- Home

- »

- Nutraceuticals & Functional Foods

- »

-

India Dietary Supplements Market, Industry Report, 2030GVR Report cover

![India Dietary Supplements Market Size, Share & Trends Report]()

India Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form (Tablets, Capsules, Powders, Gummies, Liquid), By Type, By Application, By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-620-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Dietary Supplements Market Trends

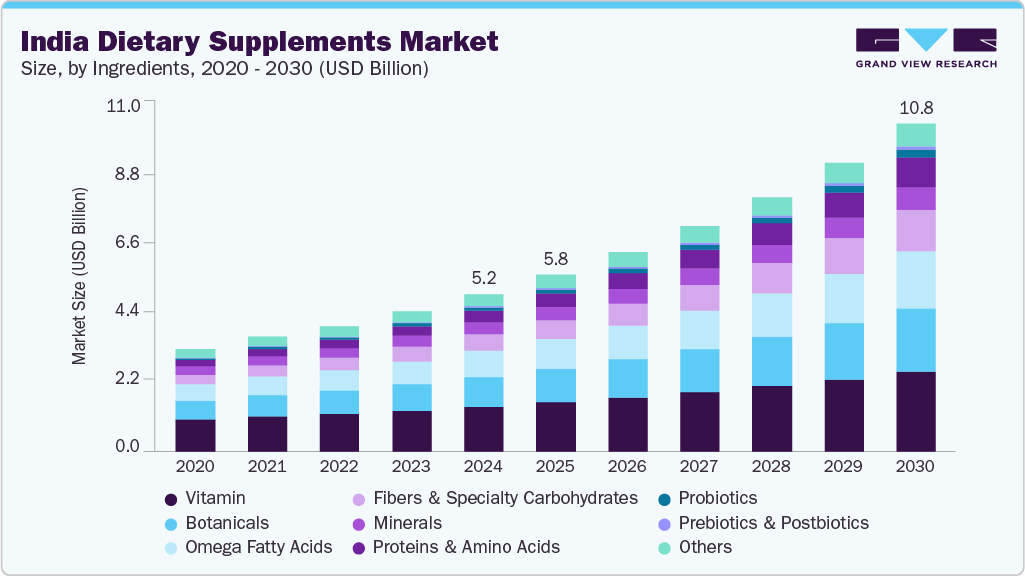

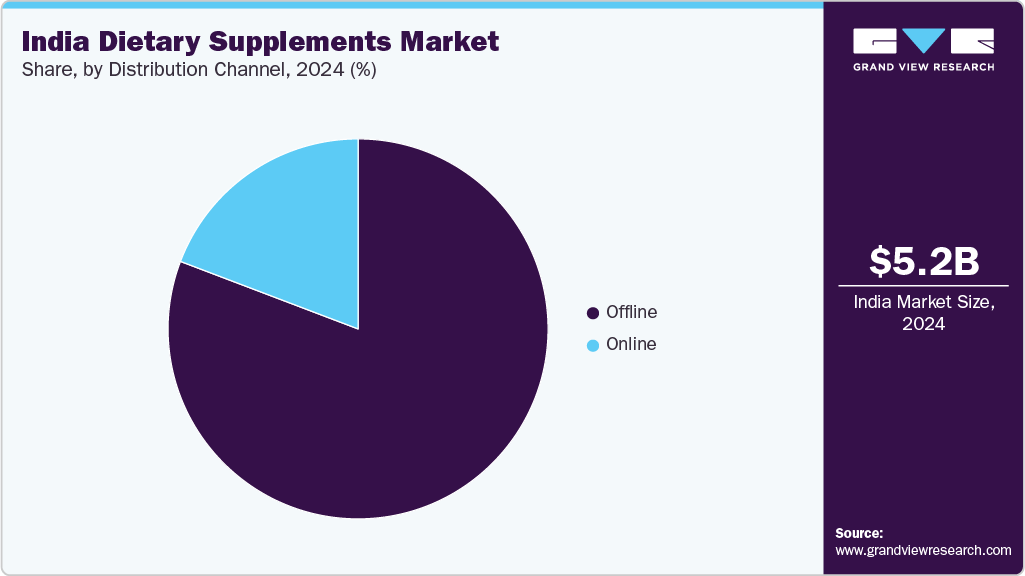

The India dietary supplements market size was estimated at USD 5.17 billion in 2024 and is projected to grow at a CAGR of 13.1% from 2025 to 2030. Increasing awareness regarding the role of dietary supplements in facilitating improved well-being, growing availability of products offered by global brands, and rising incorporation of dietary supplements in treatments related to chronic diseases are key growth drivers for this market.

