- Home

- »

- Communications Infrastructure

- »

-

Hybrid Fiber Optic Connectors Market Share Report, 2030GVR Report cover

![Hybrid Fiber Optic Connectors Market Size, Share & Trends Report]()

Hybrid Fiber Optic Connectors Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Telecom, Oil & Gas, Military & Aerospace), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-1-68038-675-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Summary

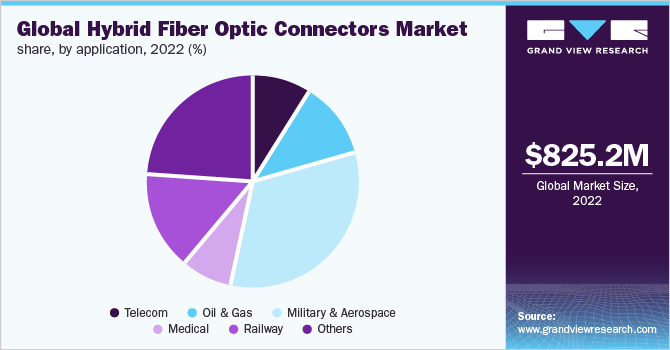

The global hybrid fiber optic connectors market size was valued at USD 825.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The need for enhanced optical performance and additional attributes, including operating conditions, mechanical and environmental constraints, reliability requirements, and maintenance plans, are expected to propel the market demand over the next few years. For instance, in September 2022, Molex LLC, a U.S.-based consumer electronics company, released ELSIS (External Laser Source Interconnect System), a hybrid optical-electrical interconnects and cage system that is a pluggable module solution for co-packaged optics. Hybrid fiber optic connectors can be incorporated into various applications that demand precise and rugged products. Moreover, geophysical, aerospace, tactical, and shipboard applications, among others present taxing environments, and hence there is a rise in the use of hybrid fiber optic connectors.

Expanded beam is a frequently used technology in harsh environments with fiber optic connectivity and offers lesser susceptibility and more ease in cleaning small particles of dirt and dust than physical contact connectors. For instance, in October 2020, DIAMOND SA, a Swiss manufacturer of optical components, announced the launch of an expanded beam (X-Beam) connector which allows reliable and low-maintenance optical connections to be resistant to water, dirt, and extreme weather conditions.

Modern hybrid connectors are manufactured to withstand extreme climatic conditions, twists, strong cable pulls and stretches, and water immersion, which is responsible for the growth of the hybrid fiber optic connector market over the forecast period. The technology is in high demand across oil & gas, railways, and military & aerospace applications due to various features, such as aluminum fabrication in consort with custom anodized finishing and stainless steel constructions. These connectors are primarily used in harsh environments because they are resistant to dirt or dust, chemicals, submersion, vibration, and humidity. Moreover, the sustained rise in technological development and integration of modern manufacturing practices is expected to increase demand for the incorporation of hybrid technology

Multiple mergers & acquisitions have been carried out by the benefactors of fiber optic component and network service provision vendors, which helps them access numerous technological patents to enhance their service portfolios. For instance, in December 2021, Amphenol Corporation, a U.S.-based electronic connector manufacturing company, announced the acquisition of Halo Technology Limited, a manufacturer of fiber optic interconnects devices, for approximately $715 million. The initiative aims to enhance Amphenol Corporation's fiber optic offering to IT and data communications, mobile networks, and broadband customers by using Halo's high-technology products.

Application Insights

The military & aerospace segment dominated the market with a revenue share of 33.4% in 2022. Hybrid connectors are designed to ensure the highest possible performance across interconnection applications in extreme environmental conditions, and their specialty is performing reliably and efficiently in rugged conditions such as shocks, vibrations, and extreme temperatures, which propels the growth of the military & aerospace segment. For instance, in January 2021, Bel Fuse Inc., an electronic connector manufacturing company, acquired RMS Connectors, Inc., a subsidiary of Cretex Companies, Inc., that manufactures harsh environment connectors mainly used in the military and aerospace industry. This acquisition would bolster Bel Fuse Inc.’s income and production capacity.

The increasing demand for fiber optic components in telecom sectors for application in dynamic forms such as distribution cables, high-density interconnect cables, trunk cable forms, and standard patch cords are attributed to the telecom segment's growth. Moreover, hybrid fiber optic connectors serve as a medium to cope with insertion loss, return loss, and back reflection, and reduce issues such as any signal loss or bonding of cable. In the telecom industry, hybrid fiber optic connectors carry numerous services, including digital TV, analog TV, telephony, video on demand, and others. Hybrid fiber optic connectors are also gaining popularity in the oil and gas industry because they help in obtaining crucial data about machinery and equipment performance, oil reserve levels, and environmental conditions. The industrial, automotive, and railway application segments are anticipated to witness significant growth, attributable to their growing adoption in dynamic manufacturing and material sensing based application-grounds. Additionally, these end-use industries also demand the interconnection of systems, to operate efficiently in rugged environments, and are keenly adopting hybrid connectors and adapters.

