- Home

- »

- Pharmaceuticals

- »

-

Huntington’s Disease Treatment Market Size Report, 2030GVR Report cover

![Huntington’s Disease Treatment Market Size, Share & Trends Report]()

Huntington’s Disease Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Symptomatic Treatment, Disease-Modifying Therapies), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-552-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Huntington’s Disease Treatment Market Summary

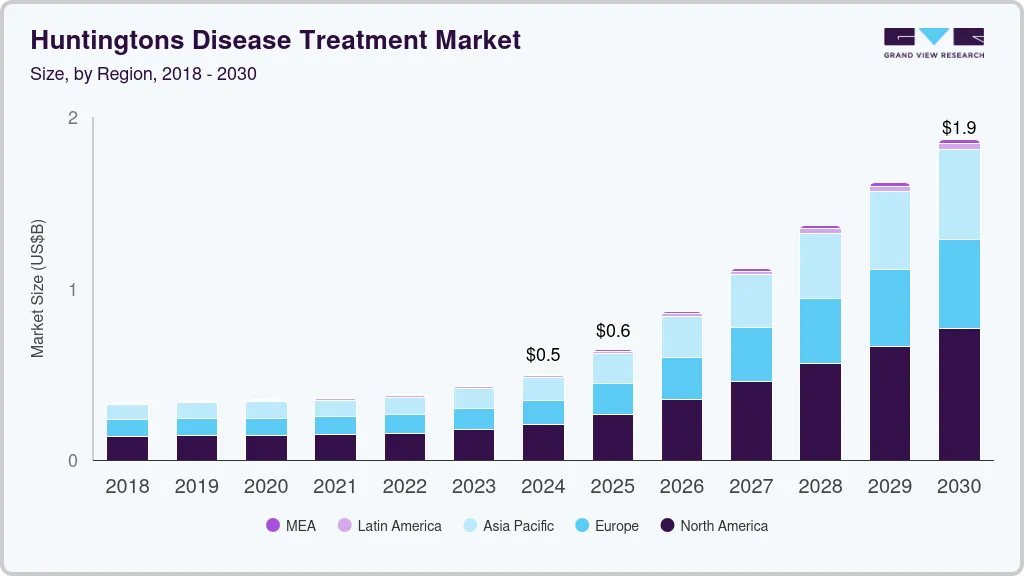

The global Huntington’s disease treatment market size was estimated at USD 500 million in 2024 and is projected to reach USD 1,871.2 million by 2030, growing at a CAGR of 23.8% from 2025 to 2030. The predicted label expansion of Ingrezza for treating chorea associated with Huntington’s Disease (HD), the high burden of HD in Western countries, and the strong product pipeline of disease-modifying therapies are anticipated to be major market drivers.

Key Market Trends & Insights

- North America Huntington’s disease treatment market held the largest revenue share of 40.85% in the HD treatment industry in 2024.

- Asia Pacific is expected to witness the fastest CAGR over the forecast period due to increased product penetration, untapped potential, and the disease's growing prevalence in developing countries.

- Based on treatment, the symptomatic treatment segment held the largest revenue share of 100% in 2024 and is expected to dominate the HD treatment industry over the forecast period.

