- Home

- »

- Renewable Energy

- »

-

Hydrogen Fueling Station Market Size, Industry Report, 2033GVR Report cover

![Hydrogen Fueling Station Market Size, Share & Trends Report]()

Hydrogen Fueling Station Market (2026 - 2033) Size, Share & Trends Analysis Report By Size (Small, Medium), By Type (On-site, Off-site), By Mobility (Fixed Hydrogen Station), By End User (Marine, Railway), By Category (Liquid to Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-140-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Fueling Station Market Summary

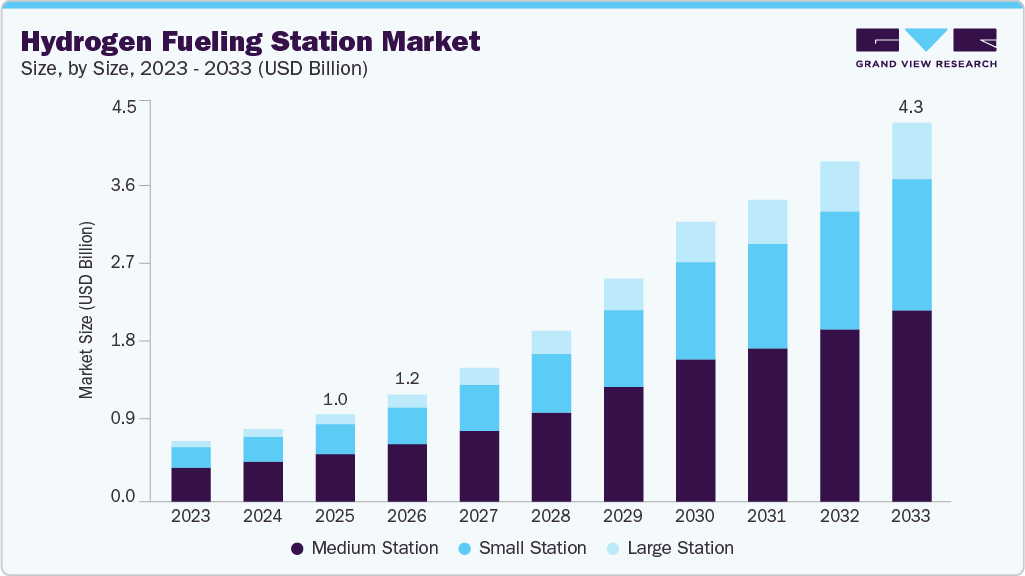

The global hydrogen fueling station market size was estimated at USD 1.00 billion in 2025 and is projected to reach USD 4.35 billion by 2033, growing at a CAGR of 19.8% from 2026 to 2033. The market is experiencing significant growth, primarily driven by the accelerating adoption of fuel cell electric vehicles (FCEVs).

