- Home

- »

- Medical Devices

- »

-

Implantable Cardiac Rhythm Management Device Market Report, 2030GVR Report cover

![Implantable Cardiac Rhythm Management Device Market Size, Share & Trends Report]()

Implantable Cardiac Rhythm Management Device Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Pacemaker, ICDs, CRT), By End-use (Hospitals, Specialty Cardiac Centers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-882-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

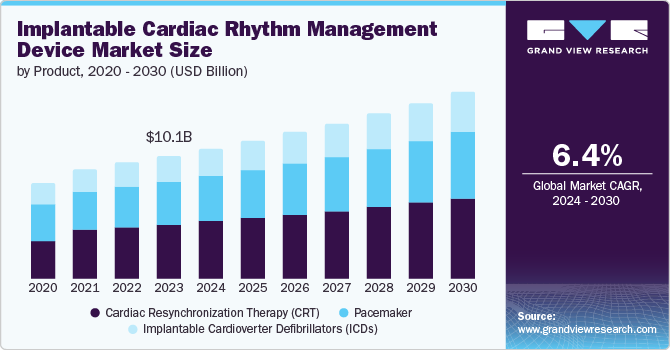

The global implantable cardiac rhythm management device market size was estimated at USD 10.13 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The increasing incidence of arrhythmia disorders is a major factor boosting market growth. In December 2023, according to the Heart Rhythm Society article published, atrial fibrillation (AFib) is the most widespread form of cardiac arrhythmia, affecting nearly 40 million people globally and approximately 6 million individuals in the U.S. alone. This condition has a considerable impact on public health globally.

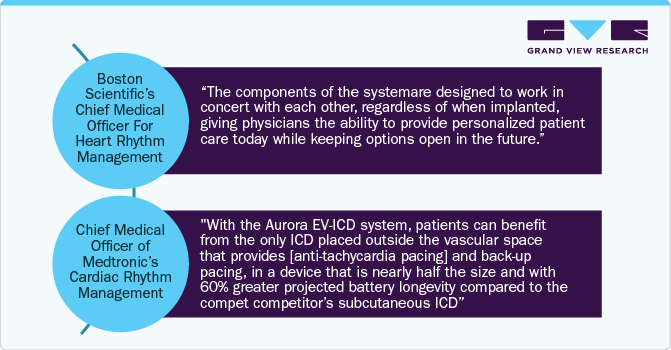

Technological advancements in device functionality drive the market's growthby enhancing treatment efficacy and patient outcomes. According to the Heart Rhythm Society article published in May 2024, recent studies on ant-tachycardia pacing (ATP) in transvenous implantable cardioverter defibrillators (TV-ICDs) highlight significant reductions in the risk of all-cause shocks, highlighting ATP's role in improving primary prevention outcomes. Additionally, assessments of integrated systems, such as the Boston Scientific modular cardiac rhythm management mCRM System, show low complication rates and excellent communication success between components. These systems provide versatile solutions for patients requiring both defibrillation and pacing functionalities. These advancements validate the effectiveness of new technologies and the way for broader adoption and improved cardiac care globally.

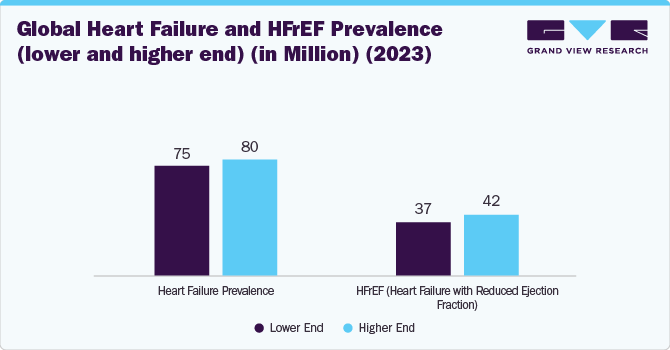

Rising Heart failure (HF) cases fuel the growth of the market. In 2023, around 75 million to 80 million patients globally suffered from HF, of which nearly 50% suffered from HFrEF (high variation in ejection rates was observed across the globe. This demographic shift highlights the critical role of early detection and effective management strategies in mitigating HF severity and reducing hospitalizations.

