- Home

- »

- Homecare & Decor

- »

-

Gift Wrapping Products Market Size And Share Report, 2030GVR Report cover

![Gift Wrapping Products Market Size, Share & Trends Report]()

Gift Wrapping Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Paper & Board, Plastic, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-208-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gift Wrapping Products Market Summary

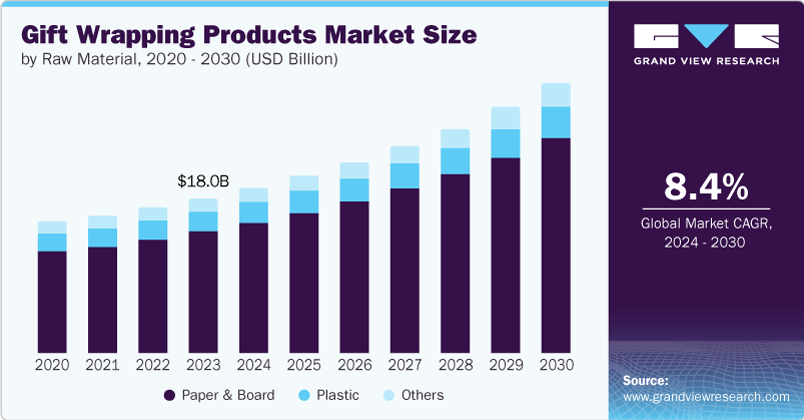

The global gift wrapping products market size was estimated at USD 18.02 billion in 2023 and is projected to reach USD 31.31 billion by 2030, growing at a CAGR of 8.4% from 2024 to 2030. Consumers increasingly seek unique and visually appealing ways to present their gifts, driving demand for innovative and customized wrapping solutions.

Key Market Trends & Insights

- North America gift wrapping products market accounted for the largest market revenue share of 38.5% in 2023.

- The U.S. gift wrapping products market is anticipated to grow significantly over the forecast period.

- By raw material, the paper and board segment accounted for the largest market revenue share of 78.3% in 2023.

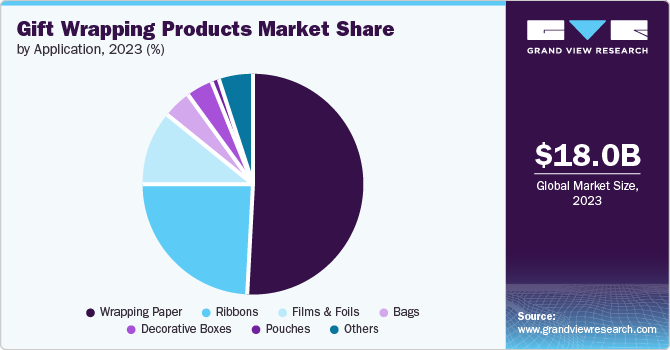

- By application, wrapping paper accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18.02 Billion

- 2030 Projected Market Size: USD 31.31 Billion

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

This trend aligns with the desire to make gifts more memorable and special, leading to demand for various wrapping materials such as wrapping papers, gift bags, ribbons, and bows.

The gift wrapping products market experiences peak demand during seasonal celebrations such as Christmas, Valentine’s Day, birthdays, and other major holidays. Seasonal trends are crucial in driving sales as consumers seek specific themes, colors, and designs for their gift presentations during these occasions. Retailers and e-commerce platforms capitalize on these peak periods by offering a wide range of wrapping products tailored to seasonal preferences, further fueling market growth.

Consumers are increasingly seeking creative ways to personalize their gifts, and gift wrapping has become a popular area for DIY enthusiasts. This trend is evident in the rising interest in craft supplies, wrapping tutorials, and using unique materials such as handmade paper, decorative ribbons, and customized tags. The desire for distinctive and personalized gift presentations encourages consumers to invest in various wrapping products and materials, stimulating market growth.

Social media platforms like Instagram, Pinterest, and TikTok showcase creative gift-wrapping ideas, trends, and tutorials, inspiring users to explore new wrapping techniques and products. Influencers and bloggers often feature and review various gift wrapping products, which helps to drive consumer interest and purchase behavior. The visual nature of these platforms enables users to discover and adopt new wrapping ideas, thereby increasing demand for diverse and innovative gift wrapping solutions.

