- Home

- »

- Green Building Materials

- »

-

Insulated Concrete Form Market Size, Industry Report, 2030GVR Report cover

![Insulated Concrete Form Market Size, Share & Trends Report]()

Insulated Concrete Form Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polystyrene Foam, Polyurethane Foam), By Application (Residential, Non-residential), By Region (North America, Asia Pacific, Europe, CSA, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-447-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulated Concrete Form Market Summary

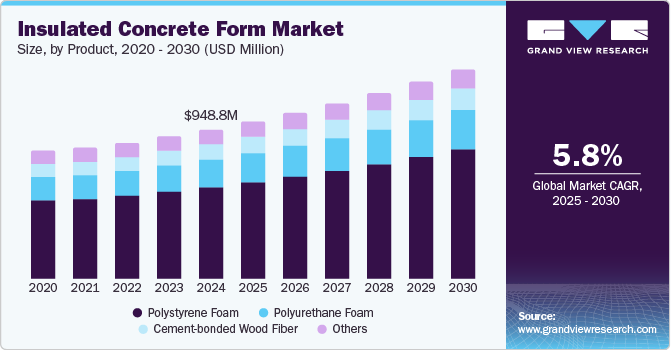

The global insulated concrete form market size was estimated at USD 948.8 million in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030, driven by the rising demand for energy-efficient and sustainable construction solutions. With increasing awareness of environmental sustainability and stringent building energy regulations, insulated concrete form (ICF) systems are gaining traction as they provide superior thermal insulation, reducing heating and cooling costs in residential and commercial structures.

Key Market Trends & Insights

- North America insulated concrete form market dominated the global market and accounted for the largest revenue share of about 36.6% in 2024.

- By product, the polystyrene foam segment led the market and accounted for the largest revenue share of 61.1% in 2024.

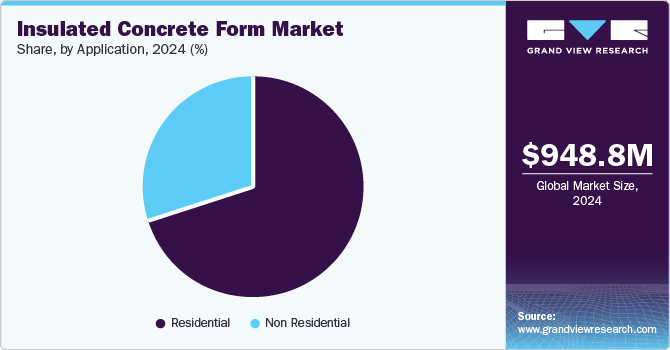

- By application, the residential segment dominated the market and accounted for the largest revenue share of 70.0% in 2024.

Market Size & Forecast

- 2022 Market Size: USD 948.8 Million

- 2030 Projected Market Size: USD 1,326.6 Million

- CAGR (2025-2030): 5.8%

- North America: Largest market in 2024

Additionally, government initiatives promoting green building certifications, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), have further fueled the adoption of ICFs in modern construction projects.

The rising demand for residential construction is also contributing to market expansion, particularly in North America and Europe, where energy-efficient homes are becoming a priority. ICFs offer soundproofing, fire resistance, and improved indoor air quality, making them highly attractive for housing developments. Additionally, with growing urbanization and infrastructure development in emerging economies, governments, and private sector, investors are incorporating ICFs into large-scale housing and commercial projects to enhance efficiency and sustainability.

Another key factor driving market growth is ICFs' superior durability and structural strength, making them an ideal choice for disaster-resistant buildings. Regions prone to extreme weather conditions, such as hurricanes, earthquakes, and wildfires, are increasingly adopting ICF technology due to its high impact resistance and enhanced safety features. The long lifespan and reduced maintenance costs of ICF structures compared to traditional building materials make them a cost-effective option for developers and homeowners.

