- Home

- »

- Organic Chemicals

- »

-

India Adipic Acid Market Size, Share, Industry Trend Report 2018-2025GVR Report cover

![India Adipic Acid Market Size, Share & Trends Report]()

India Adipic Acid Market (2018 - 2025) Size, Share & Trends Analysis Report By Application (Nylon 6,6, Polyurethane), By End-Use (Construction, Furniture & Interior, Automotive, Footwear), And Segment Forecasts

- Report ID: GVR-2-68038-110-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

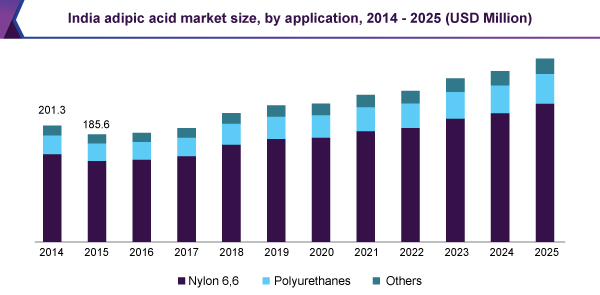

The India adipic acid market size was valued at USD 186.9 million in 2016. The market is expected to progress at a CAGR of 6.2% over the forecast period. Increasing demand for lightweight and durable products in the automotive, construction, and electronics industries is one of the key trends projected to stoke market growth.

Rapid expansion of the construction sector in India to accommodate the burgeoning population is anticipated to fuel consumption of adipic acid in building components such as exterior panels, insulation materials, and housing electronics. Robust growth of the automotive and packaging industries is another factor driving the market in this region.

The demand for adipic acid derivatives, such as nylon and polyurethane, is poised to increase in end-user applications such as automotive, construction, and footwear owing to their exceptional properties. This, in turn, is likely to boost the growth of the market over the forecast period. Flourishing end-use industries in the country are estimated to trigger the uptake of adipic acid. The chemical industry is one of the key contributors to the Indian economy and offers immense opportunities for the growth of the market.

Government initiatives to attract foreign investments in the chemical sector and strong support for R&D are among the various factors that are expected to drive the market further. The government has also permitted 100% FDI under the automatic route and licensed chemicals sector, except for a few hazardous chemicals.

Application Insights

Adipic acid is used as a monomer in the manufacturing of nylon 6,6. Approximately 70% to 80% of adipic acid manufactured is used to produce nylon 6,6. Other applications of adipic acid include polyurethanes and adipic acid esters, such as Di–2–Ethylhexyl Adipate (DOA) which are utilized as plasticizers for polyvinyl chloride (PVC) resins.

Growing environmental awareness has led to an increase in the number of consumers opting for lightweight vehicles with lower fuel consumption and emissions. A significant shift in consumer trends coupled with the presence of strict government rules on vehicular emissions is encouraging automobile manufacturers to replace metal components with nylon products in crankcases and oil containers. The factor will help the nylon 6,6 segment to maintain its dominance throughout the forecast period.

Polyurethane is projected to be the fastest-growing segment in terms of value as well as volume during the forecast period and accounts for a share of approximately 16.0% in the market volume by 2025. There is a high demand for innovative PU (rigid & flexible) foams in several end-use industries on account of their durability, versatility, low cost, and high functionality. PU is employed in construction & building, automotive, furniture & interiors, footwear, electronic appliances, and coatings, adhesives, sealants and elastomers (CASE) applications.

As sensitivity toward energy efficiency and energy-saving initiatives has been resonating across the country, PU is becoming increasingly popular as an insulation material. Indian Polyurethane Association (IPuA) is playing an instrumental role in promoting the need for insulation in buildings through the India Insulation Forum (IIF), which in turn is anticipated to supplement the growth of the segment.

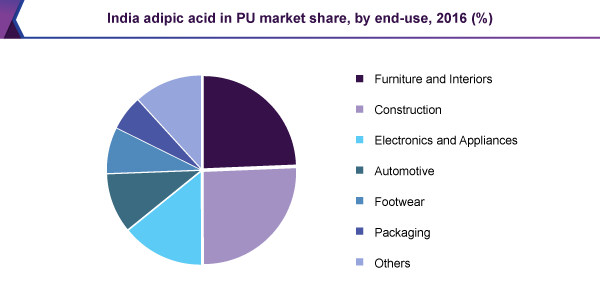

End-Use Insights

Furniture & interior is the most promising end user of polyurethane. In terms of revenue, the segment is poised to progress at a CAGR of 7.2% over the forecast period. Construction is likely to be the most significant end-use segment for PU throughout the forecast period.

Polyurethane foams are considered as excellent and safe filling materials for mattresses & seating cushions. They can also be easily altered to the required density and, thus, offer flexibility to furniture designers for developing innovative new products. Properties of flexible PU foams such as softness, durability, and shape retention make it a suitable choice for furniture & bedding, thereby resulting in growing demand in the furniture & interiors segment. Developing furniture industry is poised to offer massive growth opportunities to players in the India adipic acid market.

Although PU is lightweight, it is highly resistant to abrasion and thus, is used for producing hardwearing shoe soles. In the footwear sector, sports and trekking shoes & boots is the most significant application area of PU. It is also used in casual, fashionable, and formal shoes as well as good-quality safety shoes.

Flourishing electrical & electronics and automotive industries in the country are likely to boost the demand for polyurethane in the coming years. PU is also widely used in the building & construction industry as an insulating material. Favorable government initiatives and developing economic environment in the country are factors estimated to propel the demand for PU in the construction segment over the forecast period.

Non-foam PU is widely used in the electrical & electronics industry owing to its excellent dielectric properties, thermal conductivity, resistance to electrical insulation and thermal shock, mechanical strength, adhesion, and hardness. PU potting compounds provide consistent material performance to electrical & electronic components and protect them from application & environmental stress.

Key Companies & Market Share Insights

The market is highly fragmented in nature owing to the presence of a large number of importers and small-scale local manufacturers. Product pricing is expected to act as a critical factor for sustaining market competition. Rise in GDP and purchasing power is projected to generate tremendous growth potential for the domestic market over the forecast period. Major adipic acid manufacturers and distributors operating in the country include Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, and Ascend Performance Materials LLC.

India Adipic Acid Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 234.7 million

Revenue forecast in 2025

USD 314.4 million

Growth Rate

CAGR of 6.2% from 2017 to 2025

Base year for estimation

2016

Historical data

2014 - 2015

Forecast period

2017 - 2025

Quantitative units

Revenue in USD million and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

India

Country scope

India

Key companies profiled

Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, and Ascend Performance Materials LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented India adipic acid market report on the basis of application:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2014 - 2025)

-

Nylon 6,6

-

Polyurethanes

-

Furniture and Interiors

-

Construction

-

Electronics and Appliances

-

Automotive

-

Footwear

-

Packaging

-

-

Others

-

Frequently Asked Questions About This Report

b. The India adipic acid market size was estimated at USD 234.7 million in 2019 and is expected to reach USD 237.3 million in 2020.

b. The India adipic acid market is expected to grow at a compound annual growth rate of 6.2% from 2017 to 2025 to reach USD 314.4 million by 2025.

b. Construction industry dominated the India adipic acid market with a share of 25.6% in 2019. This is attributable to rapid expansion of the construction sector in India to accommodate burgeoning population .

b. Some key players operating in the India adipic acid market include Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, and Ascend Performance Materials LLC.

b. Key factors that are driving the market growth include increasing demand for lightweight and durable products in automotive, construction, and electronics industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.