- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Industrial Coatings Market Size, Share, Industry Report, 2033GVR Report cover

![Industrial Coatings Market Size, Share & Trends Report]()

Industrial Coatings Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Water-borne, Solvent-borne), By Product (Acrylic, Polyurethane), By End Use (Marine, General Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-686-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Coatings Market Summary

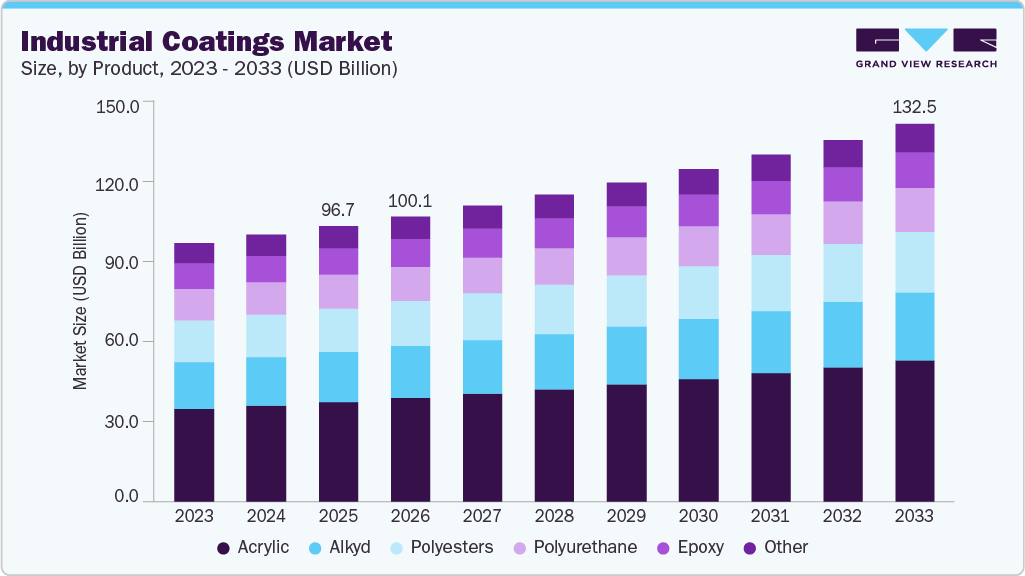

The global industrial coatings market size was estimated at USD 96.72 billion in 2025 and is projected to reach USD 132.45 billion by 2033, growing at a CAGR of 4.1% from 2026 to 2033. The increasing usage of refinish coatings for automotive maintenance, repair, and aftermarket painting to enhance visual appearance, surface protection, and corrosion resistance is expected to propel the demand for industrial coatings.

Key Market Trends & Insights

- Asia Pacific dominated the global industrial coatings market with the largest revenue share of 42.0% in 2025.

- The industrial coatings industry in China is expected to grow at the fastest CAGR of 4.8% from 2026 to 2033.

- By product, the acrylic segment is expected to grow at the fastest CAGR of 4.5% from 2026 to 2033.

- By technology, the water borne segment led the market with the largest revenue share of 35.2% in 2025.