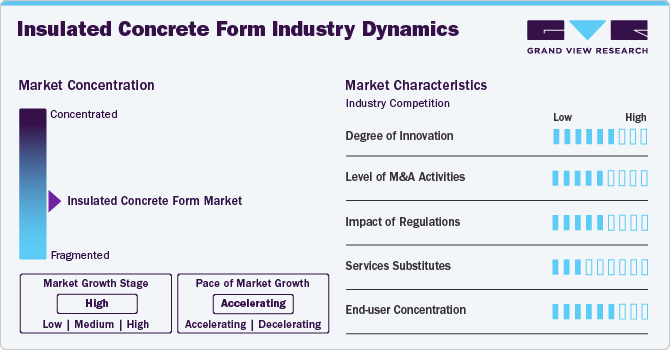

Market Concentration & Characteristics

The Insulated Concrete Form (ICF) Market exhibits a moderate to high market concentration, with a few dominant players driving innovation and technological advancements. The industry is characterized by a high degree of innovation, as manufacturers continuously enhance product performance by integrating advanced insulation materials, fire-resistant additives, and improved interlocking designs. The adoption of smart building technologies and energy-efficient construction practices has further encouraged research and development in the sector. Additionally, advancements in recycled and sustainable materials for ICF production are gaining traction, aligning with global sustainability initiatives and green building standards.

Regulatory frameworks play a crucial role in shaping the ICF market, as building codes and energy-efficiency regulations increasingly favor materials that offer superior insulation and structural durability. Government incentives and certifications, such as LEED (Leadership in Energy and Environmental Design) and Net Zero Energy Building (NZEB) standards, have accelerated the adoption of ICF in both residential and commercial construction. However, service substitutes, such as traditional concrete block construction and precast panels, pose competition, particularly in regions where conventional methods remain cost-effective. Despite this, the end-user concentration remains strong in sectors prioritizing energy efficiency, disaster resilience, and long-term cost savings, including residential housing, commercial buildings, and infrastructure projects in disaster-prone areas.

Product Insights

The polystyrene foam segment led the market and accounted for the largest revenue share of 61.1% in 2024, driven by its superior insulation properties, durability, and lightweight structure. Polystyrene foam, particularly expanded polystyrene (EPS) and extruded polystyrene (XPS), is widely used in residential, commercial, and industrial construction ICF systems. The material’s high thermal resistance (R-value) significantly enhances energy efficiency, reducing heating and cooling costs in buildings. As energy regulations become stricter, builders and developers are increasingly adopting polystyrene foam-based ICFs to meet green building certifications such as LEED and BREEAM.

The polyurethane foam segment is expected to grow at the fastest CAGR of 6.1% over the forecast period.Polyurethane foam offers excellent thermal resistance (R-value), reducing heat transfer and enhancing energy efficiency in buildings. As governments worldwide implement stricter energy efficiency regulations and green building standards, the adoption of polyurethane foam-based ICFs has increased.

Application Insights

The residential segment dominated the market and accounted for the largest revenue share of 70.0% in 2024, driven by the increasing need for disaster-resistant housing, particularly in regions prone to hurricanes, wildfires, and earthquakes. ICF structures provide high impact resistance, superior fire protection, and enhanced structural integrity, making them an ideal choice for residential buildings in disaster-prone areas. Additionally, the long lifespan and minimal maintenance requirements of ICF homes make them cost-effective in the long run, further encouraging homeowners and developers to adopt this technology.

Commercial segment is expected to grow significantly at CAGR of 5.3% over the forecast period. The rise in sustainable and eco-friendly housing trends has played an important role in expanding the commercial ICF market. As consumers become more environmentally conscious, they seek materials that reduce carbon footprints and enhance indoor air quality. ICF structures use recyclable materials and minimize construction waste, aligning with global sustainability goals. Additionally, the long-term cost savings associated with lower maintenance and energy expenses make ICF an attractive choice for residential developers and homeowners.

Regional Insights

North America insulated concrete form market dominated the global market and accounted for the largest revenue share of about 36.6% in 2024, driven by the rising demand for energy-efficient and sustainable construction materials. With increasing awareness of green building practices and stringent energy regulations, builders and developers are turning to ICF for its superior thermal insulation, durability, and environmental benefits. ICF structures provide enhanced energy efficiency by reducing heating and cooling costs, making them an ideal choice for residential, commercial, and institutional buildings. The adoption of net-zero energy buildings (NZEBs) and Leadership in Energy and Environmental Design (LEED-certified) projects in the U.S. and Canada further supports market expansion.

