- Home

- »

- Pharmaceuticals

- »

-

Infectious Disease Therapeutics Market, Industry Report 2030GVR Report cover

![Infectious Disease Therapeutics Market Size, Share & Trends Report]()

Infectious Disease Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Infection (Bacterial, Viral), By Drug Class (Antibacterial, Antiviral), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-580-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Infectious Disease Therapeutics Market Summary

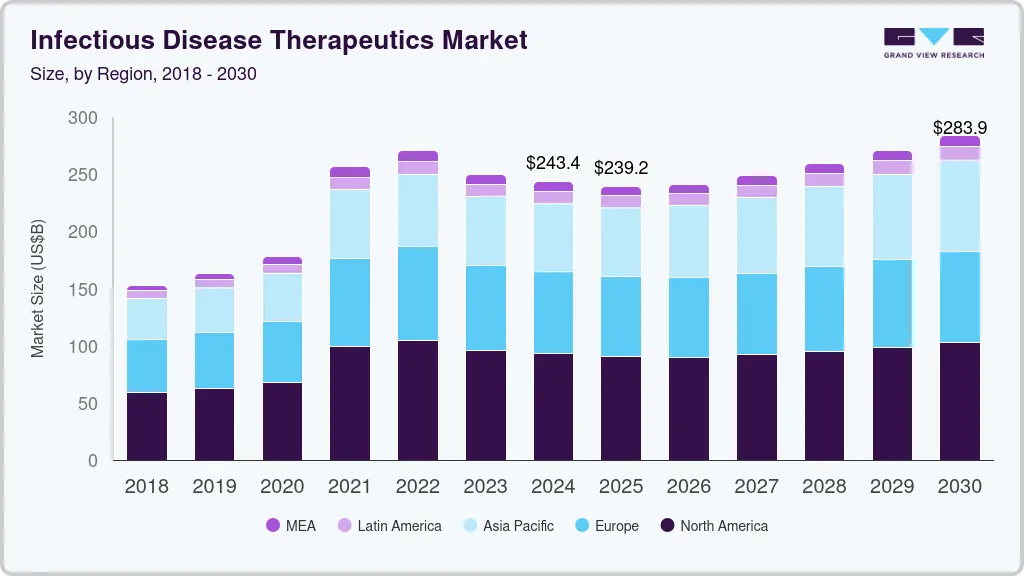

The global infectious disease therapeutics market size was estimated at USD 243,409.1 million in 2024 and is projected to reach USD 283,908.2 million by 2030, growing at a CAGR of 3.5% from 2025 to 2030. The market is expanding due to rising global health threats, increasing outbreaks of drug-resistant infections, and heightened awareness of disease prevention.

Key Market Trends & Insights

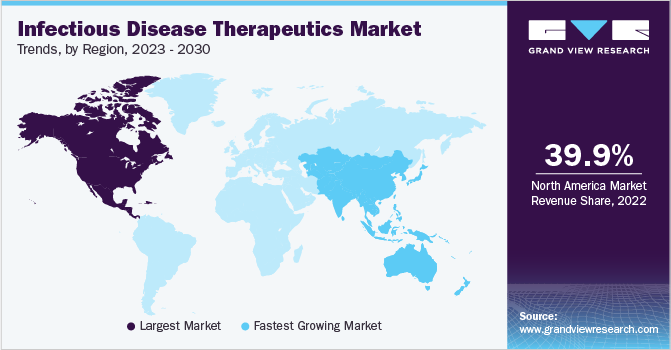

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, viral infections accounted for a revenue of USD 97,444.7 million in 2024.

- Parasitic Infections is the most lucrative infection type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 243,409.1 Million

- 2030 Projected Market Size: USD 283,908.2 Million

- CAGR (2025-2030): 3.5%

- North America: Largest market in 2024

The growing burden of chronic infections like tuberculosis, hepatitis, and HIV/AIDS is driving sustained demand for effective treatments. Technological advancements in rapid diagnostics, immunotherapies, and personalized medicine enhance treatment efficacy.

