- Home

- »

- Advanced Interior Materials

- »

-

Hospital HVAC Systems Market Size, Industry Report, 2033GVR Report cover

![Hospital HVAC Systems Market Size, Share & Trends Report]()

Hospital HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Heating, Ventilation, Cooling), By End Use (Intensive Care Unit, Operating Rooms), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-133-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hospital HVAC Systems Market Summary

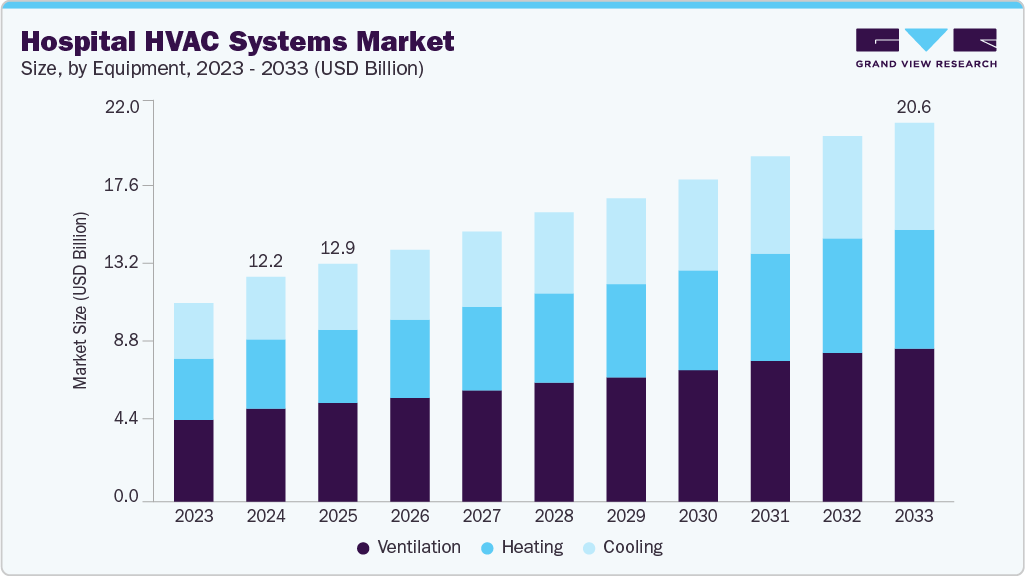

The global hospital HVAC systems market was valued at USD 12,212.0 million in 2024 and is projected to reach USD 20,588.7 million by 2033, growing at a CAGR of 6.0% from 2025 to 2033. Growth is driven by rising demand for reliable, energy-efficient, and regulation-compliant air handling systems in critical hospital zones such as ICUs, operating rooms, and isolation wards.

Key Market Trends & Insights

- Asia Pacific dominated the hospital HVAC systems market with the largest revenue share of 38.3% in 2024.

- The hospital HVAC systems market in Malaysia is expected to grow at a rapid CAGR of 8.9% from 2025 to 2033.

- By equipment, the cooling segment is expected to grow at a considerable CAGR of 6.3% from 2025 to 2033 in terms of revenue.

- By end use, the Intensive Care Unit (ICU) segment is expected to grow at a significant CAGR of 6.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 12,212.0 Million

- 2033 Projected Market Size: USD 20,588.7 Million

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

Government initiatives in regions like North America and Europe, including incentives and rebates for clean heating and cooling technologies, are further supporting market expansion. In addition, the accelerating pace of hospital construction across the globe is playing a significant role in driving demand for hospital HVAC systems. As healthcare infrastructure expands to accommodate rising population needs, urbanization, and growing incidences of chronic illnesses, new hospitals and medical campuses are being developed with greater emphasis on advanced environmental control systems.

