- Home

- »

- Pharmaceuticals

- »

-

Herbal Medicine Market Size, Share & Growth Report, 2030GVR Report cover

![Herbal Medicine Market Size, Share & Trends Report]()

Herbal Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Intervention (Ayurveda, Traditional Chinese Medicine), By Product Form (Tablet/Capsules, Powder), By Source, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-293-0

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbal Medicine Market Summary

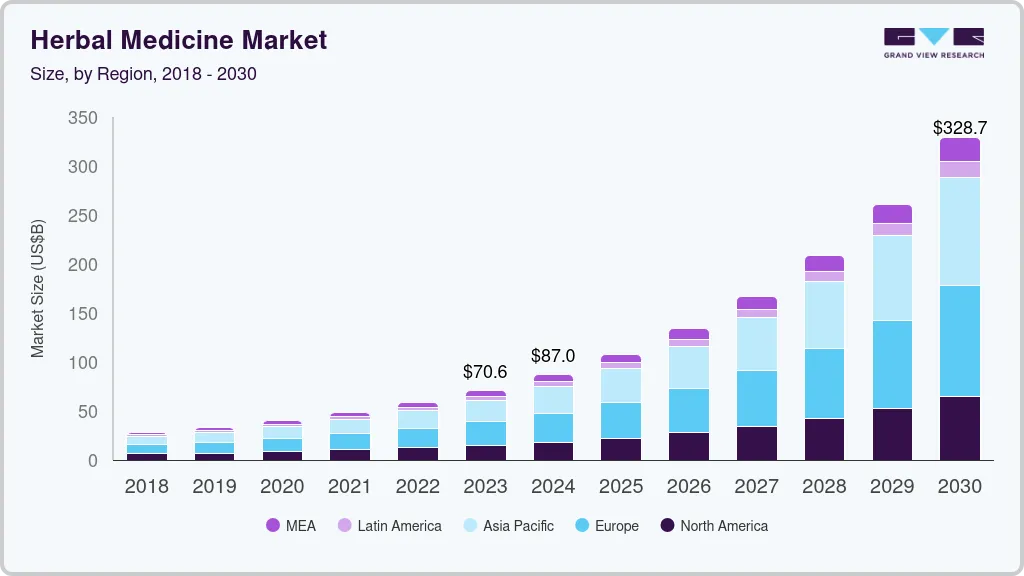

The global herbal medicine market size was estimated at USD 70.57 billion in 2023 and is projected to reach USD 328.72 billion by 2030, growing at a CAGR of 20.91% from 2024 to 2030. This growth is majorly due to rising health consciousness, increasing consumer preference for natural remedies, and technological advancements in the extraction and formulation of herbal medicines.

Key Market Trends & Insights

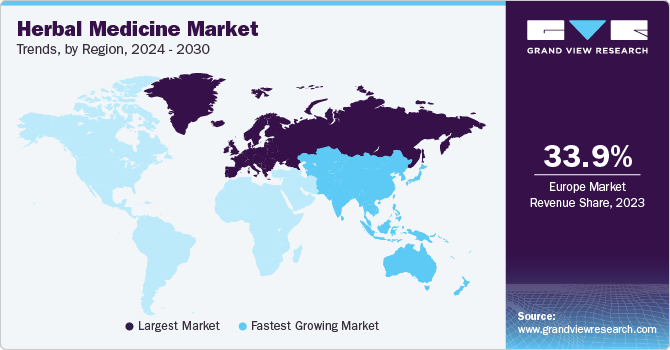

- Europe dominated the herbal medicine market with the largest revenue share of 33.98% in 2023.

- The herbal medicine market in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- Based on intervention, the ayurveda segment led the market with the largest revenue share of 27.7% in 2023.

- Based on product form, the tablet/capsules segment led the market with the largest revenue share of 46.10% in 2023.

