- Home

- »

- Healthcare IT

- »

-

Healthcare Cyber Security Market Size & Share Report, 2030GVR Report cover

![Healthcare Cyber Security Market Size, Share & Trends Report]()

Healthcare Cyber Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Type Of Threat, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-635-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Cyber Security Market Summary

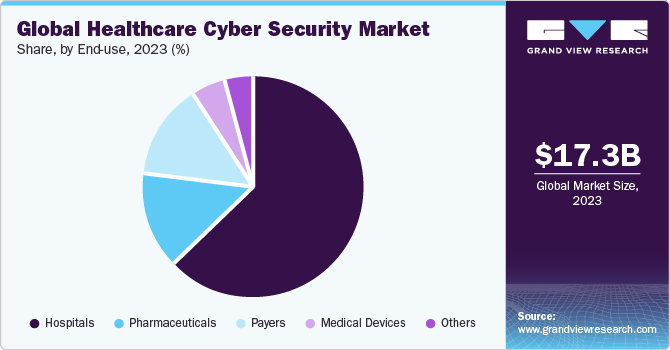

The global healthcare cyber security market size was estimated at USD 17.28 billion in 2023 and is projected to reach USD 56.34 billion by 2030, growing at a CAGR of 18.5% from 2024 to 2030. Increasing cases of cyber-attacks, rising privacy & security concerns, and higher adoption of advanced cybersecurity solutions are fueling market growth.

Key Market Trends & Insights

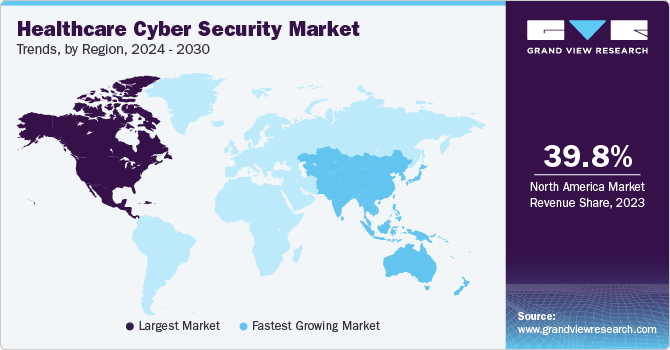

- The healthcare cyber security market in North America held a dominant share of 39.8% in 2023.

- The U.S. healthcare cybersecurity market held the largest share in 2023.

- Based on type, under the solution segment, the antivirus and antimalware segment dominated the market with a share of 25.8% in 2023.

- By type of threat, the malware segment dominated the market with a share of 25.7% in 2023.

- By end-use, the hospital segment held the largest revenue share of over 62.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 17.28 Billion

- 2030 Projected Market Size: USD 56.34 Billion

- CAGR (2024-2030): 18.5%

- North America: Largest market in 2023

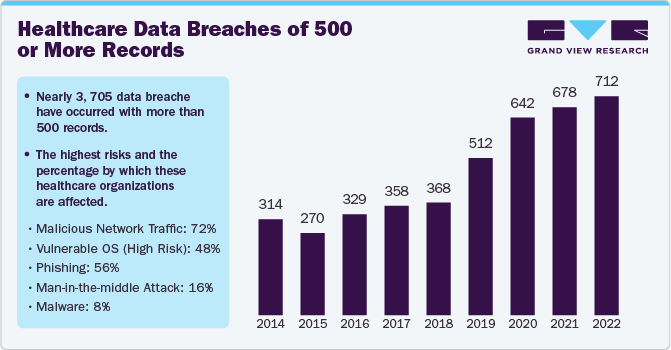

According to the HHS Office for Civil Rights (OCR) December 2023 update, cyber events in healthcare are on the rise in the U.S. Between 2018 and 2022, the number of large breaches reported to OCR increased by 93%, from 369 to 712, with a staggering 278% increase in large breaches involving ransomware.

The growing adoption of cloud-based solutions in the healthcare sector, rise in the adoption of connected devices and smartphones, and the adoption of 5G technology are factors estimated to further contribute to market growth. The use of Internet of Medical Things devices for better patient care poses potential threats in the healthcare sector, leading to increased demand for advanced healthcare cyber security solutions.

