- Home

- »

- Medical Devices

- »

-

Hormonal Contraceptive Market Size & Share Report, 2030GVR Report cover

![Hormonal Contraceptive Market Size, Share & Trends Report]()

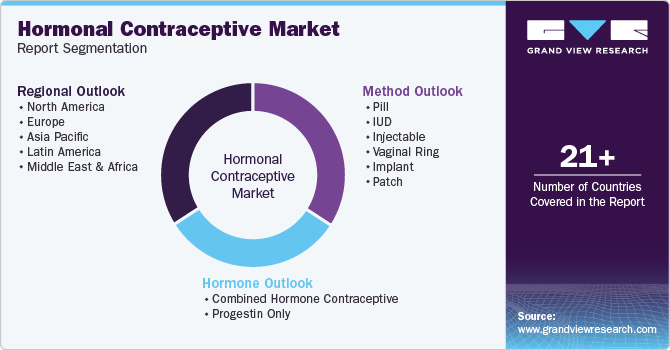

Hormonal Contraceptive Market (2025 - 2030) Size, Share & Trends Analysis Report By Method (Pill, IUD), By Hormone (Combination Hormonal Contraceptives, Progestin-only), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-2-68038-348-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hormonal Contraceptive Market Summary

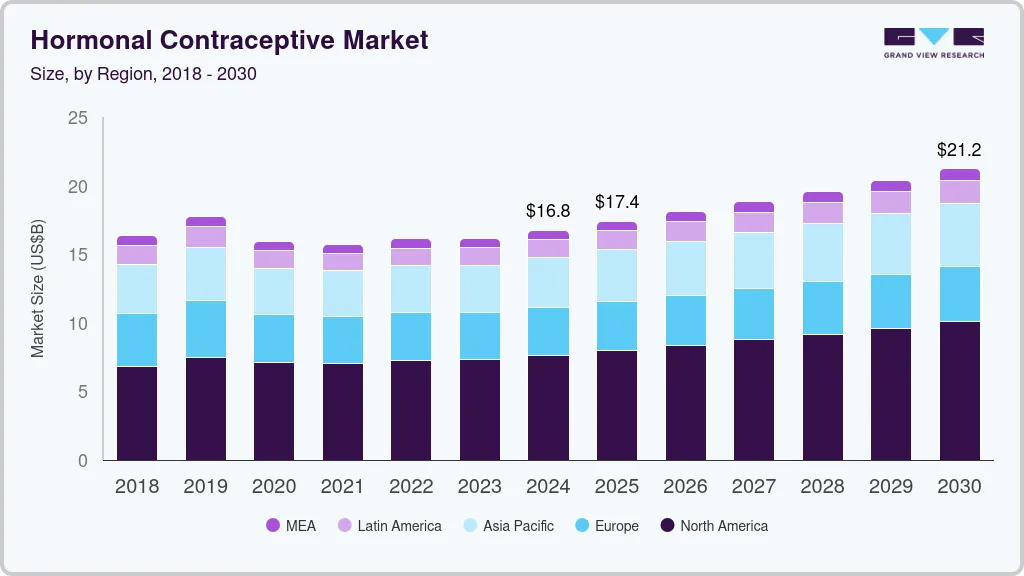

The global hormonal contraceptive market size was estimated at USD 16.75 billion in 2024 and is projected to reach USD 21.21 billion by 2030, growing at a CAGR of 4% from 2025 to 2030. Increasing awareness in emerging economies regarding hormonal contraception methods, growing investments by the major players for the R&D of novel contraceptive devices, and supportive initiatives by various governments to increase access to contraceptive products are the factors propelling the industry’s growth.

Key Market Trends & Insights

- North America region held the largest revenue share of 45.41% in 2023.

- The U.S. market held the largest share in 2023.

- Based on method, the pill segment dominated the market with a revenue share of 47.44% in 2023.

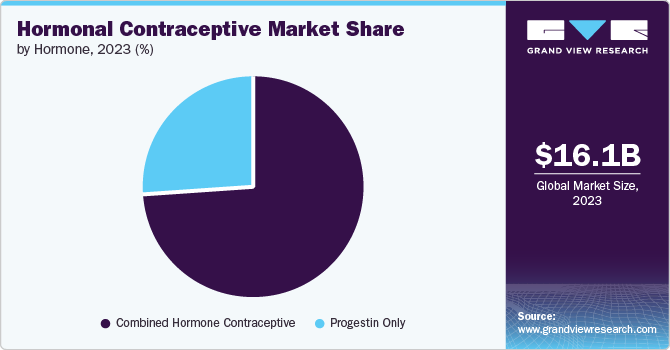

- Based on hormone, the combined hormone contraceptive segment dominated the market in 2023 with a revenue share of over 73%.

