- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid Raw Material Market, Industry Report, 2033GVR Report cover

![Hyaluronic Acid Raw Material Market Size, Share & Trends Report]()

Hyaluronic Acid Raw Material Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Pharmaceutical & Medical, Cosmetic & Aesthetic, Nutraceutical & Food Supplement), By Source (Non-animal, Animal), By Grade (Cosmetic Grade, Food Grade), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-431-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyaluronic Acid Raw Material Market Summary

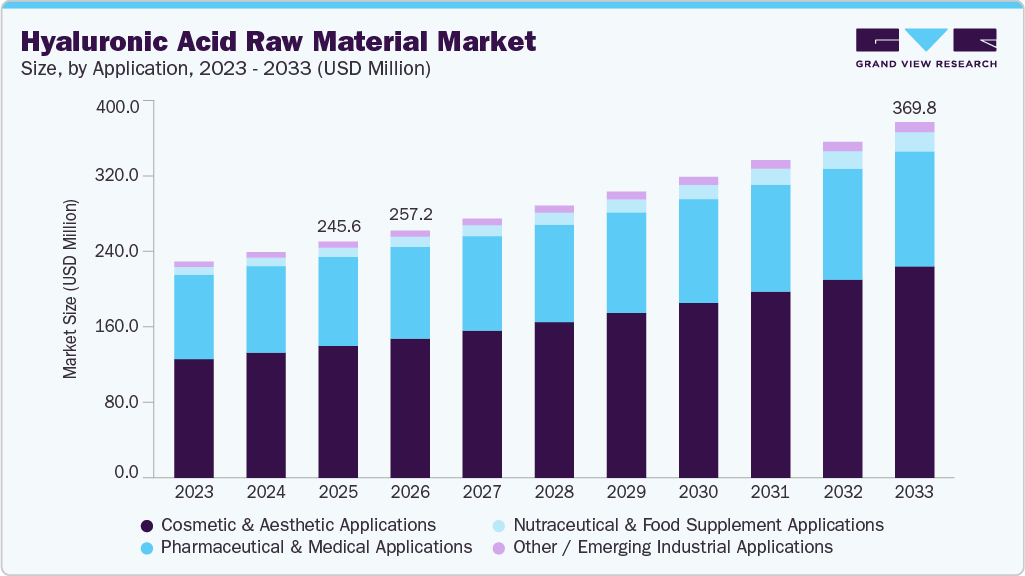

The global hyaluronic acid raw material market size was estimated at USD 245.62 million in 2025 and is projected to reach USD 369.79 million by 2033, growing at a CAGR of 5.25% from 2026 to 2033. This growth is driven by the increasing demand for hyaluronic acid (HA) in medical aesthetics and pharmaceutical & orthopedic applications.

Key Market Trends & Insights

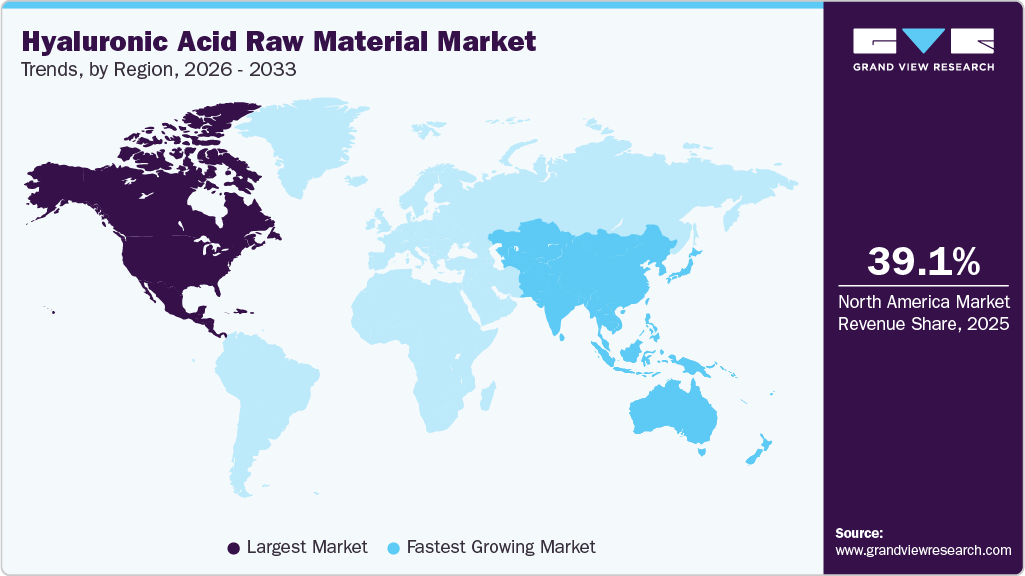

- North America dominated the global market with a revenue share of 39.07% in 2025.

- The U.S. hyaluronic acid raw material market is experiencing strong growth driven by innovation across science, healthcare, and wellness sectors.

- By application, the cosmetic & aesthetic applications segment dominated the market with a share of 55.87% in 2025.

