- Home

- »

- Electronic Devices

- »

-

Industrial And Commercial LED Lighting Market Report, 2033GVR Report cover

![Industrial And Commercial LED Lighting Market Size, Share & Trends Report]()

Industrial And Commercial LED Lighting Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Application (Indoor, Outdoor), By End Use (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-575-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial And Commercial LED Lighting Market Summary

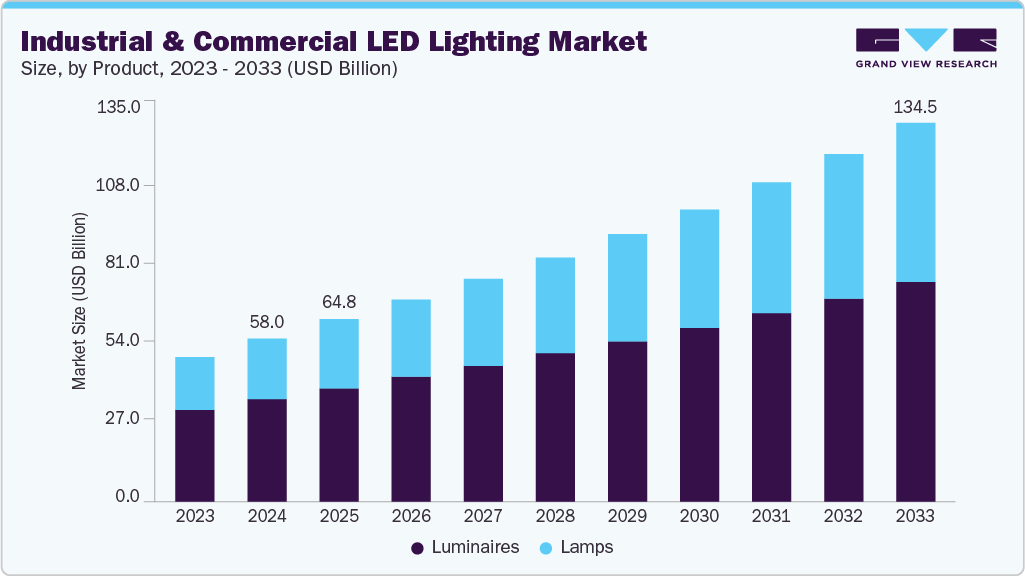

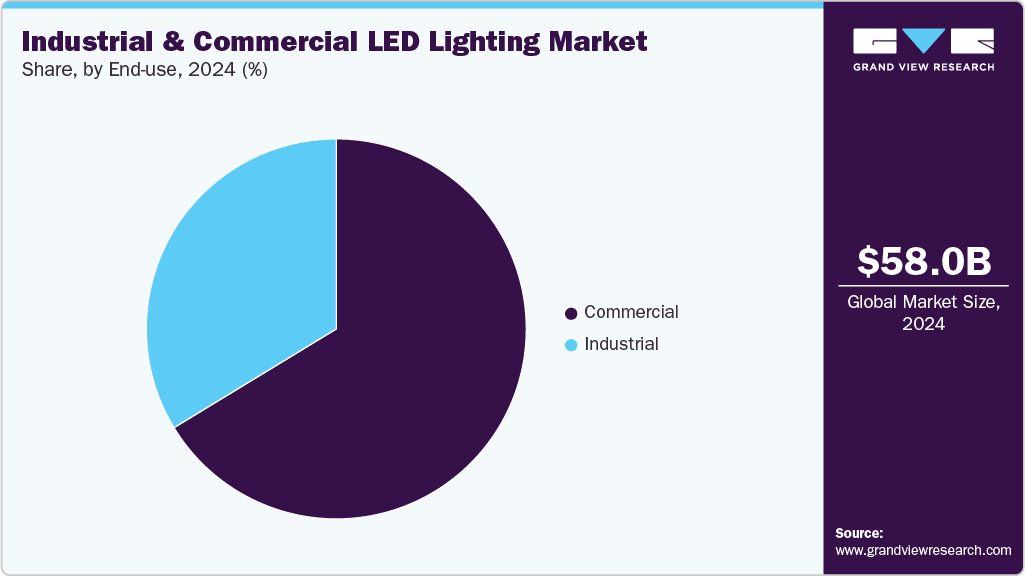

The global industrial and commercial LED lighting market size was estimated at USD 58.00 billion in 2024 and is projected to reach USD 134.51 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033. Rising demand for energy-efficient lighting products is driving industrial and commercial LED lighting market growth.

Key Market Trends & Insights

- Asia Pacific held 42.9% revenue share of the industrial and commercial LED lighting market in 2024.

- In the U.S., stringent energy codes, corporate sustainability initiatives, and continued efficiency gains in solid-state lighting are accelerating the demand for industrial and commercial LED lighting.

