- Home

- »

- Biotechnology

- »

-

Human Liver Model Market Size, Industry Report, 2030GVR Report cover

![Human Liver Model Market Size, Share & Trends Report]()

Human Liver Model Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (2D Models, 3D Models), By Application (ADME Studies, Toxicology Testing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-355-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Liver Model Market Size & Trends

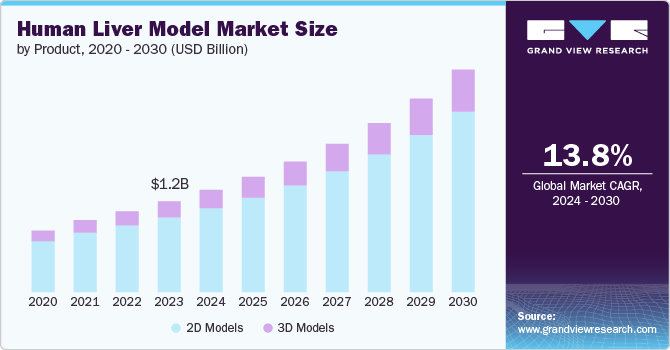

The global human liver model market size was valued at USD 1.34 billion in 2024 and is projected to grow at a CAGR of 14.04% from 2025 to 2030. The industry is driven by the increasing prevalence of liver diseases, advancements in organ printing technologies, and increased demand for therapeutic drugs for liver cancer, which is expected to propel its growth.

According to the Health Resources & Services Administration, in 2023, in the U.S., 106,800 individuals are waiting for organ transplants. The healthcare landscape is evolving, and advancements in 3D printing technology are set to transform healthcare by addressing organ shortages and improving patient care globally.

The prevalence of liver diseases is on the rise globally, leading to a growing demand for advanced research tools, including human liver models. Chronic liver conditions such as non-alcoholic fatty liver disease (NAFLD), alcoholic liver disease, viral hepatitis, and liver cancer are becoming increasingly common due to factors such as unhealthy diets, sedentary lifestyles, alcohol consumption, and viral infections. For instance, NAFLD emerged as the most prevalent chronic liver disorder in Western countries, affecting approximately 25% of the global population. This significant rise in the prevalence of liver diseases has driven the urgent need for more accurate and efficient human liver models to support research and drug development efforts.

Organ 3D printing technologies have advanced significantly recently, particularly in developing human liver models. These advancements have revolutionized regenerative medicine and drug testing by providing more accurate and personalized models for research purposes. For instance, in February 2023, researchers at the University of California San Diego made significant progress in addressing challenging issues in bio-printing 3D-engineered tissues, achieving high cell density, viability, and precise fabrication resolution.

Market Concentration & Characteristics

The human liver model industry is experiencing significant innovation, driven by advancements in organ-on-chip technology, 3D bioprinting, and stem cell research. These models are increasingly used for drug testing, disease modeling, and personalized medicine, offering more accurate alternatives to animal testing. As technology improves, liver models are becoming more complex and reliable, enhancing pharmaceutical research and therapeutic development.

The level of collaboration and partnership in the human liver model industry remains moderate, as companies form strategic partnerships to strengthen their market presence and capitalize on the emerging trends in healthcare.

Regulation significantly impacts the human liver model industry. Regulatory bodies like the FDA and EMA set guidelines for the use of liver models in drug testing and disease research. Strict compliance with these regulations drives market growth, fosters innovation, and ensures that models meet high standards for reliability and reproducibility.

Product expansion in the human liver model industry is driven by advancements in technology and growing demand for more accurate drug testing and disease modeling tools. Companies are diversifying their offerings with more sophisticated liver models which can enhance drug discovery, toxicology testing, and personalized medicine, catering to diverse industry needs.

The human liver model industry is experiencing substantial regional growth, as companies strategically focus on different geographic regions to leverage diverse research areas and regulatory frameworks. This approach is enhancing market penetration and fostering overall growth.