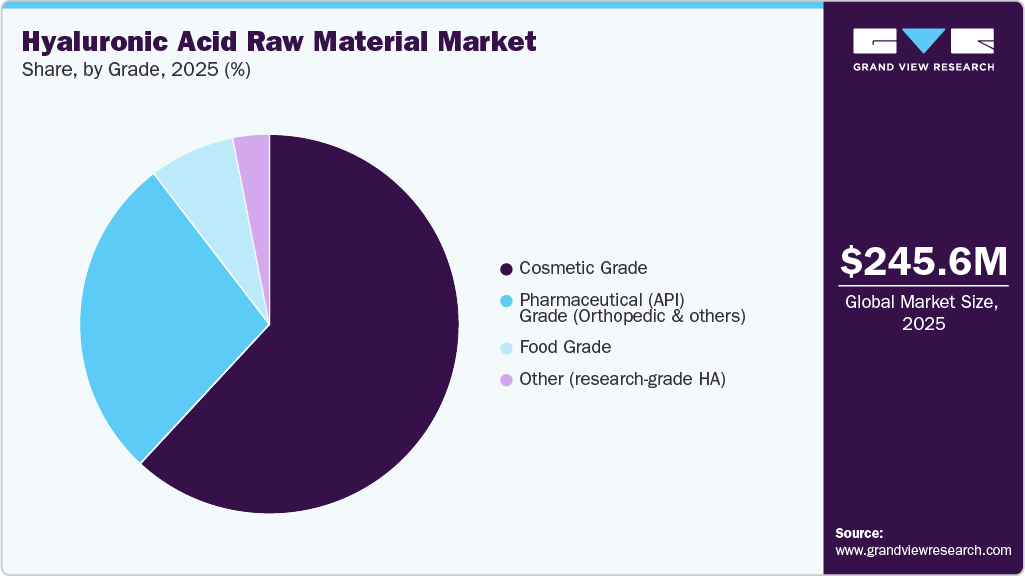

- By grade, the cosmetic grade segment held the largest market share of 61.91% in 2025.

- By source, the non-animal hyaluronic acid segment dominated the market in 2025 and is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 245.62 Million

- 2033 Projected Market Size: USD 369.79 Million

- CAGR (2026-2033): 5.25%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The global hyaluronic acid raw material industry is experiencing significant growth, primarily driven by the increasing demand for aesthetic treatments and dermal fillers. According to a report from the American Society for Aesthetic Plastic Surgery, in March 2024, the number of non-surgical aesthetic procedures has increased, with dermal fillers accounting for a significant share of this growth.

Hyaluronic acid is a key ingredient in these fillers, used for anti-aging, lip enhancement, facial contouring, and wrinkle treatment. This rise is attributed to changing consumer attitudes towards cosmetic procedures and a growing acceptance of such treatments. The increasing number of aesthetic procedures, particularly among younger populations seeking preventive treatments, is contributing to the growing demand for high-quality, injectable-grade hyaluronic acid. Additionally, the increasing disposable income in regions such as the Asia Pacific, particularly in countries like South Korea and China, is further driving demand, as more individuals seek minimally invasive aesthetic treatments.

In parallel, hyaluronic acid is experiencing increased use in medical and therapeutic applications, further contributing to the market's expansion. A study published in the Journal of Orthopedic Research in September 2023 reported that the global market for HA-based viscosupplements for osteoarthritis treatment is growing steadily. Hyaluronic acid is also widely used in ophthalmology for cataract surgeries. According to the American Academy of Ophthalmology Dry Eye Syndrome Preferred Practice Pattern, conservative management of dry eye includes use of artificial tears and ocular lubricants-many of which contain hyaluronic acid/sodium hyaluronate-reflecting HA’s widespread role in clinical dry eye therapy.

Additionally, HA-based hydrogels and patches are increasingly used in wound care for chronic wounds, burns, and surgical incisions. According to the World Health Organization article published in September 2025, noncommunicable diseases (NCDs) such as diabetes, cardiovascular diseases, and chronic respiratory conditions continue to impose a major and growing global health burden, accounting for the majority of deaths worldwide. Diabetes prevalence, for example, rose from an estimated 200 million in 1990 to around 830 million in 2022, with the number of affected individuals increasing most rapidly in low‑ and middle‑income countries, highlighting the increasing clinical demand for related therapeutic and wound‑care interventions, further driving the need for hyaluronic acid in therapeutic and wound-care applications. This diversification of HA’s use across multiple medical disciplines strengthens its position as a key material in the healthcare sector.

The cosmetics and personal care sector also remains a major driver for HA demand, with the ingredient being widely incorporated into skincare products due to its hydrating properties. This growth is driven by increasing consumer interest in skincare products, ranging from serums and creams to masks and hybrid formulations. Interest in oral hyaluronic acid supplementation for skin health has increased in recent years, with clinical research and meta‑analyses indicating potential benefits for skin hydration and elasticity. Randomized controlled trials have shown that oral HA intake can significantly enhance skin hydration and appearance, supporting its inclusion in anti‑aging and cosmetic nutraceutical regimens. As e-commerce continues to grow and cross-border beauty trends gain traction, the global demand for HA in both topical and ingestible products is expected to continue, further contributing to the expansion of the HA raw material market.

Opportunity Analysis

The expanding clinical applications of hyaluronic acid in ophthalmology and eye health represent a significant opportunity for HA raw material suppliers. According to a clinical review in Frontiers in Ophthalmology, hyaluronic acid eye drops and ophthalmic formulations are widely used to treat dry eye disease, improving tear film stability and corneal lubrication, with studies demonstrating effectiveness across multiple patient groups. In one recent clinical evaluation published in March 2025, high‑molecular‑weight HA eye drops were shown to support the recovery of corneal nerves and maintain ocular surface moisture in patients with dry eyes, indicating potential for broader therapeutic use in ophthalmic care. Given that dry eye disease affects hundreds of millions of individuals globally, with a prevalence range of 5-50% in epidemiological studies, the sustained and growing need for HA‑based ocular products underscores a developing segment for high‑quality HA raw materials in both optimized formulations and emerging ophthalmic delivery systems.

Another emerging opportunity lies in the use of hyaluronic acid in regenerative medicine and tissue repair, extending beyond traditional cosmetic and joint applications. A review of HA-based biomaterials highlights ongoing research into HA hydrogels that support tissue regeneration, wound healing, and the management of chronic inflammatory conditions, with HA hydrogels demonstrating the capability to modulate inflammatory responses, improve angiogenesis, and facilitate extracellular matrix remodeling in wound environments. The biomedical properties of hyaluronic acid are being explored not only for conventional wound care but also in advanced applications, such as scaffolds for tissue engineering and drug delivery systems, thereby expanding the potential use cases for HA derivatives in clinical settings. As research continues to validate these functions, HA suppliers can explore partnerships with biomedical developers to supply raw materials tailored for regenerative and therapeutic formulations, offering differentiation from commodity HA grades and supporting broader adoption in medical device and advanced therapy sectors.

