- Home

- »

- Plastics, Polymers & Resins

- »

-

Industrial Packaging Market Size, Industry Report, 2033GVR Report cover

![Industrial Packaging Market Size, Share & Trends Report]()

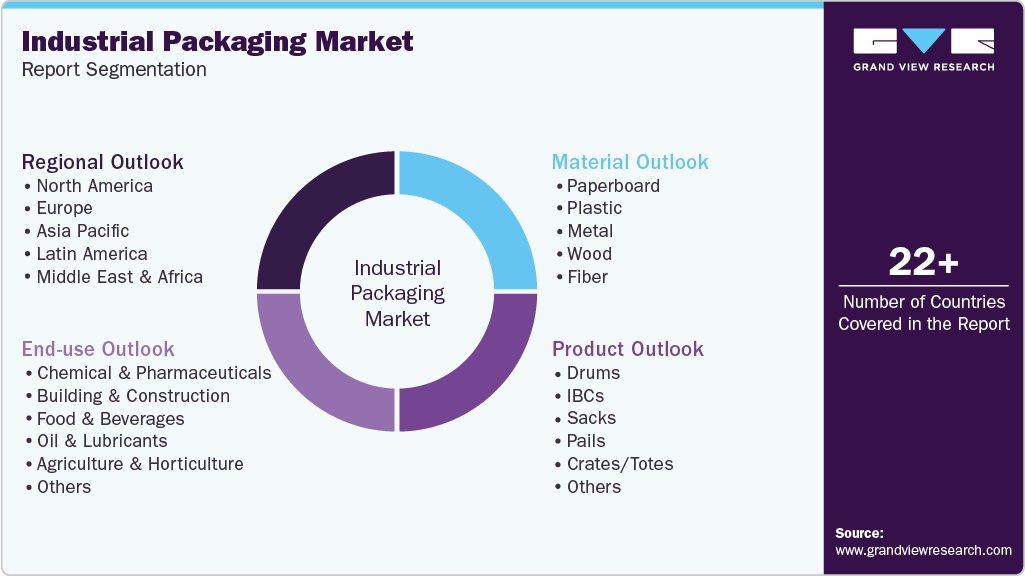

Industrial Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Paperboard, Plastic, Metal, Wood, Fiber), By Product (Drums, IBCs, Sacks, Pails, Crates/Totes), By End Use (Chemical And Pharmaceuticals, Oil And Lubricants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-846-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Packaging Market Summary

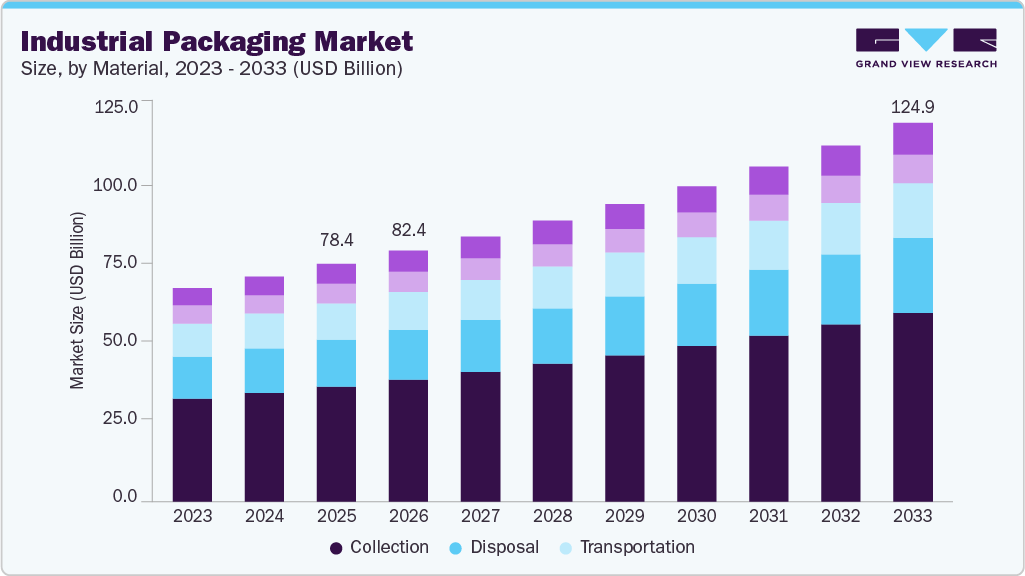

The global industrial packaging market size was estimated at USD 78.44 billion in 2025 and is expected to reach USD 124.97 billion, expanding at a CAGR of 6.0% from 2026 to 2033. The demand for industrial packaging in the global market is growing primarily due to the expansion of industrial production and increasingly complex global supply chains.