Favorable reimbursement policies, such as the U.S. medicare system, are among the major factors driving the implantable cardiac rhythm management device market. For instance, In March 2024, Medtronic and Abbott offer comprehensive coding guides for implantable cardiac rhythm management device (ICRMD) management services, detailing the specific current procedural terminology (CPT) codes and healthcare common procedure coding system (HCPCS) codes necessary for billing. These guides help ensure that healthcare providers receive accurate reimbursement for their services, in compliance with CMS (Centers for Medicare & Medicaid Services) requirements.

Increased strategic initiatives by the key market players are boosting the market's growth. For instance, in November 2023, Abbott introduced the AVEIR DR leadless pacemaker system, the world's first dual chamber leadless pacing solution. It caters to patients with irregular or slow heart rhythms, providing a minimally invasive alternative to conventional pacemaker implantation procedures. This innovation represents a significant advancement in cardiac care by offering advanced pacing technology without the need for traditional leads or invasive surgeries.

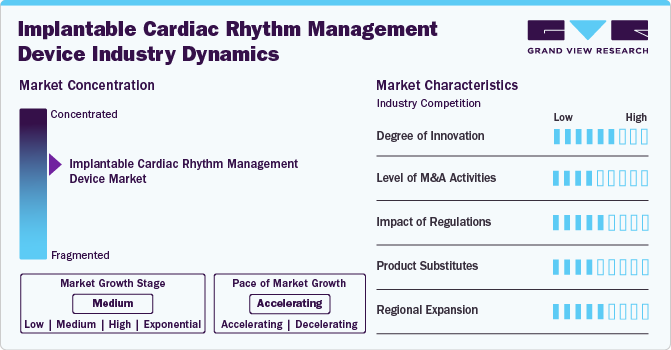

Market Concentration & Characteristics

The market is witnessing a high degree of innovation, with companies introducing devices with remote monitoring capabilities, enhancing patient care and management.

Several market players, such as Abbott, Boston Scientific Corporation, and Medtronic, are involved in mergers and acquisitions. Through M&A activity, these companies employ key strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive cardiovascular interventions.

Regulations in the market have a significant impact, with changes necessitating manufacturers adjusting their products or processes accordingly. Moreover, regulations can also influence the competitive landscape in the market. For instance, China’s volume-based procurement (VBP) policy has significantly impacted the implantable cardiac rhythm management devices (ICRMDs) market by reducing prices and increasing competition among manufacturers. This policy has made ICRMDs more affordable, enhancing patient access and potentially increasing adoption rates. However, it also pressures profit margins and fosters intense competition from local Chinese manufacturers, which can drive innovation and challenge established market players.

Market players are expanding regionally by entering new geographical markets, establishing partnerships with local distributors, and adapting products to meet specific regional healthcare needs.

Product Insights

The cardiac resynchronization therapy (CRT) segment held the largest share of over 44.0% in 2023 due to ongoing product advancements, growing initiatives by key companies, and increasing product adoption. Moreover, in February 2024, MicroPort introduced the GALI SonR CRT-D and NAVIGO 4LV left ventricular pacing leads in Japan. This introduction substantially enhances MicroPort CRM's cardiac rhythm management portfolio in the Japanese market, delivering advanced solutions to enhance patient treatment options. Moreover, in July 2023, BIOTRONIK revealed FDA approval for its Amvia Edge pacemakers and CRT Pacemakers (CRT-P). Amvia Edge, the smallest MR conditional single-chamber pacemaker on the market, offers a range of patient-centric clinical solutions and automated workflow improvements. This approval highlights BIOTRONIK's commitment to advancing cardiac care with innovative, compact devices that enhance patient safety and clinical efficiency.

The implantable cardioverter defibrillators (ICD) segment is expected to grow at the fastest CAGR during the forecast period due to ongoing product advancements, growing initiatives by key companies, the rapid increase in the elderly population, and the rise in the incidence of sudden cardiac arrests (SCAs). Moreover, the use of ICDs in patients with nonischemic cardiomyopathy significantly enhances survival rates and reduces mortality risk, presenting lucrative opportunities for manufacturers. For instance, In October 2023, MicroPort CRM launched the INVICTA defibrillation lead and ULYS Implantable Cardioverter Defibrillator (ICD) in Japan. These devices are designed to be MRI conditional at 1.5T and 3T when implanted together as a system, offering advanced capabilities in cardiac care within the Japanese market. Moreover, in October 2023, Medtronic was given FDA approval for its Epsila EV SureScan defibrillation lead and Aurora EV-ICD MRI SureScan system. These devices are intended to manage severe heart rhythm disorders that can cause sudden cardiac arrest (SCA). The Aurora EV-ICD stands out for its unique combination of the life-saving capabilities of conventional ICDs with MRI compatibility, representing a significant breakthrough in cardiac care technology.