“IoMT devices are increasingly important in the delivery of healthcare”, during the Covid pandemic, remote patient monitoring became crucial. The patients could leave hospital early and be monitored at their own homes. But this requires the remote devices to perform safely and to be protected from hacking or ransomware on a systematic level”.

-Stephen Gilbert, Professor at the TUD Dresden University of Technology (Germany) and coordinator of the project

Healthcare cybersecurity firms offer services and solutions to healthcare institutions, safeguarding hospitals and patient information from data breaches and cyberattacks. Cybersecurity encompasses risk management techniques, software, and technology designed to prevent digital attacks, data theft, and unauthorized network, device, and program access. The market features numerous advanced healthcare cybersecurity solutions providing comprehensive attack surface analysis.

The increasing data breach in the industry further propels the demand for healthcare cybersecurity. For example, according to IBM's 2021 Cost of a Data Breach Report, the average cost of a data breach in the healthcare sector reached USD 9.23 million in 2021. In addition, the U.S. Department of Health and Human Services Secretary's Breach of Unsecured Protected Health Information documented around 592 breaches of unsecured protected patient data affecting over 500 individuals within the past two years, currently under investigation by the Office for Civil Rights.

Survey/Case Study Insights

-

The Fresenius attack underlines the need for cybersecurity

-

Fresenius, a German healthcare company that operates globally, is Europe's largest private hospital operator. The company's operations are divided into four independent businesses, including dialysis products and services, private hospital operation, pharmaceutical drug, and medical device provision, as well as healthcare project management services

-

On May 4, 2020, Fresenius was hit by a cyberattack that involved a new strain of ransomware called Snake. The attack reportedly affected every part of the company's operations, and patient data from some of its dialysis centers in Serbia was leaked. The cybercriminals stole the data before encrypting it and threatened to publish the data online if the ransom was not paid. It's worth noting that this wasn't the first time cybercriminals had targeted Fresenius. In the past, the company had already paid a seven-figure ransom to recover from a similar attack. This incident highlights the importance of having robust cybersecurity measures in place to prevent such attacks

-

Study on data breaches, healthcare systems, cybersecurity, and security challenges in the U.S.

-

According to a data security study survey, the data breaches are as follows: caused misuse of data (29.5%), by human error (33.5%), theft (16.3%), Malware (10.8%), Hacking (14.8%). These data breaches affect the healthcare industry in many ways

-

Analyst insights: The healthcare sector is particularly vulnerable to data breaches from the high value of Protected Health Information (PHI) on the black market. Breaches can result from diverse methods, such as phishing, DoS attacks, and human error. The repercussions for healthcare organizations are significant, underscoring the importance of implementing robust measures to mitigate cyberattack risks

The COVID-19 pandemic increased the adoption of cyber security services and solutions as a result of increased data breaches and a surge in cyberattacks targeting the healthcare sector. Phishing incidents in healthcare experienced a significant uptick during the pandemic, driving increased cybersecurity demand.

Expanding internet penetration and digital platform adoption in healthcare further highlight the necessity for cybersecurity measures. In addition, the adoption of advanced cybersecurity solutions is poised to drive market growth. Increased investments in healthcare cybersecurity by both healthcare organizations and government initiatives are expected to further bolster the market growth.

