- Home

- »

- Healthcare IT

- »

-

Healthcare Bioconvergence Market Size, Share Report, 2030GVR Report cover

![Healthcare Bioconvergence Market Size, Share & Trends Report]()

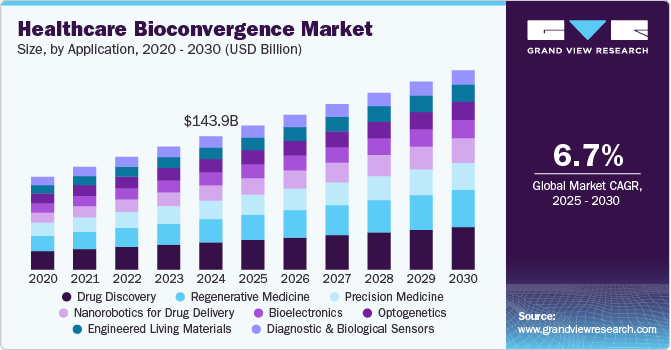

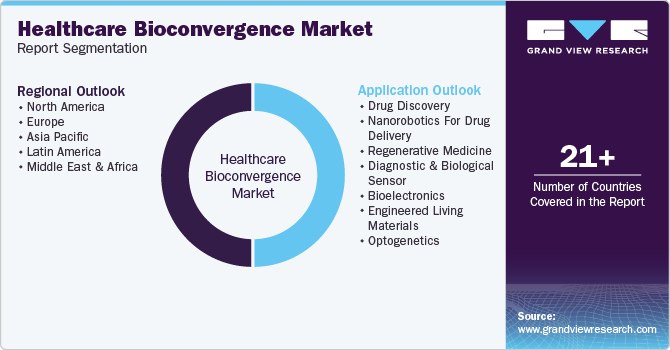

Healthcare Bioconvergence Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Drug Discovery, Nanorobotics for Drug Delivery, Regenerative Medicine, Diagnostic and Biological Sensors, Bioelectronics), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-012-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Bioconvergence Market Trends

The global healthcare bioconvergence market size was estimated at USD 143.9 billion in 2024 and is anticipated to grow at a CAGR of 6.7% from 2025 to 2030. The market growth is attributed to the development of stem cell technology, which fixes injured cells, tissues, and organs and increases government support through funding and initiatives. The combination of high-tech advancements such as robotics, machine learning, ergonomics (relationship between individuals and their environment), artificial intelligence, biology, and cloud computation is also expected to contribute to market growth over the forecast period.

The growing awareness and adoption of bioconvergence in healthcare fuel significant market expansion. Bioconvergence integrates hybrid biochemical elements, enabling advanced applications across various healthcare domains. For example, hybrid biochemical components facilitate the development of functional 3D tissue models, which play a critical role in stem cell therapy and regenerative medicine.

In addition, brain-computer interfaces leverage bioconvergence to enhance the understanding of neurological diseases by pinpointing root causes and influencing factors. Bio-sensors and hybrid systems support continuous monitoring and early diagnosis in diagnostics and patient monitoring. Furthermore, target-specific drug delivery systems-incorporating advancements in material science and nanorobotics-enhance precision in drug administration, optimizing therapeutic efficacy while minimizing side effects. These advancements highlighted bioconvergence's transformative impact on healthcare innovation and patient outcomes.

The COVID-19 pandemic has driven transformative advancements in health technology, drug research, and medical innovation. Artificial intelligence (AI) tools have become integral in accelerating drug discovery and vaccine development by analyzing genomic sequences of infected individuals to predict potential drug candidates and peptide bonds. These AI-driven methods enhance the speed and accuracy of target identification, virtual screening, and validation processes, significantly reducing time-to-market for new therapies.

In support of these advancements, the U.S. government, in 2021, committed approximately USD 1.7 billion to enhance the monitoring, identification, and management of coronavirus variants and build infrastructure for expanded genomic sequencing capabilities. Similarly, LifeArc, a UK-based medical research organization, announced in February 2021 a funding allocation of USD 5.74 million (£5 million) to support the GenOMICC COVID-19 project. This funding covers patient recruitment, sample collection and processing, and bioinformatics analysis, contributing to more profound insights into COVID-19 and strengthening pandemic response capabilities.