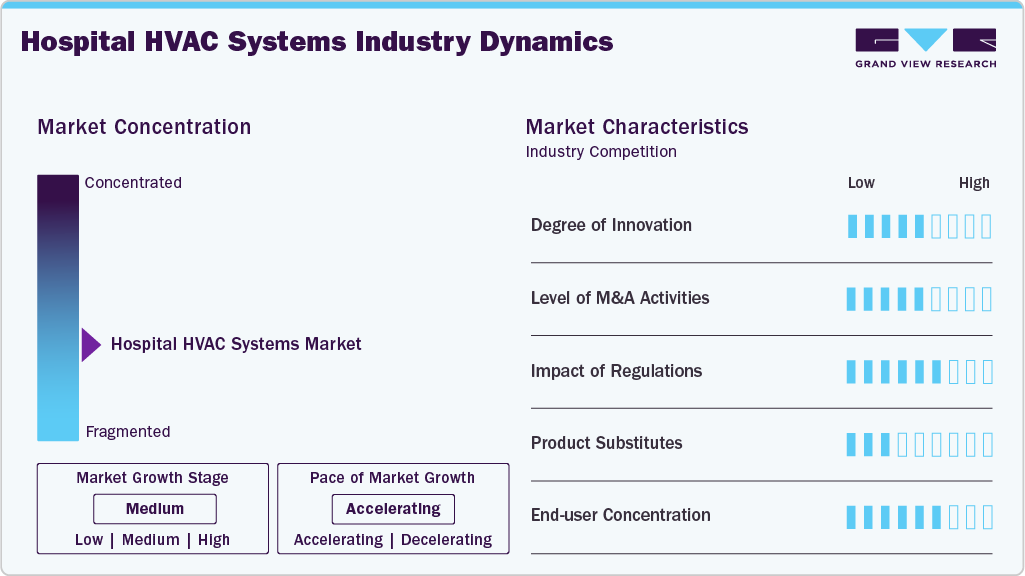

Market Concentration & Characteristics

The global hospital HVAC systems industry exhibits a moderately consolidated structure, characterized by the presence of a few dominant multinational HVAC companies alongside several specialized regional players. Leading manufacturers such as Carrier, Daikin, Trane, and Johnson Controls hold significant market share due to their broad product portfolios, technological expertise, and established installation and maintenance networks. These firms often form long-term contracts with healthcare providers, facility managers, and infrastructure developers, securing their foothold in new hospital construction and retrofit projects.

A defining characteristic of the hospital HVAC systems industry is its emphasis on precision, reliability, and regulatory compliance. Unlike standard commercial HVAC systems, hospital HVAC solutions are tailored to critical zones such as isolation wards, surgical suites, intensive care units (ICUs), and pharmaceutical storage areas-each with unique temperature, humidity, filtration, and airflow requirements. As a result, customization and adherence to stringent health and safety codes (such as ASHRAE 170, FGI Guidelines, and CDC standards) are central to product development and deployment strategies.

Regulatory bodies and healthcare accreditation agencies play a vital role in shaping market dynamics by enforcing standards for air quality, infection control, and energy efficiency. In response, manufacturers are increasingly integrating advanced filtration systems (like HEPA and UVGI), building automation, and smart diagnostics into their HVAC units. Energy efficiency and indoor air quality (IAQ) remain critical concerns for healthcare operators, prompting the adoption of low-energy HVAC solutions and intelligent ventilation systems that reduce operational costs while ensuring patient safety.

While demand for hospital HVAC systems is strong due to ongoing hospital infrastructure upgrades, population aging, and the rise in infectious disease preparedness, the market also faces pressures from capital expenditure constraints and lengthy procurement cycles in public healthcare systems. To maintain competitiveness, key players are investing in modular HVAC units, AI-driven building management systems, and service-based models that offer predictive maintenance and lifecycle cost savings. In this evolving landscape, the ability to balance regulatory compliance, operational efficiency, and indoor environmental control will define long-term success.

Drivers, Opportunities & Restraints

The hospital HVAC systems industry is primarily driven by rapid expansion in global healthcare infrastructure, with rising investments in new hospital construction and refurbishment of existing facilities. Hospitals increasingly require specialized HVAC systems that provide reliable temperature, humidity, and pressure control while supporting infection prevention and energy efficiency goals. Growth is further supported by government-backed clean energy incentives, regulatory mandates for air quality, and increased healthcare spending in both developed and emerging economies.