The growing incidence of infectious diseases worldwide has led to a robust demand for effective anti-infective agents. Diseases caused by bacteria, viruses, and fungi continue to rise, fueled by factors such as global travel, urbanization, and climate change, which increase the spread of pathogens across regions. This global health challenge necessitates a proactive approach to developing anti-infective agents to combat new and re-emerging diseases. Notable examples include recent outbreaks of Ebola and Zika, reinforcing the need for quick-response treatments. The COVID-19 pandemic highlighted this urgency, underscoring the critical role of targeted antiviral therapies to contain and treat high-impact infections swiftly.

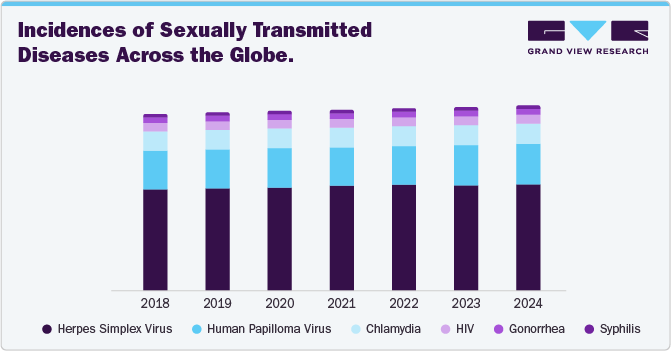

HIV remains a major global public health challenge, with ongoing efforts to reduce new infections and expand treatment access. According to UNAIDS, 39.9 million people were living with HIV in 2023, including 38.6 million adults and 1.4 million children. Women and girls accounted for 53% of cases. In 2023, approximately 1.3 million people acquired HIV, reflecting a 39% decline since 2010 and 60% since 1995. Since 2003, the U.S. President’s Emergency Plan for AIDS Relief (PEPFAR) has provided HIV testing for 71.1 million people and lifesaving ART for 20.5 million individuals. It has also enabled 5.5 million babies to be born HIV-free and supports over 327,000 healthcare workers worldwide.

A study published by the CDC stated that as of 2022, 296 million people globally were suffering from chronic hepatitis B infection. Around 820,000 deaths occur due to hepatitis B annually, causing 25% of chronic hepatitis B cases to ultimately progress to liver cancer. Rapid detection of infectious diseases with PCR facilitates timely intervention and can enable the delivery of appropriate treatments. For instance, the detection of tuberculosis is slow through conventional techniques, which can be overcome with molecular diagnostic tests for faster results.

Moreover, pharmaceutical companies are accelerating R&D activities to advance innovative therapies, including developing new classes of antibiotics, antivirals, and antifungals designed to combat resistance issues that threaten the efficacy of existing drugs. Investments in genomic analysis, artificial intelligence, and drug-repurposing platforms enable faster identification of promising drug candidates, streamlining development and shortening time to market-ultimately helping save more lives.

Overview Of Some Key Funding In The Infectious Disease Therapeutics Market

Funding Provider

Description

CARB-X

Launched a 2025 funding round to support the development of new anti-infective therapeutics, specifically targeting Gram-negative pathogens with small-molecule drugs. (2025).

Appili Therapeutics

Secured funding and regulatory engagement for ATI-1801 and ATI-1701, advancing key infectious disease therapeutics while progressing with a take-private transaction with Aditxt. (2025)

BARDA (Biomedical Advanced Research and Development Authority)

Provided USD 35 million to ModeX Therapeutics for COVID-19 multispecific antibodies and USD 16 million for an influenza program, bringing total funding to USD110 million, with potential up to USD 205 million. (2024)

ImCheck Therapeutics (French Government - France 2030 Plan)

Received USD 22.01 million in non-dilutive funding to support the development of innovative anti-infective therapies. (2024)

BARDA (GigaGen Partnership)

Awarded USD 19.6 million, potentially up to USD 135 million, to develop a polyclonal antibody platform for botulism, adaptable for other infectious diseases. (2024)

Source: Annual Reports, Press Release

Furthermore, collaborations and partnerships between large pharmaceutical companies, biotech firms, academic institutions, and research organizations strengthen R&D efforts in the infectious disease therapeutic market. These alliances foster innovation by combining resources and expertise, leading to faster breakthroughs in treatment options. Such partnerships have proven essential in responding swiftly to emerging infectious diseases.

