- Home

- »

- Healthcare IT

- »

-

Healthcare Analytics Market Size, Industry Report, 2033GVR Report cover

![Healthcare Analytics Market Size, Share & Trends Report]()

Healthcare Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Descriptive Analysis, Predictive Analysis), By Component (Software, Hardware), By Delivery Mode, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-937-1

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Analytics Market Summary

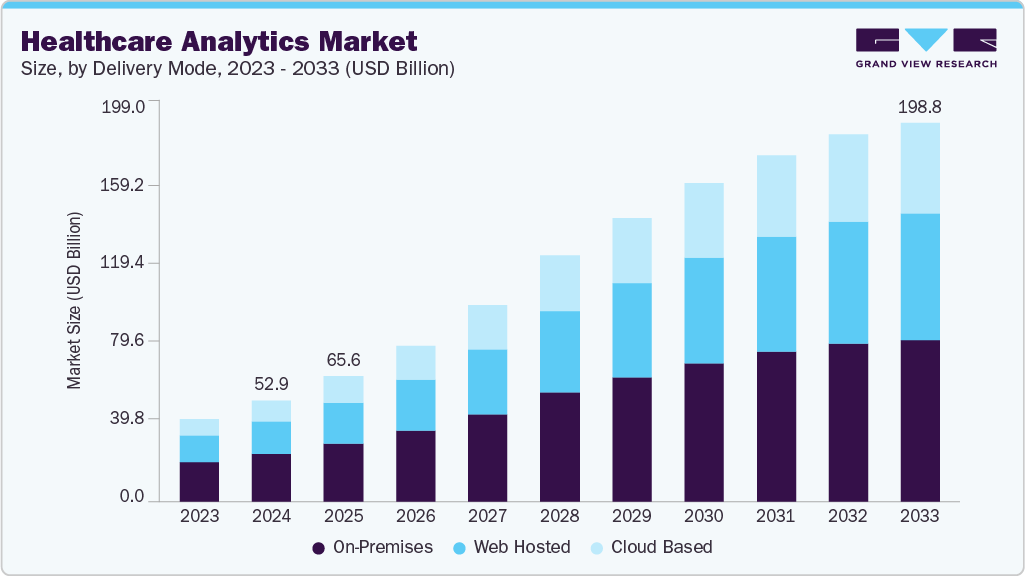

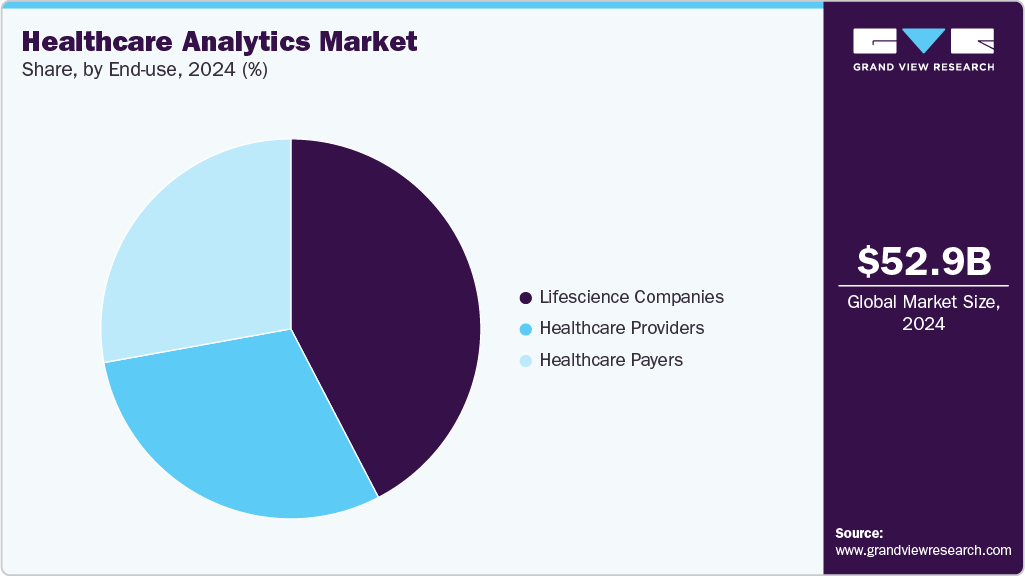

The global healthcare analytics market size was estimated at USD 52.98 billion in 2024 and is projected to reach USD 198.79 billion by 2033, growing at a CAGR of 14.85% from 2025 to 2033. This growth is attributed to the increasing challenges, such as inadequate patient care, rising treatment costs, and low levels of patient retention and engagement.