Key Market Trends & Insights

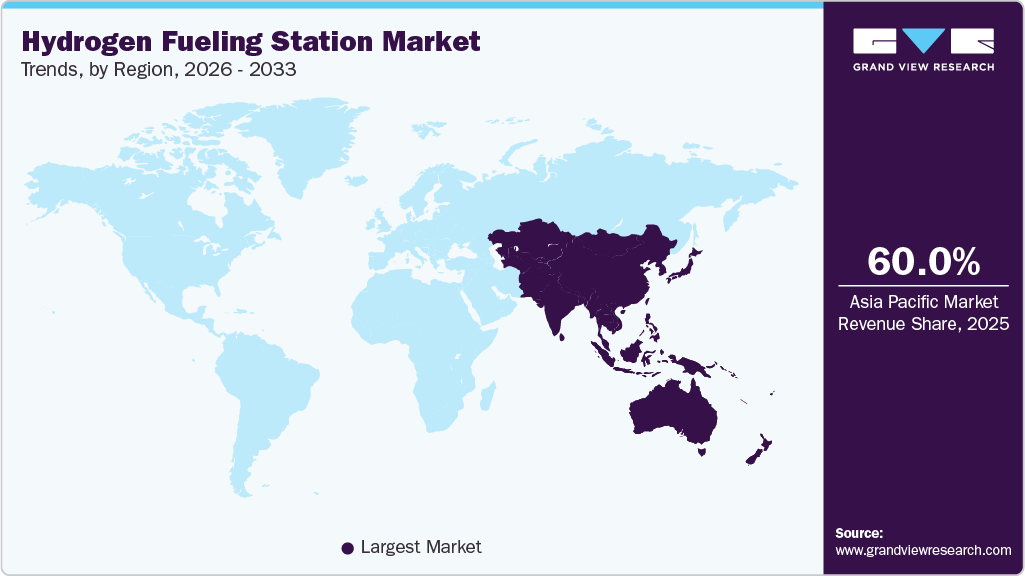

- Asia Pacific hydrogen fueling station market held the largest share of over 60% of the global market in 2025.

- By size, medium station held the largest market share of over 54% in 2025.

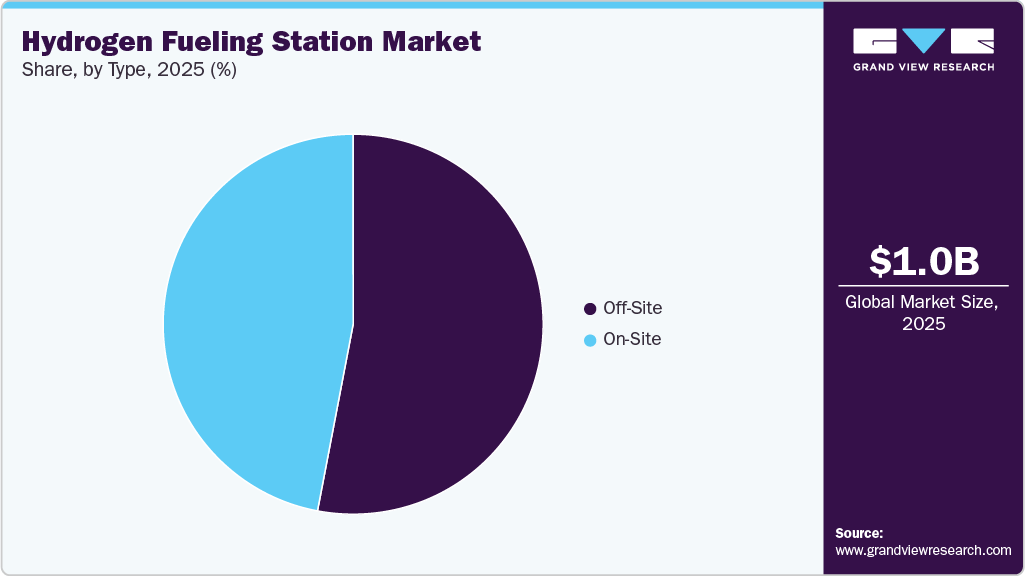

- By type, the off-site segment held the highest market share in 2025.

- By mobility, the mobile hydrogen station segment held the largest revenue share of more than 57% in 2025.

- By end user, commercial vehicles held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.00 Billion

- 2033 Projected Market Size: USD 4.35 Billion

- CAGR (2026-2033): 19.8%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

Major automotive manufacturers have committed to the commercialization of hydrogen-powered trucks, buses, and passenger cars, creating a direct and urgent demand for refueling infrastructure.Long-haul trucking, maritime shipping, and heavy industry are increasingly viewed as ideal applications for green hydrogen. Consequently, the growth of fueling stations is no longer solely tied to light-duty vehicles but is expanding to include heavy-duty corridors and industrial hubs. This diversification broadens the market's base and attracts investment from industrial gas companies, energy majors, and logistics firms who see hydrogen as both a business opportunity and a pathway to meet stringent emissions targets.

Innovations in compressors, dispensers, and on-site hydrogen production-particularly electrolyzers powered by renewable energy are making stations more economically viable. Standardization of components and the development of higher-capacity stations are lowering the levelized cost of hydrogen dispensed. Furthermore, as the number of stations increases, economies of scale in manufacturing and lessons learned from early deployments are driving down capital expenditures, making subsequent stations cheaper and faster to build.