End-use Insights

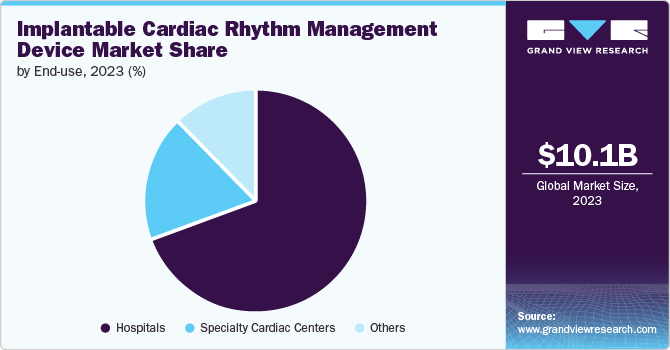

The hospitals segment held the largest share of 68.9% in 2023. Hospitals are crucial centers for implementing and evaluating new technologies, such as the dual-chamber leadless pacemaker system, which has been a significant focus of R&D efforts. For instance, in March 2022, the Cleveland Clinic successfully implanted the AVEIR leadless pacemaker system in a U.S. patient as part of a global clinical trial. Such initiatives are expected to propel segment growth over the forecast period. This milestone showcases the advancements in implantable cardiac rhythm management and emphasizes the hospital’s role in driving innovation & improving patient care through the adoption of new technologies. Additionally, hospitals play a key role in adopting and assessing innovations like implantable cardiac rhythm management devices (ICRMDs). Integrating these advanced devices into clinical practice, hospitals can directly observe their effectiveness, gather valuable data, and refine their use to enhance patient outcomes. This central role in technology evaluation helps ensure that new medical advancements are safe and effective before broader implementation.

The specialty cardiac centers segment is expected to grow at the fastest CAGR during the forecast period. Specialty cardiac centers are equipped with technologically advanced facilities and specifically designed for advanced cardiac care. For instance, a specialty cardiac center with state-of-the-art electrophysiology labs can adopt the newest ICRMDs to provide highly accurate and effective treatment for patients with complex arrhythmias. This can lead to significantly improved patient outcomes, such as reduced incidence of sudden cardiac arrest and better quality of life. Moreover, the use of advanced remote monitoring systems integrated into ICRMDs at specialty cardiac centers. These systems allow continuous monitoring of patient's cardiac rhythms and early detection of any irregularities, enabling timely interventions and reducing the risk of severe cardiac events.

Regional Insights

North America dominated the ICRMD market with a share of 47.6% in 2023, owing to the favorable reimbursement policies, high prevalence of cardiovascular diseases, including arrhythmias, and regulatory approvals and product launches, which drive the demand for implantable cardiac rhythm management devices (CRMDs) in North America. According to the Verywell health article published in November 2022, atrial fibrillation is a prevalent condition affecting a significant segment of the population, with estimates indicating it impacts between 2% to 9% of individuals in the U.S. This cardiac disorder's significant links to serious health complications like strokes and heart failure are driving market growth by emphasizing the urgent need for advanced treatments and technologies. As healthcare systems strive to address these challenges effectively, there is increasing investment and innovation in cardiac care solutions, fueling growth in the market for ICRMDs medical devices and therapies.

U.S. Implantable Cardiac Rhythm Management Device Market Trends

The U.S. accounted for the largest share of the implantable cardiac rhythm management device market in the North American region. The key factors for the market's growth are the increasing prevalence of heart disease and related conditions and the FDA's regulatory review process facilitating innovation and advancements in implantable CRMD technology. According to the Healthline media article published in May 2024, in the U.S., one in every four deaths is caused by cardiac disorders. As of January 2024, about 877,500 people die each year due to heart disease. Furthermore, heart disease is one of the leading causes of death in the country. Thus, the demand for implantable CRMD has significantly increased to help reduce mortality due to cardiac conditions, likely boosting market growth.

