare infrastructure and a rise in the number of dental clinics in the developed regions of North America is expected to create growth opportunities for the market.

Europe Intraoral Cameras Market Trends

Europe intraoral cameras market is likely to account for a significant CAGR of 12.3% over the forecast period due to advancements in the technology of intraoral cameras and awareness among the population to adopt these technologies. The rise in periodontal diseases in the geriatric population propels the demand for intraoral cameras shortly. In addition, the Centers for Disease Control and Prevention, and the European Federation of Periodontology (EFP) drive the awareness programs for the general population.

Asia Pacific Intraoral Cameras Market Trends

Asia Pacific is expected to experience remarkable growth in the global intraoral cameras market attributed to the significant economic development, which has resulted in improved healthcare infrastructure and higher disposable incomes. Consequently, there is a growing demand for enhanced dental care in Asia Pacific. The rise in the aging population is majorly focused on preventive care is a key factor for market growth.

Key Intraoral Cameras Company Insights

Some key players in the market are Danaher, Dentsply Sirona, and Carestream Health among others. The key companies are focusing on strategic initiatives such as the introduction of novel products through customization according to consumers’ needs, partnerships, collaborations, and mergers and acquisitions to expand their product portfolio and extend leadership positions in the field of dental imaging. Moreover, the competition between key players is intense in the coming years as they focus more on geographical expansion, strategic collaborations, partnerships, and new product launches.

-

Dentsply Sirona is the manufacturer and distributor of a wide range of dental products and technologies. The company offers a diverse range of products including dental equipment, imaging systems, restorative materials, endodontic solutions, and orthodontic appliances. The company provides advanced imaging capabilities, enabling them to capture high-quality, detailed images of patients' oral cavities.

-

Dental Imaging Technologies Corporation is a manufacturer of innovative dental imaging solutions, primarily focused on the development and distribution of advanced intraoral cameras. The company offers cutting-edge imaging technologies, including high-resolution sensors, LED illumination, and user-friendly software interfaces.

Key Intraoral Cameras Companies:

The following are the leading companies in the intraoral cameras market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Dentsply Sirona

- Owandy Radiology

- Carestream Health

- TPC Advanced Technology Inc.

- Digital Doc LLC

- Dental Imaging Technologies Corporation.

- Prodent

Recent Developments

-

In May 2024, Danaher, a global science and technology innovator launched a collaboration with Johns Hopkins University aiming to develop new methods for diagnosing mild TBI.

Intraoral CamerasMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.30 billion

Revenue forecast in 2030

USD 4.58 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; India; South Korea; Australia; South Korea; Thailand; Brazil; Mexico; UAE; South Africa

Key companies profiled

Medtronic; Fresenius SE & Co KGaA; Getinge AB; Terumo Medical Corporation; MicroPort Scientific Corporation; Nipro Medical Corporation; Kewei Medical; Braile Biomedica; Livanova Plc; Chalice Medical Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intraoral Cameras Market Report Segmentation

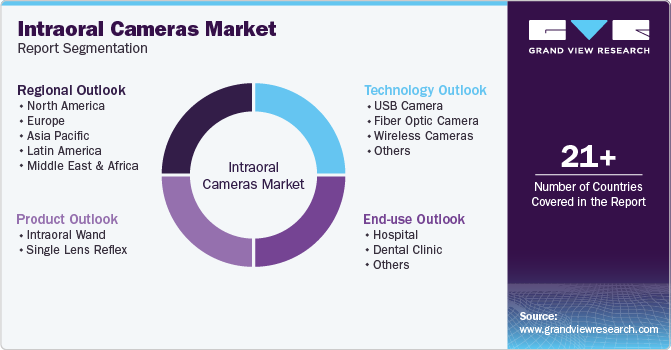

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global intraoral cameras market report on the basis of product, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Intraoral Wand

-

Single Lens Reflex

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

USB Camera

-

Fiber Optic Camera

-

Wireless Cameras

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Dental Clinic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.