- Home

- »

- Consumer F&B

- »

-

Gum Arabic Market Size, Share And Trends Report, 2030GVR Report cover

![Gum Arabic Market Size, Share & Trends Report]()

Gum Arabic Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Beverages, Dairy Products, Confectionery, Pharmaceuticals), By Source (Acacia Senegal, Acacia Seyal), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-428-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gum Arabic Market Summary

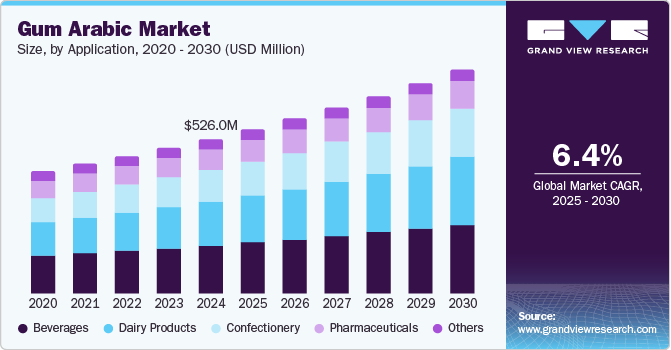

The global gum arabic market size was valued at USD 526.0 million in 2024 and is projected to reach USD 762.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. Owing to the increasing demand for natural and clean-label ingredients in the food and beverage industry. Consumers have become increasingly health-conscious and have sought products with natural ingredients, free from synthetic additives.

Key Market Trends & Insights

- The North America gum arabic market dominated the global revenue with a share of 36.2% in 2024.

- The U.S. gum arabic market is expected to be driven by the increasing focus on sustainability and ethical sourcing practices during the forecast period.

- By application, The beverages segment dominated the market with a revenue share of 31.5% in 2024

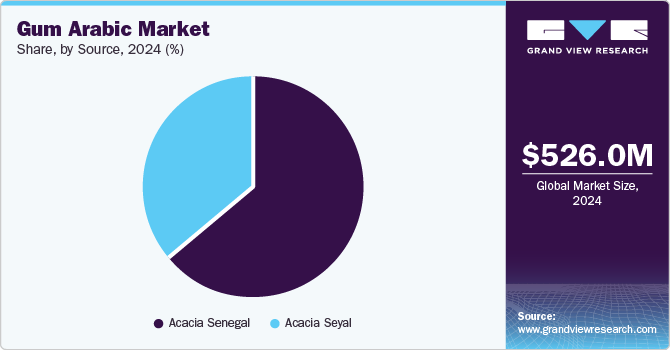

- By source, Acacia senegal segment led the market with the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 526.0 Million

- 2030 Projected Market Size: USD 762.2 Million

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Gum arabic, a natural emulsifier and stabilizer, fits perfectly into this trend, enhancing various food products' texture and shelf life. In addition, sustainability and ethical sourcing practices have rapidly driven the market. The market witnessed a growing emphasis on sustainable harvesting and ethical sourcing of gum arabic, particularly from regions including Africa where it is predominantly sourced.

Producers have adopted sustainable practices to ensure the long-term availability of gum arabic, which supports environmental conservation and resonates with consumers who prefer ethically sourced products. Moreover, the rise of e-commerce platforms has further boosted the market accessibility of gum arabic. Online retail has made it easier for consumers to discover and purchase products containing these food ingredients, thereby expanding the market reach. This trend particularly benefits small and medium-sized enterprises that can now access a broader customer base without extensive physical retail networks.

Additionally, technological advancements in extraction and processing techniques have improved the efficiency and quality of gum arabic production. This makes it more cost-effective and consistent in quality, enabling manufacturers to meet the growing demand while maintaining high-quality standards.

Despite the positive growth trends, the gum arabic market has faced significant challenges such as supply chain disruptions and quality consistency issues. Variations in climate, soil conditions, and harvesting techniques can lead to fluctuations in the quality of gum arabic, affecting its reliability in certain applications. However, ongoing efforts to improve sustainable harvesting practices and technological advancements in processing are expected to mitigate these challenges.

Application Insights

The beverages segment dominated the market with a revenue share of 31.5% in 2024 due to the increasing consumer demand for natural ingredients. The market witnessed consumers becoming more health-conscious and preferring beverages free from synthetic additives and preservatives. In a recent report, 42% of the survey respondents preferred products that are free of additives and preservatives to be healthy. Gum Arabic is a natural emulsifier and stabilizer that enhances various beverages' texture and stability, including fruit juices, flavored waters, and soft drinks.

The dairy products segment is expected to emerge as the fastest-growing segment over the forecast period, owing to the growing demand for functional dairy products. These products, which include probiotic yogurts and fortified milk, often require ingredients that can improve their consistency and shelf life. Gum arabic is highly valued in this context for its ability to stabilize flavors and prevent the separation of ingredients, ensuring a uniform and appealing product. In addition, the rise of plant-based and lactose-free dairy alternatives has contributed to the demand for gum arabic. The market experienced a growing need for natural ingredients that can provide the desired texture and mouthfeel in these products.

