- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Gummy Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Gummy Market Size, Share & Trends Report]()

Gummy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Minerals, Dietary Fibers), By Ingredient (Gelatin, Plant-Based Gelatin Substitutes), By End-use (Adults, Kids), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-513-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gummy Market Summary

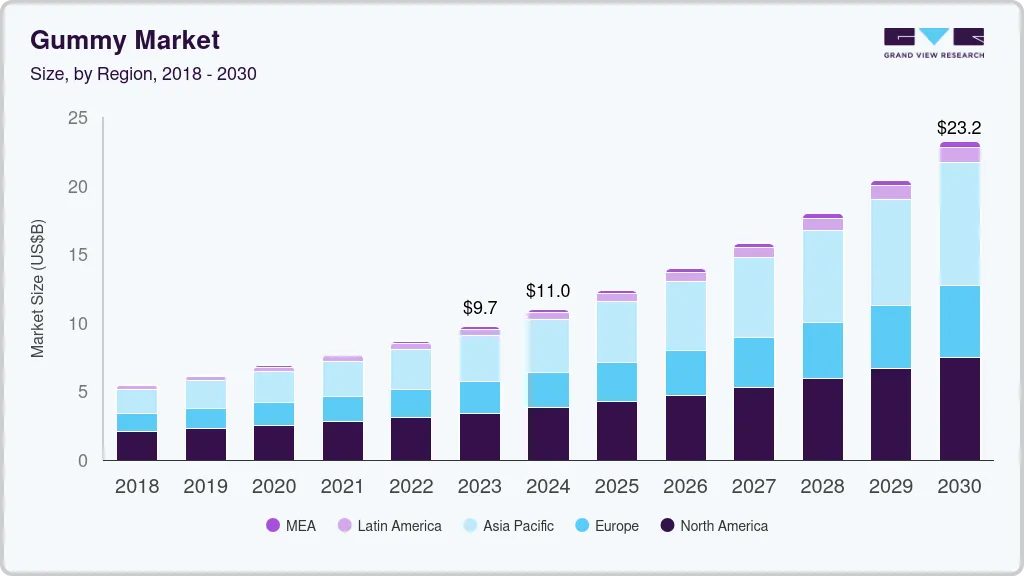

The global gummy market size was estimated at USD 9.72 billion in 2023 and is projected to reach USD 23.22 billion by 2030, growing at a CAGR of 13.2% from 2024 to 2030. The growth factors such as increasing demand for functional and fortified gummies, the availability of gummy supplements in different flavors for customers in search of taste with health benefits, and growing demand for natural products, as well as a growing interest in vegan gummies, are being projected to augment demand over the forecast period.

Key Market Trends & Insights

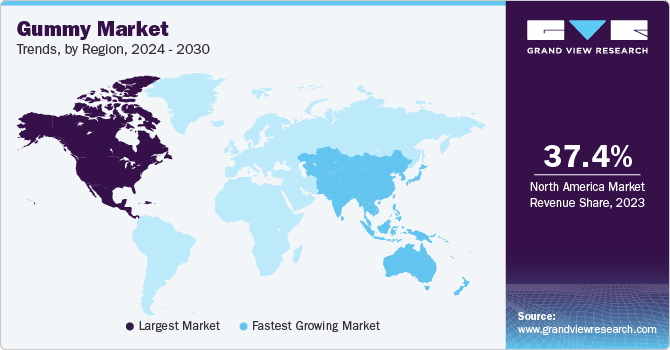

- The North America gummy market accounted for a share of 37.42% of the global revenues in 2023.

- The U.S. gummy market is growing due to rising demand for convenient, tasty supplement and medication formats.

- By product, vitamin gummies segment dominated the market with a share of 23.9% in 2023.

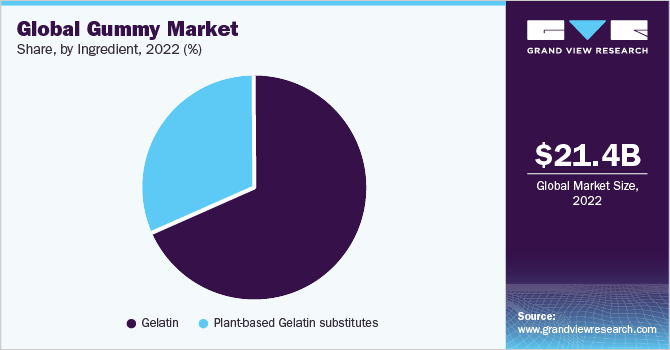

- By ingredient, gelatin segment dominated the market with a revenue share of 67.8% in 2023.

