- Home

- »

- Biotechnology

- »

-

Genomics Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Genomics Market Size, Share & Trends Report]()

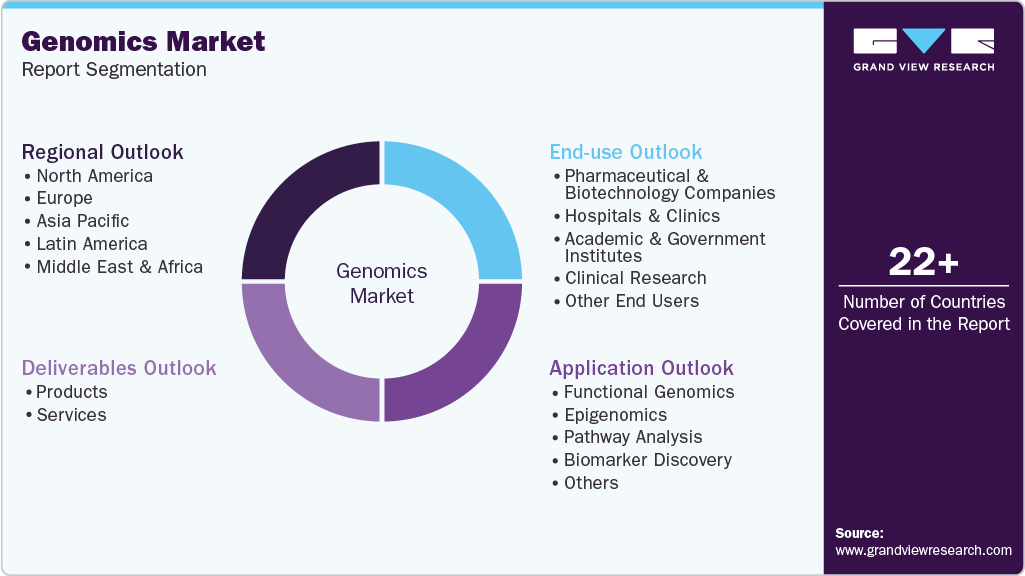

Genomics Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Functional Genomics, Epigenomics, Pathway Analysis, Biomarker Discovery), By Deliverables (Products, Services), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-188-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Genomics Market Summary

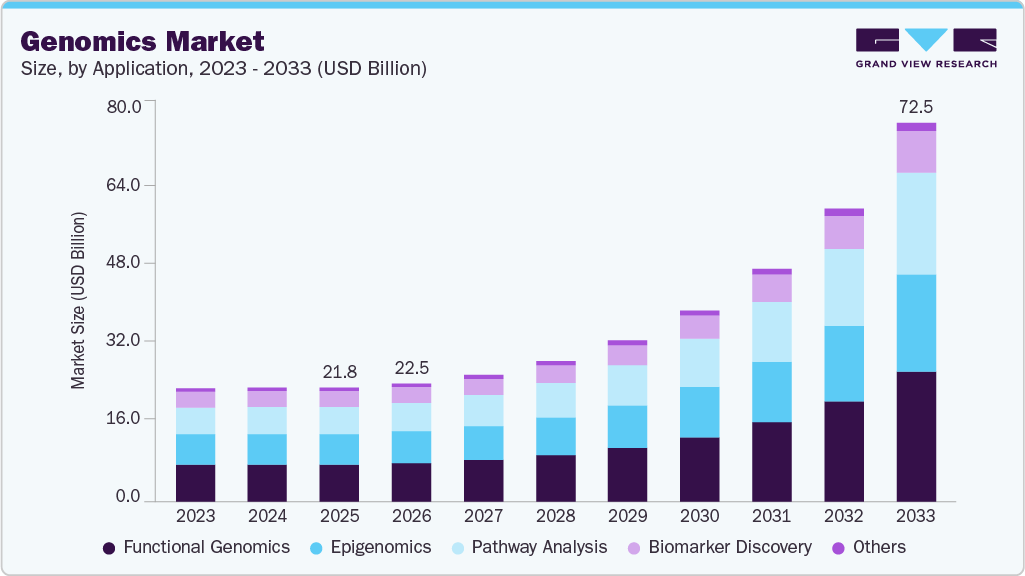

The global genomics market size was estimated at USD 21.76 billion in 2025 and is projected to reach USD 72.50 billion by 2033, growing at a CAGR of 18.2% from 2026 to 2033. This growth is supported by emerging genomics applications, which enable advanced genetic design, pathway engineering, and data-driven biological innovation across healthcare, industrial biotechnology, and research applications.