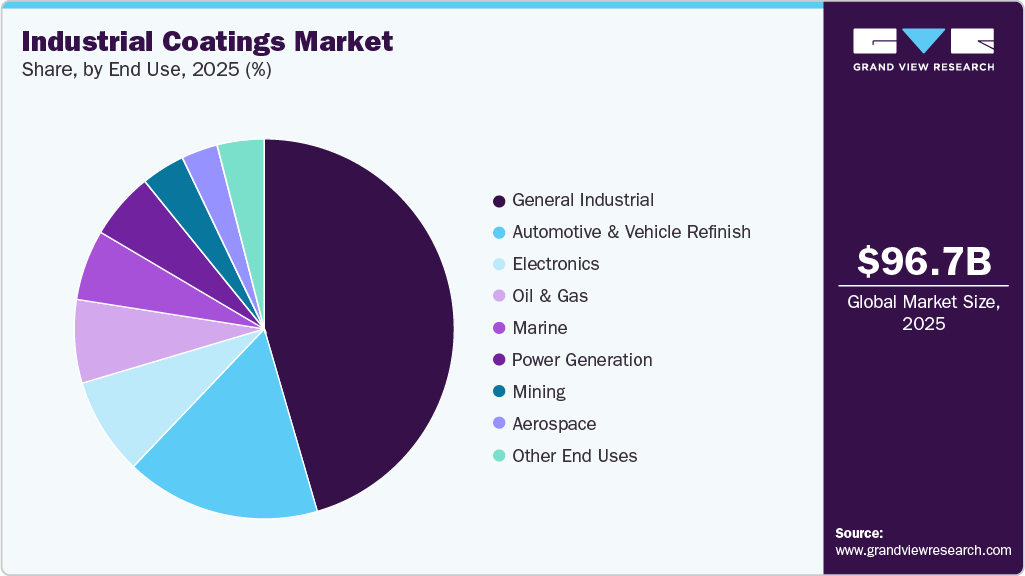

- By application, the general industrial segment led the market with the largest revenue share of 45.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 96.72 Billion

- 2033 Projected Market Size: USD 132.45 Billion

- CAGR (2026-2033): 4.1%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

Industrial coatings are widely used in various end use sectors such as automotive and vehicle refinishing, electronics, aerospace, oil & gas, mining, marine, and power generation. Automotive and refinish coatings are among the major industrial coatings. The growing usage of refinish coatings for automotive maintenance, repair, and aftermarket painting, due to visual appearance, surface protection, and corrosion resistance, is expected to propel the demand for industrial coatings.Industrial coatings are widely used in commercial and industrial applications such as warehouses, hospitals, manufacturing and industrial plants, showrooms, commercial and retail stores, garages, and airplane hangars. They protect floors from moisture, stains, and cracks and provide a high-performance, smooth, and durable surface that lasts several years and withstands heavy loads.

The growth in the construction industry globally has been a significant factor contributing to the demand for floor coatings. Countries such as the U.S., China, India, Indonesia, the UK, Saudi Arabia, and the UAE are majorly contributing to the growth of the global construction industry. The growing population and rising industrialization have encouraged governments to increase construction spending to expand infrastructural development.

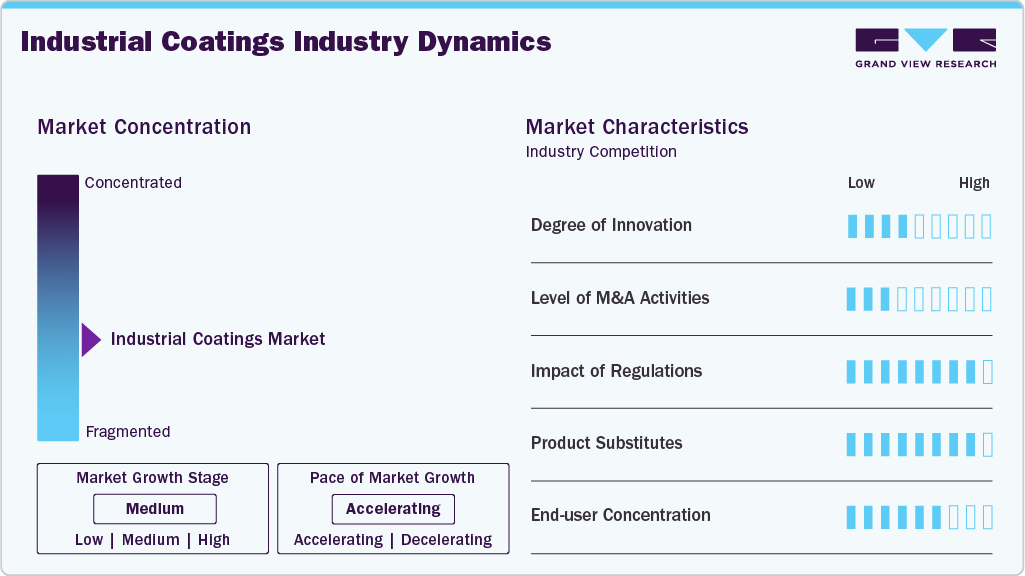

Market Concentration & Characteristics

Some of the major companies actively operating in the global industrial coating industry include Nippon Paint Holdings Co., Ltd., BASF SE, AKZO NOBEL N.V., and PPG Industries Inc.The market is highly competitive due to the presence of well-established global players and regional players. Some of the companies are integrated across the value chain and have multiple channels for manufacturing and distributing their finished products globally.