- Based on source, the roots segment led the market with the largest revenue share of 38.07% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 70.57 Billion

- 2030 Projected Market Size: USD 328.72 Billion

- CAGR (2024-2030): 20.91%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers are increasingly seeking plant-based solutions due to concerns over the adverse effects of synthetic drugs, aligning with a broader shift towards holistic wellness and preventive healthcare. According to the World Health Organization (WHO), 80% of the world's population which is approximately 4 billion people, use herbal medicine for some aspect of primary health care.

The rising demand for organic and ethically sourced ingredients in various products, including herbal remedies, highlights the market's growth. Traditional medicine systems like Ayurveda and Traditional Chinese Medicine (TCM) also contribute to expanding the market as their holistic approaches gain global recognition. Moreover, the trend towards personalized healthcare and wellness tourism further fuels the demand for botanicals tailored to individual needs, promising continued market expansion in the forecast period.

Herbal medicines come in various forms, from basic preparations like tinctures and extracts to more refined products such as tablets and capsules. Countries have varying regulatory frameworks for these medicines; some classify them separately, while others include them within broader categories like "natural health products" alongside vitamins and minerals. Botanicals contain active ingredients which are often unknown. Practitioners believe that using an active ingredient in isolation can lose its impact or become less safe. For instance, salicylic acid, found in meadowsweet, is used to make aspirin, which can cause stomach lining bleeding. However, meadowsweet contains other compounds to prevent irritation from salicylic acid.

Some of the herbal supplements and their uses are listed below:

Herbal Supplements And Uses

Herbal Supplements

Description

Echinacea

Used for prevention against cold and flu

Hawthorn

Used for prevention of several heart-related conditions. It is also supportive in treating high blood pressure, atherosclerosis, angina and heart failure.

St. John's Wort

Helps to treat mental disorders and recommended for mild to moderate depression.

Evening Primrose

Helpful in reducing symptoms of premenstrual syndrome and arthritis.

Feverfew

Used for migraine headaches and menstrual cramps.

The demand for herbal medicines increased due to the increasing consumer focus on preventive healthcare and immunity-boosting products during the COVID-19 pandemic. The lockdowns and social distancing measures led to a shift in consumer behavior towards natural and organic products, including Ayurveda supplements and herbal medicines. Moreover, the growing awareness about the benefits of botanicals in managing stress and anxiety levels also contributed to the market growth during COVID-19.

The advancements in extraction and formulation technologies have improved the effectiveness and consistency of herbal medicines, leading to novel dosage forms like Nano emulsions and sustained-release formulations. Analytical techniques like chromatography, spectroscopy, and DNA barcoding enable accurate identification, authentication, and quality control of herbal raw materials and finished products, preventing adulteration and ensuring product integrity. National Institutes of Health also launched HerbList, an app for research-based information about the safety and effectiveness of botanical products to help consumers navigate information about popular herbs and supplements.

Researchers increasingly explore traditional knowledge systems and ethnobotanical practices to identify new medicinal plants and bioactive compounds. This interdisciplinary approach fosters collaboration between traditional healers, scientists, and healthcare professionals to validate traditional remedies and discover novel therapeutic agents. With the growing use of these medicines alongside conventional drugs, there's a promoted focus on understanding potential herb-drug interactions. Research in this area aims to identify interactions that may affect drug metabolism, efficacy, or safety, leading to better-informed prescribing practices.

Market Concentration & Characteristics

The market is undergoing significant innovation in extraction methods, formulation techniques, and product delivery systems. This has led to more efficient herbal extracts and improved potency and efficacy. Research into medicinal plant therapeutic properties and novel bioactive compounds has also led to new products with enhanced health benefits. Phytopharmaceuticals involve developing medicines with scientifically validated therapeutic properties.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players driven by the growing demand for natural and organic products, consolidation in the industry, and the need to expand geographical reach. The acquisition of emerging herbal medicine manufacturers by larger pharmaceutical companies enables access to new distribution channels and strengthens research and development capabilities. For instance, in November 2022, Mankind Pharma, an Indian pharmaceutical company, acquired a majority stake in Upakarma Ayurveda Private Limited, which manufactures, develops, and sells Ayurvedic and herbal products. This acquisition aims to expand Upakarma Ayurveda's range of products and services by utilizing Mankind Pharma's strong distribution network.

