- Home

- »

- Biotechnology

- »

-

Immunotoxins Market Size And Share, Industry Report, 2030GVR Report cover

![Immunotoxins Market Size, Share & Trends Report]()

Immunotoxins Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pseudomonas Exotoxin), By Application (Therapy Development), By End-use (Pharmaceutical & Biotechnology Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-464-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immunotoxins Market Size & Trends

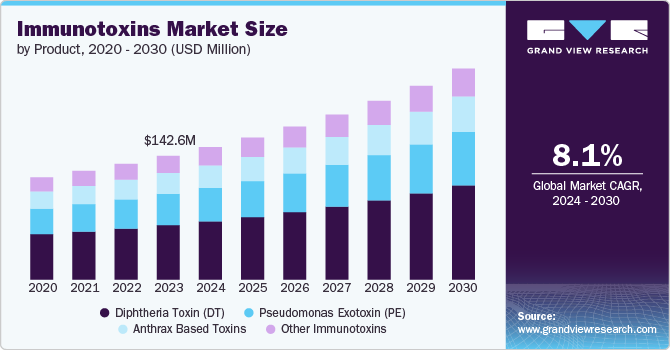

The global immunotoxins market was valued at USD 152.6 million in 2024 and is projected to grow at a CAGR of 8.23% from 2025 to 2030. The rising prevalence of chronic diseases such as cancer and technological advancements are the factors driving the market growth. Cancer remains one of the leading causes of death worldwide. Conventional therapeutic approaches often present challenges due to their limited specificity, potentially resulting in significant side effects and harm to normal tissues. Targeted cancer therapy can enhance the effectiveness of anti-cancer drugs and reduce undesired side effects. Specifically targeting cancer cells with cytolethal bacterial toxins has shown promise for eradicating cancer cells.

Bacterial toxins have shown potential for cancer treatment due to their ability to specifically target cancer cells and their cytotoxic properties. Toxins such as Pseudomonas exotoxin, diphtheria toxin, and plant-derived ricin can be targeted to specific sites on the surface of cancer cells and can effectively kill them. By combining these toxins with cell-binding proteins like monoclonal antibodies or growth factors, they can selectively bind to and eliminate cancer cells.

Bacteria-derived toxins possess potent anticancer properties by affecting cell cycle progression, apoptotic pathways, and tumorigenesis processes. For example, toxins like Exotoxin A from Pseudomonas aeruginosa can induce apoptosis in cancer cells by various mechanisms such as inactivating PARP, inducing caspase-dependent apoptosis, and disrupting cellular functions.

Moreover, the development of PE-based immunotoxins has shown promise in treating various malignancies, including prostate and hematological cancers like hairy cell leukemia. Clinical trials have demonstrated significant efficacy, with some immunotoxins achieving complete remission in patients resistant to standard therapies. For instance, moxetumomab pasudotox (HA22), derived from PE38, has gained FDA approval for treating relapsed or refractory hairy cell leukemia due to its high response rates and manageable safety profile. Ongoing research continues to explore the potential of PE-derived immunotoxins in targeting other tumor types and improving therapeutic outcomes through enhanced delivery mechanisms.

The COVID-19 pandemic had a significant impact on the market, causing disruptions in several aspects of the market including clinical trial disruptions, supply chain challenges, and stringent regulations. The pandemic led to a shift in priorities and resources towards combating the virus, but it also underscored the importance of ongoing cancer research efforts. The pandemic impacted the development of immunotoxins, leading to clinical trial delays, reducing funding, and shifting resources to COVID-19 research.

Market Concentration & Characteristics

The degree of innovation in the immunotoxin industry is significant, with new technologies and processes constantly being developed to improve efficiency and effectiveness. Researchers are developing novel recombinant immunotoxins against different types of cancers that are more efficient than the existing drugs. Furthermore, the use of immunotoxins has gained traction for innovative approaches to drug discovery in medicine and therapeutics.

The market is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market.

Regulatory requirements governing the use and production of immunotoxins can pose challenges for market players. Compliance with regulations related to biosafety, immunotherapy, and other aspects can increase operational costs and create barriers to entry for new entrants in the market.

The immunotoxins industry is anticipated to experience growth due to expanding applications, advancements in biotechnology and production processes, and increased R&D investments. However, currently, the industry also observes fewer product launches and the commercial availability of immunotoxin products in the market, mainly due to possible toxicity prophylaxis and less demand for therapy.

The industry is experiencing moderate regional expansion, driven by an increasing customer base for immunotherapies. Companies are partnering with distributors to extend their regional presence.

Product Insights

Diphtheria Toxin (DT) segment dominated the product segment in the market with a market share of 43.91% in 2024. Diphtheria toxin has been used in cancer treatment as part of targeted therapies designed to attack cancer cells. These treatments work by attaching the toxin to specific proteins or receptors that are found in high numbers on the surface of cancer cells, such as the transferrin or interleukin-13 receptors. Once the toxin enters the cancer cell, it triggers the cell to die. By combining an antibody or other targeting molecule with diphtheria toxin, researchers have created fusion proteins that have been effective in killing brain cancer cells, especially those that don’t respond well to standard treatments like radiation or chemotherapy. Thus, anticipated to propel the growth of the segment over the forecast period.