Key Market Trends & Insights

- Asia Pacific dominated the industrial packaging market with the largest revenue share of over 38.33% in 2025.

- The industrial packaging market in U.S is expected to grow at a substantial CAGR of 4.6% from 2026 to 2033.

- By material, the polypropylene (PP) segment accounted for the largest revenue share of 50.33% in 2025, and is forecasted to grow at a significant CAGR from 2026 to 2033 in terms of revenue.

- By End Use, the pharmaceutical & nutraceutical segment is expected to grow at a fastest CAGR of 5.4% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 78.44 Billion

- 2033 Projected Market Size: USD 124.97 Billion

- CAGR (2026-2033): 6.0%

- Asia Pacific: Largest market in 2025

Industries such as chemicals, pharmaceuticals, food and beverages, construction, and automotive are producing and transporting larger volumes of bulk and semi-bulk goods across long distances. This has heightened the need for packaging solutions that can protect products from physical damage, contamination, and environmental exposure during storage and transit. As cross-border trade intensifies and manufacturers rely more on multimodal transportation, industrial packaging such as drums, intermediate bulk containers (IBCs), sacks, and crates has become essential for ensuring product integrity and operational efficiency.Another major driver is the rising emphasis on safety, regulatory compliance, and performance reliability. Many industrial products, particularly chemicals, hazardous materials, and pharmaceutical ingredients, must meet strict international handling and transportation standards. This has increased demand for certified, high-strength, and tamper-resistant packaging that minimizes leakage, spoilage, and loss. At the same time, businesses are seeking packaging solutions that reduce operational risks and product wastage, as damaged goods can lead to significant financial and reputational losses. As a result, industrial packaging is increasingly viewed not just as a cost component, but as a value-adding element within the supply chain.

In addition, sustainability initiatives and technological advancements are reshaping the industrial packaging landscape and driving market growth. Companies are adopting reusable, recyclable, and lightweight packaging solutions to reduce environmental impact and comply with evolving sustainability regulations. This shift toward circular packaging systems is encouraging investment in innovative materials and designs that offer durability while lowering overall lifecycle costs. Simultaneously, advancements in packaging technology, such as improved material strength, automation compatibility, and tracking features, are enhancing efficiency and visibility across logistics networks. Together, these factors are accelerating adoption and reinforcing long-term demand for industrial packaging worldwide.

