- Home

- »

- IT Services & Applications

- »

-

Identity Governance And Administration Market Report, 2033GVR Report cover

![Identity Governance And Administration Market Size, Share & Trends Report]()

Identity Governance And Administration Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud-Based, Hybrid), By Functionality, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-714-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Identity Governance And Administration Market Summary

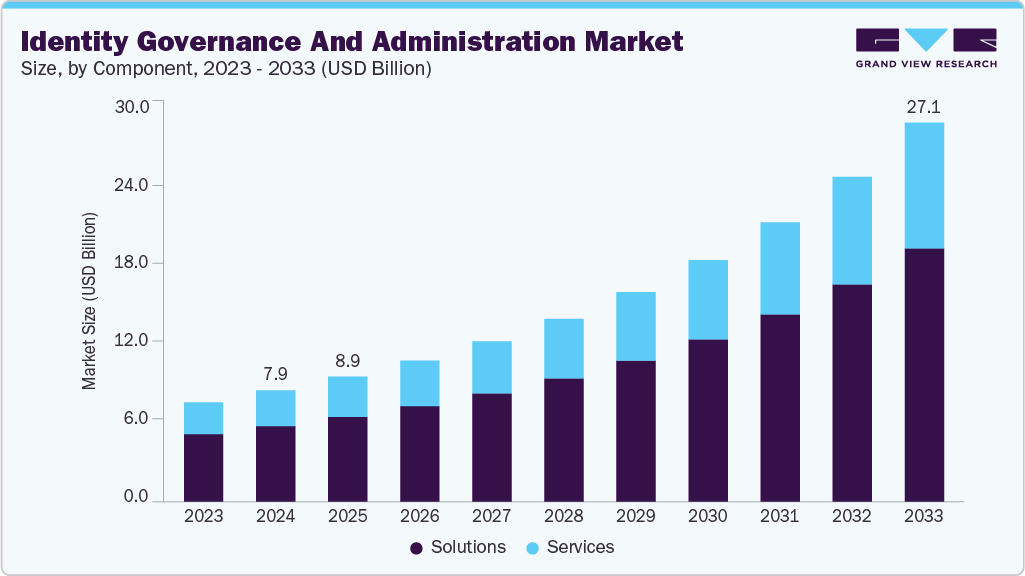

The global identity governance and administration market size was estimated at USD 7.95 billion in 2024 and is projected to reach USD 27.11 billion by 2033, growing at a CAGR of 14.9% from 2025 to 2033. The market growth is driven by the rising need for centralized identity lifecycle management, regulatory compliance, and secure access governance in increasingly hybrid and multi-cloud enterprise environments.

