- Home

- »

- Drilling & Extraction Equipments

- »

-

Industrial Diamond Market Size, Share, Industry Report 2030GVR Report cover

![Industrial Diamond Market Size, Share & Trends Report]()

Industrial Diamond Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Synthetic, Natural), By Application (Construction, Transportation, Electronics, Others), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-3-68038-211-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Diamond Market Summary

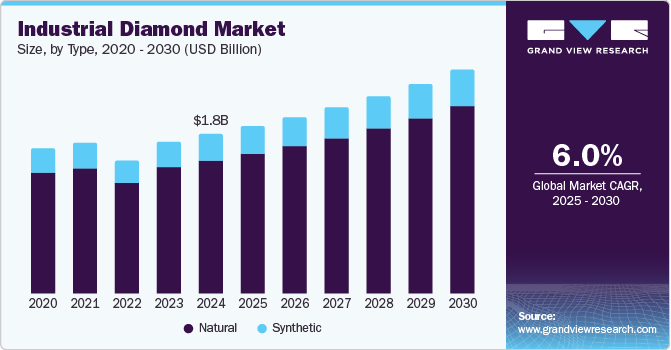

The global industrial diamond market size was estimated at USD 1.8 billion in 2024 and is projected to reach USD 2.5 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. Innovations in synthetic diamond production are enhancing the quality and versatility of industrial diamonds, making them increasingly desirable.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 42% in 2024.

- China industrial diamond market is anticipated to record substantial revenue during the forecast period.

- Based on type, the synthetic diamond segment dominated the market with the largest revenue share of 83.4% in 2024

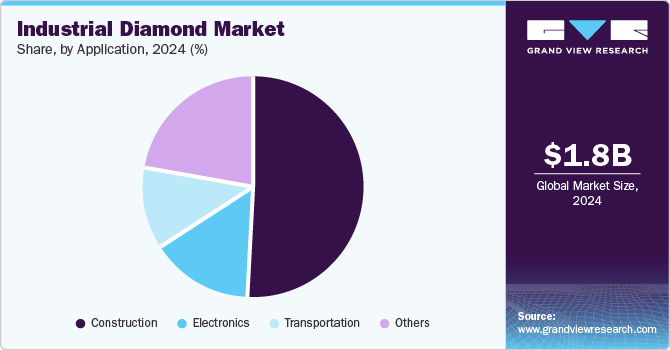

- Based on application, the construction segment dominated the market with the largest revenue share of 51.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.8 Billion

- 2030 Projected Market Size: USD 2.5 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest Market in 2024

- North America: Fastest growing market

These advancements in diamonds allow for customized solutions across various application areas. The rising use of industrial diamonds in automotive, aerospace, electronics, and precision engineering industries is substantially driving market growth. Superior properties of industrial diamonds, such as hardness and thermal conductivity, are critical for high-performance tools and components in these sectors. As these industries grow and evolve, the demand for advanced industrial diamonds continues to rise, propelling market expansion.

Rising urbanization and infrastructure projects are significantly catalyzing the market growth by contributing to demand for construction tools and equipment. The development in urban areas necessitates extensive construction activities, which rely heavily on industrial diamonds for cutting, drilling, and grinding. Moreover, the availability of raw materials in key regions supports the production of synthetic diamonds. These readily accessible resources, combined with advanced manufacturing processes, ensure a steady supply of high-quality industrial diamonds, meeting the growing needs of various industries and fueling market growth.

Type Insights

The synthetic diamond segment dominated the market with the largest revenue share of 83.4% in 2024 by offering cost-effective and highly customizable solutions. Unlike natural diamonds, synthetic diamonds can be tailored to specific industrial applications, enhancing their performance and efficiency. Their superior properties, such as chemical inertness, low friction, and excellent abrasive resistance, make them ideal for use in sectors like automotive, aerospace, and electronics. The production of synthetic diamonds is more sustainable and scalable, meeting the growing demand in various industries and substantially contributing to market expansion.

The natural diamond segment is expected to emerge as the fastest growing segment and record a CAGR of 5.6% over the forecast period due to the unparalleled hardness and cutting efficiency of this category of diamonds. These attributes make natural diamonds indispensable for high-precision applications in industries such as construction, mining, and manufacturing. Despite the challenges of mine closures and limited supply, the demand for natural diamonds remains robust, driven by their superior performance and durability. As industries increasingly seek high-quality materials for demanding applications, natural diamonds continue to gain traction, fueling significant growth in this market segment.