Raw Material Insights

The paper and board segment accounted for the largest market revenue share of 78.3% in 2023. Consumers increasingly seek gift wrapping options made from recycled paper, biodegradable materials, or sourced from sustainably managed forests. This trend is reflected in the development and expansion of eco-friendly paper and board products, which cater to the market’s growing environmental concerns and comply with stricter regulations to reduce waste and promote sustainability.

The plastic segment is anticipated to grow significantly over the forecast period. Plastic wraps, bags, and ribbons offer a range of advantages, including durability, flexibility, and water resistance, which make them ideal for various gift wrapping applications. Plastic materials can be produced in multiple textures, finishes, and colors, allowing for a wide range of creative and decorative options. The ability to make plastic in different forms, from glossy and frosted finishes to textured and embossed surfaces, helps meet diverse consumer preferences and supports the market's growth.

Application Insights

Wrapping paper accounted for the largest market revenue share in 2023. Consumers emphasize the visual appeal of gift presentations, driven by the desire to make gifts look unique and memorable. The market for wrapping paper has expanded to include a wide variety of designs, from elegant and minimalist patterns to vibrant and festive themes. Introducing premium materials such as embossed, metallic, and textured papers caters to consumers’ desires for attractive, luxurious gift-wrapping options.

Decorative boxes is anticipated to register the fastest CAGR during the forecast period. The increasing trend of personalized and customized gifting options has fueled the demand for unique and aesthetically pleasing packaging solutions like decorative boxes. Consumers are increasingly seeking ways to make their gifts stand out, leading to a surge in the popularity of decorative boxes that offer both functionality and visual appeal.

Regional Insights

North America gift wrapping products market accounted for the largest market revenue share of 38.5% in 2023. North America has a strong culture of gift-giving for various occasions and consumers are willing to spend more on high-quality, attractive gift wrapping products to enhance the overall gift-giving experience. The robust economic environment and higher disposable incomes in North America further support increased spending on both gifts and their presentation, thereby driving the growth of the gift wrapping products market.

U.S. Gift Wrapping Products Market Trends

The U.S. gift wrapping products market is anticipated to grow significantly over the forecast period. Celebrations such as Christmas, Halloween, Thanksgiving, and Valentine's Day create peak periods for gift-giving, consequently driving up the demand for wrapping products. These holidays are marked by increased consumer activity, including purchasing themed wrapping papers, gift boxes, and festive accessories. Retailers often launch special collections and promotional offers during these times, capitalizing on the heightened consumer interest in creating memorable gift presentations. The cyclical nature of these holidays ensures a recurring boost in demand for gift wrapping products each year.

Europe Gift Wrapping Products Market Trends

Europe gift wrapping products market was identified as a lucrative region in 2023. The convenience of online shopping has revolutionized the way consumers purchase gift wrapping supplies. E-commerce platforms offer an extensive range of products, from classic wrapping papers to innovative, customizable options. The rise of digital retail channels has made it easier for consumers to access a diverse selection of gift wrapping products from various brands and retailers.

The UK gift wrapping products market is expected to grow rapidly in the coming years. British consumers are looking for unique and meaningful gifts and ways to enhance their presentation. This trend is evident in the growing market for luxurious materials such as high-end wrapping papers, bespoke gift bags, and decorative ribbons. The rise of personalized gift wrapping services that offer custom designs, monograms, and exclusive patterns reflects this shift toward premium gift wrapping solutions.

Asia Pacific Gift Wrapping Products Market Trends

Asia Pacific gift wrapping products market is anticipated to register the fastest CAGR over the forecast period. As economies across Asia Pacific experience robust growth, particularly in countries such as China, India, and Indonesia, disposable incomes among the middle class have increased noticeably. This economic uplift translates into higher consumer expenditure on non-essential items, including gift wrapping products. People are more willing to invest in aesthetically pleasing and high-quality gift wraps to enhance their gift-giving experiences, reflecting a broader spending trend on luxury and personalized goods.