Key Market Trends & Insights

- The North America genomicsmarket held the largest share of 42.25% of the global market in 2025.

- The genomics industry in the U.S. is expected to grow significantly over the forecast period.

- By deliverables, the products segment held the highest market share in 2025.

- By application, the functional genomics segment dominated the 2025 market share for the genomics market.

- By end-use, hospitals and clinics segment is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 21.76 Billion

- 2033 Projected Market Size: USD 72.50 Billion

- CAGR (2026-2033): 18.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growing Clinical Applications of Genomics

Increasing applications in clinical diagnostics, oncology, and rare diseases are significantly driving the growth of the genomics market. In clinical diagnostics, genomics enables early and accurate detection of genetic disorders, infectious diseases, and inherited conditions through advanced sequencing and molecular testing technologies. The integration of genomics into routine diagnostic workflows has improved disease risk assessment, prognosis, and treatment selection, supporting the shift toward personalized and preventive healthcare. Growing adoption of next-generation sequencing and companion diagnostics is further strengthening the role of genomics in clinical decision-making.

In oncology, genomics has become a critical tool for tumor profiling, biomarker identification, and targeted therapy selection. Comprehensive genomic analysis helps healthcare providers to better understand cancer heterogeneity, predict treatment response, and monitor disease progression. The increasing use of genomic testing in precision oncology, supported by pharmaceutical partnerships and clinical trials, is accelerating demand for sequencing platforms, reagents, and bioinformatics solutions. As cancer incidence continues to rise globally, genomics-driven oncology applications are expected to remain a key growth driver for the market.

Genomics is also transforming the diagnosis and management of rare diseases, where traditional diagnostic approaches often face limitations. Whole-exome and whole-genome sequencing enable faster identification of disease-causing variants, reducing diagnostic timelines and improving patient outcomes. Growing awareness among clinicians, expanding newborn screening programs, and supportive government initiatives are encouraging the adoption of genomics in rare disease diagnosis. Collectively, these expanding applications across clinical diagnostics, oncology, and rare diseases are enhancing the clinical value of genomics and reinforcing its importance in modern healthcare systems.

Growing Precision Medicine Adoption

Growing adoption of precision medicine and personalized healthcare is a key driver shaping the genomics market. Genomic insights enable healthcare providers to tailor treatments based on an individual’s genetic profile, improving therapeutic efficacy while reducing adverse effects. Advances in sequencing technologies and data analytics have strengthened the integration of genomics into clinical workflows, supporting personalized treatment planning across oncology, cardiology, and rare diseases. Increasing awareness among clinicians and patients is further accelerating the shift toward individualized healthcare solutions.

Pharmaceutical and biotechnology companies are increasingly leveraging genomics to support targeted drug development, companion diagnostics, and patient stratification in clinical trials. This approach enhances success rates, reduces development timelines, and lowers overall healthcare costs. Supportive regulatory frameworks, rising investments in precision medicine initiatives, and expanding genomics-based diagnostic offerings are expected to sustain long-term growth, reinforcing genomics as a cornerstone of personalized healthcare delivery.

