- Home

- »

- Medical Devices

- »

-

Injection Pen Market Size And Share, Industry Report, 2030GVR Report cover

![Injection Pen Market Size, Share & Trends Report]()

Injection Pen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Reusable), By Application (Osteoporosis, Diabetes, Anaphylaxis), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-445-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Injection Pen Market Summary

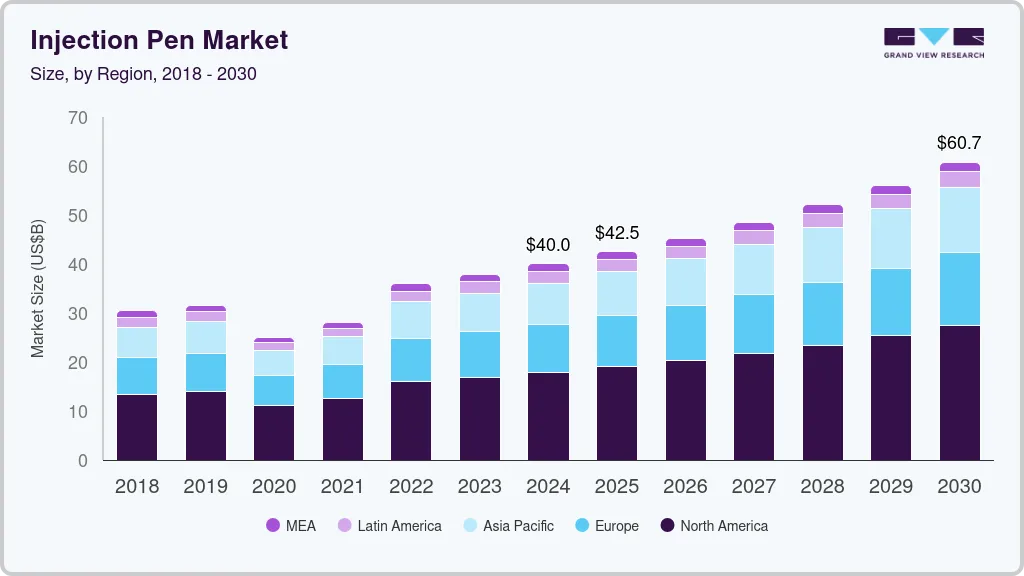

The global injection pen market size was estimated at USD 40.0 billion in 2024 and is projected to reach USD 60.7 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. A rising number of chronic diseases, osteoporosis, diabetes, cardiovascular disease, and multiple sclerosis are driving the demand for injection pens market.

Key Market Trends & Insights

- North America dominated the injection pen market and accounted for a 44.7% share in 2024.

- The U.S. injection pen market dominated North America in 2023.

- By product, the reusable segment accounted for the largest revenue share of 70.4% in 2024.

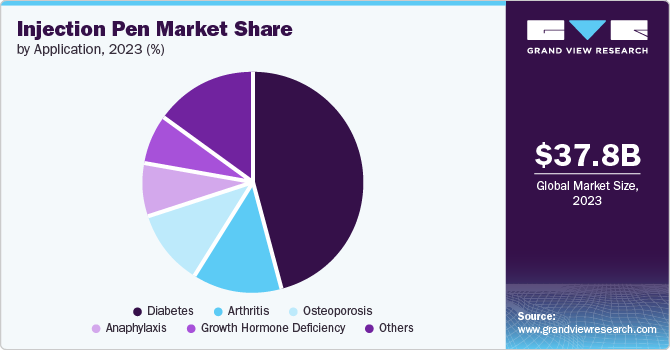

- By application, the diabetes segment dominated the market and accounted for a 45.7% share in 2024.

- By end use, the hospital segment dominated the market with the largest revenue share of 39.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.0 Billion

- 2030 Projected Market Size: USD 60.7 Billion

- CAGR (2025-2030): 7.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Injector pens are ideal for chronic conditions that require frequent dosing. Another factor propelling the market is the growing utilization of innovative reusable injection pens, and the growing demand for automated injection pens. Medical practitioners are turning to automated injection pens owing to their safety, simplicity, convenience, and accuracy in administering medication.