Europe Implantable Cardiac Rhythm Management Device Market Trends

The implantable cardiac rhythm management device market in Europe held the second-largest revenue market share in 2023. This can be attributed to the increasing prevalence of cardiac disorders, such as atrial fibrillation.Additionally, technological advancements in these devices, including enhanced battery life and remote monitoring capabilities, have improved patient outcomes and expanded their adoption.

The Germany implantable cardiac rhythm management device market dominated, with a revenue share of 24.7% in 2023 in Europe. The factors contributing to this large share are the presence of key market players, high awareness and adoption of heart failure treatment, and advanced healthcare infrastructure. For instance, BIOTRONIK SE & Co. KG, headquartered in Germany, is one of the leading companies in the global implantable cardiac rhythm management device market.

Implantable cardiac rhythm management device market in the UK held the second-largest market share in Europe. The rise in cardiovascular disease-related deaths highlights the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. In January 2024, according to a Guardian News & Media Limited article published, the premature death rate from cardiovascular disease in the UK increased to 80 per 100,000 individuals in 2022.

France's implantable cardiac rhythm management device market is anticipated to witness a significant CAGR of 6.2% during the forecast period. The healthcare system offers relatively good coverage for CRMs, incentivizing hospitals and healthcare providers to adopt new & innovative devices. This is anticipated to lead to increased demand and market growth. Moreover, the new product launches and approvals are expected to support market growth in the forecast years. For instance, in January 2024, MicroPort Scientific Corporation received the CE mark approvals for TALENTIA and ENERGYA.

Asia Pacific Implantable Cardiac Rhythm Management Device Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period.Improved awareness about cardiac health and better diagnostic capabilities are leading to early detection and treatment of cardiac conditions, driving the adoption of ICRMDs.Another major factor driving the market growth is the rising elderly population in the Asia Pacific region. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, about 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population.

Japan implantable cardiac rhythm management device market held the largest market share in the Asia Pacific region. The increasing geriatric population, products launched by key manufacturers, and advancements in ICRMDs fuel the market growth. For instance, in January 2022, Medtronic obtained approval from Japan’s Ministry of Health, Labor, and Welfare to sell and receive reimbursement for the Micra AV Transcatheter Pacing System (TPS). The company launched the product in Japan, marking a significant milestone in bringing advanced cardiac pacing technology to Japanese patients.

Implantable cardiac rhythm management device market in China accounted for the second-largest share of the implantable cardiac rhythm management device market in the Asia Pacific region in 2023 due to the launch of new products and collaborations between industry players and healthcare providers to increase the adoption of advanced medical technologies. For instance, in December 2021, LifeTech Scientific Corporation, a Chinese medical device company, expanded its partnerships with Medtronic to advance strategic cooperation on the HeartTone domestic pacemaker initiative and initiate collaboration on domestically produced MRI-compatible pacemakers.

India implantable cardiac rhythm management device market is experiencing significant growth, driven by several key factors. Growing awareness of advanced cardiac care options, increasing incidence of cardiovascular disorders, expanding healthcare infrastructure. For instance, in October 2023, doctors at Lucknow, India hospital successfully implanted a leadless pacemaker in a minimally invasive procedure in a 65-year-old man. This achievement highlights the growing expertise and adoption of advanced cardiac care techniques in India.

Latin America Implantable Cardiac Rhythm Management Device Market Trends

The Latin American implantable cardiac rhythm management device market is growing due to several factors. The growing awareness about cardiovascular-related mortality and increasing regulatory frameworks and support fuel the market's growth.

Brazil implantable cardiac rhythm management device market is expanding due to several distinct growth drivers. Rising healthcare expenditures and government initiatives to improve cardiac care infrastructure drive the market. Moreover, the number of Atrial fibrillation cases has increased, fueling the market growth. According to the Elsevier B.V. article published in October 2023, Brazil's atrial fibrillation (AF) affects around 1.5 million people, which fuels the market growth.

Middle East & Africa Implantable Cardiac Rhythm Management Device Market Trends

The MEA implantable cardiac rhythm management device market is expected to grow lucratively due to the rising prevalence of CVDs and the increasing adoption of advanced medical technologies in the region.