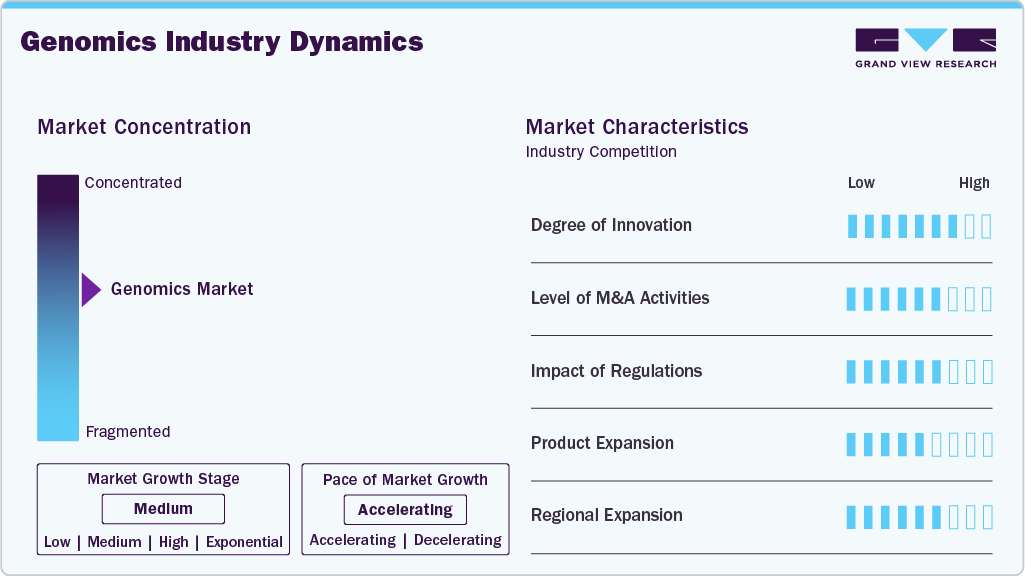

Market Concentration & Characteristics

Innovation intensity in the genomics industry remains high, driven by rapid advancements in sequencing technologies, single-cell analysis, and AI-enabled data interpretation. Companies are increasingly investing in R&D to improve accuracy, speed, and scalability while expanding clinical and research applications. Strategic partnerships, platform upgrades, and integration of genomics with precision medicine continue to accelerate innovation and strengthen competitive differentiation across the market.

The genomics industry has witnessed a strong increase in innovation, driven by rapid advancements in next-generation sequencing, single-cell genomics, and AI-enabled data analytics. These developments have improved sequencing speed, accuracy, and scalability, enabling broader adoption across research, clinical diagnostics, drug discovery, and precision medicine applications worldwide.

Regulatory frameworks in the genomics industry are evolving to balance innovation with patient safety, data privacy, and ethical considerations. Governments and regulatory bodies are establishing guidelines for genetic testing, data protection, and clinical validation to ensure responsible use of genomic information, while supportive policies and harmonization efforts are accelerating commercialization and adoption of genomics technologies.

Product expansion in the genomics market is expected to grow, driven by continuous advancements in sequencing platforms, reagents, and bioinformatics solutions. Companies are expanding their product portfolios to address rising demand from research, clinical diagnostics, and precision medicine applications, while focusing on improved accuracy, faster turnaround times, and scalable solutions to strengthen market competitiveness.

Regional expansion in the genomics market is being experienced across both developed and emerging economies, supported by increasing adoption of advanced sequencing technologies, rising healthcare investments, and growing government initiatives promoting genomics research. Companies are strengthening their geographic presence through partnerships, local manufacturing, and research collaborations to capture untapped opportunities and expand their global footprint.

Application Insights

The functional genomics segment dominated the overall market with the largest revenue share of 32.77% in 2025. The dominance of the segment can be attributed to research studies aiming to understand a particular phenotypical expression of a given disease condition. Many gene therapies for cancers are designed on the basis of functional genomic technology. For instance, in December 2025, Ochre Bio and Lexogen entered into a strategic partnership to build one of the world’s largest human liver functional genomics datasets, leveraging advanced sequencing and transcriptomics technologies, which underscores the growing commercial adoption of functional genomics tools and highlights increasing demand for high-quality genomics data to support drug discovery and translational research.

Pathway analysis segment is predicted to emerge as the most lucrative of all by 2033. Usage of pathway analysis in developing next-generation therapeutics has emerged as one of the fastest-growing applications. Pathway-based analysis has gained more attention after the emergence of clinical genomics and personalized therapies. This is mainly because genomics and personalized therapies aid in the in-depth analysis of the ability to navigate signaling pathways and disease networks.

