- Home

- »

- Advanced Interior Materials

- »

-

Industrial Dust Collector Market Size, Industry Report, 2030GVR Report cover

![Industrial Dust Collector Market Size, Share & Trends Report]()

Industrial Dust Collector Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Baghouse, Cartridge), By End-use, By Mechanism (Dry, Wet), By Mobility (Portable, Fixed), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-453-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Dust Collector Market Summary

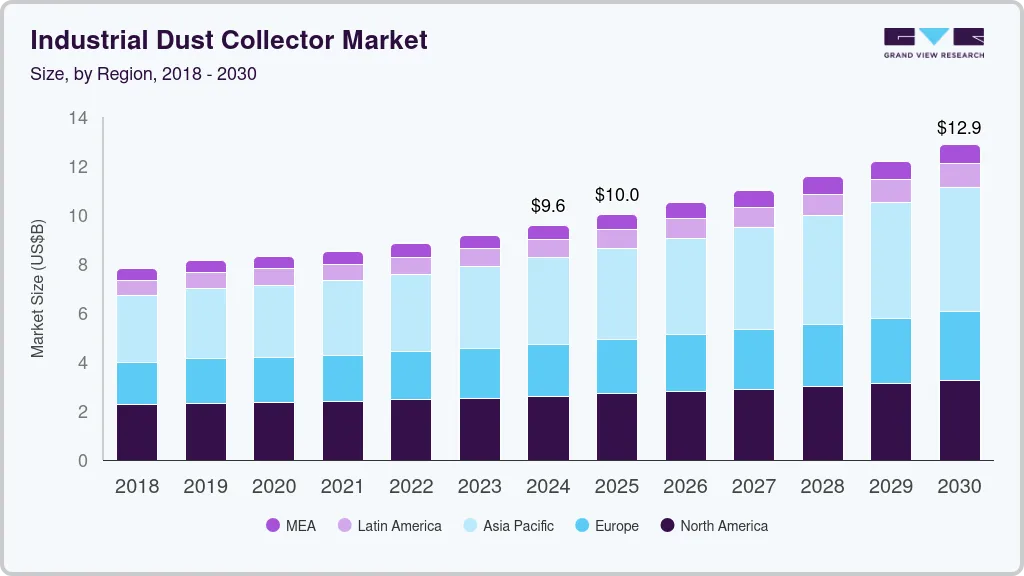

The global industrial dust collector market size was estimated at USD 9.58 billion in 2024 and is projected to reach USD 12.89 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. This growth can be attributed to the stringent government regulations aimed at environmental compliance, compelling industries to adopt effective dust collection system.

Key Market Trends & Insights

- The Asia Pacific industrial dust collector market dominated the global market and accounted for the largest revenue share of 36.7% in 2024.

- The industrial dust collector market in China led the Asia Pacific market and held the largest revenue share in 2024

- By end use. the cement industry segment led the market and accounted for the largest revenue share of 21.1% in 2024

- By mechanism, the dry mechanism segment led the global industrial dust collector industry and accounted for the largest share of 66.1% in 2024

Market Size & Forecast

- 2024 Market Size: USD 9.58 Billion

- 2030 Projected Market Size: USD 12.89 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

In addition, increasing hygiene standards, particularly in the food industry, and heightened workplace safety awareness are significant contributors. Furthermore, expanding industrial activities, rapid infrastructure development and rising coal power plant operations further amplify the demand for industrial dust collectors, ensuring cleaner air and safer working environments across various sectors.

Industrial dust collectors capture and filter airborne particulate matter generated during various industrial processes. The market for these systems is expanding significantly due to several driving factors. One primary catalyst is the tightening of environmental regulations globally, compelling industries to implement effective dust collection solutions to mitigate air pollution and enhance workplace safety. As governments enforce stricter guidelines, businesses increasingly invest in advanced technologies that efficiently capture harmful emissions.