Key Market Trends & Insights

- North America dominated the market and accounted for a 48.0% share in 2024.

- Asia Pacific is anticipated to register the fastest growth rate of 16.55%.

- By type, the descriptive analytics segment held the largest market share of 45.9% in 2024.

- By component, the services segment dominated the market with a revenue share of 37.9% in 2024.

- By delivery mode, cloud based is anticipated to register the fastest growth rate of 16.62%.

Market Size & Forecast

- 2024 Market Size: USD 52.98 Billion

- 2033 Projected Market Size: USD 198.79 Billion

- CAGR (2025-2033): 14.85%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the complexity of interpreting marketing analytics is driven by the sheer speed, volume, variety, and questionable authenticity of available data, which further complicates decision-making, significantly drives the role of healthcare analytics in the market. According to an article published by Infosys Limited in December 2022, the healthcare sector currently contributes nearly 30% of the world’s total data volume, and this figure is projected to grow at a strong CAGR of 36% through 2025.A rapid rate of technological advancements and massive investments by the healthcare industry into IT development and digitization have been key factors for the monumental growth of the healthcare analytics industry. In January 2021, Optum, Inc. collaborated with Change Healthcare to advance the technology-enabled healthcare platform. Both companies provide their consumers with data analytics solutions, software, and a technology-advanced healthcare platform. Analytical platforms that are currently being deployed by healthcare institutions across the globe help in patient management and retention, due to which better care can be delivered. Deployment of healthcare analytical platforms not only increases the productivity of staff, but overall patient management has been improved and the burden on caregivers has been minimized.

Government initiatives and a massive flux of money in the healthcare industry also drive innovation. They are responsible for the increasing adoption of such analytical platforms by healthcare establishments. Analytical platforms are used by hospitals and other establishments for managing and interpreting clinical data from various studies conducted, studying historical data and analyzing it to establish trends, and developing methods, tools, and technologies to get optimal results.

Policymakers are also deploying these analytics platforms to study statistics and models for making better decisions and policies regarding healthcare establishments and delivering care to patients. The U.S. government has been taking initiatives in this direction; the HealthData.gov portal has information from several federal databases on topics such as community health performance, clinical data, and medical and scientific knowledge for developers, which is accessible via an application programming interface.

The healthcare marketing analytics is witnessing strong growth driven by the rising adoption of digital health platforms, increasing demand for personalized patient engagement, and the shift toward data-driven decision-making in marketing strategies. Factors such as the integration of AI and predictive analytics, growing use of social media and omnichannel campaigns, and regulatory emphasis on transparent communication are further accelerating adoption. Key healthcare marketing analytics companies include IQVIA, Oracle, SAS Institute, Adobe, and Veeva Systems, focusing on advanced analytics platforms, real-world evidence integration, and cloud-based solutions to help healthcare providers, payers, and life sciences companies optimize outreach, measure ROI, and improve patient-centric marketing outcomes.

AI in Healthcare Analytics Market

The AI in healthcare analytics industry is experiencing rapid growth, driven by the rising need for real-time insights, predictive modeling, and clinical decision support across healthcare systems. Increasing adoption of electronic health records (EHRs), growing healthcare data volumes, and the push toward value-based care are fueling demand for AI-powered analytics to improve patient outcomes, reduce costs, and enhance operational efficiency. Applications span clinical risk prediction, population health management, drug discovery, imaging analytics, and hospital workflow optimization. In addition, the market is witnessing steady innovation and strategic collaborations among technology vendors and healthcare providers to enhance data-driven care delivery. Recent developments in the market for healthcare analytics include new AI-enabled platforms, partnerships, and advanced predictive solutions aimed at improving healthcare efficiency and patient care.