Regulatory frameworks govern herbal medicines' production, distribution, and marketing, ensuring consumer safety and product quality. Some countries have stringent regulations requiring botanicals to undergo rigorous testing and clinical trials to demonstrate safety and efficacy before they can be marketed to consumers. Evolving regulatory landscapes, such as the implementation of Good Manufacturing Practices (GMP) and Herbal Medicine Compendium (HMC), aim to standardize quality control measures and enhance consumer confidence in herbal medicines. In Europe, European Herbal and Traditional Medicine Practitioners Association (EHTPA), British Herbal Medicine Association (BHMA) and the Medicine and Healthcare products Regulatory Agency (MHRA) develop and regulate set of practice and training standards for herbal medicine.

Herbal medicines might face competition from alternative treatment modalities, including conventional pharmaceutical drugs and dietary supplements. In some cases, consumers may opt for synthetic drugs over botanicals due to perceived efficacy, convenience, or physician recommendations. Growing consumer interest in preventive healthcare and natural remedies drives demand for herbal medicines as substitutes for synthetic drugs, particularly in the treatment of chronic conditions and lifestyle-related diseases.

Regional expansion plays a significant role in shaping the competitive landscape of the global market, allowing companies to expand their product portfolios, enter new markets, and achieve economies of scale. Companies are establishing partnerships or distribution agreements with local firms to penetrate new markets and adapt products to meet regional preferences and regulatory requirements. Increasing globalization and cross-border trade facilitate the expansion of herbal medicine manufacturers into new territories, focusing on regions experiencing demographic shifts, rising disposable incomes, and growing awareness of natural healthcare solutions.

Intervention Insights

Based on intervention, the ayurveda segment led the market with the largest revenue share of 27.7% in 2023. This growth is driven by increased awareness and adoption of Ayurveda and growing consumer demand for natural and holistic healthcare solutions. The market is leveraging technology to improve product quality, increase efficiency, and enhance the consumer experience. For instance, the Indian government launched a digital platform called the Ayurveda Health and Wellness Centre to provide telemedicine and e-consultation services to patients. Companies in the market are forming partnerships and collaborations to expand their reach and capabilities. For instance, Dabur India Ltd. joined Amazon to sell its Ayurvedic products online. This partnership enabled Dabur to reach a broader consumer base and leverage Amazon's logistics and distribution network.

The apitherapy segment is anticipated to grow at the fastest CAGR over the forecast period, due to the broader acceptance among the medical community owing to the growing scientific evidence supporting the therapeutic benefits of honeybee products. Apitherapy uses products derived from honeybees, such as honey, bee venom, and beeswax, for medical purposes and has been growing in popularity as people seek natural and alternative therapies for various health concerns. The apitherapy market is leveraging technology to improve product quality, safety, and efficacy. For instance, a Canadian company called Apiterra uses artificial intelligence and machine learning to identify the most effective strains of honeybees for producing high-quality honey and other bee products.

As the apitherapy market grows, there has been increased regulatory scrutiny to ensure the safety and efficacy of honeybee products. For instance, the U.S. FDA issued warning letters to companies that make unsubstantiated claims about the health benefits of their apitherapy products. In July 2022, the FDA issued warning letters to four companies, Shopaax.com, MKS Enterprise LLC, Thirstyrun LLC (also known as US Royal Honey LLC), and 1 am USA Incorporated dba Pleasure Products USA, for illegally selling honey-based products that may cause a health risk to consumers.

Product Form Insights

Based on product form, the tablet/capsules segment led the market with the largest revenue share of 46.10% in 2023. The increasing preference for convenient dosage forms among consumers played a pivotal role in driving the demand for tablets and capsules. These forms offer ease of consumption, precise dosing, and portability, catering to the busy lifestyles of modern consumers. In addition, advancements in formulation technologies have enhanced the efficacy, stability, and bioavailability of herbal ingredients in tablet and capsule formulations, bolstering their acceptance among health-conscious individuals.