Regional Insights

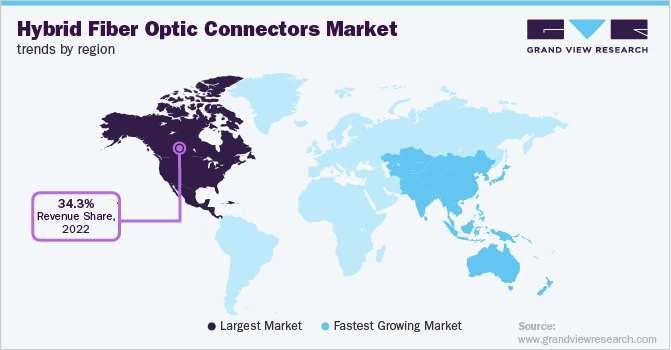

North America dominated the market with a revenue share of 34.3% in 2022. The increasing expenses on high data rate telecommunications technology, such as point-to-point and passive optical networks, have increased the demand for hybrid fiber optic connectors in the U.S., which is responsible for driving the market in the North American region. Moreover, the manufacturers in the region are capitalizing on supplemental efforts and emphasizing delivering a quality product that is durable, reliable, and capable of more processing with consistent throughput. For instance, in April 2021, Amphenol Corporation, a U.S.-based electronic connector manufacturing company, acquired MTS Systems Corporation, a supplier of test systems and industrial position sensors. This acquisition aims to strengthen Amphenol Corporation sensors' product portfolio. The increased deployment of data centers in this region is propelling the hybrid fiber optic connectors market forward. Furthermore, data centers require high data bandwidth to transmit large amounts of data over long distances, which is driving up demand for hybrid fiber optic connectors for use in data centers.

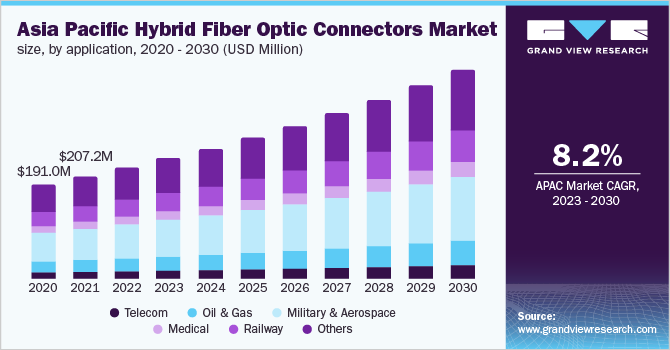

The Asia Pacific regional market is expected to be the fastest-growing market, owing to the rapid improvements in manufacturing practices and infrastructure development activities, which have contributed to the swift uptake of hybrid fiber optic technology in end-use industries such as automotive and railway sectors. Emerging economies in the Asia Pacific, such as China and India, are investing significantly in developing aerospace and defense capabilities responsible for the growth of hybrid optic fiber connectors in this region. Subsequently, Asia Pacific is anticipated to hold substantial potential for the extensive adoption of expanded beam connectors. The growing use of hybrid fiber optics in broadband connection will potentially increase in countries such as Japan, China, and India. Moreover, the existence of sustainable growth prospects supported by increased broadband users is one of the primary reasons for the region's increased demand for hybrid fiber optic connectors.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaborations among the key players. For instance, in March 2021, Bel Fuse Inc., an electronic connector manufacturing company, acquired EOS Power India Pvt. Ltd for USD 7 million cash from funds on hand. This acquisition is intended to expand Bel Fuse Inc.'s offerings in industrial and medical markets. Some of the prominent players in the Hybrid Fiber Optic Connectors market include:

-

Amphenol Corporation

-

Bel Fuse Inc.

-

Canare

-

Diamond SA

-

Fischer Connectors SA

-

Glenair

-

Hirose Electric Co., Ltd.

-

ITT INC

-

LEMO

-

Molex, LLC

-

OPTICAL CABLE CORPORATION (OCC)

-

ODU GmbH & Co.KG

-

QPC FIBER OPTIC, LLC

-

Smiths Interconnect

-

Souriau

-

Stäubli International AG

-

Stran Technologies

-

TE Connectivity

-

Teledyne Defense Electronics

-

TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

-

X-BEAM TECH CO, LTD

Hybrid Fiber Optic Connectors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 882.2 million

Revenue forecast in 2030

USD 1,400.3 million

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

Amphenol Corporation; Bel Fuse Inc.; Canare; Diamond SA; Fischer Connectors SA; Glenair; Hirose Electric Co., Ltd.; ITT INC; LEMO; Molex LLC; OPTICAL CABLE CORPORATION (OCC); ODU GmbH & Co.KG; QPC FIBER OPTIC, LLC; Smiths Interconnect; Souriau; Stäubli International AG; Stran Technologies; TE Connectivity; Teledyne Defense Electronics; TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION; X-BEAM TECH CO, LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

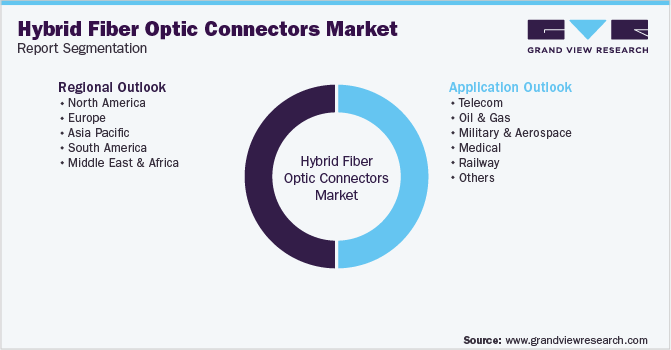

Global Hybrid Fiber Optic Connectors Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid fiber optic connectors market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global hybrid fiber optic connectors market size was estimated at USD 825.2 million in 2022 and is expected to reach USD 882.2 million in 2023.

b. The global hybrid fiber optic connectors market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 1,400.3 million by 2030.

b. North America dominated the hybrid fiber optic connectors market with a share of 34.3% in 2022. This is attributable to the strong technical adoption base, the presence of leading players in the region, and as a result of the availability of high government funding in the region.

b. Some key players operating in the hybrid fiber optic connectors market include Amphenol Corporation; Diamond SA; Hirose Electric Company; LEMO; and QPC Fiber Optic, LLC.

b. Key factors that are driving the market growth include growing demand from military; railway, and oil & gas industries, the ability of hybrid connectors to function in harsh environments; and rising government funding and active involvement in industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.