- By End-use, adults segment dominated the market with a revenue share of 66.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.72 Billion

- 2030 Projected Market Size: USD 23.22 Billion

- CAGR (2024-2030): 13.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, gummies are a convenient and easy-to-use format for delivering a wide range of active ingredients, including vitamins, minerals, and supplements, thus growing popularity of gummies as a delivery format is considered one of the major factors driving the growth of the global gummy industry. Consumer preferences are evolving when it comes to food and supplements. There has been a significant increase in consumer demand for nutraceutical products in recent years due to growing health awareness and concerns about the negative effects of processed foods and artificial ingredients.

Consumers are looking for products that not only taste good but also offer additional health benefits. This trend is especially noticeable in the gummy industry, where consumers are seeking out functional and fortified gummies that contain vitamins, minerals, and other nutrients. The increasing demand for these types of gummies can be attributed to the growing awareness of the importance of maintaining good health through proper nutrition. People are becoming more informed about the nutrients their bodies need and are looking for convenient and enjoyable ways to supplement their diets.

Gummies are a perfect delivery format for various nutrients since they are easy to consume and can be formulated with a wide range of active ingredients. For instance, some gummies contain vitamins and minerals that support immune health, while others may be formulated with omega-3 fatty acids that are essential for heart health. Additionally, some gummies contain probiotics and prebiotics, which help promote a healthy gut.

Manufacturers are developing new delivery technologies that allow for the targeted release of active ingredients in gummies. For instance, some gummies are designed to release their active ingredients slowly over time, providing sustained benefits. Furthermore, manufacturers are constantly introducing new and innovative gummy formulations, such as those designed for specific health concerns or targeted to different age groups, which are driving the growth of the gummies market in adults. For instance, in February 2022, Optibac Probiotics launched a new vegan gummy supplement aimed at supporting gut and immune health in adults. The product contains a probiotic strain called Bacillus coagulans Unique IS-2.

Furthermore, gummy bears are popular in the gummy market because of their unique texture, fruity flavors, and cute bear-shaped appearance. The chewy and gummy texture of gummy bears makes them enjoyable to eat, and they come in a variety of flavors, appealing to a wide range of tastes. Additionally, the fun and colorful nature of gummy bears makes them attractive to both children and adults. Their convenient size and portability also contribute to their popularity as a snack or treat. Overall, gummy bears have become a beloved classic in the gummy market due to their playful appeal and delicious taste.

Market Concentration & Characteristics

The gummy market is experiencing robust growth driven by several key factors that appeal to a diverse consumer base. One of the primary drivers is the evolving consumer preference for convenient and enjoyable ways to consume nutritional supplements and vitamins. Gummies offer a tasty and easy alternative to traditional pills or capsules, making them particularly attractive to individuals who may find it challenging to swallow pills.

The gummy market has benefited from the increasing health and wellness trend, as consumers seek products that not only taste good but also offer functional benefits. Many gummies are fortified with vitamins, minerals, and other health-promoting ingredients, aligning with the growing awareness and demand for products that contribute to overall well-being. This convergence of flavor and functionality has propelled gummies into a popular choice among consumers looking to support their health in a delicious manner.

Product Insights

Vitamin gummies dominated the market with a share of 23.9% in 2023, owing to the increasing prevalence of vitamin deficiencies. Many people are deficient in vitamins, particularly Vitamin D and B12, due to factors such as diet and lifestyle. Vitamin gummies offer a convenient way to supplement these nutrients. Furthermore, Vitamin gummies are gaining traction among working professionals as they promote metabolic health and regulate glycemic index & folic acid count in the human body. Additionally, effective marketing campaigns, including endorsements by health professionals and social media influencers, have helped to increase awareness and demand for vitamin gummies. In April 2022, Nature's Truth, a manufacturer of wellness products, including vitamins and supplements, launched various vitamin gummies for adults owing to the increasing popularity of vitamin gummies.

The demand for psilocybin/psychedelic mushroom gummies is expected to grow at a CAGR of 18.6% from 2024 to 2030, owing to the increasing interest in alternative therapies, changing attitudes towards psychedelics, better dosage control, and taste. Manufacturers are launching new products due to the growing popularity of psilocybin/psychedelic mushrooms. For instance, in January 2023, Galaxy Treats, a Nevada-based company that produces cannabinoids and active ingredients, launched its new product called Moon Shrooms Amanita Mushroom Gummies. The gummies are infused with Amanita mushrooms, which are known for their psychoactive properties, and are a part of the company's expanding portfolio of innovative products.