The powder form segment is expected to grow with the fastest CAGR during the forecast period, due to its versatility and ease of consumption. Powdered forms offer flexibility in dosage, allowing consumers to customize their intake based on individual needs and preferences. Moreover, powdered products often boast higher bioavailability than other dosage forms, leading to faster absorption and potentially enhanced efficacy. This factor has attracted health-conscious consumers seeking efficient and potent natural remedies. In addition, the growing trend towards DIY healthcare and home remedies has spurred the demand for powdered herbs, empowering individuals to create personalized formulations for various health concerns.

Source Insights

Based on source, the roots segment led the market with the largest revenue share of 38.07% in 2023, owing to their traditional use in herbal remedies and various formulations. In addition, the increasing scientific validation of the pharmacological benefits of multiple root extracts has bolstered their appeal among modern consumers seeking evidence-based natural remedies. Research studies highlighting the anti-inflammatory, antioxidant, immune-modulating, and adaptogenic properties of root-derived compounds have further propelled their utilization in herbal medicine formulations, catering to various health concerns. The growing trend towards sustainable and ethically sourced ingredients has heightened interest in wildcrafted and organically cultivated roots, ensuring quality, purity, and environmental responsibility throughout the supply chain. Furthermore, the expanding availability of roots-based products through traditional and online retail channels has facilitated consumer access and market penetration, driving robust growth within the segment.

The leaves segment is expected to grow at the fastest CAGR during the forecast period. The widespread recognition of leaves' therapeutic properties, including antioxidant, anti-inflammatory, and detoxifying effects, has fueled their increasing utilization in herbal remedies. Leaves offer a rich source of bioactive compounds such as polyphenols, flavonoids, and essential oils, contributing to their appeal among health-conscious consumers seeking natural alternatives. The versatility of leaves allows for diverse applications in herbal formulations, including teas, extracts, tinctures, and topical preparations, catering to a broad spectrum of health needs. Furthermore, growing consumer awareness of the benefits of plant-based diets and holistic wellness practices has spurred demand for leaves-based herbal products, driving market expansion.

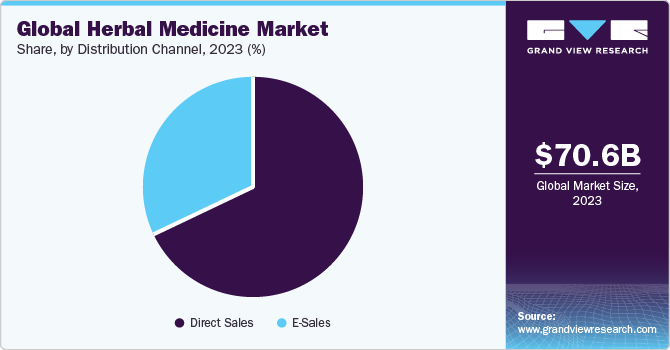

Distribution Channel Insights

Based on distribution channel, the direct sales channels segment held the market with the largest revenue share of 67.62% in 2022. The increased awareness about the benefits of herbal medicines has led to a surge in demand, effectively catered by companies using direct sales channels. Direct sales channels enable companies to offer personalized recommendations and customized products based on individual consumer needs. This level of customization enhances the overall consumer experience and drives higher sales through direct channels.

The e-sales segment is expected to grow at the fastest CAGR during the forecast period. The integration of technology in the herbal medicine sector has made it easier for consumers to access information about the herb and product, contributing to the market growth of the e-sales segment in the global market. This is strongly supported by many factors, such as increasing investments in the improvement of internet connectivity, rising adoption of mobile devices, and awareness created through social media. E-commerce platforms have played a significant role in expanding their reach globally. For instance, in February 2022, Amazon India announced a dedicated storefront on its marketplace solely focused on herb-based Ayurvedic medicines and supplements. This storefront aims to increase the visibility of Ayurveda products, which include a wide range of immunity boosters, oils, and other supplements from small businesses and D2C brands.