Market Concentration & Characteristics

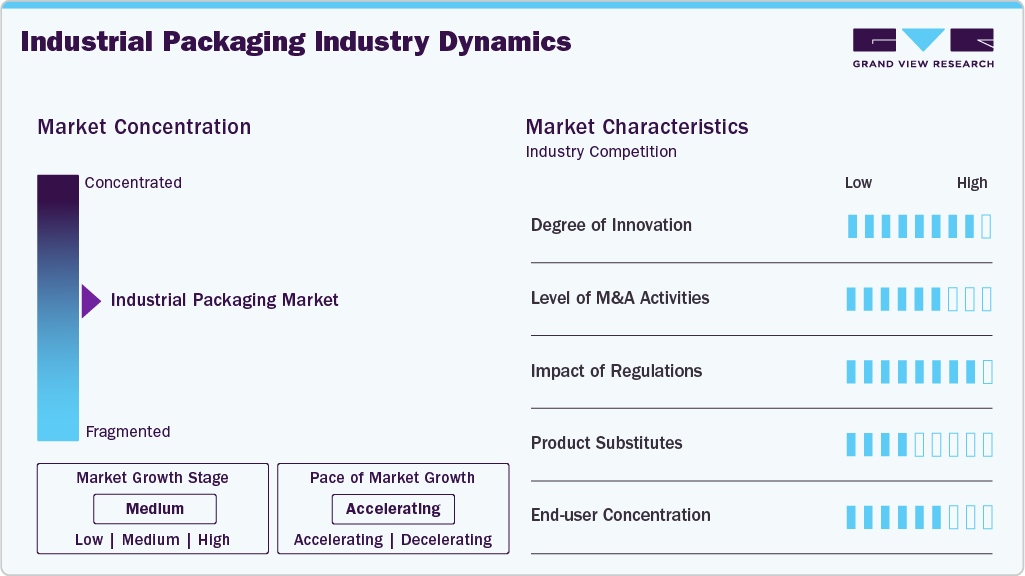

The industrial packaging market is characterized by a moderate to high level of industry concentration, with a mix of large multinational players and numerous regional manufacturers. Global companies dominate high-volume and high-specification segments due to their scale, technological capabilities, and established relationships with large industrial customers. However, regional and local players remain important, particularly in cost-sensitive markets and for customized or short-distance logistics needs. This dual structure creates a competitive environment where scale, consistency, and compliance matter, while flexibility and customer proximity also play a critical role.

Another defining characteristic of the industry is its strong dependence on end use industries and overall industrial activity. Demand for industrial packaging closely follows trends in manufacturing output, infrastructure development, and trade volumes across sectors such as chemicals, pharmaceuticals, food and beverages, construction, and agriculture. As these industries expand or contract, packaging demand responds accordingly, making the market somewhat cyclical. Long-term supply contracts and repeat business are common, as customers prioritize reliability, standardized specifications, and continuity of supply, which helps stabilize revenues for established players.

The market is also marked by capital intensity, regulatory oversight, and increasing innovation requirements. Manufacturing industrial packaging, especially rigid formats like drums, IBCs, and metal containers, requires significant investment in machinery, tooling, quality control systems, and safety certifications. Regulatory compliance related to hazardous materials, food safety, and environmental standards further raises entry barriers. At the same time, innovation in materials, lightweighting, reusability, and sustainability has become a key differentiator, pushing companies to invest continuously in product development and process efficiency to remain competitive in the global market.

Material Insights

The paperboard segment recorded the largest market revenue share of 48.57% in 2025. The paperboard material segment has dominated the industrial packaging market largely due to its cost-effectiveness, versatility, and widespread applicability across multiple end use industries. Paperboard packaging is widely used for cartons, boxes, corrugated containers, and bulk packaging solutions that are essential for transporting industrial goods, automotive components, food products, and consumer durables. Its ability to provide adequate strength and protection while remaining lightweight makes it highly suitable for large-volume shipments and palletized logistics.

In addition, paperboard offers ease of customization in terms of size, strength, and printability, allowing manufacturers to optimize packaging for different product types while supporting branding and handling instructions. These functional and economic advantages have made paperboard the preferred material for a broad range of industrial packaging applications.

Moreover, paperboard is also the fastest-growing material segment due to strong sustainability and regulatory tailwinds. Compared to plastic and metal alternatives, paperboard is renewable, recyclable, and biodegradable, aligning closely with global efforts to reduce packaging waste and carbon emissions. Many industrial users are actively replacing plastic-based packaging with fiber-based solutions to meet environmental targets and comply with evolving regulations.

Advancements in corrugated and coated paperboard technologies have further improved moisture resistance, load-bearing capacity, and durability, enabling paperboard to penetrate applications traditionally served by rigid plastics. As a result, rising environmental awareness, combined with continuous material innovation, is accelerating the adoption of paperboard and driving its rapid growth within the industrial packaging market.

Product Insights

The drums segment accounted for the largest market share of 31.63% in 2025 and expected to grow at a CAGR of 6.4% over the forecast period. Drums have dominated the industrial packaging product segment primarily because of their high versatility, durability, and suitability for handling bulk liquids and semi-liquid materials across a wide range of industries. They are extensively used in chemicals, pharmaceuticals, oil and lubricants, food ingredients, and specialty industrial applications where safe containment is critical. Drums offer strong resistance to impact, leakage, and external contamination, making them ideal for hazardous and non-hazardous materials alike. Their standardized sizes and designs also allow for easy stacking, palletization, and compatibility with existing handling and transportation infrastructure, which reduces logistics complexity and operational costs for industrial users.