Deliverables Insights

The product segment dominated the market in 2025 and is expected to grow at the fastest CAGR over the forecast period. The products used in genomics are broadly segmented into two categories-instruments or systems that are required for the synthesis and sequencing of the nucleic acid sequences and consumables & reagents. The increase in preference for personalized medicines and decline in costs of DNA sequencing owing to the launch of NGS technology resulted in the development of novel products or systems.

The genomics market is gradually becoming more competitive with new product launches. For instance, in October 2025, Genomics launched Mystra, an AI-enabled human genetics platform, aimed at accelerating drug target discovery and clinical development by integrating large-scale genomic data with advanced analytics. This launch reflects direct commercial innovation within the genomics market, highlighting the increasing convergence of genomics and artificial intelligence to support biopharmaceutical R&D.

The service segment is expected to register a steady CAGR by 2033. The high cost of products, the demand for expertise required for genomics, and the focus on core operations by the end user are the major factors driving the services segment. NGS-based services held a major share in the genomics services segment due to the rapid adoption of Whole Genome Sequencing (WGS) and applications of sequence databases for disorder screening and prognosis. However, data processing and interpretation, rather than data production has become the need for current development and application.

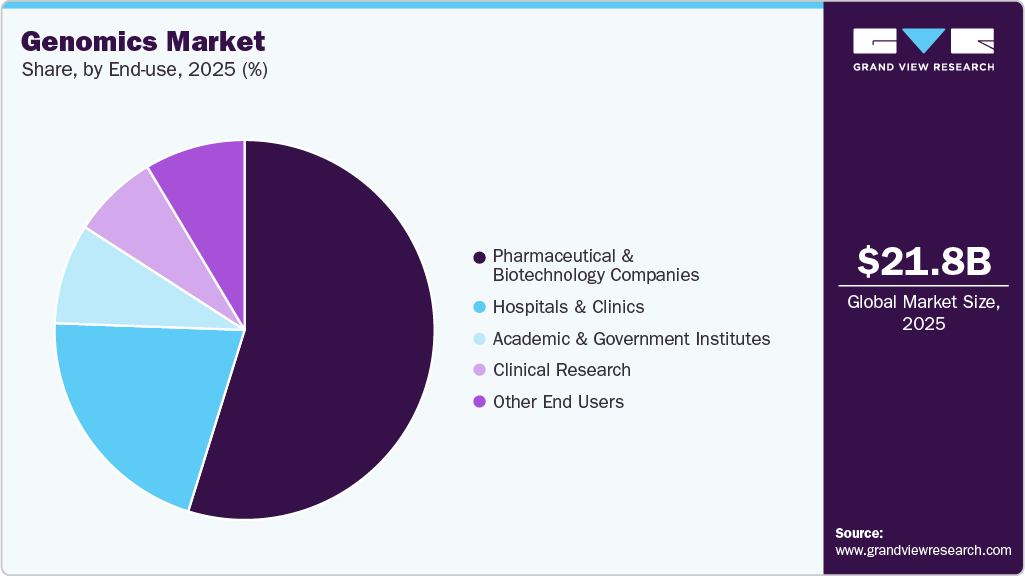

End-use Insights

The pharmaceutical and biotechnology companies segment led the market with market share of 54.80% in 2025. This is attributed to the increasing demand for use of genomics in drug discovery. Moreover, the market is driven by increasing adoption of spatial genomics & transcriptomics technologies. Numerous trials are underway for novel drug discovery using underlying knowledge from genomics. For instance, in October 2025, Helix announced that it would present new population-scale genomic research at the ASHG 2025 Annual Meeting, showcasing insights generated from large-scale genomic data. This development highlights ongoing commercial activity in the genomics market, reflecting growing investment in population genomics to support research, diagnostics, and precision medicine applications.

The hospital and clinic segment is estimated to grow at a substantial pace during the forecast period. Several hospitals and clinics are currently offering genomic sequencing services to patients and are using this technology in the daily practice of medicine. For instance, in October 2025, researchers reported a breakthrough enabling whole-genome sequencing to be completed within hours, significantly improving sequencing speed and efficiency. This advancement underscores direct innovation in the genomics market, with potential to accelerate adoption of rapid sequencing technologies across research and clinical applications.

