- Home

- »

- Advanced Interior Materials

- »

-

High Purity Pig Iron Market Size, Industry Report, 2033GVR Report cover

![High Purity Pig Iron Market Size, Share & Trends Report]()

High Purity Pig Iron Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Energy, Industrial, Automotive & Transportation), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-977-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

High Purity Pig Iron Market Summary

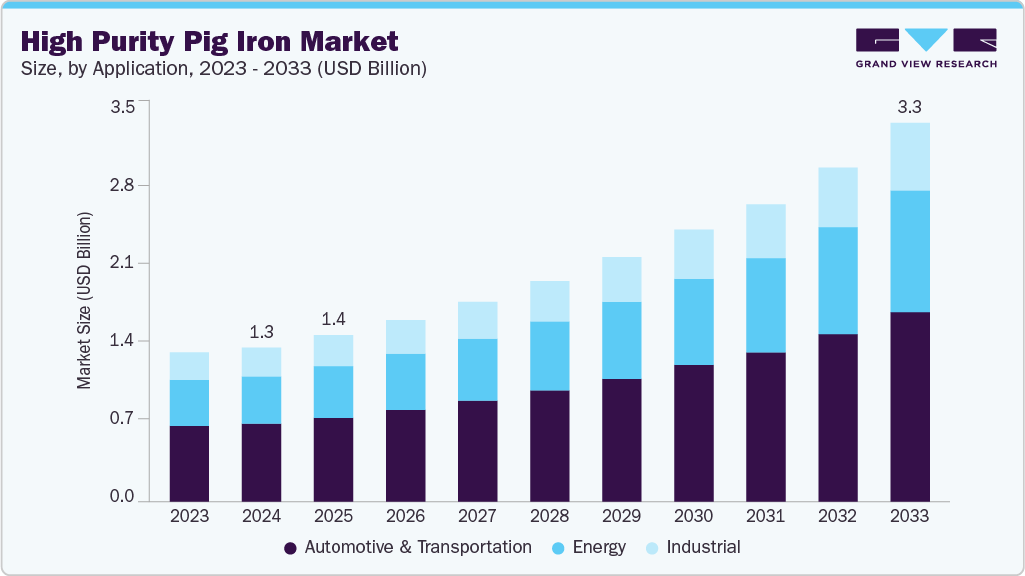

The global high purity pig iron market size was estimated at USD 1.34 billion in 2024 and is projected to reach USD 3.30 billion by 2033, growing at a CAGR of 10.8% from 2025 to 2033. High-purity pig iron (HPPI) is highly valued in industrial applications due to its exceptionally low levels of impurities, such as sulfur, phosphorus, and manganese, as well as its consistent chemical composition and high carbon content.

Key Market Trends & Insights

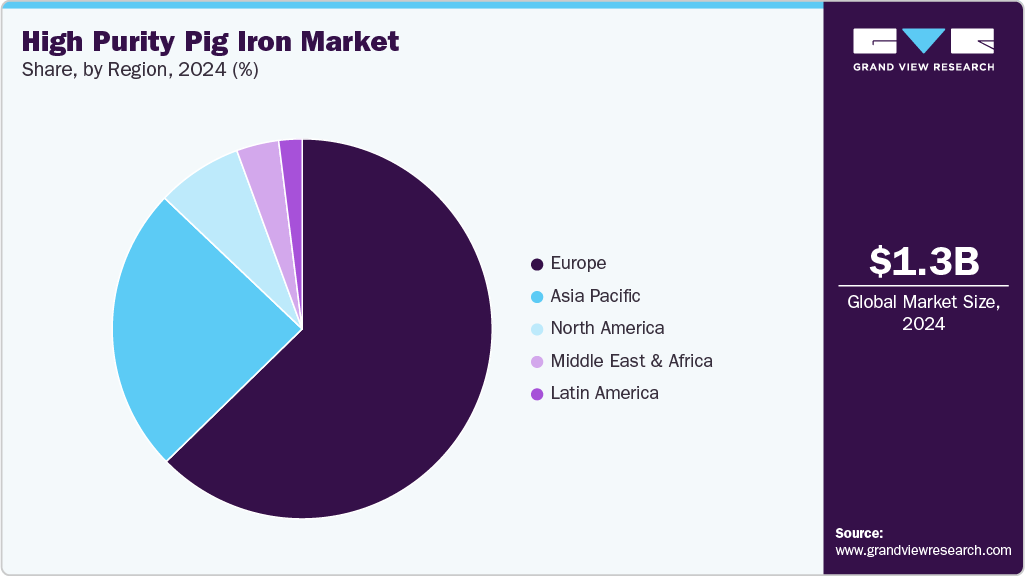

- Europe dominated the high purity pig iron market with a revenue share of 62.7% in 2024.

