- Home

- »

- Next Generation Technologies

- »

-

Industrial Metaverse Market Size, Industry Report, 2033GVR Report cover

![Industrial Metaverse Market Size, Share & Trends Report]()

Industrial Metaverse Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Hardware), By Technology (AR, VR), By Application, By End use (Automotive, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-129-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Metaverse Market Summary

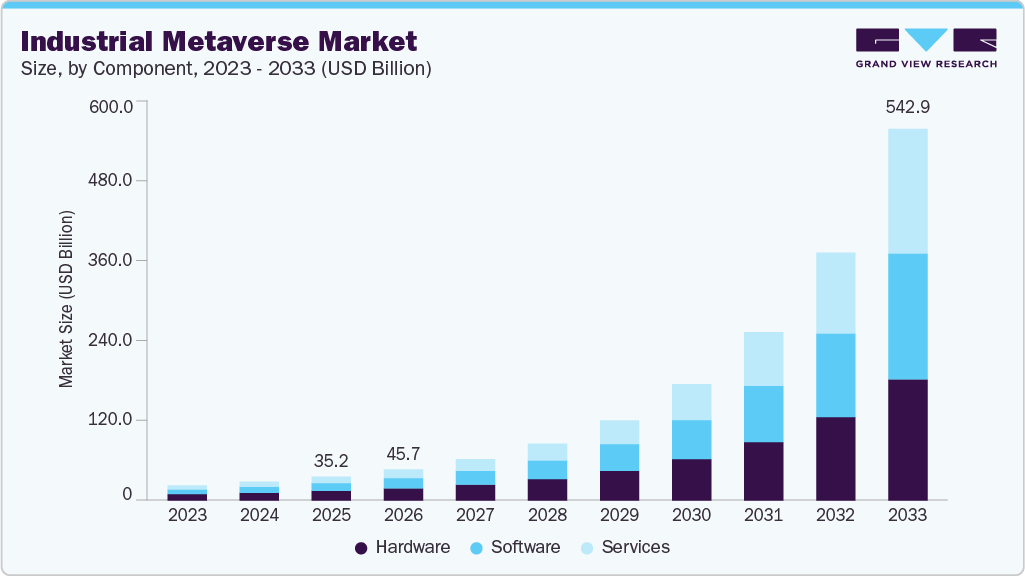

The global industrial metaverse market size was estimated at USD 35.20 billion in 2025 and is projected to reach USD 542.99 billion by 2033, growing at a CAGR of 42.4% from 2026 to 2033. The market is growing as improvements in infrastructure and connectivity are lowering deployment barriers.

Key Market Trends & Insights

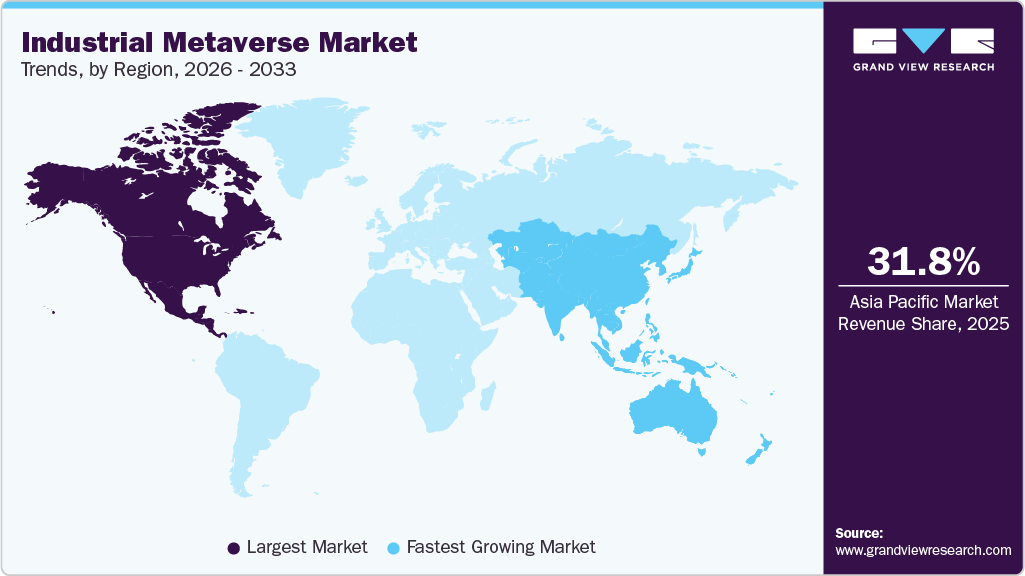

- North America industrial metaverse dominated the global market with the largest revenue share of 31.8% in 2025.