China gift wrapping products market held a substantial market share in 2023. Traditional Chinese festivals, such as the Lunar New Year, Mid-Autumn Festival, and Dragon Boat Festival, are celebrated with elaborate gift exchanges. These occasions are marked by giving gifts to family, friends, and business associates, creating a robust market for gift-wrapping products. Additionally, the emphasis on symbolic gestures and aesthetics in gift presentations during these festivals fuels the demand for high-quality, decorative wrapping materials.

Key Gift Wrapping Products Company Insights

Some of the key companies in the gift wrapping products market include Hallmark, Card Factory plc, Mondi., IG Design Group Plc, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Hallmark offers a wide range of gift wrapping products to complement its greeting cards and other offerings. The company’s gift wrapping products include various designs of wrapping paper, gift bags, tissue paper, ribbons, bows, and other accessories to help customers beautifully present their gifts for different occasions such as birthdays, holidays, weddings, and more.

-

Card Factory plc offers an extensive selection of gift wrapping products to complement its offerings. The company’s products include various types of wrapping paper, gift bags, ribbons, bows, and other accessories to help customers beautifully present their gifts for any occasion.

Key Gift Wrapping Products Companies:

The following are the leading companies in the gift wrapping products market. These companies collectively hold the largest market share and dictate industry trends.

- Hallmark

- Card Factory plc.

- Mondi.

- IG Design Group Plc

- Karl Knauer KG

- DS Smith

- Shenzhen Fuxiang Gifts & Packaging Co. Ltd.

- BumbleBee Box Co.

- Valtenna S.r.l.

- Shenzhen Tianya Paper Products Co., Ltd.

Recent Developments

-

In May 2022, Smurfit Kappa (SKUK), a manufacturer of paper-based packaging products, acquired Atlas Packaging, an independent corrugated packaging provider. This strategic move aims to strengthen SKUK's ability to provide the UK market and its customers with innovative and sustainable gift packaging solutions.

Gift Wrapping Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.27 billion

Revenue forecast in 2030

USD 31.31 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and South Africa

Key companies profiled

Hallmark; Card Factory plc.; Mondi.; IG Design Group Plc; Karl Knauer KG; DS Smith; Shenzhen Fuxiang Gifts & Packaging Co. Ltd.; BumbleBee Box Co.; Valtenna S.r.l.; Shenzhen Tianya Paper Products Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

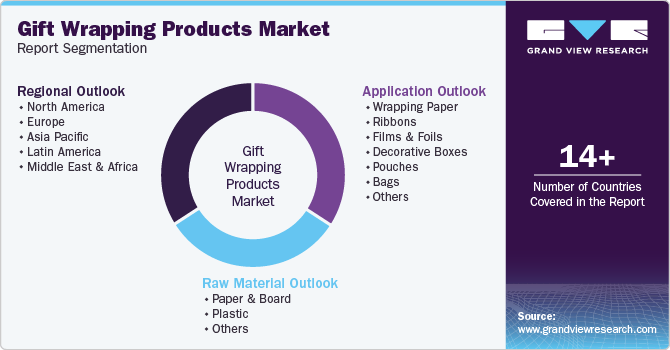

Global Gift Wrapping Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gift wrapping products market report based on raw material, application, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper & Board

-

Plastic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wrapping Paper

-

Ribbons

-

Films & Foils

-

Decorative Boxes

-

Pouches

-

Bags

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gift wrapping products market size was estimated at USD 16.15 billion in 2019 and is expected to reach USD 17.31 billion in 2020.

b. The global gift wrapping products market is expected to grow at a compound annual growth rate of 7.4% from 2019 to 2025 to reach USD 24.85 billion by 2025.

b. North America dominated the gift wrapping products market with a share of 35.7% in 2019. This is attributable to rising spending power of consumers, coupled with consumers' preference towards purchase of gifts with elegant wrapping that enhance the aesthetics and attractiveness of the gifts.

b. Some key players operating in the gift wrapping products market include Hallmark, Card Factory, Mondi Group, IG Design Group plc, Karl Knauer KG, DS Smith, Shenzhen Fuxiang Gifts & Packaging Co. Ltd, Bayley’s Boxes Inc., and Valtenna SRL, among others.

b. Key factors that are driving the market growth include increasing product innovation and rise in purchasing power of consumers, which increases the demand for elegant and customized gifting options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.