- Home

- »

- Medical Devices

- »

-

High Pressure Balloon Catheter Market, Industry Report 2030GVR Report cover

![High Pressure Balloon Catheter Market Size, Share & Trends Report]()

High Pressure Balloon Catheter Market (2025 - 2030) Size, Share & Trends Analysis Report By Use (Diagnostic & Therapeutic), By Material (Nylon, Polyester), By Application (Cardiology, Urology), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-489-7

- Number of Report Pages: 221

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

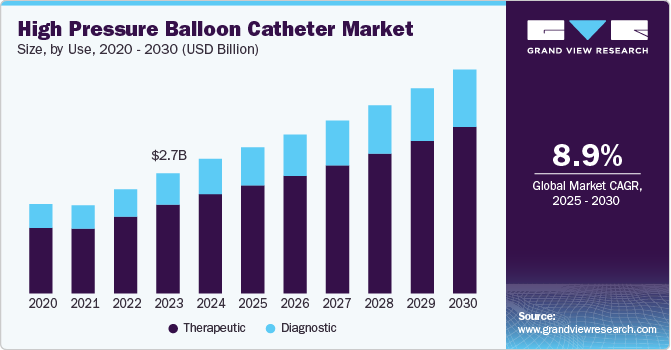

The global high pressure balloon catheter market size was estimated at USD 3.03 billion in 2024 and is anticipated to grow at a CAGR of 8.90% from 2025 to 2030, driven by several key factors such as rising prevalence of cardiovascular diseases, including coronary artery disease and peripheral arterial disease. The World Health Organization (WHO) reported that cardiovascular diseases are the foremost cause of death worldwide, claiming approximately 17.9 million lives annually. According to Eurostat report, in 2021, a total of 1.1 million transluminal coronary angioplasty procedures were performed across 25 EU countries with available data. Croatia had the highest rate of angioplasty procedures, recording 553 procedures per 100,000 residents. Germany followed in second place with 390 procedures, while Latvia, Austria, and Bulgaria reported rates of 328, 324, and 303 procedures per 100,000 inhabitants, respectively.

With an aging population and increased lifestyle-related risk factors, the need for effective interventional cardiology solutions has surged. Moreover, increased healthcare expenditures and investments in medical technologies by hospitals and clinics are fostering growth in the industry. Support from regulatory authorities, such as recent FDA and marketing approvals for new devices, enhances market accessibility and adoption. For instance, in January 2023, MicroPort obtained marketing registration approval in Peru from the Peruvian General Directorate of Medicines, Supplies, and Drugs for its Firefighter NC Balloon Catheter, a new generation of balloon catheters that are both high-pressure resistant and facilitate rapid exchange.

In addition, March 2022, SIS Medical AG (Swiss Interventional Systems), one of the global manufacturers in interventional cardiology, announced the U.S. Food & Drug Administration's approval of its lead product, the OPN NC Super High Pressure PTCA Balloon Catheter. In addition, the rising prevalence of obesity and diabetes, major risk factors for cardiovascular conditions, further propels the demand for interventional treatment options. For instance, according to the International Diabetes Federation report published in 2022, over 537 million adults aged 20 to 79 are living with diabetes, which equates to one in ten individuals. This figure is projected to increase to 643 million by 2030 and reach 783 million by 2045.

One of the most notable advancements in the industry is the development of new materials and designs that improve the mechanical properties of the catheters. Manufacturers are investing in research and development to create ultra-thin, high-strength materials that can withstand higher pressures while maintaining a smaller profile. For instance, advancements in polymer technology have led to the creation of balloons that can expand significantly at high pressures without rupturing. This enables more effective dilatation of narrowed vessels, thereby improving the success rates of procedures. Manufacturers are increasingly offering a range of balloon sizes, shapes, and lengths that can cater to individual patient anatomies and specific clinical scenarios. This customization ensures that healthcare providers have the right tools at their disposal to address varying medical needs, promoting better procedural effectiveness and patient safety.