- By product, luminaires systems segment held the largest revenue share of 62.8% in 2024.

- By application, indoor segment held the largest revenue share in 2024.

- By end use, commercial segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 58.00 Billion

- 2033 Projected Market Size: USD 134.51 Billion

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest market in 2024

The global push for energy efficiency is a key factor driving the adoption of LED lighting products in industrial and commercial sectors. Organizations are under increasing pressure to reduce operational costs while maintaining high productivity and safety standards. Traditional lighting technologies, such as incandescent and fluorescent lamps, consume significantly more energy and have higher maintenance requirements. In contrast, LEDs offer substantially lower energy consumption, directly translating into cost savings on electricity bills, particularly for large-scale commercial buildings, warehouses, and industrial facilities where lighting accounts for a major portion of total energy usage.

The adoption of smart lighting products integrated with the Internet of Things (IoT) is creating a major opportunity for the industrial and commercial LED lighting market. IoT-enabled LEDs can connect with centralized control platforms, allowing facility managers to monitor lighting conditions across multiple zones in real time. This functionality ensures optimal illumination in critical work areas, improves workplace safety, and enhances operational efficiency, making smart lighting highly attractive to factories, warehouses, office campuses, and retail complexes. For instance, in October 2024, ABB partnered with Austria-based Zumtobel Group to combine advanced lighting management systems with ABB’s building automation and electrification expertise. This collaboration aims to deliver integrated, sustainable, and energy-efficient smart building products tailored for industrial, commercial, and institutional environments.

As industrial and commercial facilities continue to embrace digital transformation, the convergence of LED lighting with IoT, data analytics, and Building Management Systems is expected to accelerate. Partnerships between lighting product providers and automation leaders will likely expand, enabling more advanced, interoperable, and sustainable smart building ecosystems. In the coming years, demand will be driven by efficiency and cost savings, regulatory pressures, and corporate sustainability targets, positioning smart LED products as a cornerstone of next-generation industrial and commercial infrastructure.

For instance, in June 2025, Signify partnered with Schneider Electric and Pineapple Partnerships to launch Pineapple CoRE, a collaboration aimed at decarbonizing commercial real estate. The initiative merges Signify’s connected lighting products with Schneider Electric’s automation and energy management expertise, along with Pineapple’s systems-change consultancy, to help property owners upgrade lighting, implement IoT-based controls, modernize infrastructure, and unlock finance for sustainability.

Product Insights

The luminaires segment dominated the industrial and commercial LED lighting market with a market share of 62.8% in 2024. The luminaires segment is experiencing significant industrial and commercial lighting growth, driven by rising demand for energy-efficient, durable, and intelligent lighting products. Organizations across manufacturing, commercial, and public infrastructure sectors are replacing traditional lighting systems with LED luminaires to reduce operational costs, improve illumination quality, and meet sustainability objectives. The segment is also benefitting from advancements in smart lighting technologies, which enable integrated control, monitoring, and predictive maintenance.

The lamps segment is projected to be the fastest-growing segment from 2025 to 2033. Increasing emphasis on energy efficiency, operational cost reduction, and environmental sustainability propels market growth. Organizations across various sectors are progressively replacing traditional incandescent, halogen, and fluorescent bulbs with LED lamps due to their superior energy performance, longer lifespan, and reduced maintenance requirements. This shift is further accelerated by advancements in LED technology, offering higher lumen output, better color rendering, and compatibility with smart lighting controls, suitable for diverse industrial and commercial applications.

Application Insights

The indoor segment dominated the industrial and commercial LED lighting market in 2024. The surge in commercial real estate development drives the growth of the indoor lighting segment. Rapid urbanization has led to increased construction of office buildings, malls, hotels, hospitals, and educational campuses, all requiring efficient lighting systems. Developers and facility managers are opting for advanced products such as connected lighting, which integrates with building management systems to optimize energy use while ensuring appropriate illumination levels. This convergence of smart building technologies and indoor lighting is further accelerating demand. According to the U.S. edition of its Economic Impacts of Commercial Real Estate report 2025, it highlighted that commercial construction projects launched in 2024 added USD 544.7 billion to the nation’s gross domestic product and generated 2.7 million jobs.

The outdoor segment is projected to grow significantly from 2025 to 2033. The growing popularity of mixed-use commercial developments and open-air retail environments drives market growth. Outdoor shopping centers, entertainment districts, and recreational spaces are designed to attract customers beyond traditional working hours, and lighting plays a vital role in extending usability into the evening. Developers are adopting outdoor lighting for functional illumination to enhance ambience and create welcoming environments. This shift highlights the importance of outdoor lighting in supporting economic activity by encouraging longer customer engagement and foot traffic in commercial areas.