Key Market Trends & Insights

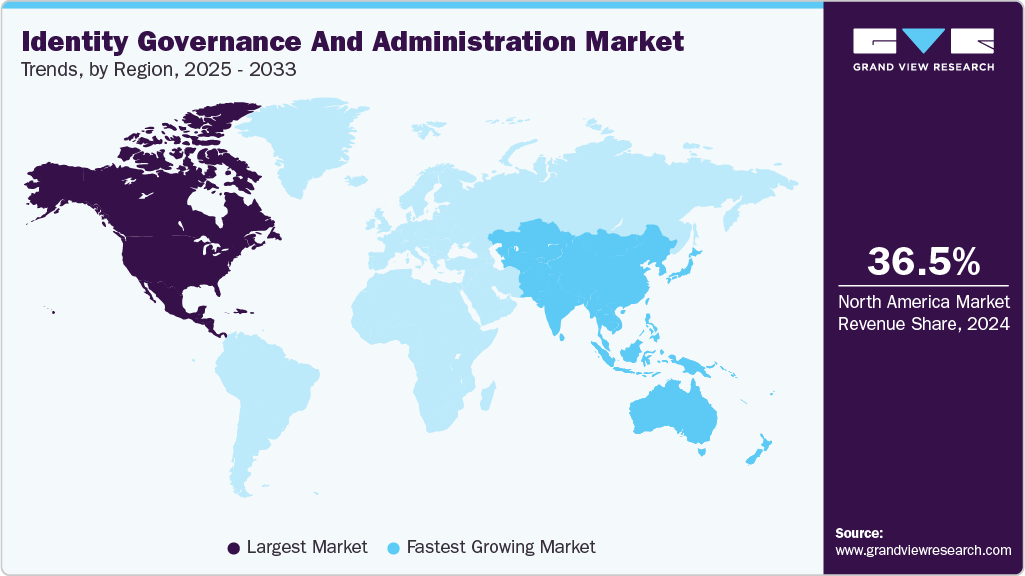

- North America held a 36.5% revenue share of the global market in 2024.

- In the U.S., the market is driven by the increasing adopting of cloud-native and hybrid identity governance and administration (IGA) solutions to enhance scalability, flexibility, and security.

- By component, the solutions segment held the largest revenue share of 67.9% in 2024.

- By deployment mode, the cloud-based segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.95 Billion

- 2033 Projected Market Size: USD 27.11 Billion

- CAGR (2025-2033): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations across sectors such as BFSI, healthcare, government, IT, and manufacturing are shifting from fragmented identity management tools toward unified, policy-driven IGA platforms that automate provisioning, de-provisioning, entitlement management, and access reviews. This shift is further fueled by growing cyberthreats, Zero Trust adoption, and stringent data protection mandates like GDPR, HIPAA, and CCPA, which require auditable access controls and identity risk mitigation. Additionally, cloud-native IGA solutions integrated with AI-based anomaly detection and behavioral analytics are enabling real-time risk scoring, policy enforcement, and adaptive access control.

Furthermore, the IGA market is rapidly converging with adjacent domains such as Privileged Access Management (PAM), Identity Access Management (IAM), and cloud security posture management, forming an integrated identity security fabric that spans across hybrid and multi-cloud environments. Organizations are embedding IGA workflows directly into mission-critical business applications, including ERP, CRM, and HR platforms, to enable automated onboarding, role-based access provisioning, compliance reporting, and governance at scale. The infusion of AI-driven identity intelligence is facilitating predictive access governance, dynamic role mining, and continuous policy optimization, thereby reducing reliance on manual processes and accelerating compliance readiness. This evolution is driven by the rising need to manage identity sprawl, mitigate insider threats, and enforce least-privilege principles across increasingly complex IT ecosystems.

For instance, in July 2024, SailPoint enhanced its Identity Security Cloud with AI-powered role insights, enabling enterprises to streamline role modeling, minimize excessive privileges, and maintain a secure and compliant access environment. This advancement reflects a broader industry shift toward intelligent, context-aware governance solutions capable of adapting to evolving business needs and regulatory demands. By combining real-time identity analytics with automated policy enforcement, such innovations help enterprises strengthen security posture, improve operational efficiency, and extend governance capabilities to SaaS applications, DevOps pipelines, and OT/IoT devices.

Component Insights

The solutions segment accounted for the largest revenue share of 67.9% in the global identity governance and administration market in 2024, driven by enterprises’ rising need for comprehensive platforms that unify identity lifecycle management, access certification, and policy enforcement. As digital transformation is accelerating and regulatory compliance requirements are intensifying, organizations are prioritizing robust IGA solutions capable of integrating with diverse enterprise systems, automating governance workflows, and providing real-time visibility into access risks.

Additionally, these platforms address critical challenges such as identity sprawl, orphaned accounts, and excessive privilege accumulation while ensuring adherence to industry-specific regulations like GDPR, HIPAA, and SOX. Moreover, their ability to embed governance capabilities within ERP, CRM, and cloud applications enhances operational efficiency, reduces security gaps, and strengthens overall risk posture. For instance, in April 2024, Atos announced a new version of its Evidian Identity Governance and Administration solution, offering advanced capabilities for role mining, access request automation, and compliance reporting, alongside improved integration with cloud and on-premise applications.Therefore, the accelerating shift toward AI-enhanced, interoperable governance platforms capable of scaling with enterprise complexity is reinforcing the solutions segment’s market leadership in the IGA space.