Recent Developments in AI-Enabled Healthcare Analytics:

Company

Announcement Date

Initiative / Solution

Key Focus & Impact

Oracle

May 2025

Strategic partnership with the Cleveland Clinic and G42 to develop an AI-based global healthcare delivery platform

Aims to improve patient care, public health management, and affordability through advanced AI, data analytics, and clinical expertise.

Oracle

October 2024

Oracle introduced Oracle Analytics Intelligence for Life Sciences, an AI-powered platform designed to help life sciences companies, academic medical centers, health systems, and research institutes derive deeper insights into diseases and patient impact.

The solution enables organizations to enhance therapeutic launch strategies by leveraging a pre-built, continuously updated analytics ecosystem that integrates a broad range of real-world data sources, including CancerMPact and multi-omics datasets.

SCOR

October 2024

AI-based predictive engine launched in Vietnam in partnership with Insmart JSC

Enhances underwriting, claims, and operational efficiencies for life & health insurance using machine learning and data analytics.

Clarify Health

October 2024

Clarify Performance IQ Suite

AI-powered predictive analytics solution helping health plans and providers optimize network performance, control costs, and improve care quality with ML and generative AI.

Innovaccer

August 2024

Government Health AI Data and Analytics Platform (GHAAP)

Unifies healthcare data, enhances interoperability, and supports modernization of Medicaid and public health systems through AI-driven analytics.

Market Concentration & Characteristics

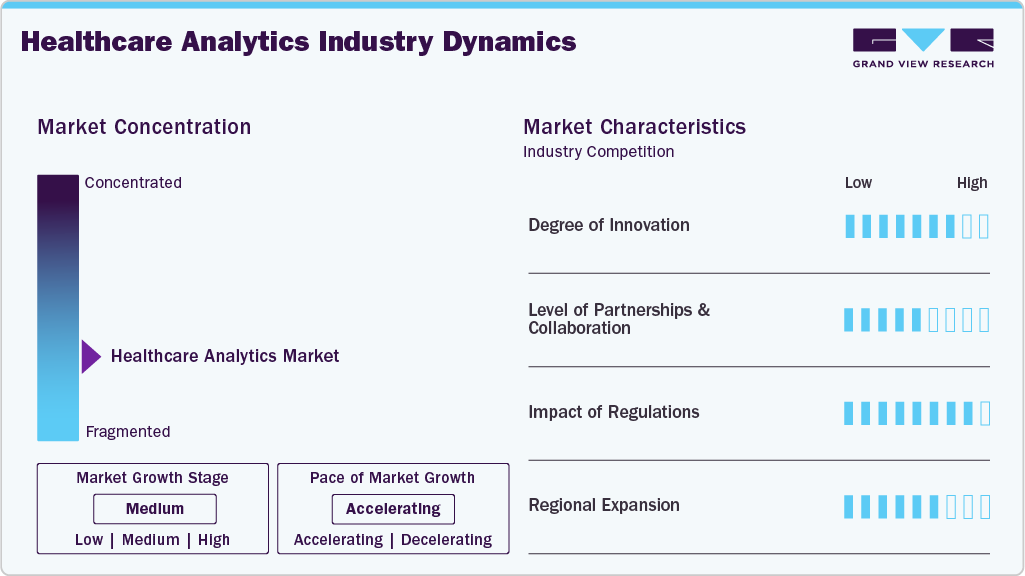

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the healthcare analytics industry is high, driven by federal policies supporting interoperability, the shift toward value-based care, and rising demand for AI-driven insights to improve patient outcomes and operational efficiency. Healthcare organizations are increasingly deploying predictive analytics, population health management tools, and AI-enabled platforms that integrate seamlessly with EHRs to reduce administrative burden and optimize care delivery. For instance, in October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered platform that unifies diverse data to accelerate insights and optimize therapeutic strategies in life sciences. The platform supports multidisciplinary research and enhances clinical decision-making on Oracle Cloud Infrastructure.

The level of partnerships and collaboration activities in the market is high, reflecting the sector’s emphasis on interoperability, advanced data sharing, and accelerating innovation to support value-based care. For instance, on June 2025, Mathematica and Tuva Health announced a partnership to improve healthcare data analytics for government and public health agencies by combining Mathematica’s advanced algorithms with Tuva Health’s open-source data model. This collaboration enables faster, higher-quality insights, empowering agencies to make evidence-based decisions and further strengthening the role of partnerships in shaping the future of U.S. healthcare analytics.