- The industrial metaverse industry in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, hardware led the market and held the largest revenue share of 40.2% in 2025.

- By technology, the VR segment held the dominant position in the market and accounted for the largest revenue share of 37.1% in 2025.

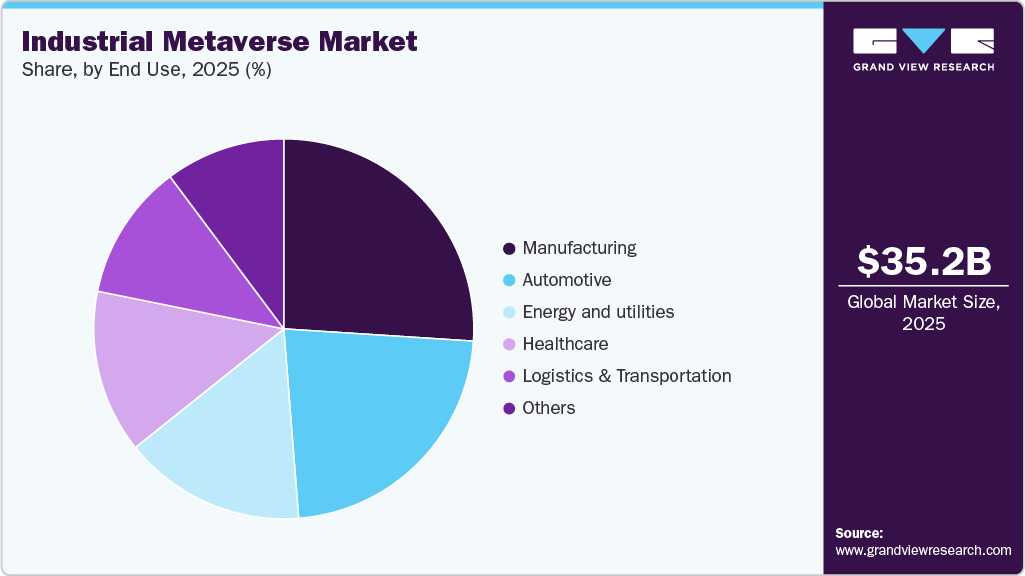

- By end use, the automotive segment is projected to grow significantly over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 35.20 Billion

- 2033 Projected Market Size: USD 542.99 Billion

- CAGR (2026-2033): 42.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The adoption of 5G networks is enabling low-latency, real-time interactions across industrial environments. Cloud platforms support large-scale data processing and centralized management of virtual assets. Edge computing further strengthening scalability by enabling faster decision-making closer to operations.The integration of digital twins has strengthened the industrial metaverse industry by enabling virtual representations of physical assets and processes that support efficiency and innovation. Through real-time monitoring, predictive analytics, and advanced simulation, digital twins help optimize operations, improve productivity, and reduce operational risks. These capabilities enhance collaboration and support more informed decision-making across industrial environments. As adoption continues to grow, digital twins are becoming essential components of industrial digital transformation strategies in an increasingly digitalized economy. For instance, in January 2025, NVIDIA Corporation expanded its Omniverse platform with enhanced digital twin and physical AI capabilities to support large-scale industrial simulations. These updates strengthened real-time collaboration and visualization across manufacturing and infrastructure environments.

Virtual Reality (VR) and AR (Augmented Reality) Technology enhance the industrial metaverse by offering immersive training experiences, remote assistance, advanced visualization, safety training, and remote monitoring capabilities. These Technology enable employees to engage in realistic simulations, improving learning outcomes and reducing skill acquisition time. AR applications facilitate remote assistance and collaboration, enhancing troubleshooting and maintenance processes. VR tools simplify design and visualization, reducing development costs and identifying design flaws early. Moreover, VR and AR are utilized in safety training programs to simulate hazardous scenarios, improving safety awareness and emergency response preparedness. Moreover, AR-enabled smart devices provide technicians with real-time data during maintenance tasks, enhancing efficiency and accuracy. VR and AR Technology contribute significantly to productivity, safety, and innovation within the industrial metaverse.