The services segment in the IGA market is projected to grow at the fastest CAGR of 15.3% during the forecast period, driven by the rising complexity of hybrid IT environments and the need for specialized expertise to design, integrate, and optimize governance frameworks. Additionally, the growth is also fueled by increasing demand for managed identity services that provide continuous monitoring, compliance reporting, and rapid incident response.

Moreover, the shift toward AI-enabled IGA deployments is creating a stronger need for professional services to customize predictive analytics, automate access reviews, and align governance models with evolving regulatory requirements. Furthermore, the growing prevalence of multi-cloud and SaaS ecosystems is prompting enterprises to seek advisory and integration services for cross-platform governance, while the rising frequency of M&A activities is generating demand for identity consolidation and migration services to ensure secure, unified access control. Consequently, the aforementioned factors are projected to drive the growth of the services segment during the forecast period.

Deployment Mode Insights

The cloud-based deployment segment accounted for the largest revenue share of 55.4% in 2024 in the identity governance and administration market, driven by its unmatched scalability and agility, enabling seamless onboarding of users and services across hybrid and multi-cloud environments. It also simplifies governance across diverse IT ecosystems by offering centralized policy control and integration with both SaaS and legacy platforms. It also strengthens security and compliance through built-in threat protection, automated policy enforcement, and robust access controls.

Furthermore, the emergence of platforms that consolidate universal directories, identity orchestration, single sign-on (SSO), MFA, access management, and reporting into a unified, browser-based console is streamlining operations and enhancing compliance readiness. For instance, in October 2023, ManageEngine introduced its cloud-native identity platform, Identity360, featuring a built-in Universal Directory, smart-template-based identity orchestration, SSO, MFA, and full lifecycle management to simplify access control, enable seamless provisioning workflows, and improve compliance in cloud-first enterprise environments. In conclusion, these capabilities are solidifying cloud-based deployment as the preferred model for modern IGA strategies and accelerating its market dominance.

The hybrid segment in the global identity governance and administration (IGA) market is expected to grow at a CAGR of 21.3% over the forecast period, driven by enterprises’ need to manage complex IT environments that combine on-premises systems with cloud applications, ensuring consistent identity governance and compliance across both. Traditional IGA solutions face challenges integrating legacy on-premises infrastructure, creating security gaps and governance blind spots. This fuels demand for hybrid models that offer scalable, flexible, and secure identity management adaptable to evolving business needs. For instance, in April 2024, Zilla Security launched Zilla PO Box, a next-generation solution designed to extend identity governance to hybrid and on-premises environments by automating permissions management across SaaS, cloud platforms, and on-premises systems such as Active Directory and popular databases.

Its extensible architecture supports integration with proprietary systems via APIs, file imports, SQL queries, and robotic automation, providing enterprises with unified visibility and control across diverse infrastructures. Subsequently, such innovation highlights the industry’s shift toward hybrid IGA deployments, which are expected to accelerate as organizations seek to enhance security, compliance, and operational efficiency.

Functionality Insights

The access certification & compliance control segment accounted for the largest revenue share of 28.5% in the global IGA market in 2024, driven by the increasing emphasis on regulatory compliance and risk mitigation across industries. Organizations are prioritizing automated access reviews and certification processes to ensure that users have appropriate permissions and to detect and remediate excessive or outdated access rights. This focus is driven by stringent regulations such as GDPR, HIPAA, and SOX, which require detailed audit trails and periodic access attestations to maintain compliance and avoid penalties.

Additionally, advancements in AI and analytics are enabling more efficient and accurate compliance controls, helping enterprises reduce manual effort while strengthening their security posture. For instance, in October 2023, Pathlock introduced its Application Access Governance (AAG) solution, which enhances traditional access certification processes by incorporating a risk-based approach. AAG evaluates not only whether access is actively utilized but also assesses the associated risks, such as segregation of duties violations and exposure to sensitive data, providing organizations with a more comprehensive view of access-related risks and enabling more informed decision-making. In conclusion, such development underscores the industry's shift towards more intelligent and risk-aware access certification processes, highlighting the critical role of access governance in modern IGA strategies.