The industry is also witnessing a shift toward lower-cost, high-quality alternatives due to the rising demand in emerging economies. As healthcare costs continue to escalate, there is an increasing emphasis on developing cost-effective yet reliable high-pressure balloon catheters. Manufacturers are exploring various strategies, including optimizing supply chains and utilizing local materials, to reduce production costs without compromising quality.

Regulatory approvals are becoming more streamlined owing to the increasing number of high-pressure balloon catheter innovations entering the market. Regulatory bodies are collaborating with manufacturers to accelerate the approval processes for novel devices, ensuring that patients can access the latest advancements in medical technology swiftly.

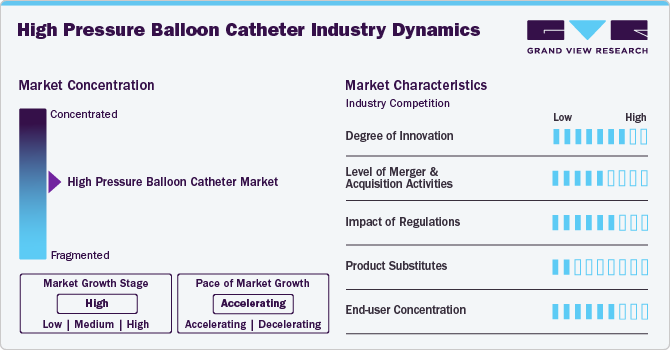

Market Concentration & Characteristics

The industry growth stage is high, and the pace is accelerating. The high pressure balloon catheter industry is characterized by a high degree of growth due to the increasing peripheral angioplasty procedures and growing product launches. For instance, Zylox-Tonbridge Medical Technology Co., Ltd., one of the prominent players operating in the market is expected to launch its ultra-high-pressure balloon catheter in 2026.

The industry is experiencing a significant surge in innovation, driven by advancements in materials, technology, and medical procedures. These catheters, primarily used in interventional cardiology and vascular treatments, have evolved to meet the increasing demands for safety, efficacy, and ease of use. Innovations include the development of new balloon materials that enhance durability and provide better conformability to vessel walls, reducing the risk of complications during procedures. The market is also witnessing a trend towards hybrid devices that combine balloon catheters with drug delivery systems, allowing localized treatment to mitigate restenosis and improve long-term results. The shift towards minimally invasive techniques has fueled demand for innovative products that optimize patient recovery times and reduce hospital stays.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent criteria that manufacturers must adhere to for product approval. These regulations, while essential for safeguarding patient welfare, can also create barriers to market entry due to extensive testing and documentation requirements. Furthermore, favorable reimbursement policies from government programs such as Medicare and Medicaid significantly increase the accessibility of high pressure balloon catheters. However, the regulatory process can be time-consuming and costly for manufacturers, negatively impacting innovation and market entry for smaller companies.

The industry is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their use portfolios, leverage synergies, and enter new markets. Established players are acquiring smaller innovators to gain access to cutting-edge technologies, while strategic collaborations are emerging to enhance distribution networks.

The threat of substitutes for the industry is significantly moderate. One prominent substitute is the conventional balloon catheter, which, although not designed for high-pressure applications, provides a cost-effective and widely used option for dilation procedures. These catheters may be suitable for less demanding interventions where high-pressure capabilities are not critical. In addition, stent-based technologies, especially drug-eluting stents, have emerged as effective options for vascular lesions. These stents often reduce the necessity for repeated balloon angioplasty, changing the treatment landscape significantly.

Key players operating in the industry are increasingly adopting regional expansion strategies to enhance their market presence and address the growing demand. For instance, in February 2023, SIS Medical AG, announced the launch of its OPN NC percutaneous transluminal coronary angioplasty (PTCA) dilatation catheter that features 'Twin-Wall' technology in the U.S.

Use Insights

Therapeutic segment held the largest revenue share of around 73.86% in 2024. High-pressure balloon catheters are essential in interventional procedures particularly angioplasty and stent placement, where they are used to dilate narrowed arteries, thereby restoring blood flow and improving patient outcomes. This therapeutic application not only addresses immediate medical needs but also significantly enhances the quality of life for patients suffering from conditions like coronary artery disease.

