- Home

- »

- Agrochemicals & Fertilizers

- »

-

Insecticides Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Insecticides Market Size, Share & Trends Report]()

Insecticides Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Organophosphates, Pyrethroids), By Application (Cereals & Grains, Oilseeds & Pulses), By Region (Central & South America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-033-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insecticides Market Summary

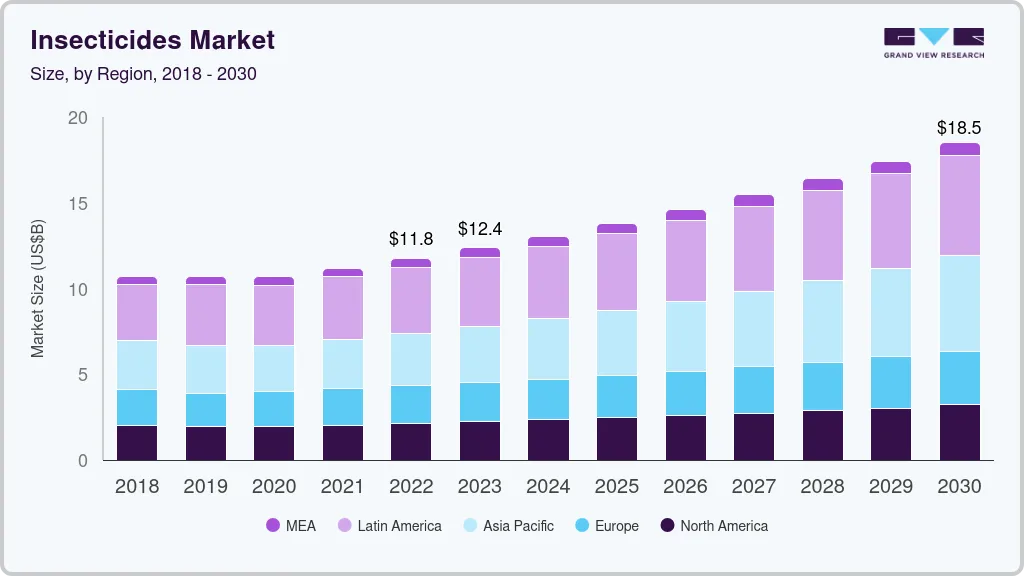

The global insecticides market size was estimated at USD 9.12 billion in 2022 and is projected to reach USD 13.08 billion by 2030, growing at a CAGR of 4.6% from 2023 to 2030. The growth is attributable to its increasing application for preventing attacks from pests and insects in agricultural fields.

Key Market Trends & Insights

- The Asia Pacific region dominated the industry in 2022 and accounted for the highest share of 57.6% of the overall revenue.

- By type, the organophosphate type segment is among the dominant segments and accounted for the second-highest revenue share of more than 4.90% of the overall revenue in 2022.

- By application, the cereals & grains application segment dominated the global market in 2022 and accounted for the largest share of more than 42.80% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 9.12 Billion

- 2030 Projected Market Size: USD 13.08 Billion

- CAGR (2023-2030): 4.6%

- Asia Pacific: Largest market in 2022

These products are widely used in agricultural applications to keep crops away from the attack of insects across the globe. Rising demand for food worldwide is the main driving factor behind the growth in agricultural production on a global level. Countries like China, India, and the U.S. are the key producers of crops and extensively utilize insecticide products to fuel their crop production volume. These products offer effective application in the agricultural field as well as in residential uses for killing insects, such as roaches.The growing agricultural industry on account of the rising demand for food is anticipated to drive product demand during the forecast period. Asia Pacific, Europe, and North America are anticipated to witness substantial growth in agricultural production due to the rapid increase in food demand triggered by the rising population. The National Statistical Office (NSO) estimated a 4.6% of year-on-year growth of agricultural production in India in 2022. In addition, European Union data suggests that oilseed production is anticipated to reach 33.0 million tons yearly in 2032, witnessing an increase of almost 2.8 tons from 2022. Growing agricultural production across all parts of the world is likely to drive the demand over the forecast period. The continuous increase in the global population is another major driver for rising global food consumption.

According to the United Nations, the global population is expected to be 7.6 billion in 2023 and is anticipated to reach 8.6 billion and over 9.8 billion, respectively by 2030 and 2050. The continuously increasing global population is anticipated to surge the demand for food, thereby fueling the consumption of insecticides to increase agricultural yields. Governments of different countries have been launching several schemes for the benefit of farmers and to increase their crop yields to fulfill the growing global demand for food. Continuous interactions between concerned government agencies and farmers have motivated the latter to follow high-class farming practices. These practices use various technologies and chemicals, such as insecticides, to ensure minimum loss of food and maximum agricultural yields. High awareness about the usage and support from the concerned government is anticipated to bolster the product demand.

