- Home

- »

- Medical Devices

- »

-

Healthcare Contract Development And Manufacturing Organization Market, 2033GVR Report cover

![Healthcare Contract Development And Manufacturing Organization Market Size, Share & Trends Report]()

Healthcare Contract Development And Manufacturing Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Small Molecule, Large Molecule), By Product (Pharmaceutical, Medical Devices), By Service, By Workflow, By Therapeutic Area, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-438-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Contract Development And Manufacturing Organization Market Summary

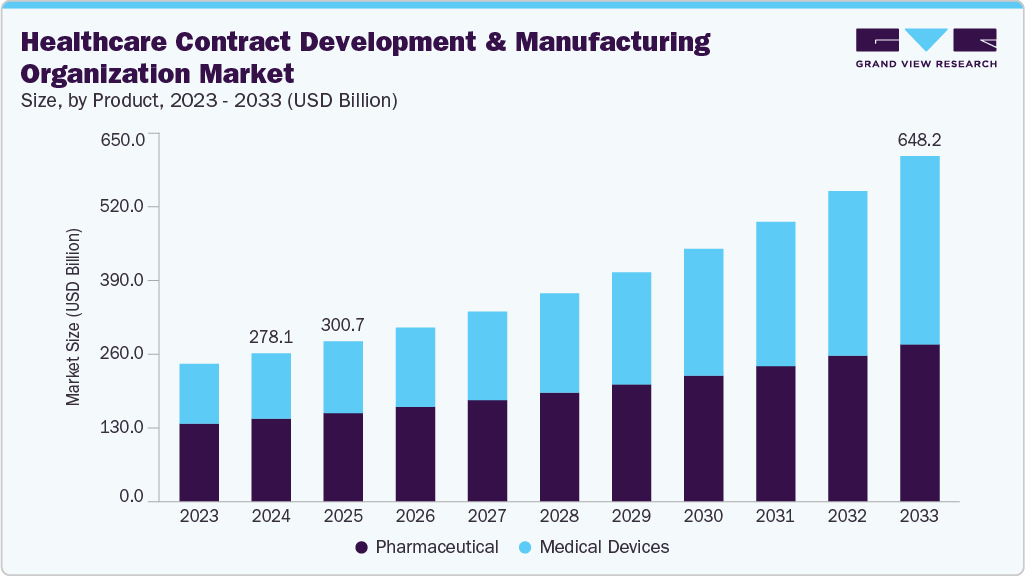

The global healthcare contract development and manufacturing organization market size was estimated at USD 278.1 billion in 2024 and is projected to reach USD 648.2 billion by 2033, growing at a CAGR of 10.08% from 2025 to 2033. The market growth is driven by rising demand for outsourced services, expansion of product pipelines, and an increasing focus on cost optimization by life sciences companies.