Moreover, the dominance of drums is their regulatory acceptance, reusability, and cost efficiency over the product lifecycle. Many drums, particularly steel and high-density polyethylene (HDPE) variants, meet international safety and transport regulations, making them suitable for cross-border trade and long-distance shipping. Drums can be reused, reconditioned, or recycled multiple times, which lowers total ownership costs and supports sustainability objectives. In addition, well-established global supply networks and widespread availability of drum handling equipment make them a reliable and familiar choice for manufacturers, reinforcing their continued dominance within the industrial packaging market.

Crates/totes are the fastest growing segment in the industrial packaging market due to their reusability, durability, and alignment with modern logistics and sustainability practices. Unlike single-use packaging formats, crates and totes are designed for repeated handling and long service life, making them highly attractive for industries focused on reducing packaging waste and overall logistics costs. Their rigid structure provides superior protection for goods during handling and transportation, particularly for automotive components, electronics, food processing, and intra-plant material movement. As companies increasingly shift toward closed-loop and returnable packaging systems, the adoption of crates and totes is accelerating across global supply chains.

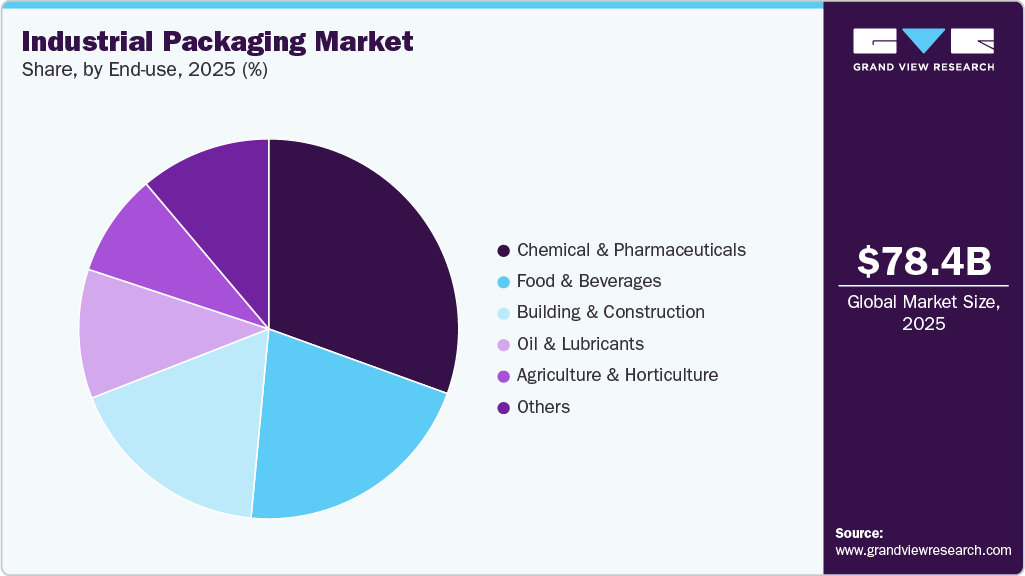

End Use Insights

The Chemical and Pharmaceuticals end use segment dominated the market with a major revenue share of 30.53% in 2025. The chemicals and pharmaceuticals segment dominates the industrial packaging end use landscape because these industries generate consistently high volumes of bulk and high-value materials that require specialized, secure packaging. Chemical manufacturers handle a wide range of liquid, semi-solid, and powdered products, many of which are hazardous, corrosive, or sensitive to contamination. This creates sustained demand for robust industrial packaging formats such as drums, IBCs, sacks, and lined containers that can ensure safe storage and transportation. Pharmaceuticals further add to this demand through the movement of active pharmaceutical ingredients (APIs), intermediates, and bulk formulations, all of which require controlled, contamination-free packaging throughout the supply chain.

In addition, stringent regulatory and safety requirements significantly reinforce the dominance of this end use segment. Both chemical and pharmaceutical industries must comply with strict international standards related to material compatibility, leak prevention, labeling, and traceability. As a result, these industries rely heavily on certified industrial packaging solutions rather than low-cost or informal alternatives. The global expansion of chemical production capacity, rising pharmaceutical manufacturing—particularly for generics, biologics, and specialty drugs—and increasing cross-border trade further amplify packaging demand. Together, the combination of high production volumes, regulatory intensity, and risk sensitivity makes chemicals and pharmaceuticals the largest and most stable end use segment in the industrial packaging market.