Moreover, the increasing prevalence of chronic diseases, coupled with an aging population, is driving demand for effective therapeutic interventions. Advances in technology have also led to the development of more sophisticated high-pressure balloon catheters that offer improved performance and safety profiles, further increasing their attractiveness in clinical settings.

Diagnostic segment on the other hand is expected to witness a significant growth from 2025 to 2030 owing to increasing prevalence of cardiovascular diseases, rising awareness about minimally invasive procedures, and technological advancements in catheter designs. High-pressure balloon catheters are essential tools used in various diagnostic procedures, particularly in the assessment and treatment of arterial blockages and vascular lesions. They are primarily utilized during angioplasty procedures to expand narrowed arteries and facilitate the delivery of diagnostic imaging agents.

Additionally, the increasing investment in healthcare infrastructure, particularly in emerging markets, is expected to further propel the segmental growth in the market.Material Insights

Nylon held the largest revenue share of around 52.26% in 2024. One of the most critical factors contributing to the dominance of the nylon segment is its excellent mechanical properties. Nylon is known for its high tensile strength, flexibility, and durability, making it an ideal choice for high-pressure applications. When used in balloon catheters, nylon can withstand the rigorous conditions of high-pressure inflation without compromising structural integrity. This resilience is vital during procedures such as angioplasty, where balloons must expand rapidly and withstand significant pressures to achieve optimal results.

Furthermore, nylon exhibits favorable elongation properties, allowing it to stretch and adapt during the inflation process. This characteristic is crucial, as it enables the balloon to conform to the shape of the vessel, providing a more effective treatment by ensuring that the entire lesion site is adequately dilated. This adaptability also minimizes the risk of dissection or damage to the vessel wall, thereby enhancing patient safety during procedures. Cost-effectiveness is also an essential consideration in the selection of materials for high-pressure balloon catheters. Nylon is generally more affordable compared to polyesters such as polyurethane or polyethylene terephthalate (PET).

The polyester segment is expected to be the fastest growing segment from 2025 to 2030. Polyester exhibits high tensile strength and resistance to fractures, making it an ideal material for devices that must endure high pressures during inflation. This durability ensures that polyester balloons can effectively dilate narrowed arteries or blockages without compromising their structural integrity. Clinicians and healthcare providers prioritize materials that can reliably perform under such demanding conditions, leading to an increasing preference for polyester-based catheters during the forecast period.

Application Insights

Cardiology held the largest revenue share in 2024 owing to rising prevalence of cardiovascular diseases, advancements in interventional techniques, the efficacy of balloon catheter technologies, and an evolving healthcare landscape that prioritizes minimally invasive approaches. Conditions such as coronary artery disease, myocardial ischemia, and other vascular disorders require timely and efficient interventions to restore blood flow. High-pressure balloon catheters have become crucial tools in treating these ailments by allowing for angioplasty procedures that dilate narrowed arteries. As the incidence of CVD continues to rise, driven by factors such as aging populations, lifestyle changes, and increasing obesity rates, the demand for effective treatments, including balloon angioplasty, grows, positioning the cardiology segment as the largest and most vital application in this market.

The urology segment is expected to witness significant growth from 2025 to 2030 owing to increasing incidence of urological disorders. Conditions such as urinary tract obstruction, benign prostatic hyperplasia (BPH), and kidney stones are becoming more prevalent due to factors like an aging population, lifestyle changes, and a higher incidence of obesity. With these conditions often requiring timely intervention to prevent complications, the demand for effective treatment options is rising sharply. High-pressure balloon catheters have become essential tools in the management of these urological issues, enabling healthcare providers to perform procedures such as balloon dilation and colonic urethral stenting with increased efficacy.