A growing number of diabetic patients and its seriousness worldwide has necessitated demand for insulin injections. For instance, according to the Institute for Health Metrics and Evaluation, over 500 million individuals globally have diabetes, impacting people of all ages and genders in every nation. This number is expected to surpass 1.3 billion in the next three decades, with diabetes becoming one of the top 10 causes of death and disability, with a current global prevalence rate of 6.1%. Moreover, sales of injection pens for administering insulin to treat type 2 diabetes have surpassed sales of vials, as reported by the National Institutes of Health (NIH). Injection devices are commonly utilized to self-administer insulin injections for diabetes treatment daily. Patients prefer using a pen injection method, rather than a syringe, to administer insulin from a vial due to its simplicity. As a result, the growing occurrence of diabetes within the population has led to a rise in the use of injection pens.

The demand for injection pens has also surged due to the growing incidence of autoimmune diseases like rheumatoid arthritis. The global prevalence of rheumatoid arthritis is approximately 0.5-1%, with biologic drugs requiring subcutaneous administration driving the adoption of injection pens. Similarly, growth hormone deficiencies, requiring frequent injections, have contributed to market expansion, with pens offering better dosing accuracy and reducing administration discomfort.

Technological advancements are revolutionizing the injection pen market. Features such as dose memory, variable dosing, and ergonomic designs are enhancing patient adherence and convenience. Additionally, disposable pens dominate the market due to their ease of use and reduced risk of contamination, while reusable pens, favored for their cost-effectiveness, also hold a significant share.

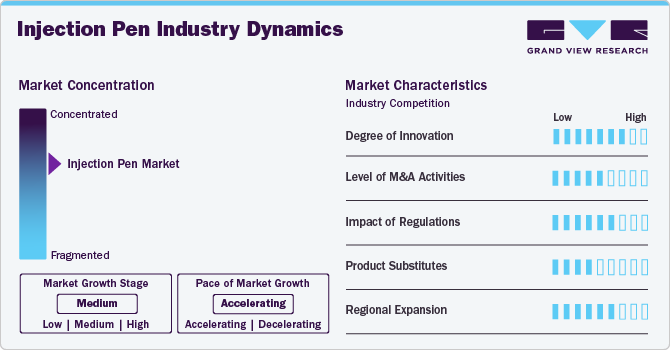

Market Concentration & Characteristics

The injection pen industry is moderately concentrated, with key players like Novo Nordisk, Eli Lilly, Sanofi, and Ypsomed dominating the market. These companies drive innovation through advanced technologies such as smart pens and user-friendly designs. The industry is characterized by high demand for insulin delivery devices and biologic drug administration, addressing rising chronic disease prevalence. Growth is fueled by increasing self-administration trends, regulatory support, and expanding healthcare access globally. While disposable pens dominate due to convenience, reusable pens are popular for cost-effectiveness. Emerging markets and advancements in smart pen technologies further enhance the industry's growth prospects.

The injection pen market demonstrates a high degree of innovation, as evidenced by the May 2024 launch of Metoject Subcutaneous Injection Pen in Japan by Eisai Co., Ltd. and nippon medac Co., Ltd., a subsidiary of medac GmbH. This self-administrable methotrexate (MTX) pen for rheumatoid arthritis is the first of its kind in Japan. It aims to reduce patient burden and enhance self-injection safety. The product, available in varying dosages, received manufacturing and marketing approval in February 2024 and was added to Japan’s National Health Insurance Drug Price List. With 700,000-800,000 rheumatoid arthritis patients in Japan, this innovative pen addresses a critical therapeutic need.

