- Home

- »

- Communications Infrastructure

- »

-

Integrated Systems Market Size And Share Report, 2030GVR Report cover

![Integrated Systems Market Size, Share & Trends Report]()

Integrated Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Integrated Platform/Workload Systems, Integrated Infrastructure Systems), By Service, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-427-7

- Number of Report Pages: 132

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Integrated Systems Market Size & Trends

The global integrated systems market size was valued at USD 26.46 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.4% from 2023 to 2030. Major networking, storage, management, and systems purveyors are foreseen to have a huge stake in the market as consumers progressively demand abridged deployments and fewer standalone solutions. Integrated systems demand huge investments in technology, channel partnerships, service delivery, and integration. The market is also foreseen to grow considerably as consumers trade single module performance for integrated service delivery, trending a phase change in data center infrastructure.

The IT sector is evolving and has rapidly shifted from traditional silos. Over the last few years, the industry has experienced the emergence of integrated systems, wherein data center technologies are melded into pre-engineered and tested systems to operate as a whole. The underlying rationales for the aforementioned trend include reducing Total Cost of Ownership (TCO), lowering risk, and improving profitability. IT executives are increasingly considering integrated systems as an efficient way to enhance business agility. IT organizations focus on integrated systems adoption to support on-demand IT infrastructure and increase IT staff productivity and operational efficiency, which is expected to accelerate the market growth over the forecast period. Further, the benefits associated with integrated systems help end-users better respond to customer demands and tap several market growth opportunities effectively.

Product Insights

Based on product, the market is segmented into integrated platform/workload systems and integrated infrastructure systems. The integrated platform/workload systems segment accounted for the largest revenue share of around 53.3% in 2022. Integrated platforms are sold with additional pre-integrated customized system engineering and packaged software optimized to enable functions such as storage, application development, testing, and integration tools such as application development software, databases, testing, and integration tools. In contrast, integrated infrastructure encompasses storage, server, and network integrated to provide shared computer infrastructure.

The integrated infrastructure systems segment is estimated to register the fastest CAGR of 17.6% over the forecast period. The rise of autonomous driving technologies has also contributed to the growth of the safety segment in the market for integrated systems. Autonomous vehicles have many sensors and connectivity capabilities, enabling them to gather real-time data and make proactive decisions to avoid accidents. Furthermore, there is a growing concern for road safety and a need to reduce accidents and fatalities. Governments and regulatory bodies promote adopting integrated systems technologies to enhance road safety.

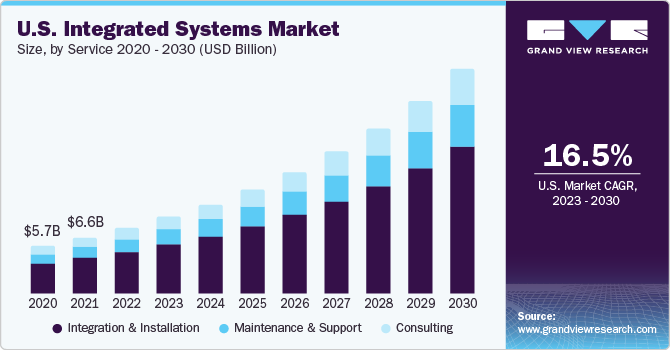

Service Insights

Based on service, the market is segmented into integration & installation, consulting, and maintenance & support. The integration & installation segment accounted for the largest revenue share of around 63.7% in 2022 and is estimated to register the fastest CAGR of 18.9% over the forecast period. Installation and integration services include implementation and begin with breaking down organizational silos, including servers, storage facilities, and networking that can be easily melded with the existing infrastructure to optimize enterprise IT performance. The segment is expected to witness high growth over the next few years, which may be attributed to high demand across several small, medium, and large-scale enterprises.

The consulting segment is estimated to grow significantly over the forecast period. Consulting services include understanding user requirements and provisioning a plan to build and operate integrated systems catering to several IT needs of an organization. Maintenance and support services include after-sales services and annual or preventive maintenance contracts. Maintenance and support tasks help enterprises free their staff to focus on core organizational competencies and innovate. It is expected to fuel the integrated systems market demand over the forecast period.