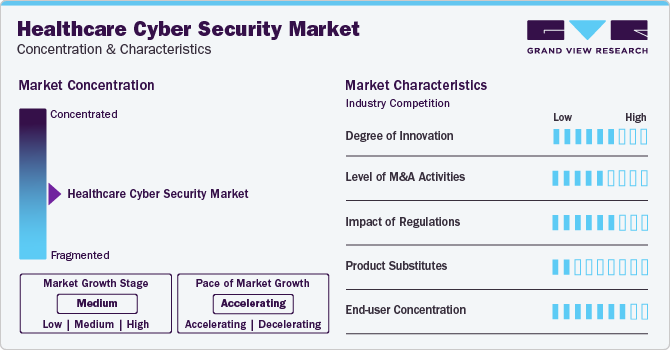

Market Concentration & Characteristics

The healthcare sector is increasingly targeted by cyberattacks due to its vast amount of sensitive patient data. This continuous need for innovation in cybersecurity technologies to counter evolving threats. Mergers and acquisitions (M&As) play a significant role in this market, as companies seek to bolster their cybersecurity offerings, expand market presence, or acquire specialized technology and expertise. For example, in May 2022, Clearwater Compliance LLC acquired CynergisTek, a leading cybersecurity, privacy, compliance, and IT audit firm serving regulated industries. This all-cash transaction valued CynergisTek at approximately USD 17.7 million. The acquisition demonstrates CynergisTek's commitment to cybersecurity, privacy, and audit services tailored to healthcare and other clients

The impact of regulation is high in the market. Regulatory bodies like the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., the General Data Protection Regulation (GDPR) in the European Union, and various national regulations worldwide impose stringent requirements on healthcare organizations to safeguard patient data. This necessitates investments in cybersecurity solutions to ensure compliance, thereby driving market growth

The threat of substitute products is anticipated to be low to moderate in the market. Healthcare cybersecurity solutions are essential for protecting patient data, ensuring regulatory compliance, mitigating cyber risks, and maintaining the trust and integrity of healthcare services in an increasingly digital and interconnected environment

End-users in the market include pharmaceuticals, medical devices, payers, hospitals, and others. The growing integration of medical devices into networked systems highlights the critical importance of ensuring their cybersecurity to prevent potential breaches that may endanger patients or compromise their data. These factors drive demand for cybersecurity solutions across various end-use industries

Type Insights

Based on type, the market is segmented into solutions and services. Under the solution segment, the antivirus and antimalware segment dominated the market with a share of 25.8% in 2023. Various solutions have been developed to tackle the different threats. Some of the key solutions include identity and access management, risk and compliance management, Security Information and Event Management (SIEM), Intrusion Detection System (IDS)/Intrusion Prevention System (IPS), and data encryption software, firewalls, antivirus, antimalware software, and others.

The Intrusion Detection System (IDS)/Intrusion Prevention System (IPS) segment is anticipated to grow at a significant CAGR of 19.1% over the forecast period. Healthcare organizations are prime targets for cyberattacks due to the sensitive nature of patient data they handle. The rising number of cyber threats, including ransomware, data breaches, and phishing attacks, has necessitated the implementation of robust intrusion detection and prevention measures. The services segment is further segmented into security services, management services, and others.

Type of Threat Insights

The malware segment dominated the market with a share of 25.7% in 2023. The healthcare industry has multiple cybersecurity-related issues. It includes malware that compromises system integrity and patient privacy, and Distributed Denial of Service (DDoS) attacks that disrupt providers' ability to provide effective patient care. The ransomware attack is the extensively used malware type due to the awareness and preferences of the hackers for ransomware. For instance, as per TechTarget, Inc.'s January 2021 update, Emsisoft data showed, 560 healthcare facilities fell victim to ransomware attacks by the malware variant in 2020 in the U.S.

Moreover, the advanced persistence threat segment is witnessing lucrative growth and is anticipated to witness a steady CAGR from 2024 to 2030. The spyware segment is expected to grow at a significant CAGR from 2024 to 2030. The healthcare sector is becoming increasingly digitized, with electronic health records (EHRs), telemedicine, and IoT medical devices being integrated into healthcare systems. This expands the attack surface for cyber threats like spyware.

End-use Insights

The hospital segment held the largest revenue share of over 62.0% in 2023. Hospitals are extremely vulnerable to cyber-attacks as they store an incredible amount of patient data. These attacks spiked during the pandemic, threatening private data and patient care. Such cases boost the adoption and use of cybersecurity solutions. For instance, a security breach at Blackbaud, a cloud computing company, resulted in the exposure of patient data from more than 46 health systems and hospitals.

