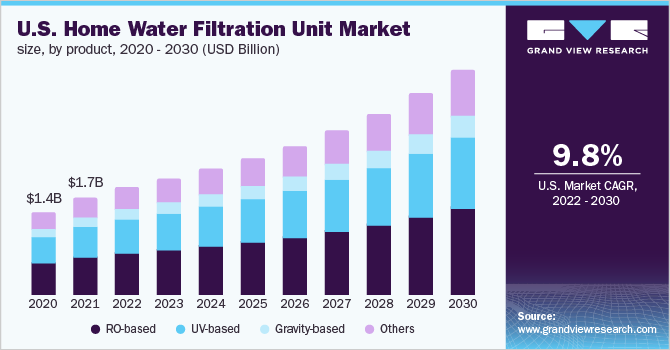

Home Water Filtration Unit Market Size, Share & Trends Analysis Report By Product (RO-based, UV-based), By Region (Asia Pacific, Europe, Middle East & Africa, North America), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-317-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

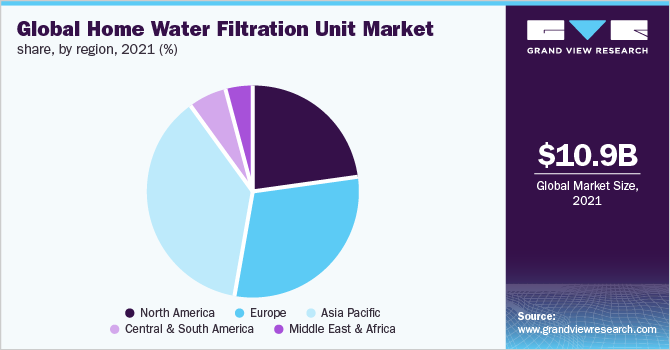

The global home water filtration unit market size was valued at USD 10.85 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.5% from 2022 to 2030. In recent years, the industry has gained immense traction as a result of changing lifestyles, especially in urban areas. The scarcity of drinking water has obligated the domestic authorities to provide the population with an adequate supply of the same. Taking advantage of this opportunity, companies, such as Eureka Forbes and Aquaguard, have emerged as the market leaders in the domestic segment. The global water purifier market has been negatively impacted, due to the COVID-19 pandemic. The production of water purifiers was temporarily suspended due to lockdowns.

Due to a decline in product demand and disruptions in the supply of components, manufacturing companies faced challenges. Furthermore, numerous countries faced conditions like curfews where businesses were not permitted to operate, which had a negative impact on the demand for water purifiers. According to a report published in 2021 by A.O. Smith, a global water technology company, reported its 2020 sales of USD 2.9 billion. The company's sales were approximately 3% lower than sales of USD 3.0 billion reported in 2019. However, the industry is expected to gradually return to pre-pandemic levels as people resume normal life and still have concerns for their health.

Moreover, manufacturers are focusing on innovative technologies to bring more advanced products to the market. For instance, the new technology by Eureka Forbes, Active Copper Zinc Booster Cartridge infuses Copper and Zinc ions into the water to give pure and enriched healthy water. These fa factors are anticipated to have a positive impact on the industry. Product penetration in developed countries, such as the U.S. and Canada, is relatively higher. On the contrary, vast semi-urban and rural areas in developing countries, such as India and China, remain untapped. The home water filtration unit is seen as a necessity, especially in metros and urban cities, due to rising microbial and chemical contamination in the surface water sources.

Growing awareness about the adverse effects of contaminated surface water, along with a declining level of potable water, has resulted in a significant shift in consumer preferences for technology-based domestic water purification systems worldwide. Rising concerns over different waterborne diseases, such as E.Coli and cholera, have augmented the popularity and demand for such purifiers in the global industry. Consumer preference has shifted substantially to a long-term solution, such as water purifiers, which are portable and reasonable to purchase. The value of ownership is an old concept where there is a tendency to acquire assets, which could give results for a longer duration.

One such type is the domestic water purifier. It is a necessity as well as a commodity, which is the need for time. Buying water is not a feasible choice for the long term. Hence, the global market is expected to overcome such restraints to augment the dormant demands of consumers, especially those in rural and semi-urban areas. For instance, Kent launched Kent Grand Plus, coupled with TDS controllers, to ensure the purest drinking water for domestic purposes. Kent water purifier products are ideal for Indian conditions because they are equally easy to handle municipal water supply and natural groundwater.

Based on product, RO-based is the fastest and largest category in the market owing to the benefits of advanced technology that is specialized to remove 90 to 99% of contaminants present. Rising water pollution and rapid urbanization are the major factors that are expected to present lucrative opportunities for the industry in the future. For instance, the European real estate industry is booming in countries, such as Germany and France, thereby leading to a shortage of potable water for the growing population in this region. Hence, the demand for portable filtration systems is increasing in these countries.

This, in turn, drives the companies to tap into the booming market. The market in the Asia Pacific is primarily driven by the increased demand from the growing urban population and rising per capita expenditure. Increasing product demand in the Asia Pacific region is due to a higher concentration of impurities present in untreated water as per the Asian Water Development Outlook (AWDO). For instance, companies, such as Havells, Blue Star, and AO Smith, have launched several products for the domestic category in the past few years due to extensive demand for such purifiers in India and the Indian subcontinent.

