- Home

- »

- Network Security

- »

-

Insider Threat Protection Market Size & Share Report, 2030GVR Report cover

![Insider Threat Protection Market Size, Share & Trends Report]()

Insider Threat Protection Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution, By Deployment, By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global insider threat protection market size was valued at USD 3.81 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 17.4% from 2023 to 2030. The market growth can be attributed to the aggressive investments by governments and organizations to develop robust threat intelligence solutions and the growing demand for managed and professional security services. Organizations are laying down data access control measures, such as implementing a security culture and improving employee and contractor screening so that critical information remains protected from unauthorized disclosure. By establishing such measures, the risk of sensitive information by authorized entities can be minimized. These factors would further supplement the growth of the market for insider threat protection solutions during the forecast period.

With the rise of the remote working model, there has been an increase in the threat of data breaches and malware attacks. This has been a growing concern for data security, as the devices can be stolen, lost, or hacked, potentially leading to a breach of sensitive corporate data. Insider risk management solutions can help address these cybersecurity concerns by providing security features such as real-time behavioral analysis of events, as well as historical visibility of memory, disks, and devices.

In addition, several industry verticals have regulatory requirements that dictate how data should be handled and secured. Insider risk management solutions can help organizations meet these requirements and ensure compliance, further driving the demand for insider threat protection solutions.

Emerging technologies such as Artificial Intelligence (AI) and Machine Learning (ML) help enterprises better protect themselves against insider threats. For instance, in December 2022, LogRhythm Inc., a technology-based security solution provider, announced a partnership with SentinelOne, an autonomous cybersecurity company. The partnership aimed at providing an integrated security solution to help businesses secure their operations by detecting and responding to threats in the work environment.

The integrated solution would help users streamline security operations and enhance response workflows by supporting security teams in reducing event noise and gaining specific insights into cybersecurity threats. These developments are expected to further drive the growth of the ITP market during the forecast period.

However, complexity is one of the key restraints to the growth of the insider risk management market. Insider risk management solutions can be complex to implement and manage, requiring significant IT expertise. This can be a challenge for smaller organizations that may need more resources or expertise to manage these solutions. Additionally, as the number of applications and devices that need to be managed surges, the complexity of insider risk management solutions can also increase.

This can lead to increased expenses, long implementation periods, and a greater probability of errors. To address this complexity, several vendors are focusing on developing user-friendly and intuitive interfaces that make it easier for organizations to manage their devices and applications. Thus, while complexity is a significant restraint for the insider threat protection market, there are efforts underway to make these solutions more accessible and manageable for organizations of all sizes.

As per reports published in 2020, around 60% of organizations have over 30 cyber security incidents annually, involving insider attacks. To overcome such challenges, market players are introducing new solutions based on AI, ML, big data analytics, IoT, 5G, edge computing, and cloud computing. Thus, it is imperative for enterprises to deploy capable solutions that can continuously monitor employee activity. This includes promoting security-aware culture change and transforming the organization digitally. Identifying early warning signs of dissatisfaction and managing them quickly is crucial to stop such attacks.

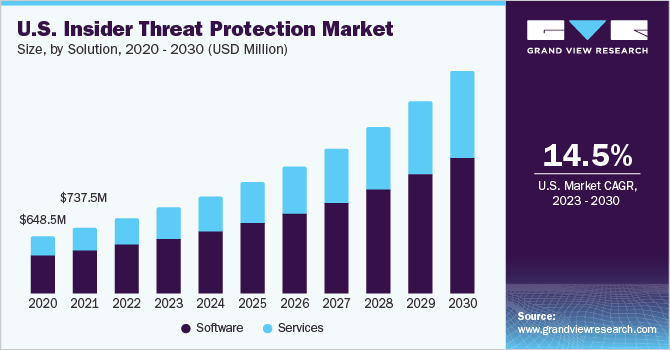

Solution Insights

The software segment accounted for the largest revenue share of 64.2% in the global market in 2022. Insider threat protection software provides the highest level of protection features, such as behavioral protection, threat insight and intelligence, cloud-based endpoint detection, and a variety of security analytics techniques.

For instance, in April 2023, DTEX Systems, an insider risk and threat management solution provider, announced that a leading global bank had selected DTEX InTERCEPT, an insider risk management software, to augment perceptibility into insider threat management and ensure regulatory compliance. With this cyber security solution, the bank would be able to enhance its insider risk management capabilities within the organization. Such developments would further drive the growth of the segment during the forecast period.