Major oil and gas companies are integrating hydrogen into their energy transition plans, leveraging their existing real estate, customer networks, and fueling expertise to deploy stations. Simultaneously, consortia involving automakers, infrastructure developers, and government bodies are collaborating to plan and fund coordinated regional networks. These partnerships mitigate risk, share knowledge, and ensure that station deployment aligns with vehicle roll-out plans, creating a more synchronized and efficient growth trajectory.

Drivers, Opportunities & Restraints

The primary driver of the hydrogen fueling station market is a powerful combination of regulatory push and technological pull. Ambitious national hydrogen strategies, particularly in Europe, East Asia, and North America, are channeling billions in subsidies and setting clear deployment targets to build foundational infrastructure. This government action is directly responding to and enabling the rollout of fuel cell electric vehicles (FCEVs) for both passenger and, more significantly, heavy-duty transport like trucks and buses, where battery electrification faces range and refueling time challenges.

Significant opportunities for market expansion lie in diversifying beyond road transport and leveraging technological innovation. The application of hydrogen in maritime ports, for airport ground support, and within large industrial and logistics hubs presents a massive new frontier for stationary and mobile refueling points.

However, the market faces considerable restraints, with high capital expenditure (CapEx) remaining the most formidable barrier. The cost of compressors, storage tanks, and dispensing equipment, coupled with complex permitting and a lack of standardized components, makes stations exponentially more expensive than conventional or electric vehicle chargers.

Size Insights

Medium station segment held the largest revenue share of over 54% in 2025.

The growth of the medium-sized hydrogen station segment, typically defined as stations with capacities between 500 kg/day and 1,000 kg/day, is primarily driven by the strategic deployment within early commercial corridors and expanding urban hubs. These stations represent a "sweet spot" for initial infrastructure rollouts, offering a viable economic balance between the high capital expenditure of larger, heavy-duty truck-focused stations and the limited throughput of smaller, pilot-scale sites.

The growth of the large hydrogen station segment, typically defined as stations with daily capacities exceeding 1,000 kg/day and often reaching 2,000 kg/day or more, is fundamentally driven by the imperative to decarbonize heavy-duty transportation and industrial sectors. The primary catalyst is the accelerating regulatory push and corporate commitments to transition long-haul trucking, regional freight, buses, and even maritime and rail applications away from diesel.

Type Insights

Off-site segment held the revenue share of around 53% in 2025.

Off site hydrogen fueling stations grow as a result of expanding hydrogen supply chains that deliver fuel from centralized production facilities to distributed refueling points. These stations rely on imported compressed or liquid hydrogen transported by trucks and trailers instead of generating it on location, which allows quicker deployment in areas where on-site production infrastructure is limited or costly.

Growth in the on-site segment of the hydrogen fueling station market is propelled by the strategic advantages of producing hydrogen directly at refueling locations. On-site generation via technologies such as water electrolysis or small reformers lessens dependency on external supply chains and eliminates transportation challenges and related costs. This localized production approach is especially appealing where hydrogen demand is high or unpredictable because it improves supply reliability for fleets of fuel cell vehicles and supports consistent station throughput.

Mobility Insights

Mobile hydrogen station segment held the largest revenue share of over 57% in 2025.

As fuel cell electric vehicles expand beyond early pilot areas into broader commercial fleets, logistics networks, and fleet deployments, mobile stations can be rapidly deployed to meet demand in regions with limited fixed stations or where infrastructure build-out is still underway. Their ease of installation and relocation makes them appealing for temporary needs such as construction sites, remote transport hubs, or special events. It enables hydrogen providers to test demand patterns before committing to fixed refueling assets.

Fixed hydrogen stations are gaining momentum because they provide reliable, high-capacity refueling infrastructure that supports increasing numbers of fuel cell vehicles and commercial fleets in urban and corridor networks. These permanent sites typically offer greater storage and dispensing capabilities compared with mobile solutions, enabling them to serve high-demand locations where frequent refueling is essential for efficiency and user confidence.

End User Insights

Commercial vehicles segment held the largest revenue share of over 43% in 2025.

Commercial vehicles in the hydrogen fueling station market are gaining ground because heavy-duty trucks, buses, and other fleet vehicles are increasingly adopting fuel cell technology as a solution for long-range zero-emission transport. Hydrogen fuel cell trucks are being deployed in daily service in several regions, especially where long haul distances and heavy payloads make battery solutions less practical, which boosts demand for dedicated hydrogen refueling infrastructure.

