- Home

- »

- Advanced Interior Materials

- »

-

Industrial Hose Market Size, Share & Growth Report, 2030GVR Report cover

![Industrial Hose Market Size, Share & Trends Report]()

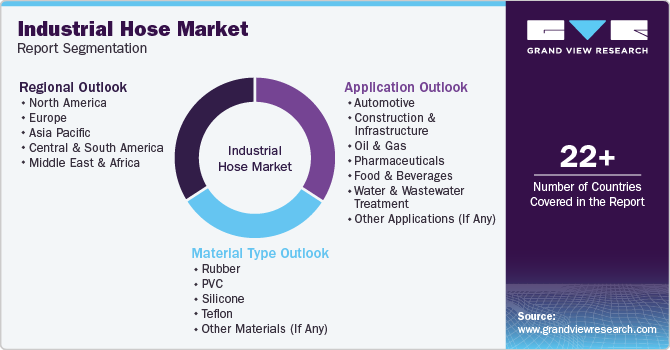

Industrial Hose Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Rubber, PVC), By Application (Automotive, Construction & Infrastructure), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-429-7

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Hose Market Size & Trends

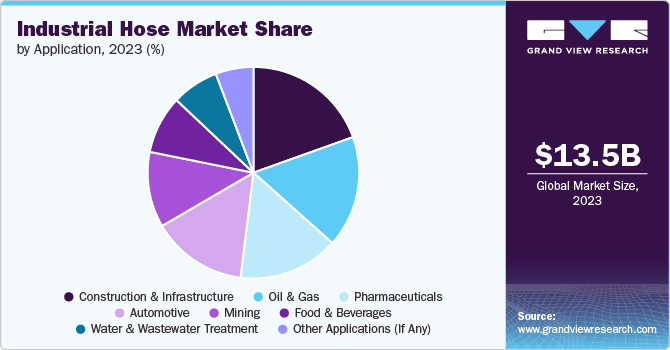

The global industrial hose market size was estimated at USD 13.53 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030, owing to its increasing critical applications across diverse industries, including automotive, construction, and chemicals. This increase in demand is further fueled by the expansion of oil and gas exploration, ongoing infrastructure development, growth in the automotive sector, and rising investments in the mining industry.

The rising construction industry significantly drives the product market by increasing the demand for various types of hoses essential for construction operations. As construction projects become more extensive and complex, the need for durable, high-performance products to handle materials like concrete, water, and fuel escalates.

A hose is a flexible conduit used to transport fluids, gases, or granular materials from one place to another. Designed for various purposes, the product varies in size, length, and configuration based on its intended use. Hoses are widely employed across industries such as automotive, construction, agriculture, and chemicals. They are a specialized category crafted to meet the rigorous demands of industrial settings.

The industrial hoses are built to handle diverse substances, including water, chemicals, oil, air, and abrasive materials, with options available in different sizes and materials to suit specific needs. Essential in sectors such as manufacturing, construction, and agriculture, industrial hoses facilitate efficient substance transfer and support the smooth operation of machinery and equipment.

The market faces several constraints that can hinder its growth and stability. Fluctuations in raw material costs, such as rubber, PVC, and steel, can impact manufacturing expenses and product prices, leading to market instability. Regulatory compliance with safety and quality standards adds complexity and costs to production, particularly when differing regulations across regions are considered.

Material Insights

Rubber dominated the market with a revenue share of 39.4% in 2023. Rubber is a widely used material for product manufacture due to its excellent flexibility, durability, and resistance to a range of harsh conditions. Various types of rubber, such as synthetic rubber (including nitrile, neoprene, and EPDM) and natural rubber, are selected based on their specific properties. The choice of rubber material ensures that the industrial hoses can handle the required pressures, temperatures, and chemical exposures, providing reliable performance across diverse applications.

PVC (polyvinyl chloride) is a popular material for product due to its cost-effectiveness, versatility, and broad range of performance characteristics. PVC products are lightweight and flexible, making them easy to handle and install in various applications. They offer excellent resistance to abrasion, weathering, and a range of chemicals, though their performance can vary depending on the specific formulation and reinforcement used.

PVC products are also resistant to UV light and can be manufactured in a range of colors and sizes to meet specific application needs. While not as heat-resistant as rubber, PVC hoses are ideal for applications involving water, air, and mild chemicals and are widely used in agriculture, construction, and general industrial settings

Application Insights

Construction & infrastructure dominated the market with a revenue share of 19.6% in 2023. In the construction and infrastructure sectors, industrial hoses are essential for delivering concrete and grout efficiently, facilitating the smooth flow of materials like water and fuel to construction equipment, and supplying compressed air to pneumatic tools. They play a critical role in stormwater and wastewater management systems, handling high-pressure and harsh environments with ease.

During pipeline construction, industrial hoses are used for testing and cleaning, while in road construction, they are crucial for asphalt delivery and site cleanup. Their durability and flexibility make them indispensable for managing the diverse demands of modern construction and infrastructure projects.

