- Home

- »

- Catalysts & Enzymes

- »

-

India Enzymes Market Size & Share, Industry Report, 2030GVR Report cover

![India Enzymes Market Size, Share & Trends Report]()

India Enzymes Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Microorganisms, Plants), By Product (Proteases, Lipases), By Application (Industrial, Specialty), And Segment Forecasts

- Report ID: GVR-4-68040-209-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Enzymes Market Size & Trends

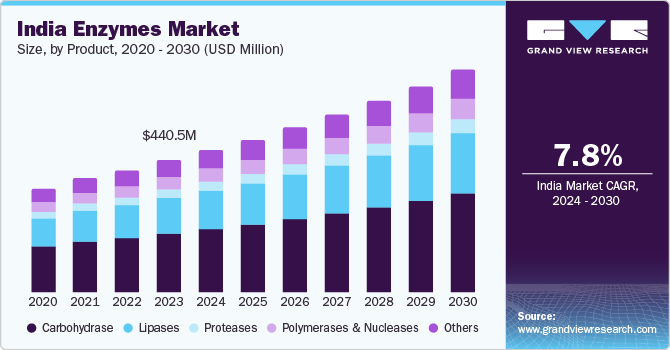

The India enzymes market size was valued at USD 440.5 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030. The growth of detergent and chemical industries in India is anticipated to contribute to market expansion throughout the forecast period. The rise in awareness regarding declining nutrition levels among consumers has resulted in a surge in protein consumption, thereby driving the demand for proteases in the food industry.

The country, also known for its strong textile manufacturing base, has witnessed a growing demand for eco-friendly and sustainable textiles. It has led to the use of enzymes in the textiles industry as they are biodegradable and are pollution free. This also makes them an attractive alternative to harsh chemicals in the textiles industry. Moreover, as enzymes can reduce the requirement for high temperatures and excessive water consumption during textile processing, it leads to significant energy and water savings. This aligns with the sustainability and resource conservation goals of governments of countries of Asia Pacific.

According to the India Brand Equity Foundation (IBEF), the country witnessed significant growth in textile and apparel production and exports in recent years. In the financial year 2022, the exports of textiles and apparel reached USD 44.4 billion, reflecting an increase of 41% year-on-year.

In the personal care and cosmetics industries, enzymes have gained prominence as natural and sustainable alternatives to synthetic ingredients. Proteases and lipases, offer numerous benefits, including exfoliation and skin rejuvenation, as well as enhanced product stability. India, with its increasing population and growing disposable income, has emerged as a key market for personal care products and cosmetics.

Market Concentration & Characteristics

The India enzymes market is consolidated in nature with top players accounting for more than 75% of the market share. Companies such as Novozymes India, DuPont, DSM, Advance Enzyme Technologies, BASF SE, and Ultreze Enzymes Private Limited are key players in the Indian market.

Manufacturers are expanding their network and investing in strategic investments such as new product launches or mergers and acquisitions. For instance, in May 2022, the Proctor & Gamble (P&G) company set up their first manufacturing plant in India for liquid detergent, on Hyderabad's outskirts with an investment of USD 26.83 million. Also, Procter & Gamble's Tide with Febreze Freshness: This detergent uses product to remove stains and odors, and it also contains a Febreze scent to leave clothes smelling fresh.

Source Insights

Microorganisms source dominated the market with a revenue share of 80.8% in 2023. This is attributed to the demand for fungal enzymes, primarily due to their expanding usage across various end-use sectors. They play a vital role in the preparation and manufacturing of numerous food products such as soy sauce, beer, baked goods, processed fruits, and dairy items. Bacterial products, predominantly sourced from Bacillus, are also widely utilized in various applications in the country.

Plant-derived enzymes, such as bromelain from pineapple and papain from papaya, are notable examples of products sourced from plants. The growth is attributed to their ability to enhance digestion and reduce strain on the small intestine. Additionally, growing awareness concerning the benefits of natural cosmetic, nutraceutical, and food & beverage products in India, is anticipated to contribute to the segmental growth in the near future.

