- Home

- »

- Pharmaceuticals

- »

-

Immune Checkpoint Inhibitors Market Size Report, 2030GVR Report cover

![Immune Checkpoint Inhibitors Market Size, Share & Trends Report]()

Immune Checkpoint Inhibitors Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (PD-1, PD-L1, CTLA-4), By Application (Lung Cancer, Breast Cancer, Melanoma), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-257-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immune Checkpoint Inhibitors Market Summary

The global immune checkpoint inhibitors market size was estimated at USD 48.42 billion in 2023 and is projected to reach USD 154.25 billion by 2030, growing at a CAGR of 17.9% from 2024 to 2030. The growing prevalence of cancer, such as lung, breast, bladder, and cervical cancer, along with melanomas, and Hodgkin lymphoma, has led to a wider use of immune checkpoint inhibitor treatment.

Key Market Trends & Insights

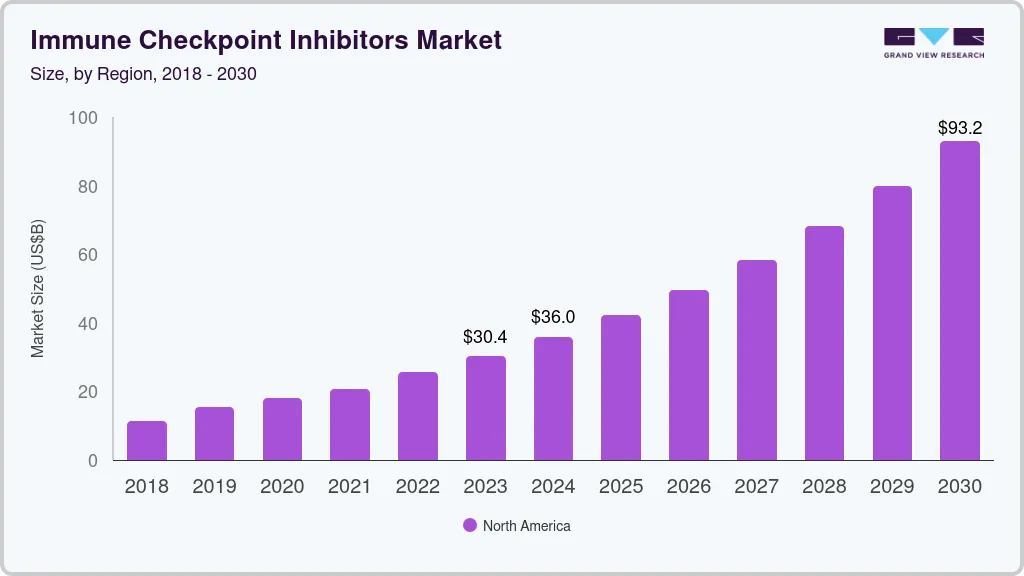

- North America dominated the immune checkpoint inhibitors market for the largest revenue share of 62.81% in 2023.

- The immune checkpoint inhibitors market in U.S. held the largest share in North America in 2023.

- The immune checkpoint inhibitors market in Asia Pacific is anticipated to witness at a significant CAGR during the forecast period.

- Based on type, the PD-1 segment led the market with the largest revenue share of 73.3% in 2023.

- In terms of application, the lung cancer segment led the market with the largest revenue share of 25.41% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 48.42 billion

- 2030 Projected Market Size: USD 154.25 billion

- CAGR (2024-2030): 17.9%

- North America: Largest market in 2023

According to the Canadian Cancer Society, two in five Canadians are estimated to be diagnosed with cancer in their lifetime and one in four is likely to die due to the disease in the country. In addition, according to the Cancer Research UK, around 28 million new cancer cases are expected globally every year by 2040. The incidence of the disease is rising steadily, which is expected to boost demand for effective diagnostic methods, including immune checkpoint inhibitors.