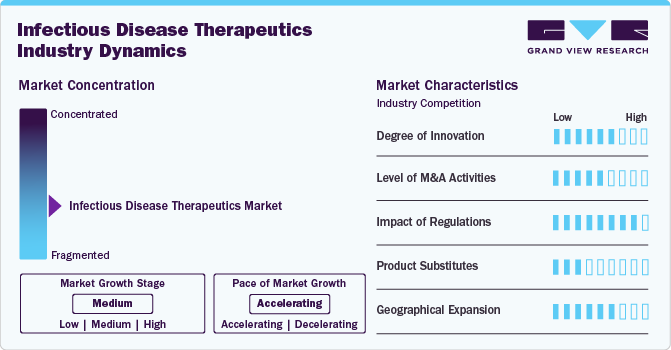

Market Concentration & Characteristics

The infectious disease therapeutics industry continues to evolve with advancements in antiviral drugs, antibiotics, monoclonal antibodies, and vaccine development. Pharmaceutical companies focus on improving drug formulations, enhancing bioavailability, and developing combination therapies to address antimicrobial resistance. The market is witnessing increasing research into host-directed therapies, novel antimicrobial peptides, and immune-modulating agents to enhance treatment outcomes.

Mergers and acquisitions significantly shape the competitive landscape as pharmaceutical companies seek to expand their portfolios in vaccines, antivirals, and antibacterial treatments. Strategic acquisitions focus on strengthening research pipelines, securing proprietary drug formulations, and expanding market reach. The rising demand for novel therapies to combat drug-resistant pathogens and emerging infectious diseases drives consolidation efforts among key market players.

Regulatory agencies such as the FDA, EMA, and national health authorities enforce stringent approval processes for infectious disease therapeutics. Drug development must comply with rigorous clinical trial requirements, post-marketing surveillance, and pharmacovigilance protocols. Market access is significantly influenced by pricing regulations, reimbursement policies, and global health organizations' procurement strategies. Fast-track approvals and priority review programs support the development of treatments for high-burden infectious diseases, but regulatory compliance remains a critical factor in market entry and expansion.

The market faces competition from preventive measures such as vaccines, sanitation improvements, and public health initiatives aimed at reducing disease transmission. Alternative therapeutic approaches, including passive immunization and convalescent plasma therapy, offer treatment options for specific infections. However, the continued emergence of resistant pathogens and the need for effective treatment regimens sustain the demand for pharmaceutical interventions, particularly in bacterial, viral, fungal, and parasitic infections.

Pharmaceutical companies are expanding into high-growth regions such as Asia Pacific, Latin America, and Africa, driven by the increasing burden of infectious diseases, rising healthcare expenditure, and government-led treatment initiatives. Market growth is supported by partnerships with global health organizations, vaccine procurement programs, and funding from international agencies to improve access to essential medicines. However, expansion efforts face challenges related to intellectual property rights, local manufacturing requirements, and pricing controls in emerging markets.

Infection Insights

Viral infections dominated the market with a 42.58% share in 2024. The rising prevalence of viral infections, including influenza, HIV, hepatitis, and emerging threats like COVID-19 and monkeypox, is a key driver in the market. Increasing globalization, urbanization, and climate change contribute to the rapid spread of viral diseases, fueling demand for antiviral drugs and vaccines. Advancements in biotechnology, RNA-based therapies, and monoclonal antibodies are accelerating treatment options. Governments and health organizations are investing in pandemic preparedness and vaccine development, further driving market growth.

