- Home

- »

- Pharmaceuticals

- »

-

HPV Associated Disorders Market, Industry Report, 2033GVR Report cover

![HPV Associated Disorders Market Size, Share & Trends Report]()

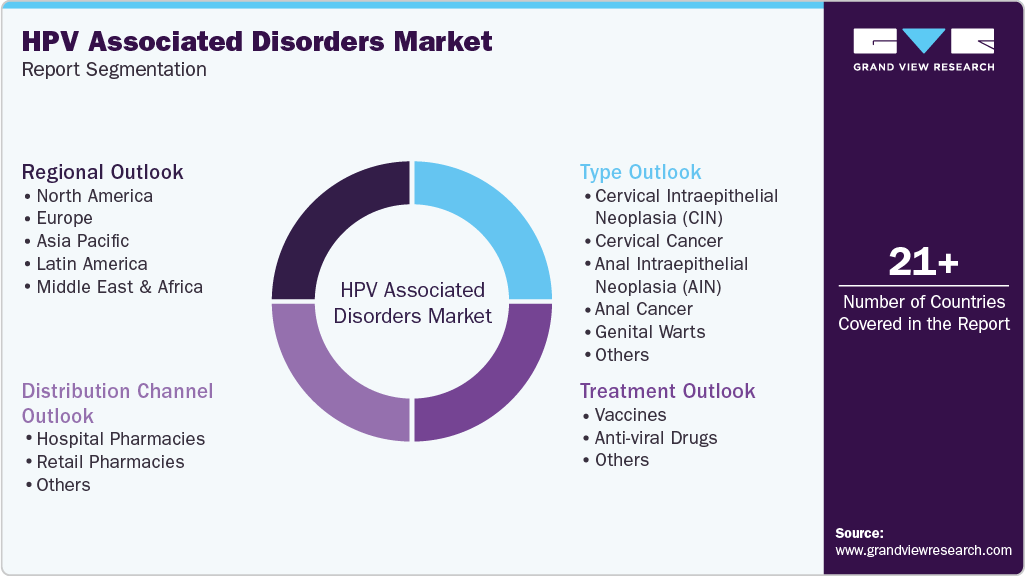

HPV Associated Disorders Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, (Cervical Intraepithelial Neoplasia (CIN), Cervical Cancer), By Treatment (Vaccines, Anti-viral Drugs), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-436-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HPV Associated Disorders Market Summary

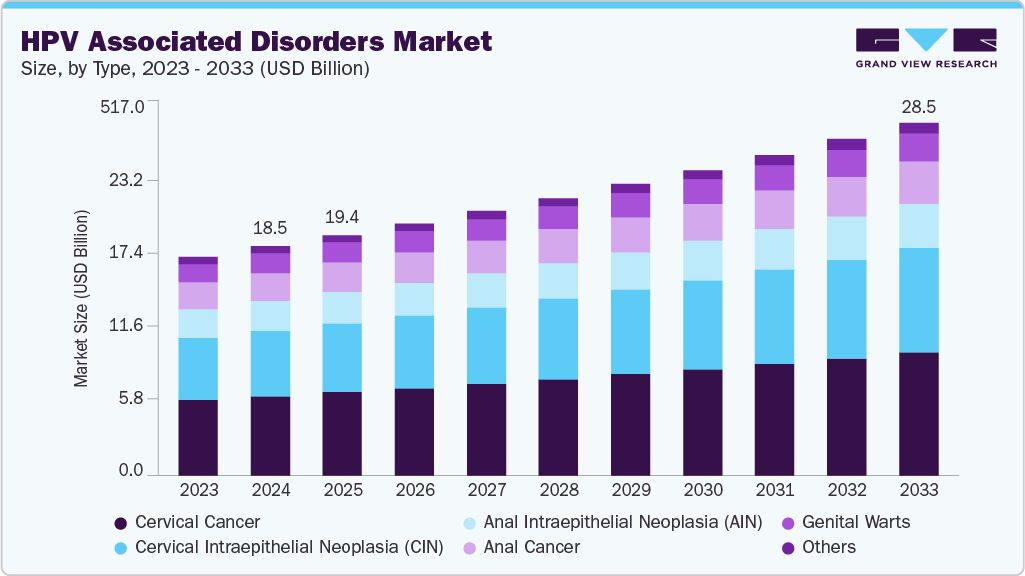

The global HPV associated disorders market size was estimated at USD 18.5 billion in 2024 and is projected to reach USD 28.5 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The industry is witnessing strong growth due to the rising prevalence of HPV infections worldwide.