Increasing focus on development of novel immune checkpoint inhibitors by numerous research organizations is projected to positively impact the market growth over the forecast period. For instance, according to an article published by RICE UNIVERSITY, in May 2023, researchers from the Baylor College of Medicine and RICE UNIVERSITY, developed a novel glyco-immune checkpoint inhibitor to stop bone cancer metastasis for breast cancer survivors. Furthermore, growing funding for immunotherapy to develop novel drugs including immune checkpoint inhibitors is a key factor contributing to the market growth. For instance, in August 2023, the Department of Urologic Surgery in the UC Davis Comprehensive Cancer Center received a USD 1.4 million grant from the Department of Defense Congressionally Directed Medical Research Program. The research is being conducted to develop to improve the immunotherapy treatment in drug resistant prostate cancer.

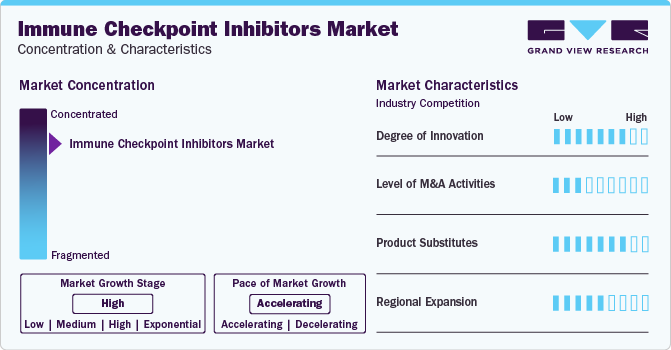

Market Concentration & Characteristics

Market growth stage is high, and the pace of growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid development of novel formulations and reduced treatment time. For instance, in August 2023, a subcutaneous formulation of Roche's Tecentriq with Halozyme's ENHANZE significantly shortened treatment duration to seven minutes, a notable improvement compared to the standard intravenous infusion, which typically takes 30-60 minutes. Halozyme Therapeutics, Inc. received approval for the subcutaneous formulation in Great Britain by the Medicines and Healthcare Products Regulatory Agency (MHRA).

The level of merger & acquisition activities is moderate in global market. However, players in market leverage strategies such as acquisition, collaboration, and partnerships to increase their product capabilities and promote reach of their offerings globally. For instance, in February 2023, Nectin Therapeutics Ltd., collaborated with Merck & Co., to evaluate the antitumor activity, safety, and tolerability of NTX1088 in combination with KEYTRUDA (pembrolizumab). This combination is indicated for treatment of patients with locally advanced and metastatic solid tumors.

There are a considerable number of direct product substitutes for immune checkpoint inhibitors. The presence of various conventional treatments like chemotherapy, radiation therapy, and targeted therapies may be considered substitutes, especially in cases where immunotherapy is not suitable or effective are projected to adversely impact market growth. However, increasing research and development activities on immune checkpoint inhibitors are expected to replace conventional treatments, thereby lowering threat to some extent.

Companies are focusing on regional expansion in the global market. Currently U.S. holds the market share, although companies are making efforts to expand their presence, especially in emerging economies.

Type Insights

Based on type, the PD-1 segment led the market with the largest revenue share of 73.3% in 2023. PD-1 inhibitors have demonstrated efficacy in a broad spectrum of neoplasms, including melanoma, lung & bladder cancer, and more. Positive clinical outcomes and durable responses in various cancer types drive their widespread adoption. Moreover, PD-1 inhibitors are often used in combination with other cancer therapies, such as chemotherapy, targeted therapies, and CTLA-4 inhibitors.

New product development and launches are expected to drive market growth. For instance, in February 2023, BeiGene LTD. received approval for PD-1 Inhibitor Tislelizumab in combination with platinum chemotherapy and fluoropyrimidine by the China National Medical Products Administration (NMPA). This combination approach enhances treatment efficacy of patients with metastatic or advanced unresectable gastric gastroesophageal junction or gastric adenocarcinoma. Furthermore, increasing clinical trials and regulatory approvals for PD-1 inhibitors in multiple indications and across different lines of treatment contribute to their growing utilization. For instance, in February 2023, Shanghai Junshi Biosciences Co., Ltd and Coherus BioSciences, Inc. presented positive results of a Phase 3 clinical trial evaluating Toripalimab, a PD-1 monoclonal antibody. Toripalimab is indicated treatment of patients with metastatic or recurrent nasopharyngeal carcinoma. Therefore, the aforementioned factors are fueling the segment growth.