Market Concentration & Characteristics

The hyaluronic acid raw material market is characterized by a moderately fragmented supply base, with production primarily sourced from microbial fermentation and limited animal-derived sources. According to market segmentation data, microbial fermentation accounts for the majority of global HA raw material production, owing to its better control of molecular weight and standardized output. In contrast, the animal-derived supply remains less dominant due to variability in yield and ethical concerns. Fermentation‑based sourcing is increasingly preferred for pharmaceutical and cosmetic applications, reflecting a shift in supply dynamics and a broader range of producer participation across regions. This diversified input structure results in a market where no single supplier dominates globally, but where specialization and quality differentiation increasingly shape competitive positioning.

Innovation in hyaluronic acid raw materials is largely driven by improvements in production technology and formulation developments, rather than by new raw material chemistries. Microbial fermentation methods, including the use of bacterial strains such as Streptococcus zooepidemicus, remain the predominant production technology because they enable consistent molecular-weight control and scalable, high-purity outputs suitable for medical and cosmetic applications. These advancements support downstream innovation such as tailored molecular weights for specific applications, cross‑linked products for extended performance, and controlled rheological properties for injectables. The evolution of production technology enhances the functional utility of HA raw materials in both clinical and consumer sectors.

The complexity of production processes and quality requirements influences barriers to entry in the hyaluronic acid raw material industry. High-purity HA, particularly for injectable and medical applications, requires controlled fermentation, downstream purification systems, and stringent process controls to achieve consistent molecular profiles and low levels of contaminants. New entrants must establish bioprocess capabilities that meet industry standards to be competitive. Additionally, upstream investments in fermentation infrastructure, quality assurance, and stable raw material supply chains constrain entry by smaller producers, reinforcing the importance of technical competence in scalable production.

Regulatory frameworks significantly shape the hyaluronic acid raw material market by enforcing safety, purity, and classification standards that vary with end‑use application. In many regions, HA used for injectable, ophthalmic, or medical purposes is subject to rigorous regulatory scrutiny that influences production parameters and documentation requirements. Regulatory oversight covers microbial production practices, contaminant limits, and traceability to ensure compliance with health and safety guidelines. These regulatory expectations increase compliance efforts for manufacturers and can influence the pace at which new producers and new grades of HA enter specific therapeutic segments.

Source substitution in the hyaluronic acid raw material industry reflects a transition from animal-derived to fermentation-derived HA, driven by concerns over supply consistency, safety, and ethical considerations. Traditional animal-derived HA, historically extracted from tissues such as rooster combs, has seen a reduced prominence due to variable yields and contamination risks. Microbial fermentation techniques address these challenges by offering scalable production that aligns with quality and regulatory expectations for many medical and cosmetic applications. This trend toward microbial sources represents a form of substitution that supports broader adoption of HA in regulated sectors.

The geographical expansion of the hyaluronic acid raw material market is evident, as producers and end-users alike seek growth beyond traditional Western markets into the Asia Pacific and other emerging regions. The regional adoption of HA in aesthetic medicine, skincare, and medical therapeutics continues to rise, particularly in markets with growing middle-class demand and expanding healthcare infrastructure. Producers are aligning their capacity and distribution to meet this diversified regional demand, with fermentation-based producers scaling their operations to serve multiple continents efficiently. This geographic extension supports broader availability of hyaluronic acid raw materials while also adapting to local regulatory and quality requirements.

Application Insights

The cosmetic & aesthetic applications segment dominated the hyaluronic acid raw material market with a revenue share of 55.87% in 2025, due to the widespread use of hyaluronic acid in dermal fillers, anti-aging skincare formulations, moisturizing products, and minimally invasive aesthetic procedures. Growth in consumer spending on appearance-enhancement treatments, the rising adoption of HA-based injectable products in dermatology clinics, and the increasing availability of advanced formulations, such as cross-linked HA, also supported the segment’s leading position. The cosmetic care market has continued to evolve with the introduction of newer HA-based serums, lotions, and moisturizers that aim to offer improved skin hydration, anti-aging benefits, and an enhanced skin feel. A review published in 2025 in the Journal of Dermatology & Cosmetology titled “Hyaluronic acid in modern Cosmeceuticals: a review of skin health and anti‑aging innovations” discusses HA’s wide‑ranging roles in skin health and anti‑aging applications. The authors note that HA has emerged as a pivotal bioactive ingredient in modern cosmeceuticals due to its remarkable hydrophilicity, biocompatibility, and multifunctional dermatological benefits, including skin hydration, repair, and anti‑aging effects.

Nutraceutical & food supplement applications is the fastest-growing segment in the hyaluronic acid raw material industry. Recent product and regulatory activity have reinforced the nutraceutical positioning of HA. In July 2025, Bioiberica published clinical data for its Dermial HA matrix ingredient, which showed improvements in skin hydration and wrinkle reduction after 12 weeks in a controlled study, further supporting its use as a “beauty-from-within” nutricosmetic. At the same time, manufacturers are introducing oral HA blends that combine HA with collagen, vitamin C, or glucosamine to address both skin and joint health. Several ongoing clinical trials registered on ClinicalTrials.gov are evaluating combination nutraceuticals containing HA for joint symptoms and skin parameters. These new product launches and clinical investigations reflect the growing commercial adoption of oral hyaluronic acid in supplement portfolios.