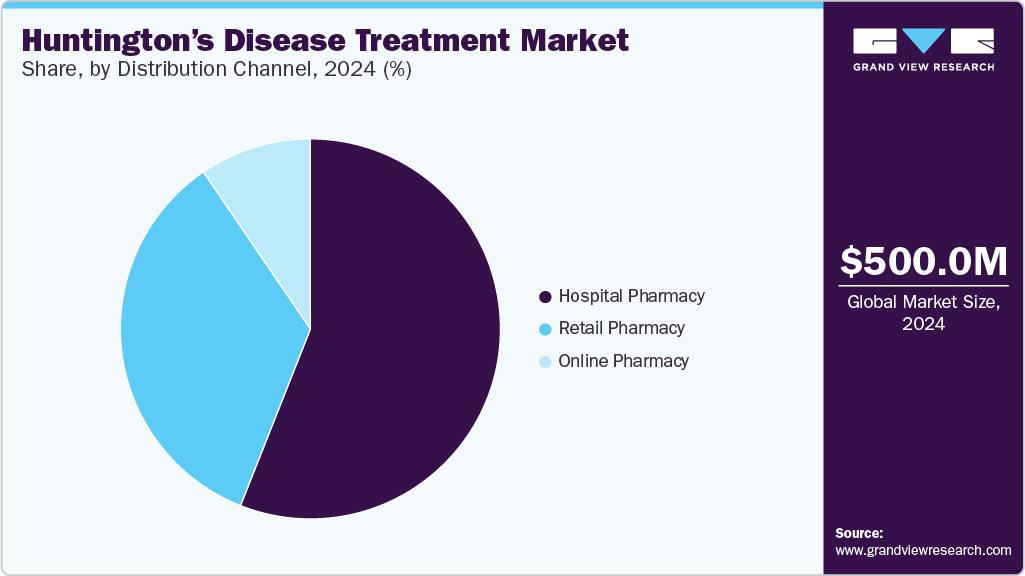

- Based on distribution channel, the hospital pharmacy segment dominated the market in 2024, accounting for a revenue share of over 56.00%.

Market Size & Forecast

- 2024 Market Size: USD 500 Million

- 2030 Projected Market Size: USD 1,871.2 Million

- CAGR (2025-2030): 23.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to a study published in the Journal of the International Parkinson and Movement Disorder Society, the incidence of HD is 0.48 per thousand, and its prevalence is 4.88 per thousand, which has increased over the years, further fueling the need for effective and innovative treatment options.

According to a study published in the Journal of the International Parkinson and Movement Disorder Society, the incidence of HD is 0.48 per thousand, and its prevalence is 4.88 per thousand, which has increased over the years, further fueling the need for effective and innovative treatment options.

The growing demand for Huntington’s disease (HD) treatments is driven by the disease's progressive neurological nature and significant geographic prevalence variations; it is more prevalent in regions like Europe, North America, and Australia and less common in the Asian population. This disparity, influenced by differences in case ascertainment and diagnostic criteria, increases the need for effective therapies in high-prevalence areas.

HD is a hereditary condition, leading to an increased demand for genetic counseling services, early testing, and diagnostic tools to identify at-risk individuals. These resources are essential for helping families make informed decisions about family planning, early intervention, and potential participation in clinical trials. With growing awareness, the importance of genetic counseling in managing the disease is also increasing. A study published in Neurological India in 2022 examined the complexities of genetic counseling and testing for HD. It highlighted challenges such as anticipation, consanguinity, and the prevalence of intermediate alleles. The research emphasized the need for comprehensive pre- and post-test counseling to aid families in making informed decisions and coping with potential outcomes.

Due to the absence of a cure for HD, the demand for effective treatments remains significant owing to the severe impact of the disease, the lack of effective therapies, and the continued advancements in gene therapy and neuroprotective research. Continuous efforts aim to enhance the quality of life of individuals affected by the disease, slow its progression, and ultimately identify a potential cure.

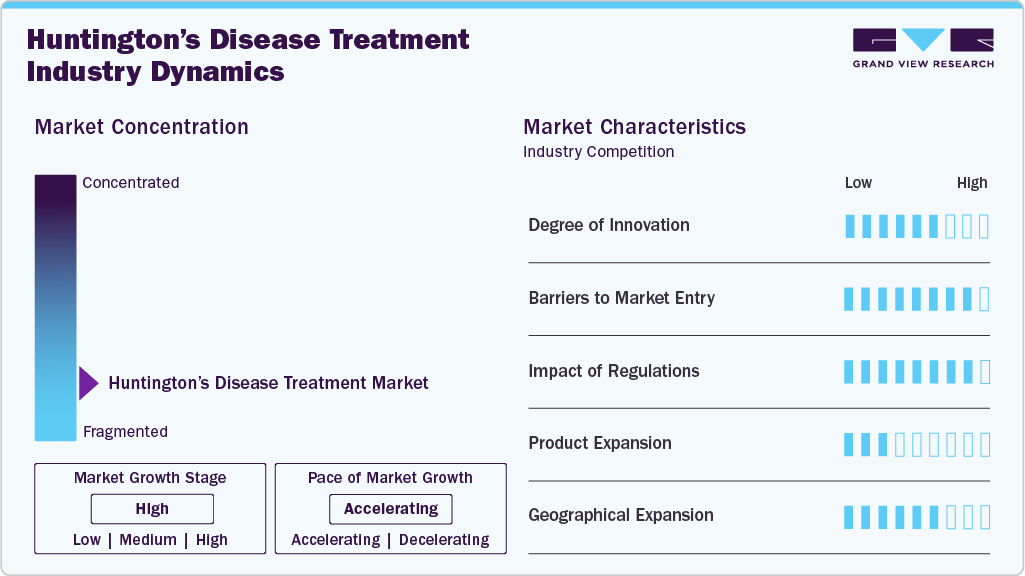

Market Concentration & Characteristics

The HD treatment market is marked by a high degree of innovation driven by ongoing research and development efforts. For instance, in December 2024, UCLH launched the first human trial for HD, testing ALN-HTT02, an RNA interference therapy developed by Alnylam Pharmaceuticals and Regeneron. Researchers have also made significant strides in gene therapies, with new treatments targeting the genetic causes of HD. These developments highlight the rapidly evolving nature of the HD treatment landscape, where continuous innovation is crucial for meeting the growing demand for effective therapies and improving patient outcomes.