Product Insights

The 2D models segment held the largest market share in 2024. One key driver is the widespread adoption of 2D models in pharmaceutical research and drug development due to their cost-effectiveness and simplicity compared to more complex 3D models. Additionally, the ease of use and well-established protocols for 2D models make them a preferred choice for many researchers. Instances supporting this dominance include the high demand for screening compounds for hepatotoxicity testing, where 2D models are efficient and reliable, leading to their increased utilization in various research applications.

The 3D models segment in the human liver model market is expected to witness the highest CAGR of 15.69% from 2025 to 2030 due to its ability to closely mimic the complex structure and function of the human liver. These models provide:

-

A more accurate representation of in vivo conditions.

-

Making them valuable tools for drug development.

-

Disease modeling.

-

Personalized medicine.

For instance, Emulate Inc. offers organs-on-chips technology that recreates the microenvironment of human organs, including the liver, allowing for more precise testing of drug responses and toxicity levels.

Application Insights

Based on application, the ADME (absorption, distribution, metabolism, and excretion) studies segment held the largest revenue share of 38.94% in 2024. The increasing demand for accurate and efficient drug development and testing processes drives this segment. By utilizing human liver models for ADME studies, researchers can simulate human physiological conditions more accurately, leading to better predictions of drug behavior in humans. As a result, there is a high demand for liver models in the biopharmaceuticals industry which boosts the segment growth.

The toxicology testing segment is projected to exhibit the highest growth at a CAGR of 15.69% from 2025 to 2030 in the human liver model market. This can be attributed to the increasing demand for more accurate and predictive in vitro models to assess the safety and efficacy of new drug candidates, chemicals, and cosmetic ingredients. Pharmaceutical and chemical companies are increasingly adopting human liver models, such as 3D bio-printed liver tissues and organ-on-a-chip platforms, to replace traditional animal testing methods, which fail to predict human-specific responses accurately. These factors are likely to drive the segment.

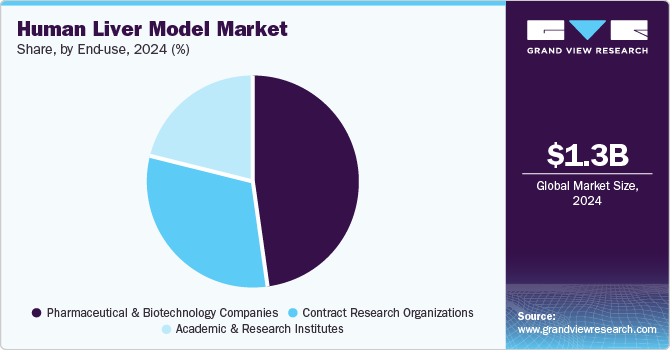

End Use Insights

Pharmaceutical & biotechnology companies held the largest revenue share of 48.33% in 2024. This dominance is primarily driven by the increasing demand for advanced liver models for drug development and toxicity testing within these industries. During preclinical studies, pharmaceutical and biotechnology companies rely heavily on human liver models to assess drug metabolism, drug-drug interactions, and hepatotoxicity. Using human liver models allows these companies to enhance the efficiency and accuracy of their drug development processes, leading to cost savings and reduced time-to-market for new pharmaceutical products.

The Contract Research Organizations (CROs) segment is anticipated to witness the highest CAGR of 15.42% from 2025 to 2030 within the human liver model market. The increasing demand for personalized medicine and the rising prevalence of liver diseases propel the need for advanced research and development in this field. CROs offer specialized services and expertise that pharmaceutical companies and research institutions can leverage to accelerate drug discovery processes related to liver diseases.

