- Home

- »

- Automotive & Transportation

- »

-

Internal Combustion Engine Market Size, Share Report, 2030GVR Report cover

![Internal Combustion Engine Market Size, Share & Trends Report]()

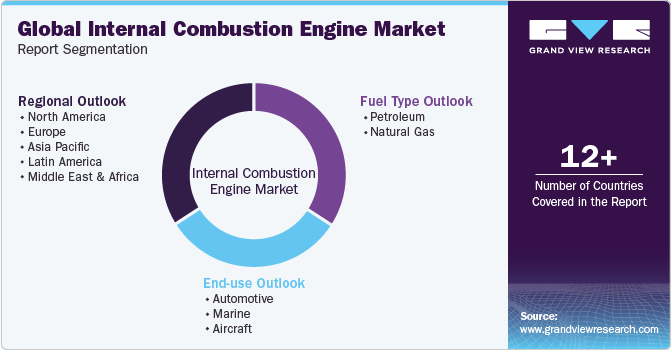

Internal Combustion Engine Market (2023 - 2030) Size, Share & Trends Analysis Report By Fuel Type (Petroleum, Natural Gas), By End-use (Automotive, Marine, Aircraft), By Region, And Segment Forecasts

- Report ID: 978-1-68038-591-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Internal Combustion Engine Market Summary

The global internal combustion engine market size was estimated at USD 181,836 thousand units in 2022 and is projected to reach USD 366,726 thousand units by 2030, growing at a CAGR of 9.2% from 2023 to 2030. The market has witnessed tremendous growth and is expected to expand further, owing to a rise in demand for passenger and commercial vehicles in developed and emerging countries.

Key Market Trends & Insights

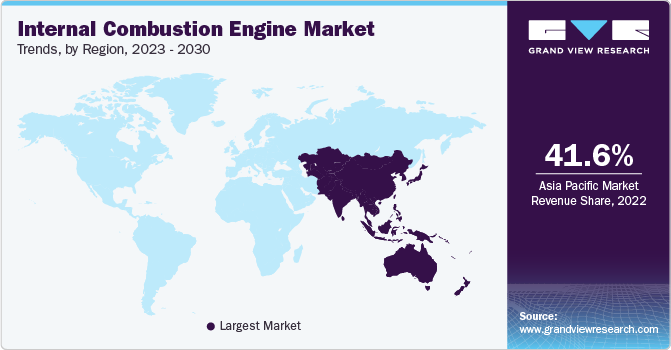

- Asia Pacific dominated the market and accounted for the largest volume share of 41.6% in 2022.

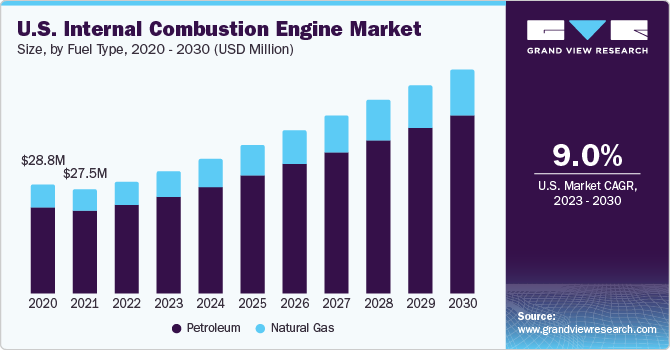

- North America is expected to expand at a CAGR of 8.9% during the forecast period.

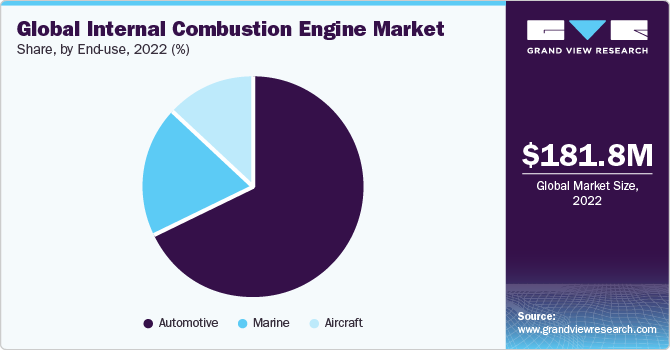

- By end-use, the automotive segment accounted for the largest volume share of 68.1% in 2022.

