- Home

- »

- Renewable Energy

- »

-

Geothermal Energy Market Size And Share Report, 2030GVR Report cover

![Geothermal Energy Market Size, Share & Trends Report]()

Geothermal Energy Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Flash Steam, Dry Steam), By Power, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-249-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geothermal Energy Market Summary

The global geothermal energy market size was estimated at USD 7.45 billion in 2023 and is projected to reach USD 9.22 billion by 2030, growing at a CAGR of 3.1% from 2024 to 2030. The growing demand for geothermal energy is driven by several factors.

Key Market Trends & Insights

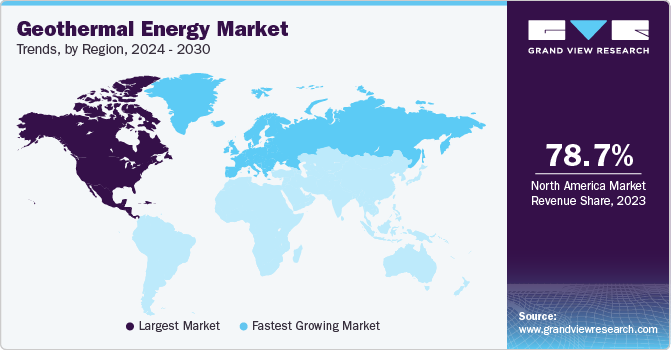

- Asia Pacific dominated the geothermal energy market with the significant revenue share of 34.7% in 2023.

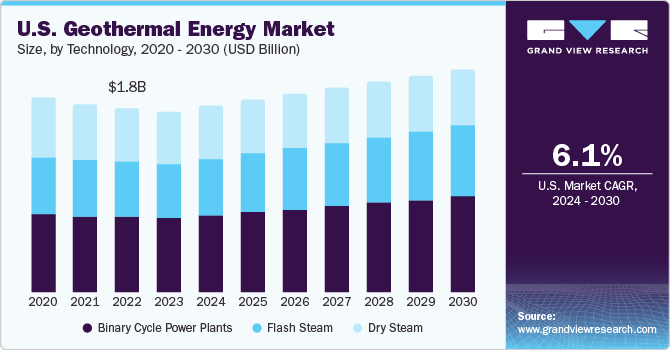

- The geothermal energy market in U.S accounted for largest revenue share of 78.7% in North America.

- By technology, the binary cycle power plants segment led the market with the largest revenue share of 30.5% in 2023

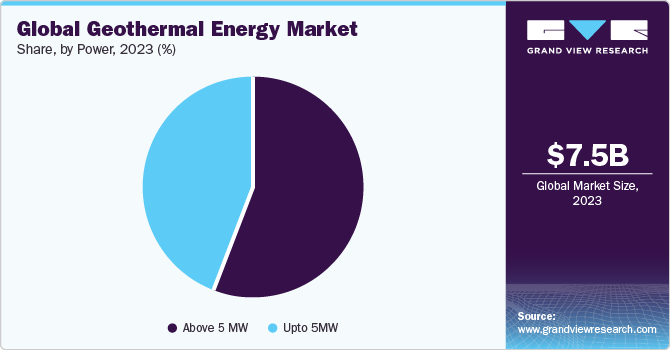

- By power, the above 5 MW segment led the market with the largest revenue share of 56.4% in 2023.

- By application, the residential segment led the market with the largest revenue share of 40.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.45 Billion

- 2030 Projected Market Size: USD 9.22 Billion

- CAGR (2024-2030): 3.1%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

One of the main drivers is the increasing demand for uninterrupted power supply for residential, commercial, and industrial sectors, and rising demand for power generation through sustainable energy in various industries. Geothermal energy is sourced from reservoirs of hot water beneath the Earth’s surface. With applications in several economic sectors, increased use of geothermal energy has the potential to decrease the use of fossil fuels and the resulting greenhouse gas emissions which caters for the global ambition to reduce carbon emissions. As several countries across globe thrive to reduce dependence on fossil fuels, geothermal energy is emerging as a promising solution to mitigate growing energy demand and reduction in greenhouse gas emissions in coming years.

The U.S. is among the early adopters of renewable energy solutions in the power generation sector owing to the increased importance being given to clean energy solutions as per the Energy Act introduced by the government. Such initiatives have provided guideline such as Inflation Reduction Act (IRA) of 2022, and Infrastructure Investment, and Jobs Act for the implementation of renewable energy sources in the energy generation sector.Rising distribution costs, main grid failures leading to blackouts, and incentive programs introduced by the U.S. government are expected to drive end-users to switch to geothermal energy sources, which is expected to augment the market demand.

