- Home

- »

- Medical Devices

- »

-

Germany Oral Care Market Size Analysis, Report, 2024 - 2030GVR Report cover

![Germany Oral Care Market Size, Share & Trends Report]()

Germany Oral Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Denture Products, Dental Accessories), By Distribution Channels (Convenience Stores, Online Retail Stores), And Segment Forecasts

- Report ID: GVR-4-68040-195-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

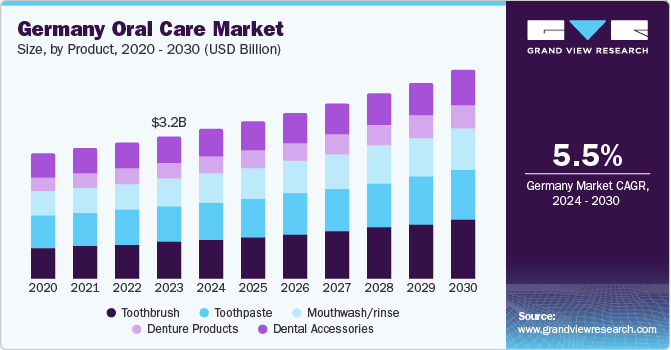

The Germany oral care market size was estimated at USD 3.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5 % from 2024 to 2030. This growth is attributed to the rising prevalence of dental conditions, increasing preference for cosmetic dentistry, and the rise in disposable income. The German government provides insurance coverage for basic dental care including regular checkups, fillings, and dental surgeries. As per an article published by BMC Oral Health in October 2023, approximately 60.0% of the population of Germany opted for regular dental check-ups, showing awareness of dental care. According to a report, the country has nearly 80,000 licensed dentists, and both public and private healthcare insurance plans primarily cover dental care.

Other dental conditions such as cavities, gum disease, and oral cancer, are becoming increasingly common in Germany. Factors such as the aging population, changing dietary habits, and poor oral hygiene growing demand for dental services and oral care products.

According to Clinicaltrial.gov 2022 data, 34 active clinical trials on dental conditions highlight the importance of oral healthcare in the country. Several key healthcare firms provide funds for all the clinical trials to develop a treatment or dental equipment to cure diseases in the country. The rising clinical trials are expected to increase the opportunity for the market players to develop innovative dental equipment, thereby boosting the market growth.

Market Concentration & Characteristics

The market growth is highly supported by merger and acquisition activities undertaken by key players. The market is characterized by a high degree of innovation owing to intense competition among prominent market players to create innovative oral care products in the market. For instance, in March 2023, Sunstar launched an innovative GUM Playbrush for the young population in Germany.

Government authorities such as the Federal Ministry of Health, the Federal Institute for Drugs and Medical Devices (BfArM), and the Federal Joint Committee (G-BA) which play a significant role in shaping the healthcare policy regulatory framework of oral care market in Germany undertake the regulatory regulation.

Several competitors in the oral care market focus on product expansions to enhance their production and patient outcomes. For instance, in September 2023, Hermes Pharma decided to invest 25 million euros to expand the production capabilities of the company. This expansion is likely to escalate manufacturing.

Product Insights

The toothbrush segment dominated the market with a revenue share of 25.4 % in 2023. This is due to the increasing consumer preference for innovative and creative toothbrushes. In addition, key players in the market incorporate natural/organic products in their portfolios to enhance consumer engagement and product sales. For instance, in September 2021, Germany’s Favorite oral care brand GSK Consumer Healthcare (GSKCH) launched an innovative toothbrush with novel properties. The product is named DR.BEST, which consists of renewable castor oil-based bristle and 100% plastic-free packaging.

The mouthwash/rinse is anticipated to witness the fastest CAGR from 2024 to 2030. Increasing awareness about oral care among the population and dentists' recommendations to enhance dental care, is likely to fuel the market growth. Moreover, key manufacturers in the oral care market are focusing on the innovative and high efficiency products to improve the oral health and overall experience of consumers.