India, one of the highly populated countries in the world, has seen a significant increase in the demand for nutrient-rich foods, functional dietary products, and supplements in recent years. This rise in demand is mainly driven by the growing prevalence of chronic non-communicable diseases (NCDs), such as diabetes, cardiovascular diseases, and cancer. Dietary supplements are increasingly utilized during the treatment of these conditions to support gut health, boost immunity, and enhance overall well-being. In addition, many young adults in urban India consume multivitamins, prebiotics, probiotics, postbiotics, and omega-3 supplements to improve their health.

Products such as protein powders, protein-infused bars, vitamin gummies, probiotic yogurt and others are increasingly being adopted by urban consumers. The availability of such products through e-commerce and quick-commerce platforms in India generates greater consumer engagement. In addition, domestic market trends and preferences of local customers also shape various developments in this market. For instance, in July 2024, HealthOK (Mankind), partnered with Bikanervala, a multinational food service, to promote its vegetarian multivitamin offering. The partnership is a strategic decision as both brands are vegetarian, and the organizations aim to make it easier for vegetarians to have a healthy lifestyle.

Consumer Insights

In India, more consumers are inclined toward combining traditional medicine with modern innovation-based offerings. This includes supplements incorporating ingredients associated with Ayurveda references, such as Shatavari, Ashwagandha, Triphala, Amla, etc. This has stimulated multiple new developments and product launches in the domestic market. For instance, in October 2024, Nutrabay, a sports nutrition startup, launched its new offering, Shilajit. With this launch, the organization aims to widen its audience and position the brand in the holistic nutrition segment.

The portfolios backed by strong marketing campaigns and innovation-based advertising gain increasing customer attention. Internet marketing, AI-driven advertising, and social media marketing are increasingly used to attract customers. Rising participation in sports and outdoor activities, accompanied by growing awareness regarding enhanced nutrition, are expected to result in growing consumption of dietary supplements in India.

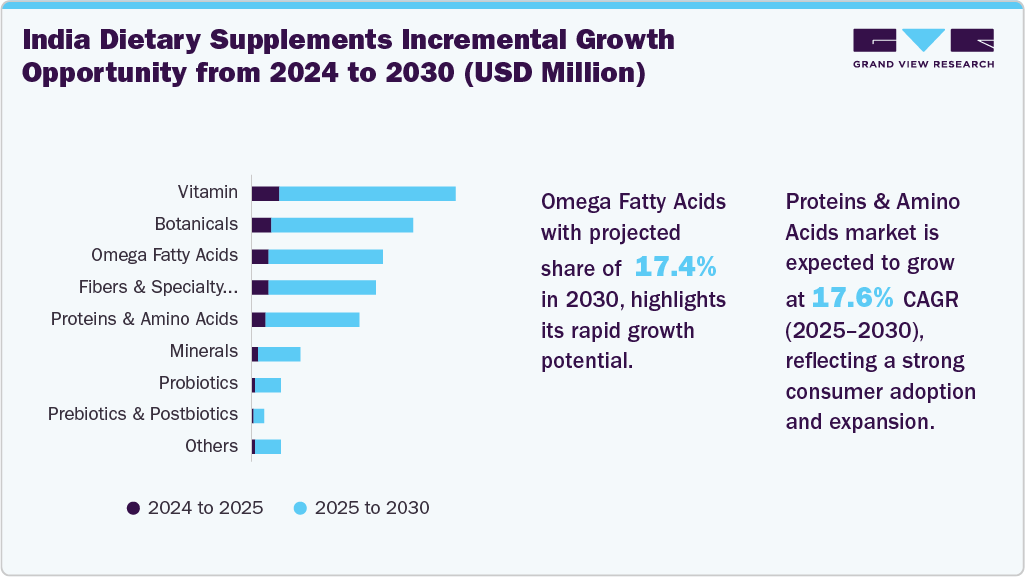

Ingredient Insights

The vitamins segment dominated the Indian dietary supplements market and accounted for a revenue share of 28.5% in 2024. Growth of this segment is primarily driven by factors such as increasing consumption of multivitamins and vitamin-enriched fortified foods in the country, growing availability of products such as vitamin gummies, innovation strategies embraced by the key manufacturers, and ease of accessibility through online marketplaces. In May 2025, Rasayanam, one of the emerging brands in India's health and wellness market, launched multivitamin tablets for men. The newly launched product by Rasayanam features a blend of vitamins, minerals, and other nutrition ingredients incorporated to provide benefits associated with energy and immunity.

The proteins & amino acids segment is likely to experience the fastest growth in the Indian dietary supplements market during the forecast period. Protein powders and protein liquids are increasingly adopted by Indian consumers owing to rising awareness regarding the role of protein in weight management and muscle gains. Many consumers undergoing treatment for obesity and intensive diets for weight management purchase protein-based supplements to support physical workout regimes and medications. New launches associated with innovations and novel applications are expected to facilitate the growth of this segment over the forecast period.