Source Insights

The non-animal hyaluronic acid segment dominated the market in 2025 and is expected to grow at the fastest CAGR over the forecast period. It is primarily produced through microbial fermentation and alternative bio-extraction. It has emerged as the dominant source for medical, cosmetic, and nutraceutical applications due to its alignment with modern requirements for purity, traceability, and sustainability. As regulatory frameworks tighten and consumer preferences shift toward products with verifiable safety profiles, the demand for non-animal HA continues to grow. Microbial fermentation and strain engineering, as highlighted in a 2024 review published in Fermentation (MDPI), have become integral to commercial hyaluronic acid production, enabling suppliers to meet the increased demand for high-quality HA that is both scalable and customizable to various application needs.

Recent advancements in non-animal HA production emphasize precision fermentation, improved strain engineering, and environmentally efficient processing. Givaudan Active Beauty’s launch of PrimalHyal 50 Life in January 2024, a low-molecular-weight HA ingredient with a reduced environmental footprint, underscores the industry's shift toward sustainable practices. This was followed by the introduction of PrimalHyal UltraReverse in April 2025, an ultra-low-molecular-weight HA for topical use, reflecting a trend toward highly defined, application-specific HA grades for cosmetics and personal care products. Additionally, technical studies, including a 2024 study on enhanced HA production from the bacterial strain Priestia flexa, demonstrate the industry's focus on improving fermentation platforms and tailoring hyaluronic acid molecular weights to meet diverse market demands, further bolstering the rapid growth of non-animal-derived HA.

Grade Insights

The cosmetic-grade segment dominated the hyaluronic acid raw material market, accounting for a revenue share of 61.91% in 2025. This is due to the fact that cosmetic-grade hyaluronic acid remains a key ingredient in skincare products, such as creams, serums, and moisturizers, driven by strong consumer demand for hydration and skin-quality benefits. According to the International Society of Aesthetic Plastic Surgery, approximately 34.9 million aesthetic procedures were performed worldwide in 2023, supporting ongoing demand for topical HA. Product innovations, such as Givaudan Active Beauty's launch of PrimalHyal 50 Life in 2024 and PrimalHyal UltraReverse in 2025, highlight a focus on sustainable, low-molecular-weight HA for targeted topical delivery. Clinical studies further confirm the efficacy of hyaluronic acid in enhancing hydration, improving skin texture, and reducing fine lines, thereby solidifying its position in the personal care industry.

The pharmaceutical (API) grade hyaluronic acid segment is the fastest-growing segment in the hyaluronic acid raw material market, driven by its crucial role in orthopedics and the expanding therapeutic applications. Beyond its well-established use in knee osteoarthritis viscosupplementation, recent studies, such as those published in the European Journal of Orthopaedic Surgery & Traumatology and Biomedicines, show that HA injections benefit hip osteoarthritis and support bone regeneration when combined with scaffolds or cell therapies. The growing need for hyaluronic acid in orthopedic meshes, injectable depots, and HA-coated implants for tissue integration further fuels demand. Investments in GMP manufacturing, like Lifecore Biomedical's recent capacity expansions, underscore the rising need for high-quality, modification-ready HA for orthopedic APIs and biologic combination products.

Regional Insights

North America dominated the global market with a revenue share of 39.07% in 2025. The North America hyaluronic acid raw material market continued to expand, driven by scientific innovations, clinical advancements, and rising consumer awareness in the United States, Canada, and Mexico. In the U.S., the increasing demand for refined HA inputs was highlighted by progress in aesthetic and dermatological treatments. A key example came in July 2024 when Allure reported that the injectable treatment Skinvive had received FDA approval in May 2023. Clinical results showed a 63% patient satisfaction rate at six months, reflecting the growing use of specialized HA grades in aesthetic procedures, ophthalmology, tissue repair, and regenerative medicine.

U.S. Hyaluronic Acid Raw Material Market Trends

The U.S. hyaluronic acid raw material market is experiencing strong growth driven by innovation across science, healthcare, and wellness sectors. Research institutions, biotechnology firms, and advanced manufacturers are increasingly recognizing hyaluronic acid for its versatility in moisture management, tissue compatibility, and structural flexibility. The country’s shift toward personalized care and evidence-based formulations has led to greater adoption of more refined, functionally precise HA grades. A prime example is the approval of the injectable treatment Skinvive by the U.S. Food and Drug Administration in May 2023, with clinical outcomes showing a 63% patient satisfaction rate and a 49% increase in aquaporin 3. This highlights the growing demand for specialized HA inputs in clinical and cosmetic applications.

The U.S. market continues to expand as healthcare providers increasingly adopt HA-enriched formulations in ophthalmic procedures, regenerative medicine, and soft tissue management. The clinical success of products like Skinvive reinforces the need for HA materials with stability, uniformity, and biocompatibility. U.S. research centers are working to refine HA-based technologies to meet specialty requirements, collaborating with raw material suppliers to design compositions for orthopedic, dermatological, and regenerative applications. On the consumer side, increasing awareness of HA’s benefits has driven demand in skincare products and wellness supplements, encouraging growth in both food-grade and specialty hyaluronic acid varieties. Digital platforms, professional advisors, and social media influencers continue to promote HA’s functional benefits, solidifying the U.S. as a rapidly evolving and high-demand market for HA raw materials.

The Canada hyaluronic acid raw material market saw a rising demand as clinicians and brands focused on evidence-supported product performance. Notably, in May 2023, Galderma introduced Restylane EYELIGHT, which achieved 84% patient satisfaction after 12 months, reinforcing the confidence in HA-based injectables. This growth also extended to joint wellness and ophthalmology. In Mexico, aesthetic procedures experienced significant growth, with the ISAPS Global Survey 2022 and 2023 reporting approximately 197,441 HA injectable procedures, accounting for 26.1% of non-surgical treatments. By 2023, the total number of aesthetic procedures in Mexico had risen to 1.7 million, driven by the widespread adoption of HA fillers, skincare products, wellness supplements, and medical formulations for hydration and tissue support. This momentum confirmed the region’s growing reliance on HA-based treatments across clinical and consumer sectors.