Regulations play a crucial role in shaping the market, ensuring safety, efficacy, and quality standards. Strict approval processes by regulatory bodies like the FDA, EMA, and PMDA govern the manufacturing, marketing, and usage of injection pens. These regulations address design standards, drug delivery accuracy, and patient safety. For instance, Japan’s approval of Metoject® in 2024 highlights rigorous compliance with manufacturing and health insurance policies. Additionally, evolving guidelines for biosimilars and reusable pens impact market dynamics, encouraging innovation and sustainability. Regulatory frameworks also facilitate global market access while ensuring products meet diverse regional healthcare requirements.

Mergers and acquisitions (M&A) in the injection pen industry gained attention in June 2023 when Novo Nordisk initiated exclusive negotiations to acquire a controlling stake in BIOCORP. Novo Nordisk plans to purchase BIOCORP’s 45.3% shareholding from BIO JAG. Additionally, minority shareholders holding 19.0% of shares committed to transferring their stakes post-acquisition. This strategic move aims to strengthen Novo Nordisk’s position in innovative drug delivery solutions.

In the market for injection pens, product substitutes include traditional syringes, wearable drug delivery devices, and oral or transdermal drug formulations. While injection pens offer convenience, precision, and reduced pain, syringes remain cost-effective and widely available. Wearable devices, such as insulin pumps, provide continuous delivery, reducing the need for frequent injections. Oral and transdermal alternatives appeal to patients preferring non-invasive options. However, these substitutes may lack the accuracy or efficacy of injection pens for certain drugs. Advances in non-invasive technologies and drug formulations pose a potential challenge to market growth, emphasizing the need for innovation in pen design.

The industry is witnessing significant regional expansion, driven by rising healthcare awareness and increasing prevalence of chronic diseases. In January 2024, Brazilian biopharmaceutical company Cristalia introduced a reusable pen injector for its biosimilar growth hormone, developed in collaboration with Nemera. Such partnerships highlight the focus on localized solutions to address specific market needs. Additionally, growing investments in emerging markets, advancements in drug delivery technologies, and demand for patient-friendly devices are fueling regional growth.

Product Insights

The reusable segment accounted for the largest revenue share of 70.4% in 2024 and is expected to grow at the fastest CAGR over the forecast period due to the growing focus on environmental sustainability in the healthcare industry. Disposable injection pens generate significant plastic waste, raising concerns about their ecological impact. Reusable pens, on the other hand, offer a more environmentally friendly alternative. This resonates with both patients and healthcare prioritizing eco-conscious practices.

In addition, patients who requires regular injections benefit from this cost-effective solution. Moreover, healthcare facilities have the potential to decrease their total costs for injection pens by switching to reusable models. Furthermore, technology improvements are leading to the creation of user-friendly designs that encourage taking medication correctly and guarantee precise dosing. Furthermore, efforts were made to improve convenience and safety by focusing on easy cartridge replacement and proper sterilization procedures.

Application Insights

The diabetes segment dominated the market and accounted for a 45.7% share in 2024, due to injection pens multiple advantages over traditional insulin administration methods such as syringes and vials. These pens provide improved precision in dosage, easier use, discretion, and mobility, specifically designed for those managing diabetes as part of their daily schedules. Unhealthy eating habits are a primary factor in raising blood sugar levels, playing a major role in the development of type 1 diabetes.

Anaphylaxis is projected to grow at the fastest CAGR over the forecast period. This surge is primarily driven by a concerning rise in the global prevalence of anaphylaxis, particularly among children. This fuels the demand for epinephrine auto-injectors, a critical tool for managing anaphylactic reactions. In addition, increasing awareness about anaphylaxis and its potentially life-threatening nature is prompting healthcare professionals to prescribe auto-injectors more readily.

End Use Insights

The hospital segment dominated the market with the largest revenue share of 39.4% in 2024, due to the quick acceptance and boost from the rise in government efforts to enhance healthcare infrastructure and the increasing population of diabetes patients within the evaluated timeframe. The primary factors driving the growth of this market are enhanced healthcare spending by consumers, higher disposable income, and increased consumer awareness of injection pen usage. This is mainly due to the growing elderly population and the increasing prevalence of diseases such as diabetes. Hospitals contain specific infrastructure and advanced medical equipment. Additionally, an increasing number of patients with diabetes and chronic conditions require injection pens, resulting in more procedures being performed in hospitals.

