- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Glass Packaging Market Size, Share & Growth Report, 2030GVR Report cover

![Glass Packaging Market Size, Share & Trends Report]()

Glass Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Borosilicate, De-alkalized Soda Lime Glass), By Product (Bottles, Jars & Containers) By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-119-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Packaging Market Summary

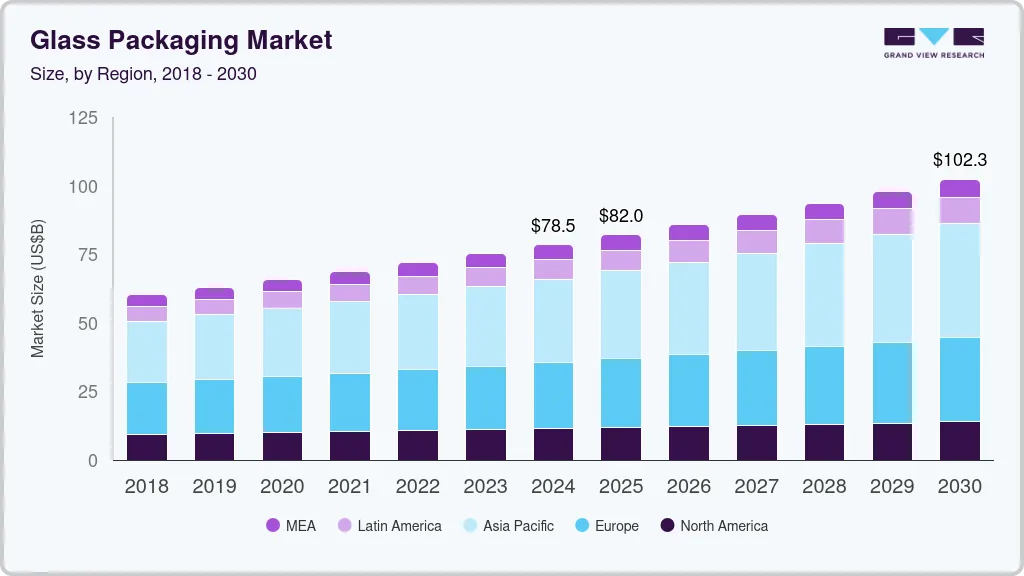

The global glass packaging market size was estimated at USD 78,483.4 million in 2024 and is projected to reach USD 102,311.2 million by 2030, growing at a CAGR of 4.5% from 2025 to 2030. Glass packaging has long been preferred for its exceptional qualities, such as purity, recyclability, and preservation of product integrity.

Key Market Trends & Insights

- The Asia Pacific glass packaging market dominated the global market and accounted for the largest revenue share of 36.0% in 2023.

- The glass packaging market in China led the Asia Pacific market and accounted for the largest revenue share of 41.6% in 2023, driven by rising disposable incomes, changing lifestyles, and increasing westernization.

- Based on material, Soda-lime glass dominated the market and accounted for the largest revenue share of 67.0% in 202,3 as it is economical, chemically stable, moderately durable, and malleable.

- In terms of product, Vials led the market and accounted for the largest market share of 31.5% in 2023.

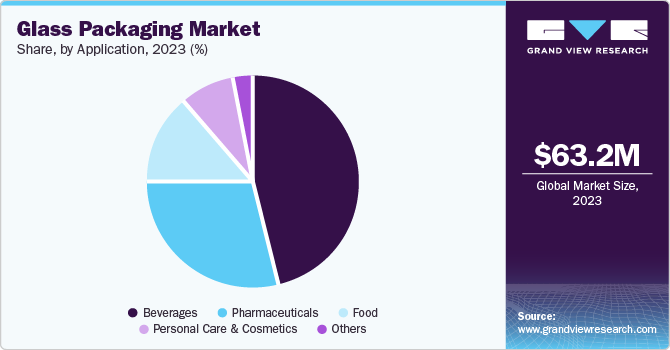

- On the basis of application, Beverages accounted for the largest market share, 46.1%, in 2023.

Market Size & Forecast

- 2024 Market Size: USD 78,483.4 million

- 2030 Projected Market Size: USD 102,311.2 million

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2023

However, several key players and trends have emerged to influence the glass packaging sector's dynamics. Prominent players in the industry have developed comprehensive manufacturing competencies and distribution networks, allowing them to serve diverse industries such as food and beverages, cosmetics, pharmaceuticals, and others.

Over the past few years, there has been a significant increase in demand for glass packaging in the pharmaceutical and cosmetics sectors. This increase in popularity can be attributed to a combination of factors, such as the unique properties of glass, evolving consumer preferences, and regulatory requirements. By using glass packaging, these industries have not only met strict standards for product preservation and safety but have also found opportunities for brand distinction and the promotion of sustainable practices, ultimately leading to the expansion of the market.