Form Insights

The tablets segment accounted for India's largest revenue share of the dietary supplement market. This growth is driven by several advantages that tablets offer, such as ease of use for consumers and improved storage convenience for manufacturers and marketers. When dietary supplements are consumed in tablet form, they undergo several processes, including disintegration, dissolution, absorption, distribution, and utilization. Tablets protect sensitive ingredients, such as vitamins, from external influences, including moisture and sunlight, while controlling dosages to desired levels. Furthermore, manufacturing tablets is more cost-effective compared to other forms of supplements.

The powder segment is projected to experience substantial growth from 2025 to 2030. This growth is largely driven by the rising consumption of protein powders and the availability of powdered supplements that can be transformed into ready-to-drink liquids through specific preparation methods before consumption.

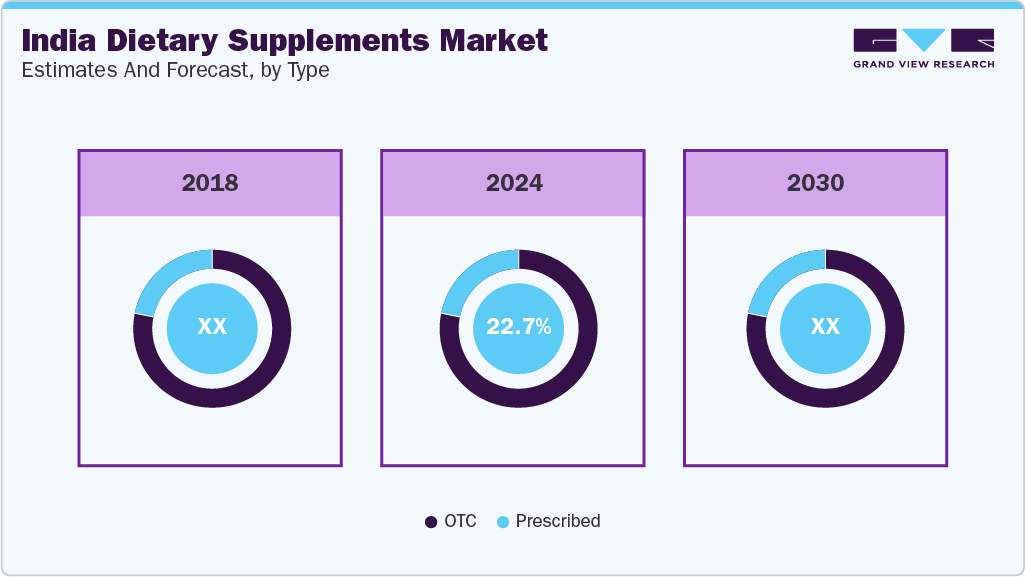

Type Insights

In 2024, the OTC segment accounted for the largest revenue share of the market. This growth can be attributed to increased spending on lifestyle improvements, particularly in the health and wellness category, and a rise in self-care awareness. The significant expansion of India's e-commerce and online retail industry has also contributed to this trend. A large proportion of the country's young population and their growing interest in fitness and outdoor activities are expected to drive the growth of this segment further.

The prescribed dietary supplements market is expected to grow at the fastest CAGR from 2025 to 2030. Several factors, including the increasing integration of dietary supplements into the treatment of chronic diseases and the rising recommendations for nutritional supplements and nutraceuticals by health professionals, primarily influence the growth of this segment. Additionally, advancements in diagnosis and testing technologies have enhanced the identification of lifestyle diseases and deficiencies, further contributing to the expansion of this market.

Application Insights

The immunity segment dominated the Indian dietary supplements market with a revenue share of 12.6% in 2024. This is attributed to factors such as the growing consumption of multivitamins and protein supplements designed for immunity boosting and the increasing inclusion of dietary supplements in treatments of gut ailments, cancer, cardiovascular diseases, and other chronic non-communicable diseases. According to WHO, nearly 77.0 million individuals aged above 18 have type 2 diabetes in India. In recent years, the rising prevalence of lifestyle-driven health issues in urban areas has also stimulated demand for immunity boosters.

On the basis of application, the prenatal health segment is expected to grow at the fastest CAGR of 18.1% from 2025 to 2030. According to UNICEF, approximately 25 million children are born annually in India. However, nearly 35.0% of maternal deaths originate from premature births. The increasing incidence rate of pregnancy issues has resulted in a growing consumption of dietary supplements and other nutrition-enhancement products.