Key Market Trends & Insights

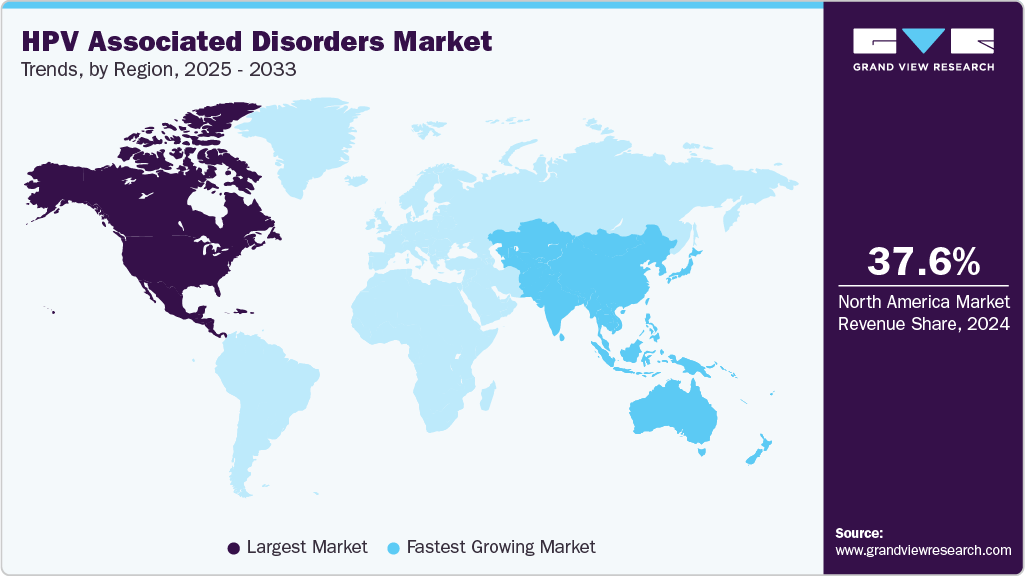

- North America HPV associated disorders market held the largest share of 37.55% of the global market in 2024.

- The HPV associated disorders industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the cervical cancer segment held the largest market share of 34.68% in 2024.

- By treatment, the vaccines segment accounted for the largest market share in 2024.

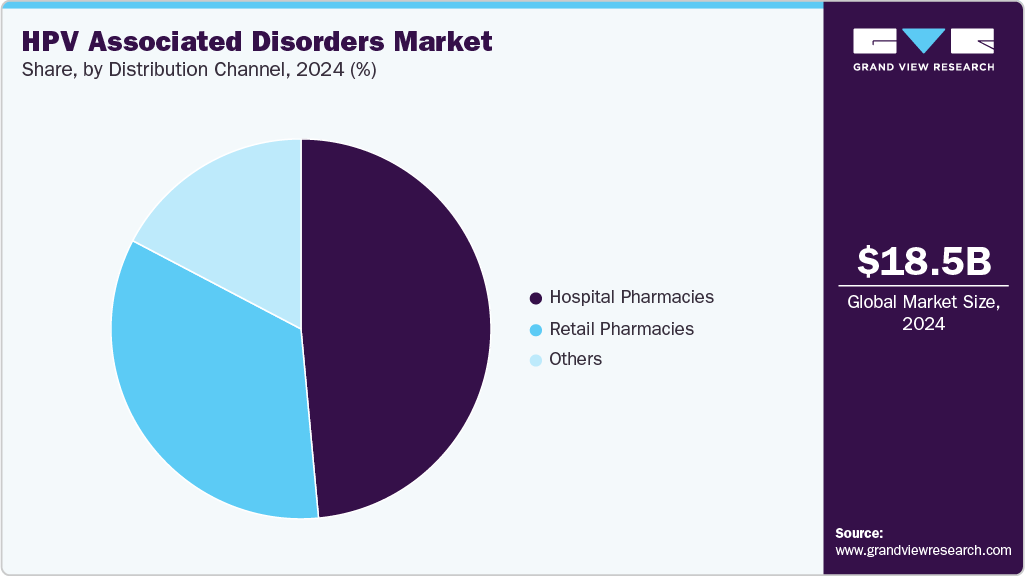

- By distribution channel, the hospital pharmacies segment registered the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.5 Billion

- 2033 Projected Market Size: USD 28.5 Billion

- CAGR (2025-2033): 4.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Persistent HPV infections are recognized as a major cause of cervical, anal, vulvar, vaginal, penile, and oropharyngeal cancers, which has increased the need for timely diagnosis and treatment. Growing demand for molecular diagnostic tests that can accurately detect high-risk HPV strains is fueling adoption in clinical settings, while healthcare systems are prioritizing screening programs to identify precancerous changes early. For instance, in March 2024, World Health Organization findings indicated that human papillomavirus (HPV) encompassed a group of around 200 known viruses, with most infections remaining harmless while some high-risk types caused genital warts and various cancers. In approximately 90% of cases, the body naturally cleared the infection. In 2019, HPV was estimated to have caused about 620,000 cancer cases in women and 70,000 in men. Cervical cancer became the fourth leading cause of cancer among women in 2022, with 660,000 new cases and 350,000 deaths globally. Cervical cancers represented over 90% of all HPV-related cancers in women. These figures highlight the substantial global burden of HPV-related disease, strengthening the demand for advanced diagnostics and effective treatments.