Their extensive resources and technological improvement provide them with a competitive advantage in product innovation, quality assurance, and cost-effectiveness. The rise in disposable income, urbanization, and the growing consumption of food and beverages primarily fuel the growth of the global glass packaging market. Furthermore, the increasing emphasis on personalization and customization will drive the demand for glass packaging.

In response to this sustainability wave, the demand for glass packaging as an eco-friendly option has witnessed growth. The use of recycled glass, combined with innovations in manufacturing techniques, has cemented the way for lightweight yet sturdy glass packaging solutions, minimizing the carbon footprint of production and transportation. This collaboration between utility, aesthetics, and environmental insight forms the bedrock of glass packaging's contemporary allure.

Gen Z and millennials have grown up in an age of heightened environmental consciousness, having seen firsthand the effects of plastic pollution, climate change, and depletion of natural resources. They thus become aware of the value of the environment and look for sustainable solutions. Glass is an eco-friendly and recyclable material that complements the principles of waste reduction and environmental conservation held by Gen Z and millennials.

Material Insights

Soda-lime glass dominated the market and accounted for the largest revenue share of 67.0% in 2023 as it is economical, chemically stable, moderately durable, and malleable. It possesses the unique ability to be reheated multiple times, allowing for the completion of an article as needed. These characteristics render it ideal for producing a diverse range of glass items, such as light bulbs, windowpanes, bottles, and artistic creations.

De-alkalized soda lime glass is expected to grow at a CAGR of 3.9% over the forecast years. It is frequently used for packing acidic and neutral parenteral arrangements and, where stability data demonstrate their suitability, for alkaline parenteral preparations. Type II has a lower melting point than other types. Therefore, it is prominently used in the pharma sector.

Product Insights

Vials led the market and accounted for the largest market share of 31.5% in 2023. This growth is attributed to glass vials and ampoules' enhanced transparency, which allows for easy viewing and monitoring of the contents. Vials and ampoules are predominantly utilized in the pharmaceutical sector. Nevertheless, these items are also used in the cosmetics and food industries. The rise in regulations within the food industry is a significant driver for expanding vials and ampoules in the food and beverage sector.

Ampoules are expected to grow at a CAGR of 6.3% over the projected years. The ampoule encompasses various types of injectable medicines or vaccines in the pharmaceutical industry. The large number of people suffering from diseases worldwide has resulted in a significant growth factor for the pharmaceutical glass ampoules market. The demand for glass ampoules has grown in recent years due to the rise in vaccination programs. The healthcare industry considers packaging vaccines in glass ampoules a significant concern.

Application Insights

Beverages accounted for the largest market share, 46.1%, in 2023. Glass packaging has a wide range of uses, contributing to the growth of the global glass packaging market. The beverage industry, in particular, has recognized the advantages of using glass packaging. Glass's resistance to air and other external elements helps maintain the quality of beverages, whether a bottle of fine wine or a fizzy soda. Glass's exceptional ability to preserve taste and quality has solidified its position as a preferred choice for alcoholic and non-alcoholic drinks.

The pharmaceuticals segment is projected to grow at a CAGR of 4.8% over the forecast years.The demand for bottles, ampules, and other glass packaging solutions is driven by the growing need for pharmaceutical drugs and medicines, backed by technological advancements in the pharmaceutical industry. Furthermore, the notable benefits of glass, including its chemical durability and ability to withstand various chemical compositions, are key drivers influencing packaging suppliers to prefer glass as a pharmaceutical material.

Regional Insights

The North America glass packaging market is anticipated to grow at 4.1% over the forecast period attributed to advance primary, secondary, and tertiary-care healthcare facilities. Furthermore, the well-developed reimbursement system, government funding, and rising health consciousness have contributed to integrating sensors into medical devices.

U.S. Glass Packaging Market Trends

The glass packaging market in the U.S. is expected to witness significant growth over the projected years. A considerable aspect driving the market is lifting demand for sustainable and eco-friendly packaging solutions in response to heightened environmental awareness among consumers. The rising demand for glass packaging in the pharmaceutical sector, driven by glass's inert and non-reactive properties, contributes to market growth. The aging population in the U.S. and the simultaneous increase in the pharmaceutical industry are expected to fuel the demand for glass packaging.

Canada glass packaging market is expected to grow significantly owing to the rise in beer consumption. Beer is a significant use of glass bottles to preserve its contents from UV light exposure. Furthermore, the increasing popularity of cosmetics and fragrance products, particularly luxury and premium items, has fueled the demand for glass bottles and containers. Canada's status as a significant exporter of glass and glassware also provides a competitive edge for the industry's growth opportunities.