Several companies in the HD treatment industry are actively pursuing mergers and acquisitions to strengthen their market presence. This strategy helps companies boost research strength, expand their therapeutic profiles, and achieve operational efficiency. For instance, in December 2024, PTC Therapeutics signed a licensing deal with Novartis for its HD drug, PTC518. This partnership marks a shared commitment to create pioneering HD treatments and enhance patient care.

Regulations within the HD treatment market establish fundamental drug safety, efficacy, and availability standards. They regulate the approval process, clinical trial protocols, manufacturing, labeling, and post-market monitoring. For instance, the European Medicines Agency (EMA) enforces strict guidelines for orphan drugs, such as those used to treat rare conditions like HD, to ensure that treatments are subject to rigorous testing for safety and efficacy. These laws protect patients by reducing risks and providing them with access to transparent information regarding the treatments for HD.

Enhanced awareness and activism are expanding public concern about treatments for the progression and symptoms of HD. Advancements in medical technology, including digital biomarkers, wearables, and AI-based diagnostic technologies, also revolutionize the monitoring and management of HD, allowing more individualized, data-informed care and longer-term treatment benefits.

The growing elderly population in Asia, especially in countries like China, also propels the demand for HD treatments. With an aging population, the incidence of neurodegenerative diseases is increasing, which emphasizes early diagnosis and extended care. For instance, China invests in research, development, and innovation of therapies for rare and long-term neurological conditions such as HD. This has made China a prominent and rising Asian Pacific HD treatment industry market.

Treatment Insights

The symptomatic treatment segment held the largest revenue share of 100% in 2024 and is expected to dominate the HD treatment industry over the forecast period. This growth is due to the availability of symptom management products and patent protection of these products. Xenazine and Austedo are considered first-line therapy for chorea associated with HD. The R&D of potential product candidates for symptom management of HD may contribute to segment growth. For instance, in September 2024, the U.S. FDA granted fast-track designation to PTC518, an oral therapy developed by PTC Therapeutics for HD. This designation aims to accelerate the development and analysis of drugs addressing serious conditions with unmet medical needs. PTC518 demonstrated up to a 43% reduction in mutant Huntingtin protein levels in blood and cerebrospinal fluid in a phase 2 study, driving market expansion.

The disease-modifying therapies segment is anticipated to witness the fastest growth over the forecast period, owing to increased research and development in this field and a rise in the demand for advanced products, such as gene therapy and stem cell therapy. Favorable regulatory support, such as the U.S. FDA's fast track designation, boosts market momentum. In December 2023, Lexeo Therapeutics secured FDA fast track and orphan drug designations for LX2020, an AAVrh10-based gene therapy targeting PKP2 Arrhythmogenic Cardiomyopathy (ACM). This initiative addresses a significant unmet medical need in the U.S. The upcoming HEROIC-PKP2 phase 1/2 trial will assess LX2020's safety, tolerability, and preliminary efficacy in adult patients with PKP2-ACM.

Distribution Channel Insights

The hospital pharmacy segment dominated the market in 2024, accounting for a revenue share of over 56.00%. This dominance can be attributed to hospitals' robust healthcare infrastructure, multidisciplinary treatment approaches, and specialized expertise in managing complex medications. Hospitals serve as primary healthcare providers for patients with complex conditions like HD, and their pharmacies ensure the availability and distribution of specialized medications. With a multidisciplinary team of experts and a focus on patient care, hospital pharmacies have established themselves as key stakeholders in effectively managing and treating HD.

The online pharmacy segment is anticipated to grow at the fastest CAGR during the forecast period due to internet and smartphone usage. The convenience of ordering medications on an e-commerce website and the expanding e-commerce services worldwide are expected to drive segment growth. In addition, online pharmacies facilitate convenient access to specialized drugs, chronic care subscriptions, and enhanced drug compliance through automated refills, which are some concerns in HD's long-term care.