Key Market Trends & Insights

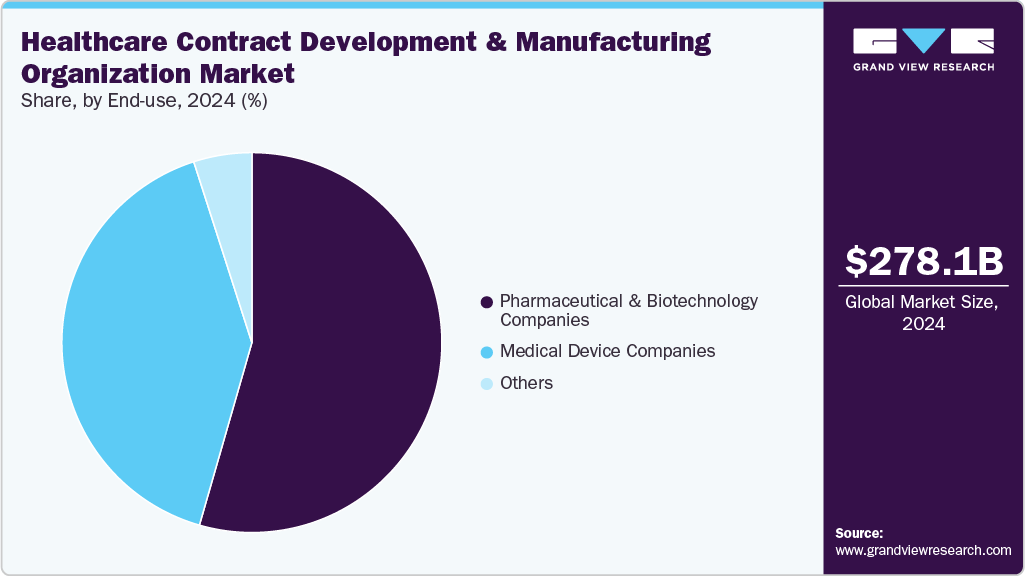

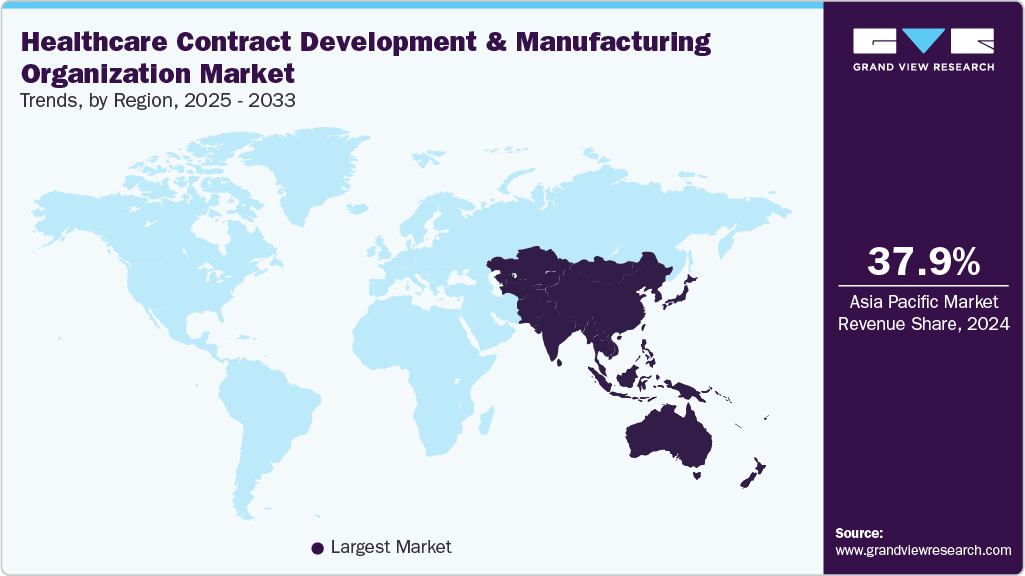

- The Asia Pacific healthcare contract development and manufacturing organization market held the largest revenue share of 37.90% in 2024.

- The healthcare contract development and manufacturing organization market in China is witnessing new growth opportunities due to strong government initiatives, rising biologics production, and increasing pharmaceutical outsourcing.

- Based on type, the small molecule segment held the largest revenue share of 36.70%.

- Based on product, the pharmaceutical segment dominated the healthcare contract development and manufacturing organization industry with the largest revenue share in 2024.

- Based on service, the contract manufacturing segment accounted for the largest share of the healthcare contract development and manufacturing organization market in 2024 during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 278.1 Billion

- 2033 Projected Market Size: USD 648.2 Billion

- CAGR (2025-2033): 10.08%

- Asia Pacific: Largest Market in 2024

Besides, the outsourcing strategies have been widely adopted as pharmaceutical and biotechnology companies seek to mitigate operational complexities while maintaining scalability and flexibility. Besides, the rising need for accelerated drug development timelines, the surge in biologics and biosimilars production, and the globalization of clinical & commercial supply chains contribute to market growth. In addition, the rapidly aging population, patent expirations, rising antibiotic resistance, and the rising need for personalized medicine are some of the key factors fueling the growth of the healthcare contract development and manufacturing organization industry.In addition, for many pharmaceutical companies, innovation and speed to clinic are considered highly significant for market growth. Numerous small to mid-sized firms and specialty pharmaceutical players are dependent on achieving these critical requirements within the industry. Many CDMOs and CROs have positioned themselves as one-stop-shop providers, with the CRO model encompassing a range of services from API development to dosage form, and from early-stage development through commercialization. Thus, to deliver such comprehensive solutions, CDMOs are required to maintain a broad range of enabling technologies and specialized capabilities tailored to address complex challenges, further accelerating market entry.

Significant investments in capacity expansion, infrastructure modernization, and advanced technology integration within the CDMO sector support the market growth. In addition, companies are investing in R&D to discover new compounds and develop the next big blockbusters, significantly increasing the number of generic manufacturers. According to the American Journal of Managed Care, the pharmaceutical market will be driven by an unmet need in various disorders, and R&D activities for developing orphan therapies will increase because the orphan drug market is likely to reach USD 262 billion by 2024. The National Institutes of Health Office of Rare Diseases Research, as of 2019, has identified roughly 7,000 orphan diseases. About 1,043 projects on orphan diseases were reported to be in the development stage, of which 822 were in clinical development.

Furthermore, among pharmaceutical & medical devices companies, technological advancements have been incorporated with the support of CDMO services, enabling greater efficiency and precision in drug discovery, development, and manufacturing. Besides, automation, advanced analytics, and artificial intelligence have been increasingly adopted to streamline processes and reduce error rates.

Likewise, artificial intelligence and machine learning continue to be significant areas of interest for pharmaceutical investments, as they may support the identification & development of treatments in the field of preclinical validation, target identification, and efficiency of clinical development. Moreover, mergers and acquisitions are likely to increase between pharmaceutical and biopharmaceutical companies to diversify their product portfolio, expand their geographical footprint, and mitigate R&D risks. Such factors are expected to drive the market growth.

Opportunity Analysis

The healthcare CDMO market is experiencing significant growth due to changing pharmaceutical and biotechnology industry dynamics. Companies increasingly outsource to reduce operational complexity, accelerate their time-to-market, and optimize costs. The rising demand for biologics, biosimilars, cell and gene therapies, and mRNA-based platforms has led to a substantial need for specialized development and manufacturing services, making CDMOs essential strategic partners.

In addition, the increasing number of small and mid-sized biopharma companies lacking in-house capabilities drives the demand for comprehensive end-to-end solutions. Moreover, CDMOs offer integrated services from drug discovery to commercialization as clients prioritize efficiency, speed, and flexibility. This expansion into emerging markets and the globalization of supply chains further emphasize the need for CDMOs with scalable operations and global regulatory expertise. Furthermore, investments in advanced technologies will likely improve competitiveness in the market. Such factors are expected to drive the market.