Moreover, the rising prevalence of chronic diseases is impacting global inhabitants and driving key players to develop ground-breaking discoveries in bioconvergence. Bioconvergence is also used in other applications such as gene therapy, bioelectronics, drug delivery, diagnostic & biological sensors, regenerative medicine, and precision medicine. Optimizing the accuracy and precision of drug delivery has been a significant challenge for the medical community. The development of nano-robots from biological systems and bioconvergence has helped revolutionize the delivery of drugs to target-oriented and site-specific cells.

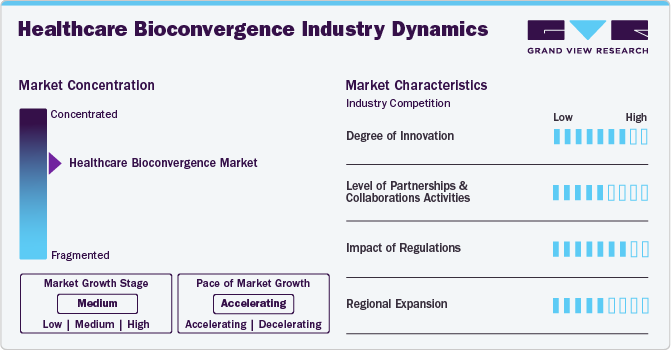

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The market is consolidated, with few providers dominating the market.

The market exhibits a high degree of innovation, driven by the fusion of biotechnology, digital technologies, and engineering. Groundbreaking advancements such as AI-driven drug discovery, bioelectronics, and personalized medicine transform patient care and treatment development. For instance, in September 2024, Ginkgo Bioworks Holdings, Inc. introduced two innovative solutions aimed at enhancing the capacity of pharmaceutical and biotech firms to advance medicinal development, furthering its collaboration with Google Cloud established previously.

The offering is an industry-pioneering protein large language model (LLM) developed jointly with Google Cloud Consulting. This model equips individual researchers and corporate entities with the capability to forge new medicines leveraging Ginkgo's proprietary data.

In addition, Ginkgo has rolled out a model API, a sophisticated instrument intended to integrate biological AI models seamlessly with the workflows of machine learning professionals. This API is now accessible on Ginkgo's platform, with the protein-based LLM expected to be available through Google Cloud's Vertex AI Model Garden for corporate users shortly.

The industry's level of partnerships & collaborations is moderate. Strategic alliances between biotech firms, medical device companies, AI developers, and academic institutions are common. These collaborations accelerate R&D, integrate advanced technologies, and streamline regulatory processes.

The impact of regulations on the market is high. Strict oversight ensures safety and efficacy, particularly as advanced technologies like AI, bioengineering, and personalized medicine emerge. Regulatory bodies enforce drug approvals, data privacy, and medical device safety standards. While these regulations slow market entry, they also build trust, ensure compliance, and foster long-term stability, essential for sustainable growth in this complex field.

The regional expansion in the market is moderate, with growth concentrated in North America, Europe, and Asia-Pacific. These regions benefit from strong R&D ecosystems, government support, and biotech and digital health investments. However, regulatory and infrastructure challenges in emerging markets limit global reach.

Application Insights

Based on application, the drug discovery segment dominated the market with a market share of 20.46% in 2024 owing to the increasing prevalence of a broad range of diseases, growing healthcare costs, and the approaching patent expiration of popular medications. According to the National Cancer Institute, cancer ranks as a primary cause of mortality globally. In 2022, nearly 20 million new incidences and approximately 9.7 million fatalities due to cancer were detected across the globe. Projections for 2040 indicate an anticipated increase in annual new cases to 29.9 million, with cancer-related fatalities expected to reach 15.3 million.