The parasitic infections segment is the fastest-growing market, driven by increasing prevalence, rising drug resistance, and global health initiatives targeting malaria, leishmaniasis, and schistosomiasis. Pharmaceutical advancements focus on novel antiparasitic drugs, combination therapies, and repurposed treatments to address emerging resistance. Government programs, WHO-led eradication efforts, and funding from global health organizations further support market expansion. Growth is prominent in high-burden regions across Africa, Asia-Pacific, and Latin America, where improved access to therapeutics is a key priority.

Drug Class Insights

Vaccine dominated the anti-infective agents market with a 32.75% share in 2024, driven by rising disease prevalence, growing awareness, and strong government immunization programs. Emerging and re-emerging infections, such as COVID-19, influenza, HPV, and RSV, fuel demand for new and improved vaccines. Advances in mRNA, recombinant, and vector-based vaccine technologies enhance efficacy and speed up development. Increased R&D investments, global health initiatives, and regulatory support accelerate market growth. In addition, the expansion of pediatric and adult immunization programs, alongside rising concerns about antimicrobial resistance, boosts vaccine adoption.

The antiparasitic drugs segment is experiencing significant growth due to the rising prevalence of malaria, leishmaniasis, and other parasitic infections. Increasing drug resistance drives demand for novel formulations and combination therapies. Pharmaceutical companies are expanding research into next-generation antiparasitics, supported by global health initiatives and funding from organizations like WHO. Growth is strongest in high-burden regions, including Africa, Asia-Pacific, and Latin America, where improved access to treatment and government-led eradication programs contribute to market expansion.

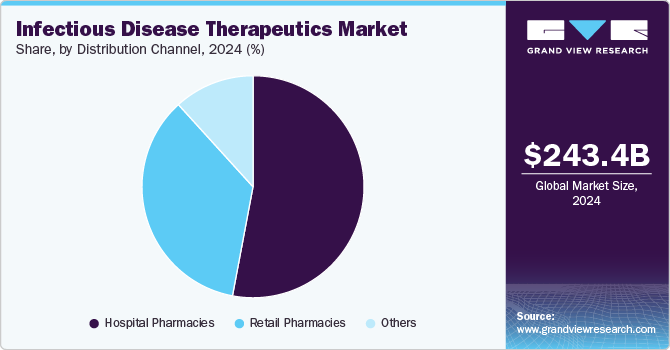

Distribution Channel Insights

Hospital pharmacies dominated the market with a revenue share of 52.19% in 2024, driven by the rising number of hospitalizations globally. Hospitals offer comprehensive patient care, prompt reimbursement, and favorable insurance policies, making them a preferred choice for patients. Hospital pharmacies are typically found in large medical institutions with advanced healthcare facilities, often including specialized departments such as infectious disease or intensive care units, where patients with severe infections receive treatment.

The other pharmacy segment is experiencing rapid growth due to the increasing adoption of online pharmacies, which enhance accessibility and convenience for infectious disease therapeutics. E-commerce platforms enable direct-to-consumer sales, reducing dependency on traditional retail channels. Regulatory support for online drug sales and rising internet penetration are driving market expansion. Consumers prefer online platforms for affordability, availability, and doorstep delivery, especially in remote areas. The demand for antiparasitic drugs, antibiotics, and antivirals through online channels is rising, particularly in high-burden regions across Asia-Pacific, Latin America, and Africa.

Regional Insights

North America holds a leading position in the 2024 infectious disease therapeutics market, accounting for 38.09% of the global share. Growth is driven by the high prevalence of bacterial, viral, and parasitic infections and increased adoption of antibiotics, antivirals, and antiparasitic drugs. The expanding use of vaccines and monoclonal antibodies is improving treatment outcomes. Hospital-based treatments dominate distribution, while retail and online pharmacies are witnessing growing demand for infectious disease management.

U.S. Infectious Disease Therapeutics Market Trends

The infectious disease therapeutics market in the U.S. leads the North American market, supported by substantial biopharma investments, high R&D expenditure, and early regulatory approvals. Rising utilization of antiviral drugs, antibiotics, and combination therapies drives market growth. The expansion of hospital-based care, along with increased accessibility of outpatient treatments, supports market penetration. Government initiatives and strategic pharmaceutical collaborations further strengthen the market landscape.