Regional Insights

North America genomics market accounted for the largest market share of 42.25% in 2025, driven by the strong presence of leading genomics companies, high adoption of advanced sequencing technologies, and robust funding for genomic research. The region benefits from a well-established healthcare and life sciences infrastructure, widespread use of genomics in clinical diagnostics and drug discovery, and supportive government and private investments, which continue to accelerate innovation and commercialization across the genomics market.

U.S. Genomics Market Trends

The genomics market in the U.S. is expected to expand in the near future due to rising adoption of next-generation sequencing technologies, increasing integration of genomics in clinical diagnostics and precision medicine, strong biopharmaceutical R&D investments, and continued government and private funding supporting large-scale genomic research initiatives. For instance, in December 2025, Illumina and MyOme partnered through a strategic investment to support MyOme’s clinical trial leveraging whole-genome sequencing, highlighting direct commercial activity within the genomics market.

Europe Genomics Market Trends

The genomics market in Europe is experiencing a significant revenue growth in 2025, driven by increasing adoption of next-generation sequencing technologies, rising investments in precision medicine and personalized healthcare, and supportive regulatory frameworks that encourage genomic research and diagnostics. Strong presence of leading genomics companies, expanding clinical genomics applications, and collaborations between academic institutions and industry players are further fueling market expansion. In addition, government funding initiatives, public-private partnerships, and growing awareness of the benefits of genomics in disease diagnosis, therapeutic development, and population health management are accelerating technology adoption. These factors collectively position Europe as a key hub for innovation and commercialization in the global genomics market.

The genomics market in the UK held a significant share in 2025. Widespread adoption of advanced sequencing technologies, robust investment in precision medicine and clinical genomics, and strong collaborations between academic institutions and industry is anticipated to propel market growth. Furthermore, supportive government initiatives, public-private partnerships, and increasing awareness of genomics applications in disease diagnosis and drug development further strengthened the UK’s position as a key contributor to the European genomics market.

France genomics market is expected to grow remarkably over the forecast period. This is attributed to increasing adoption of next-generation sequencing technologies, expanding applications in clinical diagnostics and personalized medicine, and strong government support for genomics research. Moreover, collaborations between academic institutions and biotechnology companies, rising investment in precision healthcare, and growing awareness of genomics’ role in disease prevention and drug development are driving market expansion.

The genomics market in Germany is anticipated to grow significantly over the forecast period. The nation has significant rising adoption of advanced sequencing technologies, expanding applications in clinical diagnostics and personalized medicine, and strong government and private funding for genomics research. Strategic collaborations between research institutions and biotechnology companies, coupled with increasing awareness of genomics in disease management and drug development, are further fueling market growth and positioning Germany as a key hub in the European genomics landscape.

Asia Pacific Genomics Market Trends

The Asia Pacific genomics market is projected to grow at the fastest CAGR of 19.0% over the forecast period, owing to the increasing adoption of advanced sequencing technologies, expanding applications in clinical diagnostics, precision medicine, and personalized healthcare, and rising investments from both government and private sectors in genomics research. Growing awareness of genomics’ role in disease diagnosis, drug development, and population health management, coupled with strategic collaborations between academic institutions and biotechnology companies, is accelerating technology adoption. In addition, emerging economies in the region are witnessing rapid infrastructure development and increasing healthcare expenditure, positioning APAC as the fastest-growing market in the global genomics landscape.

The genomics market in China is expected to grow over the forecast period. This is propelled to grow owing to the growing adoption of advanced sequencing technologies, supportive government policies, increased investment in healthcare infrastructure, collaborations between biotech firms and research institutions, and expanding applications in diagnostics, precision medicine, and drug development.

Japan genomics marketis witnessing significant growth over the forecast period. This is attributed to the increasing adoption of next-generation sequencing technologies, supportive government initiatives for genomic research, growing investment in healthcare infrastructure, and expanding applications in clinical diagnostics, precision medicine, and drug development, which collectively are driving the market forward.

Middle East & Africa Genomics Market Trends

The MEA genomics marketis projected to grow significantly over the forecast period. This expansion is driven by increasing adoption of advanced sequencing technologies, rising investments in healthcare infrastructure, supportive government initiatives promoting genomic research, and growing applications in clinical diagnostics, precision medicine, and drug development across the region.

