- Home

- »

- Biotechnology

- »

-

Injectable Drug Delivery Devices Market Size Report, 2030GVR Report cover

![Injectable Drug Delivery Devices Market Size, Share & Trends Report]()

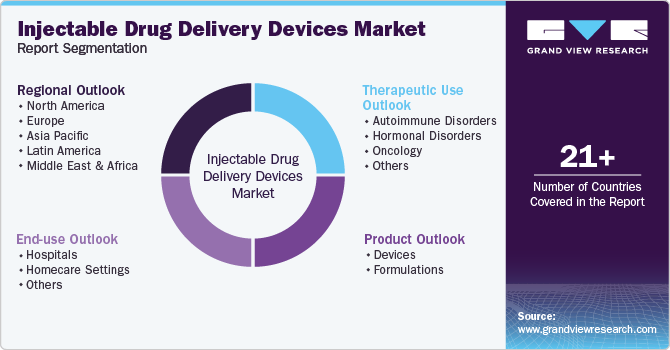

Injectable Drug Delivery Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Devices, Formulations), By Therapeutic Use (Autoimmune disorders, Hormonal disorders), By End-use (Hospitals, Homecare Settings), By Region, And Segment Forecasts

- Report ID: 978-1-68048-GVR-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Injectable Drug Delivery Devices Market Summary

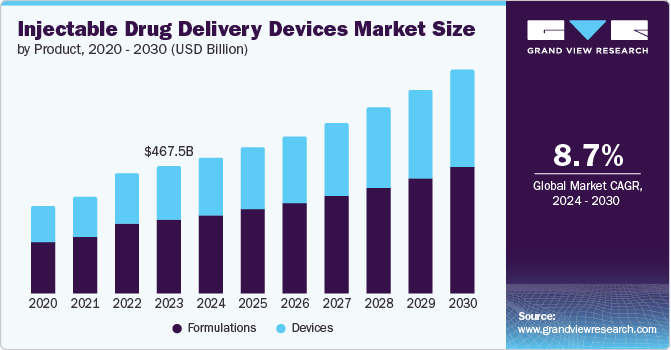

The global injectable drug delivery devices market size was valued at USD 467.5 billion in 2023 and is projected to reach USD 823.29 billion by 2030, growing at a CAGR of 8.4% from 2024 to 2030. The rising prevalence of chronic diseases and increasing technological advancements are driving demand for injectable drug delivery devices. Government initiatives for various injectable drugs for chronic diseases is further fueling the market growth.

Key Market Trends & Insights

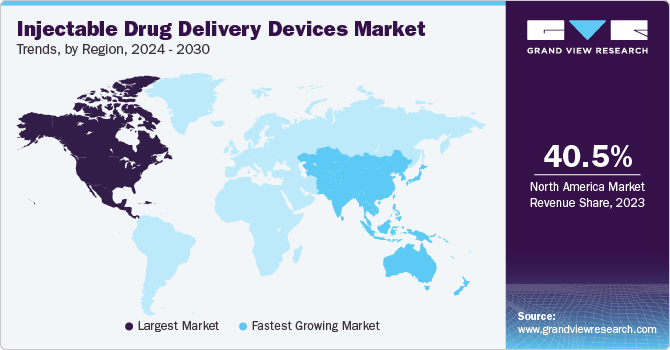

- North America injectable drug delivery devices market dominated the with 40.5% market share in 2023.

- The U.S. injectable drug delivery devices market dominated the North America market in 2023.

- By product, the formulations segment dominated the market with 57.9% of revenue share in 2023.

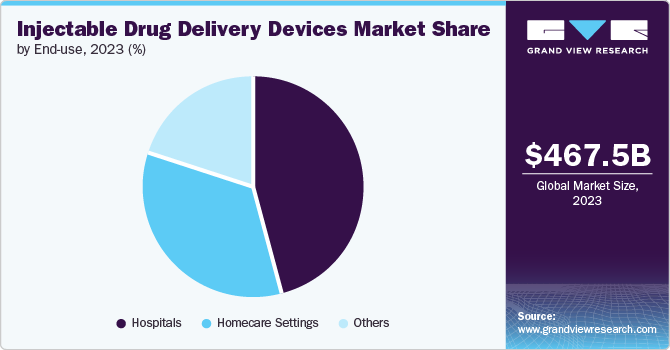

- By end-use, hospitals dominated the market with 53.2% share in 2023.