Advancements in treatment solutions represent another major growth driver for the HPV associated disorders market. Innovative therapies, including immunotherapies and targeted drugs, are gaining traction as they provide improved outcomes for patients with HPV-driven malignancies. Pharmaceutical companies are investing heavily in research and development to bring novel therapies into the landscape, strengthening the treatment pipeline. For instance, in April 2025, authors at BioMed Central Ltd. reported that human papillomavirus (HPV), a DNA virus, had been established as a causative agent of cervical, vulvar, vaginal, penile, anal, and head & neck cancers. They noted that persistent infection and the oncogenic potential of certain HPV genotypes drove most HPV-related cancers.

High-risk strains, especially HPV-16 and HPV-18, accounted for over 70% of cervical cancer cases globally and contributed substantially to other genital and head and neck malignancies. At the molecular level, the study found that the overexpression of E6 and E7 oncoproteins disrupted cell-cycle regulation, impeded programmed cell death, and promoted the accumulation of DNA damage, thereby transforming normal cells into malignant ones. The review also emphasized recent breakthroughs in using biomarkers—such as mRNAs, miRNAs, lncRNAs, proteins, and genetic markers—for monitoring cancer therapy responses. Clinical studies are producing encouraging results in terms of survival rates and reduction in disease recurrence, which is expected to expand adoption. These advancements are bridging gaps in treatment, addressing unmet clinical needs, and enhancing overall patient quality of life.