Impact of U.S. Tariffs on the Global Healthcare Contract Development And Manufacturing Organization Market

U.S. tariffs have impacted the healthcare CDMO industry, affecting costs, supply chains, and partnerships. Besides, higher tariffs on raw materials and APIs from countries like China and India have raised input costs for CDMOs dependent on international sourcing. These increased costs have led to more expensive drug development and manufacturing for pharmaceutical clients. Besides, the supply chain disruptions have prompted CDMOs to relocate operations, further managing tariff impact. While CDMOs in North America have benefited from rising domestic demand, smaller companies have faced challenges to stay competitive. This uncertainty surrounding tariffs has also caused delays in cross-border collaboration, impacting product development timelines. However, CDMOs with manufacturing networks & compliance capabilities have found new opportunities amid these challenges. Those who can navigate changing trade dynamics and optimize supply chains will likely seize emerging business prospects in this tariff-affected environment.

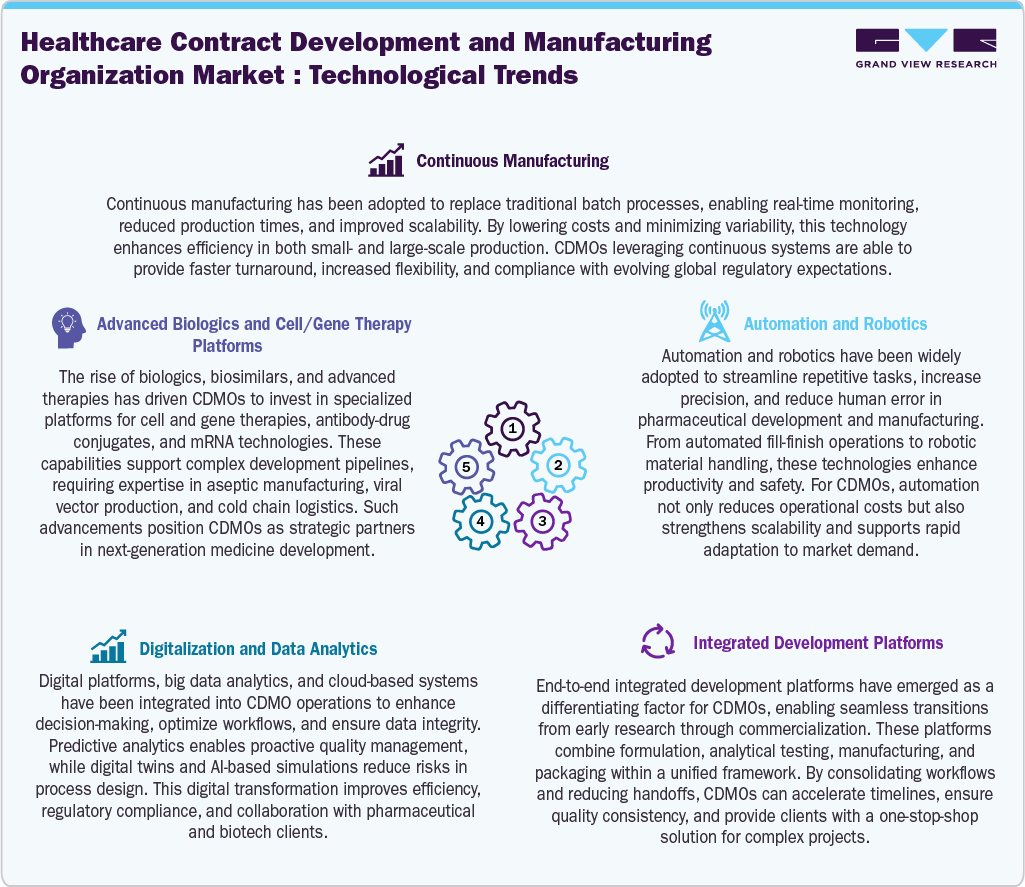

Technological Advancements

Technological innovations are reshaping the Healthcare CDMO sector, improving efficiency, quality, and creativity across the entire value chain. The shift towards continuous manufacturing has enabled smooth production processes and enhanced scalability while complying with stringent global quality regulations, which are anticipated to propel market growth. In addition, the growing complexity of pharmaceutical pipelines is fueling investments in biologics and cell and gene therapy platforms. Moreover, CDMOs are adopting specialized skills in viral vector production, aseptic processing, and mRNA technologies to cater to the rising demand for personalized treatments. Furthermore, these advancements reinforce the essential role of CDMOs in developing innovative therapeutics. Besides, incorporating digital tools and data analytics improves operational workflows, ensures data accuracy, and enables predictive quality control. This approach emphasizes efficiency, consistency, and adaptability, positioning CDMOs as versatile partners capable of addressing the dynamic challenges within the industry.