Product Insights

Carbohydrase dominated the market with a revenue share of 43.6% in 2023. Enzymes like carbohydrase that are manufactured by using various microorganisms and plants have zero negative impact on the environment and as a result, are considered eco-friendly. These are widely used in textile industry, bioethanol production, and in starch processing. Such factors create lucrative growth opportunities for the market participants in India. For instance, DSM has launched a new line of carbohydrase that is specifically designed for use in the textile industry. These can remove starch and other impurities from textiles, which can improve their appearance and quality.

Industrial enzymes market in India is expected to witness significant growth during the forecast period owing to the increasing demand for food products and beverages, detergents, and nutraceuticals in the country. The prominence of India as a consumer of these products makes it a key contributor to the expansion of market in Asia Pacific. Lipases, which are used in dairy processed products and biological detergents, are expected to witness lucrative growth opportunities in the country over the forecast period. These are also anticipated to witness surged consumption in textile manufacturing and denim bleaching units in India.

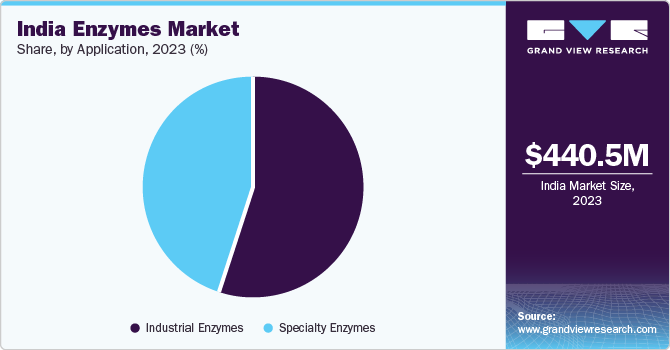

Application Insights

Industrial applications dominated the market with a revenue share of 54.7% in 2023. The growth of market in India is also influenced by a growing consumer base and increasing government initiatives such as Make in India. Major companies such as GCMMF (Amul) and ITC Limited have recognized the potential of the food & beverage industry in the country. As such, they have made investments in this industry.

The surging domestic demand for processed food products and beverages and the increasing retail sales of cosmetics, sports drinks, and dietary supplements in sub-metro cities of the country, including Pune and Bangalore, have further contributed to the market growth in India. Moreover, the use of industrial enzymes is expected to witness a significant surge in bakery, dairy, and cheese products in India in the coming years.

The key applications of specialty enzymes in the pharmaceutical sector include promoting wound healing, diagnosing diseases, as well as killing disease-causing microorganisms. Increasing research & development activities have made it possible for these products to be utilized in drug delivery and formulation. Key manufacturers in the Indian pharmaceutical industry are inclined toward the production of enzyme-based pharmaceutical drug formulations that have fewer side effects.

Favorable policies by the government to support the pharmaceutical sector along with growing investment by private companies across developing economies like India are expected to drive the pharmaceutical industry, which, in turn, is projected to boost the consumption of specialty enzymes in the coming years.

Key India Enzymes Company Insights

The India enzymes market is consolidated in nature. However, contract manufacturers, i.e. third-party companies, specialize in the production on behalf of other companies. These manufacturers have the expertise, facilities, and resources to produce enzymes at large scale. They work with industrial enzyme manufacturers to produce enzymes based on their formulations or specifications such as creative enzymes and enzymicals.

Novozymes India, DuPont, DSM, BASF SE, Advance Enzyme Technologies, and Ultreze Enzymes Private Limited are some of the leading market participants in the India enzymes market.