For instance, in July 2023, AkzoNobel N.V. launched its new product for powder coating, an Interpon D Stone Effect. The product helps in transforming aluminum surfaces in order to offer texture like natural stone. It helps in achieving a stone look in a sustainable and more cost-effective way.

Manufacturers of industrial coatings distribute finished products through direct and indirect channels. Companies distribute their products through third-party vendors, distributors, and wholesalers. Product manufacturers form alliances and strategic business partnerships with distributors and suppliers to ensure the marketing and distribution of their products.

Echmei, IndiaMart, PCE International, Industrial Coatings Ltd., and Syensgo are some of the distributors operating in the industrial coating industry. The final product is used in the aerospace, oil & gas, marine, general industry, power generation, automotive & refinish, and mining end use sectors.

Product Insights

The acrylic segment led the market with the largest revenue share of 36.2% in 2025 and is anticipated to grow at the fastest CAGR of 4.5% over the forecast period, due to its properties such as corrosion resistance, good adhesion, barrier and inhibiting ability, and fast drying.

Polyurethane industrial coating is widely used in various end use industries, due to its excellent performance under extreme temperatures and varied environmental conditions. It is flexible and soft and exhibits low permeability, along with good impact and skid resistance. It coats structural steel, marine applications, truck bed liners, and automobiles.

Epoxy industrial coatings are widely used in construction, shipbuilding, and wastewater treatment plants due to their excellent properties, such as resistance to stains, cracking, extreme temperatures, and blistering. The product is also used in home appliances, such as refrigerators and washing machines, to protect them from food acids, corrosive gases, and humidity, as well as to extend the service life and improve the aesthetics of the appliances.

Technology Insights

The water borne segment led the market with the largest revenue share of 35.5% in 2025. The water-based industrial coatings dry more quickly than solvent-based coatings, as water evaporates rapidly from the coating layer. This results in faster drying without the formation of a surface skin. Water-based industrial coatings are mainly used in cases where solvent-based coatings might react with the substrate.

They are excellent primers, as they offer great thermal and corrosion resistance. In addition, they are flame-resistant and have low toxicity, due to their low VOC content and low hazardous air pollutant emissions. Water-based coatings usage is expected to increase, due to strict regulations regarding solvents in coatings in the U.S. and other mature European countries.

Solvent-borne industrial coatings are widely used in the general industry, oil & gas, marine, automotive, and other sectors. Properties such as lower drying times and better functionality in open and humid conditions are expected to fuel the segment's growth over the forecast period.

End Use Insights

The general industrial segment led the market with the largest revenue share of 45.5% in 2025. The general industry end-use segment includes the consumption of industrial coatings in coil, packaging, construction, agriculture, and wood applications. Increasing demand for industrial coatings from metal roofing, wall panels, HVAC equipment, automotive, appliances, and other applications, owing to excellent corrosion protection, long-lasting color, and scratch resistance, is anticipated to positively influence the overall market growth over the forecast period.

Industrial coating is widely used in the automotive applications to protect and enhance various components such as body panels, wheels, chrome plating etc. They provide automotive parts (made of plastics and composites) with aesthetically pleasing visual color effects such as matte, high-gloss, pearl, and metallic. Automotive refinish coatings are specifically designed for repairing and refurnishing vehicles. They are formulated to cure at ambient temperatures or low-temperature baking, allowing for quicker turnaround times in repair facilities.

Industrial coating is used in various electronic applications such as tablets, PCs, smartphones, touch displays, white goods, and wearable devices. It provides durability, design, color, and advanced functionality such as anti-fingerprint, anti-smudge, anti-glare, and low reflection for touch & display screens.

Regional Insights

The industrial coatings market in North America is anticipated to grow at a significant CAGR during the forecast period, supported by a mature industrial base, high replacement demand, and strong presence of oil & gas, aerospace, and automotive manufacturing. The region continues to benefit from technological innovation, strict performance standards, and increasing adoption of high-value, low-VOC, and specialty coating solutions.