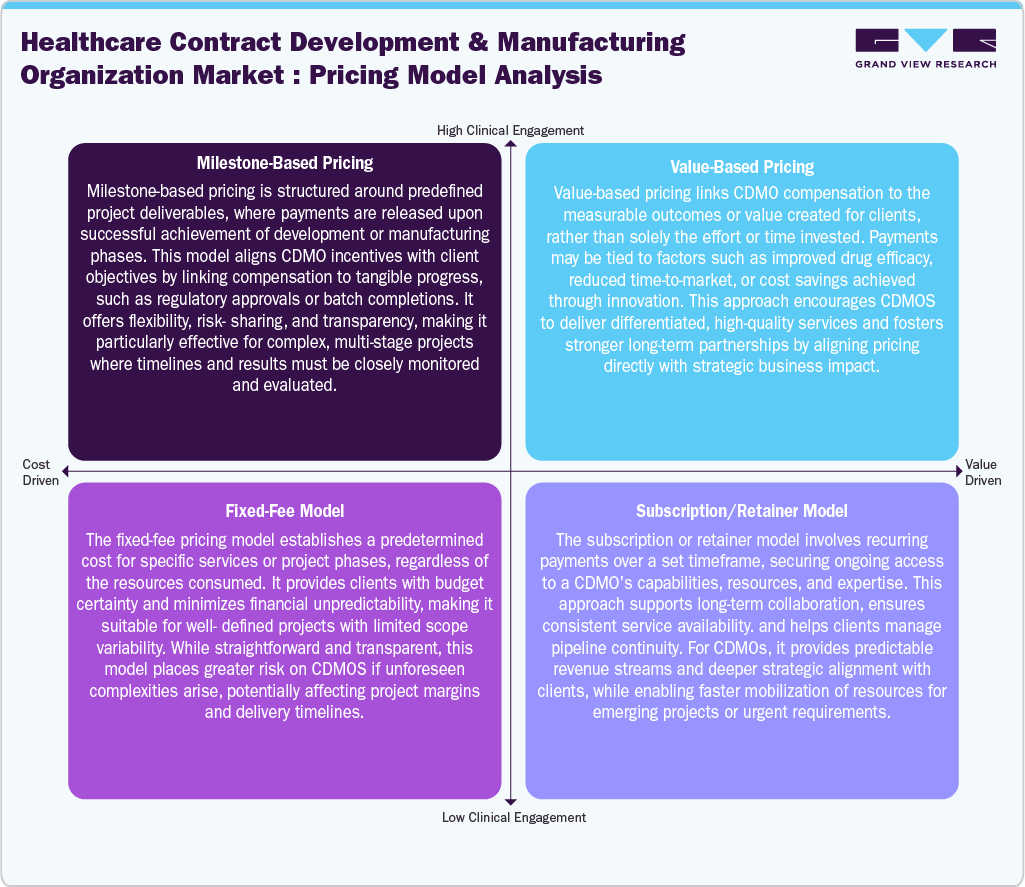

Pricing Model Analysis

Healthcare CDMOs employ pricing models according to client requirements, project requirements, and financial predictability. For instance, milestone-based pricing links payments to deliverables like regulatory submissions and clinical trials, fueling the transparency and mutual risk-sharing. In addition, value-based pricing is focused on measurable outcomes, incentivizing innovation by offering compensation to reduce costs and faster time-to-market results. Moreover, the fixed-fee model provides budget certainty for clearly defined projects but can expose CDMOs to risk with unexpected complexities. Furthermore, subscription or retainer models ensure ongoing payments for continuous resource access, promoting stability and predictable revenue for both parties

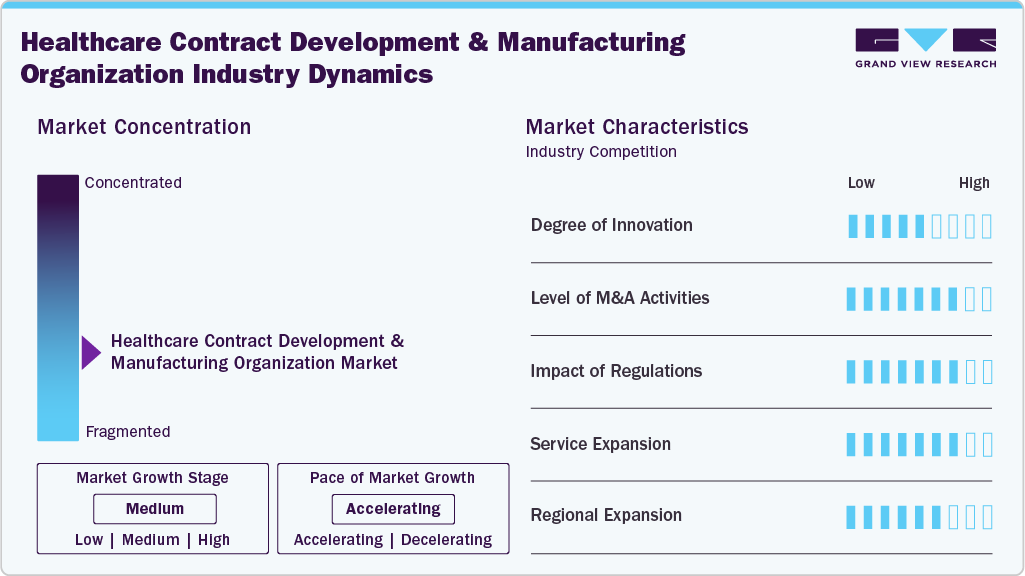

Market Concentration & Characteristics

The healthcare contract development and manufacturing organization market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Advanced technologies like continuous manufacturing, digital platforms, and innovative biologics production drive the degree of innovation. The rising demand for cell and gene therapies, mRNA platforms, and personalized medicine has accelerated R&D investments. CDMOs are embracing innovation to differentiate their service offerings and improve efficiency, scalability, and regulatory compliance amid increasingly complex pharmaceutical pipelines.

M&A activity in the healthcare contract development and manufacturing organization industry continues strongly, fueled by the need for expanded capabilities, geographic reach, and specialized skills. Strategic acquisitions focus on biologics, cell and gene therapy platforms, and fill-finish services. This allows companies to enhance their end-to-end offerings, boost competitiveness, and build long-term client partnerships within an increasingly fragmented global outsourcing landscape.