Opportunities in the market are being shaped by the rising demand for airborne infection isolation rooms and protective environment zones, particularly in response to pandemic preparedness and updated infection control protocols. Healthcare facilities are rapidly adopting smart HVAC systems, integrating IoT-based sensors, predictive maintenance platforms, and building management systems (BMS) to enhance operational efficiency, safety, and compliance. There is also a growing emphasis on retrofitting legacy systems with code-compliant, energy-efficient equipment, unlocking significant potential in developed markets like the U.S., Germany, and Japan.

However, the hospital HVAC systems industry faces constraints such as high installation and maintenance costs, which can deter adoption, especially in smaller or public healthcare institutions with tight capital budgets. In addition, long procurement cycles and delayed decision-making in public sector hospital projects often lead to extended lead times and hinder market momentum. Addressing the need for skilled labor in hospital-grade HVAC design and integration remains another pressing challenge.

Equipment Insights

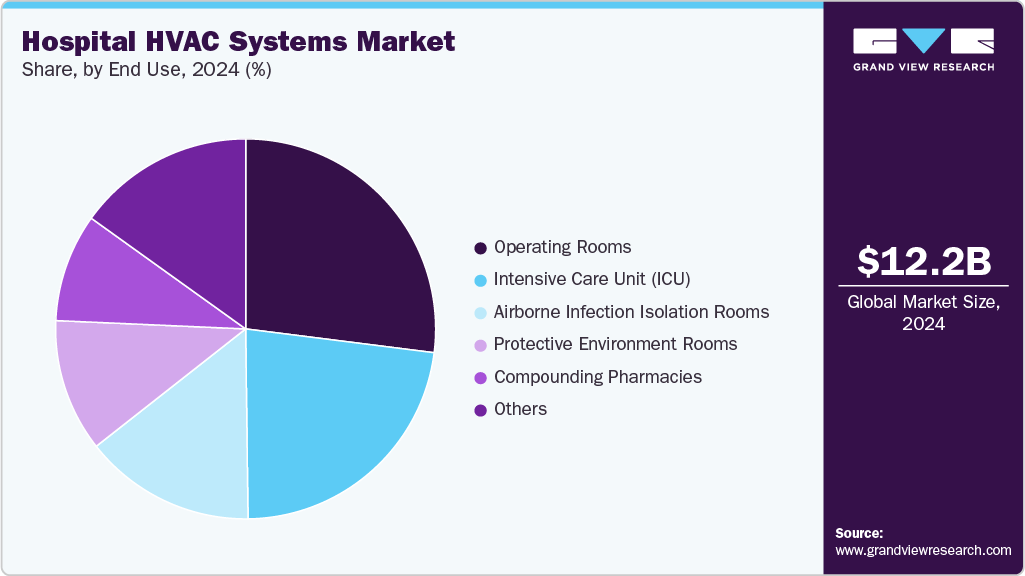

The ventilation segment led the market with the largest revenue share of 41.4% in 2024. Ventilation plays a vital role in maintaining sterile environments and ensuring infection control in critical areas such as operating rooms, ICUs, isolation wards, and compounding pharmacies. Hospitals increasingly deploy air handling units (AHUs), exhaust systems, energy recovery ventilators, and HEPA filtration units to ensure proper air exchange, filtration, and pressurization.

The growing use of climate-sensitive areas such as ORs, patient isolation rooms, and protective zones is fueling demand for the cooling segment, which comprises chillers, cooling towers, and integrated HVAC systems capable of delivering precise thermal regulation. The increasing use of smart control systems and low-GWP refrigerants in these systems is also contributing to adoption in retrofit and new-build hospital projects.

End Use Insights

The operating rooms (ORs) segment led the market with the largest revenue share of 27.0% in 2024. This dominance is driven by the critical need for sterile air environments and highly controlled airflow, humidity, and pressurization. Hospitals are increasingly adopting laminar airflow systems, HEPA filtration, and environmental control units in ORs to meet stringent compliance requirements from organizations like ASHRAE, CDC, and WHO.