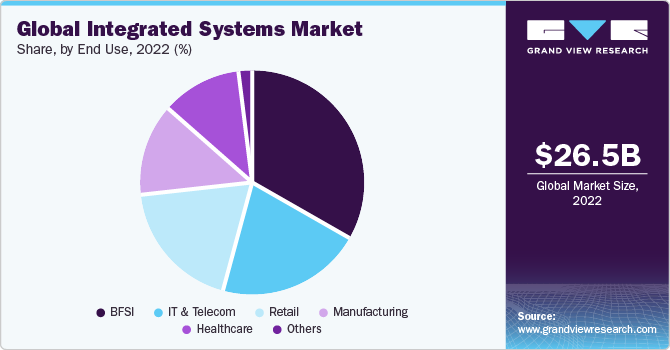

End Use Insights

Based on end use, the market is segmented into BFSI, IT & telecom, retail, manufacturing, healthcare, and others. The BFSI segment accounted for the largest revenue share of around 33.4% in 2022 and is estimated to register the fastest CAGR of 20.5% over the forecast period. The growing trend of mobile banking and digital transactions has significantly increased the demand for integrated systems within the BFSI sector. Financial institutions are adopting mobile banking applications and online platforms to provide convenient and accessible customer services. Integrated systems support these digital channels by seamlessly integrating backend systems, ensuring smooth transaction processing, and enabling real-time account information updates.

The healthcare segment is estimated to grow significantly over the forecast period. The growing need for data security and privacy in the healthcare industry drives market growth. Integrated systems offer advanced security features and compliance measures to safeguard sensitive patient information. With the rising number of cyber threats and stringent data protection regulations, healthcare organizations are increasingly adopting integrated systems to ensure patient data's confidentiality, integrity, and availability.

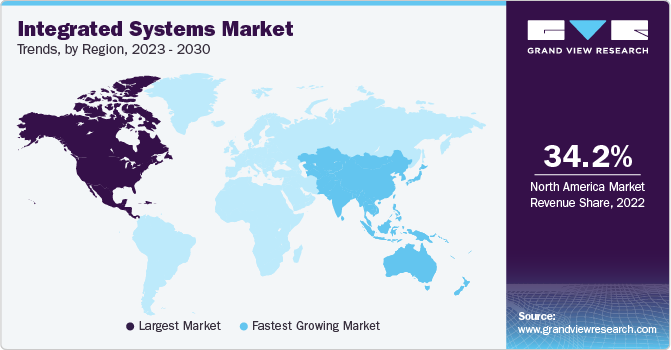

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.2% in 2022, owing to technological advancements and high market penetration of integrated systems. Further, the presence of Facebook and Amazon, which have successfully deployed integrated systems architecture, may also drive the regional market for integrated systems demand over the forecast period.

Asia Pacific is expected to register the highest CAGR of 22.7% over the forecast period. This may be primarily attributed to this region's data center transformation projects and rapid IT infrastructure development. In light of the gradual improvement seen across major economies globally over the last few years, buyer confidence in deploying integrated systems initiatives is expected to exhibit considerable demand, however, with much less zeal.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in April 2023, Microsoft partnered with Epic Systems Corporation to develop and incorporate generative AI technology into the healthcare sector. This collaboration leverages the extensive capabilities of Azure OpenAI Service1 and Epic's renowned electronic health record (EHR) software. By expanding their longstanding partnership, both companies enable organizations to utilize Epic environments on the Microsoft Azure cloud platform. The following are some of the major participants in the global integrated systems market:

-

Accenture

-

Capgemini

-

Cisco Systems, Inc.

-

CSC

-

Deloitte

-

EMC

-

Fujitsu

-

Hitachi, Ltd.

-

HP Development Company, L.P.

-

Huawei Technologies Co., Ltd.

-

IBM Corporation

-

Oracle

-

VCE

Recent Developments

-

In May 2023, Arrive collaborated with HEI Integrated Systems to accelerate the progress of "smart anywhere" technologies that can be applied in various locations worldwide, including diverse environments. This collaboration combined Arrive's advanced smart Mobility-as-a-Service (MaaS) solutions with HEI’s Integrated Systems expertise in integrated and versatile infrastructure technology and solutions. By leveraging the strengths of both companies, this partnership aims to shape and innovate sustainable smart city technologies.