The sector is significantly shaped by evolving global regulatory frameworks that govern quality, safety, and data integrity. Stricter monitoring by the FDA and EMA agencies has raised compliance costs and elevated industry standards. CDMOs with robust quality systems and regulatory know-how are better positioned to gain client trust and seize opportunities in the highly regulated therapeutic market.

Service expansion within the CDMO sector responds to client demands for integrated, end-to-end solutions. Many companies are broadening their capabilities across drug discovery, formulation, clinical trial supply, and large-scale manufacturing. Investments are also targeting high-potency APIs, biologics, and advanced therapies. This strategic expansion enables CDMOs to offer increased flexibility, lessen outsourcing complexity, and improve client retention.

Regional expansion has become a vital growth strategy for CDMOs aiming to support global pharmaceutical pipelines. Facilities are being built or expanded in emerging markets like Asia-Pacific and Latin America to capitalize on cost advantages and rising local demand. Thus, growth in North America and Europe emphasizes advanced therapies and regulatory compliance, ensuring well-balanced global service coverage.

Type Insights

In 2024, the small molecule segment held the largest revenue share of 36.70%. For small molecules, CDMOs offer comprehensive services, including active pharmaceutical ingredient (API) development, formulation, analytical testing, and commercial manufacturing. These molecules are a critical part of the pharmaceutical outsourcing sector and remain prevalent in therapeutic pipelines due to growing patent expirations, an increasing demand for generics, and the rising complexity of drug design, which have accelerated the need for outsourcing. By utilizing specialized expertise, global supply chains, and advanced technology, CDMOs significantly reduce time-to-market and ensure compliance with quality standards for small-molecule products.

The large molecule segment is expected to grow significantly during the forecast period. The rise of biologics, biosimilars, and advanced therapies drives the segment. CDMOs are investing in infrastructure for recombinant proteins, monoclonal antibodies, and cell and gene therapies. In addition, these projects demand complex manufacturing capabilities, strict quality controls, and advanced cold-chain logistics. Pharmaceutical and biotech companies increasingly rely on CDMOs to accelerate biologics development, reduce costs, and ensure regulatory compliance. With growing demand for targeted and personalized treatments, large molecule-focused CDMOs are well-positioned to capture long-term opportunities in the global healthcare CDMO market.

Product Insights

The pharmaceutical segment dominated the healthcare contract development and manufacturing organization industry with the largest revenue share in 2024. The market services play a critical role in supporting pharmaceutical companies across drug development. By providing expertise in formulation, clinical supply, manufacturing, and regulatory compliance, CDMOs help optimize efficiency and reduce time-to-market. In addition, patent expirations, complex drug pipelines, and rising cost pressures have backed outsourcing strategies, enabling pharma firms to focus on R&D innovation. CDMOs offering integrated solutions are increasingly preferred, as they streamline processes from active pharmaceutical ingredient (API) synthesis to commercial-scale production. With the pharmaceutical sector prioritizing innovation, scalability, and global supply chains, CDMOs remain essential strategic partners for new growth opportunities.

The medical devices segment is expected to grow significantly during the forecast period. The market is driven by growing requirements for services across the design, prototyping, testing, and manufacturing. In addition, regulatory compliance, cost pressures, and the need for advanced materials have strengthened reliance on CDMOs. Specialized providers deliver expertise in precision engineering, sterile packaging, and scalability for complex devices. Moreover, with growing demand for combination products and minimally invasive technologies, CDMOs offering integrated device solutions are increasingly positioned as key enablers of innovation, speed-to-market, and global competitiveness in the medical device sector. Such factors are expected to drive the market.

Service Insights

The contract manufacturing segment accounted for the largest share of the healthcare contract development and manufacturing organization market in 2024 during the forecast period. In healthcare CDMO, contract manufacturing enables pharmaceutical and biotech companies to outsource production processes while focusing on innovation and commercialization. The market players offer a range of services for API synthesis, formulation, dosage manufacturing, packaging, and distribution. Besides, it provides scalability, cost efficiency, and access to specialized technologies, particularly for companies without in-house capacity. Increasing complexity in biologics, injectables, and high-potency APIs has heightened reliance on CDMOs with advanced infrastructure. Regulatory compliance and quality assurance remain critical, with leading CDMOs differentiating through global networks and integrated supply solutions. Thus, the manufacturing continues to drive significant growth within the broader healthcare CDMO outsourcing market.

The contract development segment is expected to grow significantly during the forecast period. The segment is accelerating early-stage drug discovery and formulation, further contributing to market growth. These services include preclinical testing, process optimization, analytical method development, and clinical trial material preparation. Besides, in pharmaceutical and biotech companies, contract development supports reducing risk, enhancing efficiency, and access specialized expertise by outsourcing development activities. Moreover, CDMOs with integrated development and manufacturing platforms offer a seamless pathway from concept to commercialization, strengthening their position as strategic partners in managing complex pipelines and driving faster market entry.

Workflow Insights

The commercial segment dominated the healthcare contract development and manufacturing organization industry with the largest revenue share in 2024. Commercial-scale capabilities are vital to healthcare CDMOs, supporting pharmaceutical and biotech companies in transitioning from clinical development to market-ready production. CDMOs provide large-scale manufacturing, packaging, labeling, and global distribution services emphasizing quality, compliance, and scalability. With rising global demand for small and large molecules, CDMOs offering end-to-end commercial solutions are positioned to become long-term partners in sustaining product availability and global market success.