The food and beverages segment is witnessing the fastest CAGR in the industrial packaging market primarily due to rising global food production, processing, and distribution activities. Growing urbanization, population expansion, and changing consumption patterns have increased demand for packaged and processed food products worldwide. This has led to higher volumes of bulk ingredients such as grains, sugar, dairy inputs, edible oils, and liquid concentrates being transported between producers, processors, and distributors. Industrial packaging solutions like sacks, drums, IBCs, and crates are essential to maintain product quality and prevent spoilage across increasingly long and complex supply chains, driving rapid growth in this segment.

Another major factor is the heightened focus on food safety, hygiene, and cold-chain efficiency. Regulatory authorities and food companies are placing greater emphasis on contamination prevention, traceability, and compliance with food-grade standards, which is accelerating the shift toward high-quality, certified industrial packaging. At the same time, growth in frozen foods, ready-to-drink beverages, and global food exports is increasing the need for temperature-resistant, moisture-barrier, and reusable packaging formats. Sustainability trends are also influencing food and beverage manufacturers to adopt recyclable and reusable industrial packaging solutions, further accelerating demand and contributing to the segment’s fastest growth rate within the industrial packaging market.

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 4207% in 2025. Asia Pacific dominates the industrial packaging market due to its large-scale manufacturing base and its role as a global production and export hub. The region hosts some of the world’s most extensive manufacturing ecosystems, spanning chemicals, pharmaceuticals, food and beverages, electronics, automotive, and construction materials. Countries such as China, India, Japan, South Korea, and several Southeast Asian nations produce and export massive volumes of industrial goods, all of which require reliable bulk and transit packaging. The sheer scale of industrial output, combined with high intra-regional and inter-regional trade flows, results in sustained and high demand for industrial packaging across the region.

The industrial packaging demand in China is growing due to the country’s continued shift toward high-value manufacturing and export diversification. Beyond traditional mass manufacturing, China is expanding rapidly in specialty chemicals, electric vehicles, batteries, electronics, and advanced materials, all of which require reliable bulk and protective packaging. In addition, the growth of domestic logistics networks and inland industrial clusters has increased internal movement of goods, driving demand for standardized, high-volume industrial packaging to support efficient storage and transportation across vast distances.

North America Industrial Packaging Market Trends

In North America, growth in industrial packaging demand is being driven by supply chain restructuring and nearshoring trends. Manufacturers are relocating or expanding production closer to end markets to reduce geopolitical risk and improve supply reliability. This shift is increasing regional manufacturing activity, cross-border trade within the US-Mexico-Canada corridor, and demand for durable industrial packaging suited for frequent handling and shorter but higher-frequency transport cycles. The emphasis on operational resilience has made industrial packaging a critical component of regional supply chain strategies.

The U.S. market is experiencing strong demand growth due to expansion in pharmaceuticals, chemicals, and food processing, supported by domestic investment and policy incentives. Increased spending on healthcare manufacturing, specialty chemicals, and energy-related products has led to higher volumes of bulk material movement. Additionally, the U.S. logistics ecosystem emphasizes compliance, traceability, and performance reliability, which is driving demand for high-quality, certified industrial packaging rather than low-cost alternatives.

Europe Industrial Packaging Market Trends

In Europe, demand growth is largely fueled by strict environmental regulations and the transition toward circular packaging systems. European manufacturers are actively adopting reusable, recyclable, and returnable industrial packaging to meet sustainability targets and regulatory mandates. This transition is increasing replacement demand for modern packaging solutions across industries such as chemicals, food processing, and industrial manufacturing. Cross-border trade within the EU further amplifies the need for standardized packaging formats that comply with harmonized regulations.

Germany’s growing demand is closely linked to its position as Europe’s industrial and engineering backbone. The country has a strong concentration of chemical producers, automotive manufacturers, machinery exporters, and industrial equipment suppliers, all of which rely on precision, durability, and high-performance packaging. Germany’s emphasis on export quality, process efficiency, and automation-friendly logistics has increased the use of standardized, reusable, and heavy-duty industrial packaging, supporting steady and sustained market growth.