Regional Insights

North America Huntington’s disease treatment market held the largest revenue share of 40.85% in the HD treatment industry in 2024. This growth can be attributed to the high disease burden, increased healthcare expenditure, technological advancements, proactive government initiatives, and increased patient awareness about treatments for HD. The presence of key pharmaceutical companies, such as H. Lundbeck A/S and Teva Pharmaceutical Industries Ltd., which continue to expand access to symptom management therapies, contributes significantly to the region’s strong market position.

U.S. Huntington’s Disease Treatment Market Trends

The Huntington’s disease treatment market in the U.S. is driven by factors such as high disease prevalence, an aging population, and a well-established healthcare infrastructure that supports early diagnosis and long-term care. The country also benefits from strong R&D activities, with numerous clinical trials, significant neurodegenerative disease research investments, and regulatory incentives, such as the FDA's fast track and orphan drug designations, encouraging the development of innovative therapies and rapid approvals.

Europe Huntington’s Disease Treatment Market Trends

The Huntington’s disease treatment market in Europe for HD treatments shows high growth, driven by the increasing development activities by key players, rising patient awareness, and strong regulatory support. For instance, in April 2025, Prilenia Therapeutics entered into a collaboration and license agreement with Ferrer to commercialize and co-develop pridopidine in Europe and select international markets. The growing demand for innovative therapies, such as pridopidine, is supported by the EMA’s review of the drug, with the review from the Committee for Medicinal Products for Human Use (CHMP) expected in the second half of 2025. This collaboration highlights the expanding opportunities in Europe for developing and commercializing treatments for rare diseases such as Huntington’s.

The UK Huntington’s disease treatment market is witnessing significant growth in the HD treatment industry owing to the increasing incidence and burden of chronic neurodegenerative disorders such as HD. Older individuals are more likely to develop or exhibit symptoms of neurodegenerative conditions, and with improved diagnostic capabilities, more cases are being identified earlier. For instance, in April 2025, a study revealed that northern Scotland has one of the highest rates of HD globally, with 14.5 cases per 100,000 people, over five times the global average. Researchers identified more than 160 adults in regions such as Grampian, Highland, Orkney, Shetland, and the Western Isles, who carry the gene but remain untested, and estimate each diagnosed individual has at least 2.2 relatives at 50% genetic risk, a key driver of market growth.

The Huntington’s disease treatment market in Germany is driven by rising awareness among healthcare professionals, ongoing clinical research for disease-modifying therapies, and advancements in neurodegenerative diagnostics. Increasing government support for rare disease management, expansion of neurology-focused healthcare infrastructure, and specialized treatment centers also contribute to market development. Moreover, pharmaceutical interest in orphan drug designation and evolving patient access programs supports the growth trajectory of treatment options nationwide.

France Huntington’s disease treatment market benefits from centralized care for rare diseases, strong insurance coverage, and specialist neurology networks. National registries and clinical pathways support consistent care standards. Use of antipsychotic and antidepressant therapies remains high, while investigational drugs are gaining traction through clinical collaborations. Hospital pharmacies dominate, with university hospitals playing a key role in treatment access.

Asia Pacific Huntington’s Disease Treatment Market Trends

The Huntington’s disease treatment market in Asia Pacific is expected to witness the fastest CAGR over the forecast period due to increased product penetration, untapped potential, and the disease's growing prevalence in developing countries. Governments are increasingly undertaking initiatives to improve the population's health status, which is expected to drive the regional market.

China Huntington’s disease treatment market is expanding due to several factors, such as the continuous investment in healthcare modernization in China. This can be attributed to improved neurological services, expanded insurance coverage, and enhanced access to rare disease diagnoses and treatments, especially in urban regions. For instance, in April 2025, a research study published in Nature Communications by a Hong Kong research team revealed a new therapeutic target for HD by uncovering a 4.5-fold elevation of the protein PAPD5 in diseased brain cells. This discovery adds to the knowledge of the mechanism of the disease and provides the basis for new therapeutic approaches.

The Huntington’s disease treatment market in Japan is influenced by its aging population, emphasis on rare disease policies, and integration of genetic counseling services. Government initiatives support orphan drug development, and national centers for neurological disorders guide therapy use. Retail and hospital pharmacies contribute to therapeutic delivery, supported by a strong network of university hospitals and registries.

Latin America Huntington’s Disease Treatment Market Trends

The Huntington’s disease treatment market in Latin America is moderately growing, led by Brazil and Argentina. Support comes from expanded neurology services and better rare disease reporting. National health initiatives drive treatment access, including symptomatic therapies in public formularies. Hospital neurology units remain key distribution points, and rising advocacy shapes care policies.