The impact of regulations on the global healthcare analytics industry is significant, as countries adopt various policies to manage data privacy, interoperability, and digital health adoption. Frameworks such as the EU’s General Data Protection Regulation (GDPR), data localization laws in Asia-Pacific, and international standards such as ISO for health IT influence how data is stored, accessed, and analyzed. While these regulations improve trust, transparency, and patient rights, the differences across regions increase complexity for multinational healthcare organizations, often necessitating tailored compliance strategies that raise costs but also promote investment in secure, interoperable analytics platforms.

The healthcare analytics industry is witnessing growth across various regions, driven by the rising adoption of electronic health records (EHRs), growing demand for predictive and prescriptive analytics in clinical and operational settings, and government initiatives promoting digital health transformation. In addition, favorable regulatory approvals and strategic partnerships between global manufacturers and local distributors are accelerating market penetration.

Type Insights

Descriptive analysis held the largest market share of 45.9% in 2024. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment. Descriptive analytics has proved to be a valuable tool for understanding what happened by accessing historical data and turning it into actionable insights. In addition, hospitals are using it to monitor the performance of insurance claims by detecting irregularities and errors in the claims. Many organizations are using descriptive analysis tools to increase market growth potential.

Predictive analysis is anticipated to be the fastest-growing analytics type segment over the forecast period since it uses datasets created by descriptive analytics to analyze data for actionable future insights. More and more companies are launching purpose-built solutions that embed risk stratification, propensity scoring, and next-best-action capabilities into clinical, payer, and consumer engagement workflows. For instance, in May 2024, mPulse announced the launch of its integrated predictive analytics and omnichannel engagement solution, marking a new category in digital health by enabling personalized digital interventions aligned with AI-powered predictive models.

Component Insights

The services segment led the market in 2024 with a share of 37.9%. The healthcare industry has been investing heavily in IT to develop platforms and digitize data for analytics. Most companies require a data analytics component, so they are outsourcing this aspect of their IT. As a result, data analytics companies offering comprehensive services have grown, contributing to the segment's expansion.

The services segment is expected to grow at the fastest rate over the projected period, owing to increased patient load in the healthcare industry and rising disease prevalence, which has led to large amounts of clinical data being generated. This puts immense pressure on the industry to provide better care, improved outcomes, and cost-effective treatments, further driving market growth. The need to adopt analytical tools and methods for better patient monitoring and delivering enhanced treatments are key factors fueling this segment's growth.

Delivery Mode Insights

The on-premises segment dominated the market with a revenue share of 47.04% in 2024. Most institutions are currently installing software and tools to store data at their premises due to the ease of access and security, resulting in a large market share of this type of delivery. Current systems in small organizations are practical, but when scaled up, it can take time and effort to manage data if an organization is dealing with a large dataset. This can mean a large capital investment in data storage and security.

The cloud-based segment is projected to grow at the fastest CAGR of 24.4% over the forecast period, owing to ease of storage, less capital investment, and increased flexibility and efficiency; these factors also add up to continuous growth in this delivery mode. Cloud-based storage can also be on-premises, but issue of scalability comes into picture, even though public cloud storage solutions are a key factor for the growth of cloud-based storage solutions becoming the fastest growing sub-segment, limitations of same include less privacy, and more security concerns regarding loss of data.

Application Insights

Financial applications held the largest market share in 2024. Healthcare institutions and organizations are continually striving to minimize cost of treatment yet deliver better care to patients, attributed to the growth of this segment. The financial segment is anticipated to grow at the fastest rate over the forecast period. Thus, companies perform better by reducing costs and preventing fraud.

Healthcare institutions incur costs in the form of insurance claims, which can also be fraudulent. To mitigate such risks and minimize such occurrences, healthcare organizations deploy analytical tools for predictive and descriptive analysis to deliver better care to patients, reduce overall costs of operations, and minimize fraud in insurance claims. The need to perform financially well has been a key driver for adopting this application type.