- By euel type, the petroleum segment accounted for the dominant share of 81.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 181,836 Thousand Units

- 2030 Projected Market Size: USD 366,726 Thousand Units

- CAGR (2023-2030): 9.2%

- Asia Pacific: Largest market in 2022

Electric powertrains are increasingly combined with internal combustion engines (ICE) to improve vehicle fuel economy, a key factor driving the market's growth. The product demand is increasing across agriculture, construction, mining, and power generation industries. A lack of EV infrastructure availability globally is also responsible for the uptake of the ICE market. Also, the rising popularity of vehicles using gasoline and growing shale gas production are other factors driving market growth.

Strict laws and criteria for efficient technologies are expected to boost the ICE market. For instance, the Indian government has made flex-fuel engine manufacturing mandatory for vehicle manufacturers, thus prompting them to increase the manufacturing of ICE. Moreover, the current absence of a strong EV infrastructure and charging stations might lead to the industry's steady rise in the forecast period.

The emergence of the COVID-19 pandemic had a negative impact on the manufacturing of industrial engines and other equipment. As the virus spread worldwide, several countries went into lockdown, leading to the closure of the manufacturing industry. It also led to a disruption in the supply chain of raw materials and essentials for engine manufacturing. Several engine manufacturers reported a revenue and demand decline throughout this period. From 2020 through mid-2021, the pandemic caused noticeable market disruption.

As governments worldwide gradually withdrew different containment measures to stimulate the economy, the energy and power industry started picking up quickly. Internal combustion engines took a lift in the second half of 2021, positively impacting industrial equipment manufacturing, including that of internal combustion engines. Strict government mandates regarding CO2 emissions have provided a solution to the manufacturers. During the forecast period, they are expected to offer lucrative opportunities for global market advancement.

IC engine demand has gained traction throughout many years. However, factors such as the increasing price of crude oil, stringent emission norms, fuel supply security, and noise pollution have compelled OEMs to shift their focus toward natural gas and hydrogen-based engines. For instance, in April 2021, Toyota announced that it is developing a hydrogen-fueled combustion engine that will be used in sports vehicles with the aim to create a thriving and sustainable mobility society.

Similarly, Cummins Inc. has introduced a new natural gas heavy-duty powertrain. The ISX12N near-zero natural gas engine and the Endurant HD N 12-speed automated transmission from Eaton Cummins Automated Transmission Technologies are well suited for haul-fleet that regionally carry heavy-duty cargo. This development aims to reduce emissions and improve the company's sustainability profile.

Technological advancements bring evolution to the internal combustion engine design, allowing it to provide more power while using less fuel. Meanwhile, engines will continue to play an essential role in the automotive industry's evolution. Also, they could improve in areas such as thermal efficiency, emissions, and electrification. Introducing the new concept of low-temperature combustion (LTC) is a cutting-edge idea for internal combustion engines that has recently gotten much attention.

The LTC technology has significant advantages, such as decreasing nitrogen oxides (NOx) and particulate matter (PM) and reducing specific fuel usage. However, controlling ignition time and heat release rate (HRR) are major obstacles to overcome before LTC technology can be widely adopted in vehicle engines. Also, internal combustion engines are no longer the only choice for vehicle power trains due to the development of alternative energy and hybrid vehicle technologies. Moreover, the rising adoption of EVs and the increasing shortage of fossil fuel reserves resulting in higher petroleum product costs are major factors restraining market growth.

Furthermore, regulatory presence in the market for internal combustion engines due to their environmental effects and increasing fuel consumption regulations has raised technological costs and posed a serious challenge to the thermal efficiency of ICEs. Therefore, all of the above are restraining factors and will further challenge the internal combustion engine market growth during the forecast period.

End-use Insights

The automotive segment accounted for the largest volume share of 68.1% in 2022 and is expected to expand at the fastest CAGR of 9.4% over the forecast period. This expansion is linked to rising consumer disposable income levels, which have increased car usage worldwide. Automotive manufacturers are focused on developing efficient internal combustion engines that offer high returns on manufacturing investments. Furthermore, technological advancements that increase IC engine fuel economy, emissions, and performance are expected to propel market growth during the forecast period.