Regional Insights

The herbal medicine market in North America is experiencing steady growth, driven by factors such as increasing consumer awareness regarding natural remedies, a rising preference for preventive healthcare, and a growing demand for organic products. The expansion of product offerings by major players, a focus on research and development for novel formulations, and the integration of herbal supplements into mainstream healthcare is driving the market growth.

U.S. Herbal Medicine Market Trends

The herbal medicine market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to the growing health consciousness, rising healthcare costs, and a favorable regulatory environment for herbal supplements. For instance, the Herbal Medicines Compendium (HMC) is an online resource by the U.S. Pharmacopeial Convention provides standards for herbal ingredients used in medicines. It is primarily expressed in monographs, which contain general information, definitions, and specifications for critical quality attributes.

Europe Herbal Medicine Market Trends

Europe dominated the herbal medicine market with the largest revenue share of 33.98% in 2023. This growth is influenced by rising geriatric population, increasing prevalence of chronic diseases, and a growing preference for plant-based therapies. The adoption of traditional remedies, integration of herbs into mainstream healthcare, and emphasis on quality assurance and safety standards with a long history of herbal traditions, Europe represents a mature yet evolving market, characterized by moderate growth and a diverse array of products. In Europe, herbal remedies fall into three categories. The most rigorously controlled are prescription drugs, which include injectable forms of phytomedicines and those used to treat life-threatening diseases. The second category is OTC phytomedicines, similar to American OTC drugs. The third category is traditional herbal remedies, products that typically have not undergone extensive clinical testing but are judged safe on the basis of generations of use without serious incident.

The herbal medicine market in the UK is driven by increasing awareness of the benefits of herbal remedies, and rising consumer preference for sustainable products. The growing popularity of herbal teas and supplements, emergence of boutique brands, and integration of herbs into functional foods and beverages is driving the market growth. Despite regulatory challenges, the UK herbal medicine market continues to grow as consumers seek natural alternatives for their healthcare needs.

The France herbal medicine market has a strong cultural affinity and the increasing adoption of preventive healthcare and a growing demand for premium herbal products are driving the market growth. In France, traditional medicines can be sold with labeling based on traditional use, which requires licensing by the French Licensing Committee and approval by the French Pharmacopoeia Committee.

The herbal medicine market in Germany is fueled by high healthcare expenditure, an aging population, and a growing interest in alternative medicine. The expansion of pharmacies, the popularity of standardized herbal extracts, and the increasing use of herbal supplements for immune support are driving the market growth for herbal medicines. With a robust regulatory framework and widespread acceptance of natural therapies, Germany remains a leading European market.

Asia Pacific Herbal Medicine Market Trends

The herbal medicine market in Asia Pacific is characterized by rapid growth and is expected to grow at the fastest CAGR during the forecast period, driven by factors such as a long history of traditional medicine, increasing consumer awareness of natural remedies, and rising healthcare costs. Traditional herbal practices deeply rooted in countries like India, China, and Japan contribute to the market's growth. The growing acceptance of supplements, expansion of distribution channels, and government initiatives promoting traditional medicine is driving the market growth. With a diverse range of botanical remedies and a large consumer base, the Asia Pacific region is a significant contributor to the global market.

The India herbal medicine market is experiencing robust growth, propelled by factors such as a rich tradition of Ayurveda, increasing demand for natural and organic products, and government support for traditional medicine systems. For instance, in March 2022, an agreement was signed by the Government of India and the World Health Organization (WHO) to launch the WHO Global Centre for Traditional Medicine. This center aims to use technology and modern science to mobilize the potential of traditional medicine from around the world to improve people’s health. The Government of India has invested USD 250 million to support the establishment of this global knowledge center for traditional medicine.