End Use Insights

Life science companies dominated the market with a revenue share of 42.37% in 2024. Currently, the largest users of analytical tools and platforms are life-science companies for reducing their product costs, increasing profit margins, producing better products, and driving faster adoption and growth in the segment. Companies constantly invest in improving their product portfolios and offerings to cater to a wider population. This gives rise to a need for analytical tools to better understand and predict the market and drive value-based decisions.

Healthcare providers are anticipated to register the fastest growth rate through the forecast period. The burden of delivering cost-effective care and better patient management has been tremendous on hospitals and healthcare professionals, which has resulted in the growth of this segment. The need to manage patient records, disease surveillance, and deliver cost-effective care to patients have been key factors for the wider adoption of healthcare analytics and are foreseen to propel segment growth.

Regional Insights

North America healthcare analytics industry dominated the global market in 2024 with a revenue share of 48.0%. The region has state-of-the-art healthcare facilities, and the adoption of these platforms and better technological availability have all resulted in a large market share for North America. The rising burden of chronic ailments and an increasing geriatric population have also created a need for hospitals and other organizations to adopt analytics tools. In addition, the presence of key players has also been a factor in the large market revenue share. In March 2022, Microsoft launched Microsoft Cloud for Healthcare, a collaboration between patients and providers to help deliver better insights related to patient care.

U.S. Healthcare Analytics Market Trends

The healthcare analytics industry in the U.S. is expanding rapidly, driven by government incentives that promote widespread digitization and interoperability. According to The Assistant Secretary for Technology Policy/Office, as of 2021, nearly all non-federal acute care hospitals (96%) and about 78% of office-based physicians had implemented certified electronic health records (EHRs) a significant increase from 2011, when adoption was just 28% for hospitals and 34% for physicians. This swift transition has established a solid digital foundation for analytics, further strengthened by policies focused on improving data exchange across healthcare environments.

Europe Healthcare Analytics Market Trends

The healthcare analytics industry in Europe is driven by increased EHR adoption, rising demand for value-based care, and strong regulatory frameworks that focus on data privacy and interoperability. EU initiatives such as the Data Governance Act, Data Act, and the European Health Data Space (EHDS) are key to this expansion, aiming to unify and simplify health data access across the continent to support research, innovation, and data-driven healthcare. Although challenges related to privacy, technical integration, and intellectual property persist, effective implementation is expected to improve collaboration among patients, providers, governments, and industry, boosting the region’s healthcare analytics capabilities.

The UK healthcare analytics industry is expanding rapidly, driven by NHS digital transformation, strong government support, and increasing adoption of AI and predictive analytics. Alongside public initiatives, industry-academia collaborations are advancing innovation; for instance, in June 2024, SAS and the Maxwell Centre at the University of Cambridge announced a partnership to integrate the SAS Viya AI and analytics platform into the university environment, encouraging collaboration with researchers and startups.

The healthcare analytics industry in Germany is growing steadily, supported by strong government initiatives to digitize healthcare, rising adoption of electronic health records under the Digital Healthcare Act (DVG), and increasing demand for AI-driven solutions to improve efficiency and patient outcomes.

Asia Pacific Healthcare Analytics Market Trends

Asia Pacific healthcare analytics industry is anticipated to register the fastest growth rate of 16.55% over the forecast period. Fast development, more spending capacity, and a growing population have all resulted in the fast growth registered by APAC. There have been significant growth and advancements in industry in this region, which has also contributed to its growth. The reliance of consumers and healthcare providers on IT has been increasing; thus, the adoption rates of the analytics sector have also gone up. Australia-based start-up for healthcare analytics Prospection has opened an office in Japan and will collaborate with international pharma customers to develop new treatments for the Japanese population.

The healthcare analytics industry in Japan is experiencing steady growth, fueled by government-led digital health initiatives, increasing adoption of electronic medical records, and a rising demand for AI-driven solutions to enhance care quality and efficiency. In March 2023, Fujitsu introduced a new cloud-based platform in Japan designed to securely collect, combine, and analyze health-related data from electronic medical records and personal health devices. Supporting the HL7 FHIR standard, the platform enables personalized healthcare, drug development, and the creation of a digital health ecosystem powered by AI and IoT, demonstrating Japan’s dedication to advancing healthcare analytics and precision medicine.