- By therapeutic use, autoimmune disorders dominated the market with 43.3% of revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 467.5 Billion

- 2030 Projected Market Size: USD 823.29 Billion

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Chronic diseases such as diabetes, cancer, and autoimmune disorders are becoming increasingly common around the world. The World Health Organization (WHO) estimates chronic diseases such as diabetes, cancer, and cardiovascular diseases, contribute to over 70% of deaths globally. These conditions often require long-term treatment with injectable medications, which is fueling the demand for injectable drug delivery devices. The United Nations projects the global population aged 65 or above to reach 1.6 billion by 2050. This elderly population is more susceptible to chronic diseases, further increasing the demand for injectable drug delivery devices.

The market is witnessing continuous development in new and improved devices like autoinjectors, wearable injectors, and needle-free injectors. Government agencies around the world are increasingly focusing on improving healthcare access and affordability. This includes initiatives to promote the use of injectable drugs for chronic disease management. Such initiatives are expected to further propel the market growth. There is a notable shift towards self-administration of medications, as they provide convenience and empower patients to manage their health more effectively, driving the market growth.

Product Insights

The formulations segment dominated the market with 57.9% of revenue share in 2023. This is due to the increasing prevalence of chronic diseases, increasing adaption of self-injection and the rising demand for biologics. Furthermore, innovations in formulation technologies such as long-acting injectables and depot formulations are enabling more convenient dosing schedules, further propelling market growth.

The devices segment is anticipated to witness the significant CAGR of 9.3% over the forecast period. There's a growing focus on user-friendly and convenient devices. These devices simplify self-administration, improve medication adherence, and enhance the overall patient experience. The rise of personalized medicine is driving interest in these innovative solutions as they offer tailored treatment options based on individual patient profiles.

End-use Insights

Hospitals dominated the market with 53.2% share in 2023. Hospitals are increasingly adopting advanced injectable devices due to their ability to provide rapid therapeutic effects, which is crucial in emergency care and critical situations. Hospitals constantly strive to streamline workflows and manage costs. Advanced delivery devices can automate medication administration, reducing reliance on nursing staff and potentially lowering overall healthcare expenditures.

Homecare settings are projected to grow fastest at a CAGR of 9.2% over the forecast period. The increasing number of elderly patients requiring chronic disease management at home is a major factor. Self-administration devices such as autoinjectors and prefilled syringes empower patients to manage their conditions independently. The development of user-friendly devices that enable self-administration empowers patients to take control of their health while reducing healthcare costs associated with hospital stays.

Therapeutic Use Insights

Autoimmune disorders dominated the market with 43.3% of revenue share in 2023. This is due to the increasing prevalence of autoimmune disorders such as rheumatoid arthritis, lupus, and multiple sclerosis, requiring long-term treatment regimens that often involve biologics and other complex medications administered via injection. Autoimmune diseases often require long-term medication use. Injectable devices, particularly self-administration options such as autoinjectors, can improve patient convenience and adherence to treatment plans, leading to better disease management.

Oncology is anticipated to witness the fastest CAGR of 9.3% over the forecast period. This is due to growing incidence of cancer globally and the evolution of targeted therapies. According to International Agency for Research on Cancer, there were an estimated 20 million new cancer cases and 9.7 million deaths in year 2022. Cancer treatments increasingly rely on sophisticated biologics and immunotherapies that are often delivered through injections.

Regional Insights

North America injectable drug delivery devices market dominated the with 40.5% market share in 2023. North America has a significant population with chronic diseases such as diabetes, cancer, and autoimmune disorders. These diseases often require long-term treatment with injectable medications, fueling demand for advanced delivery devices.