The clinics segment is anticipated to grow at the fastest CAGR over the forecast period, due to the growing occurrence of chronic illnesses requiring heightened patient monitoring and medications. Government efforts to encourage patients to adhere to their medications and master injection techniques may motivate healthcare providers to use injection pens in clinical settings.

Regional Insights

North America dominated the injection pen market and accounted for a 44.7% share in 2024. The rising occurrence of non-communicable diseases, such as diabetes, cancer, cardiovascular conditions, and multiple sclerosis in countries like Canada and the U.S. is a major factor driving the growth of the market. Increased healthcare spending, better knowledge of modern drug delivery methods, and easy access to injection pens and cartridges are driving the market in North America

U.S. Injection Pen Market Trends

The U.S. injection pen market dominated North America in 2023 due to the importance of government laws backing the healthcare system and the rising prevalence of illnesses such as diabetes, and cardiovascular disease. As per the report by CDC, in the U.S. in 2000, there were more than 120 million individuals with more than one chronic condition. This number is expected to experience an annual increase of more than 1% until 2030. Therefore, from 2000 to 2030, there will be a 40% increase in the population of North America with chronic illnesses, equating to roughly 50 million people.

Europe Injection Pen Market Trends

Europe injection pen market was identified as a lucrative region in 2023 owing to the increasing age of the population in the region. Moreover, this region leads in conducting clinical trials, and worldwide, it ranks in the top five. The EU Clinical Trials Register currently shows 43,941 clinical trials with a EudraCT protocol.

The UK injection pen market is expanding with the nationwide launch of Novo Nordisk’s free recycling initiative for injection pens used by individuals with diabetes, obesity, and growth disorders. This follows a successful pilot program that began in November 2021, covering 13 clinical commissioning groups in Greater Manchester, Leicestershire, Rutland, and the Greater Glasgow and Clyde Health Board. The pilot led to the recycling of over 15,000 FlexPen and FlexTouch devices, which dispense insulin and other medications. This initiative supports sustainability efforts while catering to the growing demand for injection pen solutions in the UK.

The injection pen market in France is growing due to the country's significant diabetes prevalence. In 2021, France had a total adult population of 46.02 million, with an 8.6% diabetes prevalence, resulting in 3.94 million adult diabetes cases. This highlights a growing demand for effective diabetes management solutions.

The Germany injection pen market’s growth is primarily fueled by the country’s advanced healthcare infrastructure and high demand for chronic disease management. With a well-established healthcare system, Germany supports the widespread adoption of injection pens, particularly for diabetes and autoimmune disorders. Additionally, technological innovations in drug delivery, such as smart injection pens, enhance patient adherence and convenience.

Asia Pacific Injection Pen Market Trends

The Asia Pacific injection pen market is expected to experience rapid growth, with a projected CAGR of 8.0% from 2025 to 2030, due to the incidence of chronic diseases, such as diabetes, being on the rise. This is attributed to urbanization, changing lifestyles, and an aging population. This increase has greatly boosted the need for injection pens, which are favored for self-administering insulin and other necessary medications used to treat chronic conditions.

The injection pen market in Japan is expanding due to the high prevalence of diabetes, with approximately 11 million people affected in 2021, representing 11.8% of the adult population. This growing diabetic population drives demand for effective and convenient drug delivery solutions like injection pens.

The China injection pen market held a substantial market share in 2023 driven by a demographic shifts and changes in lifestyle. The increasing elderly population is a significant factor, leading to a higher chance of developing issues such as diabetes.

The injection pen market in India is poised for significant growth, driven by the increasing prevalence of chronic diseases like diabetes, which affects over 77 million people in the country. With diabetes awareness rising, more individuals are seeking convenient and effective self-management solutions, fueling the demand for injection pens. Additionally, India's growing healthcare infrastructure and expanding middle class contribute to market expansion.

