- Home

- »

- Advanced Interior Materials

- »

-

India Barite Market Size And Share, Industry Report, 2030GVR Report cover

![India Barite Market Size, Share & Trends Report]()

India Barite Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Oil & Gas, Chemicals, Fillers), And Segment Forecasts

- Report ID: GVR-4-68040-293-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Barite Market Size & Trends

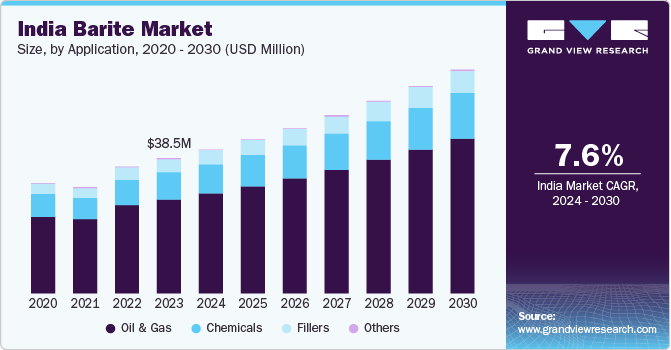

The India barite market size was estimated at USD 38.5 million in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The increasing demand for oil and gas, expansion in the renewable energy sector, and increased usage in paints and coatings are driving the demand for barite in the market. Barite is a dense mineral composed of barium sulfate (BaSO4) with a high specific gravity, making it valuable in various industrial applications.

Barite is essential in the oil and gas sector, operating as a vital component in drilling fluids to regulate pressure and avert blowouts while drilling. Its inclusion is vital for upholding wellbore stability, managing formation pressure, and transporting rock fragments to the surface during drilling activities, thus guaranteeing operational safety and efficacy.

Barite is used to produce lead-acid batteries with a wide range of applications, including in renewable energy systems such as wind turbines and solar power installations. Lead-acid batteries are known for their reliability, low cost, and ability to store large amounts of energy, making them a popular choice for energy storage in various renewable energy applications. Barite is commonly used as a component in the production of lead-acid batteries, where it serves as a filler material to enhance the battery's performance and durability.

As the world moves towards sustainable energy sources to reduce the impact of climate change and decrease reliance on fossil fuels, the demand for renewable energy technologies such as wind turbines and solar power systems is expected to grow significantly. This increasing focus on sustainable energy solutions is anticipated to drive the demand for lead-acid batteries, boosting the need for barite as a key ingredient in these batteries. Barite's properties make it well-suited for use in lead-acid batteries, where it helps improve the battery's efficiency, longevity, and overall performance.

Market Concentration & Characteristics

Market concentration in the barite industry is high. The Indian barite industry is dominated by a few key producers who hold a significant share of the market. These major players have established themselves as key suppliers in the industry. Furthermore, the barite industry requires substantial investments in mining operations, processing facilities, and transportation infrastructure. The significant barrier to entry poses a challenge for new entrants seeking to penetrate the market and compete with established manufacturers.

The market growth stage is medium, and the pace is accelerating. The Indian market is characterized by a moderate degree of innovation. While the mineral itself has well-established uses in industries such as oil and gas drilling, paints and coatings, and construction, there is ongoing research and development aimed at exploring new applications and enhancing existing products. Innovations in processing techniques, quality control measures, and product formulations are improving the performance and versatility of barite in different end-use sectors, driving growth and expanding market opportunities.

The availability of substitutes and competitive pricing play a role in shaping the filler segment of the barite market. Ilmenite, synthetic hematite, iron ore, nano silica, and celestite are some popular alternatives for barite utilized in diverse industries. Celestite is seen as an effective replacement for barite in many sectors, particularly in oil and gas drilling, because of their comparable characteristics. Similarly, nano-silica particles can serve as a substitute for enhancing lubrication, enhancing drilling mud density, reducing pressure transmission, and decreasing permeability.

Application Insights

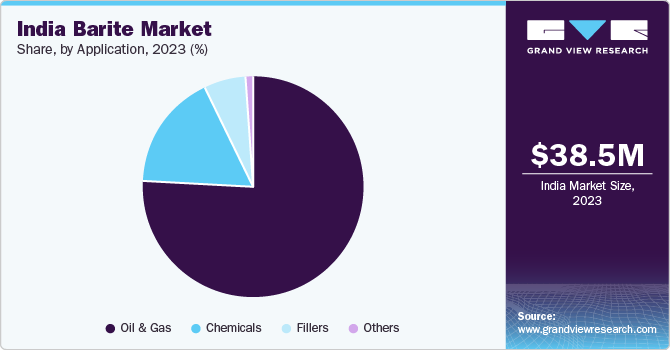

Based on application, the market is categorized as oil & gas, chemicals, fillers, and others. The oil & gas segment held the market with the largest revenue share of 69.7% in 2023, owing to the rising demand for energy and electricity. India is the third-largest oil consumer and the fourth-largest gas consumer in the world. According to the NITI Aayog, the total petroleum product consumption in 2023 increased to 223.02 million tonnes from 194.30 million tonnes in 2021, boosting the overall demand for barite.