Application Insights

The construction segment dominated the market with the largest revenue share of 51.4% in 2024 owing to extensive use of diamonds in cutting, drilling, grinding, and polishing applications. The surge in infrastructure projects globally with urbanization, has led to a considerable demand for construction tools embedded with industrial diamonds, which offer enhanced efficiency and precision in construction activities. Furthermore, initiatives like the 'Smart City Mission' and large-scale infrastructure investments by governments have fueled the market growth.

The electronics segment is expected be the fastest growing segment with a CAGR of 6.2% during the forecast period, fueled by the escalating demand for high-performance and miniaturized electronic devices. Industrial diamonds are essential for manufacturing precision components like semiconductors, microchips, and other electronic parts owing to their superior hardness and thermal conductivity. Advancements in consumer electronics, telecommunications, and the rise of smart devices are some of the factors fueling their demand. As the technology sector continues to innovate and expand, the need for industrial diamonds in electronics is expected to surge, leading to market expansion.

Regional Insights

North America is projected to record the fastest CAGR of 5.5% over the forecast period, driven by strong demand from the construction, automotive, and electronics industries. The region's advanced technological infrastructure and commendable investments in research & development are expected to aid in enhancing market size. The U.S., a major consumer and producer of synthetic diamonds, is bolstered by government initiatives to improve infrastructure. Besides, the presence of leading companies and a skilled workforce further accelerates market expansion, making North America a key contributor to the global market.

U.S. Industrial Diamond Market Trends

The U.S. held a key position in the industrial diamond market in 2024 due to its advanced technological infrastructure and significant investment in R&D. The country boasts a robust industrial base, particularly in sectors, such as aerospace, automotive, and electronics, which demand high-quality industrial diamonds. Moreover, the presence of leading companies and a skilled workforce further bolsters the market share. Government support for infrastructure projects and innovation also play a critical role. These factors collectively ensure the U.S. maintains its competitive edge and contribution to the global industry.

Ample investments in the mining and construction sectors are expected to make Canada a crucial market contributor by 2030. The country's vast natural resources and advanced mining technologies support the production of high-quality industrial diamonds. Furthermore, the country’s strong industrial base, coupled with government initiatives to enhance infrastructure and innovation, are expected to propel the demand for industrial diamonds. The presence of skilled labor and a robust regulatory framework further accelerates development. These factors position Canada as a vital contributor to the global market.

Europe Industrial Diamond Market Trends

Europe industrial diamond market established a significant foothold in 2024, driven by its advanced technological capabilities and strong industrial base. The region excels in manufacturing precision tools and machinery, utilizing industrial diamonds for superior performance. European countries like Germany, the UK, and France are leaders in sectors such as automotive, aerospace, and electronics, driving high demand for industrial diamonds. Notable investment in research & development, coupled with stringent quality standards, enhances Europe's competitive edge. Favorable government policies and a skilled workforce further promote the region's market leadership.

Industrial diamond market in Germany is expected to record a sizable CAGR from 2025 to 2030, driven by its advanced engineering prowess and high-quality manufacturing standards. The country's strong industrial base, particularly in automotive, machinery, and precision engineering, generates significant demand for industrial diamonds. Germany excels in research and development, continuously innovating synthetic diamond technologies to maintain a competitive edge. Favorable government policies and substantial investment in infrastructure and industry further support market growth. Also, a highly skilled workforce aids in strengthening Germany's position in the global industrial diamond market.

France industrial diamond market is projected to record a noteworthy share by 2030 with advancements in its high-tech industries and manufacturing capabilities. The country's strong focus on research & development, particularly in aerospace, automotive, and electronics sectors, is expected to favor the demand for industrial diamonds. Government initiatives to support innovation and infrastructure development are further expected to enhance market growth. Moreover, France's commitment to sustainable and cutting-edge technologies positions it as a crucial contributor to the global industry.

Asia Pacific Industrial Diamond Market Trends

Asia Pacific dominated the market with the largest revenue share of 42% in 2024, driven by significant industrial growth, technological upgrades, and increasing demand across sectors like manufacturing, construction, and electronics. Countries such as China, Japan, and India lead the way with strong manufacturing capabilities and high consumption of industrial diamonds for applications like cutting, grinding, and drilling. The region’s growing infrastructure projects, cost-effective production methods, and expanding industrial base have solidified its dominant position in the global industrial diamond market, fueling continued growth and innovation.