Europe Hyaluronic Acid Raw Material Market Trends

Europe is experiencing steady growth in demand for hyaluronic acid raw materials as consumers increasingly prioritize scientifically validated hydration, barrier reinforcement, and long-term comfort. Beauty brands across the region are integrating high-purity cosmetic-grade HA into serums, moisturizers, and dermocosmetic formulations to meet the demand for visible, yet gentle, performance. This trend is reflected in product innovations, such as UKLASH's launch of its Vitamin C & HA Eye Serum in February 2025, which highlights the growing reliance on hyaluronic acid in daily beauty routines. In Germany, BioScience GmbH reinforced Europe’s science-driven approach by announcing a CE mark extension for its complete HA filler portfolio in October 2025, following a one-year evaluation involving 70 patients. Regulatory tightening further influenced the market, with France introducing a prescription requirement for injectable HA and Spain withdrawing improperly marketed HA products.

Europe's medical and therapeutic sectors have also expanded the adoption of HA, alongside stricter regulatory oversight. HA-based formulations are increasingly used by dermatologists, ophthalmologists, orthopedic teams, and regenerative medicine specialists to enhance procedural comfort and improve recovery outcomes. In Italy, the launch of Profhilo Structura by IBSA Italy in October 2024, developed using the patented NAHYCO process, underscored Europe’s leadership in HA-based regenerative aesthetics. Similarly, FarmaImpresa’s MDR certification for its high-molecular-weight HA intra-articular products in July 2023 highlighted the growing demand for medical-grade HA. In Northern Europe, studies such as the one from Aarhus University in Denmark, which show significant improvements in chondrocyte binding with HA-chitosan hydrogels, further demonstrate HA's expanding potential in regenerative medicine and controlled drug delivery. Across Central and Northern Europe, countries such as Sweden, Norway, and Poland are driving the use of HA in dermatology, ophthalmology, and aesthetic treatments, thereby solidifying Europe's position as a leader in the global HA raw material market.

The UK hyaluronic acid raw material market is experiencing steady growth, driven by investments in scientific advancements, personalized wellness, and sophisticated beauty formulations. UK consumers are increasingly receptive to ingredients backed by research, prompting brands to prioritize hyaluronic acid for enhanced hydration, refined texture, and improved surface comfort. Many local companies are developing skincare routines that combine botanical elements with clinically validated actives, making HA a key component in their product lines. For example, in February 2025, CEW UK reported the launch of UKLASH’s UKSKIN Vitamin C & Hyaluronic Acid Eye Serum, designed to restore radiance and smooth fine lines, illustrating the growing reliance on HA in consumer skincare.

Medical specialists in the UK are also embracing HA-enriched formulations, as the success of products like the UKSKIN Eye Serum enhances public trust in HA’s performance. Eye care professionals use HA-based solutions for clarity and comfort during delicate procedures, while orthopedic teams seek controlled HA formulations to support joint mobility. Researchers are exploring HA structures that improve compatibility with tissue environments, advancing the development of next-generation therapeutic materials. As consumer-driven breakthroughs highlight HA’s versatility and safety, medical practitioners are increasingly focused on sourcing high-quality raw materials that meet both clinical and patient-driven expectations. This evolving landscape underscores the UK's growing commitment to HA-based solutions in both aesthetic and therapeutic fields.

The hyaluronic acid raw material market in Germany is experiencing steady growth in the demand for hyaluronic acid raw materials, driven by its culture of precision science and responsible product development in both medical and consumer markets. The country’s longstanding commitment to quality motivates companies to select hyaluronic acid ingredients that adhere to stringent production and performance standards. German consumers are increasingly seeking skincare and wellness products that enhance moisture retention, improve surface resilience, and promote overall skin comfort. This demand encourages manufacturers to use advanced HA grades, reflecting the country's emphasis on high-quality, performance-driven solutions. A key example is BioScience GmbH’s receipt of a CE-mark extension in October 2025 for its complete HA filler portfolio, which included dermal fillers for new applications such as the buttocks, hands, and calves, demonstrating Germany's leadership in clinically validated HA technologies.

Healthcare institutions across Germany mirror this trend of scientific precision and regulatory rigor. Eye care specialists rely on HA-enriched solutions for stable performance and safe interaction with delicate tissues. Likewise, soft tissue management specialists are expanding the use of refined hyaluronic acid compositions, as seen in the one-year clinical evaluation of BioScience GmbH’s HA fillers, which confirmed broader procedural applications. Academic research groups are also focused on refining HA’s molecular structure to enhance its therapeutic effectiveness, ensuring that HA raw materials meet the rigorous demands of Germany's healthcare sector. These advancements, combined with innovation in product formulations, continue to drive the demand for consistently processed, medical-grade hyaluronic acid in the country.

Asia Pacific Hyaluronic Acid Raw Material Market Trends

The Asia Pacific hyaluronic acid raw material industry is experiencing robust growth, driven by aging populations, scientific advancements, and evolving beauty cultures across key markets such as Japan, China, and India. As demographic shifts continue, the need for HA-based solutions is on the rise. In 2024, Japan recorded 36.25 million people aged 65+, China reached nearly 297 million people aged 60+ in 2023, and India had 149 million seniors in 2023, all contributing to increased demand for HA in hydration-focused skincare, joint-support therapies, ophthalmic lubricants, and moisture-restoring treatments. Hyaluronic acid aligns well with regional preferences for gentle, effective, and research-backed formulations, making it widely used in serums, creams, dermocosmetics, and wellness products across the region.