On the other hand, the clinical segment is projected to grow at a significant CAGR during the forecast period. Clinical-stage services within healthcare CDMOs focus on supporting drug candidates through development trials. Offerings include formulation, clinical trial material manufacturing, packaging, labeling, and logistics management. CDMOs ensure regulatory compliance while optimizing timelines and reducing risks during critical phases of clinical development. They enable smaller biotech and specialty pharma companies to advance therapies efficiently by providing flexibility and scalability. Besides, integrated CDMO platforms support the bridge to the transition from clinical to commercial stages, ensuring continuity and accelerating speed-to-market in an increasingly competitive healthcare landscape.

Therapeutic Area Insights

The oncology segment accounted for the largest share of the CDMO industry in 2024 during the forecast period. The segment growth is driven by the rising complexity of cancer drug pipelines, including targeted therapies, immunotherapies, and antibody-drug conjugates, which require advanced development and manufacturing capabilities, further contributing to market growth. In addition, CDMOs provide expertise in high-potency APIs, sterile injectables, and biologics, ensuring quality and compliance in highly regulated environments. Thus, as the incidence of cancer rises, CDMOs increasingly focus on offering specialized oncology solutions, further strengthening partnerships.

The autoimmune diseases segment is expected to grow significantly during the forecast period. The growing prevalence of autoimmune diseases has created opportunities for healthcare CDMOs to support the development of biologics, biosimilars, and targeted therapies. These treatments demand complex manufacturing, robust analytical testing, and regulatory compliance. Moreover, CDMOs provide expertise in formulation, sterile production, and delivery systems tailored to autoimmune drugs, which is expected to drive the market over the estimated time period.

End-use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest share of the healthcare CDMO market in 2024 during the forecast period. Healthcare CDMOs are essential collaborators for pharmaceutical and biotechnology companies, delivering comprehensive outsourcing services throughout the drug development process. They enhance scalability, reduce costs, and support global supply chains for pharma firms while providing biotech innovators with critical infrastructure, technical know-how, and regulatory support. There is a growing preference for integrated service models that cover all phases, from discovery to commercialization. As drug pipelines become more complex and the need for quicker market entry increases, CDMOs allow both pharma and biotech companies to concentrate on innovation while relying on outsourced expertise for operational tasks and compliance.

The medical device companies segment is expected to grow at the second-highest CAGR during the forecast period. Medical device companies are increasingly partnering with Healthcare CDMOs to access specialized design, testing, and manufacturing capabilities. CDMOs support compliance with stringent regulatory standards while enabling scalability and cost efficiency. Outsourcing helps device companies accelerate innovation and market entry from prototyping to full-scale production. As demand for complex and combination products grows, CDMOs with integrated healthcare expertise provide significant value by ensuring quality, efficiency, and global distribution support for medical device manufacturers. Such factors are expected to drive the market.

Regional Insights

Asia Pacific dominated the global healthcare contract development and manufacturing organization industry in 2024, holding a revenue share of 37.90%. The growth is driven by rising pharmaceutical outsourcing, growing biologics demand, and cost advantages. Countries such as China, India, Japan, and South Korea are some of the major countries in the region, focusing on expanding manufacturing capacities & specialized expertise. Besides, investments in advanced bioprocessing, continuous manufacturing, and digital technologies enhance service efficiency and contribute to market growth. In addition, multinational companies are increasingly partnering with regional CDMOs to gain access to scalable and cost-effective solutions. Regulatory harmonization, supportive government policies, and growing clinical trial activities further strengthen new growth opportunities for the healthcare CDMO industry.

China Healthcare Contract Development And Manufacturing Organization Market Trends

The healthcare contract development and manufacturing organization market in China is witnessing new growth opportunities due to strong government initiatives, rising biologics production, and increasing pharmaceutical outsourcing. Local CDMOs are investing heavily in biologics, biosimilars, and cell & gene therapy capabilities, while enhancing compliance with NMPA and global regulatory standards. Besides, strategic partnerships with multinational companies strengthen the market presence, and large-scale manufacturing facilities enable global supply. In addition, a growing number of clinical trial activities & demand for cost-effective development solutions are further accelerating market growth.

The Japan healthcare contract development and manufacturing organization market growth is driven by the rising demand for innovative therapies, advanced biopharmaceutical research, and increasing pharmaceutical outsourcing. In the Asia Pacific region, the Japanese CDMOs specialize in high-value services including sterile injectables, biosimilars, and precision medicine. Besides, regulatory alignment under the PMDA ensures stringent quality standards, fueling investment in manufacturing and new service innovations. Besides, partnerships among domestic players and global pharmaceutical companies are strengthening capabilities in biologics and advanced therapies. With an emphasis on innovation, reliability, and compliance, the country remains a critical market for CDMOs offering high-end, specialized healthcare manufacturing services.

The healthcare contract development and manufacturing organization market in India is experiencing rapid expansion, attributed to cost advantages, a strong generics base, and rising biologics demand. The CDMOs in the market are expanding into complex formulations, biosimilars, and biologics manufacturing while enhancing regulatory compliance to meet FDA, EMA, and WHO standards. Besides, strategic collaborations with global pharmaceutical companies have increased outsourcing opportunities, creating new avenues for market growth. Investments in capacity expansion, sterile facilities, & advanced technologies are enabling the country to transition from low-cost manufacturing to high-value CDMO services, positioning it as a key outsourcing market globally.