Product Insights

The RO-based product segment dominated the global industry in 2021 and accounted for the maximum share of more than 38.00% of the overall revenue. This was owing to the benefits of its de-contamination process as compared to other products. RO-based purifiers not only kill micro-organisms, but also remove heavy metals, pesticides, and dissolved solids. Increasing cases of waterborne diseases have made consumers cautious about the health risks associated with impure drinking water. Moreover, increasing penetration of low-budget residential water purifiers, such as candle-filter purifiers, by local manufacturers like Rama in developing countries, along with the emergence of advanced and innovative water purifiers by companies like Kent and AO Smith, is expected to stimulate global demand for residential water purifiers over the coming years.

The UV-based product segment held a considerable share in 2021 and is expected to witness substantial growth over the coming years. These products provide a complete cure to the water as radiations irradiate the water and penetrate the cells of bacteria and viruses, thereby destroying their reproductive ability. Usually, such purifiers are manufactured in conjunction with other forms of filtration, such as Reverse Osmosis (RO) or activated carbon. Gravity-based water filters are widely used across the residential sector owing to their low costs. The fact that these purifiers can operate without electricity is a bonus.

These filters offer various types of filtrations, among which, activated carbon and ultra-filtration are the most popular. Factors, such as zero energy consumption and easy portability, are facilitating the adoption of gravity-based water filtration units among households. Owing to the depleting water quality, especially in Asia Pacific and Africa, governments are heavily investing in sustainable and efficient water purification infrastructure. The other category in the product segment includes household filtration equipment using multiple technologies based on RO and UV including candle filter purifiers. For instance, Livpure is a new entrant in this industry. The company launched the Livpure Glo 7-liter RO+UV+MineralizerWater Purifier that can purify up to 12 liters of water per hour, thereby catering to modern-day needs.

Regional Insights

The Asia Pacific region dominated the global industry in 2021 and accounted for the maximum share of more than 36.65% of the overall revenue. Product demand is anticipated to gain increasing traction in this region on account of the increasing number of players in the market, accompanied by large-scale investments in R&D. Companies, such as Eureka Forbes, have a wide consumer base, thereby promoting the growth of the industry. Europe is anticipated to emerge as the second fastest-growing region during the forecast period.

Factors driving the demand for domestic water purifiers in this region are growing cases of jaundice and waterborne infections, rising awareness about sanitation among the urban population, and exponential growth of residential constructions in the region. Central & South America is expected to register a significant CAGR over the forecast period. Countries, such as Argentina and Brazil, are among the leading consumers due to the growing levels of water pollution and the unnatural taste of the water due to repetitive chlorination. Evoqua, Avista Technologies, and Daikin America, Inc. are the major suppliers of domestic water purifiers in the Central & South America region, especially Argentina.

Key Companies & Market Share Insights

The industry is majorly dependent on consumer preference due to the presence of leading vendors competing in terms of variety and prices. Companies, such as Eureka Forbes Ltd. and Kent RO System Ltd., are popular amongst consumers, especially across the Indian sub-continent, as these are available in various design options. Companies focus strategies, such as on new product & technology development and M&A, to gain higher industry share. For instance:

-

In May 2022, Eureka Forbes Ltd. launched its new campaign ‘Pani mein Zinc aisa kahaan hota hai, jahan Aquaguard hota hai’, with brand ambassador Madhuri Dixit. The campaign highlights the new copper and zinc cartridge feature in the Aquaguard range. Conceptualized by Taproot Dentsu India Communications Pvt. Ltd.

-

In October 2022, HUL’s Pureit launched its new range - Pureit Vital Series, a new range of RO + UV + Minerals-based water purifiers with FiltraPower Technology, which is proven to remove toxic substances, such as industrial chemicals, pesticides, and pathogens, and provide safe drinking water

Some of the key companies in the global home water filtration unit market are as follows:

-

Kent RO System Ltd.

-

Brita Gmbh

-

Eureka Forbes Ltd.

-

Tata Chemicals

-

HaloSource, Inc.

-

Panasonic

-

Amway Corp.

-

Aquasana

-

GE Water & Process Technologies, Inc.

-

Eureka Forbes Ltd.

Home Water Filtration Unit Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 12.12 billion |

|

Revenue forecast in 2030 |

USD 26.73 billion |

|

Growth rate |

CAGR of 10.5% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Germany; France; China; India; Argentina; Israel |

|

Key companies profiled |

Amway Corp.; Eureka Forbes; Hindustan Unilever; LG Electronics; Panasonic, HaloSource Inc.; Whirlpool, Kent RO Systems Ltd.; Brita GmbH; Koninklijke Philips |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Home Water Filtration Unit Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global home water filtration unit market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

RO-based

-

UV-based

-

Gravity-based

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Argentina

-

-

Middle East & Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global home water filtration unit market size was estimated at USD 10.85 billion in 2021 and is expected to reach USD 12.12 billion in 2022.

b. The global home water filtration unit market is expected to grow at a compound annual growth rate of 10.5% from 2022 to 2030 to reach USD 26.73 billion by 2030.

b. Asia Pacific dominated the home water filtration unit market with a share of 36.7% in 2021. This is attributable to increasing product demand among middle-income households and large-scale investments for R&D and new product development by manufacturers.

b. Some key players operating in the home water filtration unit market include Best Water Technology Group; Kent RO System Ltd.; Brita Gmbh; Eureka Forbes Limited; Tata Chemicals; HaloSource Inc.; Panasonic; Amway Corporation; Aquasana; GE Water & Process Technologies Inc.; and Eureka Forbes Limited.

b. Key factors that are driving the market growth include changing consumer lifestyles, most notably in urban areas; growing awareness about the ill effects of contaminated surface water; and declining levels of potable water worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."