Clinical and medical adoption further strengthens Asia Pacific’s reliance on hyaluronic acid raw materials. Japan and China are expanding the use of HA across ophthalmology, dermatology, tissue repair, and regenerative medicine, supported by institutional growth, such as China’s establishment of 7,881 integrated medical and elderly-care centers in 2023. India’s evolving healthcare ecosystem is increasingly incorporating hyaluronic acid into dermatology, orthopedics, and ophthalmology procedures to address the needs of the aging population. Australia also adds momentum with a well-established aesthetic-medicine sector and strong usage of hyaluronic acid-based dermal fillers, viscosupplementation products, and ophthalmic treatments. As consumer habits shift, regional beauty and wellness brands prioritize high-quality, stable, and clinically compliant HA, positioning Asia Pacific as one of the fastest-growing and most dynamic markets for HA raw materials.

The Japan hyaluronic acid raw material market is expected to grow, as the country continues to witness a rising application of hyaluronic acid (HA) raw materials, driven by the country's embrace of advanced beauty science, specialized healthcare, and refined wellness traditions. Japanese consumers value products offering gentle effectiveness, subtle refinement, and long-term comfort, which makes HA-based formulations a natural fit. In September 2024, Al Jazeera reported that Japan's population aged 65 or older had reached a record high of 36.25 million people, accounting for 29.3% of the total population. This demographic shift is fueling increased demand for HA-based skincare and moisture-restoring products. Given Japan's climate, which often brings dry indoor air during colder seasons, beauty companies are incorporating HA into lotions, lightweight serums, and restorative essences that align with Japan’s preference for elegant and calming textures.

Medical practice in Japan is also contributing to the growing demand for HA, particularly in areas where precision, clarity, and tissue support are essential. Eye-care specialists frequently use HA-enriched solutions to improve comfort and support healing after procedures, while research groups are investigating HA’s role in maintaining cellular balance and controlled hydration in clinical environments. With Japan's aging population creating heightened needs for joint-support therapies, ophthalmic lubricants, and regenerative medicine, medical-grade HA is increasingly relied upon. This growing medical adoption, combined with high standards for purity and consistency, is strengthening the healthcare sector’s demand for reliable HA raw materials, ensuring Japan’s role as a significant market for HA across both consumer and clinical applications.

The hyaluronic acid raw material market in China has become one of the most significant markets in the Asia Pacific, driven by rapid economic growth, increasing consumer sophistication, and a thriving manufacturing ecosystem. As of October 2024, Xinhua reported that China’s population aged 60 and above had reached nearly 297 million, accounting for 21.1% of the total population, with 216.76 million aged 65 and above. This demographic shift has significantly increased the demand for moisture-retaining and skin-supportive ingredients, driving the use of hyaluronic acid in domestic skincare formulations. As Chinese beauty brands continue to innovate with textures and hydrating formats preferred by local consumers, HA remains central to product development and ingredient sourcing.

Within China’s medical community, hyaluronic acid (HA) is gaining traction as healthcare institutions explore its benefits in ophthalmology, dermatology, and tissue-related medicine. In October 2024, Xinhua reported that China had established 7,881 integrated medical and elderly care institutions in 2023, marking a 12.8% year-over-year increase. Additionally, 3,476 convenient living circles across 150 pilot regions served 64.55 million elderly residents, further expanding the clinical demand for age-related treatments incorporating HA, such as ophthalmic lubricants, wound-healing gels, and joint-support therapies. As research universities continue to study HA's behavior in biological systems, the demand for consistent, medical-grade hyaluronic acid grows. Consumer behavior also supports this market, with increasing participation in the pension system and growing interest in wellness, hydration, and anti-aging solutions, driving further demand for HA-enriched skincare and supplements across the country.

Latin America Hyaluronic Acid Raw Material Market Trends

The Latin America hyaluronic acid (HA) raw material market is steadily expanding, driven by demographic shifts, a growing aesthetic culture, and advanced beauty practices. Brazil plays a central role in this growth, supported by its aging population. In December 2023, IBGE reported that Brazil’s elderly population aged 65+ grew by 57.4% from 14.1 million in 2010 to 22.2 million in 2022, now representing 10.9% of the population. This increase in older adults has spurred demand for HA-based moisturizers, serums, ophthalmic lubricants, joint-support injectables, and moisture-restoring treatments. In Argentina, the high rate of cosmetic interventions further boosts demand, with ISAPS data from May 2024 noting 8.81 cosmetic procedures per 1,000 people, including a significant number of non-surgical HA-based procedures.

The region’s expanding medical-aesthetic sector strengthens demand for pharmaceutical-grade and injectable-grade HA. In Brazil, major cities such as São Paulo and Rio de Janeiro are experiencing a consistent demand for HA fillers and skin boosters in aesthetic clinics for rejuvenation purposes. Argentina has advanced its technical expertise in HA applications, with a 2022 randomized clinical trial in the Journal of Dermatology & Cosmetology confirming the safety and efficacy of multi-layer “sandwich” HA filler techniques. As minimally invasive treatments become more popular and accessible, dermatologists and aesthetic professionals across Latin America are increasingly seeking reliable HA sources that meet high clinical standards. Environmental factors such as strong sunlight, heat, humidity, and urban pollution in Brazil and Argentina further drive demand for HA-enriched skincare products that offer hydration and barrier support. With growing consumer interest, aging demographics, and an expanding clinical base, Latin America is emerging as a dynamic and rapidly developing market for HA raw materials in skincare, medical-aesthetic, and wellness applications.