- The high purity pig iron market in Asia Pacific is expected to grow at a substantial CAGR of 11.1% from 2025 to 2033.

- By application, automotive & transportation dominated the market with a revenue share of over 50.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.34 Billion

- 2033 Projected Market Size: USD 3.30 Billion

- CAGR (2025-2033): 10.8%

- Europe: Largest market in 2024

- Asia Pacific: Fastest-growing market

These properties improve final product castability, surface finish, and mechanical properties. It finds significant applications in wind energy, automotive, industrial machinery, and infrastructure components. The wind energy sector produces large, high-strength castings like rotor hubs and bearing housing. The automotive industry utilizes HPPI for engine blocks, brake components, and gearboxes, where durability and machinability are essential. Heavy machinery and agricultural equipment are used for complex and wear-resistant castings. The consistency and superior metallurgical properties of HPPI make it indispensable in industries that demand tight tolerance, high fatigue strength, and corrosion resistance.

Sustainability initiatives and recycling play a growing role in shaping the future of the HPPI market. As environmental regulations tighten and industries pursue decarbonization goals, there is increasing emphasis on developing low-carbon production methods and enhancing resource efficiency. Recycling scrap metal and optimizing blast furnace operations to reduce energy consumption and emissions are becoming key strategies among producers. Furthermore, integrating carbon capture technologies and using renewable energy sources in smelting processes are being explored to align with global climate targets.

Drivers, Opportunities & Restraints

The high-purity pig iron industry is primarily driven by the growing demand for precision castings across automotive, wind energy, and industrial machinery sectors. As these industries shift toward high-performance components, there is a clear preference for raw materials with consistent chemical composition and low impurity levels. The expansion of renewable energy infrastructure, particularly wind power, has further accelerated demand, as critical components like turbine hubs and bearing housing require strong, defect-free castings. In addition, the rising need for clean input materials in specialty steel production continues to support industry growth, especially as end-users increasingly emphasize quality and reliability.

At the same time, the market presents a range of opportunities. One of the most promising areas lies in adopting sustainable production technologies, including using renewable energy, carbon capture systems, and improved energy efficiency in smelting operations. The push toward circular economy models is also gaining traction, encouraging the recovery and reuse of industrial scrap and end-of-life castings, which can serve as alternative feedstock. Furthermore, emerging economies investing heavily in infrastructure and manufacturing present a significant growth avenue for high-grade iron products.

However, the industry also faces notable restraints. The production of high-purity iron requires substantial energy and high-quality raw materials, which increases operational costs and limits the entry of smaller players. Volatility in the prices of iron ore, coke, and other inputs can disrupt supply chains and affect profit margins. Moreover, tightening environmental regulations are compelling producers to invest in cleaner technologies and compliance systems, which may strain financial and technical resources in the short term. These challenges must be addressed strategically to ensure sustained growth and competitiveness in the years ahead.

Application Insights

Based on application, automotive & transportation dominated the market with a revenue share of over 50.0% in 2024, in the global market. This dominance is attributed to the increasing use of ductile iron castings in critical vehicle components such as engine blocks, suspension systems, brake calipers, transmission parts, and steering knuckles. High purity pig iron is favored in these applications due to its low impurity content, which enhances the final components' mechanical strength, fatigue resistance, and machinability. As automakers shift toward lightweight yet durable materials to meet fuel efficiency and emission standards, the demand for high-quality input materials like HPPI continues to rise. Furthermore, the growth of electric vehicles (EVs) and heavy commercial vehicles globally has amplified the need for specialized castings, further reinforcing this segment’s lead in the overall market.