The access management segment is projected to grow at the highest CAGR of 16.0% during the forecast period, driven by the increasing complexity of IT environments and the need for robust security measures. Organizations are adopting advanced access management solutions to address challenges such as managing a growing number of applications and identities, ensuring compliance with stringent regulations, and protecting against sophisticated cyber threats. These solutions enable organizations to enforce least-privilege access controls, conduct real-time access reviews, and automate provisioning and deprovisioning processes, thereby enhancing security and operational efficiency.

For instance, in June 2025, Lumos launched Albus, the first true AI multi-agent system designed to help organizations adopt identity governance and administration at scale. Albus leverages artificial intelligence to reason through access decisions, explain its recommendations, and act, assisting IT and security teams in managing who gets access to what, and why. By automating complex tasks like role modeling and access reviews, Albus enables organizations to enforce least-privilege controls, reduce access risk, and drive the creation of right-sized access policies without additional headcount. Therefore, such innovation underscores the industry's shift towards more intelligent and autonomous access management solutions, highlighting the critical role of access governance in modern IGA strategies.

Organization Size Insights

The large enterprise segment accounted for the largest revenue share of 69.6% in the global identity governance and administration (IGA) market in 2024, driven by the increasing complexity of IT environments and the need for robust security measures. Large organizations operate across multiple regions, have diverse user bases, and manage a vast array of applications and systems, necessitating comprehensive identity governance solutions to ensure compliance, mitigate risks, and streamline operations. These enterprises are adopting advanced IGA solutions to address challenges such as managing a growing number of applications and identities, ensuring compliance with stringent regulations, and protecting against sophisticated cyber threats.

For instance, in December 2024, Tuebora launched Ask Tuebora, a generative AI tool designed to simplify complex workflows and automate repetitive Identity Access Management (IAM) tasks. Ask Tuebora eliminates the need to learn specific system vendor terminology or multiple user interfaces, reducing onboarding time and resources. By leveraging this intuitive tool, users can simplify and automate a wide spectrum of IAM tasks, enhancing efficiency and security across large-scale enterprises. Consequently, such development underscores the industry's shift towards more intelligent and autonomous IGA solutions, highlighting the critical role of identity governance in large enterprise strategies.

The small and medium-sized enterprise (SME) segment in the global identity governance and administration market is projected to register the fastest CAGR of 15.6% during the forecast period. This growth is driven by SMEs' increasing adoption of digital transformation initiatives, heightened awareness of cybersecurity risks, and the need for cost-effective, scalable identity governance solutions. SMEs are rapidly adopting cloud-based and AI-powered IGA platforms to manage user access, ensure compliance with data protection regulations, and protect against identity-related threats without heavy upfront investments.

Additionally, the availability of managed services and flexible subscription models lowers barriers to entry, enabling SMEs to implement robust identity governance frameworks that were previously accessible mainly to large enterprises. This trend is further accelerated by regulatory pressures and the increasing adoption of remote and hybrid work models, which require secure, efficient identity management. For instance, in April 2024, Delinea acquired Fastpath, an identity governance and administration (IGA) and identity access rights provider. This acquisition automates and expands Delinea's capabilities to improve control, privileged access, and governance, reduce enterprise cybersecurity risk, and ensure compliance. By enhancing its offerings, Delinea aims to provide SMEs with more accessible and efficient IGA solutions, supporting their growth and security needs.