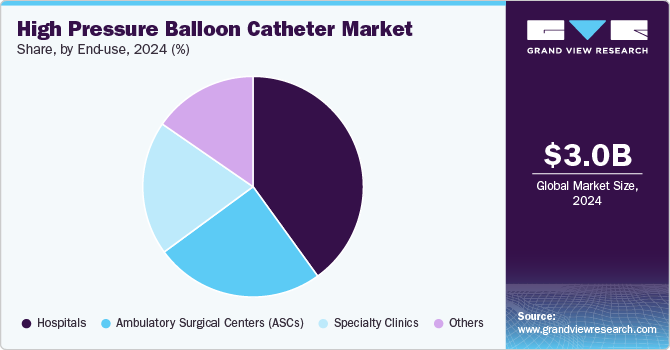

End-use Insights

Hospitals held the largest revenue share of around 40.04% in 2024 owing to increasing number of surgical procedures, advancements in technology, a growing preference for minimally invasive interventions, improved patient care standards, and the evolution of regulatory frameworks that support hospital-based care. As global healthcare systems become increasingly focused on combating chronic diseases, particularly cardiovascular and urological conditions, hospitals have become centralized hubs for delivering advanced medical interventions. High-pressure balloon catheters are used extensively in various procedures, including angioplasties and urological interventions such as ball dilation and urethral stenting. The sheer volume of surgeries performed in hospitals ensures that high-pressure balloon catheters remain in high demand, thus reinforcing hospitals as the most significant end-user of these devices.

Ambulatory Surgical Centers (ASCs) are expected to witness significant growth from 2025 to 2030 owing to rising demand for outpatient procedures, advancements in surgical technologies, cost-effectiveness, increased patient comfort and preference for minimally invasive procedures, and supportive regulatory environments that facilitate ASC operations. Increasing demand for outpatient procedures is one of the most significant drivers.

As healthcare systems worldwide continue to emphasize value-based care, there is a substantial shift toward treating patients in outpatient settings rather than hospitals. ASCs specialize in providing surgical services on an outpatient basis, allowing patients to undergo procedures and return home the same day. This trend has led to a surge in demand for high-pressure balloon catheters, which are essential tools in various ambulatory procedures, including urological interventions and vascular surgeries. The ability of ASCs to efficiently manage a high volume of outpatient surgeries positions them to leverage the capabilities of high-pressure balloon catheters effectively.

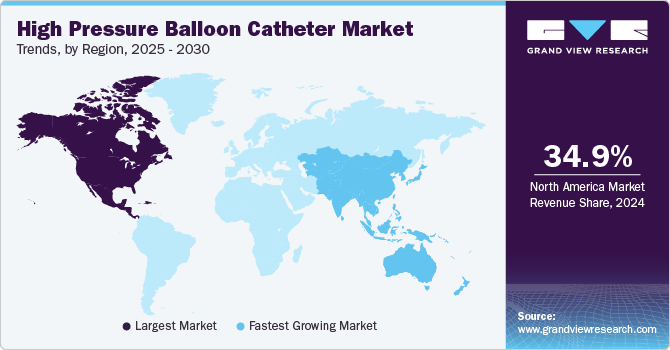

Regional Insights

North America high pressure balloon catheter marketaccounted for a significant share of the global market owing to the presence of key manufacturers, increasing prevalence of cardiovascular diseases, technological advancements, a robust healthcare infrastructure, and a growing preference for minimally invasive procedures. As a result, the market is witnessing significant investment and innovation, positioning North America as a leading region in the global market for high-pressure balloon catheters.

One of the primary drivers of the North American market is the rising prevalence of cardiovascular conditions. According to the American Heart Association, cardiovascular diseases remain the leading cause of death in the region, creating a pressing need for reliable and effective medical interventions. High-pressure balloon catheters are essential tools in various cardiovascular procedures, particularly in percutaneous coronary interventions (PCI), where they are employed for angioplasty and stenting. The increasing number of interventions aimed at treating coronary artery disease significantly contributes to market growth and underscores the importance of high-pressure balloon catheter in modern medicine.