Asia Pacific Glass Packaging Market Trends

The Asia Pacific glass packaging market dominated the global market and accounted for the largest revenue share of 36.0% in 2023. This growth is attributed to the rising demand for sustainable and eco-friendly packaging solutions, as glass is a 100% recyclable material that reduces environmental impact. In addition, the growth of the region's food, beverage, and pharmaceutical industries is also fueling demand for high-quality, safe, and durable glass packaging. Furthermore, innovative packaging designs and technologies that enhance the aesthetic appeal of glass products further stimulate market expansion.

The glass packaging market in China led the Asia Pacific market and accounted for the largest revenue share of 41.6% in 2023 driven by rising disposable incomes, changing lifestyles, and increasing westernization, which has fueled demand for glass packaging, particularly in the alcoholic beverage and food & beverage industries. Furthermore, the growing healthcare and cosmetics sectors have contributed to the surge in demand for glass packaging, with glass being the preferred material for products like ampoules, dropper bottles, and high-end cosmetic containers.

The India glass packaging market is expected to grow at a CAGR of 6.2% over the forecast period owing to changing lifestyles, rising disposable incomes, and increasing westernization, which have fueled demand for glass packaging, particularly in the alcoholic beverage and food and beverage industries. Furthermore, the growing healthcare and cosmetics sectors have contributed to the surge in demand for glass packaging, with glass being the preferred material for products like ampoules, dropper bottles, and high-end cosmetic containers.

Key Glass Packaging Company Insights

Some of the key companies in the global glass packaging market include Piramal Glass Pvt. Ltd.; Owens-Illinois Inc.; WestPack LLC; Gerresheimer AG; Hindustan National Glass & Industries Ltd.; Ardagh Group; HEINZ-GLAS GmbH & Co. KGaA; Agrado Sa.; SGD SA (SGD Pharma); Crestani Srl in the market are focusing on development of glass packaging to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Piramal Glass Private Limited serves customers worldwide by manufacturing glass containers and glass bottles for packaging pharmaceuticals, cosmetics, perfumery, specialty food, beverages, and decorative products.

-

Hindustan National Glass & Industries Limited manufactures and sells glass containers for the pharmaceutical, liquor, beer, beverages, cosmetics, and processed food industries.

Key Glass Packaging Companies:

The following are the leading companies in the glass packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Piramal Glass Pvt. Ltd.

- Owens-Illinois Inc.

- WestPack LLC

- Gerresheimer AG

- Hindustan National Glass & Industries Ltd.

- Ardagh Group

- HEINZ-GLAS GmbH & Co. KGaA

- Agrado SA

- SGD SA (SGD Pharma)

- AAPL Solutions Pvt. Ltd.

- Crestani Srl

- Schott Kaisha Pvt. Ltd.

- AGI Glaspac (HSIL Ltd.)

- Borosil Glass Works Ltd. (Klasspack Pvt. Ltd)

- Haldyn Glass Limited (HGL)

- Sunrise Glass Industries Private Limited

- Ajanta Bottle Pvt. Ltd.

- G.M Overseas

- Empire Industries Limited- Vitrum Glass

- Consol Speciality Glass Limited

Recent Developments

-

In February 2024, O-I Glass launched a lightweight glass wine bottle known as Estampe. When sold in France, Estampe has a 25% smaller carbon footprint than traditional 500g wine bottles. The 390g Estampe bottle, verified by the Carbon Trust, uses up to 80% recycled content, which is significantly more than the 50% norm for Europe.

-

In June 2023, Corning and SGD Pharma partnered to establish a new glass tubing plant in India to increase the nation's pharmaceutical production capacity. The partnership combines Corning's patented glass-coating technology with SGD's experience in vial converting to improve vial quality, filling-line productivity, and injectable therapy delivery worldwide.

Global Glass Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82019.9 million

Revenue forecast in 2030

USD 102,311.2 million

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Piramal Glass Pvt. Ltd.; Owens-Illinois Inc.; WestPack LLC; Gerresheimer AG; Hindustan National Glass & Industries Ltd.; Ardagh Group; HEINZ-GLAS GmbH & Co. KGaA; Agrado Sa; SGD SA (SGD Pharma); AAPL Solutions Pvt. Ltd.; Crestani Srl; Schott Kaisha Pvt. Ltd.; AGI Glaspac (HSIL Ltd.); Borosil Glass Works Ltd. (Klasspack Pvt. Ltd); Haldyn Glass Limited (HGL); Sunrise Glass Industries Private Limited; Ajanta Bottle Pvt. Ltd.; G.M Overseas; Empire Industries Limited- Vitrum Glass; Consol Speciality Glass Limited

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass packaging market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Borosilicate

-

De-alkalized Soda Lime Glass

-

Soda Lime Glass

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Jars & Containers

-

Vials

-

Ampoules

-

Cartridges & Syringes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Pharmaceuticals

-

Food

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.