HPPI is highly valued in the automotive and transportation industry due to its low impurities, such as sulfur and phosphorus, which help produce clean, defect-free castings essential for high-stress components like engine blocks, brake systems, and suspension parts. Its consistent chemical composition ensures uniform mechanical properties and dimensional accuracy, critical for precision manufacturing. The high carbon content enhances graphitization, improving tensile strength, wear resistance, and thermal conductivity, which are key for load-bearing and heat-intensive applications. Furthermore, its excellent castability allows the formation of complex shapes with minimal machining, while the resulting components offer superior fatigue strength and impact resistance, making HPPI an ideal material for durable and high-performance vehicle parts.

In the energy sector, it is widely used due to its ability to deliver reliable performance in demanding and high-temperature environments. Its low impurity content ensures the production of defect-free, high-strength castings, which are essential for critical components such as wind turbine hubs, generator housing, and components used in power plants. The consistent chemical composition of HPPI enhances the structural integrity and dimensional precision of these parts, which must withstand heavy loads and harsh operating conditions over long periods. Its high carbon content supports the production of ductile iron with excellent mechanical properties, including fatigue resistance and thermal stability, which is crucial for equipment subjected to cyclic stress and fluctuating temperatures. Moreover, HPPI’s castability allows for the efficient manufacturing of significant, complex components with minimal material waste, making it a preferred material in both traditional and renewable energy infrastructure.

Regional Insights

Demand for high purity pig iron market in North America is expected to grow moderately, shaped by macroeconomic conditions and industry-specific developments. In Canada and Mexico, elevated interest rates and an industrial slowdown have tempered construction and steel production demand. However, the region continues to witness stable consumption from electric arc furnace (EAF)-based steelmaking, where HPPI produces high-quality ductile iron and specialty steels. Mexico’s infrastructure programs and automotive manufacturing hubs, particularly around Nuevo León and Guanajuato, are sustaining demand for HPPI in refractory linings, engine blocks, and precision casting applications. Mexico is a strategic regional consumption point, especially in the foundry and automotive sub-segments.

U.S. High Purity Pig Iron Market Trends

The high purity pig iron market in the U.S. is forecast to grow steadily in 2025, supported by a resilient manufacturing base and positive economic indicators. The IMF projects 2.1% GDP growth for the U.S. in 2025, driven by increased industrial production, clean energy investments, and strategic supply chains reshoring, including raw steel and casting materials. HPPI is gaining importance due to its critical role in producing defect-free, high-strength components for automotive, wind energy, and defense applications. Furthermore, U.S. federal initiatives supporting sustainable manufacturing and domestic mineral processing under acts like the Infrastructure Investment and Jobs Act (IIJA) are enhancing the competitiveness of local foundries and ductile iron producers that rely on HPPI. The move toward EAF steelmaking, which depends on consistent and high-purity charge materials, is also a significant tailwind for the industry.

Asia Pacific High Purity Pig Iron Market Trends

The high purity pig iron market in Asia Pacific represents the fastest-growing, driven by rapid industrialization and infrastructure development. Countries such as China, India, South Korea, and Vietnam are seeing strong demand from the automotive, construction, and machinery sectors, which are increasingly using ductile iron castings in engine parts, pumps, and structural components and India, expanding manufacturing hubs in Tamil Nadu, Gujarat, and Maharashtra, along with rising investments in urban infrastructure and smart cities, fuel demand for high-quality casting materials. In addition, government initiatives like ‘Make in India’ and the Production Linked Incentive (PLI) Scheme for specialty steel are expected to drive increased domestic consumption of HPPI. Across the region, the ongoing transition to cleaner industrial practices, including the growth of EAF-based steelmaking, continues to favor high-purity input materials.

Europe High Purity Pig Iron Market Trends

The high purity pig iron market in Europe is expected to grow steadily, supported by the region’s strong policy commitment to decarbonization and resource efficiency. The shift toward EAF steel production to meet stringent EU emission targets has created consistent demand for HPPI as a clean charge material that reduces impurities in final steel products. Countries like Germany, France, and Sweden are integrating HPPI in producing ductile iron components for the automotive and renewable energy sectors, aligning with broader electrification and mobility transformation goals. Moreover, refractory applications in high-temperature industrial processes, such as cement, steel, and chemical manufacturing, also sustain demand. With EU Green Deal investments and initiatives like Fit for 55, HPPI is poised to strategically support low-emission manufacturing and infrastructure resilience across the continent.

Key High Purity Pig Iron Company Insights

Some of the key players operating in the market include Eramet Group, Ironveld Plc, QIT-Fer et Titane, and Mineral-Loy.