U.S. High Pressure Balloon Catheter Market Trends

The high pressure balloon catheter market in the U.S. is driven by the growing prevalence of coronary artery disease (CAD). High-pressure balloon catheters, primarily used in interventional procedures such as angioplasty, are pivotal in treatment protocols for cardiovascular diseases, vascular obstructions, and other medical conditions requiring localized drug delivery or minimally invasive interventions.

According to a research article, the prevalence of CAD among adults in the U.S. remained relatively stable between 2019 and 2022, averaging around 4.6%. However, a slight increase was noted in both 2021 and 2022. Additionally, a recent report from the American Heart Association reports that heart disease continues to be the leading cause of death in the U.S. According to the U.S. Centers for Disease Control and Prevention (CDC), in 2022, around 702,880 people died from heart disease. That's the equivalent of one in every five deaths.

Canada high-pressure balloon catheter market has been witnessing significant growth driven by advancements in medical technology and an increasing prevalence of cardiovascular diseases. The Public Health Agency of Canada reports that heart disease ranks as the second leading cause of death in the country. Around one in twelve Canadian adults aged 20 and older, or about 2.6 million individuals, are living with diagnosed heart disease. High-pressure balloon catheters are essential tools in various medical procedures, particularly in the treatment of coronary and peripheral artery diseases. These devices are designed to withstand high inflation pressures, allowing for effective dilation of stenotic vessels and deployment of stents.

Europe High Pressure Balloon Catheter Market Trends

The high-pressure balloon catheter market in Europe is witnessing significant growth, driven by advancements in technology, an increasing angioplasty surgery, and growing awareness and preventive measures. For instance, cardiovascular diseases are the main cause of death in EU. One of the most common procedures used to treat cardiovascular diseases is transluminal coronary angioplasty. For instance, in 2021, a total of 1.1 million transluminal coronary angioplasty procedures were performed across 25 EU countries for which data was available. Croatia recorded the highest ratio of angioplasty procedures that year, reporting 553 procedures per 100,000 inhabitants followed by Germany followed with 390 procedures.

Further, according to SIS Medical AG, one of the major manufacturers of high pressure balloon catheter reported in 2022, that since the market introduction of its lead product, OPN NC TWIN-Wall Super High Pressure PTCA Balloon, more than 100,000 patients already have been successfully treated with OPN NC.

The UK high pressure balloon catheter market is driven by growing lifestyle-related health issues such as obesity and diabetes, and growing demand for effective treatment options, including angioplasty procedures involving high pressure balloon catheters. According to a report by the British Heart Foundation, approximately 7.6 million people in the UK are living with heart disease, comprising over 4 million men and 3.6 million women. Annually, around 100,000 hospital admissions occur as a result of heart attacks. In addition, according to the same source, British Heart Foundation, around 6.4 million are living with a heart disease in England as of September 2024.

Manufacturers are increasingly focusing on developing high pressure balloon catheters that offer improved deliverability, flexibility, and safety. Innovations such as drug-eluting balloons, which release medication to prevent restenosis, are gaining traction. These advancements not only enhance patient outcomes but also contribute to the growing adoption of balloon catheter procedures.

The high pressure balloon catheter market in Germany accounted for the highest revenue share in 2024. Germany has been facing a significant increase in the number of cardiovascular diseases, one of the leading causes of morbidity and mortality in the region. Factors such as sedentary lifestyles, poor dietary habits, and rising obesity rates contribute to this growing health crisis. According to Eurostat report in 2021, Germany is ranked second with highest number of transluminal coronary angioplasty procedures in EU. Further, there is a growing trend towards minimally invasive medical procedures in Germany, driven by patient preferences for lower risk, shorter recovery times, and reduced hospital stays. High pressure balloon catheter procedures typically involve smaller incisions compared to traditional open-heart surgeries, leading to minimal trauma and faster recovery for patients. This shift is influencing healthcare providers to adopt these technologies, thereby boosting the market growth in Germany.