The Saudi Arabia genomics marketis projected to grow significantly over the forecast period. This is propelled to grow owing to increasing adoption of advanced sequencing technologies, supportive government initiatives, rising healthcare investments, and expanding applications in clinical diagnostics, precision medicine, and drug development.

The genomics market in Kuwait is also anticipated to grow, driven by increasing adoption of advanced sequencing technologies, supportive government policies, growing healthcare investments, and expanding applications in clinical diagnostics, precision medicine, and drug development.

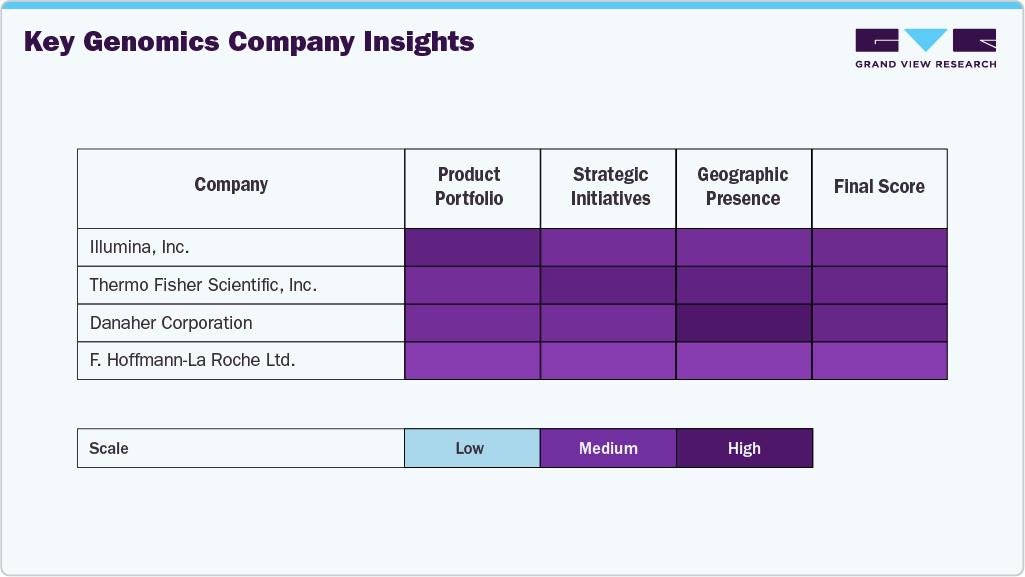

Key Genomics Company Insights

The global genomics market is dominated by a mix of pure-play sequencing companies and diversified life sciences firms. Illumina, Inc., a leader in next-generation sequencing (NGS) technologies, continues to hold a significant market share due to its comprehensive portfolio of sequencing platforms, reagents, and bioinformatics tools. Thermo Fisher Scientific, Inc. leverages its extensive Life Sciences Solutions segment to capture a sizable portion of the market, offering integrated solutions for genomics research, diagnostics, and biopharmaceutical development. Danaher Corporation, through its Life Sciences platforms including Cytiva and Pall, contributes significantly to the genomics tools and services segment, particularly in sample preparation, nucleic acid extraction, and sequencing workflow solutions.

Other key players such as BGI Genomics, QIAGEN N.V., and Oxford Nanopore Technologies are expanding their presence through innovative platforms and targeted applications in research and clinical diagnostics. BGI Genomics maintains a strong footprint in large-scale sequencing and genomic analysis, particularly in Asia, while QIAGEN focuses on NGS, PCR, and sample technologies. Oxford Nanopore has differentiated itself with portable and scalable sequencing devices, gaining adoption in both research and field-based genomics applications. Pacific Biosciences of California, Inc. (PacBio) is recognized for its high-accuracy long-read sequencing platforms, driving adoption in complex genomic analyses.