In addition, technological advancements also play a crucial role in the market growth. Innovations in filtration methods and automation have led to the development of more efficient dust collectors equipped with smart sensors for real-time monitoring and optimization of operations. This tech-driven evolution encourages companies to adopt sophisticated systems that comply with regulations and enhance productivity.

Furthermore, the rapid industrialization of emerging economies significantly contributes to the demand for industrial dust collectors. As sectors, including manufacturing and construction, expand, effective dust management solutions become paramount. This growth in industrial activities presents lucrative opportunities for local and international market players.

Type Insights

The baghouse dust collector dominated the global industrial dust collector market and held the highest revenue share of 25.8% in 2024. This growth can be attributed to its cost-effectiveness and high efficiency. These systems can capture a wide range of particulate matter, making them suitable for various industries. Furthermore, stringent environmental regulations compel manufacturers to adopt baghouse systems to comply with air quality standards. Moreover, the ongoing advancements in filtration technologies further enhance their performance, solidifying their position as a preferred choice for effective dust management.

The cartridge dust collector is expected to grow at the fastest CAGR of 6.9% over the forecast period, primarily driven by its compact design and versatility in various applications. These systems are particularly advantageous in environments with limited space, allowing for efficient dust collection without requiring extensive installation areas. In addition, the increasing focus on workplace safety and health regulations also drives demand for cartridge collectors, as they effectively reduce airborne contaminants. Furthermore, innovations in filter materials and designs improve their efficiency and longevity, making them an attractive option for industries seeking reliable dust control solutions.

End-use Insights

The cement industry segment led the market and accounted for the largest revenue share of 21.1% in 2024 due to the increasing demand for construction materials. As infrastructure projects expand, cement production rises, leading to higher dust emissions that necessitate effective dust collection systems. In addition, stricter environmental regulations to minimize air pollution further compel cement manufacturers to invest in advanced dust collectors. Furthermore, these systems ensure compliance with air quality standards and enhance operational efficiency, making them essential for sustainable cement production.

The energy & power segment is expected to grow at a CAGR of 7.1% over the forecast period, owing to the rising need for cleaner energy production and environmental compliance. As power generation facilities, particularly coal-fired plants, face stringent regulations regarding particulate emissions, there is a growing demand for efficient dust collection systems. In addition, these collectors play a crucial role in capturing harmful particles released during energy production processes, thereby improving air quality and protecting public health. Furthermore, the ongoing transition to cleaner energy sources also drives innovations in dust collection technologies within this sector.

Mechanism Insights

The dry mechanism segment led the global industrial dust collector industry and accounted for the largest share of 66.1% in 2024, driven by its efficiency in handling a wide range of particulate matter. In addition, dry dust collectors are favored for their ability to operate without water, making them suitable for various applications, particularly in industries such as manufacturing and construction. Furthermore, the increasing emphasis on environmental compliance and air quality standards compels industries to adopt dry systems that effectively capture dust while minimizing operational costs.

Wet mechanism is expected to grow at a CAGR of 5.9% from 2025 to 2030, owing to its effectiveness in controlling fine particulate matter and hazardous dust. Wet dust collectors utilize water to capture airborne particles, making them ideal for industries that generate combustible or toxic dust, such as metalworking and chemical processing. In addition, the rising awareness of workplace safety and health regulations also drives demand for wet systems, as they provide enhanced filtration capabilities. Furthermore, innovations in wet collection technologies are improving efficiency, making them an attractive option for industries focused on maintaining high air quality standards.