The healthcare analytics industry in China is expanding rapidly, supported by large-scale government investments in healthcare digitization, growing adoption of electronic health records, and strong policy focus on AI integration under initiatives like “Healthy China 2030.” Rising demand for predictive analytics, population health management, and precision medicine is driving adoption among hospitals and research institutions.

Latin America Healthcare Analytics Market Trends

The healthcare analytics industry in Latin America is growing steadily, driven by increasing healthcare digitization, rising adoption of electronic health records, and government initiatives to improve care delivery and cost efficiency. Countries such as Brazil and Argentina are leading the adoption of AI-powered analytics platforms to strengthen population health management, optimize hospital operations, and support value-based care.

Middle East & Africa Healthcare Analytics Market Trends

The healthcare analytics industry in the Middle East & Africa is growing, fueled by government-led digital health efforts, increasing use of AI and predictive analytics, and initiatives to update healthcare infrastructure. While GCC countries like the UAE and Saudi Arabia are at the forefront of adoption, African markets are slowly progressing through population health and telehealth projects, supported by public private partnerships despite challenges related to infrastructure and costs.

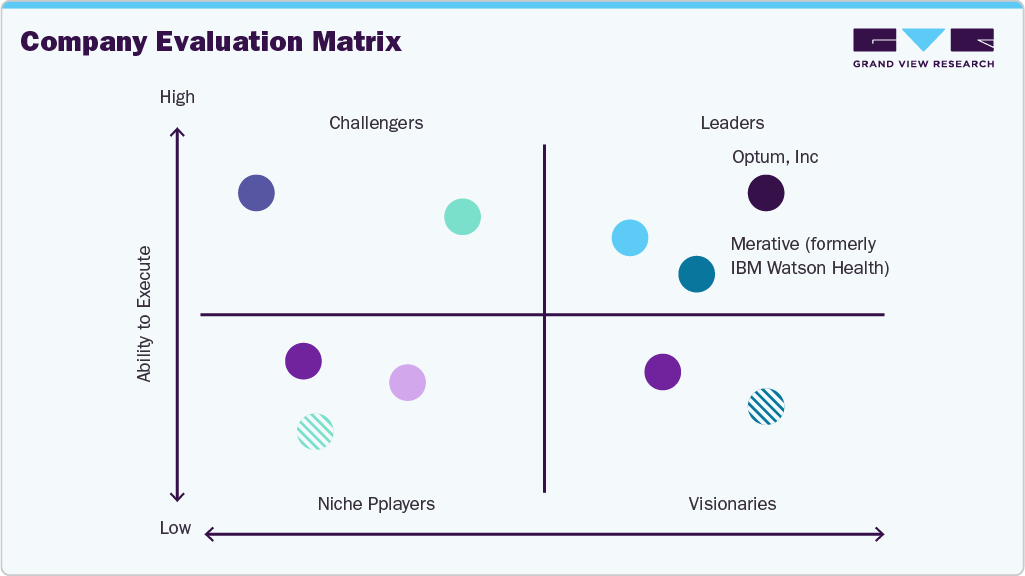

Key Healthcare Analytics Company Insights

Key industry players are adopting different strategies, constantly innovating and bringing up new technologies to understand better data derived from patient information, understand the spread and containment of disease, to deliver better care solutions to healthcare providers and institutions. Using big data analytics and AI has also given rise to new platforms to better understand and analyze data.

Key Healthcare Analytics Companies:

The following are the leading companies in the healthcare analytics market. These companies collectively hold the largest market share and dictate industry trends.

- McKesson Corporation

- Optum, Inc.

- Merative (formerly IBM Watson Health)

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- Elsevier

- Medeanalytics, Inc.

- Veradigm

- Cognizant Technology Solutions

- Infor, Inc.

- Wipro Limited

- Infosys Limited

- Health Catalyst, Inc.

- Athenahealth, Inc.

- Cloudera, Inc.

- Komodo Health

Recent Developments

-

In June 2025, Kythera Labs announced strategic partnerships with healthcare analytics firms Preverity and GAM to provide advanced data integration, de-identification, and data mastering services through its Wayfinder Platform. This collaboration enables secure, compliant, and comprehensive healthcare analytics that improve patient safety, risk management, and operational efficiency.