Market Size & Forecast

- 2024 Market Size: USD 16.75 Billion

- 2030 Projected Market Size: USD 21.21 Billion

- CAGR (2025-2030): 4%

- North America: Largest market in 2023

Rising awareness regarding the various options available to avoid pregnancy is expected to boost industry growth. The WHO provided guidelines for the use of hormonal contraceptives, such as progestogen injectables, intrauterine devices, and implants, for women at greater risk of HIV. The guidelines were based on the Evidence for Contraceptive Options and HIV Outcomes (ECHO) trial, which showed no differences in the acquisition of HIV in women using non-hormonal contraceptives such as levonorgestrel implants, copper intrauterine devices, or DMPA-IM.

In addition, industry players are increasing their market presence through strategies such as increased investment in research and development and commercializing new products. For instance, in July 2023, Perrigo Company plc or its affiliates received FDA approval for Opill (norgestrel) tablets for nonprescription use in the U.S. This approval allows customers to purchase this progestin-only pill without a prescription at convenience stores, drug stores, grocery stores, and online, providing an additional option for accessible birth control. Such strategies increase the demand for OTC hormonal contraceptives that is expected to drive the growth of market.

Long-acting contraception methods, such as IUDs and vaginal rings, have become more popular in the last decade, and their adoption is on a rise. This can be attributed to the steady increase in copayment for pills and subsequently, improving affordability. Major IUDs currently available in the U.S. are Kyleena, Mirena, Skyla, and Liletta. Moreover, adopting long-acting reversible devices is one of the major driving factors for industry growth. According to a study published in the Pharmaceutical Journal in 2021,, long-acting reversible devices are one of the most successful contraception techniques as it eliminates human error, with failure rates of less than 1% in the 1st year of usage, as it does not require user input regularly.

Industry Dynamics

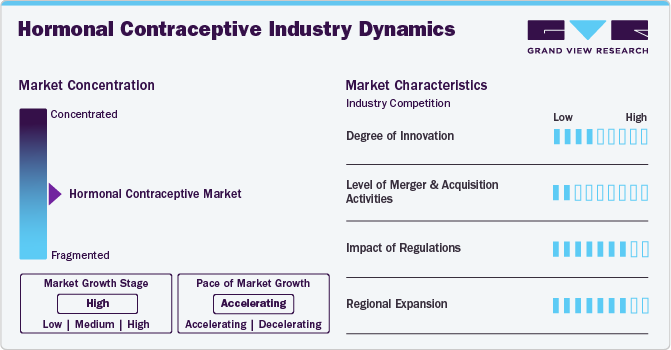

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, impact of regulations, and regional expansion. For instance, the industry is moderately consolidated, with many major players in the industry launching new innovative products. The degree of innovation is moderate, and the level of mergers & acquisitions activities is low. The impact of regulations on the industry is high, and the regional expansion of the industry is high.

The degree of innovation in the hormonal contraceptive market is moderate. Few service providers introduce new products to meet the rise in needs for products due to the increase in unwanted pregnancies. For instance, in November 2023, Mithra Pharmaceuticals, a provider of Women’s Health solutions, received additional approval for the NEXTSTELLIS (14.2 mg estetrol (E4) and 3 mg drospirenone tablets) patent in the U.S. This approval allows NEXTSTELLIS to have oral-dosage-unit protection in the U.S. market until 2036.

The level of mergers & acquisitions in the industry is low owing to stringent regulations and approvals required for products to expand their industry presence. However, few players are acquiring emerging players in different countries to increase their market presence. For instance, in March 2024, Insud Pharma, a Spain-based pharmaceutical manufacturer, acquired Viatris Inc.'s Women's healthcare business, which is primarily related to injectable and oral contraceptives. This acquisition establishes Insud Pharma's industrial presence in India with two additional manufacturing sites.

The industry is subject to strict laws and regulations due to its vital role in public health. These regulations aim to provide safe products that prevent unintended pregnancies and control population growth. Regulatory authorities demand thorough clinical trials and data to prove the effectiveness, reliability, and quality of products prior to approval. This process guarantees that the products meet the required standards for safety and effectiveness.

The level of regional expansion in the industry is high due to the increasing awareness, government initiatives, demographic shifts, and the presence of well-developed pharmaceutical sectors. The industry is experiencing significant regional expansion, particularly in the Asia Pacific, Europe, and North America regions. For instance, in June 2024, Lupin signed a supply and license agreement with OLIC (Thailand) Limited, a subsidiary of Fuji Pharma Co., Ltd., to promote Nextstellis in the Philippines and Vietnam.