Moreover, the nanorobotics for drug discovery are anticipated to witness the fastest growth over the forecast period. This growth is driven by advancements in precision medicine and the ability of nanorobots to enhance targeted drug delivery, improving efficacy and reducing side effects. These nanoscale technologies enable high-throughput screening, molecular manipulation, and real-time monitoring of drug interactions, accelerating the drug discovery process. The increasing integration of nanorobotics with AI, biotechnology, and genomics further propels innovation, making this segment a crucial component of the evolving healthcare bioconvergence industry.

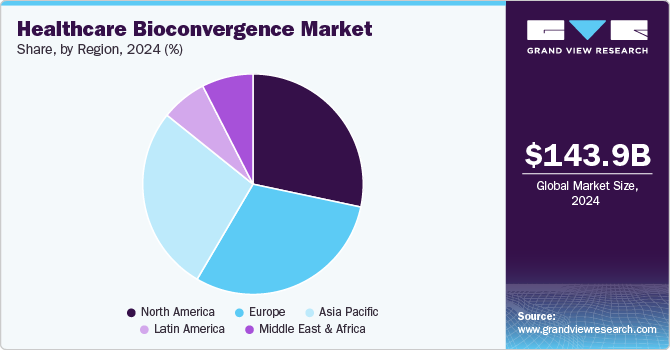

Regional Insights

North America healthcare bioconvergence market is driven by the advancements in personalized medicine, the integration of biotechnology with engineering and data science, and the rising prevalence of chronic diseases fuel the market growth. Increasing R&D investments by pharmaceutical and biotech companies, coupled with a growing focus on innovative treatment approaches, such as drug delivery systems and gene therapies, fuel the market.

U.S. Healthcare Bioconvergence Market Trends

Healthcare bioconvergence marketin the U.S. is driven by the integrating biotechnology with digital technologies, growing investment in precision therapies, and increasing collaboration between prominent players in the market.

Healthcare bioconvergence market in Canada is driven by the advancements in biotechnology, and the integration of AI, robotics, and nanotechnology in medical research. Government support for innovation and increasing healthcare spending fuel market growth as bioconvergence offers innovative solutions for complex diseases, precision therapies, and enhanced patient care outcomes.

Europe Healthcare Bioconvergence Market Trends

Europe healthcare bioconvergence market dominated the market with a revenue share of 30.13% in terms of revenue owing to leading research institutes, hospitals, and medical centers which serve as a solid basis for identifying and creating innovative medical and scientific treatments. The key driving factor of the market is the well-developed healthcare industry as well as economies of countries with advanced healthcare infrastructure such as the UK, Germany, Romania, France, and Portugal. Variables that are boosting the industry include rising government financing for cell gathering and growing R&D expenditure for 3D cell culture technologies based in Europe.

Healthcare bioconvergence market in UK is driven by the increased funding for innovative healthcare solutions. Demand is also fueled by the need for precision therapies, improved diagnostics, and growing partnerships between academia, industry, and government to accelerate healthcare innovations

Healthcare bioconvergence market in Germany is driven by factors such as strong government support for biotech innovation, extensive R&D investment, and a focus on precision medicine. In addition, Germany’s leadership in advanced engineering and medical technologies fosters growth, while its robust healthcare system drives demand for cutting-edge, personalized healthcare solutions.

Asia Pacific Healthcare Bioconvergence Market Trends

The healthcare bioconvergence market in Asia Pacific is anticipated to witness the fastest growth rate of 7.3% over the forecast period owing to the growing penetration of technology advancement in the R&D sector. Moreover, the rising prevalence of chronic diseases such as diabetes, stroke, heart disease, arthritis, multiple sclerosis, cancer, and others in the region is also contributing to market growth.

Key Healthcare Bioconvergence Company Insights

Some of the key players operating in the market are focusing on the adoption of various innovative technologies such as machine learning, artificial intelligence, cloud computing, the Internet of Things (IoT), digitalization, augmented reality, ergonomics, and big data mining. Healthcare stakeholders are integrating nanotechnology, information and communication technology, biology, and engineering wide range of possibilities.