The focus on developing next-generation nuclear reactors highlights the adoption of advanced technologies within the industrial metaverse industry. These Technology enable engineers to create virtual models of reactors, optimize design parameters, and ensure safety and efficiency. AI algorithms analyze operational data in real time, enhancing predictive maintenance and optimizing reactor performance, and data analytics provide valuable insights for decision-making and regulatory compliance. Companies are collaborating to utilize innovative solutions such as advanced simulation tools, artificial intelligence, and data analytics to address complex industrial challenges and drive sustainable growth. For instance, in February 2024, Dassault Systemes and Assystem, an independent engineering group based in Paris, strengthened their strategic partnership to expedite the development of next-generation nuclear reactors. By utilizing digital twins, this partnership aims to assist industry customers in managing project complexity and ensuring data quality and traceability for design and delivery.

Component Insights

The hardware segment led the market and accounted for 40.2% of the global revenue in 2025. Industrial metaverse solutions often require specialized hardware components customized to the unique needs of industrial applications. These may include ruggedized devices capable of withstanding harsh operating conditions, high-performance computing systems for real-time data processing, and specialized sensors for monitoring industrial processes. Hardware advancements enable the implementation of advanced capabilities within the industrial metaverse, such as immersive VR/AR experiences, real-time monitoring and control, and high-fidelity digital twins. As these Technology become more sophisticated and widely adopted, the demand for compatible hardware grows accordingly.

The services segment is projected to grow significantly over the forecast period. Industrial metaverse solutions often require customization and integration with existing systems and processes within industrial environments. Service providers offer expertise in tailoring solutions to meet the specific needs of each client, ensuring seamless integration and optimal performance. Once deployed, industrial metaverse solutions require ongoing maintenance and support to ensure continuous operation and optimal performance. Service providers offer maintenance contracts, remote monitoring, and troubleshooting services to address issues promptly and minimize downtime.

Technology Insights

The VR segment accounted for the largest revenue share in 2025. The VR segment dominated the market due to its ability to provide immersive experiences and promote realistic training simulations for industrial tasks. Moreover, VR enables virtual product design and prototyping, accelerating the design iteration process and reducing time-to-market. It also supports remote collaboration among geographically dispersed teams and enhances data visualization and analysis capabilities, particularly valuable for industries such as manufacturing. As VR technology continues to advance and become more accessible, its role in transforming industrial processes and operations is expected to grow further.

The MR segment is predicted to foresee significant growth in the forecast period. MR combines elements of both virtual and augmented reality, offering users a seamless blend of virtual and real-world environments, which enhances user engagement and interaction. MR technology enables hands-on training and simulations in real-world settings, enabling users to interact with digital content overlaid onto physical objects, making it particularly valuable for tasks that require spatial awareness and manipulation. Moreover, MR facilitates remote assistance and collaboration by enabling users to share and interact with digital content in real time, regardless of their physical location. Furthermore, MR enhances product design and prototyping processes by enabling designers to visualize and manipulate virtual models within real-world contexts, leading to faster iteration cycles and improved design outcomes.

Application Insights

The data visualization & analytics segment held the largest market revenue share in 2025. As industrial processes become increasingly digitized, there is a growing volume of data generated across various operations. Data visualization and analytics tools enable companies to make sense of this data by transforming complex datasets into visual representations that are easier to understand and interpret. Moreover, in the industrial metaverse, these tools enable users to visualize and analyze data within immersive virtual environments, providing valuable insights into operational performance, equipment health, and production efficiency. As companies strive to optimize processes and improve decision-making, there is a growing demand for advanced analytics capabilities that can uncover patterns, trends, and anomalies within industrial datasets. Moreover, data visualization and analytics tools enable real-time monitoring and predictive analytics, empowering companies to identify and address issues proactively, leading to increased efficiency and reduced downtime.

The product design & development segment is projected to grow significantly over the forecast period. VR and AR technologies enable engineers and designers to create immersive virtual environments where they can visualize and manipulate digital prototypes in real time. This immersive experience facilitates more efficient collaboration among design teams, leading to faster iteration cycles and improved design outcomes. Virtual prototyping reduces the need for physical prototypes, saving time and resources in the product development process. Moreover, VR and AR Technology allow designers to evaluate product designs within real-world contexts, enabling them to identify and address potential issues before physical production begins. The industrial metaverse facilitates remote collaboration among geographically dispersed teams, enabling seamless communication and coordination throughout the product development lifecycle.