HVAC systems used in ICUs demand exceptionally high reliability in maintaining a stable and precise indoor climate, encompassing temperature, humidity, and air pressure. These systems are also required to provide advanced air purification, often incorporating multi-stage HEPA and ULPA filtration, UV-C germicidal lamps, and active bioaerosol management to ensure the removal of airborne contaminants. The presence of vulnerable, immunocompromised patients necessitates uninterrupted system operation, where even minor fluctuations can compromise patient safety. As a result, there is growing emphasis on continuous monitoring, real-time diagnostics, and redundancy-based design, all of which are driving upgrades toward smart, predictive, and failsafe HVAC platforms tailored specifically for high-dependency hospital zones like ICUs.

Regional Insights

The hospital HVAC systems market in North America is witnessing strong growth in hospital HVAC adoption driven by regulatory mandates, aging healthcare infrastructure, and federal funding for system upgrades. There is increasing uptake of smart ventilation systems, heat recovery chillers, and zone-specific pressure control units to support advanced infection control in critical care settings.

U.S. Hospital HVAC Systems Market Trends

The hospital HVAC systems market in the U.S. accounted for the largest market revenue share in North America in 2024. Federal programs such as the Infrastructure Investment and Jobs Act and various clean energy incentives are promoting modernization of HVAC infrastructure in hospitals. Retrofit activity is especially high across older healthcare campuses, with increasing installations of IoT-enabled systems for real-time environmental monitoring and predictive maintenance.

Asia Pacific Hospital HVAC Systems Market Trends

Asia Pacific dominated the hospital HVAC systems market with the largest revenue share of 38.3% in 2024. The region is witnessing rapid growth due to increasing hospital construction, rising adoption of infection control standards, and growing healthcare expenditure. Demand is particularly strong for energy-efficient ventilation and cooling technologies in countries focusing on infrastructure modernization and regulatory compliance.

The hospital HVAC systems market in Malaysia is projected to grow at the fastest CAGR of 8.9% from 2025 to 2033, fueled by aggressive expansion of public healthcare infrastructure, implementation of cleanroom-grade HVAC systems in ICUs and operating theaters, and government-backed investments in Tier-2 and Tier-3 city hospitals. There is also increasing demand for retrofitting legacy systems with high-efficiency AHUs, UV-C filtration, and low-GWP refrigerants.

The market in China is projected to expand at a rapid CAGR of 8.3% over the forecast period, fueled by the country’s expanding healthcare infrastructure and rising focus on infection control and indoor air quality. Increasing investments in both public and private hospitals, along with a push for energy-efficient and regulatory-compliant systems, are driving demand for advanced HVAC solutions.

Europe Hospital HVAC Systems Market Trends

The hospital HVAC systems market in Europe is being driven by stringent energy efficiency regulations and aging hospital stock requiring system upgrades. The region’s net-zero building mandates and infection control norms are pushing demand for heat recovery systems, advanced filtration, and HVAC-BMS integration in healthcare environments.

The Italy hospital HVAC systems market is projected to expand at the fastest CAGR of 6.1% over the forecast period. Italy’s market is being propelled by strong domestic engineering expertise, cost-effective manufacturing, and a deep pool of skilled labor, supporting robust deployment and service capabilities. In addition, stringent energy and air quality standards-alongside increasing investment in healthcare infrastructure modernization-are fostering demand for advanced, sustainable HVAC solutions in hospitals

The hospital HVAC systems market in France is projected to grow at a rapid CAGR of 5.8% over the forecast period. Upgrades in HVAC systems across regional hospitals and rising investments in oncology and infectious disease facilities are driving demand. French hospitals are adopting modular HVAC units with integrated filtration and automated compliance monitoring systems to meet Facility Guidelines Institute (FGI) and ASHRAE ventilation requirements.

Latin America Hospital HVAC Systems Market Trends

The hospital HVAC systems market in Latin America is emerging as a fast-growing region driven by new hospital construction, particularly in urban areas, and increased focus on improving air quality in healthcare settings. While the regulatory environment is less stringent compared to developed regions, rising demand for surgical and isolation zones is accelerating system upgrades.