U.S. Injectable Drug Delivery Devices Market Trends

The U.S. injectable drug delivery devices market dominated the North America market in 2023 due to the rising incidences of chronic diseases and increasing adoption of self-administration devices among patients.

Europe Injectable Drug Delivery Devices Market Trends

The Europe injectable drug delivery devices market was identified as a lucrative region in 2023. The risk of chronic diseases such as diabetes and cancer increases with an aging population. According to European Commission, more than one fifth of European population is aged 65 years and over.

The UK injectable drug delivery devices market is expected to grow rapidly in the coming years due to increasing prevalence of chronic diseases, rising healthcare expenditure and a strong focus on personalized medicine. The UK’s Medicines and Healthcare Products Regulatory Agency recently approved Eli Lilly’s injectable diabetes medication for use as a weight loss and management treatment in adults aged 18 and over.

Asia Pacific Injectable Drug Delivery Devices Market Trends

The Asia Pacific market is anticipated to witness the fastest growth over the forecast period. This growth is attributed to the rising burden of chronic diseases and economic growth across countries in the region.

The injectable drug delivery devices market in India held a substantial market share in 2023 due to several factors such as expanding healthcare infrastructure, increasing access to advanced medical technologies and growing number of individuals suffering from chronic diseases such as diabetes. In March 2023, Sanofi launched Soliqua, a new once-daily injectable treatment in India for adults with type 2 diabetes and obesity.

Key Injectable Drug Delivery Devices Company Insights

Some of the key companies in the injectable drug delivery devices market are Baxter, Schott AG, BD, Eli Lilly and Company, Terumo Corporation, Sanofi and others. Companies in the market are focusing on launching new products to gain a competitive edge in the industry.

-

Baxter is an American multinational healthcare company. Its injectable drug delivery devices portfolio include multiple formats such as liquid vials, lyophilized vials, powder-filled vials, and prefilled syringes.

Key Injectable Drug Delivery Devices Companies:

The following are the leading companies in the injectable drug delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- Schott AG

- BD

- Eli Lilly and Company

- Terumo Corporation

- Elcam Medical

- Unilife Corporation

- Ypsomed AG

- Gerresheimer AG

- Sanofi

Recent Developments

-

In July 2024, Schott AG introduced new 10ml ready-to-use cartridges designed for storing medications for various diseases such as cancer, genetic disorders, metabolic disorders, cardiovascular conditions, and immunological diseases. These cartridges are compatible with Ypsomed's YpsoDose device, creating a pre-filled and pre-loaded system for easier self-administration by patients at home.

-

In April 2024, Baxter announced that it is expanding its product offerings in the US. The company recently launched five new injectable medications, including pre-filled syringes and ready-to-use intravenous solutions. These new products aim to address unmet needs in areas like anti-infective and anti-hypotensive medications.

-

In April 2024, Eli Lilly and Company acquireda manufacturing facility from Nexus Pharmaceuticals to boost its production of injectable medications. This FDA-approved facility is located in Wisconsin and will help Lilly meet the growing demand for its drugs. This move strengthens Lilly's position in the injectable drug market.

-

In March 2023, Sanofi launched Soliqua, a new once-daily injectable treatment in India for adults with type 2 diabetes and obesity. Soliqua comes in pre-filled pens with two dosage options. This medication combines insulin glargine and lixisenatide to improve blood sugar control for those whose diabetes isn't adequately managed by diet, exercise, or other medications.

Injectable Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 499.08 billion

Revenue forecast in 2030

USD 823.29 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapeutic use, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter, Schott AG, BD, Eli Lilly and Company, Terumo Corporation, Elcam Medical, Unilife Corporation, Ypsomed AG, Gerresheimer AG , Sanofi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injectable Drug Delivery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the injectable drug delivery devices market report based on product, therapeutic use, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices

-

Self-injection devices

-

Conventional devices

-

-

Formulations

-

Conventional drug delivery

-

Novel drug delivery

-

Others

-

-

-

Therapeutic Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune disorders

-

Hormonal disorders

-

Oncology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.