Distribution Channel Insights

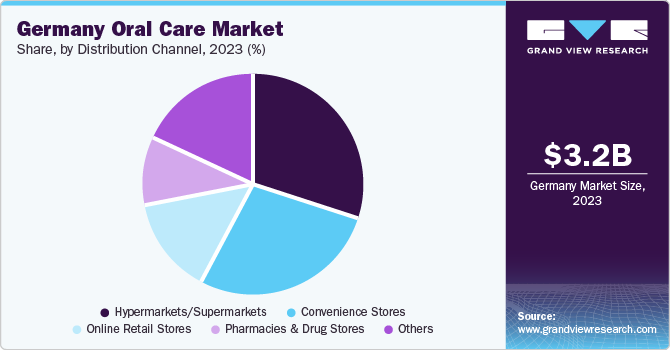

The supermarkets/hypermarkets segment dominated the market with the largest share in 2023, owing to the wide presence of supermarkets and hypermarkets in the country. Moreover, key players investing in the supermarket sector to enhance their geographical product expansion, in turn leading to market growth. For instance, in January 2024, Lidl, a German supermarket chain, announced to opening of a store in Queens, New York.

The online retail segment is projected to witness the fastest CAGR over the forecast years. This is likely due to affordability and home delivery services provided by online retailers. Various oral care manufacturer’s sale their products through online websites with plenty of discounts, attracting more consumers.

Key Germany Oral Care Company Insights

Some of the key players operating in the oral care market include Dentsply Sirona, KaVo Dental, Ivoclar Vivadent, Straumann, and Carl Martin GmBH. The market players employ strategic initiatives, such as geographical expansions, mergers and acquisitions through collaborations, and marketing campaigns to leverage growth of the market in the country.

Key Germany Oral Care Companies:

The following are the leading companies in the Germany oral care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Germany oral care companies are analyzed to map the supply network.

- Dentsply Sirona,

- KaVo Dental,

- Ivoclar Vivadent,

- Straumann

- Carl Martin GmBH

- Biolase Inc.

- GC Corporation

- Danaher Corporation (Nobel Biocare)

- Dentsply International Inc.

- 3M

Recent Developments

-

In August 2022, Luoro GmbH, a German manufacturer and supplier of sustainable launched its new ‘Mild Herbs’ Paperdent mouthwash in 500ml D-PAK™ cartons. This innovation helps the company to reduce 80% of plastic use required for usual packaging of mouthwash products.

-

In November 2022, CO. by Colgate, a new oral beauty care line that targeted the Gen-Z consumer was introduced. Products include CO. by Colgate Oh So Glowing Gel Toothpaste with Charcoal, which has stain-removing power; CO. to Go On-The-Go Anticavity Toothpaste Tabs, a waterless formula for brushing teeth on the go; and the TLC Toothbrush Starter Kit with a reusable aluminum handle and replaceable brush heads.

-

In February 2022, Colgate-Palmolive Co. introduced a recyclable toothpaste tube. It uses the same No. 2 plastic High-Density Polyethylene (HDPE), which is similar to that used in milk and detergent bottles. There are no additional actions necessary to recycle the tubes, such as rinsing, cutting, or cleaning it before placing it in a recycling container.

Germany Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.35 billion

Revenue forecast in 2030

USD 4.67 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, distribution channel

Country scope

Germany

Key companies profiled

Dentsply Sirona; KaVo Dental; Ivoclar Vivadent, Straumann; Carl Martin GmBH; Biolase Inc. ; GC Corporation; Danaher Corporation (Nobel Biocare); Dentsply International Inc.; 3M

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Oral Care Market Report Segmentation

This report forecasts revenue growth at and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany oral care market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Manual

-

Electric (Rechargeable)

-

Battery-powered (Non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/rinse

-

Medicated

-

Non-medicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Floss

-

Others

-

-

Dental Accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

-

Others

-

Oral Irrigators

-

Countertop

-

Cordless

-

-

Mouth Freshener Sprays

-

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies and drug stores

-

Convenience Stores

-

Online retail stores

-

Others

-

Frequently Asked Questions About This Report

b. The Germany oral care market is estimated at USD 3.2 billion in 2023 and is expected to reach USD 3.35 billion in 2024.

b. The Germany oral care market is expected to grow at a CAGR of 5.5% from 2024 to 2030 to reach USD 4.67 billion in 2030.

b. The toothbrush segment dominated the market with a revenue share of 25.4 % in 2023. This is due to the increasing consumer preference for innovative and creative toothbrushes.

b. Some of the prominent key players operating in the Germany oral care market include Dentsply Sirona, KaVo Dental, Ivoclar Vivadent, Straumann, and Carl Martin GmBH.

b. This market's growth is attributed to the rising prevalence of dental conditions, increasing preference for cosmetic dentistry, and the rise in disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.