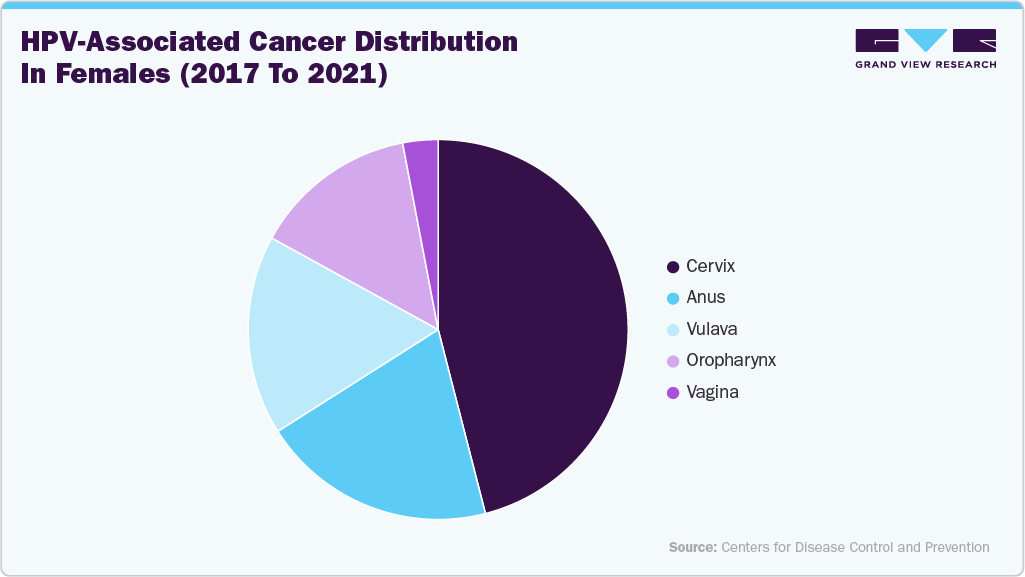

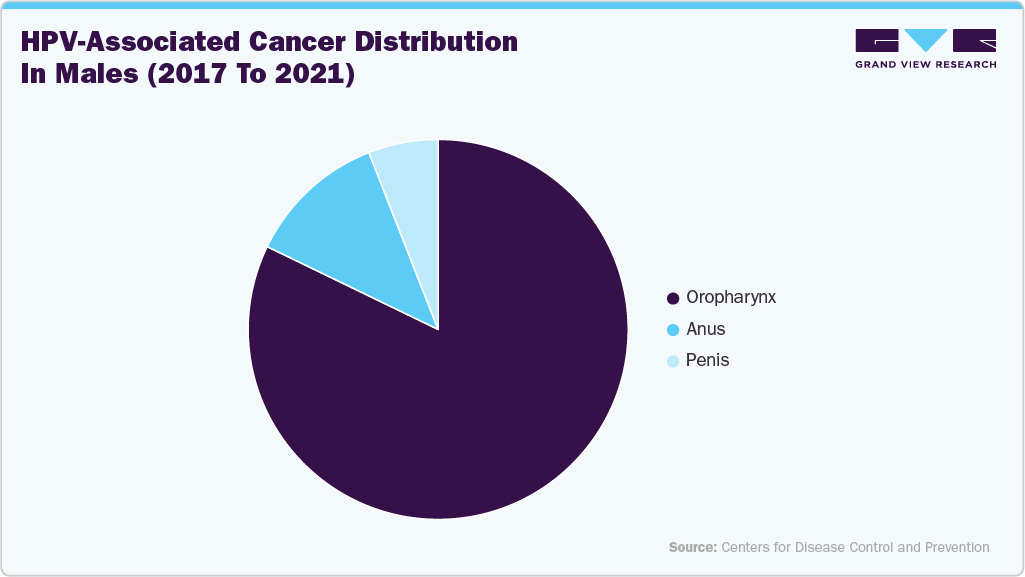

According to the CDC, between 2017 and 2021 an estimated 47,984 new HPV-associated cancer cases occurred annually in the United States, including 26,280 among females and 21,704 among males. Cervical cancer was the most common among women, while oropharyngeal cancers dominated in men. HPV was confirmed as the main causative factor for most cervical cancers, along with cancers of the vagina, vulva, penis, anus, and oropharynx. Among females, 46% of HPV-associated cancers were cervical, 20% anal, 17% vulvar, 14% oropharyngeal, and 3% vaginal. Rates varied across racial and ethnic groups, with non-Hispanic American Indian/Alaska Native females having the highest incidence and non-Hispanic Asian/Pacific Islander males showing the lowest rates.

The CDC further estimated that 37,800 cancers (79%) annually were attributable to HPV, with approximately 35,000 preventable through the 9-valent HPV vaccine. Of these, 30,700 were linked to HPV types 16 and 18, while 4,300 were tied to types 31, 33, 45, 52, and 58. HPV-negative cancers accounted for about 10% of cervical and anal cancers, 30% of oropharyngeal, vaginal, and vulvar cancers, and 40% of penile cancers. Vaccination was recommended for preteens aged 11-12, with catch-up vaccination through age 26, while vaccination for ages 27-45 was suggested through shared clinical decision-making. These findings underscored both the burden of HPV-related cancers and the critical role of vaccination in prevention.

Opportunity Analysis in the HPV Associated Disorders Market

Opportunity Area

Description

Instance

Single-dose & simplified vaccination programs

Simplified one-dose schedules reduce costs and expand coverage in LMICs.

WHO (Oct 2024) confirmed Cecolin for single-dose use, expanding access to millions of girls globally.

Therapeutic antivirals & topical treatments

Novel antivirals address persistent HPV infections and precancers beyond vaccines.

UNM (Feb 2025) developed a first-in-kind topical gel targeting MEK/ERK pathway to block E6/E7 proteins.

Advanced molecular diagnostics & self-sampling

High-sensitivity HPV assays and self-collection kits improve early detection and screening compliance.

Biomarker research (Apr 2025, BioMed Central) highlighted mRNAs, miRNAs, lncRNAs for therapy monitoring.

Biomarker-driven personalized therapies

Companion diagnostics support precision medicine and targeted drug adoption.

BioMed Central (Apr 2025) emphasized biomarkers as tools to predict and monitor treatment responses.

Combination regimens

Integrating immunotherapy with targeted drugs enhances survival outcomes in advanced cancers.

Clinical pipelines testing PD-1 inhibitors with HPV-specific therapies show encouraging early results.

Delivery innovations & patient-friendly formats

Transdermal, oral, and long-acting options improve adherence and widen patient access.

Ongoing pharma R&D is exploring long-acting vaccine formulations and oral antivirals.

Emerging market expansion

LMICs present large-scale vaccine and drug adoption opportunities with tiered pricing models.

WHO fact sheet (Mar 2024) reported 94% of cervical cancer deaths occur in low- and middle-income countries.

Real-world evidence & health-economic demonstration

Generating RWE on reduced disease burden strengthens payer support and adoption.

WHO’s 90-70-90 strategy targets prevention, early detection, and universal treatment access by 2030.