In August 2022, U.S. Department of Energy announced funding of USD 165 million to fuel growth in adoption of geothermal energy in the country. Government Efforts to meet rising electricity demand using renewable energy sources are also expected to significantly contribute to market growth. The share of renewable energy is expected to rise significantly as governments resolve to harvest as much energy as possible from renewable sources while reducing carbon emissions, thereby driving the market growth of renewable energy.

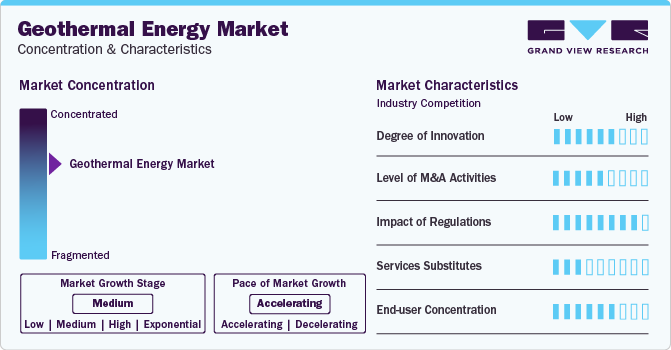

Market Concentration & Characteristics

The market is distinctly shaped by regulatory frameworks, technological advancements and geographical suitability. Unlike traditional energy sources, geothermal energy generation relies on accessing underground heat making its feasibility highly contingent on geographical conditions. Market dynamics vary geographically, with regions like U.S. and China boasting significant geological capacity.

Technological innovations such as enhanced geothermal systems and binary cycle power plants continue to improve efficiency and fuel market growth. Moreover, the market presents opportunities for sustainable energy generation through overcoming geological, technological, and regulatory challenges. Moreover, strategic initiatives such as collaboration, partnerships, and investment in global market by governments and industry players are expected to unlock the full potential of geothermal energy as a reliable and sustainable source of energy in near future.

Technology Insights

Based on technology, the market is segmented into flash steam, dry steam, and binary cycle power plants. The binary cycle power plants segment led the market with the largest revenue share of 30.5% in 2023. Binary cycle power plants utilize lower temperature geothermal resources which are more abundant globally compared to high temperature resources which makes them most viable option for regions with moderate to low geothermal heat potential to expand the geographical scope for geothermal energy development.

The flash steam segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the efficient nature of harnessing natural steam produced in underground reservoirs, converting it directly into electrical power. Flash steam geothermal energy plants offer reliable and sustainable energy solutions with minimal environmental impact which makes them attractive options for countries to diversify their energy mix. Moreover, advancements in flash steam technology such as improved drilling techniques and enhanced geothermal reservoir management have contributed to increased efficiency and cost-effectiveness, further fueling the demand for these power plants. As the countries across globe adopt sustainable energy sources for power generation the demand for geothermal energy is expected to increase significantly in coming years.

Power Insights

Based on power, The market is segmented into upto 5MW and above 5 MW. The above 5 MW segment led the market with the largest revenue share of 56.4% in 2023, owing to the increasing demand for large scale power plants which are capable of generating high amount of electricity for commercial and industrial applications. Moreover, the growing significance of geothermal energy as a reliable and sustainable source of baseload power further contributes to demand for above 5 MW geothermal power plants.

However, geothermal power plants upto 5 MW of power capacity also hold significant demand as these mid-sized geothermal power plants offer a balance between scalability, efficiency, and cost-effectiveness, making them attractive option for both developed and developing countries. As countries across globe prioritize transition to clean energy sources in residential applications, the demand for upto 5MW geothermal power plants is expected to increase over forecast period.

Application Insights

In terms of application, the market is segmented into residential, commercial, and industrial. The residential segment led the market with the largest revenue share of 40.7% in 2023, due to high demand for residential cooling and heating applications providing homeowners with renewable alternative to traditional HVAC systems. Apart from space conditioning, geothermal heat pumps can also be used for providing domestic hot water. Geothermal heat pump systems are equipped with an ancillary heat exchanger known as a desuperheater that utilizes superheated gases from the heat pump’s compressor to heat the water. In summer, desuperheater uses the surplus heat that otherwise would get dissipated into the ground. Thus, when the geothermal heat pump frequently operates during summer, it can offer significant heating capacity. However, during the fall, spring, and winter, residences have to rely on traditional water heating methods as the desuperheater does not produce much excess heat.