U.S. Industrial Coatings Market Trends

The industrial coatings market in the U.S. accounted for the largest market revenue share in North America in 2025, underpinned by ongoing investments in infrastructure refurbishment, energy transition projects, and advanced manufacturing. Demand is further strengthened by stringent regulatory frameworks, high spending on asset maintenance, and strong uptake of water-borne, powder, and high-performance protective coatings across industrial applications.

Asia Pacific Industrial Coatings Market Trends

Asia Pacific dominated the global industrial coatings market with the largest revenue share of 42.0% in 2025, driven by robust industrialization, large-scale infrastructure development, and strong manufacturing output across China, India, Japan, and Southeast Asia. The region benefits from high demand from general industrial, automotive, marine, and electronics end-use sectors, supported by expanding production capacities and cost-competitive manufacturing ecosystems. In addition, significant investments in energy, oil & gas, shipbuilding, and urban infrastructure, coupled with the presence of a large base of local and multinational coating manufacturers, have reinforced Asia Pacific’s leadership in revenue generation.

The industrial coatings market in China is expected to register at the fastest CAGR of 4.8% from 2026 to 2033, driven by sustained growth in manufacturing output, infrastructure modernization, and investments in automotive, marine, electronics, and energy sectors. Government-led initiatives supporting industrial upgrading, corrosion protection of assets, and adoption of advanced and environmentally compliant coating technologies are further accelerating market expansion.

Europe Industrial Coatings Market Trends

The industrial coatings market in Europe held a significant market share of 29.4% in 2025, driven by stringent environmental regulations, strong emphasis on sustainability, and high penetration of advanced coating technologies. The region’s demand is largely fueled by automotive, general industrial, aerospace, and marine sectors, with continued innovation in low-VOC, powder, and functional coatings supporting value growth.

The Germany industrial coatings market serves as a key growth engine within Europe due to its strong industrial manufacturing base, leadership in automotive and machinery production, and high standards for coating performance and durability. The market benefits from continuous investments in Industry 4.0, energy efficiency, and premium industrial coating systems, reinforcing stable and high-value demand.

Central & South America Industrial Coatings Market Trends

The industrial coatings market in Central & South America’s is driven by industrial expansion, infrastructure development, and growing investments in oil & gas, mining, and automotive manufacturing, particularly in Brazil and Mexico. While price sensitivity remains high, gradual adoption of durable and environmentally compliant coatings is supporting steady market growth.

Middle East & Africa Industrial Coatings Market Trends

The industrial coatings market in Middle East & Africa is supported by large-scale investments in oil & gas infrastructure, power generation, marine assets, and industrial construction. Demand is primarily driven by the need for high-performance corrosion-resistant coatings suited for harsh operating environments, with long-term growth underpinned by industrial diversification initiatives and infrastructure modernization programs.

Key Industrial Coating Company Insights

The competitive landscape of the global industrial coatings industry is characterized by intense competition among a few key players, technological advancements, and strategic initiatives aimed at maintaining industry leadership and driving innovation. Key companies have a strong presence in the overall global coatings industry, leveraging their brand reputation to maintain market share and drive growth.

Some of the key players operating in the market include

-

BASF SE operates through six business segments, namely industrial solutions, materials, surface technologies, chemicals, nutrition & care, and agricultural solutions. Products offered by the company are used in agriculture, construction, pharmaceuticals, energy & power, home care & nutrition, automotive & transportation, rubber & plastics, leather & textiles, and personal care & hygiene industries

-

Akzo Nobel N.V. is involved in manufacturing and marketing paints & performance Coatings. It operates through three business segments-specialty chemicals, performance Coatings, and decorative paints. Major products offered by the company are industrial chemicals, functional chemicals, pulp & performance chemicals, powder Coatings, and automotive & aerospace Coatings

Key Industrial Coating Companies:

The following are the leading companies in the industrial coating market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Akzo Nobel N.V.

- Axalta Coating Systems

- Jotun

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Hempel A/S

- RPM International Inc.

- Diamond Paints

- Kansai Paints

Recent Developments

-

In November 2025, AkzoNobel and Axalta announced an all-stock merger of equals, creating one of the world’s largest coatings entities with broad portfolios across industrial, protective, marine, and mobility coatings, significantly reshaping competitive dynamics.