The aircraft segment is expected to witness a significant CAGR of 8.5% over the forecast period. This segment is primarily driven by the commercial aviation industry's favorable market dynamics. Aircraft used for tourism, logistics, and defense require high-performing ICE, as it has higher torque. This internal combustion engine application in various industries is expected to encourage market growth. Furthermore, technical developments such as multi-fuel capability, which increases fuel mileage, will boost demand for the segment.

Fuel Type Insights

The petroleum segment accounted for the dominant share of 81.6% in 2022 and is expected to expand at the fastest CAGR of 9.2% over the forecast period due to the advantages of petroleum internal combustion engines, such as less vibration and noise. Moreover, technological advancements in the automotive industry are expected to increase revenue flow for the segment. This growth can be attributed to the benefits of gasoline engines, such as being efficient, cheaper, lightweight, and reducing emissions.

Although they have abundant availability and cost advantages, the natural gas segment has a lower market share. Compared to petroleum, the fuel type will take years to gain broad adoption because diesel and gasoline are used in most cars. Meanwhile, the demand for natural gas is expected to rise steadily in the foreseeable future as it is the cleanest burning of all hydrocarbons that helps reduce carbon emissions. Additionally, LNG is used as an alternative to diesel and heavy fuel oil in transport due to its low carbon emission levels.

The natural gas segment is expected to witness a significant CAGR of 9.0% over the forecast period. Natural gas is often more cost effective than traditional fossil fuels. Natural gas prices have been relatively stable or lower in some regions than gasoline or diesel in recent years. This cost advantage can make natural gas an attractive option for vehicle fleet operators and businesses with large transportation needs.

Regional Insights

Asia Pacific dominated the market and accounted for the largest volume share of 41.6% in 2022 and is expected to expand at the fastest CAGR of 9.6% over the forecast period. The primary factors driving regional market growth are the presence of several automotive manufacturers and increased demand for passenger automobiles in some of the region's major countries, such as India and China.

Furthermore, the lack of electric vehicle charging infrastructure and the expensive cost of electric motors in the region support market growth. Using natural gas in ICE due to low emission is also aimed at making ICE a viable alternative to EVs. The aviation industry in the Asia Pacific is also booming, giving the aviation engines segment opportunities to expand during the forecast period.

North America is expected to expand at a CAGR of 8.9% during the forecast period due to the high rate of automobile adoption in the region. North America is home to major automobile manufacturers such as General Motors Company and Ford Motor Corporation. Car makers are constantly redefining the design and size of the ICE to make it lightweight and smaller, as well as more efficient in performance. Such technological iterations are positively driving market growth. Europe is expected to progress in the market for internal combustion engines due to stringent government laws relating to CO2 emissions and an increasing emphasis on the usage of electric cars in the region.

Key Companies & Market Share Insights

The primary competitive strategies of manufacturing companies include the launch of new products, expansion of regional presence, and pricing. For instance, in May 2022, Renault introduced a new SUV concept with a hydrogen-powered powertrain. This SUV design includes an internal combustion engine that runs on hydrogen rather than fossil fuels like gasoline and diesel. Market suppliers have used innovative strategies such as acquisitions, collaborations, and partnerships to gain a competitive edge in the market. For instance, in June 2021, Audi publicized its plans to unveil a final combustion-engine car equipped with an IC engine in 2026.

Key Internal Combustion Engine Companies:

- AB Volvo

- TOYOTA MOTOR CORPORATION

- Volkswagen Group

- Rolls-Royce plc

- Mahindra & Mahindra Ltd.

- Renault Group

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- MAN

- General Motors

- Ford Motor Company

- FCA US LLC

- Robert Bosch GmbH

- AGCO Corporation

- Caterpillar

- Shanghai Diesel Engine Co., Ltd.