Ingredient Insights

Gelatin dominated the market with a revenue share of 67.8% in 2023, owing to its texture, versatility, cost-effectiveness, availability, stability, and compatibility with other ingredients. Gelatin is compatible with a wide range of other ingredients, including vitamins, minerals, and flavors, which makes it a popular choice for manufacturers who want to create functional gummies with added health benefits.

Furthermore, gummies made from gelatin have a chewy and soft texture that is appealing to many people. The texture of gelatin gummies is like traditional gummy candy, making them enjoyable to eat. Moreover, they have good stability and can withstand changes in temperature and humidity, which makes them suitable for storage and transportation.

The plant-based gelatin substitutes are expected to grow at a CAGR of 11.8% from 2024 to 2030, owing to health and sustainability concerns and changing dietary preferences. Consumers are increasingly concerned about their health and the environment and are looking for products that align with their values. Plant-based gummies are considered a healthier and more sustainable alternative to gelatin gummies, which are derived from animal products. Furthermore, many consumers follow vegan or vegetarian diets and are looking for gummies that align with their dietary preferences. Plant-based gummies are a suitable option for these consumers, as they are free from animal-derived ingredients.

End-Use Insights

Adults dominated the market with a revenue share of 66.3% in 2023. Adult consumers are further segmented into men, women, pregnant women, and geriatric. The various health benefits of gummy supplements, such as boosting immunity, supporting healthy aging, improving bone health, and reducing inflammation are fueling the demand for gummies among adults.

Furthermore, extensive brand campaigning by supplement manufacturers on e-commerce portals and television media has also contributed to the growing demand for adult gummies. For instance, in June 2022, vitafusion, the leading adult gummy vitamin brand in North America, partnered with brand ambassador Tiffany Haddish to launch two new gummy vitamin products: Multi + Beauty and Multi + Immune Support. These gummy vitamins offer 2-in-1 benefits, combining immune system support, beauty support, and a daily multivitamin in two delicious flavors.

The gummies market for kids is anticipated to grow at a CAGR of around 11% from 2024 to 2030. The visual appeal, fun shapes and flavors, texture, and marketing of gummies are all driving factors in their popularity among kids aged 2 to 14. Gummies are popular among kids as these gummies are often colorful and visually appealing, which can attract kids' attention. Additionally, gummies often come in fun shapes and flavors, which can make them more appealing to kids than other types of candy or sweets.

Manufacturers are launching innovative products for kids due to the growing demand for gummy supplements for kids. In March 2023, Avrio Health L.P., which is a subsidiary of Purdue Pharma L.P., introduced a new dietary supplement called Senokot Kids Laxative Gummies. This supplement is specifically designed to provide gentle and safe overnight relief of occasional constipation for children who are two years old and above.

Distribution Channel Insights

The offline channel dominated the market with a share of 81.2% in 2023. Offline distribution channels, such as supermarkets, convenience stores, and traditional retail stores, have a wider reach compared to online channels. The visibility and accessibility of gummies in offline stores play a crucial role in building brand awareness and attracting new customers.

The online channel is expected to grow at a CAGR of 12.5% from 2024 to 2030. Various promotional strategies, easy payment options, and discounts and offers also contribute to the surge in online sales of gummies. The convenience of online shopping and the ability to have products delivered to their doorstep has made it an attractive option for many customers.

Regional Insights

The North America gummy market accounted for a share of 37.42% of the global revenues in 2023. The region has been witness to an increasing demand for functional and fortified gummies, and innovation in gummy products. In the U.S., by form, gummy supplements market is the second-most popular after traditional capsules and tablets, thus indicating a significant growth in the U.S. gummy industry.

U.S. Gummy Market Trends

The gummy market in the U.S. is being driven by several factors. One of the key drivers is the growing preference for convenient and tasty delivery formats for supplements and medications. Gummy vitamins, for example, are popular among both children and adults due to their appealing taste and chewable form. Additionally, the increasing focus on health and wellness has led to a rise in demand for gummy products that offer functional benefits, such as immune support, beauty, and sleep aid. The availability of a wide range of gummy products catering to different dietary preferences, including organic, vegan, and sugar-free options, has also contributed to the market's growth. Furthermore, the influence of social media and celebrity endorsements has played a role in popularizing gummy products as a trendy and enjoyable way to consume vitamins and supplements.

Europe Gummy Market Trends

The Europe gummy market is expected to grow at a CAGR of 11.5% from 2024 to 2030. Gummies manufacturers in the region are responding to consumer demand by introducing a variety of flavors and fusion gummies that are appealing to the younger population, including children. This is expected to drive demand and contribute to the growth of the gummy industry in Europe. Germany dominated the European market with a share of around 15% in 2023.