Method Insights

Based on method, the pill segment dominated the market with a revenue share of 47.44% in 2023. The growth of segment is attributed to the simple and easy administration, easily available products, better awareness about the pills compared to long-acting reversible devices, and higher efficiency of around 99% in timely consumption. Furthermore, growing penetration in emerging countries is expected to contribute to segment growth. For instance, in July 2021, the MHRA approved the OTC sale of pills in UK pharmacies. Two contraceptive pill brands, Hana and Lovima, are selling desogestrel- synthetic progesterone, OTC with a consultation with a pharmacist.

The implant segment is anticipated to grow at the fastest CAGR during the forecast period, owing to their convenience and long-lasting effect of implants, making them an attractive option for women who want reliable contraception with minimal effort. Implants are popular among women who prefer a method that does not require daily attention. The rising number of product launches in the implant segment is expected to showcase significant growth during the forecast period. For instance, in July 2023,the Karnataka Health Department introduced two new contraception methods for women as part of the National Family Planning Programme. The sub-dermal implant and subcutaneous injection aim to promote healthier reproductive and sexual lives by spacing births effectively, rather than focusing solely on population control, which is promoting the use of contraceptives.

Hormone Insights

Based on hormone, the combined hormone contraceptive segment dominated the market in 2023 with a revenue share of over 73%. The growth of the segment can be attributed to the lower risk of pregnancy as it blocks pregnancy by two different mechanisms leading to higher success rates. Moreover, these contraceptives are associated with a lower risk of developing acne as compared to progestin-only pills.

The progestin only segment is anticipated to grow at the fastest rate during the forecast period. This can be attributed to the no estrogen-related side effects, such as migraines and fluid retention, with the medications. Both these contraceptives are similar in effects and no other methods are required when intended within 5 days of menstrual bleeding. According to the American College of Obstetricians and Gynecologists in April 2023, out of 100, only 6 to 12 women become pregnant in a year when these contraceptives are typically used. Progestin-only contraceptive methods offer a cost-effective alternative to surgical options such as implants, IUDs, and sterilization, eliminating the need for replacement every three years to prevent infections.

Regional Insights

North America region held the largest revenue share of 45.41% in 2023 and is anticipated to grow at the fastest CAGR in the forecast period. This is attributed to increased reproductive health awareness, and a high proportion of unwanted pregnancies. For instance, in June 2023, Upstream and the U.S. Department of Health and Human Services (HHS) partnered to enhance contraception access and mitigate women's health disparities in the U.S. This collaboration focuses on safeguarding reproductive care access, ensuring HHS-funded entities are well-equipped and trained to meet family planning demands.

U.S. Hormonal Contraceptive Market Trends

The U.S. market held the largest share in 2023. this can be attributed to the growing use of modern contraception, rising publicly funded family planning services, and increased awareness among adolescents and young people about sexual health and family planning.

Europe Hormonal Contraceptive Market Trends

Europe marketis anticipated to grow significantly due to the rising number of product approval, favorable government reimbursement policies, and increased reproductive health awareness. For instance, in January 2023, the Council of State in Luxembourg approved a bill to provide free access to contraceptives for all individuals, allowing them to choose the contraception method that suits them freely. This new bill provides various hormonal contraceptive methods, including pills, patches, vaginal rings, mini-pills, injections, morning-after pills, and other methods, to be reimbursed by the National Health Fund (CNS).

UK hormonal contraceptive market is expected to grow significantly over the forecast period. This is attributed to the prevalence of hormonal contraceptive use in UK servicewomen is comparable to the general UK population; the demand for hormonal contraceptive pills in prescribed form remains high, along with policies related to reduce unwanted pregnancies, such as the National Institute for Health and Care Excellence (NICE) guide about long-acting reversible contraception (LARC) for all women requiring birth control.

Hormonal contraceptive market in Germany held the largest share in 2023 due to the availability of an advanced range of contraceptive products, increased awareness programs promoting proper and consistent use of contraception, and a reduction in maternal and infant mortality rates after the use of contraception.

Asia Pacific Hormonal Contraceptive Market Trends

Asia Pacific marketis anticipated to register the second highest growth rate over the forecast period, driven by a large pool of target population, a rise in investment by key players, the introduction of novel contraception devices for females, and a rapidly growing economy.

Japan hormonal contraceptive market held the largest share in 2023, owing to the increasing emphasis on women’s health and empowerment and a growing societal shift towards gender equality and reproductive rights, which has led to more open discussions and acceptance of hormonal contraceptive use.

Hormonal contraceptive market in India is driven by factors such as the growing availability and accessibility of hormonal contraceptives through public health systems and private pharmacies, which has made these options more attainable for a larger segment of the population. Moreover, urbanization, and increased literacy rates among women is contributing to the growth of the market.