The Brazil hyaluronic acid raw material market has become an increasingly promising market, driven by the growth of its beauty, skincare, and aesthetic medicine sectors. According to the Brazilian Institute of Geography and Statistics (IBGE), in December 2023, the number of elderly people aged 65 and older in Brazil increased by 57.4% over the past twelve years, from 14.1 million in 2010 to 22.2 million in 2022, now representing 10.9% of the population. This demographic shift has boosted demand for HA-based moisturizers, serums, joint support injectables, ophthalmic lubricants, and skin hydration treatments, prompting manufacturers to secure high-quality HA raw materials for both consumer and clinical products. The expansion of Brazil’s medical aesthetic and dermatology industries has further fueled this growth, with major cities like São Paulo, Rio de Janeiro, Belo Horizonte, and Curitiba offering HA-based fillers and skin boosters for minimally invasive procedures

The aging population continues to drive demand for hyaluronic acid in anti-aging skincare, osteoarthritis therapies, and formulations targeted at older adults. IBGE data also revealed that Brazil's aging trend is accelerating, further underscoring the need for reliable HA sourcing across the country’s medical, therapeutic, and cosmetic manufacturing sectors. Additionally, Brazil’s environmental conditions, such as high temperatures, strong sunlight, humidity, and urban pollution, create skin stress, reinforcing the need for hydrating and protective products. As wellness awareness grows and manufacturers respond to demographic changes, demand for purified hyaluronic acid raw materials has steadily increased. These combined factors position Brazil as a key and continually evolving market for hyaluronic acid in skincare, wellness, and aesthetic medicine.

Middle East & Africa Hyaluronic Acid Raw Material Market Trends

The Middle East and Africa hyaluronic acid raw material industry is growing due to the rising demand from the cosmetics and personal care industry, particularly for anti-aging skincare products and dermal fillers. The increasing adoption of aesthetic procedures across Gulf Cooperation Council countries, driven by higher disposable incomes and strong beauty awareness, is fueling raw material consumption. Growth in healthcare infrastructure and pharmaceutical applications, including ophthalmology, orthopedics, and wound care, is further supporting market expansion. Medical tourism in countries such as the UAE and Saudi Arabia continues to boost demand for hyaluronic acid-based treatments. Additionally, increasing urbanization, social media influence on skincare awareness, and the gradual expansion of dermatology and aesthetic services in parts of Africa are contributing to steady regional market growth.

The Saudi Arabia hyaluronic acid raw material market has become increasingly significant, driven by modernization in the beauty, skincare, and aesthetic medicine sectors, as well as rising consumer sophistication and rapid healthcare expansion. In major cities such as Riyadh, Jeddah, and Dammam, demand for premium skincare products has grown steadily, with consumers seeking formulations that provide deep hydration, smoother texture, and protection from environmental stress. This trend has made hyaluronic acid a key ingredient in moisturizers, serums, eye creams, and dermocosmetic products, aligning with local preferences for lightweight textures and a refreshed, youthful appearance. As both domestic manufacturers and international brands strengthen their presence in the Kingdom, the demand for cosmetic-grade hyaluronic acid has increased across the personal care industry.

The growth in aesthetic medicine further contributes to the increasing demand for hyaluronic acid. Clinics offering dermal fillers, skin boosters, rejuvenation treatments, and minimally invasive procedures have expanded rapidly as more individuals seek natural-looking enhancement and preventive care. Medical professionals throughout Saudi Arabia increasingly adopt HA-based fillers and hydration treatments for facial contouring, wrinkle softening, and tissue revitalization. The expansion of private dermatology centers, aesthetic training programs, and government-supported healthcare modernization has heightened the reliance on high-purity injectable-grade hyaluronic acid, further emphasizing the need for reliable raw material sourcing in the clinical sector. These combined factors position Saudi Arabia as a growing hub for hyaluronic acid raw material demand in both the personal care and medical aesthetics sectors.

Key Hyaluronic Acid Raw Material Company Insights

The hyaluronic acid (HA) raw material market growth is driven by key players across pharmaceutical-grade, cosmetic-grade, and food-grade HA segments. Prominent companies such as Bloomage Biotech, HTL Biotechnology, Fidia Farmaceutici, Contipro, Seikagaku Corporation, Lifecore Biomedical, and Kewpie Corporation lead the market by leveraging R&D, advanced manufacturing, and a broad product portfolio. These companies supply high-quality HA to industries such as aesthetics, pharmaceuticals, and nutraceuticals, addressing both clinical and consumer needs. Bloomage Biotech is a major player, offering a range of HA products, including injectable-grade HA and recombinant collagen, with strong applications in ophthalmology, orthopedics, and nutraceuticals.

HTL Biotechnology focuses on pharmaceutical-grade hyaluronic acid and next-gen polymers for ophthalmology and rheumatology, while Fidia Farmaceutici specializes in HA-based therapies for joint disease and wound care. Seikagaku Corporation produces high-purity HA for orthopedic and ophthalmic applications, and Lifecore Biomedical offers expertise in sterile injectable hyaluronic acid. Chinese manufacturers like Shandong Focuschem Biotech, Shandong Freda Biopharm, and Shandong Topscience Biotech contribute significantly by supplying cost-effective, high-purity hyaluronic acid for skincare, aesthetics, and nutraceuticals. These companies continue to expand their production capacities and regulatory certifications to meet the growing global demand for hyaluronic acid raw materials.

Key Hyaluronic Acid Raw Material Companies:

The following are the leading companies in the hyaluronic acid raw material market. These companies collectively hold the largest market share and dictate industry trends.

- Bloomage Biotech

- HTL Biotechnology

- Fidia Farmaceutici S.p.A.

- Contipro a.s.

- Seikagaku Corporation

- Lifecore Biomedical, Inc.

- Kewpie Corporation

- Shandong Focuschem Biotech Co., Ltd.

- Shandong Freda Biopharm Co., Ltd.

- Shandong Topscience Biotech Co., Ltd.

Recent Developments

-

In June 2025, HTL Biotechnology inaugurated a new production line dedicated to sterile hyaluronic acid at its Javené facility, as part of its €100 million strategic plan. This line enables aseptic manufacturing of HA for ophthalmology, injectables, and drug-delivery applications, opening possibilities for HA combined with heat-sensitive actives.