The PD-L1 segment is expected to register at the fastest CAGR during the forecast period. PD-L1 inhibitors such as Atezolizumab (Tecentriq), Avelumab (Bavencio), and Durvalumab (Imfinzi) are gaining high popularity due to their high efficacy. These drugs can be used in combination or individually for a variety of applications including non-small cell lung cancer, and metastatic Merkel-cell carcinoma.

Application Insights

In terms of application, the lung cancer segment led the market with the largest revenue share of 25.41% in 2023. According to the WHO, lung cancer is the leading cause of death across the globe. As per the GLOBOCAN, the number of lung cancer cases is estimated to increase from 2.48 million in 2022 to 3.05 million by 2030. Rising prevalence and mortality due to lung cancer is a key factor contributing to the segment growth. In addition, companiesoperating in the market are continuously involved in the development and launch of novel immune checkpoint inhibitors for treatment of patients with lung cancer. For instance, in January 2023, Merck & Co., Inc. received approval for KEYTRUDA (pembrolizumab) as an alternative treatment option for patients following platinum-based chemotherapy and surgical resection. The drug is indicated for patients with stage IB, II, IIIA non-small cell lung cancer. Thus, prominent applications of immune checkpoint inhibitors in treatment are driving segment growth.

The Colorectal cancer segment is expected to register at a significant CAGR during the forecast period. The growing prevalence of CRC is one of the primary factors boosting the demand for therapeutics over the forecast period. According to the statistics published by WHO in July 2023, Colorectal Cancer (CRC) is the third-most common type across the globe. Approximately 1 in 10 cancer patients have CRC. It is the second-leading cause of cancer-related deaths across the world. Moreover, key players in the market are focusing on R&D activities and receiving U.S. FDA approval for treatment of colorectal cancer. For instance, in June 2020, Merck & Co., Inc.received FDA approval for KEYTRUDA (pembrolizumab) for the treatment of patients suffering from metastatic colorectal cancer. Such initiatives are anticipated to impel the market growth over the forecast period.

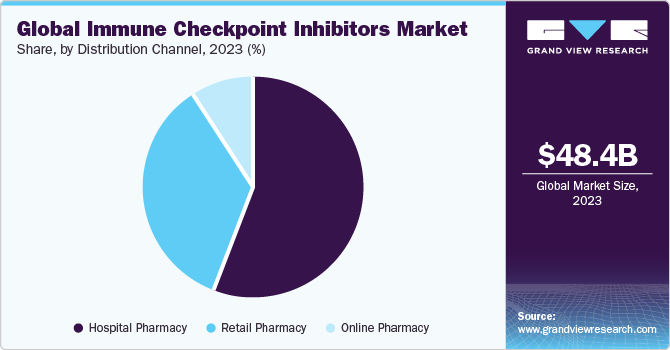

Distribution Channel Insights

Based on distribution channel, the hospitals pharmacies segment led the market with the largest revenue share of 56.06% in 2023. Immunotherapy treatments including immune checkpoint inhibitor drugs are more frequently conducted in hospital settings compared to other healthcare environments. This is attributed to the widespread availability of hospitals for primary care in numerous developing economies and a favorable reimbursement structure. Furthermore, increasing collaborations between pharmaceutical companies, academic institutions, and hospitals can facilitate access to clinical trials, early drug adoption, and knowledge exchange. For instance, according to a 2023 study, supported by AstraZeneca and the National Institute of Cancer, durvalumab, offers a promising therapeutic option in patients suffering from non-small cell lung cancer. Such partnerships can drive the integration of immune checkpoint inhibitors into hospital pharmacies for cancer care, thereby propelling the segment growth.

