- Home

- »

- Medical Devices

- »

-

In Vitro Diagnostics Contract Manufacturing Market Report, 2030GVR Report cover

![In Vitro Diagnostics Contract Manufacturing Market Size, Share & Trends Report]()

In Vitro Diagnostics Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Software & Services), By Service, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-462-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vitro Diagnostics Contract Manufacturing Market Summary

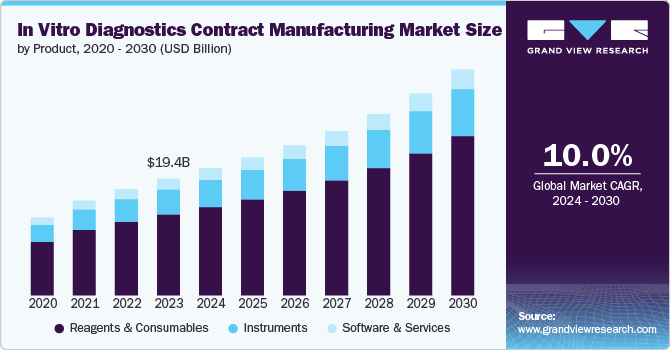

The global in vitro diagnostics contract manufacturing market size was estimated at USD 21.1 billion in 2024 and is projected to reach USD 37.45 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The global market is projected to expand rapidly due to developments in the healthcare industry.

Key Market Trends & Insights

- North America in vitro diagnostics contract manufacturing market dominated the global market in 2024 with the largest share of 41.83%.

- The U.S. in vitro diagnostics contract manufacturing market accounts for the largest share of North America.

- Based on product, the reagents & consumables segment accounted for the largest revenue share of 69.41%.

- Based on service, the manufacturing services segment accounted for the largest market share in 2024.

- Based on technology, the immunoassays segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.1 Billion

- 2030 Projected Market Size: USD 37.45 Billion

- CAGR (2025-2030): 10.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing demand for fast and accurate diagnostics testing has increased the demand for in vitro diagnostics to improve the speed and quality of diagnoses, detection, and prevention of patient care. In addition, market growth is driven by the increasing burden of chronic diseases, rising demand for personalized medicine, and increasing regulatory scrutiny.

For instance, in July 2023, the U.S. FDA announced a renewed attempt to regulate laboratory-developed tests as medical devices. Later, in September 2023, the U.S. FDA proposed that LDT manufacturers comply with medical device statutes and regulations. The FDA plans to impose this regulation in phases from 2024 to 2028. In addition, during the COVID-19 pandemic, the market for IVD contract manufacturing witnessed a sudden spike in demand for contract manufacturing services, as IVDs are widely used to diagnose, screen, and assess COVID-19 disease. In Vitro Diagnostics (IVD) have also supported reduced hospital stays, resulting in healthier populations, reduced costs, and economic growth, contributing to market growth.

Technological advancements are significantly driving market growth. Several innovations, such as microfluidics, lab-on-a-chip technology, and advanced molecular diagnostics, enhanced the accuracy, speed, and efficiency of IVD products. Automation and integration of AI and machine learning in diagnostic processes streamline workflows and assist high-throughput testing. Moreover, the development of next-generation sequencing (NGS) and point-of-care (POC) devices is expanding the application of IVD across several medical fields, from infectious diseases to oncology. These advancements support outsourcing to specialized contract manufacturers, ensuring access to state-of-the-art capabilities and cost-effective production.

The market for IVD contract manufacturing consists of a large number of key players across the globe, including Sanmina Corporation, Jabil Inc., TE Connectivity, Savyon Diagnostics, Celestica Inc., West Pharmaceutical Services, Inc., and Thermo Fisher Scientific, among several others. The growing demand for IVD products among medical device companies is expected to increase the number of CDMOs/CMOs partnerships and acquisitions in the coming years, thus boosting the global market for in vitro diagnostics contract manufacturing. For instance, in January 2023, Meridian Bioscience, Inc., SD Biosensor, Inc., and SJL Partners LLC announced the acquisition of Meridian Bioscience. Meridian Bioscience will continue to operate as an independent entity, under new ownership, headquartered in the U.S. Such initiatives are anticipated to drive market growth over the estimated period.