According to a report published in 2018 in the American Journal of Managed Care, annual spending on advertising increased by 64.0% for the next two years after a security breach in hospitals. This additional expense allows hospitals to rebuild their age and retain their patients against their competitors in the market. Such costs to the healthcare system can be avoided by implementing a better data security system, which is estimated to drive cybersecurity spending in hospitals.

Regional Insights

The healthcare cyber security market in North America held a dominant share of 39.8% in 2023. Factors driving regional market growth include the presence of key players and increased cybersecurity applications in healthcare organizations. Growing investments in cybersecurity and technological advancements further fuel market expansion. The launch of innovative products aimed at safeguarding healthcare data also plays a significant role. For example, in December 2022, Palo Alto Networks introduced Medical IoT Security, a Zero Trust security solution tailored for digital healthcare. In 2018, Cisco released the latest version of "Cisco Umbrella," deployed at the University of Kansas Hospital to protect medical devices and financial information from ransomware.

U.S. Healthcare Cyber Security Market Trends

The U.S. healthcare cybersecurity market held the largest share in 2023 due to increased cyber threats, regulatory compliance, ransomware attacks, and a focus on data privacy & protection. Healthcare organizations in the U.S. are proactively investing in cybersecurity technologies to safeguard patient data and ensure uninterrupted healthcare services amid evolving threats and regulations.

Europe Healthcare Cyber Security Market Trends

The healthcare cybersecurity market in Europe held the second-largest share in 2023. European healthcare organizations are bolstering their defense against cyber threats by investing in advanced security solutions, such as threat detection systems, encryption technologies, and endpoint security. In addition, they are enhancing staff training programs. Notably, the European Commission's December 2023 publication highlighted a significant boost in Europe's digital transition and cybersecurity efforts through a new investment of over USD 821.2 (€760) million from the Digital Europe Program.

The UK healthcare cyber security market is expected to grow at a significant CAGR of over 19.0% from 2024 to 2030. Cybersecurity remains a top priority for the UK healthcare sector as organizations strive to protect patient data, ensure regulatory compliance, and safeguard critical healthcare infrastructure against evolving cyber threats. Continuous investment in cybersecurity technologies, workforce training, and collaborative initiatives by the government and key players drive the market.

Asia Pacific Healthcare Cyber Security Market Trends

The healthcare cybersecurity market in Asia Pacific is anticipated to witness a lucrative CAGR from 20245 to 2030 due to the increased adoption and penetration of the internet in the healthcare industry. Moreover, a rise in digitalization and adoption of Electronic Health Records (EHRs), wireless medical devices, and telemedicine is fueling market growth. Also, increasing cyber-attacks in the region would propel market growth from 2024 to 2030. In February 2021, Trend Micro a Japanese multinational cyber security software company launched its Trend Micro Vision One extended detection and response platform.

The China healthcare cyber security market is expected to grow at a significant CAGR over the forecast period. Increased investment in healthcare cybersecurity, focus on data privacy, shortage of skilled cybersecurity professionals, and focus on vendor risk management are some of the factors driving market growth.

Latin America Healthcare Cyber Security Market Trends

The healthcare cybersecurity market in Latin America is anticipated to grow significantly in the coming years due to the growing significance of cybersecurity amidst a rising number of cyber threats targeting the regional healthcare sector. According to the IBM Security X-Force Threat Intelligence Index 2023 report, Latin America experienced a notable surge in ransomware attacks, surpassing other types of attacks and constituting 32% of the cases to which X-Force responded.

Middle East & Africa Healthcare Cyber Security Market Trends

The MEA healthcare cybersecurity market is anticipated to grow significantly in the coming years. Healthcare organizations in the region strive to protect sensitive patient data and ensure the security and integrity of their digital infrastructure, such factors propel the market growth.

Key Healthcare Cyber Security Company Insights

Key players operating in the market are Cisco Systems, Inc.; IBM; Marubeni Information Systems Co., Ltd; Symantec Corporation; Trend Micro Incorporated; and McAfee, LLC.; Intel Corporation; AO Kaspersky Lab; Lockheed Martin Corporation; Northrop Grumman; Imperva; Fortinet, Inc.; Medigate (Claroty). These companies are moving towards launching new solutions to meet the rising demand for healthcare cybersecurity solutions during the forecast period.