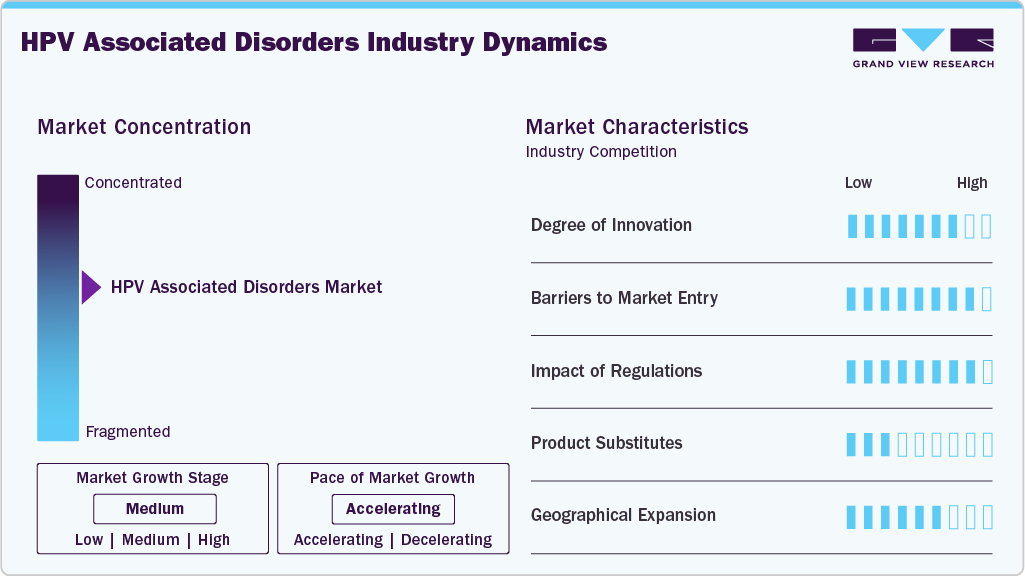

Market Concentration & Characteristics

The industry reflects steady innovation through new-generation vaccines and targeted therapies. Companies are focusing on expanding therapeutic efficacy against high-risk HPV strains linked to cervical and anal cancers. Immunotherapies are being explored to address advanced or recurrent cases where standard therapies fall short. Clinical trials are consistently broadening treatment applications beyond cervical cancer into oropharyngeal and anal cancers. The presence of leading pharmaceutical players accelerates innovation cycles and product availability. Overall, innovation is a key differentiator sustaining competitive advantage in this market.

High development costs and lengthy clinical trial requirements create significant barriers for new entrants in HPV associated disorder treatments. Established players like Merck and GlaxoSmithKline already dominate the vaccine segment with proven products. Strong intellectual property protections and exclusive patents limit competitive entry in both vaccines and antivirals. The need for large-scale manufacturing capabilities and strict quality standards further restricts participation. Market trust is heavily associated with safety and efficacy, requiring new firms to invest significantly in reputation building. These factors collectively ensure high entry barriers and concentrated market control by top-tier companies.

The treatment landscape for HPV associated disorders is shaped by rigorous regulatory oversight ensuring safety, efficacy, and consistency. Regulatory agencies demand extensive clinical evidence before approving vaccines or drugs targeting HPV-related conditions. Post-approval monitoring requirements further add to compliance obligations for manufacturers. These standards protect patient safety but extend timeframes for product commercialization. While regulations can slow market entry, they also create a protective barrier for established players with approved products. As a result, the market remains highly regulated yet stable, favoring companies with strong regulatory expertise.

The availability of substitutes in HPV disorder treatments is limited, as vaccines and antiviral drugs remain the primary therapeutic options. Surgical procedures or ablative therapies may act as alternatives for precancerous lesions, but they do not address underlying viral persistence. Vaccines prevent infection, while antivirals manage progression, leaving little room for substitute therapies. Supportive care or off-label oncology treatments are sometimes used but lack targeted efficacy. Given the unique role of vaccines and drugs in prevention and treatment, substitutes offer minimal competitive threat. This reinforces the dominance of pharmaceutical solutions in the treatment market.

Pharmaceutical leaders in the HPV associated disorders treatment industry are strategically expanding into high-burden regions. Emerging economies in Asia-Pacific and Latin America present significant opportunities due to the rising incidence and underpenetrated treatment adoption. Companies are strengthening distribution networks through hospital and retail pharmacies to improve access. Regional clinical collaborations are also enhancing the development of localized treatment approaches. Established markets in North America and Europe remain central due to advanced healthcare infrastructure. Overall, geographic expansion is a critical strategy to balance saturated developed markets with fast-growing developing regions.

Type Insights

The cervical cancer segment dominated the market with the largest revenue share of 34.68% in 2024, driven by the high prevalence of cervical cancer associated with persistent HPV infections. The availability of advanced diagnostic technologies and established treatment pathways has enhanced both detection and management rates across healthcare systems. Rising awareness of the link between HPV and cervical malignancies has encouraged greater screening participation, ensuring earlier diagnosis and intervention. For instance, in March 2024, the World Health Organization noted that nearly 94 percent of the deaths (out of 350,000 deaths in 2022) occurred in low- and middle-income countries. The report emphasized persistent HPV infection as the primary cause, while women with HIV faced six times the risk compared to those without HIV. The fact sheet further highlighted the '90-70-90' global strategy by 2030 to improve vaccination, screening, and treatment coverage. Strong demand for vaccines, oncology drugs, and continuous clinical research reinforces the leadership of this segment in the HPV associated disorders market.