The herbal medicine market in China is expected to grow at the fastest CAGR over the forecast period, due to factors such as a long history of traditional Chinese medicine (TCM), government initiatives promoting herbal remedies, and increasing consumer demand for natural healthcare solutions. The growing acceptance of TCM globally, expansion of product exports, and investment in research and development for herbal formulations. With a deep-rooted tradition and a large domestic market, China continues to lead the way in the herbal medicine industry.

The Japan herbal medicine market is expected to grow at the substantial CAGR over the forecast period. The integration of traditional Japanese herbal practices into modern medicine, expansion of product offerings, and government support for research and development is expected to drive the market growth. With a strong focus on quality and safety, Japan's market offers opportunities for growth and innovation.

Latin America Herbal Medicine Market Trends

The herbal medicine market in Latin America is characterized by factors such as a rich tradition of indigenous medicine, increasing consumer awareness of natural remedies, and growing demand for plant-based therapies. The popularity of herbal remedies in traditional healing practices, expansion of product availability, and government initiatives promoting the use of medicinal plants is driving the market growth. The National Health Surveillance Agency (ANVISA) in Brazil regulates herbal medicines under the heading of "phytotherapeutic medicines". Herbal remedies in Mexico are governed by the Federal Commission for Protection against Sanitary/Health Risk (COFEPRIS), which classifies them as "natural products". In Argentina, the National Administration of Drugs, Food, and Medical Devices (ANMAT) regulates herbal medicines under the heading of "medicinal plants".

The Brazil herbal medicine market is one of the largest market for healthcare in the Latin America region and is driven by various government initiatives, medical tourism, and high cost of conventional medicine. In April 2024, the Brazilian Health Regulatory Agency announced a public notice of selecting startups involved in R&D in order to provide regulatory support.

MEA Herbal Medicine Market Trends

The herbal medicine market in MEA is expected to grow at the fastest CAGR over the forecast period, due to growing interest in traditional healing practices, rising healthcare costs, and increasing consumer awareness of natural remedies. With a rich heritage of herbal remedies and a growing market for natural healthcare solutions, the MEA region offers opportunities for growth and development in the herbal medicine industry.According to the World Health Organization (WHO), more than 80% of the African population, relies on traditional medicine for its medical requirements. Due to its accessibility, perceived low toxicity, and low cost, traditional medicine has continued to gain acceptance throughout Africa.

The Saudi Arabia herbal medicine market is expected to at a significant CAGR over the forecast period. With a population increasingly inclined towards holistic wellness, the demand for herbal remedies has seen a notable rise in the country. According to the study published by the National Library of Medicines, in Saudi Arabia, traditional medicine is frequently relied upon for treating conditions like hypertension, diabetes, infertility, and osteoporotic fractures. Local communities in the Saudi Arabia utilize over 25 plants for addressing different health issues, with herbal remedies being especially popular among women. Studies have shown that traditional medicine is widely embraced, with a reported usage rate as high as 69.9% among the population.

Key Herbal Medicine Company Insights

In the competitive landscape of the global market, several leading players for market dominance. Key players such as Sheng Chang Pharmaceutical Company, Nordic Nutraceuticals, AYUSH Ayurvedic Pte Ltd. and Bionorica SE employ a range of strategies to maintain their competitive edge. These strategies include continuous investment in new product development, securing patent protection for their innovations, obtaining regulatory approvals, and fostering collaborations and partnerships to expand their market reach and enhance product offerings.

There are notable competitors in the market such as KindCare Medical Center, Sinomedica, Herb Pharm, and LKK Health Products Group Limited. These emerging players employ diverse strategies to bolster their presence in the market. Strategies such as a relentless focus on innovation to differentiate their products, expanding their geographic footprint to tap into new markets, and forging strategic partnerships to leverage complementary strengths help these companies in achieving their growth objectives. As competition intensifies, the ability to innovate, adapt to evolving regulatory landscapes, and forge strategic alliances will be pivotal for both established and emerging players to maintain and expand their market share in the dynamic landscape of Herbal Medicine

Key Herbal Medicine Companies:

The following are the leading companies in the herbal medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Sheng Chang Pharmaceutical Company

- Nordic Nutraceuticals (now a part of Oy Verman Ab)

- AYUSH Ayurvedic Pte Ltd.