In the pharmaceutical industry, the product is vital for ensuring the safe and efficient transfer of ingredients and finished products throughout the manufacturing process. These hoses are used for transporting bulk powders, liquids, and other materials between processing equipment, storage tanks, and packaging lines. Their applications include handling sterile solutions, transferring active pharmaceutical ingredients (APIs), and managing high-purity fluids under strict hygienic conditions.

Regional Insights

The industrial hose market in North America is driven by the construction industry, which is expected to witness significant growth over the coming years owing to high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges.

U.S. Industrial Hose Market Trends

The industrial hose market in the U.S. is driven by the construction sector, whichis expanding at a significant rate owing to positive market fundamentals for commercial real estate and a strong economy, along with rising state and federal funding for institutional buildings and public works. For instance, in March 2023, the U.S. government announced an investment worth USD 2 trillion for the development of infrastructure, including hospital buildings, roads, and other infrastructure. Thus, the growing construction industry is further expected to increase the demand for construction equipment, further fueling the consumption of the product.

Asia Pacific Industrial Hose Market Trends

The Asia Pacific industrial hose market dominated globally, with a revenue share of 37.3% in 2023, owing to rising construction activities and growing demand from the construction sector in emerging countries such as India, Japan, and South Korea.

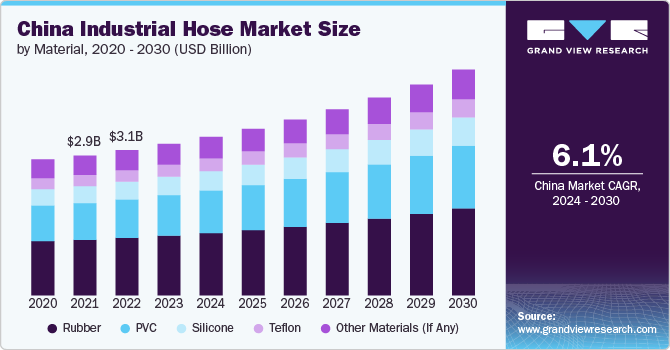

According to the ITA, China was the largest construction market in the world in 2023. The country's 14th Five-Year Plan focuses on developing new infrastructure related to transportation, energy, water systems, etc. According to the same organization, an estimated USD 4.2 trillion investment is expected in new infrastructure developments in the country between 2021 and 2025. Thus, the ongoing urbanization and the increasing infrastructure development projects are expected to boost the demand for the product in the country in the coming years.

Europe Industrial Hose Market Trends

The growth of industries such as pharmaceuticals, chemicals, and automotive is contributing to the rising demand for product in Europe. For instance, the automotive sector's shift towards electric vehicles (EVs) has increased the need for specialized product that can handle high-pressure applications and meet safety standards. The sales of electric cars increased in 2023, as per OICA, indicating a robust market for automotive-related product applications.

Key Industrial Hose Company Insights

Some of the key players operating in the market include JinYuan Rubber Manufacturing (JYM Hose) LTD, Eaton, Flexaust Inc., HANSA‑FLEX, Gollmer & Hummel GmbH, PARSCH Schläuche Armaturen GmbH & Co. KG, Polyhose, AEROFLEX.

-

HANSA-FLEX is a prominent player in the global fluid technology market, specializing in the production and supply of hydraulic hoses, fittings, and related components. The company has established a strong presence with over 458 branches in 41 countries. In recent years, HANSA-FLEX has demonstrated significant growth and innovation, particularly in its core areas of hydraulics and fluid transfer solutions.

Key Industrial Hose Companies:

The following are the leading companies in the industrial hose market. These companies collectively hold the largest market share and dictate industry trends.

- JinYuan Rubber Manufacturing (JYM Hose) LTD

- Eaton

- Flexaust Inc.

- HANSA‑FLEX

- Gollmer & Hummel GmbH

- PARSCH Schläuche Armaturen GmbH & Co. KG

- Polyhose

- AEROFLEX

Recent Developments

-

In April 2023, Kurt Manufacturing completed the acquisition of Bellatex Industries LLC, enhancing its product offerings and positioning in the industrial hose market. This strategic move aims to meet increasing market demands and expand its global footprint

-

In January 2022, Gates introduced the ProV Hydraulic Hoses, designed for various industries including agriculture and construction. This new product line reflects ongoing innovation in hose technology to meet diverse application needs

Industrial Hose Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.25 billion

Revenue forecast in 2030

USD 21.0 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

material, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

JinYuan Rubber Manufacturing (JYM Hose) LTD, Eaton Flexaust Inc., HANSA‑FLEX, Gollmer & Hummel GmbH PARSCH Schläuche Armaturen GmbH & Co. KG, Polyhose, AEROFLEX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Hose Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial hose market report based on material type, application, and region.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rubber

-

PVC

-

Silicone

-

Teflon

-

Other Materials (If Any)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction & Infrastructure

-

Oil & Gas

-

Pharmaceuticals

-

Food & Beverages

-

Water & Wastewater Treatment

-

Mining

-

Other Applications (If Any)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.