The industrial segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing the ground temperature and further reducing system efficiency and capacity.The adoption of geothermal heat pumps in industrial applications is less as compared to residential and commercial applications. Industrial environments utilize a large amount of energy, thereby producing heat that has to be removed continuously. Installing geothermal heat pumps in industrial facilities would lead to continuous heat rejection to the earth, thereby increasing the ground temperature and further reducing system efficiency and capacity. Thus, these factors are further expected to reduce the adoption of geothermal heat pumps in industrial applications.

Regional Insights

The geothermal energy market in North America is expected to grow at the significant CAGR over the forecast period. The economy of North America is the largest and one of the most robust across the globe and witnessing significant growth owing to the industrial dynamics and commodity abundance in its countries. The region includes the U.S., Mexico, and Canada, which are significant and complex economic systems.

U.S. Geothermal Energy Market Trends

The geothermal energy market in U.S accounted for largest revenue share of 78.7% in North America. The U.S. government has favorable policies in place, such as personal tax credits and direct incentives on product installation, which encourage the installation of heat pumps. Improving energy-efficiency across industries is one of the prime objectives of governments across the world. Rising need for renewable energy sources, along with extensive government support in the form of subsidies, incentives, and other monetary benefits, is projected to drive the market growth over the forecast period.

The Canada geothermal energy market is expected to grow at the significant CAGR of 1.8% during the forecast period, owing the favorable government regulations.The Canadian government offers residential geothermal tax credits and rebates in order to promote adoption of highly energy-efficient geothermal heat pumps. Nova Scotia, through its Green Heat program, offers a rebate of up to USD 2,500 on the installation of a GHP. The Manitoba Green Energy Equipment Tax Credit provides approximately USD 5,000 in incentives for the installation of GHP systems. New Brunswick offers rebates of up to USD 5,000 on GHP. Such initiatives by regional authorities are expected to boost the adoption of geothermal heat pumps in the country over the forecast period.

Asia Pacific Geothermal Energy Market Trends

Asia Pacific dominated the geothermal energy market with the significant revenue share of 34.7% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to high demand for geothermal heat pumps in the residential sector for space heating & cooling. Furthermore, rising population, improving economic conditions, and the presence of one of the largest manufacturing sectors are projected to positively impact market growth in the region.

The geothermal energy market in China accounted for largest revenue share of 27.7% in Asia pacific in 2023. Major heat pump manufacturing companies are shifting or expanding their production capacities to China for leveraging the benefits of low labor costs. China, being the largest producer of heat pumps, has attracted a lot of heat pump manufacturers to the region. Moreover, membership of China in Trans-Pacific Partnership Agreement is projected to positively influence the market growth in the country.

The South Korea geothermal energy market is expected to grow at the fastest CAGR of 3.4% over the forecast period. Rising awareness pertaining to greenhouse gas emissions and climate change is projected to propel the demand for energy-efficient technologies in the country. Furthermore, government regulations and emission standards are expected to augment the demand for energy-saving products, including geothermal heat pumps, in commercial and residential sectors.

Europe Geothermal Energy Market Trends

The geothermal energy market in Europe is expected to grow at the fastest CAGR during the forecast period. The demand for energy-efficient products in Europe is projected to be high. Various government policies are being set in an attempt to reduce the energy consumption in the region. Such initiatives are projected to boost the demand for heat pumps. The recovering construction sector is further anticipated to contribute to the market growth in Europe.

The Germany geothermal energy market accounted for largest revenue share of 28.5% in Europe. The demand for geothermal heat pumps in the country is anticipated to be driven by key application sectors including residential, industrial, and commercial. Technological advancements pertaining to the superior performance of geothermal heat pump are expected to boost the market growth over the forecast period.

The geothermal energy market in France is expected to grow at the significant CAGR over the forecast period, owing to the he increasing investments in energy-efficient solutions, concern regarding carbon emissions, climatic changes urging the need for sustainable heating and cooling solutions.

Central & South America Geothermal Energy Market Trends

The geothermal energy market in Central & South America is expected to grow at the fastest CAGR during the forecast period. The region's market expansion is driven by increasing investments in smart technologies, rising power demand, and government policies promoting clean fuels and renewable energy sources. Favorable financing schemes, technological advancements like binary technology, and the adoption of district heating technologies are key factors propelling the industry. Geothermal energy is gaining traction across various sectors, including mining, agriculture, and services, contributing to the region's energy security and environmental goals.

The Brazil geothermal energy market accounted for largest revenue share of 37.9% in Central & South America.The growing focus on using environmentally friendly technology based on natural resources coupled with increasing energy demand is anticipated to positively impact the market growth over the forecast period.