Europe Infectious Disease Therapeutics Market Trends

The infectious disease therapeutics market in Europe is experiencing steady growth, led by Germany, France, and the UK. The region benefits from strong clinical research infrastructure, government support for infectious disease management, and increasing adoption of vaccines, antibiotics, and novel therapeutics. Hospitals hold the largest distribution share, complemented by retail pharmacies and specialized infectious disease clinics.

The UK infectious disease therapeutics market is driven by increased funding for infectious disease research and expanding access to antiviral and antibiotic treatments. With ongoing clinical trials and collaborations between healthcare providers and pharmaceutical companies, the demand for monoclonal antibodies and vaccines is rising. Infectious disease clinics are gaining traction, complementing hospital-based treatment pathways.

The infectious disease therapeutics market in Germany remains a key market in Europe’s infectious disease therapeutics sector, supported by advanced manufacturing capabilities and robust biotech investments. Growing demand for antiviral medications, broad-spectrum antibiotics, and combination therapies is observed. Hospital-based treatment remains dominant, with retail pharmacies enhancing outpatient access.

France infectious disease therapeutics market is driven by the increasing adoption of antiviral drugs, antibiotic therapies, and vaccines. Regulatory advancements and public healthcare initiatives are expanding market penetration. Hospitals remain the primary distribution channel, with retail pharmacies gaining prominence in outpatient care.

Asia Pacific Infectious Disease Therapeutics Market Trends

The infectious disease therapeutics market in Asia Pacific is expanding due to the rising prevalence of bacterial and viral infections and improving healthcare infrastructure. Countries such as China, India, and Japan are leading the market, supported by increasing government initiatives and local manufacturing of antibiotics and vaccines. Hospital-based treatments and retail pharmacies are improving market penetration.

Japan infectious disease therapeutics market growth is supported by government funding for infectious disease research and a growing focus on outbreak preparedness. Hospitals remain the dominant distribution channel, with specialized infectious disease clinics improving access to treatments.

The infectious disease therapeutics market in China is expanding rapidly, supported by robust biopharma investments and increased healthcare accessibility. The demand for antibiotics, antivirals, and vaccines is growing, with hospital-based care and online pharmacy platforms facilitating patient access to treatment.

Latin America Infectious Disease Therapeutics Market Trends

The infectious disease therapeutics market in Latin America is witnessing growth driven by increasing healthcare expenditures and rising awareness of infection prevention. Brazil stands out as a key market, supported by government health initiatives and investments in biopharmaceutical development. The demand for antibiotics, vaccines, and antiviral medications is fostering market expansion.

Brazil infectious disease therapeutic market growth is fueled by a high burden of infectious diseases and expanding healthcare infrastructure. Investments in local manufacturing of antibiotics and vaccines, along with international collaborations, are enhancing treatment accessibility. Hospital-based care remains dominant, with retail and online pharmacies expanding services.

Middle East & Africa Infectious Disease Therapeutics Market Trends

The infectious disease therapeutics market in MEA is experiencing steady growth due to improving healthcare infrastructure and a rising burden of bacterial and viral infections. Countries such as Saudi Arabia are witnessing increased demand for antibiotics, antivirals, and vaccines, driven by government initiatives aimed at healthcare modernization.

Saudi Arabia infectious disease therapeutics market is expanding, supported by healthcare reforms and growing investments in infectious disease research. The rising incidence of bacterial and viral infections is increasing the demand for treatment solutions, with hospital-based services leading distribution and retail pharmacies improving patient access.

Key Infectious Disease Therapeutics Company Insights

Leading pharmaceutical companies in the market focus on drug development, strategic partnerships, and global expansion. Companies such as Pfizer, Gilead Sciences, Merck & Co., and Roche dominate the infectious disease therapeutics segment, introducing novel antibiotics, antivirals, and vaccines. Mergers, acquisitions, and increasing R&D investments are intensifying competition, driving product innovation and treatment accessibility in the market.

Key Infectious Disease Therapeutics Companies:

The following are the leading companies in the infectious disease therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- AbbVie.