The services segment is poised to advance at a CAGR of 18.3% through 2030. Insider threat protection services offer a comprehensive solution for managing and securing end-user devices. They are designed to enable organizations to increase productivity, enhance security, and ensure compliance while providing employees with the flexibility and convenience of using their personal devices for work. Professional services are gaining popularity, as they can help organizations fix vulnerabilities, reduce additional data loss, and conduct preemptive measures to protect against future cyber threats.

Deployment Insights

The cloud-based segment accounted for the higher market share of 55.6% in 2022. While cloud computing continues to evolve, cloud-based platforms are always vulnerable to cybercrimes and data breaches. Several enterprises are opting for cloud computing in the wake of the high costs associated with on-premise solutions. As such, the adoption of cloud-based insider threat management systems is expected to increase in line with the growing preference for cloud computing.

The demand for cloud-based cybersecurity systems is also expected to increase, as enterprises continue to adopt cloud-based platforms for data sharing. The significant cost savings associated with the use of cloud-based platforms are prompting commercial establishments as well as government agencies to migrate to cloud storage and opt for cloud-based platforms, which would subsequently drive the demand for cloud-based insider threat protection solutions.

The on-premise segment is anticipated to advance at a CAGR of 15.6% during the forecast period. Several large organizations prefer having complete ownership of solutions and upgrades as they possess critical business information databases. This helps them to ensure an optimum level of data security. On-premise deployment also reduces the dependency on third-party organizations, providing explicit monitoring and data protection. The inclination of organizations toward maintaining the confidentiality of in-house data is expected to drive the demand for on-premise deployment.

Enterprise Size Insights

The large enterprise segment accounted for the dominant market share of 53.5% in 2022. Large businesses face various risks such as data breaches and hacking that come with the use of advanced technologies. Large enterprises are increasingly using insider risk management solutions to prevent devices from cyber threats. They offer multiple benefits to large-scale enterprises, such as increased productivity, improved security, and cost savings.

Moreover, they provide end-to-end visibility into the activities performed on various servers, desktops, and laptops. Large enterprises are increasingly turning to insider threat solutions to manage and secure their devices efficiently and economically while ensuring compliance with industry regulations and data protection laws.

The SMEs segment is expected to expand at the highest CAGR of 18.1% during the forecast period. Due to budget constraints, small and medium-sized businesses are more vulnerable to cyber-attacks due to their low level of security. Moreover, a lack of security policies and employee skills makes them prone to cyber-attacks. Insider risk management solutions can help detect threats and secure the devices at an early stage, reducing the need for IT teams to manage distinct devices and enhancing the life expectancy of the devices by confirming they are up-to-date and well-maintained.

For instance, in May 2022, Netskope, Inc., a Security Service Edge (SSE) provider, launched an endpoint data loss prevention (EDLP) solution to protect data in a private application. This solution expands the Netskope Intelligent SSE platform capabilities to protect data within infrastructure-as-a-service (IaaS), software-as-a-service (SaaS), emails, private applications, and endpoint devices.

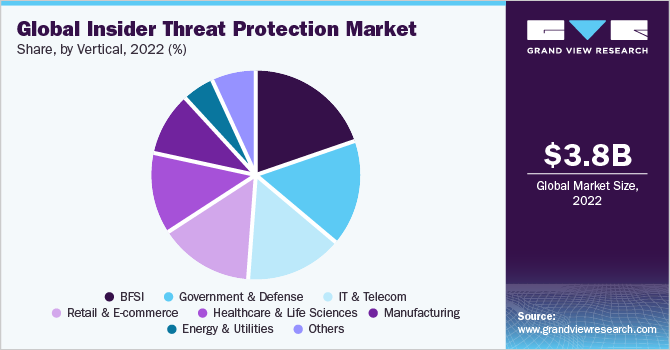

Vertical Insights

The BFSI segment accounted for the largest market share of 20.1% in 2022. The BFSI sector is responsible for storing large volumes of critical data, due to which companies are at constant risk of cyber-attacks. Moreover, financial institutions are making significant investments in enabling digital services through multiple channels, which is creating new vulnerabilities.

According to the VMware Carbon Black Threat Data report published in 2020, cyberattacks against the financial sector grew by around 240% globally between February 2020 and April 2020. Hence, organizations in the BFSI sector are integrating application security testing tools and services on a significant scale to protect applications and digital assets against fraud and manipulation.