U.S. Insulated Concrete Form Market Trends

The rising labor shortages and increasing construction costs in the U.S. have increased the demand for ICF systems, as they offer ease of installation and reduced labor requirements compared to traditional wood-frame construction. With the construction industry facing a shortage of skilled workers, developers are turning to pre-assembled and modular building systems that streamline the construction process. ICF structures require fewer materials and labor hours, making them an attractive option for both small-scale and large-scale construction projects. Furthermore, advancements in ICF block design and construction techniques have improved their adaptability for a wide range of architectural styles and building applications.

Asia Pacific Insulated Concrete Form Market Trends

The Asia-Pacific (APAC) Insulated Concrete Form (ICF) Market is experiencing significant growth, driven by the region’s rapid urbanization and increasing demand for energy-efficient construction solutions. The rising population and the expansion of metropolitan areas in countries such as China, India, Japan, and Australia have led to increased investments in residential and commercial infrastructure. Governments across the region are emphasizing sustainable construction practices, promoting the adoption of ICF systems due to their superior thermal insulation, durability, and structural strength. The growing need for disaster-resistant buildings, particularly in earthquake-prone and typhoon-affected regions, has further fueled the demand for ICF, as it offers enhanced resilience compared to traditional construction methods.

The Insulated Concrete Form (ICF) Market in China is experiencing significant growth, driven by rapid urbanization and increasing demand for energy-efficient construction materials. As China continues its large-scale infrastructure development, the need for durable and thermally efficient building solutions has intensified. ICFs, which offer superior insulation, structural strength, and reduced construction time, have become an attractive alternative to traditional building methods. The country’s push toward green building standards, such as China’s Three-Star Rating System for Green Buildings, has further encouraged the adoption of ICFs in residential and commercial projects.

Europe Insulated Concrete Form Market Trends

The Europe Insulated Concrete Form (ICF) market is driven by the increasing demand for energy-efficient and sustainable construction solutions. With the European Union’s strict energy regulations, such as the Energy Performance of Buildings Directive (EPBD) and Nearly Zero Energy Buildings (NZEB) standards, builders and developers are actively seeking high-performance insulation materials. ICF systems, known for their superior thermal efficiency and airtightness, align with these regulations by reducing heating and cooling costs while enhancing overall building sustainability. Additionally, rising environmental awareness and the push for low-carbon construction have further accelerated the adoption of ICF technology across residential, commercial, and institutional sectors.

Germany insulated concrete form market is growing due toongoing urbanization and housing shortages. With major cities such as Berlin, Munich, and Hamburg witnessing a surge in residential and mixed-use development projects, there is a rising need for cost-effective and quick-to-assemble building solutions. ICF technology allows for faster construction times compared to traditional methods, enabling developers to meet housing demands efficiently while maintaining high energy performance standards. Additionally, the advancements in ICF manufacturing and design have led to increased adoption across Germany’s construction sector. Innovations such as pre-insulated wall panels, reinforced formwork, and integrated smart building technologies make ICF an attractive solution for architects and builders aiming for modern, sustainable, and low-maintenance structures.

Central & South America Insulated Concrete Form Market Trends

The insulated concrete form (ICF) market in the Central & South America is witnessing steady growth, driven by the increasing demand for energy-efficient and sustainable construction materials. As governments and developers prioritize eco-friendly building solutions, ICFs have gained popularity due to their superior thermal insulation, reduced energy consumption, and lower carbon footprint. Countries such as Brazil, Mexico, and Argentina are promoting green building initiatives, encouraging the adoption of advanced construction technologies. Additionally, the rise in extreme weather conditions, including hurricanes and high temperatures, has increased the demand for durable and disaster-resistant structures, making ICFs a preferred choice for residential and commercial projects.