Asia Pacific High Pressure Balloon Catheter Market Trends

Asia Pacific high pressure balloon catheter market is the fastest growing region in the global market due to increasing prevalence of cardiovascular diseases, a growing geriatric population, and advancements in medical technology. The Asia Pacific region is experiencing a significant rise in cardiovascular diseases, primarily due to lifestyle changes, urbanization, and increased prevalence of risk factors such as hypertension, diabetes, and obesity.

According to the World Health Organization (WHO), cardiovascular diseases are a leading cause of death in many Asia Pacific countries. This alarming trend is prompting healthcare providers to adopt effective treatment options, including high-pressure balloon catheters, to enhance patient outcomes. Further, there is a growing trend toward minimally invasive surgical techniques in the Asia Pacific region. Patients and healthcare providers favor these methods due to their benefits, including shortened recovery times, reduced hospital stays, and less postoperative pain. High-pressure balloon catheters integrate well into these approaches, driving their increased utilization in clinical settings.

The high pressure balloon catheter market in China has experienced significant growth driven by rising incidence of CAD and peripheral artery disease (PAD) across China. An aging population combined with lifestyle changes, such as increased smoking and sedentary behavior, has escalated the demand for effective treatment options. According to the Report on Cardiovascular Health and Diseases in China 2021, approximately 330 million people in the country are impacted by cardiovascular diseases. This includes 13 million cases of stroke, 11.39 million instances of coronary heart disease, 8.9 million cases of heart failure, 5 million cases of pulmonary heart disease, 4.87 million cases of atrial fibrillation, 2.5 million instances of rheumatic heart disease, 2 million cases of congenital heart disease, 45.3 million cases of peripheral artery disease, and 245 million cases of hypertension.

Furthermore, the Chinese government has been investing heavily in healthcare infrastructure and promoting the adoption of advanced medical technologies, thereby enhancing the accessibility of high-pressure balloon catheters.

Latin America High Pressure Balloon Catheter Market Trends

The Latin America high pressure balloon catheter market is experiencing significant growth, primarily driven by the developing healthcare infrastructure, and increasing awareness and knowledge about cardiovascular diseases. Countries in the region, such as Brazil and Argentina, are significantly increasing their investments in the healthcare sector, significantly increasing the access and affordability of high pressure balloon catheters in the region.

Middle East and Africa High Pressure Balloon Catheter Market Trends

The high pressure balloon catheter market in the Middle East and Africa (MEA) is driven by the advancements in minimally invasive procedures and a growing emphasis on patient-centric care. One of the primary factors contributing to the market’s expansion is the rising incidence of lifestyle-related diseases, including hypertension and diabetes, which are major risk factors for cardiovascular complications. Countries within the region are experiencing a demographic shift, with an increase in the aging population, leading to a growing demand for effective cardiovascular interventions. With ongoing improvements in medical infrastructure and a focus on healthcare accessibility, the market presents promising opportunities for both established players and new entrants aiming to meet the region's evolving cardiovascular care demands.

Saudi Arabia high pressure balloon catheter market is driven by rising incidence of lifestyle-related diseases, including obesity, diabetes, and hypertension among the Saudi population, significantly contributes to the growing demand for effective cardiovascular treatments. According to health reports, cardiovascular diseases are among the leading causes of death in the country, prompting healthcare professionals to adopt advanced medical devices such as high pressure balloon catheter to manage these conditions effectively.

Moreover, the Saudi government's Vision 2030 initiative emphasizes the enhancement of healthcare services and infrastructure. This strategic plan includes substantial investments in medical technology and facilities, which are expected to facilitate the adoption of advanced interventional devices. The increasing availability of specialized healthcare centers and improving medical training programs further support market growth by ensuring that healthcare providers are equipped to offer high-quality care.

Key High Pressure Balloon Catheter Company Insights

Key industry players are adopting various strategic initiatives such as launches, partnerships, collaborations, mergers & acquisitions, approvals, expansion and others to increase their presence in the global high pressure balloon catheter industry. These advancements in the care market are anticipated to boost market growth over the forecast period.