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

In vitro diagnostics (IVD) contract manufacturing has marked a high degree of innovation. Key innovations such as Point-of-care (POC) and molecular diagnostics are accelerating demand for specialized manufacturing capabilities, while 3D printing and microfluidics are improving the design and production of diagnostic devices. Thus, increasing requirements for technologically advanced diagnostic testing are expected to drive the need for new innovative products.

Regulations in the In vitro diagnostics market, such as FDA and CE standards, impose stringent requirements on product safety, quality, and efficacy, thereby positively influencing contract manufacturers to invest in compliance infrastructure, including advanced quality control systems, documentation processes, and regulatory expertise. As regulations become more stringent, several manufacturers increasingly outsource manufacturing activities to CMOs and CDMOs to enhance adherence and accelerate product approval, bolstering market growth.

The level of M&A activity in the market is moderate as companies seek to expand their technological capabilities, scale, and global footprint. Furthermore, larger firms acquire smaller, specialized manufacturers to enhance service portfolios. These strategic acquisitions majorly focus on expanding capabilities in molecular diagnostics, point-of-care testing, and personalized medicine solutions and gain a competitive edge in the market.

Market participants in the IVD contract manufacturing sector are expanding services through several key strategies. These participants actively integrate advanced technologies such as automation and artificial intelligence (AI) to boost efficiency and product quality. The market focuses on customization and flexibility, offering custom solutions across development, production, and packaging.

The increasing expenditure in the medical device industry, the existence of advanced contract manufacturing market players, and the rising requirement for diverse diagnostics testing fuel the market growth. Moreover, participants are involved in strategic partnerships to broaden global reach, tap into emerging markets, and enhance operational capabilities.

Product Insights

Based on product, the market includes instruments, reagents & consumables, software & services. In 2024, the reagents & consumables segment accounted for the largest revenue share of 69.41%. The segment growth can be attributed to the rising demand for numerous reagents & consumables, growing demand for personalized medicine, rising prevalence of diseases, increasing R&D investments, and regulatory compliance and quality control. Furthermore, the continuous demand for reagents & consumables to provide reliable and standardized techniques for identifying the presence or absence of live microorganisms in pharmaceutical products is expected to support global market growth.

The instruments segment is anticipated to witness significant growth during the forecast period. The segment is driven by growing outsourcing services, technological advancements, and a growing focus on quality instrument services for product safety. These instruments offer full-service capability, enhance precision, and support manufacturers in meeting regulatory compliance.

Service Insights

Based on service, the market is segmented into manufacturing services, assay development services, and other services. The manufacturing services segment accounted for the largest market share in 2024. The growing demand for pharmaceutical products, high prevalence of chronic diseases, increasing clinical trials, cost-effective manufacturing services, and the availability of industry experts are key factors anticipated to drive market growth in the coming years.

The assay development services segment is anticipated to show lucrative growth during the forecast period. Stringent quality control processes and growing requirements for accuracy and sensitive evaluation methods drive segmental revenue growth. Furthermore, ongoing technological advancements such as high-throughput screening and automation to enhance the efficiency and accuracy of assay development drive segment growth. Moreover, integrating digital technologies and artificial intelligence (AI) is further transforming this segment by streamlining the development process, reducing time to market, and improving assay performance.

Technology Insights

Based on technology, the market is segmented into immunoassays, clinical chemistry, molecular diagnostics, hematology, microbiology, coagulation, and others. The immunoassays segment dominated the market with the largest revenue share in 2024. This can be attributed to the growing demand for point-of-care immunoassays, the development of novel immunoassay technologies, and enhanced sensitivity for rapid & accurate detection of pathogens. In addition, the growing trend for outsourcing manufacturing of immunoassay technologies among manufacturers to focus on R&D and other core competencies is accelerating segmental growth potential.

The clinical chemistry segment is anticipated to witness considerable revenue growth over the forecast period. The segment growth is driven by increasing requirements for product safety and growing demand for testing services to assess the concentration of certain substances within samples for routine quality tests and control.