North America Healthcare Contract Development And Manufacturing Organization Market Trends

The North America healthcare contract development and manufacturing organization market is expected to grow at a significant CAGR over the forecast period. The market growth is attributed to increasing demand for biologics, sterile injectables, and advanced therapies. Pharmaceutical and biotech companies opt to outsource their development and manufacturing processes to speed up their time-to-market, cut costs, and leverage specialized expertise more effectively. Moreover, technological advancements and sophisticated bioprocessing techniques are adopted to improve operational efficiency and product quality. Furthermore, stringent regulatory requirements from the FDA and GMP standards are critical for ensuring market safety and efficacy. Besides, the growth is supported by robust R&D activities, a favorable healthcare infrastructure, and an increasing focus on personalized medicine, further fueling North America's role as a leading hub for CDMO services.

The healthcare contract development and manufacturing organization industry in the U.S. accounted for the highest share of North America in 2024, owing to strong outsourcing demands from pharmaceutical and biotech companies, especially for biologics, cell & gene therapies, and sterile injectables. Besides, integrating automation, digitalization, and advanced bioprocessing technologies drives the manufacturing process. Regulatory compliance with FDA and GMP standards is crucial for operational practices and client trust. With increased R&D activity and a focus on innovative therapies, the U.S. is positioned as a leading contract development and manufacturing services market.

The Canada healthcare contract development and manufacturing organization market is expected to grow at a significant CAGR during the forecast period. The market is driven by the outsourcing of biologics, advanced therapies, and sterile injectables by pharmaceutical & biotech companies. Investments in modern facilities, automation, and advanced bioprocessing are improving operational capabilities. Compliance with Health Canada and GMP standards guarantees quality & safety, contributing to market growth. Some other factors contributing to market growth are skilled workforce, robust R&D infrastructure, and presence in the U.S., making Canadian CDMOs appealing partners for efficient, high-quality contract development and manufacturing solutions in the global market.

Europe Healthcare Contract Development And Manufacturing Organization Market Trends

Europe's healthcare contract development and manufacturing organization industry is evolving rapidly, supported by a strong pharmaceutical base, advanced biopharmaceutical research, and growing biologics requirements in the market. CDMOs in the region are expanding specialized capabilities in sterile manufacturing, biosimilars, and complex formulations, further supporting the market. Besides, stringent EMA regulations drive quality-focused operations, while innovation in continuous manufacturing and digital solutions enhances competitiveness in the market. In addition, strategic collaboration with global pharma and biotech market players and rising outsourcing fuel the market growth. Thus, the region remains a critical hub for high-value CDMO services, particularly in advanced therapy medicinal products (ATMPs), further fueling the market.

The healthcare contract development and manufacturing organization market in Germany held the highest share in 2024. This growth can be attributed to strong pharmaceutical manufacturing hubs, an advanced R&D ecosystem, and leadership in high-quality biologics & biosimilars. In addition, the CDMOs in Germany are emphasizing precision, compliance with EMA and local BfArM regulations, and investment in state-of-the-art technologies. Besides, the growing demand for sterile injectables, high-potency APIs, and advanced therapies encourages facility expansion and collaboration with multinational companies. In addition, key proximity in European markets and the presence of highly skilled talent in the country are fueling the requirement for high-value CDMO services.

The UK healthcare contract development and manufacturing organization market is expected to grow significantly over the forecast period. The country's growth is fueled by strong biotech innovation, advanced academic research, and supportive regulatory frameworks. CDMOs in the country are expanding expertise in cell & gene therapies, personalized medicines, and clinical trial manufacturing, further supporting market growth. In addition, strategic partnerships with global pharmaceutical companies and rising investments in advanced bioprocessing technologies are enhancing the country's service offerings. With an emphasis on regulatory alignment under the MHRA and access to a skilled workforce, the country is positioning itself as a center for innovative-driven CDMO services in Europe.

Latin America Healthcare Contract Development and Manufacturing Organization Market Trends

The healthcare contract development and manufacturing organization industry in the Latin America region is expected to grow significantly over the estimated time period. In Latin America, the market is developing steadily, supported by growing pharmaceutical outsourcing, government healthcare initiatives, and increasing local demand for affordable therapies. Besides, Brazil and Argentina are leading countries in the region with expanding manufacturing infrastructure & partnerships with multinational companies. In addition, regulatory scenarios are improving in the region, which has led to rising investments in sterile manufacturing and generics. While challenges such as supply chain inefficiencies and economic volatility persist, the region offers untapped opportunities for CDMOs seeking to expand regional presence and serve diverse healthcare needs.

The Brazil healthcare contract development and manufacturing organization market grow this driven by rising pharmaceutical outsourcing & government focus on improving healthcare access. Local CDMOs are strengthening generics, biosimilars, and sterile manufacturing capabilities supported by ANVISA regulations and international partnerships, contributing to market growth. Besides, increasing investments in infrastructure and collaborations with global pharmaceutical companies fuel market growth.

Middle East & Africa Healthcare Contract Development And Manufacturing Organization Market Trends

The healthcare contract development and manufacturing organization industry in MEA is expected to experience steady growth due to rising demand for affordable medicines, increasing government healthcare investments, and growing clinical research activity. Regional CDMOs are expanding generic and sterile manufacturing capabilities while focusing on compliance with international regulatory standards. Besides, partnerships with multinational companies are being established to enhance expertise and infrastructure, further contributing to market growth.

The UAE healthcare contract development and manufacturing organization market is experiencing growth driven by strong government healthcare initiatives and an expanding pharmaceutical industry. CDMOs increasingly focus on generics, sterile manufacturing, and packaging services to meet client requirements. Compliance with international standards and investment in modern facilities enhance market competitiveness. In addition, strategic partnerships with global pharmaceutical companies further strengthen the market presence, making the UAE an emerging outsourcing destination within the Middle East, offering scalability and high-quality manufacturing solutions. Such factors are expected to drive the market over the estimated time period.