-

In May 2023, Wise Systems, Inc. and IntelliShift announced a new collaboration and integrated solution to offer customers a comprehensive fleet intelligence solution. Customers access a highly accurate and dependable fleet intelligence platform by leveraging the capabilities of Wise Systems' delivery automation platform and IntelliShift's telematics data. This integration empowers businesses to have real-time visibility of their assets in the field, ensuring optimal safety and efficiency while streamlining delivery operations for drivers. The partnership between Wise Systems and IntelliShift simplifies and expands the range of solutions available for this essential business function, creating a more interconnected network.

-

In February 2023, Gradiant announced the acquisition of water treatment company, Advanced Watertek. This strategic move aims to enhance Gradiant's manufacturing capabilities for their specialized and comprehensive systems at the forefront of industrial water and wastewater treatment. These systems cater to various solutions such as desalination, water reuse, minimum, zero liquid discharge, and resource recovery. Furthermore, the acquisition is expected to boost the implementation of Gradiant's complete range of technologies and end-to-end solutions for clients based in the Middle East.

-

In January 2023, Style3D announced the acquisition of Assyst, a strategic move that will grant Style3D a significant presence in the fashion technology market in Europe. This acquisition allows Style3D to expand its range of 2D and 3D CAD-integration systems, positioning itself as a leading solution provider that offers fashion companies a comprehensive and seamless 3D-centric system. By doing so, Style3D aims to streamline the development process, reducing time-to-market and improving product efficiency, ultimately reducing cost and decreasing waste for companies in the fashion industry.

-

In November 2022, Ventev, a TESSCO Technologies, Inc. division, launched the Aruba Integrated Systems. It combines Ventev's advanced UPS power system with Aruba's full-Gigabit, fixed, and secure industrial switching platform. This integrated system supports IoT and other data requirements and has a NEMA 3R rating. It provides 480W of power to the 240W in UPS/DC and CX4100i in standard AC mode. The system can be remotely configured, eliminating the need for an engineer to be present on-site for configuration. Additionally, it includes a dry contact alarm I/O, which enables easy connection to external equipment using a two-wire interface.

Integrated Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.32 billion

Revenue forecast in 2030

USD 101.86 billion

Growth rate

CAGR of 18.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

Accenture; Capgemini; Cisco Systems, Inc.; CSC; Deloitte; EMC; Fujitsu; Hitachi; Ltd.; HP Development Company; L.P.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

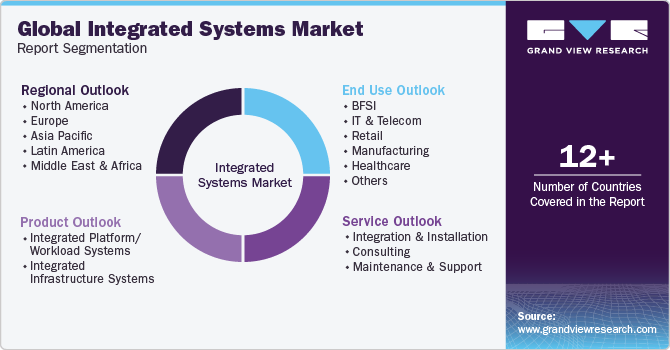

Global Integrated Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global integrated systems market based on product, service, end use, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Integrated Platform/Workload Systems

-

Integrated Infrastructure Systems

-

-

Service Outlook (Revenue in USD Million, 2017 - 2030)

-

Integration & Installation

-

Consulting

-

Maintenance & Support

-

-

End Use Outlook (Revenue in USD Million, 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Retail

-

Manufacturing

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global integrated systems market size was estimated at USD 26.46 billion in 2022 and is expected to reach USD 31.32 billion in 2023.

b. The global integrated systems market is expected to grow at a compound annual growth rate of 18.4% from 2023 to 2030 to reach USD 101.86 billion by 2030.

b. North America region dominated the integrated systems market with a share of over 34% in 2022. This is attributable to technological advancements and improving market penetration, especially with tech giants like Facebook and Amazon deploying integrated system architecture in the region.

b. Some key players operating in the integrated systems market include Accenture plc, Dell EMC, Fujitsu Ltd., Oracle Corporation, IBM Corporation, Cisco Systems, and Hitachi, Ltd.

b. Key factors that are driving the integrated systems market growth include technological advances leading to the introduction and adoption of technologies including Big Data, cloud computing, and IoT across multiple industry verticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.