The retail & e-commerce segment, on the other hand, is anticipated to expand at a CAGR of 20.9% during the forecast period. In the retail industry, threat actors often impersonate executives to convert them into insider threats with imitation, blackmail, and through social engineering techniques.

The retail industry has been using insider threat protection solutions to provide real-time visibility into endpoint activities and enable the identification and security of devices from advanced threats such as ransomware, malware, and cyber threats. By leveraging insider risk management solutions, retailers can gain a competitive advantage through enhanced threat detection and response time, reduced data breach risk, and real-time data visibility.

Regional Insights

North America held the leading revenue share of 27.7% of the target market in 2022. The market for insider threat protection in North America is driven by the increasing adoption of servers, desktops, and mobile devices; the rise in Bring Your Own Device (BYOD) trend; and the need for data security. The U.S. is expected to hold the largest share of the market during the projected period due to the high adoption of these devices and the presence of major insider risk management vendors in the region.

North America has an extensive presence of several key players in the industry, including Palo Alto Networks, SentinelOne, and Broadcom, Inc. These companies offer various ITP solutions that help organizations to perform effective security measures to secure their data, network, and systems from various cyber threats.

On the other hand, Asia Pacific is anticipated to emerge as the fastest-developing regional market at a CAGR of 19.8% during the projected period. The region has seen a rapid rise in the popularity of the Bring Your Own Device (BYOD) trend. Additionally, the growing government initiatives to support cybersecurity compliances in order to protect data from cyber threats have resulted in the need for insider risk management solutions.

In Singapore, the Cybersecurity Act (CSA), which was passed in 2018, establishes a legal framework for the maintenance of national cybersecurity. It covers 32 jurisdictions for monitoring criminal offenses such as hacking, denial-of-service attack, phishing, and malware attack, among others. Similar initiatives by regional governments would further drive the growth of the regional market during the forecast period.

Key Companies & Market Share Insights

The key players operating in the market for insider threat protection solutions aim to broaden their product offerings by utilizing a variety of inorganic growth tactics, such as partnerships, mergers, and acquisitions. For instance, in November 2022, the U.S. Department of Defense announced the Department of Defense Zero Trust Strategy and Roadmap.

Cisco Systems, Inc. has been working alongside the agency for the past few years to help define and integrate the Zero Trust principles. This strategy provides a road map through DoD Zero Trust Pillars across its Non-classified Secret Internet Protocol Router Network (SIPRNet) and Non-classified Internet Protocol Router Network (NIPRNet). Some of the prominent players in the global insider threat protection market include:

-

Cisco Systems, Inc.

-

Microsoft Corporation

-

Broadcom, Inc.

-

VMware

-

Citrix Systems

-

Kaspersky Labs

-

Ivanti

-

Micro Focus

-

Zoho Corporation Pvt. Ltd. (ManageEngine)

-

McAfee, LLC

-

International Business Machines Corporation

-

CROWDSTRIKE

-

Sophos

-

Blackberry

-

Trend Micro Incorporated

Insider Threat Protection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.45 billion

Revenue forecast in 2030

USD 13.69 billion

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Cisco Systems, Inc.; Microsoft Corporation; Broadcom, Inc.; VMware; Citrix Systems; Kaspersky Labs; Ivanti; Micro Focus; Zoho Corporation Pvt. Ltd. (ManageEngine); McAfee, LLC; International Business Machines Corporation; CROWDSTRIKE; Sophos; Blackberry; Trend Micro Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insider Threat Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global insider threat protection market report based on solution, deployment, enterprise size, vertical, and region:

- Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

-

Services

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small And Medium-sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT And Telecom

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

Manufacturing

-

Government & Defense

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insider threat protection market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 13.69 billion by 2030.

b. The global insider threat protection market size was estimated at USD 3.81 billion in 2022 and is expected to reach USD 4.45 billion in 2023.

b. The North America region dominated the market for insider threat protection in 2022 and accounted for a global revenue share of over 27.7%. The insider threat protection market in North America is driven by the increasing adoption of servers, desktops, and mobile devices, the rise in Bring Your Own Device (BYOD) trend, and the need for data security.

b. Some key players operating in the insider threat protection market include Cisco Systems, Inc., Microsoft Corporation, Broadcom, Inc., VMware, and Citrix Systems

b. The insider threat protection market growth can be attributed to the aggressive investments by governments and organizations to develop robust threat intelligence solutions and the growing demand for managed and professional security services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.