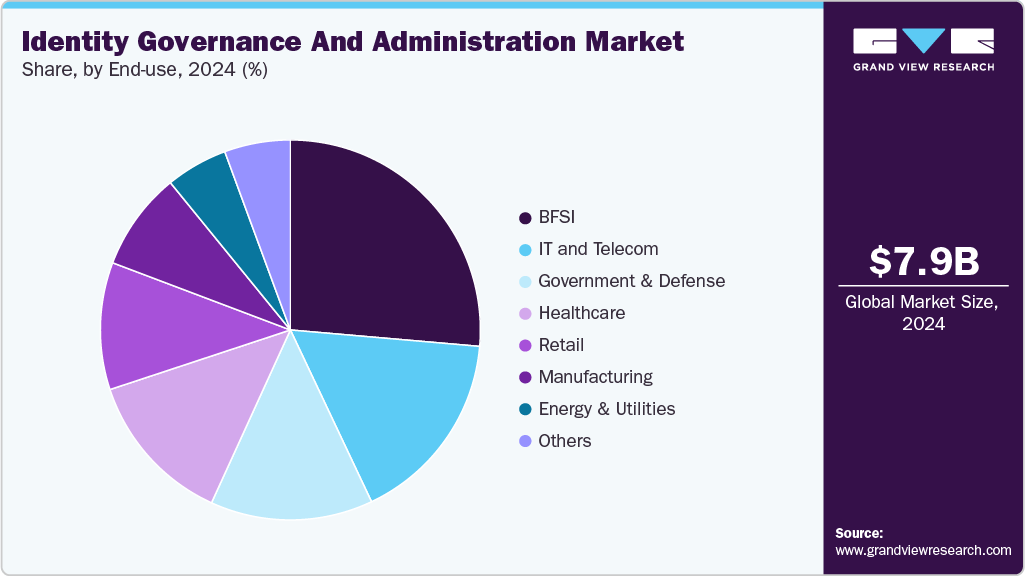

End Use Insights

The BFSI sector accounted for the largest revenue share of 26.4% in the global Identity IGA market in 2024, driven by the BFSI industry's stringent regulatory requirements, the need for robust cybersecurity measures, and the increasing complexity of managing user identities. Financial institutions are adopting advanced IGA solutions to ensure compliance with regulations such as GDPR, SOX, and PCI-DSS, mitigate risks associated with identity-based threats, and streamline access management processes.

Additionally, the rise of digital banking, mobile applications, and cloud-based services has further amplified the need for comprehensive identity governance frameworks to safeguard sensitive financial data and maintain customer trust. For instance, in April 2025, Microsoft announced the integration of its AI-driven tools into the boardrooms of leading BFSI institutions, aiming to enhance decision-making processes and operational efficiency. This initiative underscores the sector's commitment to leveraging advanced technologies to bolster security, compliance, and overall governance. By incorporating AI into their IGA strategies, BFSI organizations can proactively identify and address potential vulnerabilities, automate compliance reporting, and ensure that only authorized individuals have access to critical financial systems and data. Consequently, such a trend highlights the growing importance of advanced IGA solutions in the BFSI sector, as organizations seek to navigate the complexities of modern financial services while maintaining stringent security and compliance standards.

The healthcare segment is expected to register the fastest growth of 16.9% during the forecast period in the global identity governance and administration (IGA) market, driven by the increasing frequency of cyberattacks targeting healthcare organizations, which increases the need for robust identity and access management (IAM) solutions to safeguard sensitive patient data and ensure compliance with stringent regulations.

Furthermore, the increasing complexity of healthcare environments, characterized by the integration of various digital platforms and the rise of telemedicine, necessitates the implementation of comprehensive IGA frameworks. These frameworks facilitate secure access management, streamline user provisioning and deprovisioning processes, and enhance overall operational efficiency. For instance, in December 2024, SailPoint and Imprivata announced a strategic partnership to deliver unified identity security and access management solutions tailored for healthcare organizations. This collaboration aims to provide healthcare providers with enhanced capabilities to manage user identities, ensure compliance, and protect critical systems and data.In conclusion, the convergence of regulatory pressures, the increasing frequency of cyber threats, and the growing complexity of healthcare IT infrastructures are driving the rapid adoption of IGA solutions in the healthcare sector. These factors collectively contribute to the sector's projected leadership in market growth during the forecast period.