Asia Pacific Gummy Market Trends

The Asia Pacific gummy market is expected to grow at a CAGR of 12.9% from 2024 to 2030. Increasing consumer spending on health and wellness products owing to changing lifestyles and rising disposable income is likely to be a key factor driving industry growth in economies such as China, India, and Japan. Furthermore, gummies manufacturers in the region are responding to consumer demand by introducing a variety of flavors and fusion gummies that are appealing to the younger population, including children. This is expected to drive demand and contribute to the growth of the gummies market in the region.

Moreover, Asia Pacific is also expected to grow at a significant growth rate. The increasing health awareness and focus on preventive healthcare have led to a rise in the consumption of gummy vitamins and supplements. The availability of a wide variety of flavors and formulations in the gummy market has also contributed to its popularity. Furthermore, the influence of social media and celebrity endorsements has played a role in promoting gummy products as a trendy and desirable health and wellness option.

Furthermore, the gummy market in India is being driven by growing demand for convenient and tasty nutritional supplements. Gummies are seen as a fun and enjoyable way to consume vitamins, minerals, and other supplements, especially among children and young adults.

Key Companies & Market Share Insights

The global gummy market is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market.

Key Gummy Companies:

The following are the leading companies in the gummy market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these gummy companies are analyzed to map the supply network.

- Procaps Group

- Santa Cruz Nutritionals

- Amapharm

- Herbaland Canada

- Allseps Pty. Ltd.

- Vitux AS

- Boscogen, Inc.

- Bettera Brands, LLC

- NutraStar Manufacturing Ltd.

- Better Nutritionals

- Prime Health Ltd.

- AJES Pharmaceuticals LLC

- Lactonova

- SMPNutra.com

- Lexicare Pharma Pvt. Ltd.

- Superior Supplement Manufacturing

- Well Aliments

- Supplement Factory Ltd.

- Vitakem Nutraceutical, Inc.

Recent Developments

-

In March 2023, Goli Nutrition Inc. launched a 3-in-1 probiotic gummy combining prebiotics, probiotics, and postbiotics. These gummies maintain a healthy gut microbiome and support immune health.

Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.95 billion

Revenue forecast in 2030

USD 23.22 billion

Growth Rate (Revenue)

CAGR of 13.2% from 2024 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; Colombia; UAE; South Africa

Key companies profiled

Procaps Group; Santa Cruz Nutritionals; Amapharm; Herbaland Canada; Allseps Pty. Ltd.; Vitux AS; Boscogen, Inc.; Bettera Brands, LLC; NutraStar Manufacturing Ltd.; Better Nutritionals; Prime Health Ltd.; AJES Pharmaceuticals LLC; Lactonova; SMPNutra.com; Lexicare Pharma Pvt. Ltd.; Superior Supplement Manufacturing; Well Aliments; Supplement Factory Ltd.; Vitakem Nutraceutical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gummy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global gummy market report on the basis of product, ingredient, end-use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psilocybin/Psychedelic Mushroom

-

Melatonin

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin substitutes

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global gummy market size was estimated at USD 21.40 billion in 2022 and is expected to reach USD 23.93 billion in 2023.

b. The gummy market is expected to grow at a compound annual growth rate of 11.8% from 2022 to 2030 to reach USD 52.24 billion by 2030.

b. Vitamin gummies accounted for a market share of 24.0% in 2022. The growing use of vitamin gummies as a preventive health measure against lifestyle diseases is expected to drive the growth of this category over the forecast period.

b. Some of the key players in the gummy market are Procaps Group, Santa Cruz Nutritionals, Amapharm, HERBALAND CANADA, Allseps Pty Ltd., Vitux AS, BOSCOGEN, INC., Bettera Brands, LLC, NutraStar Manufacturing Ltd., Better Nutritionals, Prime Health Ltd., AJES Pharmaceuticals LLC, Lactonova, SMPNutra.com, LEXICARE PHARMA PVT. LTD., Superior Supplement Manufacturing, Mr. Gummy Vitamins, Well Aliments, Supplement Factory Ltd., Superior Gummy Manufacturer, Vitakem Nutraceutical, Inc.

b. The key factors that are driving the gummy market include the availability of gummy supplements in different flavors for customers in search for taste with health benefits, ease of use and variety of unique flavors, appetizing formulations offered by manufacturers to attract kids, and increasing innovation to offer natural, organic, and clean gummies by key players.

b. The India gummy market was valued at USD 1.05 billion in 2022 and is projected to reach USD 1.21 billion in 2023.

b. The Europe gummy market was valued at USD 4.92 billion in 2022 and is expected to reach USD 5.48 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.