Key Healthcare Contract Development And Manufacturing Organization Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in March 2024, Alcami Corporation mentioned a strategic partnership with Tanvex CDMO. The collaboration will enable both companies to deliver an integrated offering that spans the full value chain from bulk drug substance development and manufacturing to finished drug products. In addition, clients will benefit from Tanvex’s high-capacity biologics production capabilities combined with Alcami’s expertise in sterile liquid and lyophilized filling, packaging, and labeling. The company further mentioned that this collaboration will expand high-quality service offerings for mutual clients.

Key Healthcare Contract Development And Manufacturing Organization Companies:

The following are the leading companies in the healthcare contract development and manufacturing organization market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific, Inc.

- Labcorp Drug Development

- Jabil Inc

- Syngene International Limited

- IQVIA Inc.

- Almac Group

- Ajinomoto Bio-Pharma

- Adare Pharma Solutions

- Alcami Corporation

- Vetter Pharma International

Recent Developments

-

In March 2025, Syngene International mentioned its first U.S. facility in Maryland, a 17,000-square-foot cGMP-compliant site designed to expand its CDMO capabilities. This expansion aligns with Syngene’s global expansion strategy by strengthening its presence in the U.S. market, improving supply chain resilience, and enhancing client proximity. The Maryland site further enhances the company’s biologics operations in India, increasing total single-use bioreactor capacity from 20,000 to 50,000 liters. In addition, the company continues to provide integrated services spanning early development through commercial manufacturing.

-

In February 2025, Jabil mentioned the acquisition of Pharmaceutics International, Inc. (Pii), a CDMO, to expand support for drug development clients. Adding Pii broadens Jabil’s pharmaceutical capabilities, enabling end-to-end assistance from clinical trial phases to large-scale commercialization. This acquisition will strengthen Jabil’s position in developing & producing advanced drug delivery systems, including on-body pumps, pen injectors, auto-injectors, and inhalers.

-

In December 2024, Novo Holdings mentioned the successful acquisition of Catalent for approximately USD 16.5 billion. As part of this acquisition, the company will be selling three of Catalent’s nearly 50 global sites to Novo Nordisk A/S. The three fill-finish sites being acquired by Novo Nordisk are located in the U.S., Italy, and Belgium.

Healthcare Contract Development And Manufacturing Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 300.7 billion

Revenue forecast in 2033

USD 648.2 billion

Growth rate

CAGR of 10.08% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, service, workflow, therapeutic area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Catalent Inc.; Lonza; Recipharm AB; Siegfried Holding AG; Thermo Fisher Scientific, Inc.; Labcorp Drug Development; Jabil Inc.; Syngene International Limited; IQVIA Inc.; Almac Group; Ajinomoto Bio-Pharma; Adare Pharma Solutions; Alcami Corporation; Vetter Pharma International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare contract development and manufacturing organization market report based on type, product, service, workflow, therapeutic area, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule

-

Branded

-

Generic

-

-

Large Molecule

-

Biologics

-

Biosimilar

-

-

Medical Device

-

Diagnostics

-

Therapeutics

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical

-

API

-

Traditional API

-

HP-API

-

Biologics

-

Others

-

-

Drug Product

-

Oral topical dose

-

Semi-solid dose

-

Liquid dose

-

Others

-

-

-

Medical Devices

-

Class I

-

Class II

-

Class III

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Pre-formulation & Formulation Development Service

-

Process Development & Optimization

-

Analytical Testing & Method Validation

-

Scale-up & Tech Transfer

-

-

Contract Manufacturing

-

API Manufacturing

-

Finished drug products Manufacturing

-

Medical Devices & Combination Products

-

-

Packaging and labelling

-

Regulatory Affairs

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Infectious Diseases

-

Neurological Disorders

-

Cardiovascular Diseases

-

Metabolic Disorders

-

Autoimmune Diseases

-

Respiratory Diseases

-

Ophthalmology

-

Gastrointestinal Disorders

-

Orthopedic Diseases

-

Dental Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global healthcare contract development and manufacturing organization market size was estimated at USD 278.1 billion in 2024 and is expected to reach USD 300.7 billion in 2025.

b. The global healthcare contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 10.08% from 2025 to 2033 to reach USD 648.2 billion by 2033.

b. Asia Pacific dominated the healthcare contract development and manufacturing organization market with a share of 37.90% in 2024. The market growth is attributed to increasing demand for biologics, sterile injectables, and advanced therapies. Pharmaceutical and biotech companies opt to outsource their development & manufacturing processes to speed up their time-to-market, cut costs, and leverage specialized expertise more effectively, further contributing to market growth.

b. Some key players operating in the healthcare contract development and manufacturing organization market include Catalent Inc., Lonza, Recipharm AB, Siegfried Holding AG, Thermo Fisher Scientific, Inc., Labcorp Drug Development, Jabil Inc, Syngene International Limited, IQVIA Inc., Almac Group, Ajinomoto Bio-Pharma, Adare Pharma Solutions, Alcami Corporation, and Vetter Pharma International among others.

b. The market growth is driven by rising demand for outsourced services, expansion of pharmaceutical pipelines, and an increasing focus on cost optimization by life sciences companies. These outsourcing strategies have been widely adopted as pharmaceutical & biotechnology companies seek to mitigate operational complexities while maintaining scalability and flexibility, further contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.