Diversified life sciences companies such as Agilent Technologies and Bio-Rad Laboratories, Inc., also contribute to the market through their genomics and diagnostics offerings. Agilent’s Diagnostics and Genomics segment includes tools for NGS library preparation, microarrays, and molecular testing, while Bio-Rad focuses on reagents and instruments supporting genomics workflows. Meanwhile, F. Hoffmann-La Roche Ltd. leverages its Diagnostics segment to deliver molecular and companion diagnostic solutions, strengthening its presence in clinical genomics and personalized medicine. These companies benefit from strong global distribution networks, strategic partnerships, and collaborations with academic and biopharmaceutical organizations.

Overall, the genomics market remains highly competitive, with the top players collectively capturing a majority of the market share while continuously innovating to maintain technological leadership. Investments in next-generation sequencing, single-cell genomics, and AI-enabled data analysis are shaping market dynamics, with new entrants and regional players expanding rapidly, particularly in Asia Pacific and North America. Strategic collaborations, acquisitions, and partnerships are increasingly driving growth, enabling companies to enhance their portfolios, penetrate new applications, and address the rising demand for genomics-based research, diagnostics, and therapeutics worldwide.

Key Genomics Companies:

The following are the leading companies in the genomics market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- BGI Genomics

- QIAGEN N.V.

- Oxford Nanopore Technologies

- PacBio.

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In December 2025, Parse Biosciences and Codebreaker Labs partnered to apply whole-transcriptome single-cell profiling and causal genomics at scale, highlighting direct commercial activity and innovation within the genomics market.

-

In December 2025, Daisy Genomics, an Albuquerque-based startup, raised USD 25 million to advance its precision medicine sequencing platform, highlighting direct commercial activity and innovation within the genomics market.

-

In March 2025, Galatea Bio secured USD 25 million to advance global genomic research and precision medicine, highlighting direct commercial activity and investment within the genomics market.

Genomics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.55 billion

Revenue forecast in 2033

USD 72.50 billion

Growth rate

CAGR of 18.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deliverables, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MAE

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Illumina, Inc.; Thermo Fisher Scientific, Inc.; Danaher Corporation; F. Hoffmann-La Roche Ltd.; Agilent Technologies; BGI Genomics; QIAGEN N.V.; Oxford Nanopore Technologies; PacBio.; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global genomics market report based on application, deliverables, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Functional Genomics

-

Real-time PCR

-

Transfection

-

SNP Analysis

-

Mutational Analysis

-

Microarray Analysis

-

RNA Interference

-

-

Epigenomics

-

Bisulfite Sequencing

-

Microarray Analysis

-

Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

-

Methylated DNA Immunoprecipitation (MeDIP)

-

High Resolution Melt (HRM)

-

Chromatin Accessibility Assays

-

-

Pathway Analysis

-

Microarray Analysis

-

Bead-based Analysis

-

Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

-

Real-time PCR

-

-

Biomarker Discovery

-

DNA Sequencing

-

Microarray Analysis

-

Real-time PCR

-

Mass Spectrometry

-

Statistical Analysis

-

Bioinformatics

-

-

Others

-

-

Deliverables Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Instruments/Systems/Software

-

Consumables & Reagents

-

-

Services

-

NGS-based Services

-

Core Genomics Services

-

Biomarker Translation Services

-

Computational Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Clinics

-

Academic and Government Institutes

-

Clinical Research

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwaita

-

-

Frequently Asked Questions About This Report

b. The global genomics market size was estimated at USD 21.76 billion in 2025 and is expected to reach USD 22.55 billion in 2026.

b. The global genomics market is expected to witness a compound annual growth rate of 18.2% from 2026 to 2033 to reach USD 72.50 billion by 2033.

b. The pharmaceutical and biotechnology companies segment accounted for the major revenue share owing to the increasing number of genetic research studies aimed at the development of efficacious drugs with fewer side effects and improving the drug discovery process.

b. Major players in the genomics market include F. Hoffmann-La Roche Ltd..; Agilent Technologies, Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; 23andMe, Inc.; Illumina, Inc.; Myriad Genetics, Inc.; Foundation Medicine, Inc.; Danaher, Pacific Biosciences; Oxford Nanopore Technologies; and BGI.

b. Technological advancements in genetic tools, as well as molecular diagnostics, is one of the key driving force that has accelerated investment by genomic companies in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.