-

Novozymes India: Novozymes is a biotechnology firm that provides solutions while preserving the plant’s essential resources. The company is mainly focused on the production of biopharmaceutical ingredients, industrial enzymes, and microorganisms

-

BASF SE: BASF SE offers an extensive range of fermentation chemicals, such as organic acids, enzymes, and alcohol, catering to numerous end-use industries including pharmaceuticals, food and beverages, and plastics. The company has collaborated with other companies to open precision fermentation plants, showcasing their commitment to expanding their presence globally

-

Antozyme Biotech; ProteoZymes; YSS Industrial Enzyme; and Enzyme Development Corporation; are some of the emerging market participants in the India enzymes market.

-

Enzyme Development Corporation: Enzyme Development Corporation offers customers with application specific enzyme products, and blends. The company’s product portfolio comprises of proteases, carbohydrases, cellulases, lipases, among others

-

Antozyme Biotech: Antozyme Biotech has an integrated enzyme formulation and production model. The eco-friendly enzymes produced by the company are catered to various end-use industries such as starch, food, brewery, distillery, agriculture, wastewater treatment, pharmaceuticals, and detergents

Key India Enzymes Companies:

- Novozymes India

- BASF SE

- DuPont Danisco

- DSM

- Advanced Enzyme Technologies

- Ultreze Enzymes Private Limited

- Antozyme Biotech

- ProteoZymes

- YSS Industrial Enzyme

- Enzyme Development Corporation

- NOVUS INTERNATIONAL, INC.

- Associated British Foods plc

- Chr. Hansen Holding A/S

- Lesaffre

- Adisseo

Recent Developments

-

In January 2024, Zytex introduced PureBact, a revolutionary Microbial Culture product designed for wastewater treatment in both ETP and STP applications

-

In November 2023, Novozymes marked a significant milestone in the SAF (Sustainable Aviation Fuel) and renewable diesel industry with the launch of Quara LowP, an enzymatic solution specifically designed to transform feedstock pre-treatment process

-

In August 2022, BASF SE entered an agreement with Danstar Ferment AG to divest BASF Nutrilife baking enzymes portfolio and business

India Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 473.92 billion

Revenue forecast in 2030

USD 741.81 billion

Growth Rate

CAGR of 7.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application

Key companies profiled

Novozymes India; BASF SE; DuPont Danisco; DSM; Advanced Enzyme Technologies; Ultreze Enzymes Private Limited; Antozyme Biotech; ProteoZymes; YSS Industrial Enzyme; Enzyme Development Corporation; NOVUS INTERNATIONAL, INC.; Associated British Foods plc; Chr. Hansen Holding A/S; Lesaffre; and Adisseo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

India enzymes Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India enzymes market report based on source, product, and application.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plants

-

Animals

-

Microorganisms

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Enzymes

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceutical

-

Personal Care & Cosmetics

-

Wastewater

-

Others

-

-

Specialty Enzymes

-

Pharmaceutical

-

Research & Biotechnology

-

Diagnostics

-

Biocatalyst

-

-

Frequently Asked Questions About This Report

b. The India enzymes market size was estimated at USD 440.5 million in 2023 and is expected to reach USD 473.92 million in 2024.

b. The India enzymes market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 741.81 million by 2030.

b. Industrial enzymes dominated the India enzymes market with a share of 54.7% in 2023. This is attributed to growing consumer base and increasing government initiatives such as Make in India. Major companies such as GCMMF (Amul) and ITC Limited have recognized the potential of the food & beverage industry in the country. As such, they have made investments in this industry.

b. Some key players operating in the India enzymes market include Novozymes India; BASF SE; DuPont Danisco; DSM; Advanced Enzyme Technologies; Ultreze Enzymes Private Limited; Antozyme Biotech; ProteoZymes; YSS Industrial Enzyme; Enzyme Development Corporation; NOVUS INTERNATIONAL, INC.; Associated British Foods plc; Chr. Hansen Holding A/S; Lesaffre; and Adisseo.

b. Key factors that are driving the market growth include growth of detergent and chemical industries in India is anticipated to contribute to market expansion throughout the forecast period. The rise in awareness regarding declining nutrition levels among consumers has resulted in a surge in protein consumption, thereby driving the demand for proteases in the food industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.