End Use Insights

The manufacturing segment held the largest market revenue share in 2025. Manufacturing is witnessing growth in the market due to its integration of digital technology such as VR, AR, and digital twins. These technologies enhance operational efficiency and productivity by simplifying production workflows, optimizing equipment utilization, and minimizing downtime through predictive maintenance and real-time monitoring. The industrial metaverse promotes remote collaboration and knowledge sharing among geographically dispersed teams, enabling faster decision-making and enhancing overall agility in responding to market demands. Virtual prototyping and simulation within the industrial metaverse enable manufacturers to design and optimize production processes in a virtual environment, reducing the need for costly physical prototypes and minimizing risks associated with product development.

The automotive segment is projected to grow significantly over the forecast period. The industrial metaverse promotes the optimization of automotive supply chains by providing real-time visibility into inventory levels, production processes, and logistics operations. This enables automotive companies to simplify supply chain management, reduce costs, and improve overall efficiency. The automotive industry is increasingly focused on developing advanced driver assistance systems and autonomous vehicle technology. The industrial metaverse provides a platform for testing and validating these technologies in virtual environments, enabling automotive companies to accelerate innovation and improve safety features. Moreover, industrial metaverse enhances aftermarket services and maintenance for automotive vehicles by providing virtual diagnostics, remote assistance, and predictive maintenance capabilities. This improves vehicle reliability, reduces downtime, and enhances the overall ownership experience for customers.

Regional Insights

North America industrial metaverse industry dominated the global market with a revenue share of 31.8% in 2025. North America has a strong industrial base across various sectors, including manufacturing, automotive, aerospace, and healthcare, among others. These industries are early adopters of industrial metaverse technology, utilizing them to enhance productivity, efficiency, and innovation in their operations. Moreover, North America benefits from a robust infrastructure for digital connectivity, including high-speed internet networks and advanced data centers. This infrastructure enables seamless integration and deployment of industrial metaverse solutions, facilitating real-time collaboration, data sharing, and analysis across geographically dispersed locations.

U.S. Industrial Metaverse Market Trends

The U.S. industrial metaverse industry is witnessing a significant integration of advanced technology such as VR, AR, artificial intelligence, and digital twins. This integration enables companies to create immersive and data-driven environments for enhanced productivity and innovation across various industries.

Europe Industrial Metaverse Market Trends

The industrial metaverse industry in Europe is driven by the adoption of Industry 4.0 principles, which is setting the pace for digital transformation within the manufacturing and industrial sectors. In the European market, companies are utilizing technologies such as VR, AR, and digital twins to drive innovation and improve efficiency.

Asia Pacific Industrial Metaverse Market Trends

Asia Pacific industrial metaverse industry is anticipated to register the fastest CAGR over the forecast period. The rise of smart manufacturing and Industry 4.0 initiatives in the region is driving the adoption of advanced technologies, including the industrial metaverse. Companies are increasingly focused on digital transformation and are investing in technologies that enable real-time monitoring, predictive maintenance, and data-driven decision-making. The rapid expansion of e-commerce and the increasing digitalization of consumer behavior in the Asia Pacific is opening new avenues for the integration of metaverse technology. Specifically, these developments present opportunities for immersive virtual shopping experiences, enhanced product visualization, and engaging interactive marketing campaigns.

Key Industrial Metaverse Company Insights

Some of the key companies in the industrial metaverse industry include Bentley Systems, Inc., Dassault Systems SE, HTC Corporation, Magic Leap, Inc., Microsoft and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

HTC is a pioneering technology company known for its innovative products and strong leadership in user experience. The company is actively shaping the industrial metaverse by offering advanced virtual reality (VR) and augmented reality (AR) solutions tailored for various industries. HTC's commitment to creating immersive experiences enhances collaboration, training, and productivity within the industrial sector. By leveraging cutting-edge Technology, HTC aims to drive digital transformation and empower businesses to thrive in a connected world. Their focus on the metaverse positions them as a key player in the evolution of industrial applications, fostering new opportunities for growth and innovation.

-

Siemens offers innovative solutions that integrate the physical and digital worlds, particularly in the realm of the industrial metaverse. The company focuses on enhancing productivity and efficiency through advanced automation, data analytics, and artificial intelligence. Siemens provides a comprehensive suite of products and services, including digital twin technology, which allows businesses to simulate and optimize their operations in a virtual environment. Their offerings also encompass smart infrastructure solutions that promote sustainability and resilience in urban environments.