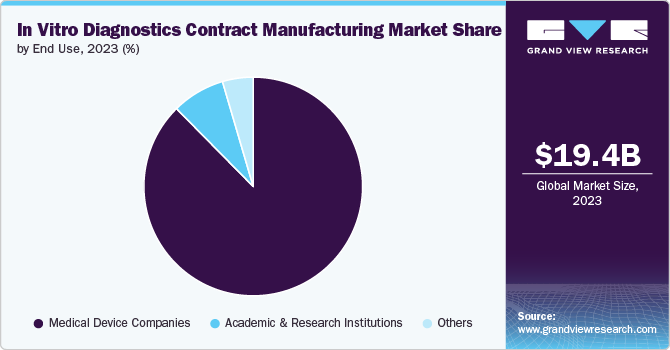

End-use Insights

In terms of end use, the market is segmented into medical device companies, academic & research institutions, and others. The medical device companies segment dominated the market with the largest revenue share in 2024. This can be attributed to the increasing introduction of new medical devices in the past two decades.

In addition, the medical device market has been experiencing growth due to technological advancements and increased healthcare expenditure across the globe. The growing complexities of IVD equipment require specialized expertise and facilities. Outsourcing to specialized medical device manufacturing for accurate and reliable results drives overall market growth.

Regional Insights

North America in vitro diagnostics contract manufacturing market dominated the global market in 2024 with the largest share of 41.83%. The presence of established CDMOs specializing in In Vitro Diagnostics contract manufacturing, such as Jabil Inc., Sanmina Corporation, and TE Connectivity, among others in the market, accelerates market progression. In addition, key CDMOs and CMOs offering IVD production services and multinational pharmaceutical & biopharmaceutical companies making significant investments in research have contributed to market growth in North America. Similarly, increasing demand for efficient healthcare in the region is expected to propel North America's market growth.

The U.S. In Vitro Diagnostics Contract Manufacturing Market Trends

The U.S. in vitro diagnostics contract manufacturing market accounts for the largest share of North America owing to established market players, increasing demand for molecular diagnostics, growing focus on the accuracy and efficiency of IVD, rising geriatric population, and increasing prevalence of chronic diseases. The U.S. has increased the number of market players offering IVD contract manufacturing to various end users to improve efficiency, accuracy, and throughput, further driving the market growth.

Canada in vitro diagnostics contract manufacturing market is driven by an increased burden of diseases, and the well-established medical device sector is likely to leverage the pipeline of promising treatments in this country. According to the International Trade Agency (ITA), the medical device market in Canada accounted for USD 6.5 billion in 2022, which is expected to grow at a rate of 2.1 % by 2026. The ITA also states that the demand for medical devices is increasing in the country owing to the growing burden of chronic diseases. This is expected to improve research on new devices in the country, thus supporting market growth. Such initiatives are expected to drive market growth over the estimated period.

Europe In Vitro Diagnostics (IVD) Contract Manufacturing Market Trends

The Europe in vitro diagnostics contract manufacturing market is driven by advanced technologies and well-established healthcare infrastructure; demand for outsourcing services and emerging research and development activities are further resulting in improved healthcare facilities and patient care, stimulating market growth. In addition, there are a large number of CDMOs and CDMOs specializing in IVD innovation in various European countries such as the UK, Germany, and France, which is expected to contribute to market growth in this region.

Germany accounts for the largest European market share due to the country's increasing demand for diagnostic tests and the continuous medical/pharmaceutical industry growth. In addition, the demand for IVD development in CMOs has significantly changed the pharmaceutical and medical device industry over the past few years. As a result, many companies have shifted their focus towards developing and producing IVD with the support of CMOs.

The in vitro diagnostics contract manufacturing market in the UK is driven by the presence of various multinational CDMOs. Significant R&D spending, healthcare research, and the rapidly evolving pharmaceutical/medical device industry have fueled the demand for UK in vitro diagnostics (IVD) contract manufacturing, which is anticipated to fuel the market. Such factors are expected to drive market growth.

Asia Pacific In Vitro Diagnostics (IVD) Contract Manufacturing Market Trends

The in vitro diagnostics contract manufacturing market in Asia Pacific is expected to witness the fastest CAGR over the forecast period. The increasing burden of infectious diseases, the growing number of medical device research organizations, and the evolving clinical trial scenario drive the market in Asia Pacific. Moreover, improvements in the regulatory framework and higher cost savings are a few factors supporting market growth.

Japan in vitro diagnostics contract manufacturing market is anticipated to be driven by diverse benefits associated with medical device outsourcing, such as optimizing R&D activities for higher productivity, regulatory compliance, cost savings, and easy market entry.