The online pharmacies segment is projected to witness at the fastest CAGR over the forecast period. Online pharmacies offer a convenient and accessible platform for patients to order and receive immune checkpoint inhibitor-based drugs. The increasing adoption of digital health solutions and telemedicine has facilitated the growth of online pharmacies. Patients receive prescriptions digitally and choose online platforms for the procurement of immune checkpoint inhibitors, aligning with broader trends in virtual healthcare. Growing internet accessibility globally contributes to the expansion of online pharmacies. Patients can easily access information about immune checkpoint inhibitors, compare products, and make informed decisions from the comfort of their homes. Such advantages of online pharmacies are expected to drive the segment growth in the near future.

Regional Insights

North America dominated the immune checkpoint inhibitors market for the largest revenue share of 62.81% in 2023, owing to high prevalence of neoplasms in the region. For instance, according to the Leukemia & Lymphoma Society (LLS), approximately one person in the U.S. is diagnosed with lymphoma, myeloma, and leukemia every three minutes. In addition, according to the CDC, around 1,603,844 new cancer cases were reported in the U.S. in 2020. Furthermore, expansion of immunotherapy institutes in the region is boosting the market growth. For instance, in March 2022, The University of Texas MD Anderson Cancer Center, launched James P. Allison Institute to develop novel immunotherapy treatments including immune checkpoint inhibitors in the U.S. In addition, increasing FDA approval of novel immune check point inhibitors in the region is propelling the market growth. For instance, in February 2021, Regeneron Pharmaceuticals Inc. received the U.S. FDA approval of Libtayo (cemiplimab-rwlc) for treating patients with non-small cell lung cancer.

U.S. Immune Checkpoint Inhibitors Market Trends

The immune checkpoint inhibitors market in U.S. held the largest share in North America in 2023, owing to key factors such as increasing prevalence of target population and advanced healthcare infrastructure in the country.

Europe Immune Checkpoint Inhibitors Market Trends

The immune checkpoint inhibitors market in Europe is expected to witness at a significant CAGR over the forecast period, due to increasing prevalence of target disease and growing demand for more efficient cancer treatments, well developed healthcare infrastructure, and emphasis on early disease detection.

The UK immune checkpoint inhibitors market is projected to expand in the future, driven by factors like increased adoption, increased R&D expenditure, and a focus on effective treatment of cancer. These factors are forecasted to boost the demand for immune checkpoint inhibitors such as PD-1, PD-L1, and CTLA-4.

The immune checkpoint inhibitors market in Germany is expected to grow at the fastest CAGR over the forecast period. This growth is fueled by factors like increased high healthcare expenditure, increased focus on research and development, and rising demand for effective cancer treatment.

The France immune checkpoint inhibitors market is expected to grow at the fastest CAGR over the forecast period. The factors influencing the market growth include increased awareness and rising research and development funding. Collaborative efforts among healthcare stakeholders are also pivotal in driving the popularity of immune checkpoint inhibitors for cancer treatment.

Asia Pacific Immune Checkpoint Inhibitors Market Trends

The immune checkpoint inhibitors market in Asia Pacific is anticipated to witness at a significant CAGR during the forecast period, owing to several factors, such as increasing healthcare reforms. Other factors contributing to market growth are improving healthcare infrastructure, a growing population, and rising number of local companies entering the market. Moreover, Asia Pacific has a large population and a high prevalence of cancer. According to Global Cancer Statistics, the estimated number of new cases of cancer in Asia in 2022 was 10.5 million. In addition, increasing focus on the development and approval of immune checkpoint inhibitors by key operating players in the market is projected to fuel the Asia Pacific market over the forecast period.

The China immune checkpoint inhibitors market is expected to grow at the fastest CAGR over the forecast period.A range of factors impact the market growth in China. The increasing target disease population and launch and approval of new products are primary driving factors. For instance, in September 2023, Guangzhou Gloria Biosciences, received approval for Zimberelimab injection by the China National Medical Products Administration (NMPA). This injection is used for the treatment of metastatic or recurrent cervical cancer.