Key Industrial Metaverse Companies:

The following are the leading companies in the industrial metaverse market. These companies collectively hold the largest market share and dictate industry trends.

- Bentley Systems, Inc.

- Dassault Systems SE

- HTC Corporation

- Magic Leap, Inc.

- Microsoft

- NVIDIA Corporation

- PTC Inc

- Siemens AG

- Swanson Analysis Systems Inc.

- Unity Software Inc.

Recent Developments

-

In February 2025, Dassault Systems SE partnered with Apple Inc. to integrate Apple Vision Pro with its 3DEXPERIENCE platform, introducing immersive spatial computing capabilities for virtual twins through the new 3DLive app. This partnership enables real-time visualization, simulation, and collaboration within industrial metaverse environments, enhancing design, manufacturing, and operational workflows across industries.

-

In February 2024, Dassault Systems SE and Bayerische Motoren Werke AG, a German multinational manufacturer of luxury vehicles, have initiated a long-term strategic partnership to utilize the 3DEXPERIENCE platform in BMW Group's future engineering platform, involving over 17,000 employees. The partnership aims to simplify collaboration and manage the complexity of connected, autonomous vehicle engineering, optimizing engineering processes and delivering personalized and sustainable experiences to customers.

-

In January 2024, Ansys Inc. introduced Ansys SimAI, an AI-powered SaaS application to transform engineering workflows by combining simulation accuracy with generative AI speed. This launch aims to accelerate performance prediction, enabling rapid analysis and reducing time-to-market for product development.

-

In October 2023, Microsoft broadened its collaboration with Siemens to extend the advantages of generative AI across global industries. Siemens introduces the Siemens Industrial Copilot, an AI-powered assistant aimed at improving cooperation between humans and machines in manufacturing. Moreover, the collaboration involves integrating Siemens Teamcenter software with Microsoft Teams, facilitating smooth virtual collaboration for design engineers and frontline workers.

-

In October 2023, Microsoft extended its partnership with Rockwell Automation, Inc., an automation company in the U.S., to accelerate the design and development of industrial automation systems using generative artificial intelligence. By combining Technology, they aim to empower the workforce and reduce time-to-market for customers building industrial automation systems.

-

In March 2023, HTC Corporation announced development of a Vive Tracker accessory, utilizing inside-out tracking technology without the need for external beacons, enhancing body tracking in VR experiences. This standalone tracker supports various applications, including VR, PC VR, and non-VR uses, such as object tracking, with compatibility across different headset platforms.

Industrial Metaverse Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 45.69 billion

Revenue forecast in 2033

USD 542.99 billion

Growth rate

CAGR of 42.4% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Bentley Systems, Inc.; Dassault Systems SE; HTC Corporation; Magic Leap, Inc.; Microsoft Corporation; NVIDIA Corporation; PTC Inc; Siemens AG; Swanson Analysis Systems Inc.; Unity Software Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Metaverse Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global industrial metaverse market report based on component, technology, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

AR

-

VR

-

MR

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Product Design & Development

-

Virtual Prototyping

-

Training & Simulation

-

Remote Collaboration

-

Maintenance & Repair

-

Supply Chain Optimization

-

Data Visualization & Analytics

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Healthcare

-

Logistics & Transportation

-

Manufacturing

-

Energy and utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial metaverse market size was estimated at USD 35.20 billion in 2025 and is expected to reach USD 45.69 billion in 2026.

b. Some key players operating in the industrial metaverse market include Bentley Systems, Inc., Dassault Systems SE, HTC Corporation, Magic Leap, Inc., Microsoft Corporation, NVIDIA Corporation, PTC Inc, Siemens AG, Swanson Analysis Systems Inc., Unity Software Inc.

b. Key factors that are driving the market growth include Digital twin adoption is a key driver, enabling real-time simulation and analysis of physical assets in a virtual environment. AR and VR technologies are key components of the industrial metaverse, providing immersive experiences and hands-on training.

b. The global industrial metaverse market is expected to grow at a compound annual growth rate of 42.4% from 2026 to 2033 to reach USD 542.99 billion by 2033.

b. North America dominated the industrial metaverse market with a share of 31.8% in 2025. Due to thriving innovation hubs and proactive regulatory initiatives, North America is witnessing rapid industrial metaverse adoption and fostering cross-industry collaboration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.