Railways are gaining traction because hydrogen fuel cell trains and related rolling stock are being adopted as a cleaner alternative to diesel locomotives, especially on non-electrified routes where full electrification is expensive or operationally challenging. Hydrogen trains emit only water vapor, helping rail operators meet stringent emission reduction goals while improving air quality along key corridors.

Category Insights

Compressed gas station segment held the largest revenue share of over 81% in 2025.

Compressed hydrogen systems use proven high-pressure storage and dispensing equipment that aligns with current fuel cell vehicle requirements, making them a practical choice for early infrastructure roll-out and expanding networks. Compressed hydrogen infrastructure leverages well-understood supply chains and established standards for high-pressure gas handling, developers and fleet operators can deploy stations more quickly and with lower technical risk compared with emerging alternatives.

Liquid hydrogen offers higher volumetric energy density compared with compressed gas, which can make liquid-to-liquid refueling attractive for heavy-duty and long-range vehicle applications where large quantities of fuel must be delivered quickly and efficiently. This efficiency becomes more important as fleets of fuel cell trucks, buses and other large vehicles scale up, requiring fueling solutions that minimize downtime and maximize operational range.

Regional Insights

Asia Pacific held over 60% revenue share of the global hydrogen fueling station market.

The Asia Pacific market is primarily driven by aggressive national strategies aimed at achieving deep decarbonization, particularly in the hard-to-abate transport and industrial sectors. Countries like Japan and South Korea have established themselves as global frontrunners, implementing comprehensive roadmaps with substantial government subsidies and public-private partnerships to build out hydrogen infrastructure. Japan’s strategic vision to become a "hydrogen society" and South Korea’s ambitious targets for fuel cell vehicle (FCV) deployment create a guaranteed demand pull, compelling investments in station networks.

North America Hydrogen Fueling Station Market Trends

In North America, the growth of the market is predominantly driven by a strong policy focus on decarbonizing medium- and heavy-duty transportation, coupled with substantial federal and state-level financial support. California remains a critical early-adopter market, where the Low Carbon Fuel Standard (LCFS) and other incentives create a favorable economic model for station operators. Furthermore, national strategies such as the U.S. National Clean Hydrogen Strategy and Roadmap provide long-term certainty, while Canada's Hydrogen Strategy similarly targets heavy-duty transport corridors, creating a clear demand signal for station deployment along key freight routes.

U.S. Hydrogen Fueling Station Market Trends

In the United States, the growth of the market is fundamentally propelled by unprecedented federal policy support and financial commitment, most notably through the Bipartisan Infrastructure Law's USD 7 billion Hydrogen Hub (H2Hubs) program and the Inflation Reduction Act's (IRA) robust production tax credits (PTCs). These initiatives create a powerful, two-pronged driver: The H2Hubs are designed to build integrated regional ecosystems that link clean hydrogen production to end use consumption, thereby mandating and co-funding associated refueling infrastructure.

Europe Hydrogen Fueling Station Market Trends

In Europe, the growth of the market is decisively driven by the continent's aggressive and legally binding regulatory framework for decarbonization, most notably the European Green Deal and the Fit for 55 package. Key directives such as the Alternative Fuels Infrastructure Regulation (AFIR) mandate the deployment of hydrogen refueling stations along the Trans-European Transport Network (TEN-T), with specific targets for minimum distances between stations for both cars and trucks by 2030. This creates a clear, non-negotiable demand for infrastructure rollout.

Latin America Hydrogen Fueling Station Market Trends

The region's unparalleled potential for cost-competitive green hydrogen production, which serves as the foundational pull for related infrastructure proliferates the market. Countries like Chile, Brazil, and Colombia possess exceptional solar and wind resources, enabling some of the world's lowest projected levelized costs for renewable hydrogen.

Key Hydrogen Fueling Station Company Insights

Some of the key players operating in the global hydrogen fueling station market include Air Liquide, China Petrochemical Corporation, among others.