Brazil Huntington’s disease treatment market is supported by public neurology programs, increased availability of psychiatric care, and government-backed rare disease treatment funding. Growing involvement in global clinical trials and genetic diagnostics is improving patient access. Hospital pharmacies and referral centers lead treatment delivery, with expanded access in urban health networks.

Middle East & Africa Huntington’s Disease Treatment Market Trends

The Huntington’s disease treatment market in the Middle East and Africa is emerging, with Saudi Arabia, UAE, and South Africa leading in rare disease initiatives. Investments in neuroscience infrastructure and rising awareness among healthcare providers are shaping treatment availability. Hospital systems and tertiary care centers are critical access points, with gradual improvements in early diagnosis.

Saudi Arabia Huntington’s disease treatment market growth is supported by the national rare disease strategy, Vision 2030 health reforms, and the expansion of neurology care capacity. Public hospitals and specialty centers are enhancing access to symptomatic treatments. Distribution remains concentrated in hospitals, with early-stage engagement in clinical research and digital health platforms.

Key Huntington's Disease Treatment Company Insights

Some key companies in the market include H. Lundbeck A/S, Teva Pharmaceutical Industries Ltd., and Bausch Health Companies Inc. These companies are leading the way in developing innovative therapeutics and advancing clinical trials, focusing on addressing the complex needs of an aging global population. Their continued investment in research and development is expected to drive market growth in the coming years.

Key Huntington's Disease Treatment Companies:

The following are the leading companies in the Huntington's disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- H. Lundbeck A/S

- Teva Pharmaceutical Industries Ltd.

- Bausch Health Companies Inc.

- Hetero

- Lupin

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- uniQure NV.

- Latus Bio

Recent Developments

-

In February 2025, Latus Bio introduced a novel computational model predicting the effects of MSH3 gene knockdown on CAG repeat expansion, a hallmark of HD progression. These findings suggest that Latus Bio's approach could offer a one-time, disease-modifying treatment for HD patients.

-

In December 2024, uniQure received FDA approval to submit a Biologics License Application (BLA) for AMT-130 under the accelerated approval pathway. The FDA agreed that the composite Unified Huntington's Disease Rating Scale (cUHDRS) could serve as an intermediate clinical endpoint, and reductions in Neurofilament Light Chain (NfL) levels in cerebrospinal fluid could provide supportive evidence of therapeutic benefit, aiding market expansion and development.

-

In October 2024, H. Lundbeck A/S announced its strategic USD 2.6 billion acquisition of Longboard Pharmaceuticals. The acquisition aimed to enhance Lundbeck's neuroscience pipeline by adding Longboard's lead asset, bexicaserin, a novel treatment for Developmental and Epileptic Encephalopathies (DEEs).

-

In July 2024, Genezen, a Contract Development and Manufacturing Organization (CDMO), acquired uniQure's commercial gene therapy manufacturing facility in Lexington, Massachusetts. The acquisition, valued at USD 25 million in preferred stock and a convertible note, will allow uniQure to repay USD 50 million in debt, significantly reducing its annual cash burn.

Huntington’s Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 642.7 million

Revenue forecast in 2030

USD 1,871.2 million

Growth rate

CAGR of 23.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

H. Lundbeck A/S; Teva Pharmaceutical Industries Ltd.; Bausch Health Companies Inc.; Hetero; Lupin; Hikma Pharmaceuticals PLC; Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd; Novartis AG; uniQure NV.; Latus Bio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Huntington's Disease Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Huntington’s disease treatment market report based on treatment, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Symptomatic Treatment

-

Disease-modifying Therapies

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

- Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. Based on treatment, the symptomatic treatment segment accounted for the largest revenue share of 100% in 2024 and is expected to dominate the HD treatment industry over the forecast period. This growth is due to the availability of symptom management products and patent protection of these products.

b. Key players operating in the market include H. Lundbeck A/S, Teva Pharmaceutical Industries Ltd., Bausch Health Companies Inc., Hetero, Lupin, Hikma Pharmaceuticals PLC

b. The predicted label expansion of Ingrezza for treating chorea associated with Huntington’s Disease (HD), the high burden of HD in Western countries, and the strong product pipeline of disease-modifying therapies are anticipated to be major market drivers.

b. The global Huntington’s disease treatment market size was estimated at USD 500 million in 2024 and is expected to reach USD 642.7 million in 2025.

b. The global Huntington’s disease treatment market is expected to grow at a compound annual growth rate of 23.83% from 2025 to 2030 to reach USD 1,871.2 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.