Regional Insights

The North America identity governance and administration marketaccounted for the largest revenue share of 36.5% in 2024 in the global market, driven by strong adoption driven by stringent regulatory frameworks such as HIPAA, SOX, and CCPA, which compel organizations to implement comprehensive identity governance to ensure compliance and data protection. Additionally, the region is witnessing rapid integration of AI and machine learning technologies in IGA solutions to enhance automation in access management, anomaly detection, and risk mitigation. Moreover, enterprises in North America are also prioritizing hybrid and cloud-native deployments to accommodate complex IT infrastructures while maintaining centralized control over identity policies. Furthermore, there is significant focus on securing remote and hybrid workforces, leading to increased deployment of zero-trust identity architectures and adaptive authentication methods. The mature cybersecurity ecosystem, combined with high awareness of insider threats and sophisticated cyberattacks, drives continuous innovation and investment in identity-centric security frameworks across sectors such as BFSI, healthcare, and government.

U.S. Identity Governance And Administration Market Trends

The U.S. identity governance and administration market is experiencing significant growth, driven by several key country trends. Organizations are increasingly adopting cloud-native and hybrid IGA solutions to enhance scalability, flexibility, and security across diverse IT environments. Moreover, there is a rising emphasis on regulatory compliance and data privacy mandates, prompting enterprises to deploy advanced IGA solutions that ensure robust audit readiness, enforce least-privilege access, and support zero-trust security frameworks.

This technological advancement is particularly crucial as organizations face the challenges of managing complex digital ecosystems and ensuring compliance with stringent regulations. Moreover, there is a growing emphasis on securing machine identities alongside human identities, reflecting the expanding perimeter of enterprise networks and the need for comprehensive security strategies. These developments underscore the dynamic nature of the U.S. IGA market, highlighting the region's commitment to adopting innovative solutions to address evolving security and compliance demands.

Europe Identity Governance And Administration Market Trends

The Europe identity governance and administration market is anticipated to register significant growth from 2025 to 2033, as organizations across the continent are increasingly adopting cloud-based IGA solutions to enhance scalability, flexibility, and security in managing user identities and access controls. This shift is particularly evident in sectors such as finance, healthcare, and government, where stringent regulatory requirements necessitate robust identity governance frameworks.

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) technologies into IGA platforms enables more proactive and automated identity management processes, including real-time access monitoring and anomaly detection. This technological advancement is crucial in addressing the growing complexity of digital ecosystems and the evolving threat landscape. Furthermore, there is a concerted effort to standardize identity management practices across European Union member states, aiming to streamline compliance processes and enhance cross-border interoperability. These developments underscore Europe's commitment to strengthening its digital infrastructure and ensuring secure and efficient identity governance across the region.

The UK identity governance and administration market is experiencing a significant transformation, driven by heightened regulatory scrutiny post-Brexit and increased focus on data privacy and cybersecurity. Organizations are prioritizing solutions that provide granular access controls and comprehensive audit trails to meet UK-specific regulations like the Data Protection Act 2018 and the UK GDPR. The rise of hybrid work models has accelerated demand for adaptive identity verification and risk-based authentication to secure distributed workforces.

Additionally, the UK market is witnessing growing investment in AI-powered IGA tools that automate compliance reporting and streamline identity lifecycle management. Financial services and public sector entities are leading adoption due to their stringent compliance mandates and complex access requirements. Overall, the UK market emphasizes tailored identity governance frameworks that balance security, usability, and regulatory compliance in a dynamic legal landscape.

Germany identity governance and administration market is characterized by several key regional trends. Organizations across Germany are increasingly adopting cloud-based IGA solutions to enhance scalability, flexibility, and security in managing user identities and access controls. This shift is particularly evident in sectors such as finance, healthcare, and government, where stringent regulatory requirements necessitate robust identity governance frameworks.

In addition, rising emphasis on data protection regulations such as the General Data Protection Regulation (GDPR) is driving organizations to implement advanced IGA solutions that ensure transparent access controls, enable comprehensive audit trails, and support stringent privacy mandates.Furthermore, there is a concerted effort to standardize identity management practices across Germany, aiming to streamline compliance processes and enhance cross-border interoperability. These developments underscore Germany's commitment to strengthening its digital infrastructure and ensuring secure and efficient identity governance across the region.