Key Healthcare Cyber Security Companies:

The following are the leading companies in the healthcare cyber security market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- IBM

- Marubeni Information Systems Co., Ltd.

- Symantec Corporation

- Trend Micro Incorporated

- McAfee, LLC.

- Intel Corporation

- AO Kaspersky Lab

- Lockheed Martin Corporation

- Northrop Grumman

- Imperva; Fortinet, Inc.

- Medigate (Claroty)

Recent Developments

-

In December 2023, Cisco Systems, Inc. Cisco, introduced the Cisco AI Assistant for Security, a pivotal advancement in embedding AI across the Security Cloud. This innovative tool signifies Cisco's commitment to empowering customers by providing them with informed decision-making support, enhancing their tool functionalities, and streamlining intricate tasks through automation

-

In December 2023, IBM and Palo Alto Networks announced an expansion of their strategic partnership aimed at empowering clients to enhance their overall security defenses and effectively address emerging cyber threats. This collaboration aims to offer clients comprehensive solutions to bolster their security posture and navigate the evolving landscape of cybersecurity challenges

Healthcare Cyber Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.4 billion

Revenue forecast in 2030

USD 56.3 billion

Growth rate

CAGR of 18.5% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, type of threat, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Israel

Key companies profiled

Cisco Systems, Inc.; IBM; Marubeni Information Systems Co., Ltd.; Symantec Corp.; Trend Micro Inc.; McAfee, LLC.; Intel Corp.; AO Kaspersky Lab; Lockheed Martin Corp.; Northrop Grumman; Imperva; Fortinet, Inc.; Medigate (Claroty)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Cyber Security Market Report Segmentation

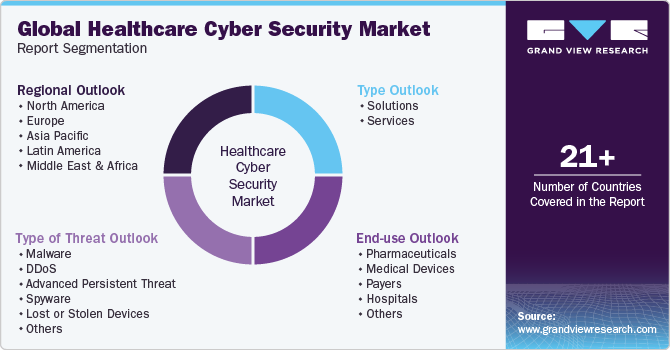

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global healthcare cyber security market report based on type, type of threat, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Identity and Access Management

-

Risk and Compliance Management

-

Antivirus and Antimalware

-

DDoS Mitigation

-

Security Information and Event Management

-

Intrusion Detection System/ Intrusion Prevention System

-

Others

-

-

Services

-

-

Type of Threat Outlook (Revenue, USD Million, 2018 - 2030)

-

Malware

-

DDoS

-

Advanced Persistent Threat

-

Spyware

-

Lost or Stolen Devices

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Medical Devices

-

Payers

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare cyber security market size was estimated at USD 17.3 billion in 2023 and is expected to reach USD 20.4 billion in 2023.

b. The global healthcare cyber security market is expected to grow at a compound annual growth rate of 18.5% from 2024 to 2030 to reach USD 56.3 billion by 2030.

b. Hospitals dominated the healthcare cyber security market with a share of 62.0% in 2023. This is attributable to the increased data breach activities using malware, phishing, or using stolen devices with unencrypted data.

b. Some key players operating in the healthcare cyber security market include Symantec, Trend Micro, Cisco, IBM, Paulo Alto Networks, Lockheed Martin, MacAfee, FireEye, Northrop Grumman, and Kaspersky.

b. Key factors that are driving the healthcare cyber security market growth include increasing the threat of cyber attacks, higher adoption of cybersecurity solutions, and rising privacy and security concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.