The Brazil hospital HVAC systems market is projected to expand at a significant CAGR of 6.7% during the forecast period, the highest in the region. Growth is driven by large-scale healthcare projects in São Paulo, Rio de Janeiro, and other metros. Increased demand for ORs, ICUs, and HVAC-integrated infection control systems is shaping supplier offerings toward compact, energy-efficient equipment with local support capabilities.

Middle East & Africa Hospital HVAC Systems Market Trends

The hospital HVAC systems market in MEA is experiencing a steady rise in demand for hospital HVAC systems, driven by a combination of climate-related challenges, large-scale public healthcare investments, and growing awareness of airborne infection risks. With average temperatures soaring across much of the region, there is a critical need for high-capacity, energy-efficient cooling systems in hospitals to maintain indoor thermal comfort and equipment performance.

The Saudi Arabia hospital HVAC systems market is anticipated to grow at the fastest CAGR of 7.1% during the forecast period, fueled by Vision 2030 investments in healthcare infrastructure and emphasis on high-acuity care. Large tertiary hospitals and specialty clinics are deploying modular HVAC systems with HEPA and UVGI capabilities, along with centralized monitoring via building automation platforms.

Key Hospital HVAC Systems Company Insights

Some of the key players operating in the market include Carrier Corporation and Daikin Industries, Ltd among others.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors.It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Daikin Industries, Ltd. offers air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key Hospital HVAC Systems Companies:

The following are the leading companies in the hospital HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Haier Group

- Johnson Controls

- LG Electronics

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- SAMSUNG

- Havells India Ltd.

- Honeywell International Inc.

- Trane

Recent Developments

-

In February 2025, Daikin Australia launched the EWYE-CZ air-to-water inverter heat pump, which uses eco-friendly R454C refrigerant and offers quiet operation-making it ideal for sensitive hospital zones. The compact system design allows flexible integration in urban and space-constrained medical campuses.

-

In September 2024, Trane announced it is transitioning its commercial HVAC systems to low-GWP refrigerants to comply with U.S. EPA regulations effective January 1, 2025. The company is also adding factory-installed leak detection systems to models with refrigerant charges exceeding 3.91 pounds, enhancing safety and efficiency. These updates apply to various product lines, including rooftop units and modular chillers, supporting sustainability goals and regulatory compliance.

Hospital HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12,918.2 million

Revenue forecast in 2033

USD 20,588.7 million

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; South Korea; Australia; Indonesia; Malaysia; Thailand; Brazil; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Carrier Corporation; DAIKIN INDUSTRIES Ltd.; Haier Group; Johnson Controls; LG Electronics; Lennox International Inc.; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Havells India Ltd.; Honeywell International Inc.; Trane.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global hospital HVAC systems market report based on the equipment, end use, and region:

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Heating

-

Ventilation

-

Cooling

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Intensive Care Unit (ICU)

-

Operating Rooms

-

Airborne Infection Isolation Rooms

-

Protective Environment Rooms

-

Compounding Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hospital HVAC systems market size was estimated at USD 12,212.0 million in 2024 and is expected to reach USD 12,918.2 million in 2025.

b. The global hospital HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 20,588.7 million by 2033.

b. The market in Asia Pacific dominated the market in 2024 accounting for 38.3% of the global revenue share driven by rapid urbanization, expanding healthcare infrastructure, and rising investments in medical facility modernization. Government-led initiatives to improve public health systems and compliance with air quality and infection control standards are further accelerating demand.

b. Some of the key players operating in the hospital HVAC systems market are Carrier Corporation, DAIKIN INDUSTRIES Ltd., Haier Group, Johnson Controls, LG Electronics, Lennox International Inc., Mitsubishi Electric Corporation, Rheem Manufacturing Company, SAMSUNG, Havells India Ltd., Honeywell International Inc., and Trane.

b. Key factors driving the hospital HVAC systems market include increasing demand for infection control and indoor air quality in healthcare settings, alongside stringent regulatory requirements for ventilation and energy efficiency. Growth in healthcare infrastructure and retrofitting of existing hospitals also contribute significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.