The cervical intraepithelial neoplasia (CIN) segment is projected to grow at a significant CAGR of 5.3% over the forecast period, fueled by rising detection of precancerous lesions through expanded HPV screening. Increased availability of molecular assays with higher sensitivity has improved early identification of CIN and strengthened clinical decision-making. Growing adoption of preventive treatment approaches is lowering the risk of progression to invasive cervical cancer, while guidelines increasingly highlight minimally invasive strategies to manage CIN effectively. To illustrate, in July 2025, a 10-year monocentric analysis in Springer Nature evaluated treatment pathways for cervical intraepithelial neoplasia grade 2 (CIN 2), also known as HSIL. Out of 187 patients, 84 (44.9%) were managed conservatively for at least seven months, while 103 (55.1%) underwent an excisional procedure (LEEP). Among those under active surveillance, 14 (16.7%) exhibited spontaneous remission, 64 (76.2%) showed persistence of the lesion, 4 (4.8%) progressed to CIN 3, and 2 (2.4%) progressed to carcinoma, including one vaginal carcinoma and one cervical adenocarcinoma. Pharmaceutical interest in therapies that address early disease stages is strengthening the pipeline, positioning CIN as a rapidly growing segment within the HPV associated disorders market.

Treatment Insights

The vaccines segment dominated the market with the largest revenue share of 63.61% in 2024 due to strong uptake of prophylactic HPV vaccines. Clinical evidence confirming their effectiveness against high-risk HPV strains has driven adoption among adolescents and young adults. For instance, in October 2024, the World Health Organization announced that a fourth WHO-prequalified HPV vaccine, Cecolin, had been confirmed for single-dose use after meeting 2022 recommendations. More than 95 percent of the 660,000 cervical cancer cases each year were caused by HPV, with one woman dying every two minutes, and 90 percent of these deaths occurring in low- and middle-income countries. Data showed coverage among girls aged 9-14 rose from 20 percent in 2022 to 27 percent in 2023, reaching 6 million additional girls. These developments reinforce vaccines as the cornerstone of HPV prevention.

The anti-viral drugs segment is forecast to grow at a CAGR of 4.5% over the forecast period, owing to rising demand for therapeutic interventions beyond prevention. Persistent HPV infections and recurrent disease continue to require effective antiviral solutions that lower the risk of progression to cancer. For instance, in February 2025, UNM Comprehensive Cancer Center’s researchers led by Michelle Ozbun, PhD, and Jason McConville, PhD reportedly developed a first-in-kind topical gel designed to prevent HPV-induced precancers from advancing to malignancy. They highlighted that no antiviral treatments for HPV-related diseases existed at that time, despite HPVs being linked to nearly 5% of cancers worldwide. The gel functioned by inhibiting the MEK/ERK pathway, lowering E6 and E7 protein production, and intercepting tumor development. Such innovations expand therapeutic options for patients already exposed to HPV, supporting the strong growth outlook for antiviral drugs within the HPV associated disorders market.

Distribution Channel Insights

The hospital pharmacies segment dominated the market with the largest revenue share of 48.52% in 2024, mainly attributed to the central role of hospitals in delivering oncology care and vaccine administration. Hospital settings provide access to specialized treatments and advanced diagnostic services for HPV-associated conditions. The need for physician-supervised administration of biologics and infusion therapies spurs demand through hospital pharmacies. High patient volumes and referral pathways further reinforce the channel’s market strength. Integration of preventive vaccines with oncology treatment programs adds to hospital pharmacy dominance. These combined drivers explain the segment’s leading position.

The retail pharmacies segment is projected to grow at a CAGR of 5.1% over the forecast period, driven by increasing accessibility of HPV vaccines and oral therapies. Patients prefer retail pharmacies for convenience, cost transparency, and faster access to preventive treatments. Expanding availability of over-the-counter products and prescription dispensing broadens retail pharmacy relevance. Retailers are strengthening their role by offering counseling and vaccination services in community settings. Rising focus on preventive health behavior among younger populations aligns with retail pharmacy accessibility. This growth trajectory positions retail pharmacies as a rapidly expanding channel in the market for HPV associated disorders.

Regional Insights

North America HPV associated disorders industry held the largest market share of 37.55% in 2024 on the back of mature screening programs and strong uptake of HPV vaccines. Broad availability of advanced diagnostic assays and established clinical care pathways supports widespread testing and treatment. High healthcare spending enables fast adoption of novel therapeutics and expanded access through hospital and retail pharmacies. Strong presence of major pharmaceutical manufacturers and diagnostics firms reinforces supply-side capacity and distribution reach. Market demand is sustained by rising awareness of HPV-related cancers and improvements in early detection. These factors combine to keep North America at the forefront of market value and innovation.