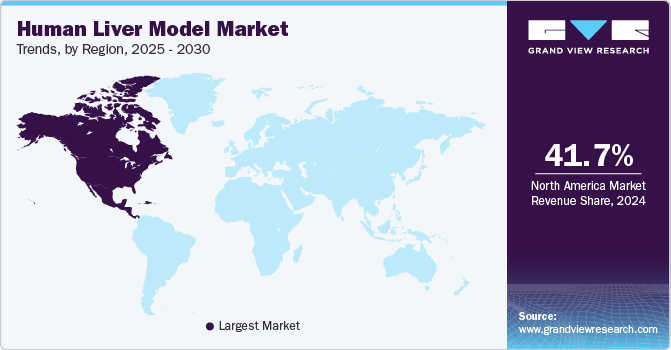

Regional Insights

North America human liver model market dominated the global industry with the largest revenue share of 41.68% in 2024, due to several unique factors. The region benefits from a robust healthcare infrastructure and favorable regulatory environment that supports the adoption of advanced technologies such as the Human Liver Model for preclinical drug testing. North America boasts a high concentration of leading academic research institutions, biotech start-ups, and pharmaceutical companies that drive innovation and collaboration in liver disease research and drug development.

U.S. Human Liver Model Market Trends

The human liver model market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period. A strong emphasis on personalized medicine and the use of advanced technologies characterizes the U.S. market. The country's healthcare system encourages the adoption of innovative solutions, such as organ-on-a-chip devices, which can simulate the function of human livers. According to the CDC, 4.5 million adults aged 18 and older are living with liver disease in the U.S. Hence, the adoption of liver models is expected to increase in this country in the coming years.

Europe Human Liver Model Market Trends

The human liver model market in Europe is witnessing several notable trends. One significant trend is the increasing adoption of advanced technologies such as 3D bioprinting and organ-on-a-chip systems for developing more accurate and physiologically relevant liver models. These innovative technologies enable researchers to mimic the complex microenvironment of the liver, leading to improved drug testing and disease modeling capabilities.

The UK human liver model market held a significant share in 2024. The UK market is witnessing significant growth, aligning with the increasing prevalence of chronic diseases. Government support for research, growing pharmaceutical investments, and collaborations between academia and industry further fuel market growth. Additionally, the push for more accurate drug testing and disease modeling contributes to the market's expansion.

The human liver model market in France is experiencing significant growth due to a strong focus on improving drug development processes, and regulatory support for alternatives to animal testing. Collaborative efforts between research institutions and pharmaceutical companies, alongside government-backed initiatives for innovation in medical technology, are accelerating the use of advanced liver models in drug testing, disease modeling, and personalized medicine.

Germany human liver model market is growing due to a combination of factors. Strong government support for innovation and research, coupled with increasing demand for alternatives to animal testing, fuels growth. Collaborative efforts between academic institutions, research organizations, and industry players further enhance the development and adoption of advanced liver models for drug testing and disease research.

Asia Pacific Human Liver Model Market Trends

The human liver model market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The market is primarily driven by the increasing demand for advanced healthcare solutions, particularly in countries like China and Japan. Strong growth in the pharmaceutical and biotech sectors, along with improving regulatory frameworks, is encouraging the development of innovative liver models. Additionally, rising awareness of personalized medicine and regenerative medicine is boosting market expansion.

China human liver model market is experiencing significant growth. In China, the human liver model market is driven by rapid advancements in biotechnology, particularly in 3D cell cultures and organ-on-chip technologies. Strong government support for scientific research, coupled with a growing emphasis on reducing animal testing, is propelling innovation. Additionally, China’s expanding pharmaceutical industry and increasing investments in personalized medicine are accelerating the adoption of human liver models for drug testing and disease research.

The human liver model market in Japan is witnessing notable growth. Japan's leading pharmaceutical and biotechnology sectors are investing heavily in human liver models for more accurate drug testing and personalized medicine. The government's support for innovation and the growing demand for alternatives to animal testing are also key factors driving market growth.

MEA Human Liver Model Market Trends

The human liver model market in the Middle East & Africa has experienced considerable growth in recent years, driven by several factors. The market is driven by increasing investments in healthcare and biotechnology, particularly in countries like the UAE and South Africa. Growing awareness of the need for alternative testing methods to animal models and improvements in research infrastructure are fuelling demand.

Saudi Arabia human liver model market has experienced steady growth in recent years, paralleling the rising prevalence of chronic diseases in the country. Government investments in healthcare innovation, coupled with initiatives like Vision 2030, support the development of advanced drug testing methods. Increasing demand for alternatives to animal testing and the expansion of the pharmaceutical sector further boost the adoption of human liver models for drug discovery and disease modeling.