Key High Pressure Balloon Catheter Companies:

The following are the leading companies in the high pressure balloon catheter market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

- APR Medtech Ltd

- Medtronic

- Terumo Medical Corporation

- Nipro Medical Corporation

- Cordis

- Relisys Medical Devices Limited

- Advin Health Care

- Nordson Corporation

- Biomerics

- Shanghai VasoLutions MedTech Co. Ltd.

- MicroPort Scientific Corporation

- KANEKA CORPORATION

- OrbusNeich Medical Group Holdings Limited

- SIS Medical AG

- Merit Medical Systems

Recent Developments

-

In August 2023, MicroPort Scientific Corporation announced that its Firefighter NC Pro PTCA Balloon Catheter (Firefighter NC Pro) has received market authorization from the U.S. Food and Drug Administration (FDA). It is a new generation of high-pressure balloon catheters launched by MicroPort Coronary.

-

In February 2023, SIS Medical AG, one of the global manufacturers in interventional cardiology announced the launch of its OPN NC percutaneous transluminal coronary angioplasty (PTCA) dilatation catheter featuring 'Twin-Wall' technology in the U. S.

-

In January 2023, MicroPort Scientific Corporation obtained marketing registration approval from the Peruvian General Directorate of Medicines, Supplies, and Drugs for its internally developed coronary balloon catheters. This includes the Foxtrot Pro Percutaneous Transluminal Coronary Angioplasty (PTCA) Balloon Catheter, the Foxtrot NC PTCA Balloon Catheter, the Firefighter PTCA Balloon Catheter, and the Firefighter NC Balloon Catheter. Firefighter NC Balloon Catheter is a new generation of balloon catheters that are both high-pressure resistant and facilitate rapid exchange.

-

In April 2022, Nipro Medical Corporation announced the introduction of its second-generation Cronus high-pressure (HP) percutaneous transluminal angioplasty (PTA) balloon catheter to the U.S. market.

-

In March 2022, SIS Medical AG announced the U.S. Food & Drug Administration's approval of its lead product, the OPN NC Super High Pressure PTCA Balloon Catheter, under 510(k) number K212393.

High Pressure Balloon Catheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.28 billion

Revenue forecast in 2030

USD 5.03 billion

Growth rate

CAGR of 8.90% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

use, material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.; APR Medtech Ltd.;

Medtronic; Terumo Medical Corporation; Nipro Medical Corporation; Cordis; Relisys Medical Devices Limited; Advin Health Care; Nordson Corporation; Biomerics; Shanghai VasoLutions MedTech Co. Ltd.;

MicroPort Scientific Corporation; KANEKA CORPORATION; OrbusNeich Medical Group Holdings Limited; SIS Medical AG; Merit Medical Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Pressure Balloon Catheter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global high pressure balloon catheter market report based on the use, material, application, end-use, and region:

-

Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Polyester

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Urology

-

Nephrology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high pressure balloon catheter market size was estimated at USD 3.03 billion in 2024 and is expected to reach USD 3.29 billion in 2025.

b. The global high pressure balloon catheter market is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2030 and is expected to reach USD 5.03 billion by 2030.

b. Based on use, therapeutic segment dominated the market with a 73.86% share in 2024. High-pressure balloon catheters are essential in interventional procedures particularly angioplasty and stent placement, where they are used to dilate narrowed arteries, thereby restoring blood flow and improving patient outcomes.

b. Some key players operating in high pressure balloon catheter market include Boston Scientific Corporation, ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD., Medtronic, Terumo Medical Corporation, Nipro Medical Corporation, Cordis, Relisys Medical Devices Limited, Advin Health Care, Nordson Corporation, Biomerics, Shanghai VasoLutions MedTech Co. Ltd, MicroPort Scientific Corporation, KANEKA CORPORATION, SIS Medical AG, and Merit Medical Systems.

b. Key factors driving the market growth include rising prevalence of cardiovascular diseases, including coronary artery disease and peripheral arterial disease and growing preference for minimally invasive interventions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.