“These partnerships demonstrate the critical need for robust data infrastructure in healthcare analytics. We're providing the essential data backbone that enables Preverity and GAM to focus on what they do best delivering specialized analytics insights while we handle the complex challenges of data integration, privacy protection, and data quality management."

-Jeff McDonald, CEO and Co-Founder of Kythera Labs.

-

In December 2024, Tuva Health launched the world's first open-source healthcare data transformation platform with USD 5 million in seed funding. The platform enables payers, providers, and pharmaceutical companies to transform claims and EHR data into analytics-ready tables, promoting transparency, scalability, and collaborative innovation to improve patient care and operational efficiency.

“Healthcare organizations have lacked a flexible, scalable, and transparent analytics solution to enhance patient outcomes and improve operational efficiency, Tuva Health’s model addresses this need, providing a comprehensive solution that meets the growing demand for innovation in healthcare.”

- Sean Doolan, Founder and Managing Partner of Virtue.

-

In May, 2024, Aetion launched Aetion Discover, a new application that provides fast, reliable, and scalable descriptive analytics for healthcare data, enabling users to generate swift hypotheses and insights across biopharmaceutical and medtech lifecycles. It offers speed, auditability, compatibility, and an intuitive interface to support data-driven decision-making.

“Time and time again, we heard our customers' interest in expanding our technology toward 'everyday insights,' and, importantly, for this [visual] exploration work to readily extend into advanced evidence generation when needed. We're glad to bring our software to a wider set of use cases, to create essential insights and efficiencies across user groups. Like all Aetion offerings, Discover is based in the latest and best science and works across a wide range of real-world data.”

- Dr. Jeremy Rassen, Aetion president, co-founder, and chief technology officer.

-

In August 2022, Syntellis Performance Solutions acquired Stratasan, an advanced healthcare market intelligence and data analytics company. This acquisition helps Syntellis Performance Solutions expand its solution or software portfolio for healthcare organizations with data and intelligence solutions to improve financial, strategic, and operational growth planning.

By adding Stratasan’s powerful strategic growth capabilities to our suite of intelligent planning and performance products, Syntellis will empower more healthcare organizations with best-in-class data and intelligence solutions to improve operational, financial and strategic growth planning so they can ensure future success and stability.

-Flint Brenton, CEO of Syntellis

Healthcare Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 65.64 billion

Revenue forecast in 2033

USD 198.79 billion

Growth rate

CAGR of 14.85% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Market Value in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, delivery mode, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

McKesson Corporation; Optum, Inc.; Merative (formerly IBM Watson Health); Oracle; SAS Institute, Inc.; IQVIA; Cognizant Technology Solutions; Infor Inc.; Wipro Limited; Infosys Limited; Health Catalyst, Inc.; Komodo Health; Cloudera, Inc.; Elsevier; MedeAnalytics, Inc.; Veradigm; Athenahealth, Inc.; Verisk Analytics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

- Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare analyticsmarket report based on type, component, delivery mode, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Descriptive Analysis

-

Diagnostic Analytics

-

Predictive Analysis

-

Prescriptive Analysis

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Web-hosted

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Financial

-

Operational and Administrative

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Payers

-

Healthcare Providers

-

Life Science Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare analytics market size was estimated at USD 52.98 billion in 2024 and is expected to reach USD 65.64 billion in 2025.

b. The global healthcare analytics market is expected to grow at a compound annual growth rate of 14.85% from 2025 to 2033 to reach USD 198.79 billion by 2033.

b. Descriptive analytics dominated the healthcare analytics market, with a share of 45.9% in 2024. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment

b. Some key players operating in the healthcare analytics market include McKesson Corporation, Optum, Inc., Merative (formerly IBM Watson Health) , Oracle, SAS Institute, Inc., IQVIA, Cognizant Technology Solutions, Infor, Inc., Wipro Limited, Infosys Limited, Health Catalyst, Inc., Komodo Health, Cloudera, Inc., Elsevier, MedeAnalytics, Inc., Veradigm, Athenahealth, Inc., and Verisk Analytics, Inc.

b. Key factors that are driving the healthcare analytics market growth include the Pressure to Curb Healthcare Cost, Emergence of Advanced Analytics Method, Growing Demand for Personalized Medication and Treatment, Rising Impact of Internet and Social Media On Healthcare

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.