End Use Insights

The commercial segment dominated the industrial and commercial LED lighting market in 2024. The increasing reliance on digital signage and visually driven marketing within commercial spaces contributes to this segment's growth. Retailers, malls, and entertainment centers are integrating lighting with displays, interactive kiosks, and digital advertisements to create immersive and engaging customer experiences. Proper illumination is critical to ensure visual clarity and attractiveness, making commercial lighting an essential component of marketing strategies. This dual function serves both operational and experiential purposes and is fueling investment in versatile lighting systems that can adapt to varying design and promotional needs.

The industrial segment is projected to grow significantly from 2025 to 2033. Industrial facilities operating in hazardous or high-risk environments, such as chemical plants, oil refineries, and mining sites, are driving demand for specialized explosion-proof and high-durability lighting systems. These environments require fixtures that can withstand extreme temperatures, corrosive substances, and potential sparks while ensuring sufficient illumination for safe operations. Compliance with stringent safety standards and risk mitigation mandates has made these specialized lighting systems a critical requirement, further expanding the industrial segment’s market scope.

Regional Insights

Asia Pacific Industrial and Commercial LED Lighting Market Trends

The Asia Pacific dominated the industrial and commercial LED lighting market with a market share of 42.9% in 2024. The industrial and commercial LED lighting market in the Asia Pacific region is experiencing significant growth, driven by regulatory mandates, rising energy costs, and an increasing focus on sustainability. Governments across the region are implementing stricter energy efficiency standards and offering incentives to promote the adoption of energy-efficient lighting products. In addition, the growing emphasis on smart city initiatives and the integration of Internet of Things (IoT) technologies are propelling the demand for intelligent lighting systems that offer enhanced control, automation, and energy savings.

The industrial and commercial LED lighting industry in China is projected to grow during the forecast period. China’s market is experiencing a robust transformation, steered by national energy efficiency targets, smart city development, and rapidly evolving technology integration. Government policies such as the 14th Five-Year Plan and the ongoing phase-out of mercury-containing fluorescent lighting are accelerating the adoption of energy-saving LEDs across factories, offices, and public infrastructure. Smart lighting featuring IoT controls, real-time monitoring, and adaptive systems is increasingly standard in both new construction and retrofits, aligning with broader ESG goals and digital city initiatives. The Chinese government is actively catalyzing LED adoption through substantial subsidy programs linked to both consumer purchases and municipal projects.

Latin America Industrial and Commercial LED Lighting Market Trends

Latin America industrial and commercial LED lighting market is expected to grow significantly with a CAGR of 10.1% during the forecast period. The commercial real estate sector is contributing significantly to market growth. Developers and operators of offices, retail centers, and hospitality spaces are prioritizing LED lighting products that provide superior color rendering, enhanced safety, and reduced maintenance costs while meeting international green building standards. This trend is reinforcing LEDs as a preferred choice for both new projects and retrofit applications.

The industrial and commercial LED lighting industry in Brazil is expected to grow during the forecast period. Brazil’s industrial and commercial LED lighting market is being driven by escalating operational cost pressures, sustainability imperatives, and government policies favoring energy efficiency. Companies and municipalities are under increasing scrutiny to reduce carbon emissions, meet regulatory requirements, and lower electricity expenditure. As urban infrastructure expands and commercial construction accelerates, demand for high-efficacy lighting, durable fixtures, and intelligent control systems is rising markedly.

North America Industrial and Commercial LED Lighting Market Trends

North America industrial and commercial LED lighting industry is projected to grow during the forecast period. The regional market is benefiting from the integration of smart and connected lighting products. Businesses are increasingly adopting LEDs with sensors, controls, and IoT platforms to optimize energy usage, monitor occupancy, and enable predictive maintenance. The growing emphasis on sustainability and carbon footprint reduction has further accelerated the deployment of LED lighting, particularly in large-scale industrial facilities and commercial real estate portfolios aiming for green building certifications such as LEED and WELL.

The U.S. industrial and commercial LED lighting industry is projected to grow during the forecast period. Innovation in product design and functionality also spurs growth in the industrial and commercial segments. For instance, in December 2024, Volterrex introduced an industrial-grade 13,000-lumen battery-powered LED balloon work light designed to deliver high-performance illumination in environments without reliable grid power. This demonstrates the industry’s push toward portable and ruggedized products. Similarly, in August 2025, E2 Lighting expanded its commercial LED lighting portfolio, offering advanced luminaires tailored for offices, retail, and institutional facilities. These developments reflect how vendors are addressing diverse customer needs ranging from portability and resilience in industrial settings to energy efficiency and design flexibility in commercial spaces.

Key Industrial And Commercial LED Lighting Company Insights

Some of the key companies operating in the market, include Signify, and Acuity Brands, Inc., among others are some of the leading participants in the industrial and commercial LED lighting market.