Latin America Hormonal Contraceptive Market Trends

Latin America marketis anticipated to grow significantly. The region’s ongoing efforts to improve access to reproductive health services and education, economic growth, and urbanization in many Latin American countries have contributed to a greater focus on women health and empowerment.

Brazil hormonal contraceptive market is anticipated to grow significantly due to initiatives by manufacturers to establish and strengthen their market presence by obtaining marketing approvals for their products or acquiring local manufacturers.

Middle East & Africa Hormonal Contraceptive Market Trends

Middle East & Africa marketis anticipated to grow significantly due to the need for population control. Moreover, several international brands are partnering with WHO, UNFPA, NGOs, and nonprofit organizations to promote contraceptive product usage in high-risk African countries driving the growth of the market over the forecast period.

South Africa hormonal contraceptive market is anticipated to grow significantly due to the rising unintended pregnancies among sex workers, MSM, and adolescents. Moreover, governments are distributing contraceptives which offer an economical contraception option for the majority of the population.

Key Hormonal Contraceptive Company Insights

The market is moderately consolidated, due to the presence of several generic drug manufacturers. Approval & commercialization of various products, increasing geographical reach, and expanding application scope of already-existing products are the major strategies being adopted by industry participants to enhance their share. To stay ahead of the competition, companies are adopting various strategies such as collaborations, acquisitions, partnerships, and launching new products.

Key Hormonal Contraceptive Companies:

The following are the leading companies in the hormonal contraceptive market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Afaxys, Inc.

- Teva Pharmaceuticals Industries Ltd.

- Bayer AG

- Organon Group of Companies

- Pfizer

- Agile Therapeutics

- Janssen Pharmaceuticals Inc.

- Lupin Pharmaceuticals Inc.

- Pregna International Ltd.

Recent Developments

-

In January 2024, Aditxt, Inc., a Richmond-based biotech company, acquired Evofem Biosciences, a California-based contraceptive manufacturer, for USD 100 million.

-

In October 2023, Xiromed launched a generic version of Nuvaring, a contraceptive vaginal ring, EnilloRing. The launch of this product offers an additional contraceptive option to patients in the U.S.

-

In August 2023, the Children's Investment Fund Foundation (CIFF), Pfizer Inc., Bill & Melinda Gates Foundation, and BD extended their 10-year partnership. The goal of this partnership is to provide over 320 million doses of Pfizer's injectable contraceptive and Sayana Press (medroxyprogesterone acetate) managed by BD Uniject Auto-Disable Prefillable Injection System by the year 2030.

-

In February 2023, the Bill & Melinda Gates Foundation partnered with private-public firms such as Bayer AG, Clinton Health Access Initiative Inc., Children's Investment Fund Foundation, United Nations Population Fund, and the governments of the U.K., Norway, the U.S., and Sweden, to provide a contraceptive implant for over 27 million women in low-income countries.

Hormonal Contraceptive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.40 billion

Revenue forecast in 2030

USD 21.21 billion

Growth rate

CAGR of 4% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, hormone, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Abbvie, Inc.; Afaxys, Inc.; Teva Pharmaceuticals Industries Ltd.; Bayer AG; Merck & Co. Inc.; Organon Group of Companies; Pfizer; Agile Therapeutics; and Janssen Pharmaceuticals, Inc.; Lupin Pharmaceuticals Inc.; Pregna International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hormonal Contraceptive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hormonal contraceptive market report based on method, hormone, and region.

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Pill

-

IUD

-

Injectable

-

Vaginal Ring

-

Implant

-

Patch

-

-

Hormone Outlook (Revenue, USD Million, 2018 - 2030)

-

Combined Hormone Contraceptive

-

Progestin Only

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hormonal contraceptives market size was estimated at USD 16.14 billion in 2023 and is expected to reach USD 16.75 billion in 2024.

b. The global hormonal contraceptives market is expected to grow at a compound annual growth rate of 4.01% from 2024 to 2030 to reach USD 21.21 billion by 2030.

b. North America dominated the hormonal contraceptives market with a share of 45.41% in 2023. This is attributable to high per capita income, a strong presence of key market players, higher awareness about sexual health, and a large number of unintended pregnancies.

b. Some key players operating in the hormonal contraceptives market are Abbvie, Inc.; Afaxys, Inc.; Teva Pharmaceuticals Industries Ltd.; Bayer AG; Merck & Co. Inc.; Organon group of companies.; Pfizer; Agile Therapeutics; and Janssen Pharmaceuticals, Inc; Lupin Pharmaceuticals Inc; Pregna International Limited.

b. Key factors that are driving the market growth include rising awareness in emerging economies regarding contraception methods, investments by key players to develop innovative devices, and supportive government initiatives to improve access to products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.