The in vitro diagnostics (IVD) contract manufacturing market in China is driven by the strong presence of local players, low operational cost, technological advancement, and growing product development in the field of IVD, such as immune diagnosis, biochemical diagnosis, molecular diagnosis, and the availability of quality services for diagnosis are further boosting the growth of the China market. Also, growing R&D expenditures by key players for the new products’ development have led to a rise in outsourcing trends, further fueling market growth.

India in vitro diagnostics contract manufacturing market is driven by key players offering a comprehensive range of medical equipment, continuous technological developments, and an increasing burden of chronic diseases. These factors have led to the rising outsourcing of IVD products. Moreover, the growing medical research and developing pharmaceuticals are further expected to drive market growth in India.

Key In Vitro Diagnostics Contract Manufacturing Company Insights

The key market players are undertaking several strategic initiatives, such as acquisitions, partnerships, expansion, agreements, collaborations, etc., to increase their market presence and gain a competitive edge, driving market growth. For instance, in November 2023, Newland EMEA launched an in vitro diagnostics product line for the healthcare industry.

Key In Vitro Diagnostics Contract Manufacturing Companies:

The following are the leading companies in the in vitro diagnostics contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Jabil Inc.

- Sanmina Corporation

- TE Connectivity

- Celestica Inc.

- Savyon Diagnostics

- West Pharmaceutical Services, Inc.

- Thermo Fisher Scientific

- KMC Systems

- Cenogenics Corporation

- Novo Biomedical

- Cone Bioproducts

- Invetech

- AVIOQ Inc.

- Meridian Bioscience Inc.

- Nemera

Recent Developments

-

In October 2023, Sysmex Corporation and Fujirebio Holdings, Inc. announced a collaboration to enhance research and development, clinical development, production, and marketing activities in immunoassay.

-

In February 2023, Siemens Healthineers and Unilabs announced an agreement of USD 221.69 million. In addition, Unilabs has invested in Siemens Healthineers’s technology, and further, it will acquire 400+ laboratory analyzers to improve its laboratory infrastructure and offer unparalleled customer service

In Vitro Diagnostics Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.89 billion

Revenue forecast in 2030

USD 37.45 billion

Growth rate

CAGR of 10.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, technology, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Jabil Inc.; Sanmina Corporation; TE Connectivity; Celestica Inc.; Savyon Diagnostics; West Pharmaceutical Services, Inc.; Thermo Fisher Scientific; KMC Systems; Cenogenics Corporation; Novo Biomedical; Cone Bioproducts; Invetech; AVIOQ Inc.; Meridian Bioscience Inc.; Nemera

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global In Vitro Diagnostics Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global in vitro diagnostics contract manufacturing market report based on product, service, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Consumables

-

Software & Services

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing Services

-

Assay Development Services

-

Other Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Clinical Chemistry

-

Molecular Diagnostics

-

Hematology

-

Microbiology

-

Coagulation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Academic & Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in vitro diagnostics contract manufacturing market size was estimated at USD 21.10 billion in 2024 and is expected to reach USD 22.89 billion in 2025.

b. The global in vitro diagnostics contract manufacturing market is expected to grow at a compound annual growth rate of 10.35% from 2025 to 2030 to reach USD 37.45 billion by 2030.

b. North America dominated the IVD contract manufacturing market with a share of 41.83% in 2024. This is attributable to rising demand for advanced diagnostics coupled with the increasing prevalence of chronic diseases such as diabetes and cancer. Additionally, technological advancements in molecular diagnostics, particularly in point-of-care (POC) testing and personalized medicine are driving regional market growth.

b. Some key players operating in the IVD contract manufacturing market include Jabil Inc., Sanmina Corporation, TE Connectivity, Celestica Inc., Savyon Diagnostics, West Pharmaceutical Services, Inc., Thermo Fisher Scientific, KMC Systems, Cenogenics Corporation, Novo Biomedical, Cone Bioproducts, Invetech, AVIOQ Inc., Meridian Bioscience Inc., Nemera.

b. Key factors that are driving the market growth include a growing focus on early disease diagnosis, increasing prevalence rate of chronic ailments, ongoing development of innovative therapeutics, rising preference for personalized medicine, changing regulatory scenario, increasing outsourcing trends, and growing R&D spending among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.