Recent Developments

-

In June 2023, General Motors unveiled its plans to allocate a substantial investment of USD 632 million towards upgrading its Fort Wayne Assembly facility in Indiana. The investment aims to equip the plant to produce the next generation of full-sized ICE trucks. This strategic initiative highlights the company’s dedication to enhancing manufacturing capabilities and addressing the evolving needs of the automotive industry

-

In April 2023, Mercedes introduced its final new combustion engine model, unveiling its sixth-generation E-Class. The vehicle would be manufactured in Germany and China and will hit the European market in the third quarter of 2023. While subsequent iterations of the E-Class will be constructed on a newly designed platform optimized for electric vehicles, the current generation will already offer hybrid options alongside traditional internal combustion engines

-

In March 2023, Rolls-Royce Power Systems unveiled its ambition to craft a high-speed internal combustion engine prototype designed for maritime vessels. This innovative engine design is geared towards running on eco-friendly methanol, thus facilitating carbon dioxide-neutral operations. The collaborative venture, codenamed "MeOHmare," has brought together the expertise of Rolls-Royce, Woodward L'Orange, and WTZ Roßlau, with their collaborative efforts dating back to early 2023

-

In March 2023, JCB Power Systems Ltd. unveiled an impressive hydrogen combustion engine, based on combustion technology that provides a cost-effective and environment-friendly alternative, with zero CO2 emissions at the point of use. The hydrogen-powered engine by JCB offers several advantages over traditional diesel or gasoline options. The engine utilizes hydrogen fuel during operation, producing only steam without CO2 emissions. Moreover, JCB's hydrogen prototype backhoe loader can perform all the functions of its diesel-powered counterpart

-

In September 2022, Anglo Belgian Corporation NV, a Belgium-based company specializing in the development and production of medium-sized engines, completed the acquisition of E Van Wingen. By joining forces through this acquisition, Anglo aims to leverage both their combined efforts and capabilities to contribute to the ongoing energy transition

-

In April 2022, Cummins Inc. completed the acquisition of Jacobs Vehicle Systems (JVS) from Altra Industrial Motion Corp. This strategic acquisition enables Cummins to leverage JVS's cutting-edge technologies, creating promising avenues for growth in their existing and upcoming advanced engine platforms. Furthermore, the integration of JVS into Cummins' portfolio ensures the availability of crucial USMCA-qualified engine components for current and aftermarket products, while expanding the range of offerings to customers worldwide

-

In April 2021, Toyota Motor Corporation revealed its commitment to realizing a carbon-neutral mobility society by announcing the development of a hydrogen engine. As part of this initiative, Toyota installed the hydrogen engine on a racing vehicle based on the company’s Corolla Sport model. This endeavor signifies Toyota's dedication to advancing alternative energy solutions and exploring the potential of hydrogen-powered engines in achieving sustainable transportation

Internal Combustion Engine Market Report Scope

Report Attribute

Details

Market volume size in 2023

198,637 thousand units

Volume forecast in 2030

366,726 thousand units

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in thousand units and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fuel type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AB Volvo; Toyota Motor Corporation; Volkswagen Group; Rolls-Royce plc; Mahindra & Mahindra Ltd.; Renault Group; Mitsubishi Heavy Industries, Ltd.; MAN; General Motors; Ford Motor Company; FCA US LLC; Robert Bosch GmbH; AGCO Corporation; Caterpillar; Shanghai Diesel Engine Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internal Combustion Engine Market Report Segmentation

This report forecasts volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global internal combustion engine market report on the basis of fuel type, end-use, and region:

-

Fuel Type Outlook (Volume, Thousand Units, 2017 - 2030)

-

Petroleum

-

Natural Gas

-

-

End-use Outlook (Volume, Thousand Units, 2017 - 2030)

-

Automotive

-

Marine

-

Aircraft

-

-

Regional Outlook (Volume, Thousand Units, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global internal combustion engine market demand was estimated at 181,835.6 thousand units in 2022 and is expected to reach 198,637.0 thousand units in 2023.

b. The global internal combustion engine market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach 366,726.0 thousand units by 2030.

b. Automotive segment dominated the internal combustion engine market with a share of 68.1% in 2022. This is attributable to rising consumer disposable income, resulting in increased sales of vehicles worldwide.

b. Some key players operating in the internal combustion engine market include Volvo AB, Toyota Motor Corporation, Volkswagen AG, Rolls-Royce Holdings plc, Mahindra & Mahindra Limited, Renault SA, Mitsubishi Heavy Industries, MAN SE, General Motors, Ford Motor, Fiat SpA, Caterpillar Incorporated, Shanghai Diesel Engine Company Limited, Bosch, and AGCO Corporation.

b. Key factors that are driving the internal combustion engine market growth include the introduction of advanced innovative variants such as low-temperature combustion engines and hybrid engine systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.