China industrial diamond market is anticipated to record substantial revenue during the forecast period, attributed to its vast production capacity and cost-effective manufacturing processes. As the world's leading producer of synthetic diamonds, China benefits from advanced technologies and economies of scale. The country's robust construction and industrial sectors drive high demand for industrial diamonds. Favorable government policies and substantial investment in infrastructure projects together play a crucial role in market growth. The availability of skilled labor and raw materials further strengthens the competitive position of China, ensuring sustained growth in the global market.

Industrial diamond market in India is projected to grow at a remarkable CAGR by 2030, driven by rapid industrialization and infrastructure development. The country's booming construction sector, propelled by initiatives like "Smart City Mission" and "Housing for All," significantly boosts demand for industrial diamonds. Expanding automotive and electronics industries in India also contribute to market growth. The supportive policies by the government and investments in technology and innovation further favor the market growth.

Key Industrial Diamond Company Insights

Some of the key companies in the industrial diamond market include De Beers; ALROSA; Applied Diamond, Inc.; Industrial Diamond Laboratories, Inc.; Morgan Advanced Materials; Scio Diamond Technology Corporation; Industrial Abrasives Limited; Advanced Diamond Solutions Inc.;Diamond Technologies Inc.; The 3M Company.

-

Applied Diamond, Inc. provides high-quality synthetic diamonds and diamond-based materials for industrial, scientific, and technological applications. They offer precision diamond cutting, as well as customized solutions for sectors like electronics, optics, and medical devices.

-

ALROSA specializes in the exploration, mining, processing, and trading of rough diamonds. The company also manufactures polished diamonds and jewelry, ensuring high standards of quality and sustainability.

Key Industrial Diamond Companies:

The following are the leading companies in the industrial diamond market. These companies collectively hold the largest market share and dictate industry trends.

- De Beers

- ALROSA

- Applied Diamond, Inc.

- Industrial Diamond Laboratories, Inc.

- Morgan Advanced Materials

- Scio Diamond Technology Corporation

- Industrial Abrasives Limited

- Advanced Diamond Solutions Inc.

- Diamond Technologies Inc.

- The 3M Company

Recent Developments

-

In May 2024, De Beers introduced a diamond verification tool for retail counters, bringing advanced synthetic diamond detection technology to identify natural diamonds versus lab-grown ones, enhancing consumer confidence by ensuring authenticity at the point of sale for both loose and set diamonds.

-

In September 2023, Fred, the Parisian jeweler and LVMH brand, unveiled a limited-edition collection that combines stunning blue lab-grown diamonds with natural diamonds, offering a unique and exclusive selection for discerning customers.

Industrial Diamond Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.9 billion

Revenue forecast in 2030

USD 2.5 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in kilotons, USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; Belgium; China; India; Japan; Brazil; UAE; Saudi Arabia

Key companies profiled

De Beers; ALROSA; Applied Diamond, Inc.; Industrial Diamond Laboratories, Inc.; Morgan Advanced Materials; Scio Diamond Technology Corporation; Industrial Abrasives Limited;Advanced Diamond Solutions Inc.;Diamond Technologies Inc.; The 3M Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Diamond Market Report Segmentation

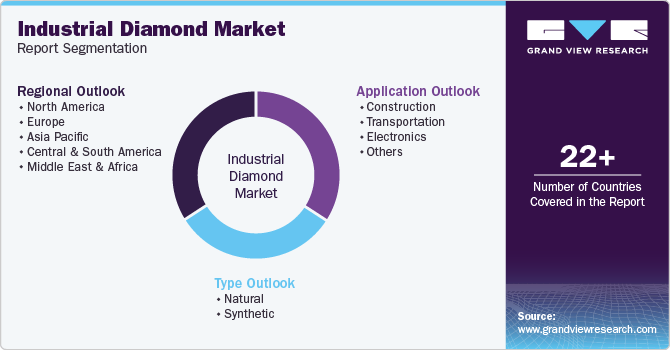

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global industrial diamond market report on the basis of type, application, and region:

-

Type Outlook (Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Transportation

-

Electronics

-

Others

-

-

Regional Outlook (Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.