U.S. HPV Associated Disorders Market Trends

The U.S. HPV associated disorders industry dominates North America due to demand for expanded screening, adoption of molecular HPV tests, and increasing recognition of vaccine benefits for both the sexes. Recent approvals of self-collection HPV tests are improving access to screening and may raise participation among underserved groups. Advanced laboratory infrastructure and payer coverage for recommended tests accelerate uptake in clinical practice. Research activity and clinical trials in the U.S. are advancing new treatment approaches for HPV-driven cancers. Rising incidence trends in certain HPV-related cancers maintain clinical urgency for better diagnostics and therapies. Public and professional awareness campaigns continue to influence testing and treatment patterns nationwide.

Europe HPV Associated Disorders Market Trends

The Europe HPV associated disorders industry shows steady demand through established screening programs, growing use of HPV-based primary screening, and strong diagnostic capability. Clinicians are shifting toward molecular HPV assays that deliver higher sensitivity for detection of high-risk strains. Partnerships between diagnostic companies and hospital networks are expanding access to laboratory-based testing across member states. Clinical research in Europe addresses therapeutic gaps for persistent infections and malignant progression. Reimbursement frameworks and payer engagement support broader adoption of recommended tests within clinical guidelines. Market maturity in Western Europe contrasts with ongoing expansion opportunities in parts of Eastern Europe.

The HPV associated disorders industry in the UK emphasizes (HPV) testing integration into routine screening and the expansion of self-sampling options to improve participation rates. Clinical networks and laboratories are modernizing workflows toward HPV-first screening algorithms for cervical cancer prevention. Growth in diagnostic volumes supports demand for reagents and platform upgrades in both hospital and private settings. Interest in therapeutic innovations is rising for patients with advanced or recurrent HPV-related malignancies. Increased public awareness and targeted outreach are influencing screening behavior across age groups. Shifts in screening intervals and modalities are reshaping service delivery models in primary and secondary care.The HPV associated disorders industry in Germany exhibits strong demand for high-quality diagnostics and specialist treatment pathways in oncology centers. Robust clinical infrastructure supports rapid incorporation of new assays and therapeutics into standard practice. Collaboration between research hospitals and industry generates clinical data that inform treatment guidelines for HPV-associated cancers. Private and public insurance reimbursement allows wide access to recommended diagnostic tests and oncologic therapies. Clinical focus spans prevention, early detection, and comprehensive management of patients with precancerous lesions. The market benefits from a high standard of laboratory services and a skilled clinical workforce.

The France HPV associated disorders industry is characterized by widespread screening uptake and growing use of HPV molecular tests in cytology workflows. Centralized reference labs and regional cancer centers support high diagnostic quality and timely patient management. Clinical research is active in evaluating therapeutic options for persistent HPV infections and associated cancers. Reimbursement pathways increasingly include validated HPV tests, supporting commercial uptake across public and private providers. Demand for improved diagnostic sensitivity drives procurement of modern testing platforms. Patient education campaigns and specialist engagement promote early detection and follow-up care.

Asia-Pacific HPV Associated Disorders Market Trends

The Asia Pacific HPV associated disorders industry is expected to register the fastest CAGR of 5.9% over the forecast period, spurred by rising awareness, expanding screening programs, and improving healthcare infrastructure. Large population bases and increasing diagnosis rates of HPV-related cancers create substantial demand for vaccines, diagnostics, and treatments. Market growth is supported by expanding hospital networks and increased availability of molecular testing in urban centers. Pharmaceutical companies are prioritizing market entry and distribution partnerships to reach underpenetrated areas. Clinical capacity building and regional research collaborations are enhancing local treatment standards. These dynamics contribute to a high projected CAGR compared with more mature regions.

The HPV associated disorders industry in Japan shows high market value for diagnostics and treatment, driven by advanced laboratory capability and a strong clinical research environment. Adoption of molecular HPV assays is widespread in hospital labs and specialized clinics. Japanese oncology centers participate in trials assessing novel therapies for HPV-related cancers and precancerous conditions. High standards for manufacturing and quality control favor supply from established multinational and domestic firms. Reimbursement and clinical guideline alignment support consistent use of validated diagnostic tests. Market opportunities focus on innovation in both preventive and therapeutic segments.

The China HPV associated disorders industry displays fast market expansion as healthcare access improves and screening uptake rises in urban areas. Growing investments in diagnostic platforms and localized manufacturing reduce test costs and broaden availability. Large-scale awareness efforts and screening pilots are increasing detection rates of precancerous lesions. Companies are forming distribution and clinical partnerships to scale testing across hospital networks and retail channels. Demand for vaccines and advanced therapeutics is expanding in parallel with diagnostics. Ongoing urban-rural capacity building will shape future penetration and treatment adoption.

Latin America HPV Associated Disorders Market Trends

The Latin America HPV associated disorders industry presents steady growth driven by increased screening initiatives and expanding access to diagnostics in major urban centers. Public and private labs are adopting molecular HPV tests to improve detection accuracy and follow-up triage. Partnerships with global manufacturers help supply vaccines and therapeutic agents to regional distributors. Clinical education and advocacy are raising awareness of HPV-related disease burden and care pathways. Market expansion focuses on improving supply chains and laboratory capacity to meet growing demand. Countries with higher screening coverage show earlier shifts toward advanced diagnostics and integrated care.