The geothermal energy market in Chile is expected to grow at the fastest CAGR during the forecast period. Chile’s abundant geothermal potential can provide a suitable option to diversify the country’s power generation mix. Moreover, Chile’s Energy Policy which aims to generate 70% of the country’s electricity from renewables by 2050, is further expected to have a positive impact on the use of geothermal energy over the coming years.

Middle East & Africa Geothermal Energy Market Trends

The geothermal energy market in Middle East & Africa is expected to grow at the fastest CAGR during the forecast period. The region's focus on reducing reliance on fossil fuels, enhancing energy security, and addressing climate change through clean energy solutions is driving the growth of geothermal energy. Government incentives, subsidies, and policies promoting renewable energy are key drivers. The MENA region's abundant solar resources make solar power generation a viable and sustainable option, contributing to the region's energy transition.

The Saudi Arabia geothermal energy market accounted for largest revenue share of 37.5% in Middle East & Africa. The government plans to increase investments in the development of transportation, infrastructure, and fast-tracking key projects. In addition, government initiatives, including Saudi Arabia Vision 2030 and National Transformation Program (NTP), are expected to promote economic development. Moreover, an increased focus on the development of transportation facilities in the country is expected to boost residential and commercial development in the vicinities, which is further expected to positively impact the market growth over the forecast period.

The geothermal energy market in UAE is expected to grow at the fastest CAGR during the forecast period.The geothermal heat pump technology is at an early stage in cooling-dominated applications in the country, its demand for cooling applications is gradually increasing. The commercial buildings in the country have fluctuating demands, a relatively high occupancy, and widely vary cooling requirements within individual zones that are not easy to meet efficiently with conventional systems.

Key Geothermal Energy Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new Technology development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In February 2024, Terrapin and TerraScale announced merger for expansion in Canada, Japan, and Switzerland with initial focus on geothermal projects

-

In February 2024, Pertamina Geothermal Energy signed collaboration agreement with Kipas Holding, a Turkish geothermal energy producing company for exploration and investments in renewable energy sector

-

In November 2023, Google and Fervo launched its first geothermal project located in Nevada, U.S. which is contributing carbon-free energy to the electric grid

-

In September 2023, Dandelion Energy announced partnership with Palmetto to expand access to renewable energy solutions by combining residential solar with geothermal heating & cooling systems

Key Geothermal Energy Companies:

The following are the leading companies in the geothermal energy market. These companies collectively hold the largest market share and dictate industry trends.

- Turboden S.p.A.

- Alterra Power Corporation

- TAS Energy

- Atlas Copco Group

- Exergy

- Toshiba Corporation

- Mitsubishi Heavy Industries

- General Electric

- Ansaldo Energia

- Ormat Technologies

Geothermal Energy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.69 billion

Revenue forecast in 2030

USD 9.22 billion

Growth rate

CAGR of 3.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, power, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; Finland; Switzerland; Netherlands; China; Japan; South Korea; Australia; Brazil; Chile; UAE; Saudi Arabia

Key companies profiled

Turboden S.p.A.; Green Energy Geothermal; Berkshire Hathaway Inc.; Terra Gen, Reykjavik Geothermal; Alterra Power Corporation; TAS Energy; Atlas Copco Group; Exergy; ElectraTherm; Calpine Corporation; Fuji Electric Co. Ltd.; Toshiba Corporation; Mitsubishi Heavy Industries; General Electric; Ansaldo Energia; Ormat Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geothermal Energy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the geothermal energy market report based on technology, power, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Flash Steam

-

Dry Steam

-

Binary Cycle Power Plants

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 5MW

-

Above 5 MW

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Finland

-

Switzerland

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global geothermal energy market size was estimated at USD 7.45 billion in 2023 and is expected to reach USD 7.69 billion in 2024.

b. The global geothermal energy market is expected to grow at a compounded annual growth rate of 3.1% from 2024 to 2030 to reach USD 9.22 billion by 2030.

b. The Asia Pacific dominated the geothermal energy market with the highest share of about 34% in 2023. This can be attributed to high demand for geothermal heat pumps in the residential sector for space heating & cooling.

b. Some key players operating in the geothermal energy market include Turboden S.p.A., Green Energy Geothermal, Berkshire Hathaway Inc., Terra Gen, Reykjavik Geothermal, Alterra Power Corporation, TAS Energy, among others.

b. Key factors driving the geothermal energy market growth include increasing demand for uninterrupted power supply for residential, commercial, and industrial sectors, and rising demand for power generation through sustainable energy in various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.