Pseudomonas Exotoxin is anticipated to grow at a significant CAGR of 8.21% over the forecast period. The growth is driven by its expanding use in targeted cancer therapies. This toxin is engineered to specifically attack cancer cells by binding to overexpressed receptors, delivering a highly potent cell-killing effect while sparing healthy tissues. Its effectiveness in treating cancers that are resistant to traditional therapies like chemotherapy has made it a valuable tool in the development of new, more precise treatments. Moreover, ongoing advancements in biotechnology are improving the stability, delivery, and targeting mechanisms of Pseudomonas Exotoxin, which is boosting its demand in the biopharmaceutical sector. These factors are positioning it as a key component in the future of cancer treatment innovation.

Application Insights

Therapy development is driving the growth of the market and is expected to see the fastest growth rate of 8.29% during the forecast period. This growth is driven by increasing investment in R&D, particularly in targeted cancer therapies, which offer more precise and effective treatment options. Advances in biotechnology and immunotherapy are also accelerating the innovation of new immunotoxin-based therapies. Additionally, the rising prevalence of cancer and the need for more specialized, less toxic treatment methods are fueling demand for these therapies in the global market.

In September 2018, the U.S. FDA approved AstraZeneca’s Lumoxiti to treat patients with relapsed or refractory hairy cell leukemia. However, due to the availability of other treatment options, complexity of administration, possible toxicity prophylaxis, and patient safety monitoring needs, in November 2022, the company announced the permanent withdrawal of Lumoxiti from the U.S. market.

Biomedical Research segment is expected to witness moderate growth over the forecast period. Scientists are engaged in studying pathways that initiate immune responses. According to an article published in October 2023 in Nature Scientific Reports, scientists from Howard University, Washington DC, U.S. investigated the innate immune modulation of hDT806 on the head and neck squamous cell carcinoma, initiated by the STING signaling pathway.

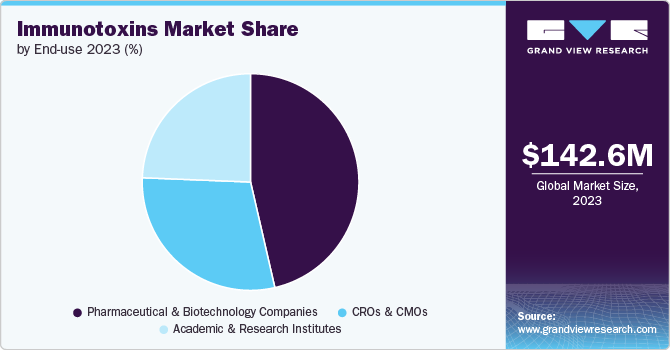

End-use Insights

Pharmaceutical and biotechnology companies are leading the immunotoxins market with a market share of 46.49% in 2024. This is mainly due to their significant investment in research and development to create new immunotoxins tailored for specific medical conditions. These companies focus on targeting antigens that are highly expressed in certain types of tumors or disease conditions, which allows for more effective treatments. By using advanced technologies like recombinant DNA, they are able to produce immunotoxins with greater precision, resulting in fewer side effects and improved therapeutic outcomes. Their efforts are driving innovation in this space, making these companies key players in advancing the market.

Academic and research institutes are expected to see significant growth of 7.98% over the forecast period. This growth is driven by ongoing research focused on developing engineered toxin fragments to reduce immunogenicity, minimize off-target toxic effects, and extend the half-life of immunotoxins. One major challenge in immunotoxin therapy is that once the immunotoxin is taken up by cells, much of it gets degraded in the lysosomes, and only a small amount manages to escape to the cytosol to trigger its toxic effect. To overcome this, researchers are working on creating new, more stable immunotoxins that can improve delivery, enhance stability, and increase their effectiveness in targeting tumors. These advancements are positioning academic and research institutions as key contributors to innovation in the field of immunotoxins.

Regional Insights

North America immunotoxins market dominated the market and accounted for 41.45% share in 2024, attributed to the region’s advanced healthcare infrastructure, strong presence of leading biotechnology firms, and significant funding for immunology and oncology research. Furthermore, growing healthcare expenditure, increasing awareness of gene and cell therapies, and supportive government initiatives are expected to boost the market.

U.S. Immunotoxins Market Trends

The immunotoxins market in the U.S. is anticipated to grow over the forecast period due to increasing government funding & growing focus on targeted treatments, and the rising prevalence of diseases. Moreover, increasing research in the fields of drug discovery and personalized medicine, is further anticipated to fuel market growth.

Europe Immunotoxins Market Trends

The Europe immunotoxins market is anticipated to grow over the forecast period. Europe has been actively involved in oncology studies and research, contributing to its growth in the region. Moreover, increasing research and development activities, collaborations between pharmaceutical companies and research institutions, and a growing demand for targeted cancer therapies, further propel market growth.