- Herbal Hills

- Herb Pharm

- LKK Health Products Group Limited

- International Chinese Body Care Houses

- KindCare Medical Center

- Pascoe Natural Medicine

- Bionorica SE

- Ming Chen Clinic

- The Center for Natural and Integrative Medicine

- Sinomedica

Recent Developments

-

In April 2024, Mitsui & Co., Ltd. announced that it will acquire 100% shares in Eu Yan Sang International Ltd, a Singapore-based company that manufactures and sells traditional Chinese medicines. The shares will be valued at around 88 billion yen

-

In March 2024, the Federal Government unveiled 4 herbal products developed by the Nigeria Natural Medicine Development Agency (NNMDA) for the management of sickle cell disease, diabetes, reducing fast ageing and treatment of upper respiratory tract infections

-

In January 2024, the National Integrated Research Program on Medicinal Plants (NIRPROMP) announced the preparation to introduce three additional herbal medicines to the market. Yerba Buena, Ulasimang Bato, and Akapulko, initially among the ten herbal medicines endorsed by the Department of Health (DOH), are poised for launch

-

In February 2023, FXB Rwanda and National Industrial Research and Development Agency (NIRDA) initiated the Phyto social enterprise (POSE) project, aiming to boost the production of herb based medicines and goods for regional and local consumption

Herbal Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 87.03 billion

Revenue forecast in 2030

USD 328.72 billion

Growth rate

CAGR of 20.91% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Intervention, product, source, distribution method, region

Country scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Region scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sheng Chang Pharmaceutical Company; Nordic Nutraceuticals (now a part of Oy Verman Ab); Herb Pharm; AYUSH Ayurvedic Pvt. Ltd.; Herbal Hills; LKK Health Products Group Limited; International Chinese Body Care Houses; KindCare Medical Center; Pascoe Natural Medicine; Bionorica SE; Ming Chen Clinic; The Center for Natural; Integrative Medicine, Sinomedica

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Herbal Medicine Market Report Segmentation

This report forecasts revenue growth at, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the herbal medicine market report based on intervention, product form, source, distribution channel and region:

-

Intervention Outlook (Revenue, USD Million, 2018 - 2030)

-

Ayurveda

-

Apitherapy

-

Bach Flower Therapy

-

Naturopathic Medicine

-

Traditional Chinese Medicine

-

Traditional Korean Medicine

-

Traditional Japanese Medicine

-

Traditional Mongolian Medicine

-

Traditional Tibetan Medicine

-

Zang Fu Theory

-

-

Product Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid/Gel

-

Tablets/Capsules

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Barks

-

Leaves

-

Roots

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales

-

E-sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global herbal medicine market size was estimated at USD 70.57 billion in 2023 and is expected to reach USD 87.03 billion in 2024.

b. The global herbal medicine market is expected to grow at a compound annual growth rate of 20.91% from 2024 to 2030 to reach USD 328.72 billion by 2030.

b. Ayurveda held the largest revenue share of 27.7% of the market in 2023. This growth is driven by increased awareness and adoption of Ayurveda and growing consumer demand for natural and holistic healthcare solutions.

b. Ayurveda held the largest revenue share of 27.7% of the market in 2023. This growth is driven by increased awareness and adoption of Ayurveda and growing consumer demand for natural and holistic healthcare solutions.

b. Key factors propelling the market include rising health consciousness, increasing consumer preference for natural remedies, and technological advancements in the extraction and formulation of herbal medicines. Consumers are increasingly seeking plant-based solutions due to concerns over the adverse effects of synthetic drugs, aligning with a broader shift towards holistic wellness and preventive healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.