Latin America Injection Pen Trends

The Latin America injection pen industry is expanding, particularly in Brazil and Argentina, driven by the rising prevalence of chronic diseases like diabetes. Brazil, with its large diabetic population, is a key growth driver, while Argentina is seeing increased adoption due to improved healthcare infrastructure and awareness. Both countries are experiencing a surge in demand for convenient, self-administered treatments, such as injection pens, due to their precision and ease of use.

Middle East & Africa Surgical Snare Market Trends

The Middle East and Africa injection pen industry is poised to grow due to rising diabetes prevalence, increasing healthcare awareness, and improving access to advanced medical devices. The region’s growing demand for convenient and effective self-management solutions, combined with technological innovations, is driving the adoption of injection pens.

The injection pen market in Saudi Arabia is steadily growing, driven by the country's high diabetes prevalence. According to the World Health Organization (WHO), Saudi Arabia ranks second in the Middle East and seventh globally for diabetes rates. Approximately 7 million people in the country are diabetic, with nearly 3 million having pre-diabetes.

Key Injection Pen Company Insights

The competitive scenario in the injection pen industry is highly competitive, with key players such as BD, Biocon, and Sanofi holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Injection Pen Companies:

The following are the leading companies in the injection pen market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Eli Lilly and Company

- Ypsomed AG

- Biocon

- Pfizer Inc.

- Novartis AG

- Novo Nordisk A/S

- Sanofi

- Owen Mumford Ltd.

- Merck KGaA

Recent Developments

-

In February 2024, Eli Lilly introduced the Mounjaro drug in the UK, making it the fourth European country to release the highly anticipated obesity medication. The MHRA approved a four-dose version of Mounjaro (tirzepatide) - Mounjaro KwikPen, for diabetes and weight management treatment.

-

In February 2023, Sanofi and Glooko Inc. partnered to enhance diabetes support for individuals and healthcare providers by combining SoloSmart with the Glooko platform. Through this collaboration, Sanofi is looking to enhance the availability of digital tools for individuals with diabetes in all the specified markets where SoloSmart will be offered.

Injection Pen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.5 billion

Revenue forecast in 2030

USD 60.7 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Eli Lilly and Company; Ypsomed AG; Biocon; Pfizer Inc.; Novartis AG; Novo Nordisk A/S; Sanofi; Owen Mumford Ltd.; Merck KGaA;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injection Pen Market Report Segmentation

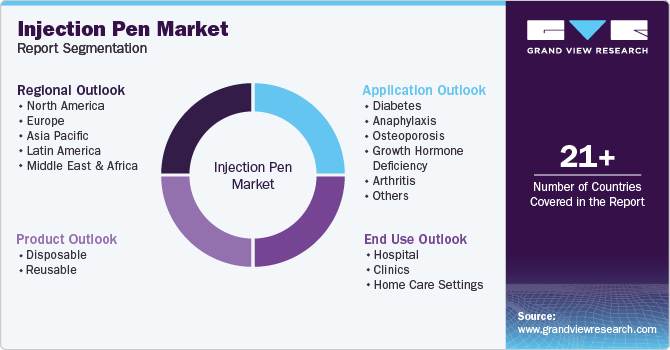

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the injection pen market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes

-

Anaphylaxis

-

Osteoporosis

-

Growth Hormone Deficiency

-

Arthritis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics

-

Home Care Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global injection pen market size was estimated at USD 40.0 billion in 2024 and is expected to reach USD 42.5 billion in 2025.

b. The global injection pen market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 60.7 billion by 2030.

b. North America dominated the injection pen market with a share of 44.7% in 2024. This is attributable to the increasing incidence of diabetes and the growing obese population.

b. Some key players operating in the injection pen market include Owen Mumford Ltd.; Eli Lilly and Company; GlaxoSmithKline plc; Mylan N.V.; AstraZeneca; Novo Nordisk; Sandoz Inc.; and Sanofi.

b. Key factors that are driving the market growth include the increasing incidence of diseases such as diabetes and arthritis and rising demand for safer and advanced drug delivery devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.