The immune checkpoint inhibitors market in Japan is expected to grow at the fastest CAGR over the forecast period. Some of the factors contributing to the market growth in Japan include increased focus on research and development, developed healthcare infrastructure, and a large geriatric population prone to developing cancer.

Key Immune Checkpoint Inhibitors Company Insights

Some of the key players operating in the global market include F. Hoffmann-La Roche Ltd., Sanofi, Merck & Co, and Bristol-Myers Squibb Company. The company's primary strategies involve a high focus on research and development, new product launches and approvals, anticipation of future market trends, and identification of opportunities and challenges.

BeiGene Ltd., Shanghai Jhunsi Biosciences Ltd, and Immutep Ltd are some of the emerging market participants in the global market. These market players are continuously focused on niche segments, leveraging specialized technologies to differentiate themselves.

Key Immune Checkpoint Inhibitors Companies:

The following are the leading companies in the immune checkpoint inhibitors market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- F. Hoffmann-La Roche Ltd.

- Merck & Co.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Regeneron Pharmaceuticals Inc.

- AstraZeneca PLC

- Shanghai Jhunsi Biosciences Ltd

- Immutep Ltd

- BeiGene Ltd

- GlaxoSmithKline PLC

Recent Developments

-

In September 2023, Merck & Co, supplemental new drug application for WELIREG (belzutifan) was accepted for priority review by the U.S. FDA. This drug is used in previously treated patients suffering with renal cell carcinoma.

-

In October 2023, Bristol Myers Squibb, received U.S. FDA approval of Opdivo (nivolumab) for treatment of completely resected stage IIB or Stage IIC melanoma in adult and pediatric patients aged 12 years and older.

-

In January 2023, Merck & Co, entered into clinical trial collaboration with Teon Therapeutics, to evaluate the efficiency of TT-816 in combination with KEYTRUDA (pembrolizumab). This drug is indicated for patients with advanced solid tumors.

Immune Checkpoint Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 57.43 billion

Revenue forecast in 2030

USD 154.25 billion

Growth rate

CAGR of 17.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sanofi; F. Hoffmann-La Roche Ltd.; Merck & Co.; Bristol-Myers Squibb Company; Eli Lilly and Company; Regeneron Pharmaceuticals Inc.; AstraZeneca PLC; Shanghai Jhunsi Biosciences Ltd; Immutep Ltd; BeiGene Ltd/ GlaxoSmithKline PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immune Checkpoint Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immune checkpoint inhibitors market report based on type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

PD-1

-

PD-L1

-

CTLA-4

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Lung Cancer

-

Breast Cancer

-

Bladder Cancer

-

Melanoma

-

Cervical Cancer

-

Hodgkin Lymphoma

-

Colorectal Cancer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East And Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the immune checkpoint inhibitors market include Sanofi, F. Hoffmann-La Roche Ltd., Merck & Co., Bristol-Myers Squibb Company, Eli Lilly and Company, Regeneron Pharmaceuticals Inc., AstraZeneca PLC, Shanghai Jhunsi Biosciences Ltd, Immutep Ltd, BeiGene Ltd, and GlaxoSmithKline PLC

b. Key factors that are driving the market growth include growing prevalence of cancer such as lung, breast, bladder, and cervical cancer along with melanomas, and Hodgkin lymphoma.

b. The global immune checkpoint inhibitors market size was estimated at USD 48.42 billion in 2023 and is expected to reach USD 57.43 billion in 2024.

b. The global immune checkpoint inhibitors market is expected to grow at a compound annual growth rate of 17.9% from 2024 to 2030 to reach USD 154.25 billion by 2030.

b. North America dominated the immune checkpoint inhibitors market with a share of 62.81% in 2023. This is attributable to high healthcare expenditure, favorable healthcare reimbursement policies for costly therapies, and increasing prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.