- Gilead Sciences, Inc.

- Bristol-Myers Squibb

- Merck & Co., Inc.

- Sandoz International GmbH

- B. Braun SE

- Xellia Pharmaceuticals

- Mankind Pharma

- Bayer AG

- AstraZeneca

- Boehringer Ingelheim International GmbH.

- Novartis AG

- F. Hoffmann-La Roche Ltd

Recent Developments

-

In February 2025, AbbVie and co-developer Pfizer's drug, Emblaveo and is approved in combination with an antibiotic medication for patients 18 years and older with abdominal infections.

-

In March 2024, AbbVie acquired Landos Biopharma, focusing on inflammatory and autoimmune diseases. Landos' lead asset, NX-13, is an oral NLRX1 agonist in Phase 2 for ulcerative colitis, a condition with infectious disease implications.

-

In February 2024, AstraZeneca has concluded the acquisition of the US-based clinical-stage biopharmaceutical company Icosavax in a USD 1.1bn deal. AstraZeneca will strenghten its vaccine pipeline with a Phase III-ready candidate for respiratory infections.

Infectious Disease Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 239.19 billion

Revenue forecast in 2030

USD 283.91 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

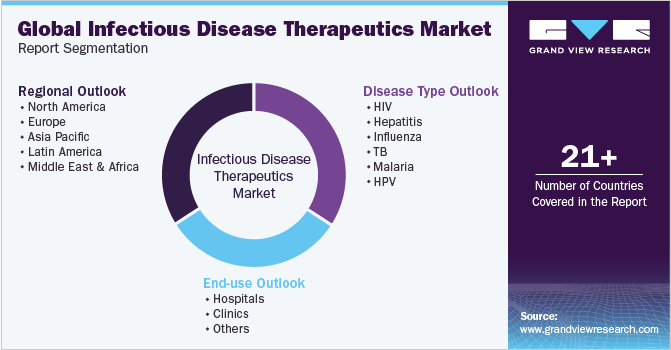

Infection, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pfizer Inc.; AbbVie; Gilead Sciences, Inc.; Bristol-Myers Squibb; Merck & Co., Inc.; Sandoz International GmbH; B. Braun SE; Xellia Pharmaceuticals; Mankind Pharma; Bayer AG; AstraZeneca; Boehringer Ingelheim International GmbH; Novartis AG; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infectious Disease Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infectious disease therapeutics market report based on infection, drug class, distribution channel, and region:

-

Infection Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial Infections

-

Viral Infections

-

Human Immunodeficiency Virus (HIV/AIDS)

-

Hepatitis (Hepatitis B, Hepatitis C)

-

Influenza

-

Others

-

-

Fungal Infections

-

Parasitic Infections

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibacterials

-

Antivirals

-

Antifungals

-

Antiparasitic Drugs

-

Vaccines

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global infectious disease therapeutics market size was estimated at USD 243.41 billion in 2024 and is expected to reach USD 239.19 billion in 2025.

b. The global infectious disease therapeutics market is expected to grow at a compound annual growth rate of 3.49% from 2025 to 2030 to reach USD 283.91 billion by 2030.

b. Viral infections segment dominated the market with a 42.58% share in 2024. The rising prevalence of viral infections, including influenza, HIV, hepatitis, and emerging threats like COVID-19 and monkeypox, is a key driver in the infectious disease therapeutics market.

b. The key players operating in the infectious disease therapeutics market include Pfizer, Bristol-Myers Squibb, Merck & Co., Inc., Sandoz International GmbH, B. Braun SE, Gilead Sciences, Merck & Co., and F. Hoffmann-La Roche Ltd., among others.

b. Key factors that are driving the market growth include rising global health threats, increasing outbreaks of drug-resistant infections, and increasing awareness of disease prevention. The growing burden of chronic infections like tuberculosis, hepatitis, and HIV/AIDS is driving sustained demand for effective treatments. Technological advancements in rapid diagnostics, immunotherapies, and personalized medicine are enhancing treatment efficacy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.