-

Air Liquide is a world-leading industrial gas company headquartered in France, with a presence in over 70 countries. Founded in 1902, its core business encompasses the production and supply of gases, technologies, and services for a wide range of industries, from healthcare to electronics and heavy industry. In the hydrogen sector, Air Liquide is a fully integrated global player, involved across the entire value chain from low-carbon production (including a significant portfolio of electrolysis projects) to storage, distribution, and end-use applications.

-

China Petrochemical Corporation, known as Sinopec Group, is the world's largest oil refining, chemical, and fuel marketing enterprise by revenue, and a state-owned flagship corporation of China. As a traditional fossil fuel giant, Sinopec is executing a strategic pivot to become China's dominant integrated hydrogen energy company, leveraging its unparalleled existing assets.

Key Hydrogen Fueling Station Companies:

The following are the leading companies in the hydrogen fueling station market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- China Petrochemical Corporation

- H2ENERGY SOLUTIONS LTD

- Cummins Inc.

- Air Products and Chemicals

- FuelCell Energy, Inc.

- ITM Power PLC

- Ballard Power Systems

- NEL ASA

- TotalEnergies

Recent Developments

- In July 2025, WestAir Gases & Equipment and Nikkiso Clean Energy & Industrial Gases Group announced a partnership to build an innovative, multi-use hydrogen fueling station in Long Beach, California. The facility is specifically engineered to bring hydrogen boil-off gas losses-a common inefficiency in storage-close to zero by combining a vehicle dispenser, a trailer filling system, and a dedicated boil-off gas compressor.

Hydrogen Fueling Station Market Report Scope

Report Attribute

Details

Market Definition

The Hydrogen Fueling Station market size represents the global revenue generated from the deployment, installation, and operation of hydrogen refueling stations, including equipment such as compressors, storage tanks, dispensers, and associated control systems, across transportation and industrial end-use applications.

Market size value in 2026

USD 1.23 billion

Revenue forecast in 2033

USD 4.35 billion

Growth rate

CAGR of 19.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in units, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Size, type, mobility, end user, category, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Spain; Italy; Netherlands; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Air Liquide; China Petrochemical Corporation; H2ENERGY SOLUTIONS LTD; Cummins Inc.; Air Products and Chemicals; FuelCell Energy, Inc.; ITM Power PLC; Ballard Power Systems; NEL ASA; TotalEnergies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Fueling Station Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hydrogen fueling station market report based on size, type, mobility, end user, category, and region.

-

Size Outlook (Revenue, USD Million; Volume, Units; 2021 - 2033)

-

Small Station

-

Medium Station

-

Large Station

-

-

Type Outlook (Revenue, USD Million; Volume, Units; 2021 - 2033)

-

On-Site

-

Off-Site

-

-

Mobility Outlook (Revenue, USD Million; Volume, Units, 2021 - 2033)

-

Fixed Hydrogen Station

-

Mobile Hydrogen Station

-

-

End User Outlook (Revenue, USD Million; Volume, Units, 2021 - 2033)

-

Marine

-

Railways

-

Commercial Vehicles

-

Aviation

-

-

Category Outlook (Revenue, USD Million; Volume, Units, 2021 - 2033)

-

Compressed Gas Station

-

Liquid to Gas

-

Liquid to Liquid

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydrogen fueling station market size was estimated at USD 1.00 billion in 2025 and is expected to reach USD 1.23 billion in 2026.

b. The global hydrogen fueling station market is expected to grow at a compound annual growth rate of 19.8% from 2026 to 2033 to reach USD 4.35 billion by 2033.

b. Based on the size segment, medium station held the largest revenue share of more than 54% in 2025.

b. Some of the key players operating in the global hydrogen fueling station market include Air Liquide, China Petrochemical Corporation, H2ENERGY SOLUTIONS LTD, Cummins Inc., Air Products and Chemicals, FuelCell Energy, Inc., ITM Power PLC, Ballard Power Systems, NEL ASA, TotalEnergies, and others.

b. The hydrogen fueling station market is primarily driven by growing demand for zero emission mobility, supported by the rapid adoption of fuel cell electric vehicles, government led decarbonization targets, expansion of hydrogen infrastructure programs, and increasing investments from energy companies and public private partnerships.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.