-

In November 2025, Wesco Group entered an agreement to acquire National Coatings & Supplies, expanding its distribution footprint in industrial and automotive refinish coatings markets in North America.

Industrial Coatings Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 100.09 billion

Revenue forecast in 2033

USD 132.45 billion

Growth rate

CAGR of 4.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Volume in kilotons, revenue forecast, company ranking, competitive landscape, growth factors, and trends

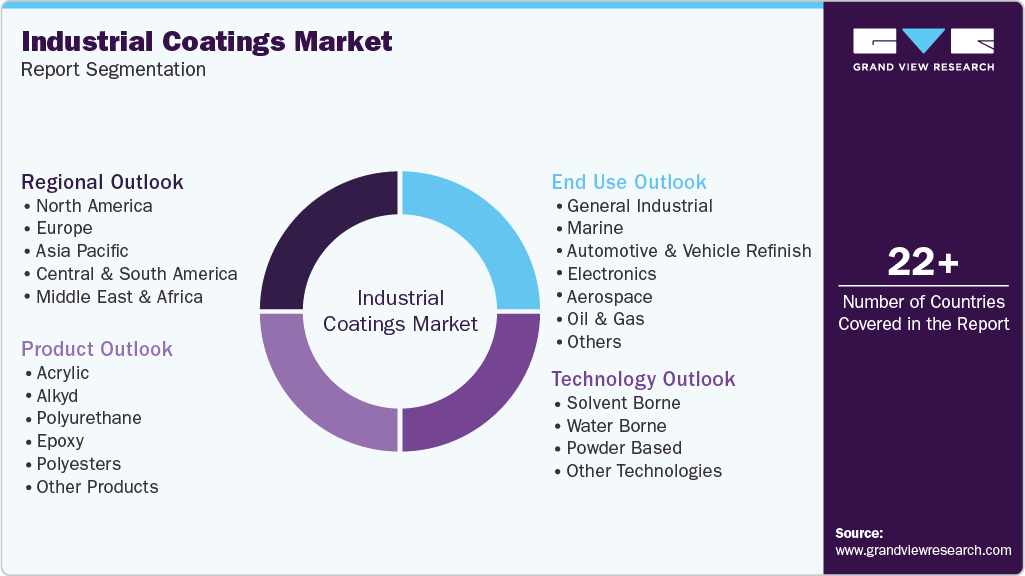

Segments covered

Product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Akzo Nobel N.V.; Axalta Coating Systems; Jotun; PPG Industries, Inc.; The Sherwin-Williams Company; Nippon Paint Holdings Co., Ltd.; Hempel A/S; RPM International Inc.; Diamond Paints; Kansai Paints

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial coatings market report based on product, technology, end use and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Acrylic

-

Alkyd

-

Polyurethane

-

Epoxy

-

Polyesters

-

Other Products

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Solvent Borne

-

Water Borne

-

Powder Based

-

Other Technologies

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

General Industrial

-

Marine

-

Automotive & Vehicle Refinish

-

Electronics

-

Aerospace

-

Oil & Gas

-

Mining

-

Power Generation

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial coatings market size was estimated at USD 96.72 billion in 2025 and is expected to reach USD 100.09 billion in 2025.

b. The industrial coatings market is expected to grow at a compound annual growth rate of 4.1% from 2026 to 2033 to reach USD 132.45 billion by 2033.

b. The acrylic segment dominated the industrial coatings market with a 36.2% revenue share in 2025 due to its cost-effectiveness, fast drying time, strong weatherability, and versatility across water-borne and solvent-borne formulations. Its widespread adoption in general industrial, automotive refinish, and electronics applications, coupled with increasing preference for low-VOC and environmentally compliant coatings, further reinforced its market leadership.

b. Some of the key players operating in the industrial coatings market include BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Jotun, PPG Industries, Inc, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Hempel A/S, RPM International Inc., Diamond Paints, and Kansai Paints.

b. The industrial coatings market is driven by rising industrialization, infrastructure development, and growing demand for corrosion protection and asset life extension across manufacturing-intensive sectors. The stringent environmental regulations and the shift toward high-performance, low-VOC coating technologies are accelerating product innovation and adoption globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.