Middle East & Africa Insulated Concrete Form Market Trends

The rising demand for disaster-resilient and durable buildings is another crucial factor driving the market. The MEA region is prone to harsh environmental conditions, including extreme heat, sandstorms, and, in some areas, seismic activity. ICF structures provide high durability, impact resistance, and superior fire protection, making them ideal for long-term construction investments. The ability of ICF to enhance structural integrity while reducing maintenance costs has made it a preferred choice for both private and public sector projects.

Key Insulated Concrete Form Company Insights

Some of the key players operating in market Airlite Plastics Company, Amvic Inc.

-

Airlite Plastics Company is a manufacturer of high-performance building materials, specializing in insulated concrete forms (ICFs) and sustainable construction solutions. With a strong commitment to energy-efficient and environmentally friendly products, the company has developed advanced ICF systems that enhance structural integrity and thermal insulation. Airlite Plastics is known for its Fox Blocks® ICF product line, which provides superior strength, soundproofing, and energy efficiency for residential, commercial, and industrial construction.

-

Amvic’s product portfolio includes Amvic ICF Blocks, Amdeck Insulated Floor & Roof Systems, and SilveRboard Insulation Panels, all designed to enhance the thermal and acoustic performance of buildings. With a strong emphasis on green building practices, Amvic’s ICF solutions contribute to LEED certification and other sustainability standards.

BASF, Beco Products Ltd. are some of the emerging market participants in Insulated Concrete Form market.

-

BASF SE is a global player with a diverse portfolio that extends into construction and building materials, including insulated concrete form (ICF) solutions. The company leverages its expertise in advanced chemistry to develop high-performance insulation materials that improve energy efficiency and building durability. BASF’s Neopor expandable polystyrene (EPS) beads are widely used in ICF manufacturing, offering superior thermal insulation, moisture resistance, and fire protection.

-

Beco Products Ltd. is a key player in the ICF market, specializing in eco-friendly and energy-efficient building solutions. The company is recognized for its Wallform Insulated Concrete Formwork, a highly durable system designed for residential, commercial, and industrial applications. Beco’s ICF products offer excellent thermal insulation, structural stability, and fire resistance, making them ideal for modern construction projects.

Key Insulated Concrete Form Companies:

The following are the leading companies in the insulated concrete form (ICF) market. These companies collectively hold the largest market share and dictate industry trends.

- Airlite Plastics Company

- Amvic Inc.

- BASF SE

- Beco Products Ltd.

- Durisol UK

- Nudura Corporation

- Quad-Lock Building Systems, Ltd.

- BuildBlock Building Systems, LLC.

- Logix Insulated Concrete Forms Ltd.

- Standard ICF Corporation

Recent Developments

In September 2022, Amvic Inc. unveiled the Amvic ICF system, a expanded polystyrene (EPS) building block engineered to improve energy efficiency and structural durability in contemporary construction. This graphite-infused ICF incorporates modular interlocking features, allowing for seamless assembly while enhancing the overall strength and stability of buildings.

Insulated Concrete Form Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 999.2 million

Revenue forecast in 2030

USD 1,326.6 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia, Brazil, Saudi Arabia; UAE

Key companies profiled

Airlite Plastics Company; Amvic Inc.; Nudura Corporation; BuildBlock Building Systems, LLC.; Logix Insulated Concrete Forms Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulated Concrete Form Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulated concrete form market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polystyrene Foam

-

Polyurethane Foam

-

Cement-bonded wood fiber

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global insulated concrete form market size was estimated at USD 948.8 million in 2024 and is expected to reach USD 999.2 million in 2025.

b. The insulated concrete form market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 1326.6 million by 2030.

b. North America dominated the insulated concrete form market with a share of 36.6% in 2024. High product penetration in the U.S. and Canada markets owing to consumer awareness regarding the benefits of insulated concrete forms has resulted in their high demand.

b. Some key players operating in the insulated concrete form market include Airlite Plastics Company; Amvic Inc.; Nudura Corporation; BuildBlock Building Systems, LLC.; and Logix Insulated Concrete Forms Ltd.

b. Key factors driving the insulated concrete form market growth include the rising acceptance of insulated concrete forms in temperate regions including Europe and North America on account of their superior thermal insulation properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.