Asia Pacific Identity Governance And Administration Market Trends

The Asia Pacific identity governance and administration (IGA) marketis expected to register the fastest CAGR of 15.4% from 2025 to 2033, driven by accelerated adoption of identity governance and administration solutions, driven by rapid digital transformation initiatives across industries like banking, healthcare, and government. Increasing regulatory enforcement around data privacy and cybersecurity, such as India’s Personal Data Protection Bill and China’s Cybersecurity Law, is prompting organizations to strengthen identity governance frameworks.

Additionally, the surge in cloud migration and mobile workforce expansion is fueling demand for flexible, scalable IGA deployments that support hybrid IT environments. Local enterprises are also investing in AI-powered automation to streamline identity lifecycle management, enhance threat detection, and reduce manual compliance efforts. Furthermore, regional collaborations and standardization efforts are emerging to improve interoperability and facilitate secure cross-border data flows, underscoring the strategic importance of identity governance in the Asia Pacific’s evolving digital ecosystem.

Japan identity governance and administration market is poised for robust growth from 2025 to 2033, with a strong emphasis on advanced identity and access management technologies such as multifactor authentication. Additionally, digital transformation in sectors such as e-commerce and finance is driving adoption of cloud-based and AI-integrated IGA solutions, with a growing trend toward identity-as-a-service (IDaaS) platforms that offer compliance, privacy, and user-centric data control. Moreover, the growing shift toward decentralized identity models built on blockchain technology, aimed at giving individuals greater control over their data and enhancing privacy protections, is also boosting the market share. Furthermore, the mature regulatory environment and data protection requirements in Japan drive organizations to prioritize continuous access certification and compliance control alongside identity lifecycle management, ensuring stringent governance in regulated industries like BFSI and healthcare.

China identity governance and administration market is characterized by regulatory-driven adoption of AI-powered continuous access certification and identity lifecycle management solutions, aligned with strict government cybersecurity mandates emphasizing multifactor authentication (MFA) for enhanced security. The market is seeing widespread deployment of cloud-based IGA platforms compliant with sovereign-cloud requirements to ensure domestic data control, reflecting China’s focus on data sovereignty and security. Multifactor authentication is notably the fastest-growing segment, driven by fintech, e-commerce, and digital payment platforms such as Alipay and WeChat Pay, where secure, rapid identity verification is critical amid rising online fraud.

In addition, the market also focuses on integrating AI for automated risk detection and compliance audits, responding to increasing cyber threats and regulatory oversight in sectors with high volumes of sensitive data. Overall, China’s IGA market distinctly prioritizes AI integration, cloud sovereignty, multifactor authentication, automation of identity processes, and enterprise-level governance driven by government regulations and digital economy demands.

India identity governance and administration market is driven by the increasing adoption of zero-trust security models, which strictly enforce identity authentication for every access request, regardless of network location. This trend is strong in BFSI, IT, and government sectors, driven by rising cyber threats and stringent compliance mandates.

Additionally, the shift toward cloud-based IAM and IGA solutions, supporting the growing remote and hybrid workforce with flexible and scalable identity governance frameworks, is bolstering the market size. Moreover, in India, the BFSI sector dominates demand due to strict KYC regulations from the Reserve Bank of India and digital lending initiatives, making it the largest and fastest-growing vertical. Government-driven biometric identity verification initiatives, such as Aadhaar-linked face authentication proofs in national exams, further push secure identity validation in public sectors. Vendor activities, including partnerships like the one between iValue Group and RSA, highlight a focus on enhancing identity and access management solutions tailored to India’s evolving cybersecurity landscape.

Key Identity Governance And Administration Company Insights

Key players operating in the identity governance and administration (IGA) industry are Amazon Web Services, Inc., Broadcom Inc. (Symantec), CyberArk Software Ltd., Evidian (Atos SE), and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, CyberArk acquired Zilla Security to enhance its Identity Security Platform by integrating Zilla’s modern, AI-powered Identity Governance and Administration (IGA) capabilities. This acquisition enables scalable automation for accelerated identity compliance, provisioning, and lifecycle management across cloud and hybrid environments, addressing legacy IGA systems with faster deployment, reduced access review effort, and improved operational efficiency. The integration aims to provide comprehensive identity security with advanced privilege controls for both human and machine identities in modern digital enterprises.