-

In July 2024, Bloomage Biotech presented its latest HA research and launched a new functional food product, MitoPQQ, at the 2024 IFT FIRST Expo. The company also highlighted HA-based products for joint and gut health, signaling the expansion of HA raw materials into functional-food and health markets beyond cosmetics and medical use.

-

In September 2025, Fidia Farmaceutici acquired Altacor Ltd., a UK-based ophthalmology specialist, giving Fidia direct entry into the UK eye-care market and extending its HA-derived product reach, including dry-eye treatments, artificial-tear formulations, and surgical support products for cataract/corneal cross-linking.

Hyaluronic Acid Raw Material Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 245.62 million

Revenue forecast in 2033

USD 369.79 million

Growth rate

CAGR of 5.25% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, source, grade, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Bloomage Biotech; HTL Biotechnology; Fidia Farmaceutici S.p.A.; Contipro a.s.; Seikagaku Corporation; Lifecore Biomedical, Inc.; Kewpie Corporation; Shandong Focuschem Biotech Co., Ltd.; Shandong Freda Biopharm Co., Ltd.; Shandong Topscience Biotech Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyaluronic Acid Raw Material Market Report Segmentation

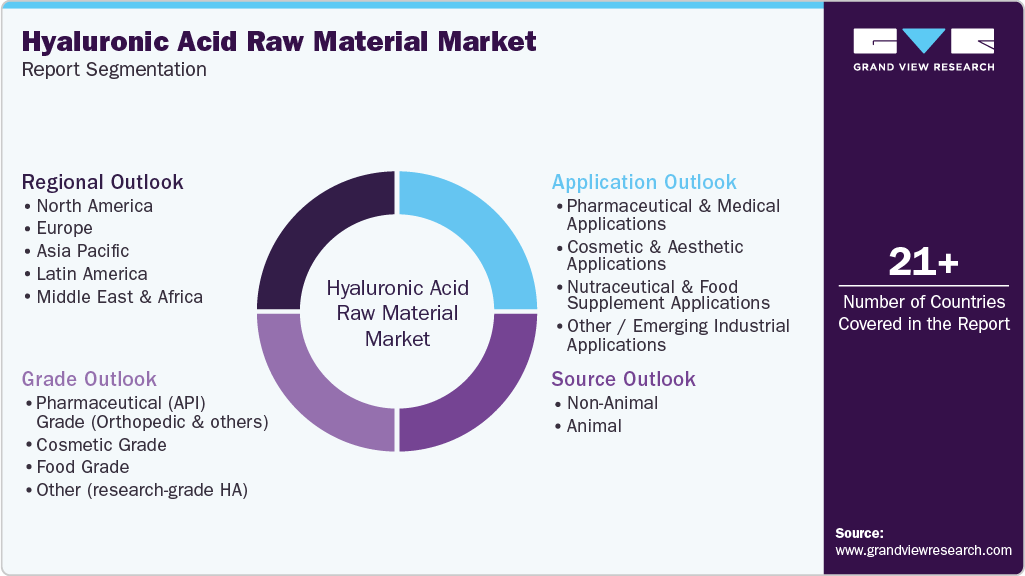

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hyaluronic acid raw material market report based on application, source, grade, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Medical Applications

-

Ophthalmology

-

Cataract surgery (as ophthalmic viscoelastic devices - OVDs)

-

Aqueous eye drops (for lubrication and corneal protection)

-

Contact lens hydration

-

-

Orthopedics

-

Viscosupplements

-

Bone regeneration (as scaffolds and fillers in orthopedic implants)

-

-

Dermatology (Medical use)

-

Advance Wound Healing (HA-based dressings and gels)

-

-

Surgical / Medical Uses

-

Surgical adhesion prevention (HA-based anti-adhesive gels and membranes)

-

Medical device coating (for biocompatibility and lubrication)

-

-

Biomaterials and Implants

-

Cell and Tissue Preservation

-

-

Cosmetic & Aesthetic Applications

-

Dermatology (Aesthetic use)

-

Intradermal (cosmetic injectables)

-

Dermal filler (aesthetic fillers)

-

-

Cosmetic / Personal Care (Creams, serums, moisturizers, lotions)

-

-

Nutraceutical & Food Supplement Applications

-

Other / Emerging Industrial Applications

-

Drug Delivery Systems (HA-based carriers for APIs)

-

Biomaterials (R&D) [Smart hydrogels, nanomaterials]

-

Other

-

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-Animal

-

Animal

-

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical (API) Grade (Orthopedic & others)

-

Cosmetic Grade

-

Food Grade

-

Other (research-grade HA)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hyaluronic acid raw material market is expected to grow at a compound annual growth rate of 5.25% from 2026 to 2033 to reach USD 369.79 million by 2033.

b. The Orthopedics segment dominated the hyaluronic acid raw material market with a share of 37.66% in 2025. This is attributable to the growing adoption of technologically advanced drugs coupled with the wide usage of hyaluronic acid in the treatment procedures of osteoarthritis.

b. Some key players operating in the hyaluronic acid raw material market include Salix Pharmaceuticals; ALLERGAN; Lifecore Biomedical, LLC; Shiseido Co., Ltd.; Anika Therapeutics, Inc.; Smith & Nephew; Maruha Nichiro Corporation; Ferring B.V.; SEIKAGAKU CORPORATION; Genzyme Corporation; F. Hoffmann-La Roche Ltd., Contipro a.s.; Zimmer Biomet.

b. Key factors that are driving the market growth include the enlarging aging population, the introduction of technologically advanced products enabling localized drug delivery and the growing number of aesthetic procedures in various countries, such as the U.S., Brazil, China, Japan, and South Korea.

b. The global hyaluronic acid raw material market size was estimated at USD 245.62 million in 2025 and is expected to reach USD 257.20 million in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.