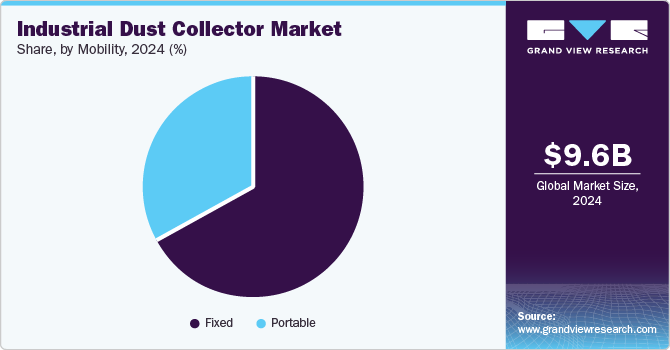

Mobility Insights

The fixed segment held the dominant position in the market, with the largest revenue share of 67.1% in 2024, primarily driven by its suitability for large-scale operations and various industrial applications. In addition, fixed dust collectors are essential for industries that generate significant dust, such as manufacturing and construction, where they provide efficient and continuous dust management. Furthermore, their ability to handle high dust loads and comply with stringent environmental regulations further drives their adoption, making them a preferred choice for businesses seeking reliable and effective dust collection solutions.

The portable segment is expected to grow at a CAGR of 6.0% over the forecast period, owing to its flexibility and cost-effectiveness. Portable dust collectors are particularly advantageous when dust generation varies across multiple locations or during short-term operations. In addition, their ease of mobility allows industries to deploy them as needed, reducing installation costs and maintenance requirements. Furthermore, as companies prioritize adaptability and efficiency in their operations, the demand for portable dust collection systems continues to rise, catering to diverse applications across various sectors.

Regional Insights

The Asia Pacific industrial dust collector market dominated the global market and accounted for the largest revenue share of 36.7% in 2024. This growth can be attributed to the rapid industrialization and urbanization within the region. In addition, as countries such as India and China expand their manufacturing capabilities, the demand for effective dust management solutions increases. Furthermore, heightened public awareness regarding air quality and occupational health is prompting industries to adopt efficient dust collectors, creating lucrative opportunities for market expansion.

China Industrial Dust Collector Market Trends

The industrial dust collector market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by its robust manufacturing sector and stringent environmental policies. In addition, the government's commitment to improving air quality has led to increased investments in dust collection technologies, thereby driving the market. Furthermore, initiatives aimed at monitoring and controlling particulate matter in urban areas are driving the adoption of advanced filtration systems, positioning China as a key market for industrial dust collectors.

Middle East & Africa Industrial Dust Collector Market Trends

The Middle East and Africa industrial dust collector market is expected to grow at a CAGR of 5.5% over the forecast period, owing to increasing industrial activities and a focus on environmental sustainability. Rapid urbanization and infrastructure development projects are generating higher levels of airborne particulate matter, necessitating effective dust management solutions. Furthermore, governments in this region are implementing stricter regulations to control emissions, compelling industries to invest in advanced dust collection systems.

North America Industrial Dust Collector Market Trends

The industrial dust collector market in North America held a significant revenue share in 2024, primarily driven by the stringent government regulations regarding emissions control. The implementation of the Clean Air Act and related standards have prompted industries to adopt effective dust collection systems to comply with environmental mandates. Furthermore, increasing investments in infrastructure and manufacturing sectors contribute to heightened demand for dust collectors. Moreover, the focus on improving workplace safety and reducing health risks associated with airborne contaminants further drives the adoption of advanced dust collection technologies in this region.

The U.S. industrial dust collector market led the North American market and accounted for the largest revenue share in 2024 due to regulatory requirements and a strong emphasis on workplace safety. In addition, ongoing technological advancements are enhancing the performance of these systems, making them more appealing to manufacturers seeking compliance and operational efficiency. Furthermore, as industries prioritize health and safety, the demand for innovative industrial dust collectors is expected to grow significantly.

Europe Industrial Dust Collector Market Trends

The industrial dust collector market in Europe is expected to grow substantially over the forecast period, owing to expanding environmental regulations and a strong focus on sustainability. In addition, the European Union has implemented stringent air quality standards that require industries to adopt effective dust management solutions. Furthermore, as countries work towards reducing emissions and improving air quality, there is a growing need for advanced filtration technologies in various sectors, including manufacturing and construction.