The fillers segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the growth in the construction industry, where barite is commonly used as a filler in products such as paints, coatings, and plastics. The construction sector's expansion, driven by infrastructure development projects, residential construction, and commercial building activities, creates a strong demand for high-quality fillers.

Key India Barite Company Insights

Some of the key players operating in the market include BAKTHA MINERALS PVT LTD, Gimpex

-

BAKTHA MINERALS PVT LTD is an exporter of minerals, including barites, offering various forms of barites such as lumps and powder to meet customer requirements and specifications. The company is actively involved in the barite industry, sourcing directly from mines in India to supply barite powder for use as a weighing agent in drilling fluids within the oil and gas industry. BAKTHA MINERALS PVT LTD ensures quality by providing a range of grades like 4.00, 4.10, 4.22, and 4.30, with specific gravities ranging from 4.1 to 4.25%

-

Gimpex Pvt. Ltd. is a mineral-oriented company that operates in the industrial minerals sector, offering a range of minerals, including barite. The company's commitment to quality, performance, and service is evident in its operations, with a focus on upgrading technology, developing new product lines, and achieving new goals. Gimpex Pvt. Ltd. is recognized as a 'Star Trade House' by the Government of India for its export performance, showcasing its significant presence in the market. The company manufactures various minerals, including barite, bentonite, coal, granite, marble, iron ore, and mill scale

Gayathri Enterprises, Intercity Mineral Enterprises are some of the other market participants in the Indian market.

-

Gayathri Enterprises is a manufacturer and supplier of minerals, including barite. The company offers a range of barite products, such as barite powder, catering to various industries like drilling, paint, rubber, and more. Gayathri Enterprises has a diverse product line, which includes minerals such as quartz powder, silica sand, and quartz lumps, showcasing its expertise in the mineral industry

-

Intercity Enterprises is a company that offers a variety of barite products, catering to industrial, medical, and manufacturing uses. The company provides different grades of barite, including off-color/half-white, snow white, extra super snow white, grey barites, and those with varying silica content

Key India Barite Companies:

- BAKTHA MINERALS PVT LTD

- Gayathri Enterprises

- Kaomin Industries LLP

- Imperial Industrial Minerals Company

- Intercity Enterprises

- Arunai Products And Services Private Limited

- Ashok Mineral Enterprises

- Gimpex

- Goldy Minerals

- Ankur Rasayan

Recent Developments

-

In May 2022, the Andhra Pradesh Mineral Development Corporation (APMDC) signed a Memorandum of Understanding (MoU) with local firms in the U.S. to facilitate exports and expand its presence in the global barytes market. The agreement aims to enable APMDC to export approximately 750 crore worth of barytes to the U.S. market, with plans to further increase this to an additional 250 crore by the end of the fiscal year. This strategic initiative signifies APMDC's inaugural foray into MoUs for barytes sales, strategically targeting the high demand for barytes minerals in the U.S.

India Barite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.0 million

Revenue forecast in 2030

USD 63.7 million

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Key companies profiled

BAKTHA MINERALS PVT LTD; Gayathri Enterprises; Kaomin Industries LLP; Imperial Industrial Minerals Company; Intercity Enterprises; Arunai Products And Services Private Limited; Ashok Mineral Enterprises; Gimpex; Goldy Minerals; Ankur Rasayan

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Barite Market Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the India barite market research report based on the application:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Fillers

-

Others

-

Frequently Asked Questions About This Report

b. The India barite market size was estimated at USD 38.5 million in 2023 and is expected to reach USD 41.0 million in 2024

b. The global India barite market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 63.7 million by 2030

b. Based on application, the oil & gas segment dominated the India barite market with a share of 69.7% in 2023 owing to the rising demand for energy and electricity

b. Some key players operating in the India barite market include BAKTHA MINERALS PVT LTD; Gayathri Enterprises; Kaomin Industries LLP; Imperial Industrial Minerals Company; Intercity Enterprises; Arunai Products And Services Private Limited; Ashok Mineral Enterprises; Gimpex; Goldy Minerals; Ankur Rasayan

b. Factors such as the increasing demand for oil and gas, expansion in renewable energy sector, and increased usage in paints and coatings are driving the India barite market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.