The human liver model market in Kuwait is experiencing notable growth. Investments in biotechnology and collaborations with global research institutions are fostering innovation in drug testing and disease modeling. Additionally, the increasing demand for alternatives to animal testing and the growing pharmaceutical sector are contributing to the adoption of advanced liver models in the country.

Key Liver Model Company Insights

Key players in the human liver model market are pursuing strategic initiatives to bolster their market position. These include collaborations, partnerships, acquisitions, and new product launches. Substantial R&D investments are being made to enhance the capabilities and accuracy of human liver models. These strategies enable companies to diversify their product offerings, improve technological competencies, and address the growing demand for advanced liver models in drug development and toxicology testing.

Key Liver Model Companies:

The following are the leading companies in the liver model market. These companies collectively hold the largest market share and dictate industry trends.

- ATCC

- Merck KGaA

- AcceGen

- ZenBio, Inc.

- Organovo Holdings Inc.

- BioIVT

- InSphero

- Emulate, Inc.

- Mimetas

- CN Bio Innovations Ltd

Recent Developments

-

In April 2024, CN Bio secured $21 million in Series B funding to address rising interest in its organ-on-a-chip (OOC) technologies. The initiative is expected to strengthen the company’s market position.

-

In December 2023, CN Bio introduced its PhysioMimix assay for non-alcoholic steatohepatitis (NASH) to validate the effectiveness of INI-822, a drug developed by Inipharm. This assay is crucial for confirming the drug's efficacy, demonstrating the utility of Organ-on-a-Chip technology in liver disease research and drug development.

-

In September 2023, UC Davis Health introduced a new program for liver transplants in adults, which enhances the current offerings of the UC Davis Transplant Center and delivers comprehensive care to individuals with liver conditions.

Human Liver Model Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.51 billion

Revenue forecast in 2030

USD 2.92 billion

Growth Rate

CAGR of 14.04% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

ATCC, Merck KGaA, AcceGen, ZenBio, Inc., Organovo Holdings Inc., BioIVT, InSphero, Emulate, Inc., Mimetas, CN Bio Innovations Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

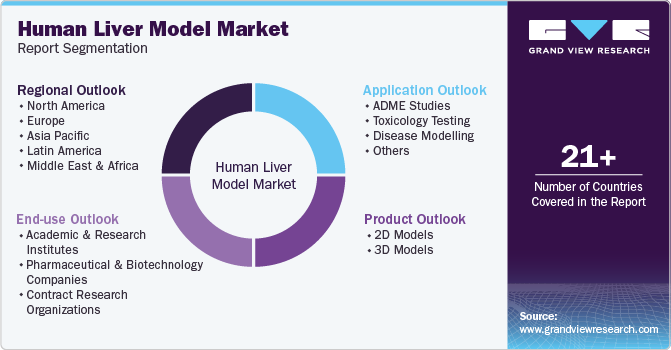

Global Human Liver Model Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human liver model market report on the basis of product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Models

-

Cell lines

-

Primary Cells

-

-

3D Models

-

Liver on Chip

-

Organoids

-

Spheroids

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ADME Studies

-

Toxicology Testing

-

Disease Modelling

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global human liver model market size was estimated at USD 1.34 billion in 2024 and is expected to reach USD 1.51 billion in 2025.

b. The global human liver model market is expected to grow at a compound annual growth rate of 14.04% from 2025 to 2030 to reach USD 2.92 billion by 2030.

b. North America dominated the human liver model market with a share of 41.68% in 2024. This is attributable to rising awareness about 3D model technologies coupled with the presence of several key players in the region.

b. Some key players operating in the human liver model market include ATCC, Merck KGaA, AcceGen, ZenBio, Inc., Organovo Holdings Inc., BioIVT, InSphero, Emulate, Inc., Mimetas, and CN Bio Innovations Ltd.

b. Key factors that are driving the market include the increasing prevalence of liver diseases, advancements in organ printing technologies, and increased demand for therapeutic drugs for liver cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.