The UK immunotoxins market is expected to grow over the forecast period due to the rising prevalence of cancer and the growing demand for targeted therapies.

The immunotoxins market in Germany is expected to grow over the forecast period due to the growing incidence and prevalence of genetic disorders,favorable government policies supporting research activities and the introduction of new drugs and therapies by key players.

The immunotoxins market in France is expected to grow over the forecast period due to the growing investments in research and development, advancements in biotechnology, and a growing emphasis on precision medicine approaches for cancer treatment.

Asia Pacific Immunotoxins Market Trends

The Asia Pacific immunotoxins market is expected to experience rapid growth, with a projected CAGR of 8.98% from 2025 to 2030.This is attributed to the rising prevalence of cancer, increasing government initiatives and funding for novel cancer therapy, and a strong presence of biotechnology and biopharmaceutical companies in the region.

The China immunotoxins market is anticipated to grow over the forecast period due to increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology and immunotherapy coupled with the rising awareness of personalized medicine, is driving the expansion of the immunotoxins market in China.

The Japan immunotoxins marketis expected to witness rapid growth over the forecast period. The increasing prevalence of diseases, coupled with the growing oncology research, anticipates market growth.

The immunotoxins market in India is anticipated to grow over the forecast period due to the rising prevalence of cancer in the country. In addition, increasing government funding for cancer research boosts market growth.

Middle East & Africa Immunotoxins Market Trends

The immunotoxins market in the Middle East and Africa is poised to grow in the near future, as increasing applications of biotechnology and immunomedicine contributing to its expansion.

The immunotoxins market in Saudi Arabia is expected to grow over the forecast period due to increasing investments in healthcare innovation and research.

The immunotoxins market in Kuwait is anticipated to witness growth over the forecast period owing to the escalating investment in scientific research and development by both governmental and private entities. This investment is propelling advancements in oncology research, consequently presenting opportunities for developing novel and enhanced cancer therapies.

Key Immunotoxins Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Immunotoxins Companies:

The following are the leading companies in the immunotoxins market. These companies collectively hold the largest market share and dictate industry trends.

- Creative Biolabs.

- List Biological Labs, Inc.

- The Native Antigen Company

- Bio-Techne.

- Abcam Plc.

- CAYMAN CHEMICAL

- Merck KGaA

- Enzo Life Sciences, Inc.

- Santa Cruz Biotechnology, Inc.

- Quadratech Diagnostics Ltd.

Recent Developments

-

In April 2024, Bio-Techne announced a distribution agreement with Thermo Fisher Scientific, Inc. Under this agreement, Thermo Fisher Scientific can distribute Bio-Techne’s products across Europe through its Fisher Scientific Channel.

-

In April 2024, Invera Inc. and Astellas Pharma collaborated to discover therapeutic bispecific antibodies. With this agreement, Astellas Pharma can use Invera’s B-Body bispecific antibody platform for bispecific therapeutic research.

-

In January 2023, List Biological Labs, Inc. expanded its bacterial therapeutic manufacturing capacity by adding a new 500L bioreactor and a tangential flow filtration system.

-

In July 2020, LGC acquired The Native Antigen Company, strengthening LGC’s IVD sector product portfolio.

-

In July 2019, The Native Antigen Company signed a distribution agreement with BIOZOl and Shanghai Bioloeaf, allowing researchers from Germany, Switzerland, Austria, and China to access the company's products.

Immunotoxins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 163.8 million

Revenue forecast in 2030

USD 243.3 million

Growth Rate

CAGR of 8.23% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Creative Biolabs.; List Biological Labs, Inc.; The Native Antigen Company; Bio-Techne.; Abcam Plc.; CAYMAN CHEMICAL; Merck KGaA; Enzo Life Sciences, Inc; Santa Cruz Biotechnology, Inc.; Quadratech Diagnostics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunotoxins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immunotoxins market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diptheria Toxin (DT)

-

Anthrax Based Toxins

-

Pseudomonas Exotoxin (PE)

-

Other Immunotoxins

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical Research

-

Therapy Development

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunotoxins market was valued at USD 152.6 million in 2024 and is projected to reach USD 163.8 million by 2025.

b. The global immunotoxins market is expected to grow at a compound annual growth rate of 823% from 2025 to 2030 to reach USD 243.3 million by 2030.

b. Diphtheria Toxin (DT) segment dominated the product segment in the immunotoxins market with a market share of 43.91% in 2024. Diphtheria toxin has been widely used in cancer treatment as part of targeted therapies designed to attack cancer cells.

b. Key players operating in the market include Creative Biolabs.; List Biological Labs, Inc.; The Native Antigen Company; Bio-Techne.; Abcam Plc.; CAYMAN CHEMICAL; Merck KGaA; Enzo Life Sciences, Inc; Santa Cruz Biotechnology, Inc.; Quadratech Diagnostics Ltd.

b. The rising prevalence of cancer and technological advancements are some of the factors anticipated to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.