End-use Insights

The adult segment accounted for the largest market share, accounting for 63.1% in 2024. The demand is growing across consumer groups, such as millennials, Gen X, Gen Z, and boomers, primarily due to shifting dietary preferences from fast food and carbonated soft drinks to fortified foods and liquid nutritional supplements. This shift is mainly influenced by increasing awareness regarding the role of food consumption in weight management, prevention of lifestyle-driven diseases, and risks associated with NCDs. In addition, easy accessibility to dietary supplements through online delivery platforms available on smartphones is expected to facilitate growing consumption by this user group. The key cities of India, such as Mumbai, Bengaluru, Chennai, Delhi, Hyderabad, Pune, Vizag, Cochin, Lucknow, Ahmedabad, and others, have vast networks of online distribution for these offerings, which is likely to support segment growth during the next few years.

The geriatric segment is anticipated to grow at the fastest CAGR during the forecast period. This is attributed to the increasing demand for dietary supplements that complement the treatments related to orthopedic health issues and immunity problems. In addition, using ingredients such as collagen is a common anti-aging treatment. Rising utilization of supplements that enhance gut health and significant inclusion of dietary supplements in treating chronic diseases such as diabetes, asthma, and cardiovascular diseases are expected to facilitate market growth.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. The dietary supplements are commonly distributed to pharmacies, hypermarkets & supermarkets, specialty stores, and grocery stores. In addition, some prescription-based dietary supplements are distributed through practitioners and are provided to patients during the treatments according to requirements. Brands prefer offline distribution owing to the improved brand visibility it ensures.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. This growth is attributed to the increasing availability of dietary supplements such as protein powders, vitamin gummies, omega-3 supplements, prebiotic drinks, probiotic foods, and others through e-commerce platforms and online delivery portals.

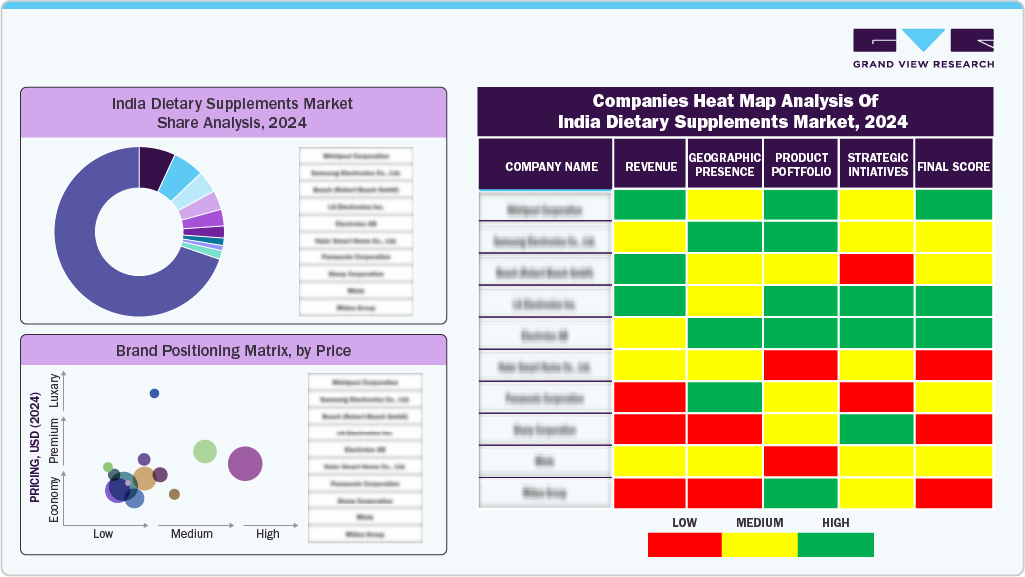

Key India Dietary Supplements Company Insights

Some key companies operating in India dietary supplements industry include Amway India Enterprises Pvt. Ltd, Amul (GCMMF), Herbalife International of America, Inc., ADM, and others.

-

ADM is a global nutrition company offering extensive products and services to businesses and consumer markets. ADM's dietary supplements portfolio features microbiome and human nutrition products.

-

Glanbia PLC is a global manufacturer of numerous products associated with categories such as performance nutrition, health and nutrition, dairy, and more. Optimum Nutrition offers a range of products in India through its brand.

Key India Dietary Supplements Companies:

- Amway India Enterprises Pvt. Ltd

- Amul (GCMMF)

- Herbalife International of America, Inc.

- ADM

- Abbott

- Bayer AG

- Glanbia PLC

- Pfizer Inc.

- GSK plc

- DuPont de Nemours, Inc.

India Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.81 billion

Revenue forecast in 2030

USD 10.77 billion

Growth rate

CAGR of 13.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel, country

Key companies profiled

Amway India Enterprises Pvt. Ltd; Amul (GCMMF); Herbalife International of America, Inc.; ADM; Abbott; Bayer AG; Glanbia PLC; Pfizer Inc.; GSK plc; DuPont de Nemours, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India dietary supplements market report based on ingredients, form, type, application, end-use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

- End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.