The growth of Germany industrial dust collector market is expected to be driven by its advanced manufacturing sector and commitment to environmental sustainability. As one of Europe’s largest economies, Germany emphasizes compliance with stringent air quality regulations that necessitate effective dust collection systems. In addition, the country's focus on innovation and technological advancements further enhances the efficiency of these systems. Furthermore, increasing public awareness regarding air quality issues propels the demand for reliable industrial dust collectors, positioning Germany as a key player in this market segment.

Key Industrial Dust Collector Company Insights

Key players in the global industrial dust collector industry include Hamon, Camfil AB, and Thermax Limited. These companies are implementing various strategies to enhance their competitive edge. These include investing in research and development to innovate advanced filtration technologies, expanding their product portfolios to meet diverse industry needs, and forming strategic partnerships to enhance market reach. In addition, companies focus on geographic expansion into emerging markets, emphasizing customer service and support to build long-term relationships.

-

Thermax Limited manufactures a range of products, including Electrostatic Precipitators (ESPs), Pulse Jet Bag Filters, and ComboFilters that combine ESP and baghouse technologies. Operating primarily in the environmental management segment, the company provides efficient systems for capturing particulate emissions across various industries such as power, cement, and steel.

-

Donaldson Company, Inc. produces diverse products such as baghouse filters, cartridge collectors, and fume extractors designed to improve air quality and protect equipment from dust and contaminants. Operating in the industrial filtration segment, the company serves multiple industries, including manufacturing, food processing, and pharmaceuticals.

Key Industrial Dust Collector Companies:

The following are the leading companies in the industrial dust collector market. These companies collectively hold the largest market share and dictate industry trends.

- FLSmidth

- Hamon

- Camfil AB

- Thermax Limited

- Kelin Environmental Protection Technology Co., Ltd.

- KC Cottrell

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.

Recent Developments

-

In March 2024, Donaldson India Filtration Systems Pvt. Ltd. inaugurated a new experience centre in Pune, showcasing its commitment to innovative filtration solutions, particularly in industrial dust collectors. The facility offers live demos of innovative dust collection systems and introduces the iCue Connected Filtration Service, enabling remote equipment performance monitoring. This initiative aims to enhance productivity and reduce air pollution in Indian industries, reinforcing Donaldson's position as a leader in dust collection technology and customer service support in the region.

-

In March 2024, Camfil Air Pollution Control (APC) launched the Gold Series Timer (GST), a cutting-edge controller designed for industrial dust collectors. This innovative system features pulse output modules that can be expanded to fit various dust collector sizes and solenoid valve types. The GST includes a differential pressure sensor for pulse-on-demand cleaning and high-pressure alarms, enhancing safety. Additionally, it offers cloud-based monitoring through the optional GoldLink connection, providing users with real-time insights into their dust collection systems' performance.

-

In January 2023, Donaldson Company unveiled the Torit Downflo Ambient Weld Fume Extractor, a new solution designed to enhance workplace safety by effectively capturing and filtering weld fumes. This industrial dust collector features advanced filtration technology and a compact design, making it ideal for various manufacturing environments. The extractor operates quietly while providing high-efficiency filtration, ensuring cleaner air for workers. Donaldson's latest innovation underscores its commitment to improving air quality and safety standards in industrial settings.

Industrial Dust Collector Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.02 billion

Revenue forecast in 2030

USD 12.89 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, mechanism, mobility, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; Japan; India; Australia; Brazil; Argentina; Colombia; Saudi Arabia; UAE; South Africa

Key companies profiled

FLSmidth; Hamon; Camfil AB; Thermax Limited; Kelin Environmental Protection Technology Co., Ltd.; KC Cottrell; Nederman Holding AB; Sumitomo Heavy Industries, Ltd.; Donaldson Company, Inc.; Babcock & Wilcox Enterprises, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Dust Collector Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global industrial dust collector market report based on type, end-use, mechanism, mobility, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Baghouse Dust Collector

-

Woven

-

Non-woven

-

-

Cartridge Dust Collector

-

Wet Scrubbers

-

Inertial Separators

-

Electrostatic Precipitator (ESP)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Energy & Power

-

Steel

-

Cement

-

Mining

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Fixed

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.