Key Industrial Packaging Company Insights

The industrial packaging market is highly competitive and moderately consolidated, with the presence of large multinational corporations alongside strong regional and niche players. Global companies compete on scale, product breadth, geographic reach, and long-term contracts with large industrial customers, allowing them to serve high-volume requirements across multiple regions. These players typically offer a wide portfolio covering drums, IBCs, sacks, crates, and customized solutions, which strengthens customer retention and increases switching costs. At the same time, regional manufacturers remain competitive by focusing on cost efficiency, faster delivery, and customized packaging solutions tailored to local industries and regulatory requirements.

Competition in the market is increasingly shaped by innovation, sustainability, and service capabilities rather than price alone. Companies are investing in lightweight materials, reusable and reconditioned packaging, and circular economy models to differentiate their offerings and align with customer sustainability goals. Value-added services such as packaging design support, regulatory compliance assistance, reverse logistics, and lifecycle management are becoming key competitive factors. As customers seek long-term supply partnerships rather than transactional purchases, players that can combine product reliability with technical expertise and sustainability-driven solutions are gaining a stronger competitive position in the global industrial packaging market.

-

On 16 July 2025, UFP Packaging revealed the U-Loc 200, the latest cart with the first tool-free disassembly and assembly. This patient-pending quicker vanishes the demand for staple guns and nails, a tool that includes a calculated 37,000 emergency room visits annually.

-

On 2 July 2025, Dow revealed the main development in sustainable packaging with the launch of its INNATE TF 220 Precision Packaging resin, which assists the growth of high-performance biaxially oriented polyethylene (BOPE) films personalized for recyclability.

-

On 2 June 2025, Industrial Physics, a top leader in measurement and test solutions, revealed its state-of-the-art automated gauges aimed at encouraging accuracy and productivity in metal packaging: the Torus Z606 Automatic Score Inspection Gauge and the Torus Z345 Automatic Color Inspection Gauge.

Key Industrial Packaging Companies:

The following key companies have been profiled for this study on the industrial packaging market

- DS Smith

- Mondi

- Sonoco Products Company

- Sealed Air

- Huhtamäki Oyj

- Smurfit Kappa

- WestRock Company

- UFP Technologies, Inc.

- Stora Enso

- Pregis LLC

- Shenzhen Hoichow Packing Manufacturing Ltd.

- International Paper

- Dordan Manufacturing Company

Industrial Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 82.84 billion

Revenue forecast in 2033

USD 124.97 billion

Growth rate

CAGR of 6.0% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

DS Smith; Mondi; Sonoco Products Company; Sealed Air; Huhtamäki Oyj; Smurfit Kappa; WestRock Company; UFP Technologies, Inc.; Stora Enso; Pregis LLC; Shenzhen Hoichow Packing Manufacturing Ltd.; International Paper; Dordan Manufacturing Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial packaging market report based on product, material, application, and region:

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Paperboard

-

Plastic

-

Metal

-

Wood

-

Fiber

-

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Drums

-

IBCs

-

Sacks

-

Pails

-

Crates/Totes

-

Others

-

-

End Use Outlook (Revenue, USD Million 2021 - 2033)

-

Chemical and Pharmaceuticals

-

Building and Construction

-

Food and Beverages

-

Oil and Lubricants

-

Agriculture and Horticulture

-

Others

-

-

Region Outlook (Revenue, USD Million 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial packaging market was estimated at around USD 78.44 billion in the year 2025 and is expected to reach around USD 82.84 billion in 2026.

b. The global industrial packaging market is expected to grow at a compound annual growth rate of 6.0% from 2026 to 2033 to reach around USD 124.97 billion by 2033.

b. One of the primary factors for rising demand is the rapid growth of the e-commerce and global logistics market

b. The paperboard segment recorded the largest market share of 48.57% in 2025 due to strong sustainability and regulatory tailwinds. Compared to plastic and metal alternatives, paperboard is renewable, recyclable, and biodegradable, aligning closely with global efforts to reduce packaging waste and carbon emissions.

b. The key players in the industrial packaging market include DS Smith, Mondi, Sonoco Products Company, Sealed Air, Huhtamäki Oyj, Smurfit Kappa, WestRock Company, UFP Technologies, Inc., Stora Enso, Pregis LLC, Shenzhen Hoichow Packing Manufacturing Ltd., International Paper, Dordan Manufacturing Company

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.