Type Insights

The organophosphate type segment is among the dominant segments and accounted for the second-highest revenue share of more than 4.90% of the overall revenue in 2022. Its high share is driven by the increasing loss of crops due to decreasing arable land and increasing insect attacks, which is anticipated to drive the demand for insecticides, especially organophosphates, owing to their low costs. Carbamates are a class of insecticides mechanically and structurally similar to organophosphate.

These are used as bait or sprays to kill unwanted insects by directly affecting their nervous system and brain. Botanical refers to products that consist of dried ground plant material, chemicals isolated from plants, or crude plant extracts used for killing or repelling insects. Many plants, such as Pyrethrum (Tanacetum cinerariifolium), sweet wormwood, and others, are toxic to insects due to their insecticidal properties, thus, naturally occurring chemicals derived from these plants are widely used as botanical insecticides.

Application Insights

The cereals & grains application segment dominated the global market in 2022 and accounted for the largest share of more than 42.80% of the overall revenue. Its high share is driven by the increasing consumption of cereals & grains, such as rice, oats, corn, wheat, sorghum, and barley, due to their nutritional benefits. The oilseeds and pulses segment also accounted for a significant revenue share in 2022. The segment includes oilseeds and pulses, such as soybean, sunflower seeds, and leguminous seeds (pulses).

The increasing focus of farmers on oilseed production is expected to drive the growth of this segment over the coming years. According to the Ministry of Foreign Affairs, in 2020, the Asia Pacific region witnessed the fastest growth in cereals and pulses followed by Europe. In addition, according to the National Food Security Mission report, India is the largest producer of cereals worldwide, accounting for around 10% of the global oilseed production with 20% of the global land area.

Regional Insights

The Asia Pacific region dominated the industry in 2022 and accounted for the highest share of 57.6% of the overall revenue. The high share is driven by the growing food demand due to the rapidly growing population in the region. Agriculture is the primary sector in many Asian countries including India and Vietnam. Insecticides are the major crop protection chemicals used in these countries due to the issues faced by insects like diamondback moths, aphids, caterpillars, and onion thrips for widely grown crops like rice, maize, wheat, and onion. The Central & South America region is also one of the leading regional markets for insecticides.

The region comprises emerging countries, such as Brazil and Argentina. The regional market of Central & South America was dominated by Brazil in 2022 owing to the large-scale production of pulses, soybeans, and sugarcane driving the consumption of insecticides for improved yield and productivity. Brazil is a major contributor to the GDP of the region and a key consumer of insecticides, herbicides, fungicides, and biopesticides. North America is expected to be a lucrative region during the forecast period owing to an increase in agricultural activities as the region is witnessing a rising demand for food.

Key Companies & Market Share Insights

The global industry is highly competitive, in terms of market share and new product development. The growing research & development activities coupled with constant innovations to keep upgrading the products have created an intensely competitive environment in the global industry. Some of the prominent companies operating in the global insecticides market include:

-

AMVAC Chemical Corp.

-

UPL Ltd.

-

Bayer AG

-

BASF SE

-

FMC Corp.

-

Corteva Agriscience

-

Nufarm Ltd.

-

Bioworks, Inc.

-

Syngenta Group

Insecticides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.52 billion

Revenue forecast in 2030

USD 13.08 billion

Growth rate

CAGR of 4.6 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AMVAC Chemical Corp.; UPL Ltd.; Bayer AG; BASF SE; FMC Corp.; Corteva Agriscience; Nufarm Ltd.; Bioworks, Inc.; Syngenta Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insecticides Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global insecticides market report on the basis of type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pyrethroids

-

Organophosphates

-

Carbamates

-

Chlorinated Hydrocarbons

-

Botanical

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. The global insecticides market size was estimated at USD 9.12 billion in 2022 ad is expected to reach USD 9.52 billion in 2023.

b. The global insecticides market is expected to grow at a CAGR of 4.6% from 2023 to 2030 to reach USD 13.08 billion by 2030

b. The Asia Pacific dominated the insecticides market with a share of over 57.6% in 2022. This is attributable to growing agricultural sector on the account of rising demand for food in Asia Pacific.

b. Some key players operating in insecticides market include AMVAC Chemical Corporation, UPL Limited, Bayer AG, FMC Corporation, and others

b. Insecticides market is driven by its growing demand from agricultural sector to protect crops from insects and increase its productivity on the account of increasing demand for food across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.