South Africa implantable cardiac rhythm management device market is growing due to rising healthcare spending, and the increasing number of hospitals in the country contributes to the market expansion. For instance, in December 2021, the Netcare Property Holdings Joint Venture established a 400-bed multispecialty hospital in South Africa. Moreover,strategic collaborations between international medical device manufacturers and local healthcare providers aim to enhance treatment outcomes and expand access to advanced cardiac care solutions.

Key Implantable Cardiac Rhythm Management Device Company Insights

Some of the key players operating in the industry include Medtronic, Abbott, and Boston Scientific Corporation. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing patient preferences. For instance, Nihon Kohden Corporation and Microport Scientific Corporation are some of the emerging players in implantable cardiac rhythm management devices.

Key Implantable Cardiac Rhythm Management Device Companies:

The following are the leading companies in the implantable cardiac rhythm management device market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- Biotronik

- Stryker

- Schiller AG

- Nihon Kohden Corporation

- Microport Scientific Corporation

Recent Developments

-

In June 2024, Abbott has revealed that its AVEIR dual chamber (DR) leadless pacemaker system has received CE Mark approval in Europe. This achievement is notable because the AVEIR is now recognized as the world's inaugural dual chamber leadless pacemaker tailored for addressing abnormal or slow heart rhythms in patients.

-

In February 2024, Microport Scientific Corporation has launched its CRT-D defibrillation device and GALI SonR CRT, along with the NAVIGO 4LV left ventricular pacing leads, in Japan.

-

In January 2024, Medtronic received the CE (Conformité Européenne) Mark for its new Micra VR2 and Micra AV2 pacemakers. These next-generation, miniature, leadless pacemakers offer extended battery life and simpler programming than their predecessors. They continue to deliver the advantages of leadless pacing, including fewer complications than traditional pacemakers.

-

In June 2023, Philips partnered with BIOTRONIK to enhance out-of-hospital cardiology lab care. This partnership expands Philips' SymphonySuite with BIOTRONIK’s cardiac rhythm management portfolio, aiming to broaden access to innovative care solutions.

-

In February 2023, Abbott entered into a definitive agreement to acquire Cardiovascular Systems, Inc., a medical device company.

Implantable Cardiac Rhythm Management Device Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.73 billion

Revenue forecast in 2030

USD 15.53 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Abbott; Boston Scientific Corporation; Koninklijke Philips N.V.; Zoll Medical Corporation; Biotronik; Stryker; Schiller AG; Nihon Kohden Corporation; Microport Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Implantable Cardiac Rhythm Management Device Market Report Segmentation

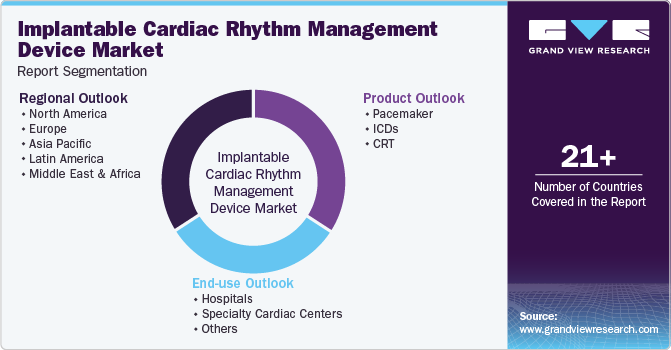

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global implantable cardiac rhythm management device market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pacemaker

-

Conventional Pacemakers

-

Leadless Pacemaker

-

-

ICDs

-

Single Chamber ICDs

-

Dual Chamber ICDs

-

-

CRT

-

CRT-Defibrillator

-

CRT-Pacemaker

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Cardiac Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global implantable cardiac rhythm management device market size was estimated at USD 10.13 billion in 2023 and is expected to reach USD 10.73 billion in 2024.

b. The global implantable cardiac rhythm management device market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 15.53 billion by 2030.

b. North America dominated the implantable cardiac rhythm management device market with a share of 47.61% in 2023. This is attributable to factors such as technological advancements, miniaturization, leadless or biocompatible materials, and government regulatory approvals.

b. Some key players operating in the implantable CRM devices market include Medtronic, Abbott, Physio-Control Inc., Schiller, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, and Biotronik.

b. Key factors that are driving the implantable cardiac rhythm management device market growth include the increasing prevalence of cardiac disorders and a growing geriatric population base.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.