Key Healthcare Bioconvergence Companies:

The following are the leading companies in the healthcare bioconvergence market. These companies collectively hold the largest market share and dictate industry trends.

- BiomX

- Singota Solutions

- Anima Biotech Inc.

- Ginkgo Bioworks

- SetPoint Medical

- Galvani Bioelectronics

- BICO - The Bio Convergence Company

Recent developments

-

In March 2024, BiomX Inc., a company in the clinical phase focusing on the advancement of innovative phage therapies aimed at particular pathogenic bacteria, has confirmed a definitive merger agreement with Adaptive Phage Therapeutics, Inc., a privately-held, U.S.-based, clinical-stage biotech entity dedicated to the advancement of phage-based treatments for bacterial infections.

“BiomX’s acquisition of APT will create a leading phage company with diverse technologies and an advanced clinical pipeline. With important data readouts for two programs expected in 2025, the funding from this transaction is designed to provide multiple opportunities to create stockholder value by reaching critical inflection points in each program’s clinical development. The announcement sends a clear vote of confidence from leading biotechnology investors who led this transaction that phage technology holds significant potential to treat serious infections with significant unmet need and limited treatment options”

- Jonathan Solomon, Chief Executive Officer, BiomX

-

In August 2023, Ginkgo Bioworks and Google Cloud have entered a five-year strategic partnership focused on leveraging cloud and AI technologies to advance cell programming and biosecurity. This collaboration saw Ginkgo developing advanced AI-driven tools for biological research and biosecurity applications, utilizing Google Cloud's Vertex AI platform. The initiative aimed at enhancing capabilities in genomics, protein functionality, and synthetic biology, thereby expediting innovation and discovery across various sectors, including pharmaceuticals, agriculture, industrial production, and biosecurity.

“We believe that by partnering with Google Cloud, Ginkgo can supercharge our mission to make biology easier to engineer. The most pressing challenges of our generation require biological solutions, and we must figure out how to better leverage our collective capabilities and move faster. With Ginkgo's automated Foundry to generate large scale biological data, Google Cloud's computing horsepower, and Google's AI expertise, I can't think of a better partner to scale AI solutions in biological engineering.”

-Jason Kelly, co-founder and CEO, Ginkgo Bioworks

-

In July 2022, Ginkgo finalized the acquisition of Zymergen, anticipated to substantially enhance its platform through the incorporation of advanced automation and software capabilities, alongside a broad spectrum of expertise in various biological engineering methodologies.

Healthcare Bioconvergence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 155.3 billion

Revenue forecast in 2030

USD 215.2 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Singapore; Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Israel; Kuwait

Key companies profiled

BiomX; Singota Solutions; Anima Biotech Inc.; Ginkgo Bioworks; SetPoint Medical; Galvani Bioelectronics; BICO - The Bio Convergence Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Bioconvergence Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare bioconvergence market report based on application, and region:

-

Application Outlook (USD Million; 2018 - 2030)

-

Drug Discovery

-

Nanorobotics For Drug Delivery

-

Regenerative Medicine

-

Diagnostic & Biological Sensor

-

Bioelectronics

-

Engineered Living Materials

-

Optogenetics

-

Precision Medicine

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare bioconvergence market size was estimated at USD 143.9 billion in 2024 and is expected to reach USD 155.3 billion in 2025.

b. The global healthcare bioconvergence market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 215.2 billion by 2030.

b. Europe dominated the market with a share of 30.13% in terms of revenue in 2024 owing to the well-developed healthcare industry as well as economies of countries with advanced healthcare infrastructure such as the UK, Germany, Romania, France, and Portugal.

b. Some of the key players operating in the market are BiomX; Singota Solutions; Anima Biotech Inc.; Ginkgo Bioworks; SetPoint Medical; Galvani Bioelectronics; BICO - The Bio Convergence Company.

b. Key factors driving the market growth include the growing geriatric population, rising stem cell technology regarding the advantages of fixing damaged cells, tissues as well as organs, and the integration of high-tech technologies and advancements in life science.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.