-

Eramet Group, headquartered in France, is a global mining and metallurgical company historically linked with high-purity pig iron through its former ownership of the Tyssedal plant in Norway. Although it no longer directly produces HPPI, it remains recognized for advancing specialty alloys and high-grade iron segments. The company focuses on manganese, nickel, and lithium, with an expanding footprint in sustainable mining practices.

-

High Purity Iron Inc. is a U.S.-based niche manufacturer that produces low-impurity pig iron for foundries and EAF steelmakers. It serves industries that require strict metallurgical standards, such as automotive, energy, and heavy machinery. The company’s core strength lies in its supply of consistent quality iron with minimal impurities, tailored for ductile iron casting applications.

-

Ironveld is a UK-listed company with operations in South Africa. It focuses on the production of high-purity iron, vanadium, and titanium. Its flagship project in the Bushveld Complex is designed to produce HPPI from magnetite ore using a direct reduction process. Ironveld’s strategy aims to supply specialist markets such as aerospace, foundry, and renewable energy.

-

QIT-Fer et Titane, located in Quebec, Canada, is a division of Rio Tinto that produces Sorelmetal, a premium high-purity pig iron known for its low residual content. Its output is used globally in ductile iron castings and precision automotive components. Due to its vertically integrated operations and advanced quality control, QIT is a benchmark for quality in the HPPI market.

Key High Purity Pig Iron Companies:

The following are the leading companies in the high purity pig iron market. These companies collectively hold the largest market share and dictate industry trends.

- Eramet Group

- High Purity Iron Inc. (USA)

- Ironveld Plc

- Kobe Steel

- Mineral-Loy

- QIT-Fer et Titane (Rio Tinto Iron & Titanium)

- Richards Bay Minerals (RBM)

- Saraf Group

- Sesa Goa Iron Ore (Vedanta)

- Tronox Holdings plc

Recent Developments

-

Rio Tinto (QIT) announced a $143 million investment in a new BioIron facility in Western Australia to develop a low-carbon iron production process using microwave energy and biomass. This supports their HPPI supply chain decarbonization goal, with commissioning expected in 2026.

-

Kobe Steel has scaled up its ITmk3® low-emission ironmaking technology, reducing blast furnace CO₂ emissions by up to 25% through advanced control systems and HBI integration. The company is aligning with Japan’s net-zero roadmap through sustainable iron production.

-

Ironveld Plc began ramping up its high-purity iron plant in South Africa, securing offtake agreements with European foundries. The company plans to expand production further as global demand for HPPI grows in clean energy and specialty alloy markets.

-

Tronox Holdings has enhanced its vertical integration strategy, linking its titanium and pig iron operations to support downstream industries like electric vehicles and aerospace. Investments were made in capacity expansion and environmental compliance across its African assets.

High Purity Pig Iron Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.34 billion

Revenue forecast in 2033

USD 3.30 billion

Growth rate

CAGR of 10.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; Turkey; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa; Iran

Key companies profiled

Eramet Group; High Purity Iron Inc. (USA); Ironveld Plc; Kobe Steel; Mineral‑Loy; QIT‑Fer et Titane (Rio Tinto Iron & Titanium); Richards Bay Minerals (RBM); Saraf Group; Sesa Goa Iron Ore (Vedanta); Tronox Holdings plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Purity Pig Iron Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global high purity pig iron market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive & transportation

-

Energy

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global high purity pig iron market size was estimated at USD 1.34 billion in 2024 and is projected to reach USD 1.45 billion by 2025.

b. The global high purity pig iron market is expected to grow at a compound annual growth rate of 10.8% from 2025 to 2033 to reach USD 3.30 billion by 2033.

b. By application, automotive & transportation dominated the market with a revenue share of over 50.0% in 2024.

b. Some of the key vendors in the global high-purity pig iron market are Eramet Group, High Purity Iron Inc. (USA), Ironveld Plc, Kobe Steel, Mineral‑Loy, QIT‑Fer et Titane (Rio Tinto Iron & Titanium), Richards Bay Minerals (RBM), Saraf Group, Sesa Goa Iron Ore (Vedanta), and Tronox Holdings plc.

b. The key factor driving the growth of the global high-purity pig iron market is primarily the growing demand for precision castings in sectors such as automotive, wind energy, and industrial machinery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.