Source Insights

Acacia senegal segment led the market with the dominant market share in 2024. The market growth can be credited to the increasing demand for natural and clean-label ingredients in various industries, including food and beverages, pharmaceuticals, and cosmetics. Acacia senegal, known for producing high-quality gum arabic, is highly valued for its natural emulsifying, stabilizing, and thickening properties. Additionally, the versatility of gum arabic sourced from Acacia senegal in various applications has been another market driver. For instance, in the food and beverage industry, it is used to enhance the texture, stability, and shelf life of products such as beverages, confectioneries, and baked goods.

The acacia seyal segment is expected to grow at the fastest CAGR over the forecast period owing to its rising adoption in the pharmaceutical and cosmetics industries. These sectors heavily rely on acacia seyal sourced gum arabic for binding, coating, and suspending properties in medications, lotions, and creams. Furthermore, advances in product development have led to the creation of more refined or specialized forms of gum arabic, such as pre-hydrated or instant powder versions, which offer convenience for manufacturers.

Regional Insights

The North America gum arabic market dominated the global revenue with a share of 36.2% in 2024. The market growth can be attributed to the growing nutraceutical sector, which increased demand for functional foods and dietary supplements that promote digestive health and overall wellness. Gum arabic is commonly used in these products due to its high fiber content and prebiotic properties, which support gut health.

U.S. Gum Arabic Market Trends

The U.S. gum arabic market is expected to be driven by the increasing focus on sustainability and ethical sourcing practices during the forecast period. U.S. consumers have increasingly become more aware of the environmental and social impacts of their purchases and prefer sustainably sourced products. Gum arabic, often harvested from acacia trees in Africa, resonates with these values when sourced responsibly.

Europe Gum Arabic Market Trends

The Europe gum arabic market captured a significant share in 2024 due to modern consumers' growing environmental awareness. As the negative impacts of synthetic additives and chemical ingredients become more apparent, the market witnessed a strong shift towards sustainable alternatives. The natural origin and biodegradability of gum arabic make it an attractive option for industries aiming to meet evolving consumer expectations. This trend aligns with the broader movement towards eco-friendly practices throughout the supply chain, including sourcing raw materials and disposing of end products.

Asia Pacific Gum Arabic Market Trends

The Asia Pacific (APAC) gum arabic market is expected to grow at the fastest CAGR during the forecast period. The increasing penetration of e-commerce platforms has driven the market. Online retail has made it easier for consumers to discover and purchase products containing gum arabic, thereby expanding the market's reach. This trend particularly benefits small and medium-sized enterprises accessing a broader customer base.

The China gum arabic market in 2024 was majorly driven by the increasing demand for natural and clean-label ingredients in the food and beverage industry. Consumers have progressively become more health-conscious and prefer products with natural additives, which boosts the use of gum arabic as a stabilizer and emulsifier. Furthermore, rising investment in nutritious food products has stimulated market demand, leading to higher consumption of premium food and beverage products that utilize gum arabic food ingredients.

Key Gum Arabic Company Insights

Key players in the global gum arabic market include Nexira, Kerry Group plc, Ingredion, and others. The market can be characterized by organic initiatives including online sales, acquisitions, and mergers, with significant investment in research and development activities. Manufacturers have increasingly focused on launching products, capacity expansion, and technological advancements to predict future trends.

-

Nexira is a global leader in natural ingredients and botanical extracts that specializes in producing high-quality acacia gum, plant extract powders, antioxidants, soluble dietary fibers, and texturizing ingredients.

-

Kerry Group plc is a major international food corporation. The company develops, manufactures, and delivers innovative ingredients and flavors for the food, beverage, and pharmaceutical industries. Kerry Group is dedicated to enhancing the nutritional profile and functionality of its products.

Key Gum Arabic Companies:

The following are the leading companies in the gum arabic market. These companies collectively hold the largest market share and dictate industry trends.

- Nexira

- Kerry Group plc

- Ingredion

- Agrigum International Limited

- Farbest Brands

- ADM

- Ashland

- Hawkins Watts Limited

- Gum Arabic Company

Recent Developments

-

In August 2024, Ampak Co. Inc. announced a strategic partnership with Agrigum International, a prominent UK-based gum arabic producer. This collaboration aims to enhance the product distribution network in the U.S. significantly.

-

In April 2024, Farbest Brands introduced Beyond Acacia, a product developed using Alland & Robert’s cutting-edge technology to enhance usability and environmental sustainability compared to traditional gum acacia. Beyond Acacia features high-density granules that are achieved through an innovative manufacturing process. These granules offer superior solubilization, super hydration, and high dispersibility, with reduced dust and foam during processing.

Gum Arabic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 558.3 million

Revenue forecast in 2030

USD 762.2 million

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, source, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, Netherlands, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Nexira; Kerry Group plc; Ingredion; Agrigum International Limited; Farbest Brands; ADM; Ashland; Hawkins Watts Limited; Gum Arabic Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gum Arabic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the gum arabic market report based on application, source, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Dairy products

-

Confectionery

-

Pharmaceuticals

-

Others

-

-

Sources Outlook (Revenue, USD Million, 2018 - 2030)

-

Acacia Senegal

-

Acacia Seyal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.