-

In December 2024, SailPoint acquired Imprivata’s Identity Governance and Administration (IGA) business and entered a strategic go-to-market partnership with Imprivata focused on healthcare. This alliance aims to unify SailPoint’s identity security platform with Imprivata’s enterprise access management solutions, offering healthcare organizations a comprehensive, integrated identity security and access management framework.

-

In October 2024, CyberArk acquired Venafi to enhance its identity governance and administration (IGA) capabilities by integrating Venafi’s machine identity management solutions. This enables CyberArk to offer comprehensive end-to-end security for both human and machine identities, automating certificate lifecycle management, workload identity, and cryptographic key security at scale.

- In February 2024, Microsoft and SAP announced a collaboration to help SAP customers modernize their identity and access management systems, enhancing integration and security.

Key Identity Governance And Administration Companies:

The following are the leading companies in the identity governance and administration market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Broadcom Inc. (Symantec)

- CyberArk Software Ltd.

- Evidian (Atos SE)

- IBM Corporation

- Imprivata, Inc.

- Micro Focus International plc

- Microsoft Corporation

- Okta, Inc.

- Oracle Corporation

- Ping Identity Corporation

- SailPoint Technologies Holdings, Inc.

- Saviynt, Inc.

- SecureAuth Corporation

- Thales Group

Identity Governance And Administration Market Report Scope

Report Attribute

Details

Market size in 2025

USD 8.94 billion

Revenue forecast in 2033

USD 27.11 billion

Growth rate

CAGR of 14.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, functionality, organization size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Broadcom Inc. (Symantec); CyberArk Software Ltd.; Evidian (Atos SE); IBM Corporation; Imprivata, Inc.; Micro Focus International plc; Microsoft Corporation; Okta, Inc.; Oracle Corporation; Ping Identity Corporation; SailPoint Technologies Holdings, Inc.; Saviynt, Inc.; SecureAuth Corporation; Thales Group

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Identity Governance And Administration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the identity governance and administration market report based on component, deployment mode, functionality, organization size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Services

-

Professional Services

-

Managed Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premise

-

Cloud-Based

-

Hybrid

-

-

Functionality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Access Certification & Compliance Control

-

Access Management

-

Identity Lifecycle Management

-

Policy & Role Management

-

Reporting & Analytics

-

Risk Management

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Retail

-

Manufacturing

-

Energy & Utilities

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global identity governance and administration market size was estimated at USD 7.95 billion in 2024 and is expected to reach USD 8.94 billion in 2025.

b. The global identity governance and administration market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2033 to reach USD 27.11 billion by 2033.

b. The solutions segment accounted for the largest revenue share of 67.93% in the global Identity Governance and Administration (IGA) market in 2024, driven by enterprises’ rising need for comprehensive platforms that unify identity lifecycle management, access certification, and policy enforcement. As digital transformation is accelerating and regulatory compliance requirements are intensifying, organizations are prioritizing robust IGA solutions capable of integrating with diverse enterprise systems, automating governance workflows, and providing real-time visibility into access risks.

b. Some key players operating in the market include Amazon Web Services, Inc., Broadcom Inc. (Symantec), CyberArk Software Ltd., Evidian (Atos SE), IBM Corporation, Imprivata, Inc., Micro Focus International plc, Microsoft Corporation, Okta, Inc., Oracle Corporation, Ping Identity Corporation, SailPoint Technologies Holdings, Inc., Saviynt, Inc., SecureAuth Corporation, Thales Group and Others.

b. Factors such as the rising need for centralized identity lifecycle management, regulatory compliance, and secure access governance in increasingly hybrid and multi-cloud enterprise environments plays a key role in accelerating the Identity Governance and Administration (IGA) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.