The HPV associated disorders industry in Brazil is a leading market in Latin America, with growing adoption of HPV testing and improving therapeutic services for HPV-driven diseases. Large referral hospitals and oncology networks support access to diagnostics and complex treatment regimens. Local manufacturing and regional distribution channels enhance product availability across major cities. Increased screening coverage in urban areas contributes to higher detection of precancerous lesions and treatment referrals. Collaboration between diagnostic firms and clinical centers is fostering real-world data generation for local practice. Market momentum reflects a mix of prevention, screening expansion, and improved treatment access.

Middle East & Africa HPV Associated Disorders Market Trends

The Middle East and Africa HPV associated disorders industry shows heterogeneous market characteristics, with pockets of advanced diagnostic capability alongside areas with limited screening coverage. Demand rises where private healthcare networks and specialist oncology centers concentrate services. Import partnerships and regional distributors play a central role in supplying vaccines, diagnostics, and treatments. Clinical training and laboratory upgrades are key to expanding molecular testing capacity in major urban centers. Market growth will depend on improving awareness and establishing sustainable diagnostics networks. Strategic regional collaboration can accelerate access to modern testing and therapeutic options.

The Saudi Arabia HPV associated disorders industry has witnessed an increased focus on expanding screening and diagnostic capacity in tertiary hospitals. Investment in laboratory infrastructure and specialist oncology services supports adoption of molecular HPV assays. Partnerships with multinational diagnostics and pharmaceutical firms strengthen supply and local service delivery. Clinical initiatives aim to integrate screening with referral pathways for the timely treatment of precancerous and malignant conditions. Rising patient awareness and healthcare modernization are influencing testing demand across urban centers. The market is positioned for measured growth as clinical capacity and diagnostic access expand.

Key HPV Associated Disorders Company Insights

Merck & Co., Inc. and GlaxoSmithKline plc lead the global market with strong vaccine portfolios targeting high-risk HPV strains linked to cervical and anal cancers. F. Hoffmann-La Roche Ltd. and Pfizer Inc. strengthen their presence through advanced diagnostics and oncology therapeutics addressing HPV-driven malignancies. AstraZeneca and Biocon are advancing research pipelines with targeted therapies and biologics designed to improve patient outcomes in HPV-related cancers. Lilly and AbbVie Inc. emphasize innovation in oncology and supportive care treatments, focusing on expanding clinical indications and patient-friendly solutions. The competitive landscape is defined by expanding treatment pipelines, strategic collaborations, and rising focus on broadening access across both mature and emerging markets.

Key HPV Associated Disorders Companies:

The following are the leading companies in the HPV associated disorders market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- GlaxoSmithKline plc

- F. Hoffmann-La Roche Ltd

- Pfizer Inc.

- AstraZeneca

- Biocon

- Lilly

- AbbVie Inc.

Recent Developments

-

In September 2024, Pfizer showcased its diverse oncology portfolio and combination approaches at the ESMO Congress. Over 50 company-sponsored abstracts, including 10 oral and mini-oral presentations, highlighted promising early results and next-generation candidates.

-

In September 2024, Merck & Co., Inc., announced positive top-line results from its Phase 3 trial (V503-064) of GARDASIL 9 in 1,059 Japanese males aged 16-26. The three-dose regimen significantly reduced six-month anogenital persistent infections from nine HPV types versus placebo. The primary endpoint targeted HPV 6/11/16/18, and the secondary HPV 31/33/45/52/58. Merck planned full data presentation and regulatory submissions.

-

In August 2024, GlaxoSmithKline plc, announced it had discontinued development of its Phase 2 HPV vaccine candidate, GSK4106647, citing lack of best-in-class potential. The decision was disclosed during its second-quarter earnings update, while Cervarix continued to be marketed in select countries

-

In May 2024, Roche announced the FDA approval of its HPV self-collection solution, expanding access to cervical cancer screenings and supporting the WHO’s goal of eliminating cervical cancer by 2030.

HPV Associated Disorders Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.42 billion

Revenue forecast in 2033

USD 28.52 billion

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, treatment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Merck & Co., Inc.; GlaxoSmithKline plc; F. Hoffmann-La Roche Ltd; Pfizer Inc.; AstraZeneca; Biocon; Lilly; AbbVie Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HPV Associated Disorders Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global HPV associated disorders market report based on type, treatment, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cervical Intraepithelial Neoplasia (CIN)

-

Cervical Cancer

-

Anal Intraepithelial Neoplasia (AIN)

-

Anal Cancer

-

Genital Warts

-

Others

-

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines

-

Anti-viral Drugs

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.