-

Signify Holding is a provider of lighting products based in the Netherlands. The company’s product portfolio includes IoT-based lighting products for residential and commercial customers. Signify’s commercial & industrial lighting portfolio features a broad array of LED fixtures and luminaires under brands such as Day-Brite CFI, Philips, Advance, and Interact. It includes high-performance recessed ceiling troffers, high-bay & industrial fixtures, general-purpose linear lighting, garage/canopy lights, outdoor floodlights, and specialty healthcare & architectural products.

-

Acuity Brands Lighting, Inc. is a provider of building and lighting technology products and services. Its product portfolio includes lighting controls, lighting components, prismatic skylights, power supplies, fluorescent, LED lighting products, high-intensity discharge, and embedded and standalone light control products. The company offers products for residential, industrial, commercial, infrastructure, life safety, and lighting control applications. Its LED lighting products are available under the Lithonia Lighting and Luminaire LED brands.

Dialight, and Advanced Lighting Technologies, LLC are some of the emerging market participants in the industrial and commercial LED lighting market.

-

Dialight is a specialist LED industrial lighting company known for its rugged, high-performance fixtures used in demanding environments. Their product range spans LED high bays, area lights, linears, floodlights, wallpacks, streetlights, emergency/exit lighting, obstruction products, and control systems. Dialight's Signals & Components division offers a wide range of LED-based products with long life cycles, serving both mature and high-growth markets like medical devices and wearable tech. Its LEDs are used in safety applications and as performance status indicators across various industries.

-

Advanced Lighting Technologies, LLC (ADLT) manufactures energy-efficient lighting materials and finished products. ADLT focuses on developing advanced lighting products to address the global demand for reduced energy consumption. The company has a global presence, with operations in Europe, Asia, Australia, New Zealand, and Canada, and supplies materials to the lighting industry worldwide. ADLT markets its brands in approximately 50 countries and maintains sales, marketing, and production facilities worldwide.

Key Industrial And Commercial LED Lighting Companies:

The following are the leading companies in the industrial and commercial LED lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- Hubbell Lighting

- Acuity Brands, Inc.

- Emerson Electric Co

- ams-OSRAM AG

- Signify Holding

- Dialight

- Zumtobel Group

- Advanced Lighting Technologies, LLC

- Nora Lighting

- Cree Lighting

- Eaton Corporation

- NVC International Holdings Ltd.

- Wipro Limited

- Syska

- Current Lighting Solutions, LLC

Recent Developments

-

In July 2025, Panasonic Corporation acquires Focus Lighting and Fixtures, a B2B lighting products provider in India. This move marks Panasonic's second acquisition in India's electrical sector in nearly 20 years, underscoring its strategy to strengthen its B2B presence in the growing Indian lighting market.

-

In May 2025, Zumtobel Group AG launched the second generation of its continuous-row lighting system, combining advanced functionality, refined design, and ultra-efficient installation. With the launch of TECTON II, the company sets a new benchmark in lighting technology. In collaboration with the engineering firm Pininfarina, Zumtobel has enhanced its universal trunking system with innovative features in technology, design, and sustainability.

-

In March 2025, Signify Holding and Dixon Technologies announced a 50:50 joint venture to manufacture lighting products and accessories in India. This collaboration aims to leverage Signify's lighting technology expertise and Dixon's manufacturing capabilities to produce high-quality, cost-competitive lighting products, supporting India's 'Make in India' initiative.

Industrial And Commercial LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.78 billion

Revenue forecast in 2033

USD 134.51 billion

Growth rate

CAGR of 9.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Panasonic Corporation; Hubbell Lighting; Acuity Brands, Inc.; Emerson Electric Co; ams-OSRAM AG; Signify Holding; Dialight; Zumtobel Group; Advanced Lighting Technologies, LLC; Nora Lighting; Cree Lighting; Eaton Corporation; NVC International Holdings Ltd.; Wipro Limited; Syska; Current Lighting Solutions, LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial And Commercial LED Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the industrial and commercial LED lighting market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Lamps

-

Luminaires

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the industrial and commercial led lighting market with a share of 42.9% in 2024. This is attributable to high construction rates, replacement of existing outdoor infrastructure, and government funding for high-efficiency building lighting.

b. Some key players operating in the industrial and commercial led lighting market include Signify Holding, Cree Inc. (IDEAL INDUSTRIES, INC.), Osram Opto, Digital Lumens Inc., Toshiba Corp., Dialight Plc, and Eaton.

b. Key factors that are driving the market growth include high efficiency, reliability, longer life span, high brightness level, condensed size, low power consumption, and growing demand for smart lighting.

b. The global industrial and commercial led lighting market size was estimated at USD 58.00 billion in 2024 and is expected to reach USD 64.78 billion in 2025.

b. The global industrial and commercial led lighting market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2033 to reach USD 134.51 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.